Navigating the complex world of student loan refinancing can be daunting, especially when considering the unique circumstances of Parent PLUS loans. This guide provides a comprehensive overview of refinancing Parent PLUS loans in a student’s name, exploring eligibility criteria, loan terms, application processes, and potential financial implications. We’ll delve into the benefits and risks, compare various lenders, and examine alternative strategies to help you make informed decisions about your financial future.

Understanding the intricacies of transferring Parent PLUS loan responsibility to the student borrower requires careful consideration of several key factors. These include the student’s creditworthiness, the potential interest rate changes, and the long-term financial impact on both the parent and the student. This analysis aims to illuminate these considerations, empowering you to make the best choice for your specific financial situation.

Eligibility Requirements for Refinancing Parent PLUS Loans

Refinancing your Parent PLUS loans in your student’s name can offer significant savings, but it’s crucial to understand the eligibility requirements before applying. Lenders assess applicants based on a combination of creditworthiness, income, and debt levels. Meeting these criteria is essential for securing a favorable interest rate and loan terms. The process can seem complex, but understanding the key elements will help you navigate it effectively.

Credit Score Requirements

A strong credit score is typically a primary factor in determining eligibility for Parent PLUS loan refinancing. Most lenders require a minimum credit score, often in the good to excellent range (generally above 660-700), though this can vary. A higher credit score usually translates to better interest rates and loan terms. Some lenders may consider applicants with lower credit scores, but they might offer less favorable rates or require a co-signer. It’s important to check each lender’s specific requirements, as they can differ significantly.

Income Levels and Debt-to-Income Ratio

Lenders assess your income to determine your ability to repay the refinanced loan. They often calculate your debt-to-income ratio (DTI), which compares your monthly debt payments to your gross monthly income. A lower DTI generally indicates a lower risk to the lender. While specific income requirements vary by lender, a stable income history is usually necessary. Some lenders may be more flexible with income levels than others, particularly if your credit score is exceptionally strong. This highlights the importance of having a comprehensive financial picture before applying.

Differences in Eligibility Requirements Between Lenders

Eligibility criteria can differ substantially between lenders. Some lenders may prioritize credit score, while others might place more emphasis on income and DTI. Some might be more lenient with borrowers who have experienced past credit issues, while others may have stricter guidelines. It’s essential to research and compare the requirements of several lenders before choosing one. This comparative analysis will help you identify the lender that best aligns with your financial profile and circumstances.

Comparison of Eligibility Criteria Across Lenders

| Lender | Minimum Credit Score | Income Requirements | Debt-to-Income Ratio (DTI) |

|---|---|---|---|

| Lender A (Example) | 680 | Stable income for past 2 years | 43% or less |

| Lender B (Example) | 660 | Sufficient income to cover monthly payments | 50% or less |

| Lender C (Example) | 700 | Verifiable income source | 40% or less |

*Note: The data presented in this table is for illustrative purposes only and should not be considered financial advice. Always refer to the official websites of the lenders for the most up-to-date and accurate information.*

Loan Terms and Interest Rates

Refinancing your Parent PLUS loans in your name can offer significant savings, but understanding the loan terms and interest rates is crucial for making an informed decision. Different lenders offer varying rates and terms, so careful comparison shopping is essential. This section will Artikel key factors to consider when evaluating refinancing options.

Interest rates for Parent PLUS loan refinancing vary considerably depending on several factors, including your credit score, income, loan amount, and the lender. While some lenders advertise exceptionally low rates, it’s important to remember that these are often introductory rates or apply only to borrowers with exceptional credit profiles. A thorough understanding of the fine print is necessary to avoid unexpected increases in your monthly payments.

Interest Rate Comparison Among Lenders

Lenders offering Parent PLUS loan refinancing often present a range of interest rates. For example, Lender A might offer rates from 4.5% to 8%, while Lender B might offer rates from 5% to 9%. These ranges reflect the varying creditworthiness of borrowers. A borrower with a high credit score and stable income will likely qualify for a rate near the lower end of the range, whereas a borrower with a lower credit score or less stable income may receive a rate closer to the higher end. It’s important to note that these are illustrative examples and actual rates can vary significantly depending on the current market conditions and individual borrower profiles. It’s advisable to obtain personalized rate quotes from multiple lenders to compare.

