Navigating the complexities of federal student loan rates can feel overwhelming, but understanding these rates is crucial for responsible borrowing and long-term financial planning. This guide provides a clear and concise overview of various federal student loan programs, their associated interest rates, and the factors that influence them. We’ll explore repayment options, the impact of interest capitalization, and strategies for effective debt management, empowering you to make informed decisions about your educational financing.

From understanding the differences between subsidized and unsubsidized loans to exploring various repayment plans like Standard, Extended, Graduated, and Income-Driven options, we’ll demystify the process. We’ll also examine how interest rates affect your overall repayment costs and provide practical advice for managing your debt effectively, even with higher interest rates. This guide aims to equip you with the knowledge needed to confidently navigate the landscape of federal student loan financing.

Understanding Federal Student Loan Rates

Navigating the world of federal student loans can feel overwhelming, especially when considering the various interest rates involved. Understanding these rates is crucial for responsible borrowing and long-term financial planning. This section will clarify the different types of federal student loans, the factors affecting their interest rates, and provide a historical perspective on rate changes.

Federal Student Loan Types and Interest Rates

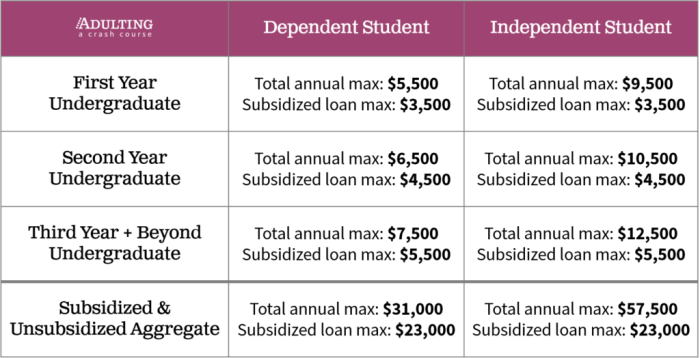

Federal student loans are offered through various programs, each with its own interest rate structure. These rates are generally fixed, meaning they remain the same for the life of the loan, unlike variable rates that fluctuate. The specific rate depends on factors detailed below, but generally, subsidized loans tend to have lower rates than unsubsidized loans. Understanding these distinctions is critical for making informed borrowing decisions.

Factors Influencing Federal Student Loan Interest Rates

Several key factors determine the interest rate you’ll receive on your federal student loan. These include the type of loan, the loan’s disbursement date, and, in some cases, credit history. The loan type is the most significant factor, with subsidized loans typically having lower rates than unsubsidized loans. The disbursement date also plays a role, as rates are set annually. While credit history is not a direct factor for most federal student loans, it might influence the eligibility for certain loan programs or private loan options.

Historical Overview of Federal Student Loan Interest Rate Changes

Federal student loan interest rates are not static; they change over time. These changes are often influenced by broader economic conditions, such as prevailing interest rates and government policy decisions. For example, rates have fluctuated significantly over the past two decades, reflecting shifts in the economic landscape. Examining historical trends provides valuable context for understanding current rates and anticipating potential future changes. Detailed historical data can be found on the official websites of the Department of Education and relevant financial institutions.

Comparison of Federal Student Loan Program Interest Rates

The following table presents a comparison of interest rates for various federal student loan programs. Note that these rates are subject to change annually and may vary slightly depending on the loan disbursement date. It is crucial to consult the official sources for the most up-to-date information.

| Loan Program | Interest Rate (Example – Subject to Change) | Loan Type | Repayment Options |

|---|---|---|---|

| Direct Subsidized Loan (Undergraduate) | 4.99% | Subsidized | Standard, Graduated, Extended |

| Direct Unsubsidized Loan (Undergraduate) | 6.54% | Unsubsidized | Standard, Graduated, Extended |

| Direct Subsidized Loan (Graduate) | 6.54% | Subsidized | Standard, Graduated, Extended |

| Direct Unsubsidized Loan (Graduate) | 7.54% | Unsubsidized | Standard, Graduated, Extended |

Calculating Loan Repayment Costs

Understanding how federal student loan repayment works is crucial for effective financial planning. This section will guide you through calculating monthly payments under different repayment plans, the impact of interest capitalization, and the effects of varying interest rates on your total repayment. We will also illustrate the difference in total cost between subsidized and unsubsidized loans.

