Navigating the complexities of income-driven repayment (IDR) plans for student loans can feel overwhelming. Understanding the recertification process, however, is crucial for borrowers seeking to manage their debt effectively and potentially qualify for loan forgiveness. This guide provides a comprehensive overview of recertifying income for student loans, covering everything from the different IDR plans available to the potential tax implications of loan forgiveness.

We’ll explore the recertification process in detail, outlining the necessary documentation, timelines, and potential consequences of missed deadlines. We’ll also examine how changes in income affect monthly payments and provide examples to illustrate the impact. Furthermore, this guide will address common mistakes borrowers make during recertification and offer practical advice to avoid them. Finally, we will compare the recertification processes across different loan servicers to help you navigate this process with confidence.

Income-Driven Repayment (IDR) Plans

Income-Driven Repayment (IDR) plans are designed to make student loan repayment more manageable by basing your monthly payment on your income and family size. Several different plans are available, each with its own eligibility criteria and repayment calculations. Choosing the right plan depends on your individual financial circumstances and long-term goals.

Types of IDR Plans

The federal government offers several IDR plans. Understanding their differences is crucial for selecting the most suitable option. These plans are regularly reviewed and may be subject to change, so it’s essential to consult the official Department of Education website for the most up-to-date information.

Income Verification Process for IDR Plans

The income verification process varies slightly depending on the specific IDR plan, but generally involves submitting documentation to your loan servicer. This typically includes tax returns (IRS Form 1040 and supporting schedules), W-2s, and potentially other income verification documents. The servicer will then use this information to calculate your monthly payment. The frequency of income recertification also differs by plan; some require annual verification, while others may require it every two years. Failure to provide the required documentation can result in your payment being recalculated based on a default income level, which may significantly increase your monthly payments.

Applying for an IDR Plan

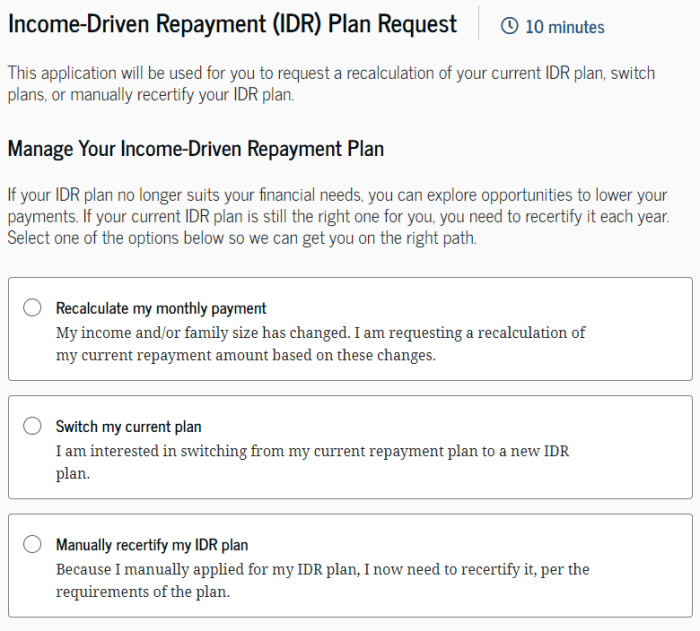

Applying for an IDR plan is generally a straightforward process. The steps Artikeld below provide a general guide, and specific steps may vary slightly depending on your loan servicer and the chosen plan.

- Determine your eligibility: Check the eligibility requirements for each IDR plan to see which one is best suited to your situation.

- Choose an IDR plan: Select the plan that best aligns with your financial circumstances and long-term goals.

- Gather necessary documentation: Collect your tax returns, W-2s, and any other required income verification documents.

- Submit your application: Complete the application through your loan servicer’s online portal or by mail. This typically involves completing a form and uploading the required documents.

- Review your payment plan: Once your application is processed, your loan servicer will notify you of your new monthly payment amount.

