Navigating the complexities of student loan debt can feel overwhelming, but understanding your options is key to financial freedom. Refinancing your Nelnet student loans offers a potential pathway to lower monthly payments, a shorter repayment term, or a switch to a more favorable interest rate. This comprehensive guide explores the intricacies of refinancing Nelnet loans, empowering you to make informed decisions about your financial future.

We’ll delve into the eligibility criteria, compare various lenders, and walk you through the application process. We’ll also examine the potential benefits and risks, providing real-world scenarios to illustrate the impact of refinancing on your overall financial picture. By the end, you’ll possess the knowledge necessary to confidently assess whether refinancing your Nelnet student loans is the right move for you.

Understanding Nelnet Student Loan Refinancing

Refinancing your Nelnet student loans can be a strategic move to potentially lower your monthly payments and overall interest costs. However, it’s crucial to understand the process, benefits, drawbacks, and available options before making a decision. This section will provide a comprehensive overview to help you navigate the refinancing landscape.

The Nelnet Student Loan Refinancing Process

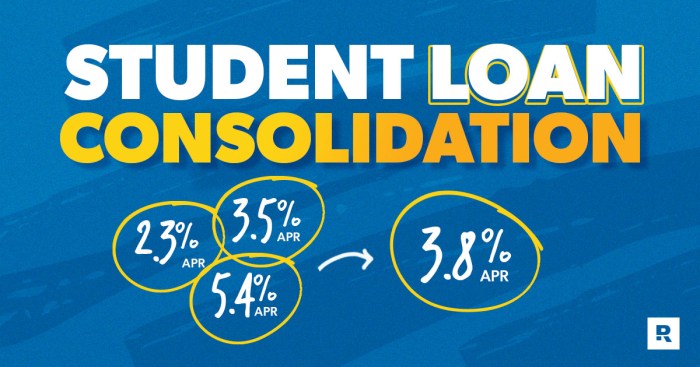

Refinancing Nelnet student loans involves replacing your existing federal student loans with a new private loan from a different lender. The process typically begins with comparing offers from various lenders, considering factors such as interest rates, loan terms, and fees. Once you’ve selected a lender, you’ll need to complete an application, providing necessary documentation like your credit report and income verification. The lender will then review your application and, if approved, disburse the funds to pay off your Nelnet loans. Finally, you’ll begin making payments on your new, refinanced loan.

Benefits and Drawbacks of Refinancing Nelnet Student Loans

Refinancing Nelnet student loans offers several potential benefits, primarily lower interest rates and potentially lower monthly payments. This can lead to significant savings over the life of the loan. However, refinancing also presents drawbacks. A primary concern is the loss of federal student loan protections, such as income-driven repayment plans and potential loan forgiveness programs. Additionally, refinancing may involve fees, and your credit score could be temporarily impacted during the application process.

Comparison of Refinancing Options for Nelnet Borrowers

Several lenders offer refinancing options for Nelnet borrowers. These lenders vary in their interest rate offerings, loan terms, and eligibility requirements. Some lenders specialize in refinancing specific types of student loans, while others offer broader options. It’s essential to compare offers from multiple lenders to find the most favorable terms. Factors to consider include the interest rate, loan term length, fees, and any additional requirements or benefits offered by the lender. For example, some lenders may offer autopay discounts or other incentives.

Situations Where Refinancing Nelnet Loans is Advantageous

Refinancing Nelnet student loans can be particularly advantageous in certain situations. For instance, borrowers with excellent credit scores may qualify for significantly lower interest rates, resulting in substantial long-term savings. Similarly, borrowers with stable income and a low debt-to-income ratio are more likely to secure favorable terms. Those facing high monthly payments might find refinancing beneficial, as it can reduce their monthly burden. Finally, individuals with a mix of federal and private loans might simplify their repayment by consolidating them into a single private loan.

Interest Rate Comparison from Different Lenders

| Lender | Interest Rate (Variable) | Interest Rate (Fixed) | Fees |

|---|---|---|---|

| Lender A | 6.5% – 18% | 7.0% – 19% | $0 – $200 |

| Lender B | 6.0% – 17% | 7.5% – 18.5% | $0 |

| Lender C | 6.8% – 19% | 7.3% – 20% | $100 – $300 |

*Note: Interest rates and fees are subject to change and are based on individual creditworthiness and loan terms. This table provides illustrative examples and should not be considered exhaustive or a guarantee of specific rates. Always check with the lender for the most up-to-date information.*

Eligibility Criteria for Nelnet Refinancing

Successfully refinancing your Nelnet student loans hinges on meeting specific eligibility requirements. These criteria are designed to assess your creditworthiness and ability to manage a new loan. Understanding these requirements is crucial for a smooth and successful application process. Failing to meet these standards could result in your application being rejected.