Calculating your monthly student loan payment involves several factors, primarily your loan principal, interest rate, and loan term. The federal government offers several repayment plans, each with its own calculation method and implications for your monthly payments and overall cost. These plans are designed to accommodate varying financial situations and income levels.

Standard Repayment Plan Calculations

The Standard Repayment Plan is the most common option. Payments are typically fixed and spread over a 10-year period. The monthly payment amount is determined by a formula that considers the loan’s principal balance, interest rate, and loan term. A common formula used to approximate the monthly payment is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly payment

- P = Principal loan amount

- i = Monthly interest rate (Annual interest rate divided by 12)

- n = Number of months in the loan term (loan term in years multiplied by 12)

For example, a $20,000 loan at a 5% annual interest rate over 10 years would result in an approximate monthly payment of $212.47. This calculation, however, is simplified and doesn’t include any potential fees or additional charges.

Interest Capitalization’s Effect on Total Loan Cost

Interest capitalization occurs when unpaid interest is added to the principal loan balance. This increases the principal amount on which future interest is calculated, leading to a larger overall loan cost. For example, if interest accrues during periods of deferment or forbearance, it will be capitalized at the end of the grace period or deferment, increasing the total amount owed. The longer the loan term, the more significant the effect of capitalization. Let’s say a $10,000 loan accrues $500 in interest during a deferment period. After capitalization, the new principal becomes $10,500, and future interest calculations will be based on this higher amount.

Impact of Different Interest Rates on Total Repayment

Higher interest rates significantly increase the total amount repaid over the life of the loan. Even a small difference in interest rates can result in a substantial increase in the total cost. For instance, a $10,000 loan at 4% interest over 10 years will cost significantly less than the same loan at 7% interest. The total interest paid will be much higher with the higher interest rate, leading to a substantially larger total repayment amount. Borrowers should strive to secure the lowest possible interest rate to minimize the total cost of their loans.

Hypothetical Scenario: Subsidized vs. Unsubsidized Loan

Let’s compare two $10,000 loans, one subsidized and one unsubsidized, both with a 5% annual interest rate and a 10-year repayment term. With a subsidized loan, the government pays the interest while the borrower is in school and during grace periods. With an unsubsidized loan, the interest accrues and is added to the principal balance, even during these periods. Therefore, the total repayment cost for the unsubsidized loan will be significantly higher due to interest capitalization during the deferment period. Assuming a four-year deferment period, the unsubsidized loan will have a higher principal amount at the start of repayment, resulting in higher monthly payments and a larger total repayment amount compared to the subsidized loan. The exact difference depends on the specific interest rate and the length of the deferment period.

Federal Student Loan Repayment Plans

Choosing the right repayment plan for your federal student loans is crucial for managing your finances and minimizing long-term costs. Different plans offer varying monthly payment amounts and total repayment periods, each with its own set of advantages and disadvantages. Understanding these differences will allow you to make an informed decision that aligns with your financial situation and goals.

Understanding the nuances of each plan requires careful consideration of your income, loan amount, and long-term financial objectives. This section will detail the key features of four common federal student loan repayment plans: Standard, Extended, Graduated, and Income-Driven.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loan borrowers. It involves fixed monthly payments over a 10-year period. This plan is straightforward and predictable, offering a relatively short repayment timeframe.

- Eligibility: Borrowers with federal student loans are automatically enrolled unless they choose a different plan.

- Advantages: Predictable monthly payments, shortest repayment period, leading to lower total interest paid.

- Disadvantages: Higher monthly payments compared to other plans, potentially creating financial strain for some borrowers.