Comparison of IDR Plans

The following table compares key features of several common IDR plans. Remember that details can change, so always check with your loan servicer for the most current information.

| Plan Name | Income Calculation | Payment Calculation | Forgiveness Eligibility |

|---|---|---|---|

| Income-Driven Repayment (IDR) – PAYE | Adjusted Gross Income (AGI) | 10% of discretionary income | 20 years of payments; remaining balance forgiven |

| Income-Driven Repayment (IDR) – IBR | Adjusted Gross Income (AGI) | 10% or 15% of discretionary income (depending on loan origination date) | 20 or 25 years of payments; remaining balance forgiven |

| Income-Driven Repayment (IDR) – REPAYE | Adjusted Gross Income (AGI) | 10% of discretionary income | 20 or 25 years of payments; remaining balance forgiven |

| Income-Driven Repayment (IDR) – ICR | Adjusted Gross Income (AGI) and family size | 12-25% of discretionary income; depends on loan amount and repayment period | 25 years of payments; remaining balance forgiven |

Recertification Process and Timing

Income-driven repayment (IDR) plans require periodic recertification of your income to ensure your monthly payments accurately reflect your financial situation. This process is crucial for maintaining the benefits of your IDR plan and avoiding potential issues with your loan servicer. Understanding the timing and requirements is key to avoiding penalties.

Recertification schedules and required documentation vary slightly depending on your specific IDR plan and loan servicer. However, the general process and potential consequences remain consistent.

Recertification Schedule

Most IDR plans require annual recertification of income. This means you’ll typically need to submit updated income information once a year. Some plans may use a different timeframe, such as every two years, so it’s vital to check your loan servicer’s website or your loan documents for your specific plan’s requirements. Failing to adhere to this schedule can lead to significant consequences. For example, if your recertification is late, your payments might be recalculated based on your previous income, potentially resulting in higher monthly payments than necessary.

Required Documentation for Income Recertification

The documents needed for income recertification usually include proof of income from the previous year. This typically involves tax returns (Form 1040 and W-2s), pay stubs, or self-employment income documentation. Additional documents might be requested depending on your individual circumstances. For instance, if you experienced a significant change in income, supporting documentation like a layoff notice or a new employment contract could be helpful. It’s always best to err on the side of caution and provide as much documentation as possible to expedite the process.

Consequences of Failing to Recertify on Time

Failure to recertify your income on time can lead to several negative consequences. Your loan servicer may calculate your monthly payment based on your previous income, potentially resulting in higher payments than you should be making. In some cases, you may be considered in default on your loans, which can damage your credit score and lead to additional fees and collection actions. Therefore, timely recertification is crucial for maintaining your financial well-being and ensuring the continued benefits of your IDR plan.

Recertification Process Flowchart

The following description details a typical recertification process. Imagine a flowchart with boxes connected by arrows.

Start: The process begins when your loan servicer notifies you that it’s time for recertification.

Gather Documentation: Next, gather the necessary documentation, including tax returns, pay stubs, and any other supporting documents.

Submit Documents: Submit your completed recertification forms and supporting documents to your loan servicer through their preferred method (online portal, mail, etc.).

Servicer Review: Your loan servicer reviews your submitted documents to verify your income information.

Payment Adjustment (If Applicable): Based on your updated income, your monthly payment will be adjusted accordingly. You will receive notification of the adjusted payment amount.

End: The recertification process is complete once your loan servicer confirms receipt of your documentation and updates your payment plan. Failure to submit documents at any stage will send the process back to the “Gather Documentation” step, with potential consequences as described above.

Impact of Income Changes on Payments

Income-Driven Repayment (IDR) plans are designed to make student loan repayment more manageable by basing your monthly payment on your income and family size. This means that changes to your income directly affect your monthly payment amount. Understanding how these changes impact your payments is crucial for effective long-term financial planning.

When your income increases, your monthly payment will generally increase as well. Conversely, a decrease in income typically leads to a lower monthly payment. The specific amount of the adjustment depends on the particular IDR plan you’re enrolled in and the magnitude of the income change. The recertification process, as discussed previously, is the mechanism through which these adjustments are made.

