Navigating the complex world of student loan debt can feel overwhelming, but understanding refinance options and their associated interest rates is crucial for achieving financial freedom. This exploration delves into the current landscape of student loan interest rates, examining the factors that influence them and outlining the various refinancing options available. We’ll explore the potential benefits and drawbacks, helping you make informed decisions about your financial future.

From understanding eligibility criteria and the impact on loan terms to analyzing the long-term financial implications, this guide provides a comprehensive overview of refinancing student loans. We’ll dissect the process, equipping you with the knowledge to confidently evaluate your options and choose the best path towards debt reduction.

Current Student Loan Interest Rate Landscape

Navigating the world of student loan refinancing can feel overwhelming, given the variety of lenders and interest rates available. Understanding the current landscape is crucial for securing the best possible terms for your financial future. This section will Artikel the factors that influence student loan interest rates and provide examples to illustrate the potential cost variations.

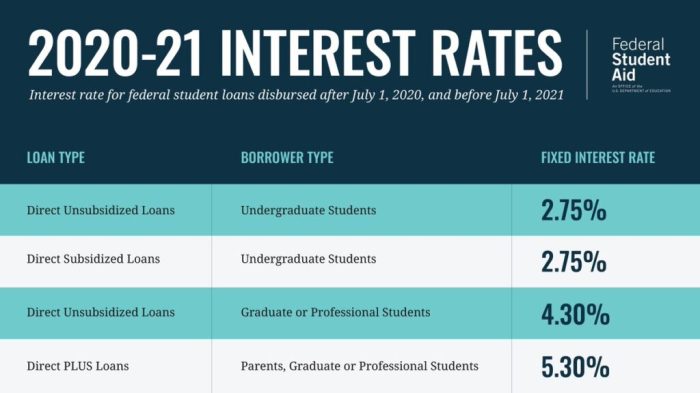

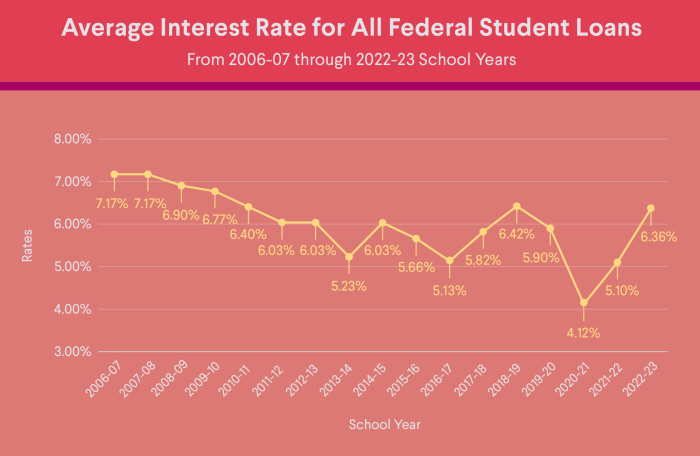

The current range of student loan interest rates varies significantly depending on several key factors. Lenders consider your credit score, the type of loan (federal vs. private), your chosen repayment plan, and the overall economic climate when determining your interest rate. Generally, borrowers with higher credit scores and lower loan-to-income ratios qualify for more favorable rates. Federal student loans typically have fixed interest rates set by the government, while private lenders offer rates that fluctuate based on market conditions and your individual creditworthiness. Choosing a shorter repayment term often results in a lower interest rate but higher monthly payments, while a longer term will typically mean a lower monthly payment but a higher overall interest cost.

Factors Influencing Student Loan Interest Rates

Several factors interact to determine the interest rate you’ll receive on a refinanced student loan. A higher credit score generally translates to a lower interest rate, reflecting a lower perceived risk for the lender. The type of loan—federal or private—also plays a crucial role, with federal loans often having more fixed and predictable rates. Your chosen repayment plan influences the total interest paid over the loan’s lifetime; shorter repayment terms result in less overall interest but higher monthly payments. Finally, prevailing economic conditions, such as the federal funds rate, can impact the rates offered by lenders.

