Navigating the complexities of student loan repayment can feel overwhelming. However, understanding the power of refinancing and utilizing a refinance student loans calculator can significantly simplify the process and potentially lead to substantial savings. This guide provides a clear and concise overview of student loan refinancing, equipping you with the knowledge to make informed decisions about your financial future.

We’ll explore the benefits and risks associated with refinancing, delve into the mechanics of using a refinance calculator, and examine the key factors influencing interest rates. We’ll also compare different lenders and provide practical tips for choosing the best option for your unique circumstances. By the end, you’ll possess the tools and understanding to confidently navigate the world of student loan refinancing.

Understanding Refinancing Student Loans

Refinancing your student loans can be a powerful tool for managing your debt, but it’s crucial to understand both the potential benefits and the associated risks before making a decision. This section will explore the various aspects of student loan refinancing to help you make an informed choice.

Benefits of Refinancing Student Loans

Refinancing can offer several advantages. Lower interest rates are a primary benefit, leading to lower monthly payments and potentially significant savings over the life of the loan. Simplifying your payments by consolidating multiple loans into a single one can improve organization and reduce administrative hassle. A longer repayment term might also be available, resulting in smaller monthly payments (though this will typically increase the total interest paid). Finally, refinancing can sometimes unlock access to better loan features, such as flexible repayment options.

Risks Associated with Refinancing Student Loans

While refinancing offers benefits, it also presents risks. Losing access to federal student loan protections, such as income-driven repayment plans and forbearance options, is a significant consideration. Refinancing typically involves a hard credit inquiry, which can temporarily lower your credit score. If your credit score is lower than it was when you initially took out your student loans, you may not qualify for the most favorable interest rates. Furthermore, locking into a fixed interest rate means you won’t benefit from potential future interest rate decreases. Finally, there are potential fees associated with refinancing, which should be factored into your decision.

Types of Student Loan Refinancing Options

Several options exist for refinancing student loans. The most common are fixed-rate loans and variable-rate loans. Fixed-rate loans offer predictable monthly payments, as the interest rate remains constant throughout the loan term. Variable-rate loans offer potentially lower initial interest rates, but the rate can fluctuate over time, leading to unpredictable monthly payments. Some lenders offer loans with varying repayment terms, allowing borrowers to choose a term that best suits their financial situation. Additionally, some lenders specialize in refinancing specific types of student loans, such as federal or private loans.

Situations Where Refinancing is Beneficial

Refinancing can be particularly advantageous in several scenarios. For example, if you have a high credit score and qualify for a significantly lower interest rate than your current loans, refinancing can save you considerable money over time. If you have multiple student loans with different interest rates and terms, consolidating them into a single loan can simplify repayment and potentially lower your overall interest rate. If you’ve experienced a substantial increase in income since taking out your student loans, you may qualify for more favorable terms. Finally, if you are seeking a more manageable monthly payment, a longer repayment term (with the understanding of increased total interest paid) may be a beneficial option.

Fixed vs. Variable Interest Rates

| Feature | Fixed Interest Rate | Variable Interest Rate |

|---|---|---|

| Interest Rate | Stays the same throughout the loan term | Fluctuates based on market conditions |

| Predictability | Highly predictable monthly payments | Unpredictable monthly payments |

| Risk | Lower risk, but potentially higher initial interest rate | Higher risk, but potentially lower initial interest rate |

| Best for | Borrowers who prioritize stability and predictability | Borrowers who are comfortable with risk and believe rates will stay low or decrease |