Income Increase Impact on Payments

An increase in income will result in higher monthly payments under an IDR plan. This is because the plan recalculates your payment based on your updated financial information. The higher your income, the greater the portion of your income allocated to your student loan repayment. This is a reflection of the principle behind IDR plans: your payment is proportionate to your ability to repay.

For example:

- If your income increases by 10%, your monthly payment might increase by a similar percentage, or even more depending on the specifics of your plan and income bracket.

- A significant income increase could lead to a substantially higher monthly payment, potentially exceeding what you were paying previously.

Income Decrease Impact on Payments

A decrease in income, such as job loss or reduced work hours, will typically result in lower monthly payments. The IDR plan will recalculate your payment based on your lower income, aiming to make your payments more affordable during a period of financial hardship.

For example:

- If you experience a 20% reduction in income, your monthly payment could be reduced by a similar percentage, providing financial relief.

- In extreme cases of income loss, your payment might be reduced to $0, depending on your plan and your financial circumstances. However, it’s important to remember that interest will still likely accrue on your loan balance during this period.

Payment Adjustment Examples

The following table illustrates how different income levels can translate into varying monthly payments under an IDR plan. Note that these are illustrative examples and the actual amounts will vary depending on the specific IDR plan, loan balance, interest rate, and other factors.

| Annual Income | Monthly Payment (Example Plan A) | Monthly Payment (Example Plan B) | Payment Difference |

|---|---|---|---|

| $30,000 | $200 | $150 | $50 |

| $45,000 | $300 | $225 | $75 |

| $60,000 | $400 | $300 | $100 |

| $75,000 | $500 | $375 | $125 |

Tax Implications of Student Loan Forgiveness

Student loan forgiveness, while a welcome financial relief for many, can have significant tax implications. Understanding these potential tax consequences is crucial for borrowers participating in Income-Driven Repayment (IDR) plans. The Internal Revenue Service (IRS) considers forgiven student loan debt as taxable income in most cases, meaning you may owe taxes on the amount forgiven. This is true regardless of whether the forgiveness is through an IDR plan or other programs.

The forgiven amount might be considered taxable income under specific circumstances. Generally, if your student loan debt is discharged (forgiven) due to completing an IDR plan, the amount discharged is usually considered taxable income in the year of forgiveness. This applies even if you never made a payment on the loan, or if you paid only a small portion of it before forgiveness. Exceptions exist, such as discharges due to total and permanent disability or death. However, these are typically handled differently than forgiveness under IDR plans.

Taxable Income Calculation for Forgiven Student Loans

The taxable income resulting from student loan forgiveness is added to your other income for the tax year in which the forgiveness occurs. This increases your overall adjusted gross income (AGI), potentially pushing you into a higher tax bracket and resulting in a larger tax liability. The amount of tax owed will depend on your individual tax bracket and any other deductions or credits you may be eligible for. It’s crucial to consult a tax professional to accurately determine your tax liability, as individual circumstances can significantly impact the final tax burden.

Examples of Tax Scenarios Related to Student Loan Forgiveness

Understanding how student loan forgiveness impacts taxes can be complex. Here are a few illustrative scenarios:

Let’s assume a borrower has $20,000 in student loan debt forgiven after completing an IDR plan. This $20,000 will be added to their taxable income for the year of forgiveness. Depending on their other income and tax bracket, this could result in a significant tax bill. For example:

- Scenario 1: A borrower in a 12% tax bracket would owe $2,400 in federal income taxes (12% of $20,000).

- Scenario 2: A borrower in a 22% tax bracket would owe $4,400 in federal income taxes (22% of $20,000).

- Scenario 3: A borrower with other significant income might find themselves in a higher tax bracket, leading to an even larger tax liability. The tax burden could be mitigated by itemized deductions, but careful planning is essential.

It’s important to note that these are simplified examples and do not include state taxes, which may also apply. The actual tax liability will depend on various factors, including the borrower’s total income, deductions, and credits.

