Securing funding for higher education is a pivotal step for many aspiring students. Navigating the complexities of student loans, however, can feel daunting. This guide offers a clear and concise pathway to understanding the eligibility criteria, application processes, and financial implications involved in qualifying for student loans. We’ll explore various loan types, repayment options, and strategies for managing student loan debt effectively, empowering you to make informed decisions about your educational financing.

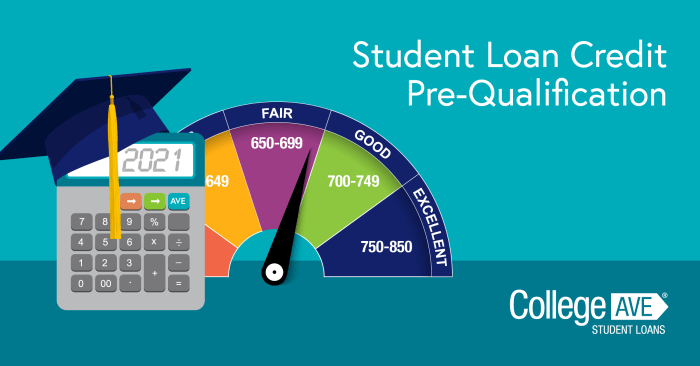

From understanding your credit score’s influence to selecting the most suitable loan type, this resource aims to demystify the process. We’ll delve into the nuances of federal and private loans, emphasizing the importance of careful planning and proactive financial management. Whether you’re a prospective student or a parent supporting a child’s education, this guide provides the essential information needed to confidently navigate the world of student loan financing.

Required Documentation and Application Process

Securing student loans involves navigating a process that requires careful preparation and attention to detail. Understanding the necessary documentation and the application steps will significantly streamline the process and increase your chances of approval. This section Artikels the key elements involved in applying for federal student loans.

Necessary Documents for Student Loan Application

Gathering the correct documentation upfront is crucial for a smooth application. Missing even one document can delay the process considerably. This checklist will help ensure you have everything you need.

- Social Security Number (SSN): This is essential for identifying you within the federal system.

- Federal Tax Information (and your parents’, if applicable): This includes tax returns or tax transcripts, and is used to determine financial need.

- Driver’s License or State-Issued ID: Used for verification of identity.

- Student Aid Report (SAR): This report is generated after completing the FAFSA and contains important information.

- High School Transcript or GED: Proof of high school completion or equivalent.

- College Acceptance Letter or Enrollment Information: Confirmation of your enrollment at a participating institution.

- Bank Account Information: For disbursement of loan funds.

The Online Application Process for Federal Student Loans

The application process for federal student loans is primarily online, making it convenient and accessible. The main portal is through the Federal Student Aid website (studentaid.gov). The process involves creating an account, completing the FAFSA, and selecting your loan type. After submission, you will receive a confirmation and updates regarding your application status. You can track your progress and communicate with the loan servicer through the online portal.

The Verification Process for Student Loans

After submitting your FAFSA, you may be selected for verification. This process confirms the accuracy of the information you provided. The verification process involves providing additional documentation, such as tax returns or W-2 forms. Failure to respond promptly can delay the disbursement of your loan funds. Expect to receive clear instructions from your institution or the Federal Student Aid office regarding what documents are required.

Completing the Free Application for Federal Student Aid (FAFSA)

The FAFSA is the gateway to federal student aid. This online application collects detailed financial information about you and your family (if applicable) to determine your eligibility for federal student aid, including loans, grants, and work-study programs. The process involves creating an FSA ID, gathering the necessary financial information, and accurately completing all sections of the form. It’s crucial to double-check all information for accuracy before submitting. Errors can lead to delays or rejection of your application.

Flowchart Illustrating the Student Loan Application Process

The following describes a flowchart illustrating the application process. The process begins with completing the FAFSA, followed by verification (if selected), loan application, loan approval, and finally, disbursement of funds. Any delays or required corrections would cause a loop back to the appropriate step in the process.

Imagine a flowchart with boxes and arrows. Box 1: Complete FAFSA. Arrow to Box 2: Verification (Yes/No). If Yes, arrow to Box 3: Provide Verification Documents. Arrow from Box 3 or No from Box 2 to Box 4: Apply for Federal Student Loan. Arrow to Box 5: Loan Approval/Denial. If Approved, arrow to Box 6: Loan Disbursement. If Denied, arrow back to Box 4 (to re-apply or correct errors).

Financial Aid and Loan Types

Securing funding for your education often involves navigating the landscape of financial aid and student loans. Understanding the different types of loans available, their associated costs, and alternative funding options is crucial for making informed decisions about your financing strategy. This section will Artikel the key features of federal student loans and explore other avenues for financial assistance.

