Navigating the complexities of student loan repayment can feel overwhelming, but understanding your options is key to long-term financial well-being. The REPAYE (Revised Pay As You Earn) plan offers a potential pathway to manageable monthly payments and eventual loan forgiveness, but it’s crucial to understand its intricacies before committing. This guide provides a clear and concise overview of the REPAYE plan, covering eligibility, payment calculations, forgiveness criteria, and potential drawbacks, ultimately empowering you to make informed decisions about your student loan debt.

We’ll explore the mechanics of REPAYE, comparing it to other income-driven repayment (IDR) plans and examining its impact on your long-term financial planning. Through real-world examples and hypothetical scenarios, we aim to demystify the process and equip you with the knowledge to effectively manage your student loans under REPAYE.

Overview of the REPAYE Student Loan Plan

The REPAYE (Revised Pay As You Earn) plan is an income-driven repayment plan for federal student loans. It offers borrowers lower monthly payments based on their income and family size, potentially leading to loan forgiveness after 20 or 25 years of payments, depending on loan type. This plan is designed to make student loan repayment more manageable for borrowers facing financial hardship.

Eligibility Requirements for the REPAYE Plan

To be eligible for REPAYE, you must have federal student loans, including Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for graduate or professional students), and Federal Stafford Loans. You must also be enrolled in or have completed a degree or certificate program. Finally, you must be making payments on your loans. Borrowers currently enrolled in another income-driven repayment plan can switch to REPAYE.

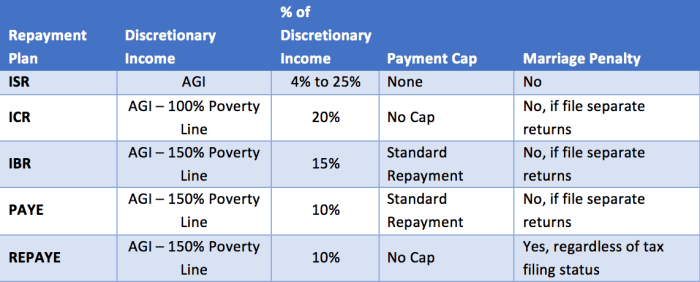

Income-Driven Repayment Features of REPAYE

REPAYE calculates your monthly payment based on your adjusted gross income (AGI) and family size. Your AGI is your gross income minus certain deductions as defined by the IRS. The payment is capped at 10% of your discretionary income, meaning the income remaining after subtracting 150% of the poverty guideline for your family size and state. If your payment calculated based on your income is less than what you would pay under a standard 10-year repayment plan, you will pay the standard repayment amount. Unpaid interest may be capitalized (added to your principal balance) at the end of each year if your payment does not cover all of the accruing interest. After making qualifying payments for 20 or 25 years (depending on when the loan was originated), the remaining balance of your Direct Subsidized, Unsubsidized, and Grad PLUS loans may be forgiven. However, this forgiven amount is considered taxable income.

Applying for the REPAYE Plan

Applying for REPAYE is straightforward. First, you will need to gather your financial information, such as your adjusted gross income (AGI) and family size. This information is typically found on your tax return. Next, you will need to complete an online application through the StudentAid.gov website. You’ll need your Federal Student Aid ID (FSA ID) to access your account. Once logged in, navigate to the repayment section and select REPAYE from the available income-driven repayment plans. The application requires providing your income and family size details. After submitting the application, the Department of Education will process it and notify you of your approval and your new monthly payment amount.

Examples of Income Scenarios and Their Impact on Monthly Payments

Let’s consider a few hypothetical examples to illustrate how income affects monthly payments under REPAYE. Assume a single borrower with $40,000 in student loan debt.

| Scenario | Adjusted Gross Income (AGI) | Family Size | Approximate Monthly Payment (REPAYE) |

|---|---|---|---|

| Scenario 1: Low Income | $25,000 | 1 | Potentially very low, possibly $0 depending on the poverty guideline for their state |

| Scenario 2: Moderate Income | $50,000 | 1 | Likely a moderate payment, significantly lower than a standard 10-year repayment plan |

| Scenario 3: High Income | $100,000 | 1 | Likely closer to the standard 10-year repayment plan amount, or potentially slightly lower |

Note: These are simplified examples. Actual payments will depend on the specific details of your loans, income, and family size, as well as the applicable poverty guidelines for your state. Consult the official Department of Education website for the most accurate and up-to-date information.

Calculating Monthly Payments under REPAYE

The REPAYE (Revised Pay As You Earn) plan calculates your monthly student loan payment based on your discretionary income and family size. Unlike standard repayment plans with fixed monthly payments, REPAYE adjusts your payment based on your income, making it more manageable during periods of lower earnings. Understanding this calculation is crucial to budgeting effectively and planning your long-term financial strategy.

REPAYE Payment Calculation Method

The REPAYE payment calculation is a multi-step process. First, your discretionary income is determined by subtracting 150% of the poverty guideline for your family size from your adjusted gross income (AGI). This figure represents the amount of income available for loan repayment after essential living expenses are considered. Next, this discretionary income is divided by 10 to arrive at a preliminary monthly payment. However, this preliminary payment is capped at the amount you would pay under a 10-year standard repayment plan for the same loan amount. Finally, this capped payment is applied to your loan. Importantly, interest continues to accrue on your loan balance, and if your income increases, your payment amount will be recalculated. If your income decreases, your payment may also decrease, although it will never go below zero.