Nelnet, like other lenders, uses a multi-faceted approach to determine eligibility. Key factors considered include your credit score, debt-to-income ratio, and the type and amount of your existing student loan debt. Providing complete and accurate documentation during the application process is also vital.

Credit Score Requirements

A strong credit score significantly increases your chances of approval for Nelnet student loan refinancing. Lenders generally prefer applicants with scores above a certain threshold, though the exact number varies depending on current market conditions and the lender’s internal risk assessment. A higher credit score demonstrates responsible financial behavior and reduces the lender’s perceived risk. A lower credit score might lead to higher interest rates or even loan denial. For example, a credit score above 700 is often viewed favorably, while a score below 660 could significantly impact your eligibility.

Debt-to-Income Ratio Assessment

Your debt-to-income (DTI) ratio, which compares your monthly debt payments to your gross monthly income, is another crucial factor. A lower DTI ratio indicates that you have more disposable income relative to your debt obligations, making you a less risky borrower. Nelnet will likely review your DTI ratio to determine your capacity to manage additional debt. A high DTI ratio could indicate that you are already heavily burdened with debt, potentially making it harder to qualify for refinancing. For instance, a DTI ratio below 43% is generally considered favorable, whereas a ratio exceeding 50% might raise concerns for lenders.

Required Documentation for Application

To successfully apply for Nelnet student loan refinancing, you will need to provide several key documents. This typically includes proof of identity (such as a driver’s license or passport), verification of income (such as pay stubs or tax returns), and details of your existing student loans (including loan balances and interest rates). You may also be required to provide documentation related to your assets and employment history. The specific documentation required can vary, so it’s essential to check Nelnet’s application requirements carefully.

Summary of Eligibility Criteria

To summarize, meeting the following criteria significantly improves your chances of approval for Nelnet student loan refinancing:

- A good credit score (generally above 660, though higher scores are preferred).

- A manageable debt-to-income ratio (typically below 43%).

- Sufficient income to support the new loan payments.

- Complete and accurate documentation supporting your application.

- Eligibility for the specific Nelnet refinancing program you are applying for (certain programs may have additional requirements).

Finding the Best Nelnet Refinancing Lender

Refinancing your Nelnet student loans can significantly reduce your monthly payments and save you money over the life of your loan. However, navigating the numerous lenders and their varying offers can be overwhelming. Choosing the right lender requires careful consideration of several key factors to ensure you secure the most favorable terms possible. This section will guide you through the process of finding the best lender for your specific needs.

The landscape of student loan refinancing is competitive, with many lenders vying for your business. Each lender offers unique terms, interest rates, and repayment options. Direct comparison is crucial to identify the best fit for your financial situation.

Comparison of Nelnet Refinancing Lenders

Several major lenders offer Nelnet student loan refinancing, including but not limited to companies like SoFi, Earnest, and Splash Financial. These lenders often compete on interest rates, fees, and repayment flexibility. For example, SoFi might offer a lower interest rate for borrowers with high credit scores, while Earnest might provide more flexible repayment options for those experiencing temporary financial hardship. Splash Financial may focus on borrowers with specific professional backgrounds. It’s important to note that these are examples, and specific offerings change frequently. Always check current rates and terms directly with each lender.

Factors to Consider When Choosing a Lender

Before selecting a lender, carefully weigh several crucial factors. This ensures you make an informed decision aligned with your long-term financial goals.

The following factors are critical for choosing the right refinancing lender:

- Interest Rate: This is the cost of borrowing money. Lower interest rates translate to lower monthly payments and less interest paid over the life of the loan.

- Fees: Many lenders charge origination fees or other processing fees. These fees can add to the overall cost of refinancing.

- Repayment Terms: Consider the loan term length (e.g., 5, 10, 15 years). Shorter terms mean higher monthly payments but less interest paid overall, while longer terms mean lower monthly payments but more interest paid overall.

- Credit Requirements: Each lender has specific credit score requirements. Understand the minimum credit score needed to qualify for refinancing.