Federal Student Loan Types: Subsidized, Unsubsidized, and PLUS Loans

Federal student loans are offered by the U.S. government and generally offer more favorable repayment terms than private loans. Three primary types exist: subsidized, unsubsidized, and PLUS loans. Each differs significantly in terms of interest accrual and eligibility requirements.

- Subsidized Loans: The government pays the interest on these loans while you’re enrolled at least half-time, during grace periods, and during deferment. This means your loan balance doesn’t grow while you’re in school.

- Unsubsidized Loans: Interest accrues on these loans from the time the loan is disbursed, regardless of your enrollment status. You’ll need to pay this interest to avoid it being capitalized (added to your principal balance) upon entering repayment.

- PLUS Loans: These loans are available to graduate and professional students, as well as parents of undergraduate students. Credit checks are required, and approval isn’t guaranteed. Interest rates are typically higher than subsidized and unsubsidized loans.

Calculating Potential Loan Amounts

The amount you can borrow depends on several factors, primarily your cost of attendance (COA) and your demonstrated financial need. COA includes tuition, fees, room and board, books, and other expenses. Financial need is determined by subtracting your Expected Family Contribution (EFC) from your COA. The EFC is calculated based on your family’s income and assets, as reported on the Free Application for Federal Student Aid (FAFSA).

For example: If your COA is $25,000 and your EFC is $10,000, your financial need is $15,000. You might be eligible to borrow up to this amount in federal student loans, though the actual amount offered might be less.

Alternative Financial Aid Options: Grants and Scholarships

Federal student loans are not your only source of funding. Grants and scholarships offer free money for education and do not need to be repaid.

- Grants: These are typically need-based and awarded by the federal government, states, colleges, and other organizations. Examples include Pell Grants and state-sponsored grants.

- Scholarships: These are merit-based or need-based awards offered by colleges, universities, private organizations, and corporations. They often require applications and may be based on academic achievement, athletic ability, or other criteria. For example, a student with a high GPA could be eligible for a merit-based academic scholarship from their university. Another student might qualify for a scholarship based on their demonstrated financial need and participation in a specific community service program.

Advantages and Disadvantages of Each Loan Type

Each loan type presents both advantages and disadvantages. Careful consideration is crucial before selecting a loan.

- Subsidized Loans: Advantage: No interest accrues while in school. Disadvantage: Lower borrowing limits compared to unsubsidized loans.

- Unsubsidized Loans: Advantage: Higher borrowing limits. Disadvantage: Interest accrues while in school, increasing the total loan cost.

- PLUS Loans: Advantage: Can cover a significant portion of educational costs. Disadvantage: Higher interest rates and credit checks are required.

Repayment Options and Planning

Successfully navigating student loan repayment requires understanding the various options available and developing a personalized repayment strategy. Choosing the right plan depends on your individual financial circumstances, income, and long-term goals. Careful planning can significantly reduce stress and ensure timely repayment.

Available Student Loan Repayment Plans

Several repayment plans cater to different financial situations. Standard repayment involves fixed monthly payments over a 10-year period. Graduated repayment starts with lower payments that gradually increase over time. Extended repayment stretches payments over a longer period (up to 25 years), lowering monthly payments but increasing the total interest paid. Finally, income-driven repayment plans tie monthly payments to your income and family size.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan repayment more manageable for borrowers with limited incomes. These plans calculate monthly payments based on a percentage of your discretionary income (income above a certain threshold). Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). The specific terms and eligibility criteria vary by plan. Importantly, after a set period of qualifying payments (typically 20 or 25 years, depending on the plan), any remaining loan balance may be forgiven. However, this forgiveness is considered taxable income.

Creating a Realistic Student Loan Repayment Budget

A realistic budget is crucial for successful repayment. Start by listing all monthly income sources and expenses. Include your student loan payments as a significant expense. If your income doesn’t comfortably cover your expenses and loan payments, explore options like reducing expenses, increasing income through a part-time job or side hustle, or refinancing your loans to a lower interest rate. A sample budget might include housing, transportation, food, utilities, loan payments, and savings. Tracking your spending and regularly reviewing your budget will help identify areas for potential savings.

Strategies for Effective Student Loan Debt Management

Effective management involves proactive strategies. Prioritize high-interest loans to minimize the total interest paid over the life of the loan. Consider refinancing your loans if you qualify for a lower interest rate. Automatic payments can help ensure timely payments and avoid late fees. Explore options for loan consolidation to simplify repayment. Building a strong credit history is also important, as it can positively influence future borrowing opportunities. Finally, regular communication with your loan servicer is crucial for addressing any issues or questions promptly.

