Navigating student loan debt can feel overwhelming, but Dave Ramsey’s proven methods offer a clear path to financial freedom. His emphasis on budgeting, saving, and strategic repayment plans provides a powerful framework for tackling even the most significant student loan balances. This guide explores Ramsey’s approach, comparing his strategies to traditional advice and detailing how to implement them effectively.

We’ll delve into the specifics of his debt snowball and avalanche methods, examining their practical application to student loan repayment. We’ll also analyze the role of refinancing and address the complexities of student loan forgiveness programs within the context of Ramsey’s financial philosophy. Ultimately, this exploration aims to equip you with the knowledge and tools to confidently manage your student loan debt using Ramsey’s principles.

Ramsey Student Loan Repayment Strategies

Navigating student loan debt can feel overwhelming, but the principles of Dave Ramsey’s financial peace plan offer a structured approach to tackling this significant financial burden. This focuses on aggressive repayment strategies designed to eliminate debt quickly and regain financial control. Understanding the various methods and their implications is crucial for effective implementation.

Comparison of Debt Repayment Methods

Choosing the right repayment strategy is a personal decision, depending on your individual financial situation and comfort level. The two most popular methods promoted by Ramsey are the debt snowball and the debt avalanche methods. The table below illustrates a comparison, using hypothetical examples to demonstrate the differences. Note that these are simplified examples and actual results will vary based on interest rates and payment amounts.

| Method | Monthly Payment (Example) | Time to Payoff (Example) | Total Interest Paid (Example) |

|---|---|---|---|

| Debt Snowball | $500 | 36 months | $3,000 |

| Debt Avalanche | $600 | 30 months | $2,500 |

.responsive-table

width: 100%;

border-collapse: collapse;

.responsive-table th, .responsive-table td

border: 1px solid #ddd;

padding: 8px;

text-align: left;

@media screen and (max-width: 600px)

.responsive-table

font-size: 12px;

.responsive-table th, .responsive-table td

padding: 4px;

Prioritizing Student Loan Repayment

Ramsey’s philosophy emphasizes prioritizing student loan repayment aggressively, even above other debts like credit cards, once a fully funded emergency fund is established. This approach, while potentially leading to higher total interest paid in the short term compared to the avalanche method, provides significant psychological benefits. The rapid payoff of smaller debts creates momentum and motivation, fueling the commitment needed to conquer larger debts like student loans. This psychological advantage is considered a crucial element of Ramsey’s success. The feeling of accomplishment from paying off smaller debts first motivates individuals to persist through the more challenging repayment of larger loans.

Implementing the Debt Snowball Method for Student Loans

The debt snowball method focuses on paying off the smallest debt first, regardless of interest rate. This approach provides a quick sense of accomplishment and encourages continued effort. Here’s a step-by-step plan for implementing the debt snowball method for student loan repayment:

1. List all debts: Create a comprehensive list of all your student loans, including the lender, balance, and interest rate.

2. Order debts smallest to largest: Arrange the loans from smallest balance to largest, irrespective of interest rates.

3. Minimum payments on all other debts: Make minimum payments on all other debts, allocating any extra funds towards the smallest student loan.

4. Aggressive repayment of the smallest loan: Focus all extra funds on the smallest loan, paying as much as possible above the minimum payment.

5. Repeat steps 3 & 4: Once the smallest loan is paid off, roll that payment amount into the next smallest loan, increasing your monthly payment significantly.

6. Celebrate milestones: Acknowledge and celebrate each paid-off loan to maintain motivation.

7. Continue until all loans are paid: Persist with this process until all student loans are eliminated.

Ramsey’s Philosophy and Student Loan Debt

Dave Ramsey’s approach to student loan repayment significantly diverges from traditional financial advice, often emphasizing aggressive repayment strategies and a strong aversion to accumulating any debt beyond a mortgage. Traditional advice, on the other hand, may advocate for a more balanced approach, considering factors like interest rates, income, and long-term financial goals before recommending a specific repayment plan. This difference stems from a fundamental contrast in financial philosophies.

Ramsey’s philosophy centers on the belief that debt is inherently destructive to financial well-being. He promotes a debt-free lifestyle as the ultimate goal, prioritizing the rapid elimination of all debt—including student loans—before focusing on other financial objectives like investing. This contrasts with traditional approaches that may suggest a more diversified strategy, balancing debt repayment with saving and investing simultaneously.