- Customer Service: Research the lender’s reputation for customer service. Read reviews and testimonials to gauge their responsiveness and helpfulness.

- Loan Forgiveness Programs: Some lenders may offer programs for borrowers who work in certain fields or public service.

Strategies for Negotiating Favorable Terms

While you cannot directly negotiate with Nelnet, you can negotiate with the refinancing lender. Strong negotiation skills can lead to better terms.

Negotiating favorable terms often involves leveraging your strengths:

- High Credit Score: A high credit score demonstrates creditworthiness, often leading to lower interest rates.

- Strong Income: A stable and high income shows your ability to repay the loan, potentially improving your chances of securing favorable terms.

- Multiple Offers: Receiving offers from multiple lenders gives you leverage to negotiate better terms with each lender. You can use competing offers to show a lender why they should offer you a more competitive rate.

- Exceptional Financial History: A consistent history of on-time payments strengthens your negotiation position.

Checklist for Evaluating Refinancing Lenders

A structured approach simplifies the comparison process. This checklist aids in objectively evaluating potential lenders.

Use this checklist to compare different lenders:

| Lender | Interest Rate | Fees | Repayment Terms | Credit Requirements | Customer Service Rating | Loan Forgiveness Programs |

|---|---|---|---|---|---|---|

| SoFi | ||||||

| Earnest | ||||||

| Splash Financial |

Using Online Tools to Compare Lender Offerings

Many online tools and websites facilitate the comparison of different lenders’ offerings. These tools often allow you to input your financial information and receive personalized rate quotes from multiple lenders simultaneously. This streamlines the comparison process and saves time. Remember to carefully review the terms and conditions before making a decision.

The Refinancing Application Process

Refinancing your Nelnet student loans can significantly impact your monthly payments and overall loan costs. Understanding the application process is crucial for a smooth and successful refinancing experience. This section details the steps involved, necessary information, potential pitfalls, and helpful tips to navigate the process efficiently.

The application process for refinancing Nelnet student loans typically involves several key steps, each requiring careful attention to detail. Accuracy and completeness are vital to ensure a timely and positive outcome. The specific requirements may vary slightly depending on the lender you choose, so always refer to their specific instructions.

Required Information for the Application

Lenders will require comprehensive financial information to assess your creditworthiness and determine your eligibility for refinancing. This usually includes personal details like your name, address, Social Security number, and date of birth. Beyond this, expect to provide detailed information about your current Nelnet loans, including loan amounts, interest rates, and remaining balances. Furthermore, you’ll need to provide details about your income, employment history, and assets. Providing accurate and up-to-date information is paramount; inaccuracies can lead to delays or rejection of your application. Some lenders may also request tax returns or pay stubs to verify your income.

Common Application Mistakes to Avoid

Several common mistakes can hinder the refinancing process. One frequent error is providing inaccurate or incomplete information on the application. This can result in delays, requests for additional documentation, or even outright rejection. Another common mistake is failing to carefully review the terms and conditions of the loan before accepting the offer. Understanding the interest rate, repayment terms, and any fees associated with the loan is crucial. Finally, neglecting to shop around and compare offers from multiple lenders can lead to missing out on potentially better terms.

Tips for a Smooth and Efficient Application Process

Preparing your documentation in advance can significantly streamline the application process. Gather all necessary financial documents, such as pay stubs, tax returns, and loan statements, before you begin. Completing the application accurately and thoroughly the first time around minimizes the risk of delays. If you have any questions, don’t hesitate to contact the lender’s customer service for clarification. Reviewing your credit report beforehand can help identify any potential issues that might affect your application. Addressing these issues before applying can improve your chances of approval.

Step-by-Step Refinancing Application Guide

- Gather Necessary Documents: Collect all required documentation, including your Nelnet loan details, income verification, and identification.

- Compare Lender Offers: Research and compare refinancing offers from multiple lenders to find the best terms and interest rates.

- Complete the Application: Fill out the application form accurately and completely, ensuring all information is correct and up-to-date.

- Submit the Application: Submit your completed application along with all supporting documentation.

- Await Lender Review: Allow the lender sufficient time to review your application and supporting documents.

- Review Loan Terms: Carefully review the loan terms and conditions before accepting the offer.

- Finalize Refinancing: Once you’ve accepted the offer, finalize the refinancing process with the lender.

Managing Your Refinanced Nelnet Loans

Successfully managing your refinanced Nelnet student loans requires proactive planning and consistent effort. By implementing effective strategies, you can minimize stress, avoid late payments, and ultimately achieve financial freedom sooner. This section Artikels key strategies for responsible loan management.