State Tax Implications

Many states also tax forgiven student loan debt. The rules vary significantly by state, so it’s essential to check your state’s specific tax laws. Some states may conform to the federal treatment of forgiven student loan debt, while others may have different rules. For example, some states may not tax forgiven student loan debt, while others may tax it at a different rate than the federal government. This adds another layer of complexity to the tax planning process. Consult a tax professional familiar with both federal and state tax laws to ensure you understand your full tax obligations.

Resources and Support for Borrowers

Navigating the complexities of student loan repayment and the recertification process can be challenging. Fortunately, numerous resources and support systems are available to help borrowers understand their options and manage their debt effectively. This section Artikels key government websites, helpful resources, and contact information for organizations that provide assistance.

Understanding the available support is crucial for successful student loan management. The right resources can simplify the process, ensuring borrowers make informed decisions and avoid potential pitfalls.

Key Government Websites and Organizations

The federal government offers several websites and organizations dedicated to assisting student loan borrowers. These resources provide comprehensive information on repayment plans, eligibility requirements, and other crucial details. The primary source of information is the official federal student aid website.

- StudentAid.gov: This website, managed by the Federal Student Aid (FSA), offers a wealth of information on federal student loans, including repayment plans, loan forgiveness programs, and tools to manage your loans. It’s the central hub for all things related to federal student aid.

- Federal Student Aid (FSA) Contact Center: The FSA offers phone and email support to answer borrower questions. This direct contact is invaluable for resolving specific issues or clarifying information found on the website.

- National Student Loan Data System (NSLDS): NSLDS provides a centralized database of student loan information. Borrowers can access their loan details, including loan servicer information and repayment history, through this system.

Helpful Resources for Borrowers Navigating Recertification

The recertification process requires careful attention to detail and accurate information. These resources can simplify the process and help borrowers avoid errors.

- Step-by-step guides on the FSA website: The FSA website provides detailed, step-by-step instructions for completing the recertification process. These guides walk borrowers through each step, ensuring a smooth and accurate submission.

- Sample recertification forms and instructions: Access to sample forms and instructions helps borrowers understand what information is required and how to properly complete the forms. This reduces the risk of errors and delays.

- Calculators and tools to estimate payments: Online calculators and tools can help borrowers estimate their future payments based on their updated income and family size. This allows for better financial planning and budgeting.

- FAQs and troubleshooting guides: The FSA website and other reputable sources often provide frequently asked questions (FAQs) and troubleshooting guides to address common issues and concerns.

Contact Information for Relevant Agencies and Organizations

Direct contact with relevant agencies and organizations can provide personalized assistance and support.

- Federal Student Aid (FSA) Contact Center: Phone number and email address should be readily available on StudentAid.gov.

- Your Loan Servicer: Each borrower has a designated loan servicer who can answer specific questions about their loans and the recertification process. Contact information for your servicer can be found on the NSLDS website.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that offers free and low-cost credit counseling services, including assistance with student loan management. Their contact information can be found on their website.

- Other non-profit credit counseling agencies: Numerous other non-profit organizations provide similar services. A search online for “non-profit credit counseling” will yield a list of organizations in your area.

Common Mistakes to Avoid During Recertification

Successfully navigating the income-driven repayment (IDR) plan recertification process is crucial for maintaining your monthly payment plan and progressing toward potential loan forgiveness. Failing to do so accurately and timely can lead to significant financial setbacks. Understanding common errors and how to avoid them is key to a smooth and successful recertification.

Recertification involves providing updated income and family size information to your loan servicer. Inaccurate or incomplete information can result in incorrect payment calculations, delaying or preventing loan forgiveness. The following points highlight frequent mistakes and offer guidance on how to prevent them.