Core Tenets of Ramsey’s Financial Philosophy Regarding Student Loan Debt

Ramsey’s philosophy, when applied to student loans, boils down to several key principles. He strongly advocates for a disciplined budget, aggressive debt repayment, and a focus on building wealth after becoming debt-free. This differs from approaches that might prioritize lower monthly payments to maintain a higher disposable income, even if it means a longer repayment period.

Budgeting and Saving within Ramsey’s Student Loan Repayment Strategy

A cornerstone of Ramsey’s method is meticulous budgeting. This involves tracking every dollar spent and identifying areas where expenses can be reduced to free up funds for debt repayment. For instance, someone following Ramsey’s plan might drastically cut entertainment expenses, sell unused possessions, or take on a second job to accelerate loan repayment. These savings are then aggressively directed towards the highest-interest debt first, a strategy known as the debt snowball method. This contrasts with the traditional approach of focusing on the highest-interest debt first (the debt avalanche method) which may yield faster overall debt reduction but can be less psychologically motivating. The snowball method prioritizes quick wins to maintain momentum and motivation, a key element of Ramsey’s approach. Once the student loans are paid off, the freed-up funds can then be redirected towards savings and investments, building a strong financial foundation. For example, someone who previously allocated $500 monthly to student loan payments could allocate that same amount towards building an emergency fund or investing.

Budgeting and Saving for Ramsey Student Loan Repayment

Successfully navigating student loan repayment using the Ramsey method requires a disciplined approach to budgeting and saving. This involves creating a realistic budget that prioritizes loan repayment while ensuring you meet your essential living expenses. Simultaneously, actively seeking opportunities to increase your income and identify areas for savings will significantly accelerate your debt-free journey.

Sample Budget Allocation

A well-structured budget is the cornerstone of effective student loan repayment. The following sample budget demonstrates how to allocate funds, keeping in mind that individual circumstances will necessitate adjustments. Remember, the percentages are examples and should be adapted to your specific income and expenses.

- Housing (Rent/Mortgage): 30% of net income. This includes rent, mortgage payments, property taxes, and homeowner’s insurance if applicable.

- Transportation: 10% of net income. This covers car payments, gas, insurance, public transportation, or other commuting costs.

- Food: 15% of net income. This includes groceries, eating out, and other food-related expenses. Prioritizing home-cooked meals can significantly reduce this cost.

- Student Loan Repayment: 25% of net income. This is a significant portion, reflecting the priority placed on rapid debt elimination. Consider using the debt snowball or debt avalanche method to strategize your repayment.

- Utilities: 5% of net income. This encompasses electricity, water, gas, internet, and phone bills.

- Savings: 10% of net income. This includes emergency funds and savings for future goals. Even small amounts consistently saved contribute significantly over time.

- Other Expenses: 5% of net income. This category covers miscellaneous expenses such as clothing, entertainment, and personal care items.

Strategies for Increasing Income

Boosting your income provides more resources to dedicate to student loan repayment. Several strategies can be employed:

- Negotiate a Raise: Research industry standards for your position and confidently present your accomplishments and value to your employer.

- Seek a Promotion: Actively pursue opportunities for advancement within your current company. Demonstrate initiative and a willingness to take on additional responsibilities.

- Find a Second Job or Gig Work: Consider part-time employment, freelance work, or the gig economy to supplement your primary income. Examples include driving for a ride-sharing service, freelance writing, or online tutoring.

- Develop and Sell a Skill: If you possess a marketable skill, such as graphic design or web development, offer your services online or locally.

Potential Savings Opportunities

Identifying and eliminating unnecessary expenses can free up significant funds for loan repayment. Some potential areas for savings include:

- Reduce Food Costs: Plan meals, cook at home more often, and utilize coupons or discount apps.

- Lower Transportation Costs: Consider carpooling, biking, walking, or using public transportation to reduce gas and maintenance expenses.

- Cut Entertainment Expenses: Limit dining out, movie outings, and other entertainment costs. Explore free or low-cost entertainment options.

- Negotiate Lower Bills: Contact your service providers (internet, phone, insurance) to negotiate lower rates or explore alternative, more affordable options.