Examples of Interest Rate Scenarios

The following table illustrates how different loan amounts, interest rates, and repayment terms can impact your monthly payments. These are examples only and actual rates may vary based on individual circumstances and lender policies.

| Loan Amount | Interest Rate | Repayment Term (Years) | Approximate Monthly Payment |

|---|---|---|---|

| $50,000 | 6.00% | 10 | $550 |

| $50,000 | 7.50% | 10 | $580 |

| $75,000 | 6.00% | 15 | $650 |

| $75,000 | 7.50% | 15 | $720 |

Refinancing Options and Eligibility

Refinancing your student loans can be a strategic move to potentially lower your monthly payments and save money on interest over the life of your loan. However, understanding the different options and eligibility requirements is crucial before making a decision. This section will Artikel the key differences between federal and private refinancing options, along with the associated eligibility criteria.

The primary distinction lies in the source of your existing loans and the lender offering the refinance. Federal student loans are backed by the government, while private student loans are offered by banks, credit unions, and other private lenders. Each type comes with its own set of benefits, drawbacks, and eligibility requirements.

Federal Student Loan Refinancing

The federal government itself does not offer a direct refinancing program for federal student loans. However, there are some options available for consolidating federal loans into a single loan with a potentially different repayment plan through the Department of Education’s programs. While this isn’t technically “refinancing” in the same way as private refinancing, it can still provide some benefits. This consolidation process often results in a simplified payment plan but may not necessarily lead to a lower interest rate. Eligibility typically requires having federal student loans in good standing.

Private Student Loan Refinancing

Private student loan refinancing involves taking out a new loan from a private lender to pay off your existing student loans. This is where you can potentially secure a lower interest rate, a shorter repayment term, or both. However, eligibility is more stringent than for federal loan consolidation.

Eligibility for private student loan refinancing typically hinges on several key factors:

- Credit Score: Lenders generally require a good to excellent credit score (typically 670 or higher) to approve refinancing. A higher credit score often translates to better interest rates.

- Income: You’ll need a stable income sufficient to make your monthly payments. Lenders will assess your income to determine your debt-to-income ratio (DTI).

- Debt-to-Income Ratio (DTI): Your DTI, calculated as your total monthly debt payments divided by your gross monthly income, is a crucial factor. A lower DTI generally improves your chances of approval and securing favorable terms.

- Loan Amount: Lenders often have minimum loan amounts they will refinance. Smaller loan balances may not be eligible for refinancing.

- Citizenship/Residency Status: Most lenders require US citizenship or permanent residency.

Comparison of Federal and Private Student Loan Refinancing

Choosing between federal loan consolidation and private refinancing requires careful consideration of your individual circumstances. Here’s a comparison:

| Feature | Federal Loan Consolidation | Private Loan Refinancing |

|---|---|---|

| Interest Rate | May not lower interest rate; weighted average of existing rates | Potentially lower interest rate based on creditworthiness |

| Loan Forgiveness Programs | Eligible for income-driven repayment plans and potential forgiveness programs (depending on loan type) | Not eligible for federal loan forgiveness programs |

| Credit Score Impact | Generally minimal impact | Requires a good to excellent credit score; can impact credit score during application process |

| Eligibility | Generally easier to qualify | More stringent eligibility requirements |

| Flexibility | Limited flexibility in repayment terms | More flexible repayment options (term length) |

Impact of Refinancing on Loan Terms

Refinancing your student loans can significantly alter your repayment schedule, impacting both the overall length of your loan and your monthly payments. Understanding these potential changes is crucial before making a decision. The primary factor influencing these changes is the new interest rate secured through refinancing.

Refinancing allows borrowers to potentially consolidate multiple loans into a single, more manageable payment, often with a lower interest rate. This, in turn, can affect the loan term. A lower interest rate may enable you to shorten the repayment period, while a higher rate might extend it. The new loan term is negotiated based on the lender’s criteria and the borrower’s creditworthiness.

Loan Term and Monthly Payment Changes

The impact of refinancing on loan terms and monthly payments can be substantial. A lower interest rate generally translates to lower monthly payments, but the overall loan term might remain the same or even shorten, depending on the borrower’s preference. Conversely, choosing a longer loan term can significantly reduce monthly payments, even if the interest rate is only slightly lower. However, this extended repayment period will lead to higher total interest paid over the life of the loan. The following table illustrates potential scenarios:

| Original Loan Term (Years) | Original Monthly Payment | Refinanced Loan Term (Years) | Refinanced Monthly Payment |

|---|---|---|---|

| 10 | $500 | 8 | $650 |

| 10 | $500 | 12 | $400 |

| 5 | $1000 | 7 | $800 |

Note: These are hypothetical examples. Actual figures will vary depending on the original loan amount, interest rate, and the terms offered by the refinancing lender.