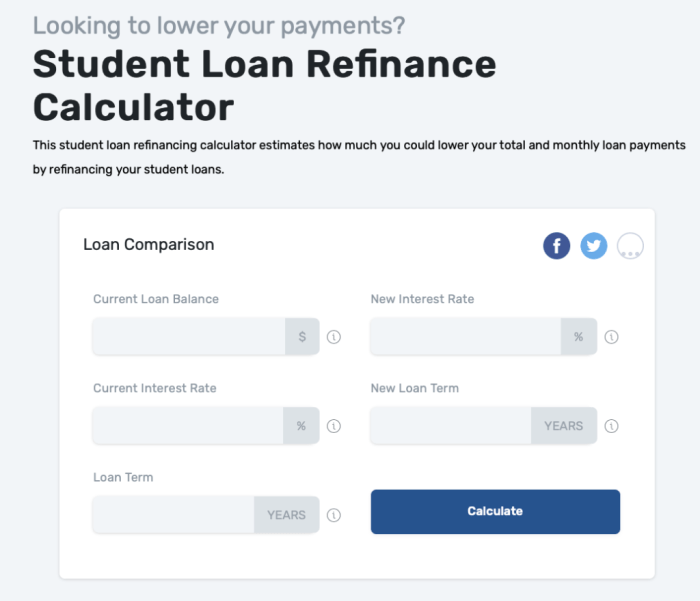

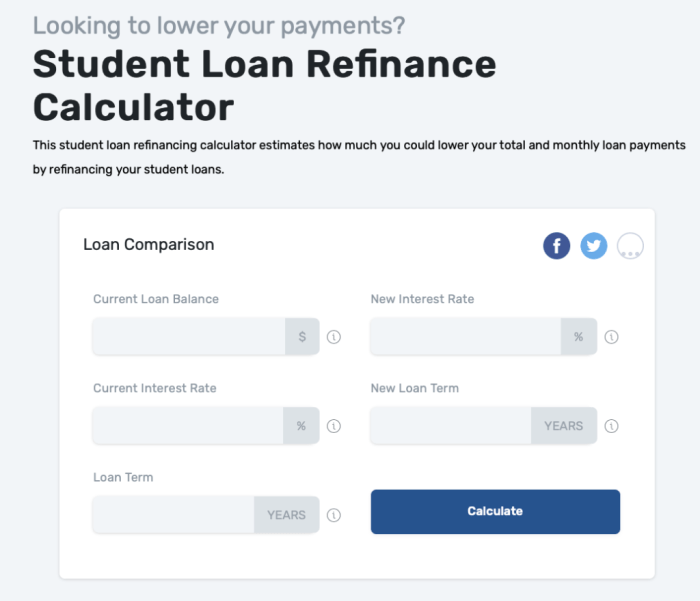

Using a Student Loan Refinance Calculator

Student loan refinance calculators are invaluable tools for anyone considering refinancing their student loans. They provide a quick and easy way to estimate potential savings and explore different repayment scenarios before committing to a new loan. Understanding how to use these calculators effectively is crucial for making informed financial decisions.

Key Inputs for Student Loan Refinance Calculators

Most student loan refinance calculators require several key pieces of information to generate accurate estimates. These typically include the total amount of your current student loan debt, the current interest rates on your loans, the remaining terms of your loans, and your desired repayment term for the refinanced loan. Additionally, many calculators allow you to input your credit score (or a range), which significantly impacts the interest rate offered. Some more sophisticated calculators may also ask for information about your income and debt-to-income ratio to assess your eligibility for refinancing. Providing accurate information is crucial for receiving a realistic estimate. Inaccurate input will lead to inaccurate results.

Determining Potential Monthly Payments

The calculator uses a standard amortization formula to determine your potential monthly payments. This formula considers the principal loan amount (the original loan balance), the interest rate, and the loan term (length of the repayment period). Essentially, the calculator divides the total loan amount plus accumulated interest over the chosen repayment period into equal monthly installments. For example, a $50,000 loan at 6% interest over 10 years would result in a higher monthly payment than the same loan over 15 years. The longer the repayment term, the lower the monthly payment, but the higher the total interest paid over the life of the loan.

Interpreting Refinance Calculator Results

The results from a refinance calculator typically include your estimated monthly payment, the total interest you’ll pay over the life of the refinanced loan, and the total amount you’ll repay. By comparing these figures to your current loan payments and total interest, you can easily assess the potential savings of refinancing. For instance, if your current monthly payments are $800 and the calculator shows a potential monthly payment of $600 with a significantly lower total interest paid, it suggests a substantial benefit from refinancing. However, always remember that these are estimates, and the final terms offered by a lender may vary slightly.