- Unsubscribe from Unnecessary Subscriptions: Review your subscriptions (streaming services, magazines, etc.) and cancel those you rarely use.

The Role of Refinancing in Ramsey’s Student Loan Strategy

Refinancing student loans, while seemingly a straightforward path to lower monthly payments, requires careful consideration within the framework of Dave Ramsey’s financial philosophy. Ramsey’s emphasis on debt-free living and aggressive debt repayment necessitates a nuanced approach to refinancing, prioritizing long-term financial health over short-term cost savings. This approach involves a thorough evaluation of the potential benefits against the inherent risks, ensuring alignment with the overall goal of becoming debt-free as quickly as possible.

Refinancing student loans aligns with Ramsey’s principles only under very specific circumstances. The core tenet is that refinancing should demonstrably accelerate the repayment process and not simply extend it at a lower interest rate. This means securing a significantly lower interest rate while maintaining, or ideally shortening, the loan term. Any refinance that results in a longer repayment period, even with a slightly lower interest rate, generally contradicts Ramsey’s aggressive debt elimination strategy. The goal is to minimize total interest paid and achieve debt freedom sooner.

Refinancing Risks from a Ramsey Perspective

The primary risk associated with refinancing student loans from a Ramsey perspective is the potential for increased total interest paid over the life of the loan. While a lower interest rate may seem appealing, extending the loan term to lower monthly payments can negate this benefit. For example, refinancing a $30,000 loan from a 7% interest rate over 10 years to a 5% interest rate over 15 years might result in lower monthly payments, but ultimately cost more in interest over the extended repayment period. Another risk lies in the potential loss of federal student loan benefits, such as income-driven repayment plans or loan forgiveness programs, which could be forfeited when refinancing into a private loan. Finally, a change in financial circumstances could make repayment more challenging, especially if the longer repayment period creates a false sense of financial security.

Refinancing Benefits from a Ramsey Perspective

The primary benefit of refinancing, when aligned with Ramsey’s principles, is a substantial reduction in the interest rate. This reduction must be significant enough to offset any increase in total interest due to a longer loan term, ideally leading to a faster payoff. For example, if a borrower could refinance a high-interest loan (e.g., 10%) down to a significantly lower rate (e.g., 3%), even with a slight extension of the loan term, the overall savings could still be substantial and justify the refinance. This situation would only be considered if the total interest paid is demonstrably lower, even with the extended repayment period. Furthermore, consolidating multiple loans into a single loan with a lower interest rate can simplify repayment and improve financial organization, a key element of Ramsey’s plan.

Factors to Consider Before Refinancing

Before pursuing student loan refinancing, a thorough evaluation is crucial. This involves comparing the total interest paid under the current loan arrangement with the projected total interest paid under various refinance scenarios. Borrowers should carefully consider the length of the new loan term, the new interest rate, and the potential loss of federal loan benefits. A detailed comparison of monthly payments, total interest paid, and loan repayment timeline is essential. They should also assess their current financial situation and projected future income to ensure they can comfortably manage the new monthly payments. Finally, obtaining multiple refinance offers from different lenders allows for a more informed decision.

Ramsey and Student Loan Forgiveness Programs

Dave Ramsey’s financial philosophy centers on aggressive debt elimination and building wealth through disciplined saving and investing. Student loan forgiveness programs, therefore, present a direct challenge to his core principles. While seemingly offering a quick solution to crippling debt, these programs can be viewed through the lens of Ramsey’s approach as potentially undermining responsible financial behavior.

