The crippling weight of student loan debt is a pervasive issue affecting millions, hindering financial stability and delaying major life milestones. This comprehensive guide delves into the current state of student loan debt in the United States, exploring its far-reaching economic and societal consequences. We will examine the various demographics disproportionately impacted, analyze historical trends, and dissect different loan types and their associated interest rates. Understanding this landscape is crucial to formulating effective solutions.

Beyond simply outlining the problem, we will explore a range of proposed solutions, from loan forgiveness programs and income-driven repayment plans to interest rate reductions and innovative debt reduction strategies employed in other countries. We will also emphasize the critical role of financial literacy in preventing future debt crises and empowering students to make informed decisions about their higher education financing.

The Current State of Student Loan Debt

Student loan debt in the United States has reached staggering levels, posing a significant challenge to individual borrowers and the national economy. The sheer magnitude of this debt, its disproportionate impact on certain demographics, and its evolving historical trends warrant careful examination. Understanding the various types of loans and their associated costs is crucial for effective policymaking and individual financial planning.

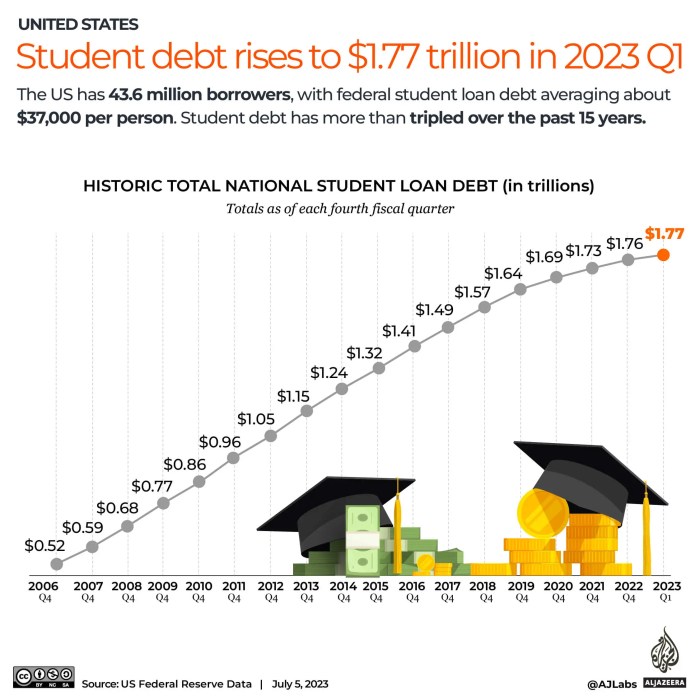

The total amount of student loan debt outstanding in the United States currently exceeds $1.7 trillion, surpassing both auto loan and credit card debt. This represents a considerable burden on millions of Americans, impacting their ability to save for retirement, purchase homes, and start families. The weight of this debt is felt across various sectors of the economy, influencing consumer spending and overall economic growth.

Demographic Groups Most Affected by Student Loan Debt

Student loan debt is not evenly distributed across the population. Younger generations, particularly millennials and Generation Z, bear the brunt of this financial burden. Minority groups, including Black and Hispanic borrowers, often face higher debt levels and more difficulty in repayment due to systemic inequalities in access to education and employment opportunities. Women also tend to accumulate more student loan debt than men, partly due to pursuing higher education in fields with lower earning potential. These disparities highlight the need for targeted interventions to address the unequal impact of student loan debt.

Historical Trends in Student Loan Debt Accumulation

The growth of student loan debt has been dramatic over the past few decades. Several factors have contributed to this rise, including the increasing cost of higher education, a decrease in state funding for public colleges and universities, and the expansion of federal student loan programs. While the availability of loans made higher education more accessible to many, it also fueled the accumulation of debt, particularly as tuition costs continued to outpace inflation. This trend underscores the complex interplay between access to education, affordability, and the resulting financial burden on borrowers.

Types of Student Loans and Interest Rates

Borrowers can access various types of student loans, each with its own terms and interest rates. Federal student loans, offered through the government, generally offer more favorable terms and repayment options compared to private student loans, which are provided by banks and other financial institutions. Federal loans include subsidized and unsubsidized loans for undergraduates and graduate students, as well as PLUS loans for parents and graduate students. Interest rates for federal loans are set annually by the government and tend to be lower than those for private loans. Private loans, on the other hand, carry variable interest rates that can fluctuate based on market conditions, potentially leading to higher overall borrowing costs.

Average Student Loan Debt Across Educational Levels

The following table compares average student loan debt across various educational levels. These figures represent averages and may vary based on factors such as the institution attended, the field of study, and individual borrowing habits. The data reflects the significant increase in debt associated with pursuing advanced degrees.

| Educational Level | Average Student Loan Debt |

|---|---|

| Bachelor’s Degree | $37,000 |

| Master’s Degree | $70,000 |

| Professional Degree (e.g., Law, Medicine) | $150,000+ |

Impacts of Student Loan Debt

The crippling weight of student loan debt extends far beyond the balance sheet, significantly impacting individuals’ economic well-being, societal participation, and personal life milestones. The sheer magnitude of this debt affects not only borrowers but also the broader economy and social fabric. Understanding these impacts is crucial for developing effective solutions.