Extended Repayment Plan

The Extended Repayment Plan offers longer repayment terms than the Standard Plan, resulting in lower monthly payments. However, this comes at the cost of paying more interest over the life of the loan.

- Eligibility: Available to borrowers with total loan balances exceeding $30,000.

- Advantages: Lower monthly payments than the Standard Plan, making repayment more manageable for some borrowers.

- Disadvantages: Longer repayment period (up to 25 years), resulting in significantly higher total interest paid.

Graduated Repayment Plan

With the Graduated Repayment Plan, your monthly payments start low and gradually increase over time. This can be beneficial initially but leads to higher payments later in the repayment period.

- Eligibility: Available to borrowers with federal student loans.

- Advantages: Lower initial monthly payments, making it easier to manage early in your career.

- Disadvantages: Payments increase significantly over time, potentially creating financial hardship later on; higher total interest paid compared to the Standard Plan.

Income-Driven Repayment Plans

Income-Driven Repayment (IDR) Plans tie your monthly payments to your income and family size. Several IDR plans exist (e.g., ICR, PAYE, REPAYE,IBR), each with slightly different eligibility requirements and payment calculations. These plans are designed to make repayment more affordable for borrowers with lower incomes.

- Eligibility: Eligibility varies by plan, but generally requires a demonstrated need based on income and family size. Specific income thresholds and loan types apply.

- Advantages: Lower monthly payments, potentially resulting in loan forgiveness after 20 or 25 years depending on the plan, depending on income and loan type.

- Disadvantages: Longer repayment periods (potentially up to 20 or 25 years), leading to higher total interest paid; forgiveness may be subject to taxation.

Impact of Interest Rates on Long-Term Financial Planning

Understanding the long-term financial implications of your student loan interest rate is crucial for making informed decisions and achieving your post-graduation goals. The interest rate significantly impacts the total amount you’ll repay and, consequently, your ability to save, invest, and build wealth over time. Higher interest rates can severely hinder your financial progress, while lower rates offer more flexibility and opportunities.

The interest rate on your student loans directly determines how much of your monthly payment goes towards principal versus interest. With a higher interest rate, a larger portion of your payment goes towards interest, meaning it takes longer to pay down the principal balance and you end up paying significantly more in total interest over the life of the loan. This can have a profound impact on your long-term financial well-being.

High Interest Rates and Post-Graduation Financial Goals

High interest rates can significantly delay or even prevent the achievement of major financial milestones. For instance, a large student loan debt burden with a high interest rate can make saving for a down payment on a home significantly more challenging. The substantial monthly payments may leave little room in your budget for saving, forcing you to delay homeownership for an extended period. Similarly, high interest rates can limit your ability to invest in retirement accounts or other investment vehicles, potentially impacting your long-term financial security. Consider a scenario where two graduates, both with $50,000 in student loan debt, have different interest rates: one at 5% and another at 10%. Over 10 years, the borrower with the 10% rate will pay substantially more in interest, leaving them with less disposable income for savings and investments.

Strategies for Managing Student Loan Debt with High Interest Rates

Several strategies can help manage student loan debt, even with high interest rates. Prioritizing high-interest loans for repayment is a common and effective approach. This involves focusing on paying down the loans with the highest interest rates first, thereby minimizing the total interest paid over the loan’s lifetime. Another strategy involves exploring refinancing options if interest rates have decreased since you initially took out the loans. Refinancing can lower your monthly payments and reduce the overall interest paid. Careful budgeting and disciplined saving are also essential. Creating a realistic budget that prioritizes loan repayment and minimizing unnecessary expenses can free up more funds to accelerate debt reduction.

Hypothetical Case Study: Long-Term Financial Consequences of High Interest Rates

Let’s consider two hypothetical graduates, Sarah and John, both graduating with $40,000 in student loan debt. Sarah secures a loan with a 7% interest rate, while John’s loan carries a 10% interest rate. Both make minimum monthly payments. Over a 10-year repayment period, Sarah will pay approximately $10,000 in interest, while John will pay approximately $16,000. This $6,000 difference represents a significant amount that could have been used for a down payment on a home, investments, or other financial goals. Over a longer repayment period, this difference would grow even larger. This example highlights the substantial long-term financial consequences of even seemingly small differences in interest rates.