Sample Repayment Schedule

The following table illustrates different repayment scenarios for a $30,000 loan at a 5% interest rate.

| Repayment Plan | Monthly Payment | Loan Term (Years) | Total Interest Paid |

|---|---|---|---|

| Standard Repayment | $300 | 10 | $6,000 |

| Graduated Repayment (starting at $200/month) | Variable | 10 | $7,000 (estimated) |

| Extended Repayment | $150 | 25 | $18,750 (estimated) |

| Income-Driven Repayment (example) | Variable (based on income) | 20-25 | Variable (potential for forgiveness) |

Note: These are simplified examples. Actual payments and interest will vary based on loan terms and individual circumstances. Consult with a financial advisor for personalized advice.

Potential Challenges and Solutions

Securing student loans can be a complex process, and while the benefits are significant, various challenges can arise along the way. Understanding these potential hurdles and having strategies in place to address them is crucial for a smooth and successful loan experience. This section Artikels common difficulties students face and offers practical solutions to overcome them.

Loan Application Challenges and Solutions

Navigating the student loan application process often presents unexpected obstacles. Common challenges include incomplete applications, missing documentation, credit history issues, and denial of the loan application. Addressing these requires careful attention to detail and proactive communication with the lender. For incomplete applications, meticulously review all requirements before submission. If documentation is missing, promptly obtain and submit the necessary materials. Credit history issues may require addressing underlying credit problems, potentially through credit counseling or debt consolidation. Loan denials often necessitate understanding the reasons for the denial and exploring alternative financing options or appealing the decision based on provided justification. Maintaining open communication with the lender throughout the process is paramount.

Managing Financial Difficulties During Repayment

Once loans are secured, the focus shifts to repayment. Unexpected financial difficulties, such as job loss or medical emergencies, can significantly impact repayment capabilities. Strategies for navigating these challenges include exploring income-driven repayment plans, which adjust monthly payments based on income and family size. Contacting the lender to discuss options like deferment or forbearance can provide temporary relief. Budgeting and financial planning tools can help manage expenses and prioritize loan repayment. Seeking guidance from a financial advisor can provide personalized strategies for long-term financial stability.

Resources for Students Struggling with Student Loan Debt

Many resources exist to support students struggling with student loan debt. The National Foundation for Credit Counseling (NFCC) offers free or low-cost credit counseling services, providing guidance on debt management strategies. The U.S. Department of Education website offers comprehensive information on repayment plans, loan forgiveness programs, and other assistance options. Non-profit organizations like the Student Loan Borrower Assistance Project provide free assistance to borrowers navigating complex loan issues. These resources provide valuable support and guidance for students facing financial hardship.

Frequently Asked Questions about Student Loan Qualification

Understanding the qualification process is vital for successful loan application. Here are answers to some frequently asked questions:

- What factors affect my eligibility for student loans? Eligibility depends on factors such as credit history (for some loans), enrollment status, and demonstrated financial need (for need-based loans). Lenders will also consider your academic record and future earning potential.

- What happens if my loan application is denied? Loan denials usually include an explanation of the reasons. Review the reasons, address any issues (e.g., credit problems), and consider appealing the decision or exploring alternative funding options.

- What are my repayment options if I experience financial hardship? Income-driven repayment plans, deferment, and forbearance are options available to borrowers facing financial difficulties. Contact your lender to explore these options.

- Where can I find help with managing my student loan debt? The U.S. Department of Education website, the National Foundation for Credit Counseling (NFCC), and other non-profit organizations offer valuable resources and assistance.

Conclusion

Successfully navigating the student loan application process requires careful planning and a thorough understanding of the various loan options available. By understanding your eligibility, gathering the necessary documentation, and creating a realistic repayment plan, you can significantly reduce stress and increase your chances of securing the financial support needed to achieve your educational goals. Remember to explore all available resources and seek professional guidance when necessary. Empowered with knowledge and a strategic approach, you can confidently embark on your educational journey.

Quick FAQs

What happens if my FAFSA application is incomplete?

An incomplete FAFSA application will likely result in delays or rejection. Ensure all required information is accurately provided.

Can I appeal a student loan denial?

Yes, you can often appeal a denial by providing additional documentation or addressing the reasons for the rejection.

What are the consequences of defaulting on student loans?

Defaulting can lead to wage garnishment, tax refund offset, and damage to your credit score.

How long does it take to receive student loan funds after approval?

The disbursement timeline varies depending on the lender and the institution, but it can take several weeks.