Examples of Loan Terms and Fees

Refinancing a Parent PLUS loan typically involves choosing a repayment term, which determines the length of time you have to repay the loan. Common repayment periods range from 5 to 15 years. A shorter repayment period leads to higher monthly payments but less interest paid over the life of the loan. Conversely, a longer repayment period results in lower monthly payments but higher overall interest costs.

For example, a $50,000 loan refinanced at 6% interest could have monthly payments of approximately $843 for a 5-year term or approximately $421 for a 10-year term. These are estimations and the actual figures will depend on the specific lender and loan terms.

Many lenders also charge fees associated with refinancing, such as origination fees or prepayment penalties. Origination fees are typically a percentage of the loan amount and are deducted upfront. Prepayment penalties may be imposed if you pay off the loan early. Carefully review the loan agreement to understand any associated fees.

Factors Influencing Interest Rates

Several factors influence the interest rate you’ll receive on a refinanced Parent PLUS loan. Understanding these factors can help you improve your chances of securing a favorable rate.

- Credit Score: A higher credit score generally results in a lower interest rate. Lenders view borrowers with higher credit scores as less risky.

- Income: A stable and substantial income demonstrates your ability to repay the loan, often leading to better interest rates.

- Debt-to-Income Ratio (DTI): A lower DTI ratio, which compares your monthly debt payments to your monthly income, indicates lower financial risk and may result in a more favorable interest rate.

- Loan Amount: The size of the loan can influence the interest rate offered. Larger loan amounts may carry slightly higher rates in some cases.

- Loan Term: Shorter loan terms generally come with lower interest rates, but higher monthly payments.

- Market Conditions: Interest rates are influenced by prevailing economic conditions and market trends. Rates may fluctuate based on overall economic health.

- Lender’s Policies: Each lender has its own underwriting guidelines and criteria that influence the interest rates they offer.

The Application Process

Refinancing your Parent PLUS loans in your student’s name can seem complex, but breaking down the process into manageable steps makes it significantly easier. The specific requirements and procedures may vary slightly depending on the lender you choose, so always refer to their individual guidelines. This Artikel provides a general overview of what you can expect.

The application process generally involves several key steps, from initial inquiry to final loan disbursement. Careful preparation and attention to detail throughout this process will ensure a smoother and more efficient experience.

Required Documentation

Gathering the necessary documentation upfront will significantly expedite the application process. Lenders typically require verification of your identity, income, and creditworthiness. This often includes providing government-issued identification, tax returns, pay stubs, and bank statements. Additionally, you will need to provide details about the Parent PLUS loan you wish to refinance, including the loan amount, interest rate, and lender. Some lenders may also request proof of enrollment or graduation for the student. Providing all required documentation promptly will prevent delays in processing your application.

Application Steps

- Pre-qualification: Before formally applying, many lenders offer a pre-qualification process. This allows you to get an estimate of your potential interest rate and loan terms without impacting your credit score. This step helps you compare offers from different lenders and choose the best option for your financial situation.

- Formal Application: Once you’ve chosen a lender, you’ll need to complete their formal application. This typically involves providing personal information, employment details, and loan details. Accuracy is crucial at this stage to avoid delays.

- Document Submission: Upload or mail all the required documentation as specified by the lender. This is where having all your documents organized beforehand will prove invaluable. Ensure all documents are legible and clearly identify the relevant information.

- Credit Check and Verification: The lender will conduct a credit check and verify the information you’ve provided. This is a standard procedure to assess your creditworthiness and ensure the accuracy of your application details.

- Loan Approval or Denial: After reviewing your application and documentation, the lender will notify you of their decision. If approved, you’ll receive a loan offer outlining the terms and conditions.

- Loan Closing and Disbursement: If you accept the loan offer, the lender will guide you through the closing process, which may involve signing electronic documents. Once the closing is complete, the funds will be disbursed according to the agreed-upon terms. This may involve direct payment to the original lender to pay off the Parent PLUS loan.