Inaccurate Income Reporting

Providing inaccurate income information is a major pitfall. This could involve underreporting or overreporting your income, both of which have serious consequences. Underreporting can lead to lower monthly payments initially, but it will ultimately result in a larger loan balance at the end of the repayment period, potentially jeopardizing loan forgiveness. Conversely, overreporting could lead to unnecessarily high payments, creating unnecessary financial strain. To avoid this, carefully review your tax returns (Form 1040) and any other relevant documentation to ensure accuracy. If you are self-employed, maintain meticulous records of your income and expenses.

Failure to Report Changes in Family Size

Changes in family size, such as marriage, divorce, or the birth or adoption of a child, significantly impact your IDR plan calculations. Failing to report these changes promptly can lead to incorrect payment calculations and potentially delay your progress towards loan forgiveness. It’s crucial to update your information immediately upon any change in your family’s composition. This typically involves submitting a new recertification application with the updated information.

Missing the Recertification Deadline

Missing the recertification deadline can result in your payments being recalculated based on your previous income information, potentially leading to higher payments than necessary. In some cases, failure to recertify on time could even lead to your loan being transferred to a standard repayment plan with much higher monthly payments. To avoid this, mark the recertification deadline on your calendar and submit your application well in advance. Contact your loan servicer immediately if you anticipate any difficulty meeting the deadline.

Submitting Incomplete or Unclear Documentation

Submitting incomplete or unclear documentation can delay the processing of your recertification application, potentially leading to payment disruptions. Make sure to provide all necessary documentation, such as tax returns, pay stubs, and any other supporting documents requested by your loan servicer. Keep copies of all submitted documents for your records. Organize your documents neatly and clearly label each item to ensure efficient processing.

Ignoring Communication from Your Loan Servicer

Ignoring communication from your loan servicer is a critical mistake. Your servicer will send reminders and important updates regarding your recertification. Failure to respond promptly can lead to missed deadlines and other complications. Always review your emails and mail carefully and respond to any requests or questions from your servicer promptly. If you are unsure about anything, contact them directly to clarify.

Comparison of Recertification Processes Across Different Loan Servicers

Navigating the recertification process for your Income-Driven Repayment (IDR) plan can vary significantly depending on your loan servicer. Understanding these differences is crucial for ensuring a smooth and timely completion of the process. This section will highlight key distinctions in documentation requirements and timelines among various servicers. It’s important to remember that this information is for general understanding and specific requirements are subject to change; always consult your individual servicer’s website for the most up-to-date details.

Differences in Recertification Processes

The recertification process, while fundamentally similar across servicers (requiring income and family size verification), differs in the specifics of the required documentation, the online portal experience, and the overall timeline. Some servicers may offer more streamlined online portals, while others may rely more heavily on paper submissions. These differences can impact the time it takes to complete the process and the level of ease experienced by the borrower.

Comparison Table of Loan Servicer Recertification Processes

| Loan Servicer | Required Documentation | Online Portal Experience | Typical Timeline |

|---|---|---|---|

| Example Servicer A (e.g., FedLoan Servicing – *Note: FedLoan Servicing no longer services federal student loans*) | Tax returns (IRS transcript often sufficient), W-2s, pay stubs, self-employment documentation (if applicable), and potentially other supporting financial documents. | Generally user-friendly online portal with clear instructions and progress tracking. May require uploading documents directly. | Typically requires recertification annually, with a processing time of several weeks. Deadlines vary. |

| Example Servicer B (e.g., Mohela) | Similar to Servicer A, often accepting IRS tax transcripts as primary documentation. May request additional documentation depending on individual circumstances. | Online portal varies in user-friendliness. May require more manual data entry or interaction with customer service. | Annual recertification is typical, with a processing time that can vary, potentially taking longer than Servicer A due to higher volume. |

| Example Servicer C (e.g., Great Lakes) | May require more extensive documentation, potentially including bank statements or other financial records in addition to tax documents. | Online portal features and ease of use vary. Customer service may be crucial for addressing issues or clarifying requirements. | Recertification timeline similar to Servicer B, with potential for longer processing times depending on documentation completeness. |

| Example Servicer D (A hypothetical example to illustrate potential variations) | Emphasizes electronic document submission and may offer a streamlined process for borrowers with simpler tax situations. | Highly user-friendly online portal with automated verification checks. May integrate directly with IRS data sources. | Faster processing time than other servicers, potentially completing within a few weeks. |