Economic Consequences for Individuals

High student loan debt imposes significant financial constraints on individuals. Repayments often consume a substantial portion of monthly income, limiting the ability to save for retirement, purchase a home, or invest in other opportunities for wealth building. This can lead to a cycle of debt, where borrowers struggle to make ends meet, hindering their overall financial stability and long-term economic prospects. For example, a recent study showed that individuals with high student loan debt are more likely to delay or forgo major purchases like a car or starting a business. This financial strain can persist for years, even decades, significantly impacting overall financial health.

Societal Implications of Widespread Student Loan Debt

The widespread prevalence of student loan debt has broader societal consequences. It can hinder economic growth by reducing consumer spending and investment. When a significant portion of the population is burdened by debt, their capacity to contribute to the economy through consumption and investment is diminished. Furthermore, high levels of student debt can exacerbate existing inequalities, disproportionately affecting low-income and minority borrowers who may have fewer resources to navigate the repayment process. This can lead to a widening wealth gap and hinder social mobility. The societal burden extends to the need for government intervention and support programs, which place additional strain on public resources.

Delaying Major Life Milestones

Student loan debt frequently delays or prevents individuals from achieving significant life milestones. The financial burden associated with repayment can make homeownership a distant dream for many, forcing them to postpone or forgo this crucial step towards building wealth and stability. Similarly, the financial pressure can delay marriage and starting a family, impacting personal life choices and family planning. For instance, many young adults choose to delay marriage or having children until their debt burden is reduced or managed, impacting family structures and demographic trends.

Correlation Between Student Loan Debt and Mental Health

A growing body of research indicates a strong correlation between student loan debt and mental health challenges. The chronic stress associated with managing substantial debt can contribute to anxiety, depression, and other mental health issues. The constant worry about repayment, coupled with the potential for financial hardship, can significantly impact overall well-being. This is particularly true for individuals who are struggling to find employment in their chosen field or facing unexpected financial setbacks. The mental health implications of student loan debt underscore the importance of comprehensive support systems and financial literacy programs.

Long-Term Financial Challenges

The long-term financial implications of significant student loan debt are substantial. Individuals may face numerous challenges, including:

- Difficulty saving for retirement.

- Inability to purchase a home or other major assets.

- Limited ability to invest in other opportunities for wealth building.

- Increased risk of bankruptcy or financial hardship.

- Reduced capacity for entrepreneurial pursuits.

- Potential for wage garnishment or other legal actions.

- Strained personal relationships due to financial stress.

The Role of Education and Financial Literacy

Financial literacy is paramount in mitigating the crippling effects of student loan debt. A strong understanding of personal finance empowers prospective students to make informed decisions about higher education financing, reducing the likelihood of overwhelming debt burdens later in life. Equipping students with the necessary knowledge and skills before they even begin considering loans is crucial for long-term financial well-being.

Importance of Financial Literacy Education for Prospective Students

Prospective students lacking financial literacy often underestimate the true cost of higher education, including tuition, fees, living expenses, and the long-term implications of borrowing. This lack of understanding can lead to borrowing more than necessary, resulting in higher monthly payments and extended repayment periods. A comprehensive financial literacy education equips students to navigate the complexities of student loan applications, understand interest rates and repayment options, and budget effectively throughout their college years. This proactive approach significantly reduces the risk of financial hardship after graduation.

Strategies for Improving Financial Literacy Among Students Before They Incur Debt

Several effective strategies can improve financial literacy among prospective students. High schools and colleges should integrate comprehensive financial literacy courses into their curricula, covering budgeting, saving, investing, and debt management. These courses should utilize interactive learning methods, such as case studies, simulations, and real-world examples, to engage students and make the information relevant to their lives. Furthermore, access to free or low-cost online resources and workshops can supplement classroom learning. These resources can provide practical tools and guidance to help students develop healthy financial habits. Finally, engaging parents and guardians in the financial literacy process is essential, fostering open communication and collaborative decision-making regarding higher education financing.

Effective Methods for Teaching Students About Responsible Borrowing and Debt Management

Effective teaching methods focus on practical application and real-world scenarios. Interactive workshops and simulations allow students to experience the consequences of different borrowing decisions, highlighting the importance of responsible borrowing and debt management. The use of budgeting tools and apps helps students track their expenses and create realistic budgets. Educators should emphasize the long-term implications of student loan debt, including the impact on credit scores, future financial goals, and overall quality of life. Furthermore, providing students with information about various repayment options, such as income-driven repayment plans and loan forgiveness programs, empowers them to make informed choices that align with their individual circumstances.