Understanding Loan Disbursement

Loan disbursement is the final stage of the refinancing process, where the lender transfers the refinanced funds. The disbursement method varies depending on the lender, but it typically involves a direct transfer to your account or a payment made to your previous lender to pay off the original Parent PLUS loan. The time it takes to receive the funds after loan closing can range from a few business days to several weeks, depending on the lender’s processing time. It is important to understand the disbursement timeline to ensure a smooth transition.

Financial Implications and Benefits

Refinancing Parent PLUS loans into your name can significantly alter your long-term financial picture. While it offers potential benefits like lower monthly payments and potentially lower overall interest paid, it also carries risks that require careful consideration. Understanding these implications is crucial before making a decision. This section will explore the potential financial advantages and disadvantages, providing concrete examples to illustrate the impact on your finances.

Refinancing your parent’s PLUS loans can lead to substantial savings over the life of the loan, primarily through lower interest rates. Many lenders offer lower interest rates on student loans than the government does on Parent PLUS loans. This difference, even a small percentage point, can accumulate to a considerable sum over several years of repayment. Conversely, refinancing might result in a higher interest rate if your credit score is low or your income is insufficient to qualify for the most favorable terms. Additionally, refinancing may lengthen your repayment term, resulting in paying more interest overall despite lower monthly payments. The choice depends on carefully weighing the short-term and long-term financial ramifications.

Monthly Payment and Total Interest Paid

Let’s consider two scenarios to illustrate the potential impact of refinancing. Suppose a Parent PLUS loan has a balance of $50,000 with a 7% interest rate and a 10-year repayment term. The monthly payment would be approximately $600. If this loan is refinanced at a 5% interest rate with a 12-year repayment term, the monthly payment could decrease to approximately $450. However, the total interest paid over the life of the loan would increase from approximately $12,000 to approximately $16,000. Conversely, if refinanced at a 4% interest rate with a 10-year term, the monthly payment would be approximately $500, and the total interest paid would decrease to approximately $10,000. These are estimates and actual figures will vary depending on the lender and specific loan terms.

Tax Implications of Refinancing Student Loans

The tax implications of refinancing Parent PLUS loans are generally minimal. Interest paid on federal student loans is usually deductible, but this deduction is subject to certain income limitations and phase-outs. Refinancing to a private loan might eliminate this deduction, depending on the lender and the loan terms. It’s crucial to consult a tax advisor to assess the specific tax consequences of your situation, as tax laws are subject to change. This is especially important if you are considering refinancing to a private loan. For example, the interest paid on a private loan might not be deductible, whereas the interest paid on the original Parent PLUS loan may have been partially deductible. This difference can impact your annual tax liability.

Risks and Considerations

Refinancing your Parent PLUS loans can offer significant financial advantages, but it’s crucial to carefully weigh the potential risks before making a decision. This section Artikels key considerations to help you make an informed choice. Understanding these potential downsides is as important as understanding the benefits.

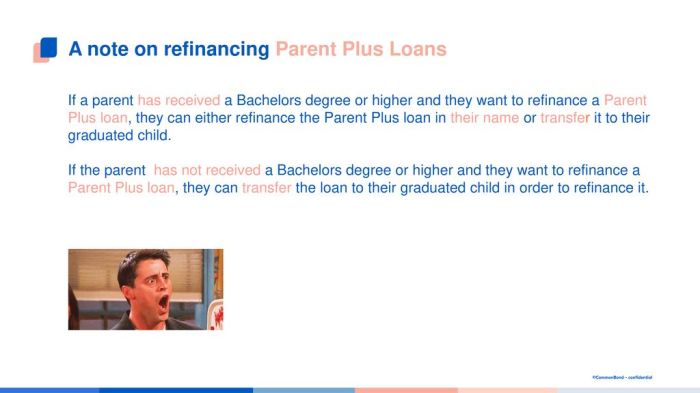

Refinancing Parent PLUS loans involves transferring your federal loans to a private lender. This action carries several implications, primarily the loss of certain federal protections and benefits. It’s a significant change that should not be undertaken lightly.