Effective management of your refinanced loans centers around understanding your repayment plan and consistently adhering to it. This includes establishing a realistic budget, setting up automatic payments, and monitoring your account regularly for any discrepancies or potential issues.

Avoiding Late Payments

Late payments can significantly impact your credit score and incur additional fees. To avoid this, establish a system for tracking your due dates. This could involve setting reminders on your phone, using a calendar, or leveraging online banking features that offer payment alerts. Consider setting up automatic payments directly from your bank account to ensure timely payments every month, eliminating the risk of forgetting. If you anticipate a potential difficulty in making a payment, contact your lender immediately to discuss possible options, such as forbearance or deferment, before a payment becomes overdue.

Staying on Top of Loan Payments

Staying organized is crucial for consistent on-time payments. Keep all relevant loan documents in a safe and accessible place. This includes your loan agreement, payment schedule, and any communication with your lender. Regularly check your loan account online for updates on your balance, payment history, and interest accrued. Consider using budgeting apps or spreadsheets to track your income and expenses, ensuring you allocate sufficient funds for your loan payments each month. This proactive approach minimizes the risk of missed payments and associated penalties.

Minimizing Interest Charges

Interest charges can significantly increase your overall loan cost. To minimize these charges, make extra payments whenever possible. Even small additional payments can substantially reduce the principal balance and shorten the loan term. Explore the possibility of making bi-weekly payments instead of monthly payments; this effectively makes an extra monthly payment each year. Consider refinancing again if interest rates drop significantly, potentially securing a lower interest rate and saving money over the life of the loan. Always prioritize paying down higher-interest loans first to maximize savings.

Sample Budget for Loan Repayment

A well-structured budget is essential for successful loan repayment. The following example demonstrates a basic framework; you should adjust it to reflect your individual income and expenses.

| Income | Amount |

|---|---|

| Net Monthly Salary | $3000 |

| Other Income (e.g., side hustle) | $500 |

| Total Monthly Income | $3500 |

| Expenses | Amount |

| Rent/Mortgage | $1000 |

| Utilities | $200 |

| Groceries | $400 |

| Transportation | $300 |

| Student Loan Payment | $700 |

| Other Expenses (e.g., entertainment, savings) | $900 |

| Total Monthly Expenses | $3500 |

Remember, this is a sample budget. Your specific budget will depend on your individual circumstances. It’s crucial to track your spending meticulously and adjust your budget as needed.

Potential Risks and Considerations

Refinancing your Nelnet student loans can offer significant benefits, such as lower interest rates and a simplified repayment plan. However, it’s crucial to carefully weigh the potential risks before making a decision. Understanding these risks and considering your individual financial situation is vital to ensure refinancing aligns with your long-term financial goals. Failure to do so could lead to unforeseen financial hardship.

Loss of Federal Loan Benefits

Refinancing your federal student loans with a private lender means you’ll lose access to federal loan benefits. These benefits can include income-driven repayment plans, deferment and forbearance options, and loan forgiveness programs. For example, if you qualify for Public Service Loan Forgiveness (PSLF), refinancing will eliminate your eligibility for this program. This loss of flexibility could significantly impact your ability to manage your debt, especially during periods of financial hardship. Consider your eligibility for and reliance on these federal programs before proceeding with refinancing.

Higher Interest Rates (in certain scenarios)

While refinancing often aims to secure a lower interest rate, this isn’t always guaranteed. If your credit score has declined since you initially took out your loans, or if interest rates have risen in the market since your original loan origination, you may find yourself with a higher interest rate than your current federal loan. This could ultimately lead to paying more in interest over the life of the loan. For example, if your credit score was 750 when you took out your federal loans, but it has dropped to 680, you may face a higher interest rate when refinancing.

Increased Monthly Payments

Refinancing can lead to higher monthly payments, even with a lower interest rate, if you choose a shorter repayment term. While a shorter repayment period reduces the total interest paid, it also increases the monthly payment amount. This could strain your budget if not carefully planned. For instance, choosing a 5-year repayment plan instead of a 10-year plan will drastically increase your monthly payment, potentially making it difficult to manage alongside other financial obligations.