Resources and Further Information

Navigating the world of federal student loans can be complex, but accessing reliable information and assistance is crucial for understanding your loan terms and managing your repayment effectively. This section provides essential resources and guidance to help you find the information you need. We will Artikel reputable websites, detail steps for accessing personalized information, and explain how to contact relevant agencies for support.

Understanding your federal student loans requires accessing accurate and up-to-date information from reliable sources. The following resources offer comprehensive guidance and support throughout the loan process.

Reputable Websites and Government Agencies

Several government websites and agencies provide comprehensive information on federal student loans. These resources offer detailed explanations of loan programs, interest rates, repayment options, and other important details. Utilizing these official channels ensures you receive accurate and reliable information.

| Agency/Website | Description | URL | Contact Information |

|---|---|---|---|

| StudentAid.gov | The official U.S. Department of Education website for federal student aid. Provides information on all aspects of federal student loans, including interest rates, repayment plans, and loan forgiveness programs. | https://studentaid.gov | Contact information is available on the website. |

| Federal Student Aid (FSA) | The primary agency responsible for administering federal student loan programs. Offers resources, tools, and assistance to borrowers. | https://studentaid.gov (same as above) | Contact information is available on the website. |

| National Student Loan Data System (NSLDS) | A central database that provides information on federal student loans. You can access your loan details, including loan balances, interest rates, and repayment history. | https://nslds.ed.gov | Contact information is available on the website. |

| Your Loan Servicer | Your loan servicer manages your federal student loans and provides customer service support. Contact information for your specific servicer can be found on the StudentAid.gov website. | Varies by servicer | Contact information varies by servicer; available through StudentAid.gov |

Accessing Personalized Loan Information

Accessing your personalized federal student loan information is straightforward. The following steps will guide you through the process of retrieving your loan details and understanding your specific interest rates and repayment schedules.

- Visit StudentAid.gov and create an account (if you don’t already have one) using your FSA ID.

- Once logged in, navigate to the “My Aid” section.

- Locate your loan information, which will typically include details such as loan balances, interest rates, and repayment schedules.

- Alternatively, use the NSLDS website to access your loan information through a different portal.

- Review your loan details carefully and contact your loan servicer if you have any questions.

Contacting Agencies for Assistance

If you need assistance understanding your loan terms, interest rates, or repayment options, contacting the appropriate agencies is crucial. The following information Artikels how to contact the relevant parties for support.

For general inquiries about federal student loans, contact the Federal Student Aid Information Center by phone or online through StudentAid.gov. For specific questions regarding your loan, contact your loan servicer directly using the contact information provided on your loan documents or through the StudentAid.gov website. The NSLDS website also provides contact information for assistance with accessing your loan data.

Epilogue

Securing a college education is a significant investment, and understanding the intricacies of federal student loan rates is paramount to ensuring a financially sound future. By carefully considering the loan type, interest rate, and repayment plan, you can minimize long-term debt and achieve your post-graduation financial goals. Remember to utilize the resources provided and seek professional guidance when necessary to make informed decisions that align with your individual financial circumstances. Proactive planning and a clear understanding of your loan terms will set you on the path to successful debt management and financial well-being.

FAQ Summary

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or while you’re in deferment. Unsubsidized loans accrue interest throughout the loan’s life.

Can I refinance my federal student loans?

Yes, but refinancing federal student loans with a private lender means losing federal protections like income-driven repayment plans and potential forgiveness programs. Carefully weigh the pros and cons before refinancing.

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in default, which has serious financial consequences.

Where can I find my federal student loan interest rate?

You can find your interest rate on your loan documents or by logging into the National Student Loan Data System (NSLDS) website.

How often do federal student loan interest rates change?

Interest rates for federal student loans are set annually and can vary depending on the loan type and market conditions.