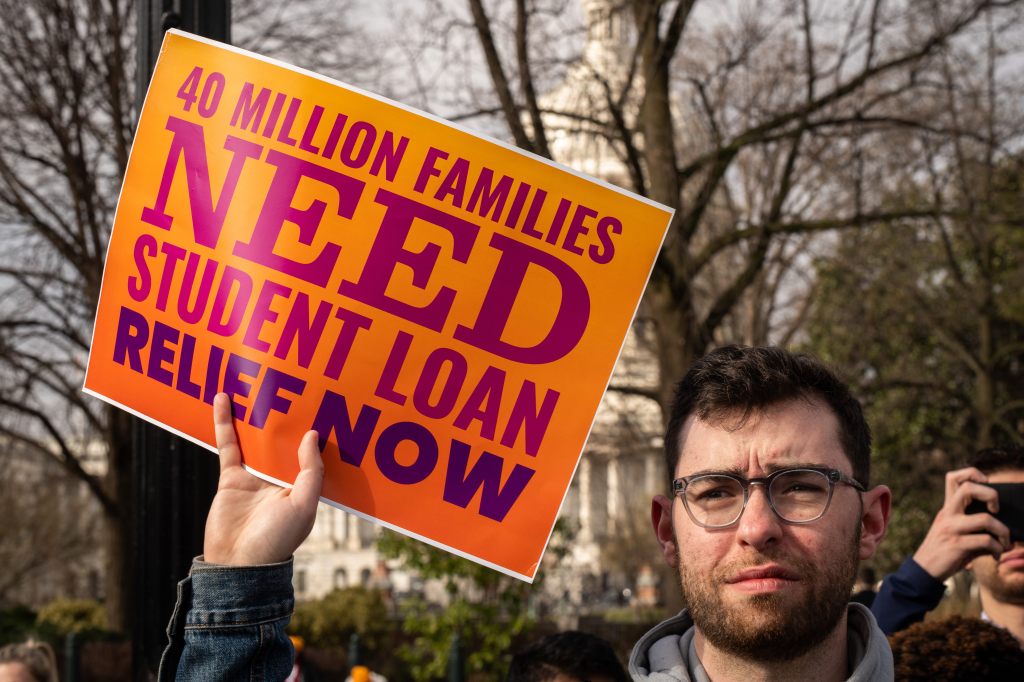

Ramsey’s approach emphasizes personal responsibility and the importance of taking ownership of one’s financial situation. He advocates for a proactive strategy of budgeting, aggressive debt repayment (often employing the debt snowball method), and building wealth through investing. From this perspective, student loan forgiveness can be seen as a form of bailout, potentially rewarding irresponsible borrowing habits and discouraging future responsible financial planning. An individual deeply entrenched in Ramsey’s philosophy might view loan forgiveness with skepticism, questioning whether it’s a fair solution compared to the disciplined approach he advocates.

Ramsey’s Perspective on the Ethical Implications of Student Loan Forgiveness

The ethical considerations surrounding student loan forgiveness are complex and viewed differently within the context of Ramsey’s philosophy. Ramsey’s approach strongly emphasizes personal accountability. Accepting loan forgiveness, from his perspective, might be seen as shirking personal responsibility for financial choices made in the past. This perspective isn’t necessarily about moral judgment but rather a focus on the long-term consequences of shifting the burden of debt onto taxpayers, potentially impacting future economic stability and potentially disincentivizing responsible borrowing. For instance, if a borrower made poor financial decisions leading to significant debt, accepting forgiveness might be viewed as ethically questionable compared to a borrower who diligently tried to manage their debt but faced unforeseen circumstances. The ethical dilemma hinges on the balance between providing relief to those struggling with debt and promoting responsible financial habits for future generations.

Outcome Summary

Successfully managing student loan debt requires a disciplined approach and a clear understanding of your financial goals. By combining Ramsey’s emphasis on budgeting and saving with strategic repayment strategies like the debt snowball method, you can significantly accelerate your progress toward becoming debt-free. Remember to carefully consider the potential risks and benefits of refinancing and to approach student loan forgiveness programs with a thoughtful understanding of their implications. Taking control of your finances empowers you to build a secure and prosperous future.

Commonly Asked Questions

What if I can’t afford the minimum payments on my student loans?

Contact your loan servicer immediately. They may offer options like forbearance or deferment, but understand these often accrue interest. Creating a realistic budget and exploring ways to increase income are crucial steps.

How does Ramsey’s approach differ from income-driven repayment plans?

Ramsey generally advocates against income-driven repayment plans, prioritizing aggressive repayment to eliminate debt faster, even if it means making sacrifices in other areas of your budget. Income-driven plans extend repayment periods, increasing total interest paid.

Can I use Ramsey’s methods if I have federal and private student loans?

Yes, Ramsey’s methods can be applied to both federal and private student loans. However, be aware that federal loans offer different repayment options and protections compared to private loans.

What if I’m facing financial hardship?

Prioritize essential expenses (housing, food, transportation). Contact your loan servicers to discuss options. Seek professional financial advice to create a plan for navigating the hardship.