Negative Impact on Credit Score (in some cases)

The refinancing process itself involves a hard credit inquiry, which can temporarily lower your credit score. Additionally, missing payments on your refinanced loan will severely damage your credit score. This can impact your ability to secure future loans or credit cards at favorable rates. A significant drop in credit score could have long-term financial consequences, affecting everything from car loans to mortgages.

Scenarios Where Refinancing May Be Detrimental

Several scenarios highlight the potential downsides of refinancing. For instance, someone with a low credit score might face higher interest rates, negating the benefits of refinancing. Similarly, individuals heavily reliant on federal loan forgiveness programs might find themselves worse off after losing access to these crucial benefits. Finally, borrowers anticipating periods of unemployment or financial instability should carefully consider the risks of fixed monthly payments that could become unsustainable.

| Risk | Benefit | Risk | Benefit |

|---|---|---|---|

| Loss of Federal Loan Benefits | Lower Monthly Payments (potentially) | Higher Interest Rates (potentially) | Shorter Repayment Term (potentially) |

| Increased Monthly Payments (potentially) | Simplified Repayment Plan | Negative Impact on Credit Score (potentially) | Lower Overall Interest Paid (potentially) |

Illustrative Scenarios

Refinancing Nelnet student loans can significantly impact your financial situation, depending on various factors. The following scenarios illustrate situations where refinancing is beneficial, detrimental, and highlights the importance of comparing lenders. Remember that these are illustrative examples and your specific circumstances may differ.

Beneficial Refinancing Scenario

Imagine Sarah, a software engineer, with $50,000 in Nelnet student loans at a 7% interest rate. Her monthly payment is $500, and she’s projected to pay approximately $80,000 over the loan’s life. She finds a refinancing lender offering a 4% interest rate with a 10-year repayment plan. Her new monthly payment would be approximately $430, saving her $70 per month. Over the life of the loan, this refinancing will save her approximately $20,000 in interest, reducing her total repayment to roughly $60,000. This scenario demonstrates a significant financial benefit due to the lower interest rate and shorter repayment term.

Detrimental Refinancing Scenario

Consider Mark, a recent graduate with $30,000 in Nelnet loans at a 6% interest rate. He has a variable income and is considering refinancing to a lower interest rate. However, he chooses a lender offering a 5% interest rate but extends the repayment term to 20 years. While the monthly payment is reduced to a more manageable amount, the extended repayment period will lead to significantly higher total interest payments. Over 20 years, Mark will pay approximately $10,000 more in interest compared to his original loan. This scenario highlights that while a lower interest rate may seem attractive, extending the loan term can negate any savings and ultimately cost more in the long run.

Importance of Comparing Lenders

Let’s examine Jessica’s situation. She has $40,000 in Nelnet loans at a 6.5% interest rate and is exploring refinancing options. Lender A offers a 5% interest rate with a 12-year repayment term, resulting in a monthly payment of $380 and a total repayment of approximately $54,700. Lender B offers a 4.5% interest rate with a 10-year repayment term, resulting in a monthly payment of $400 and a total repayment of approximately $48,000. By comparing lenders, Jessica identifies Lender B as the better option, saving her approximately $6,700 in interest payments despite a slightly higher monthly payment. This example underscores the crucial role of comparing various lenders and their terms to secure the most financially advantageous refinancing option.

Ending Remarks

Refinancing Nelnet student loans presents a significant financial decision requiring careful consideration of your individual circumstances. While the potential for lower monthly payments and reduced interest costs is attractive, it’s crucial to weigh these benefits against potential drawbacks, such as the loss of federal loan protections. By thoroughly researching lenders, understanding eligibility requirements, and carefully evaluating your financial situation, you can make an informed choice that aligns with your long-term financial goals. Remember, seeking professional financial advice can provide valuable guidance in this process.

FAQs

What is the impact of refinancing on my credit score?

Refinancing can temporarily lower your credit score due to the hard inquiry on your credit report. However, if you maintain good payment habits after refinancing, your credit score can improve over time due to a lower debt-to-income ratio and improved credit utilization.

Can I refinance only a portion of my Nelnet loans?

Some lenders allow partial refinancing, while others require refinancing your entire Nelnet loan balance. Check with individual lenders for their specific policies.

What happens if I miss a payment after refinancing?

Missing payments after refinancing will negatively impact your credit score and could lead to late fees and potential default on your loan. It’s crucial to budget carefully and ensure timely payments.

How long does the refinancing process typically take?

The timeframe varies depending on the lender and the complexity of your application. It can range from a few weeks to several months.