Scenarios Leading to Shorter or Longer Repayment Periods

Refinancing can lead to a shorter repayment period if a borrower secures a significantly lower interest rate and chooses to maintain or slightly increase their monthly payment. For instance, a borrower with a high interest rate loan might refinance at a much lower rate and choose to keep the same monthly payment amount, resulting in a faster payoff. Conversely, a borrower might opt for a longer repayment period to significantly reduce their monthly payments, even if the new interest rate is slightly lower. This is often a strategic choice for borrowers who prioritize affordability over rapid loan repayment. This trade-off increases the total interest paid over the life of the loan.

Financial Implications of Refinancing

Refinancing your student loans can significantly impact your long-term financial health, potentially leading to substantial savings or unforeseen costs. Understanding the potential implications before making a decision is crucial. The ultimate effect depends on various factors, including your current interest rate, credit score, and the terms of the new loan.

Changes in interest rates directly affect the total amount paid over the life of the loan. A lower interest rate on a refinanced loan will reduce your monthly payments and the total interest paid over the loan’s duration. Conversely, a higher interest rate will increase both your monthly payments and the total interest paid. For example, refinancing a $50,000 loan from 7% to 5% interest could save thousands of dollars over the loan’s lifespan. However, refinancing to a higher rate would have the opposite effect, potentially costing you considerably more in the long run. The impact is most pronounced over longer loan terms.

Potential Benefits and Risks of Refinancing

The decision to refinance student loans involves weighing potential benefits against potential risks. Careful consideration of these factors is essential to making an informed choice.

- Lower Monthly Payments: Refinancing can lead to lower monthly payments, freeing up cash flow for other financial goals.

- Lower Interest Rate: Securing a lower interest rate can significantly reduce the total interest paid over the life of the loan, resulting in substantial long-term savings.

- Simplified Repayment: Consolidating multiple loans into a single loan can simplify repayment, making it easier to manage your finances.

- Fixed Interest Rate: Refinancing to a fixed interest rate can provide predictability and protect against future interest rate increases.

- Longer Repayment Term: Extending the repayment term can lower monthly payments, but it will generally increase the total interest paid over the life of the loan.

- Loss of Federal Protections: Refinancing federal student loans into private loans eliminates federal protections, such as income-driven repayment plans and loan forgiveness programs.

- Higher Interest Rates: If your credit score has declined since you initially took out your student loans, you may not qualify for a lower interest rate, or you may even receive a higher one.

- Prepayment Penalties: Some private lenders may charge prepayment penalties if you pay off your loan early.

Factors to Consider Before Refinancing

Refinancing student loans can offer significant savings, but it’s crucial to carefully weigh the pros and cons before making a decision. A hasty choice could lead to unforeseen financial burdens. Thorough evaluation of your personal financial situation and a comparison of various refinancing options are essential steps in this process.

Considering refinancing involves more than just comparing interest rates. Several key factors, from your credit score to your long-term financial goals, will influence whether refinancing is the right move for you. A methodical approach to evaluating your options will help ensure you make an informed decision that aligns with your financial objectives.

Credit Score and Credit History

Your credit score plays a pivotal role in determining your eligibility for refinancing and the interest rate you’ll receive. Lenders use your credit score and history to assess your creditworthiness – a higher score typically translates to more favorable terms. A lower credit score might limit your options or result in a higher interest rate, potentially negating the benefits of refinancing. Before applying, review your credit report for accuracy and work to improve your score if necessary. Consider delaying refinancing if your score is low, allowing time to improve your credit profile before seeking better loan terms.

Current Interest Rates and Loan Terms

A comprehensive comparison of your current student loan interest rates and terms with those offered by refinancing lenders is crucial. Analyze the potential savings in interest payments over the life of the loan. Consider whether the savings justify the fees associated with refinancing, such as origination fees or prepayment penalties. For instance, if your current interest rate is already quite low, the savings from refinancing might be minimal, making it less advantageous. Carefully evaluate the total cost of both your current loans and potential refinanced loans to make an informed decision.