Tips for Effective Refinance Calculator Use

To maximize the effectiveness of a student loan refinance calculator, consider exploring different scenarios. Experiment with various loan terms to see how they affect your monthly payment and total interest. Also, try inputting different interest rate estimates to account for potential variations based on your credit score and the lender. Remember that a lower interest rate will generally lead to lower monthly payments and total interest paid. Finally, compare results from multiple calculators and lenders to ensure you’re getting the best possible deal.

Step-by-Step Guide to Using a Student Loan Refinance Calculator

First, gather all the necessary information about your current student loans. This includes the loan amount, interest rates, and remaining terms for each loan. Second, find a reputable student loan refinance calculator online; many are offered by banks and lending institutions. Third, input your data accurately into the calculator fields. Fourth, experiment with different loan terms and interest rate estimates to see the impact on your monthly payment and total interest paid. Fifth, carefully review and compare the results from different scenarios. Finally, compare the results from different calculators and lenders to find the most advantageous refinancing option. Remember to always read the fine print and understand the terms and conditions of any loan offer before signing.

Factors Affecting Refinance Rates

Securing a favorable interest rate on your student loan refinance is crucial for minimizing your overall borrowing costs. Several interconnected factors influence the rate you’ll receive, impacting both your monthly payments and the total amount you repay. Understanding these factors empowers you to make informed decisions and potentially negotiate a better deal.

Credit Score’s Influence on Refinance Eligibility and Rates

Your credit score is arguably the most significant factor determining your eligibility for refinancing and the interest rate offered. Lenders use your credit score to assess your creditworthiness – essentially, your likelihood of repaying the loan. A higher credit score (generally above 700) typically qualifies you for lower interest rates, reflecting a lower perceived risk for the lender. Conversely, a lower credit score may lead to higher rates or even rejection of your application. For example, a borrower with a 750 credit score might qualify for a rate of 5%, while a borrower with a 650 credit score might receive a rate of 7% or higher, or be denied altogether. This difference in rates can significantly impact the total cost of the loan over its lifespan.

Debt-to-Income Ratio (DTI) and its Impact

Your debt-to-income ratio (DTI), calculated by dividing your total monthly debt payments by your gross monthly income, also plays a crucial role. A lower DTI indicates that you have more disposable income relative to your debt, suggesting a lower risk of default. Lenders prefer borrowers with lower DTIs, often offering better rates to those demonstrating responsible financial management. A borrower with a DTI of 30% might receive a more favorable rate than one with a DTI of 45%.

Loan Amount and Type

The amount you’re seeking to refinance and the type of loan you’re refinancing (federal vs. private) both influence the interest rate. Larger loan amounts might come with slightly higher rates due to increased risk for the lender. Similarly, refinancing federal loans, which often have government-backed protections, may present different rate structures than refinancing private loans. For instance, the interest rate for refinancing a $50,000 loan could be marginally higher than for a $25,000 loan, all other factors being equal.

Loan Term’s Influence on Monthly Payments and Total Cost

The length of your loan term (e.g., 5 years, 10 years, 15 years) significantly impacts both your monthly payments and the total interest paid. Shorter loan terms result in higher monthly payments but lower overall interest costs due to less time accruing interest. Longer loan terms lead to lower monthly payments but significantly higher total interest costs. For example, a $30,000 loan at 6% interest would have a monthly payment of approximately $566 for a 5-year term, totaling $33,960 repaid, while the same loan with a 10-year term would have a monthly payment of approximately $320, totaling $38,400 repaid. The difference in total cost is substantial.

Prioritized List of Factors Influencing Refinance Rates

The factors affecting refinance rates can be prioritized as follows:

- Credit Score: This is the most impactful factor, directly influencing eligibility and the offered interest rate.

- Debt-to-Income Ratio (DTI): A lower DTI demonstrates financial responsibility and often leads to better rates.