Long-Term Effects of IDR Plans on Loan Forgiveness

Choosing an Income-Driven Repayment (IDR) plan significantly impacts the long-term trajectory of your student loan debt and your chances of achieving loan forgiveness. The key is understanding how your income, plan type, and loan balance interact over time to determine the ultimate outcome. While loan forgiveness through IDR plans offers a pathway to debt relief, it’s crucial to consider the potential trade-offs and long-term financial implications.

IDR plans, while designed to make monthly payments more manageable, often extend the repayment period considerably. This means you’ll pay more interest over the life of the loan. However, the potential for eventual loan forgiveness can outweigh this added interest cost for many borrowers, particularly those with high loan balances and lower incomes. The extended repayment period also means that your credit score might be affected longer than with other repayment plans.

Loan Forgiveness Timeframes Under Different IDR Plans

The time it takes to reach loan forgiveness under an IDR plan varies significantly depending on the specific plan (PAYE, REPAYE, IBR, ICR) and the borrower’s income and loan balance. Factors such as the type of loan (federal vs. private) and the timing of income changes also play a crucial role. It’s essential to carefully review the specific requirements of each plan to understand its potential impact on your individual circumstances.

- Scenario 1: High Initial Debt, Steady Low Income – PAYE Plan. A borrower with $100,000 in federal student loans and a consistently low income might qualify for loan forgiveness after 20-25 years under the PAYE plan. The extended repayment period results in substantial accumulated interest, but the eventual forgiveness eliminates the remaining balance.

- Scenario 2: Moderate Debt, Income Fluctuation – REPAYE Plan. A borrower with $50,000 in debt whose income fluctuates throughout the repayment period might find the REPAYE plan beneficial. The plan adjusts payments based on income, offering flexibility during periods of lower earnings, but the total repayment time could still exceed 20 years depending on income levels and loan forgiveness eligibility.

- Scenario 3: Lower Debt, Higher Income – ICR Plan. A borrower with $30,000 in debt and a relatively higher income might see their loan forgiven sooner under the ICR plan, potentially within 10-15 years. However, the higher payments compared to other IDR plans could mean less immediate relief. The shorter time to forgiveness might offset the higher payments in this case.

Impact of Income Changes on Forgiveness Timeline

Unexpected changes in income can significantly impact the timeline for loan forgiveness under an IDR plan. A sudden increase in income will likely result in higher monthly payments, potentially shortening the time to forgiveness, but also increasing the total amount paid. Conversely, a decrease in income can lead to lower payments, extending the repayment period and potentially increasing the total interest paid. Consistent monitoring of income and timely recertification are crucial for optimizing the plan’s benefits. Regularly reviewing your payment schedule and projected forgiveness date is highly recommended.

Final Wrap-Up

Successfully recertifying your income for student loans requires careful planning and attention to detail. By understanding the intricacies of IDR plans, the recertification process, and potential tax implications, you can effectively manage your student loan debt and potentially achieve loan forgiveness. Remember to maintain accurate records, meet deadlines, and seek assistance if needed. Proactive management of your student loans can lead to significant long-term financial benefits.

FAQ Corner

What happens if I miss my recertification deadline?

Missing your deadline can result in your payments being recalculated based on your previous income, potentially leading to higher monthly payments. It could also affect your eligibility for loan forgiveness.

Can I recertify my income more than once a year?

The frequency of recertification depends on your specific IDR plan. Some plans require annual recertification, while others may have different schedules. Check your loan servicer’s website or contact them directly for clarification.

What if my income significantly decreases?

A significant decrease in income should be reported to your loan servicer immediately. They will recalculate your monthly payment based on your updated income information. You may need to provide supporting documentation.

Where can I find more information about my specific IDR plan?

Contact your student loan servicer directly. They can provide detailed information about your specific plan, including recertification requirements and timelines.