Refinancing Process and Lender Reputation

Understanding the refinancing process and selecting a reputable lender is vital. Research the lender’s reputation, read reviews from other borrowers, and ensure they are transparent about their fees and terms. The process itself can involve paperwork, credit checks, and potentially some time delays. Factor these aspects into your decision-making process. Choosing a lender with a proven track record of customer satisfaction and clear communication will reduce potential complications. Be wary of lenders who seem too good to be true, as hidden fees or predatory lending practices could negatively impact your finances.

Step-by-Step Process for Evaluating Refinancing Options

A systematic approach to evaluating refinancing options is recommended. First, gather all relevant information about your current student loans, including interest rates, balances, and repayment schedules. Next, research different lenders, comparing their interest rates, fees, and loan terms. Then, use online calculators or seek advice from a financial advisor to estimate your potential savings and the total cost of refinancing. Finally, compare your options and choose the lender that offers the best terms and conditions while aligning with your financial goals and risk tolerance.

Checklist of Questions for Potential Lenders

Before committing to a refinance, prepare a checklist of questions to ask potential lenders. This should include inquiries about interest rates, fees, loan terms, repayment options, and the lender’s reputation and customer service. Additionally, clarify the lender’s policies on late payments and what happens if your financial situation changes. Inquire about the lender’s processes for handling complaints and disputes. Thorough questioning will ensure you understand the complete picture before signing any agreements. A clear understanding of all terms and conditions protects you from unexpected financial obligations.

Illustrative Examples of Refinancing Scenarios

Refinancing student loans can significantly impact a borrower’s financial situation, either positively or negatively depending on individual circumstances and market conditions. The following examples illustrate scenarios where refinancing proves beneficial and where it does not. These examples are for illustrative purposes only and do not constitute financial advice.

Beneficial Refinancing Scenario

Sarah, a 30-year-old software engineer, holds $50,000 in federal student loans with an average interest rate of 6.8%. Her monthly payments are $500, and she’s projected to pay off her loans in 10 years. She has a stable job with excellent credit (750 FICO score). Due to recent interest rate decreases, she qualifies for a private refinance loan with a 4.5% interest rate. By refinancing, she reduces her monthly payment to approximately $400 and shortens her repayment term to roughly 8 years, saving approximately $4,000 in interest payments over the life of the loan. Her improved credit score and stable income allowed her to secure a more favorable interest rate, resulting in substantial savings. This scenario highlights how refinancing can be advantageous for borrowers with good credit and access to lower interest rates.

Unbeneficial Refinancing Scenario

Mark, a 25-year-old freelance graphic designer, has $30,000 in federal student loans with an average interest rate of 5%. His monthly payments are $300, and he is currently on an income-driven repayment plan. He’s considering refinancing, but his credit score is only 620, and his income fluctuates. A private lender offers him a refinance loan with a 7% interest rate. While his monthly payment would decrease slightly to $280 due to a slightly longer repayment term, he would ultimately pay significantly more interest over the life of the loan—approximately $6,000 more than his current federal loan plan. Furthermore, by refinancing his federal loans into a private loan, he loses the protections afforded by federal loan programs, such as income-driven repayment plans and potential loan forgiveness programs. This scenario illustrates how refinancing can be detrimental if borrowers do not carefully consider all aspects of their financial situation and the terms of the new loan. The higher interest rate and loss of federal loan benefits outweigh any potential short-term savings in this case.

End of Discussion

Ultimately, refinancing student loans can be a powerful tool for managing debt, but it’s essential to approach the decision strategically. By carefully weighing the potential benefits against the risks, and by thoroughly researching different lenders and their offerings, you can navigate the refinancing process effectively. Remember to consider your individual financial circumstances and long-term goals before making any commitments. A well-informed decision can significantly impact your financial well-being for years to come.

Essential FAQs

What is the average interest rate for student loan refinancing?

The average interest rate varies greatly depending on credit score, loan amount, and lender. Expect rates to range from roughly 4% to 12% for private refinancing options.

Can I refinance federal student loans into private loans?

Yes, but be aware that doing so loses federal protections like income-driven repayment plans and potential forgiveness programs.

How does my credit score affect my refinance rate?

A higher credit score generally qualifies you for lower interest rates. Aim for a score above 700 for the best options.

What is the difference between fixed and variable interest rates?

Fixed rates remain constant throughout the loan term, while variable rates fluctuate with market conditions. Fixed rates offer predictability, while variable rates could potentially be lower initially.