Resources for Making Informed Decisions About Higher Education Financing

Numerous resources are available to help students make informed decisions about higher education financing. The federal government offers websites and publications with detailed information on student loans, grants, and scholarships. Non-profit organizations provide free financial literacy programs and workshops, while many colleges and universities offer financial aid counseling services to guide students through the process. Finally, online resources and personal finance tools can assist students with budgeting, tracking expenses, and managing debt. These resources provide a wealth of information and support to help students navigate the complexities of higher education financing.

Resources for Financial Literacy and Student Loan Management

| Resource Type | Resource Name | Description | Website/Contact |

|---|---|---|---|

| Government Website | StudentAid.gov | Information on federal student aid programs. | studentaid.gov |

| Non-profit Organization | National Endowment for Financial Education (NEFE) | Offers financial literacy programs and resources. | nefe.org |

| Online Tool | Mint | Budgeting and financial tracking app. | mint.com |

| College/University Service | Financial Aid Office (varies by institution) | Provides personalized financial aid counseling. | Contact your college/university directly. |

Long-Term Economic Effects of Debt Reduction

Reducing student loan debt could significantly impact the long-term health of the US economy. The ripple effects of such a policy are complex and multifaceted, affecting consumer behavior, investment patterns, and the higher education landscape itself. While the potential benefits are substantial, it’s crucial to acknowledge potential drawbacks and unintended consequences.

The potential for stimulating economic growth through student loan debt reduction is significant. A large portion of the younger generation’s disposable income is currently allocated to loan repayments, limiting their ability to participate fully in the economy. Debt reduction frees up this capital, potentially leading to increased consumer spending and investment. This increased spending can boost economic activity across various sectors, from retail and hospitality to durable goods and services.

Impact on Consumer Spending and Investment

Debt reduction directly increases disposable income for millions of borrowers. This increased financial flexibility could translate into higher consumer spending, driving demand and stimulating economic growth. For example, individuals may be more likely to purchase homes, cars, or invest in their businesses, leading to job creation and further economic expansion. Conversely, a lack of disposable income due to high student loan payments can stifle economic growth, as individuals prioritize debt repayment over consumption or investment. This constraint on spending can have a dampening effect on economic activity, particularly in sectors reliant on consumer demand.

Effects on the Higher Education System

The impact on the higher education system is less straightforward. While debt reduction could potentially increase enrollment and encourage more individuals to pursue higher education, it might also lead to increased tuition costs if colleges and universities perceive a decreased incentive for cost control. Furthermore, a significant shift in the funding model for higher education might be necessary to offset the revenue loss from reduced loan repayments. The long-term sustainability of the higher education system will need careful consideration and adaptation to any changes resulting from widespread debt forgiveness.

Potential Unintended Consequences of Large-Scale Debt Forgiveness

Large-scale debt forgiveness carries the risk of inflation. The sudden injection of capital into the economy could lead to increased demand for goods and services, outpacing supply and driving up prices. This could disproportionately affect low-income individuals who may not benefit directly from the debt relief but will still face the consequences of higher inflation. Furthermore, the cost of such a program would need to be offset through other means, potentially leading to tax increases or cuts in other government programs. The fairness of burdening taxpayers who did not take out student loans to alleviate the debt of others is also a significant consideration.

Potential Positive and Negative Economic Consequences

The following points summarize the potential positive and negative economic consequences of large-scale student loan debt reduction:

- Positive Consequences: Increased consumer spending and investment, boosted economic growth, increased homeownership rates, higher employment rates, potential for increased enrollment in higher education.

- Negative Consequences: Potential inflation, increased tuition costs, potential for reduced government spending in other areas, fairness concerns regarding taxpayer burden, potential for irresponsible borrowing in the future.

Closing Summary

Addressing the student loan debt crisis requires a multifaceted approach encompassing both immediate relief measures and long-term preventative strategies. While immediate debt reduction initiatives offer crucial short-term relief, fostering financial literacy among prospective students is paramount to preventing future cycles of unsustainable debt. By combining targeted policy interventions with proactive educational programs, we can pave the way towards a more equitable and financially secure future for generations to come. The economic implications of successful debt reduction are significant, promising boosted consumer spending and renewed economic growth.

Question & Answer Hub

What is income-driven repayment?

Income-driven repayment plans adjust your monthly student loan payments based on your income and family size, making them more manageable for borrowers with lower incomes.

Can I consolidate my student loans?

Yes, consolidating multiple student loans into a single loan can simplify repayment, potentially lowering your monthly payment (though the overall interest paid might increase depending on the interest rate).

What is loan forgiveness?

Loan forgiveness programs eliminate a portion or all of your student loan debt under specific circumstances, often related to public service or specific career fields.

What if I can’t afford my student loan payments?

Contact your loan servicer immediately. They can help you explore options like deferment, forbearance, or income-driven repayment plans to avoid default.