- Loan Amount and Type: Larger loan amounts and the type of loan being refinanced can slightly affect the rate.

- Loan Term: Choosing a shorter term reduces total interest paid but increases monthly payments.

Examples of How Various Factors Impact Total Loan Cost

Consider two borrowers refinancing $50,000 in student loans:

| Borrower | Credit Score | DTI | Loan Term | Interest Rate | Total Interest Paid (Estimate) |

|---|---|---|---|---|---|

| A | 780 | 25% | 5 years | 5% | $4,150 |

| B | 680 | 40% | 10 years | 7% | $11,500 |

This example illustrates how a higher credit score, lower DTI, and shorter loan term can significantly reduce the total interest paid over the life of the loan. Borrower A, with better credit and a shorter loan term, pays considerably less in interest compared to Borrower B.

Choosing a Lender

Selecting the right lender for your student loan refinancing is crucial. The terms you secure will significantly impact your monthly payments and overall repayment costs. Carefully comparing lenders and their offerings is essential to finding the best fit for your financial situation.

Comparing Lender Features and Services

Different lenders offer varying features and services. These can include loan amounts, interest rates, repayment terms, and additional benefits like hardship programs or customer support options. Some lenders may specialize in refinancing specific types of student loans, such as federal or private loans. Consider factors like the lender’s reputation, financial stability, and the availability of tools and resources to help manage your loan. A lender with a user-friendly online platform and responsive customer service can greatly simplify the refinancing process.

The Importance of Lender Reviews and Customer Feedback

Before committing to a lender, thoroughly review their online reputation. Websites like the Better Business Bureau (BBB) and independent review sites often provide valuable insights into customer experiences. Pay close attention to reviews that discuss aspects like customer service responsiveness, ease of application, transparency of fees, and the lender’s handling of any issues or disputes. Negative reviews, while not always indicative of a poor lender, can highlight potential red flags that warrant further investigation. Positive reviews, conversely, can offer reassurance and build confidence in a lender’s reliability.

The Student Loan Refinancing Application Process

The application process generally involves providing personal information, employment history, and details of your existing student loans. Lenders will typically pull your credit report to assess your creditworthiness. You’ll likely need to provide documentation to verify your income and student loan debt. The application process can vary between lenders, so reviewing each lender’s specific requirements is important. Once you submit your application, the lender will review it and notify you of their decision. This process usually takes several weeks.

Checklist for Selecting a Lender

Choosing the right lender involves considering several key factors. A comprehensive checklist should include:

- Interest rates and fees: Compare the Annual Percentage Rate (APR) and any associated fees across different lenders.

- Repayment terms: Consider the length of the repayment period and its impact on your monthly payments and total interest paid.

- Loan amounts: Ensure the lender offers refinancing options for your total loan balance.

- Customer service: Evaluate the lender’s responsiveness, accessibility, and overall helpfulness.

- Financial stability and reputation: Research the lender’s history and financial strength.

- Eligibility requirements: Check if you meet the lender’s criteria for refinancing.

- Additional benefits: Look for features like hardship programs or flexible repayment options.

Comparison of Key Lender Features

| Lender | APR Range | Repayment Terms | Customer Service Rating (Example) |

|---|---|---|---|

| Lender A | 4.5% – 8.0% | 5-15 years | 4.5/5 stars |

| Lender B | 4.0% – 7.5% | 3-12 years | 4.0/5 stars |

| Lender C | 5.0% – 9.0% | 5-20 years | 4.2/5 stars |

Visual Representation of Refinancing Scenarios

Understanding the potential benefits of refinancing student loans often requires visualizing the impact of different variables. Charts and graphs can effectively demonstrate how changes in interest rates and loan terms affect your total repayment costs and overall savings. This section presents several scenarios to illustrate these impacts.