Loss of Federal Student Loan Benefits

By refinancing your Parent PLUS loans into a private loan, you forfeit the benefits associated with federal student loans. These benefits include income-driven repayment plans (IDR), which adjust your monthly payments based on your income and family size, forbearance and deferment options, which provide temporary pauses in repayment during financial hardship, and loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), which can forgive remaining balances after a certain number of qualifying payments. Losing these protections could significantly impact your ability to manage your debt, especially during unexpected financial challenges. For example, if you experience a job loss, you may find it much harder to manage your payments under a private loan compared to a federal loan with IDR and forbearance options.

Implications of Defaulting on a Refinanced Loan

Defaulting on a refinanced Parent PLUS loan carries severe consequences. Unlike federal student loans, which have specific protections under federal law, defaulting on a private loan can lead to damage to your credit score, wage garnishment, and legal action by the lender. The lender may also pursue other collection methods, such as debt collection agencies, which can add to the stress and financial burden. The negative impact on your credit score can make it difficult to obtain future loans, rent an apartment, or even secure a job. For instance, a default could make it nearly impossible to buy a house for years to come due to the significant drop in credit score.

Refinancing vs. Maintaining the Original Parent PLUS Loan

The decision to refinance or maintain your Parent PLUS loans hinges on a careful comparison of advantages and disadvantages. Maintaining the original loans guarantees access to federal protections, but may involve higher interest rates. Refinancing might offer lower interest rates, but sacrifices these crucial protections. For example, a lower interest rate on a refinanced loan could lead to significant savings over the life of the loan, but the loss of income-driven repayment plans could make monthly payments unaffordable during periods of financial instability. The best option depends entirely on your individual financial circumstances, risk tolerance, and long-term financial goals.

Alternatives to Refinancing

Refinancing your Parent PLUS loans isn’t the only path to managing them effectively. Several alternative strategies can help you lower your monthly payments, potentially saving you money over the life of the loan. These options may be more suitable depending on your individual financial circumstances and long-term goals. Carefully considering the pros and cons of each approach is crucial before making a decision.

Exploring these alternatives allows you to compare refinancing with other viable strategies. Understanding the implications of each option will empower you to make an informed choice that aligns with your financial situation and priorities.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payment based on your income and family size. This can significantly lower your payments, making them more manageable, especially during periods of lower income or unexpected expenses. Several IDR plans exist, each with its own eligibility criteria and payment calculation methods. These plans are designed to make repayment more sustainable for borrowers facing financial hardship. However, it’s important to understand that extending the repayment period will typically lead to paying more in interest over the life of the loan.

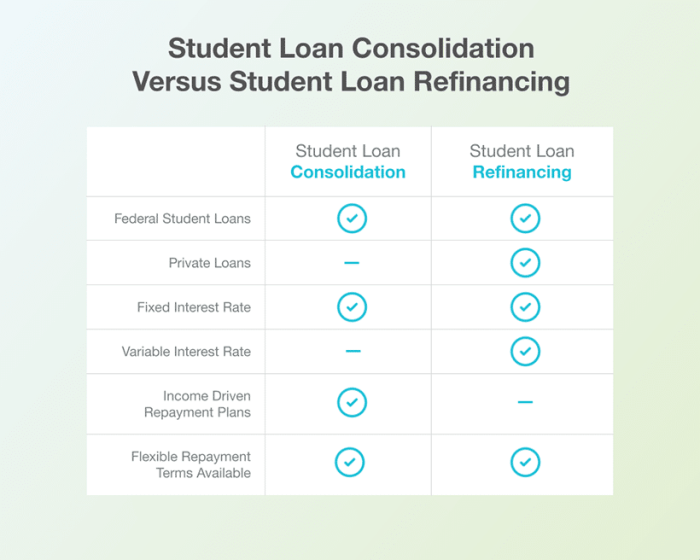

Loan Consolidation

Loan consolidation combines multiple federal student loans into a single loan with a new interest rate and repayment schedule. While this doesn’t lower your overall interest rate, it simplifies your repayment process by dealing with just one monthly payment. This can be beneficial for organization and budgeting purposes. Consolidating your Parent PLUS loans with other federal student loans might be a particularly attractive option if you have a mix of loan types with varying interest rates. However, you should carefully consider the potential impact on your overall interest paid.

Comparison of Loan Repayment Strategies

The following table compares three common loan repayment strategies: Standard Repayment, Income-Driven Repayment, and Extended Repayment. Remember that specific details may vary based on the lender and loan type.

| Repayment Plan | Monthly Payment | Repayment Period | Total Interest Paid |

|---|---|---|---|

| Standard Repayment | Fixed, typically higher | 10 years | Lower than IDR or Extended |

| Income-Driven Repayment (Example: ICR) | Variable, based on income | Up to 25 years | Higher than Standard, potentially lower than Extended |

| Extended Repayment | Lower than Standard | Up to 30 years | Highest of the three |

Illustrative Scenarios

Refinancing Parent PLUS loans can significantly alter a student’s financial trajectory, depending on individual circumstances. The following scenarios illustrate how refinancing can be beneficial in one situation and detrimental in another, highlighting the importance of careful consideration before proceeding. We will analyze the impact of refinancing on loan amounts, interest rates, and repayment periods to demonstrate the potential financial implications.

Scenario 1: Beneficial Refinancing

Imagine Sarah, who has $50,000 in Parent PLUS loans with a 7.5% interest rate and a 10-year repayment period. Her monthly payment is approximately $600. After graduating, Sarah secures a well-paying job and qualifies for refinancing with a private lender offering a 4.5% interest rate and a 12-year repayment period. This refinancing strategy reduces her monthly payment to approximately $450, saving her $150 per month. Over the life of the loan, this translates to substantial savings, potentially thousands of dollars in reduced interest payments. The longer repayment period slightly increases the total amount paid, but the lower interest rate more than compensates for this increase, resulting in significant long-term cost savings. The lower monthly payment also frees up cash flow for other financial priorities like saving for a down payment on a house or investing.

Scenario 2: Detrimental Refinancing

Now consider David, who also has $50,000 in Parent PLUS loans at 7.5% interest with a 10-year repayment plan. However, David is facing job insecurity and has a lower credit score. He is offered a refinancing option with a higher interest rate of 9% and a 15-year repayment period. While the monthly payment is lower initially (approximately $480), the extended repayment term and higher interest rate ultimately cost him significantly more over the life of the loan. He ends up paying substantially more in interest than he would have with his original loan. In this scenario, refinancing is not financially advantageous and could worsen his financial situation. The seemingly smaller monthly payment comes at the cost of a much larger total repayment amount. This scenario underscores the importance of carefully evaluating the terms of any refinancing offer, particularly when financial stability is uncertain.

Final Conclusion

Ultimately, deciding whether to refinance Parent PLUS loans in a student’s name requires a thorough assessment of individual circumstances. Weighing the potential benefits of lower interest rates and simplified repayment against the risks of losing federal protections is crucial. By carefully considering the information presented here, including the eligibility requirements, loan terms, and alternative options, borrowers can make a well-informed decision that aligns with their long-term financial goals. Remember to consult with a financial advisor for personalized guidance.

User Queries

Can I refinance a Parent PLUS loan if I have bad credit?

While some lenders may offer refinancing options with less-than-perfect credit, securing favorable terms will be more challenging. Your chances improve with a co-signer who has good credit.

What happens to federal loan benefits after refinancing?

Refinancing a federal Parent PLUS loan typically converts it into a private loan, forfeiting benefits like income-driven repayment plans and federal loan forgiveness programs.

How long does the refinancing process take?

The timeframe varies depending on the lender and the complexity of your application. It generally takes several weeks to complete the process, from application to loan disbursement.

Are there prepayment penalties for refinanced loans?

Most private lenders do not charge prepayment penalties, but it’s essential to check your loan agreement to confirm.