Potential Savings from Refinancing at Different Interest Rates

This chart displays the potential monthly payment savings and total interest savings over the life of a $30,000 loan with various refinance interest rates, assuming a 10-year repayment term. The original loan is assumed to have a 7% interest rate.

| Original Interest Rate | Refinanced Interest Rate | Monthly Payment Savings | Total Interest Savings |

|—|—|—|—|

| 7% | 5% | $67.74 | $4,064.40 |

| 7% | 6% | $26.84 | $1,610.40 |

| 7% | 4% | $109.16 | $6,549.60 |

*(Note: These figures are illustrative and based on a simplified calculation. Actual savings may vary depending on individual loan terms and lender fees.)*

Impact of Loan Term Length on Total Interest Paid

This bar graph compares the total interest paid on a $30,000 loan at a 5% interest rate across different loan terms. Shorter loan terms result in lower total interest paid, but higher monthly payments.

Imagine a bar graph. The horizontal axis displays loan terms (5 years, 10 years, 15 years, 20 years). The vertical axis represents total interest paid. The bars would show a progressively increasing height from left to right, clearly illustrating that longer loan terms lead to significantly higher total interest payments. For example, a 5-year loan might show total interest paid of $3,750, while a 20-year loan might show total interest paid of $15,000.

Advantageous Refinancing Scenario

Consider a borrower with $40,000 in federal student loans at an average interest rate of 7%. They have a good credit score and stable income. By refinancing to a private lender offering a 4% interest rate with a 10-year term, they can significantly reduce their monthly payment and save thousands of dollars in interest over the life of the loan.

Imagine a line graph. The x-axis represents time (in years), and the y-axis represents the cumulative interest paid. One line represents the original loan at 7%, showing a steep upward curve. The second line represents the refinanced loan at 4%, showing a less steep curve, clearly illustrating the reduced interest paid over time.

Scenario Where Refinancing Might Not Be Beneficial

A borrower with a low credit score and inconsistent income may find it difficult to qualify for a favorable refinance rate. They might only be offered a rate only slightly lower than their current rate, and the closing costs associated with refinancing could outweigh any potential savings. In this case, refinancing would not be advantageous.

Imagine a simple bar chart. One bar represents the total cost (principal + interest) of the current loan. The second bar represents the total cost of the refinanced loan, including closing costs. If the second bar is taller than the first, it visually demonstrates that refinancing is not financially beneficial in this scenario.

Hypothetical Loan Refinancing Scenario

Sarah has $50,000 in federal student loans at an average interest rate of 6.5%. Her current monthly payment is $600. She has a good credit score (750) and a stable income. She considers refinancing with a private lender offering a 4% interest rate over a 12-year term. The lender charges a $500 origination fee. Refinancing reduces her monthly payment to approximately $450 and saves her approximately $10,000 in interest over the life of the loan, even after accounting for the origination fee. The reduced monthly payment allows her to allocate more funds towards other financial goals.

Concluding Remarks

Refinancing your student loans can be a powerful tool for managing debt, but it requires careful consideration. By understanding the factors influencing interest rates, effectively using a refinance student loans calculator, and thoroughly researching lenders, you can make an informed decision that aligns with your financial goals. Remember, proactive planning and a clear understanding of your options are crucial to achieving long-term financial success. This guide provides a foundation for that journey, empowering you to take control of your student loan debt.

Quick FAQs

What is the difference between fixed and variable interest rates for refinanced student loans?

Fixed interest rates remain constant throughout the loan term, providing predictable monthly payments. Variable interest rates fluctuate based on market conditions, potentially leading to lower initial payments but higher payments later if rates rise.

How often should I check my credit score before applying for student loan refinancing?

It’s advisable to check your credit score regularly, ideally several months before applying for refinancing, to identify and address any potential issues that could impact your eligibility and interest rate.

Can I refinance federal student loans?

Refinancing federal student loans into private loans means losing federal protections, such as income-driven repayment plans and potential forgiveness programs. Carefully weigh the pros and cons before making this decision.

What happens if I miss a payment on my refinanced student loan?

Missing payments can negatively impact your credit score and potentially lead to late fees and penalties. Contact your lender immediately if you anticipate difficulties making a payment to explore possible solutions.