Impact of Income and Loan Amount on Monthly Payments

The following table illustrates how varying income levels and loan amounts influence monthly REPAYE payments and the remaining loan balance after 10 years. Note that these figures are illustrative and do not account for potential interest capitalization or changes in income over the repayment period. These are simplified examples for illustrative purposes and may not reflect the precise calculations used by the loan servicer.

| Income (Annual) | Loan Amount | Monthly Payment (Estimate) | Remaining Loan Balance After 10 Years (Estimate) |

|---|---|---|---|

| $40,000 | $50,000 | $150 | $40,000 (Approximate, high due to low income) |

| $60,000 | $50,000 | $250 | $30,000 (Approximate, substantial balance remains) |

| $80,000 | $50,000 | $400 | $10,000 (Approximate, loan nearing completion) |

| $60,000 | $100,000 | $500 | $70,000 (Approximate, significant balance remains) |

Income Changes and REPAYE Payments

Changes in income directly affect REPAYE payments. For instance, if your income increases, your monthly payment will be recalculated, potentially resulting in a higher payment. Conversely, a decrease in income could lead to a lower monthly payment. These adjustments occur annually, reflecting the income reported on your tax return. This dynamic feature helps borrowers manage their debt during periods of financial instability, while still working towards eventual loan forgiveness if eligibility requirements are met.

REPAYE vs. Standard Repayment

Let’s consider a hypothetical scenario: Sarah has a $50,000 student loan. Under a standard 10-year repayment plan, her monthly payment would be approximately $500. However, if Sarah’s annual income is $40,000, her REPAYE payment might be significantly lower, potentially around $150, as shown in the table above. This difference highlights the potential benefit of REPAYE for borrowers with lower incomes, allowing them to make more manageable payments while still working towards loan repayment. However, it’s crucial to remember that REPAYE typically extends the repayment period, potentially leading to more interest paid over the life of the loan compared to a standard plan.

Forgiveness and Loan Discharge under REPAYE

The REPAYE (Revised Pay As You Earn) plan offers the possibility of student loan forgiveness after a specific period of qualifying payments. Understanding the conditions, application process, and potential tax implications is crucial for borrowers considering this plan. This section details the requirements and procedures involved in achieving loan forgiveness through REPAYE.

Conditions for Loan Forgiveness under REPAYE

Loan forgiveness under REPAYE is contingent upon making qualifying monthly payments for 20 or 25 years, depending on your loan type and when you entered repayment. For Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans, and Federal Stafford Loans, 20 years of qualifying payments are required for forgiveness. For loans consolidated after October 1, 2007, 25 years of payments are needed. These payments must be made on time and meet the minimum monthly payment calculated based on your income. It is important to note that any missed payments or periods of deferment or forbearance may extend the time needed to reach loan forgiveness. Furthermore, the amount forgiven depends on the remaining loan balance at the time of forgiveness.

Applying for Loan Forgiveness

After making the required number of qualifying monthly payments, you must apply for loan forgiveness through the Federal Student Aid website. This process typically involves submitting documentation verifying your income and payment history. The application itself will require detailed personal and loan information. The Department of Education will review your application, and if approved, the remaining balance of your eligible loans will be forgiven. This process can take several months, so it’s essential to apply well in advance of reaching the 20 or 25-year mark. Failure to apply will mean you won’t receive loan forgiveness, even if you’ve made all the required payments.

Tax Implications of Loan Forgiveness under REPAYE

A significant aspect to consider is the tax implications of loan forgiveness. Generally, the amount of student loan debt forgiven under REPAYE is considered taxable income. This means you will likely need to pay federal and potentially state income taxes on the forgiven amount in the year it’s forgiven. However, there are some exceptions, and the specific tax implications will depend on your individual circumstances and tax bracket. It is highly recommended to consult with a tax professional to understand your potential tax liability before applying for forgiveness. They can help you accurately estimate your tax burden and advise you on any strategies to mitigate it. For example, a borrower in a higher tax bracket will face a greater tax liability compared to a borrower in a lower bracket.

Comparison of REPAYE Loan Forgiveness with Other Income-Driven Repayment Plans

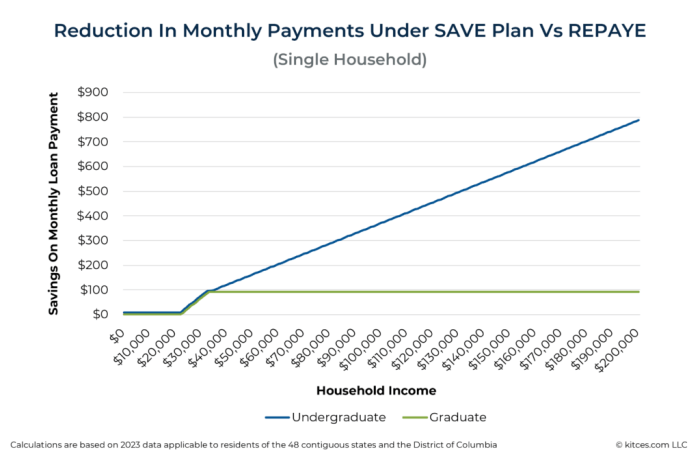

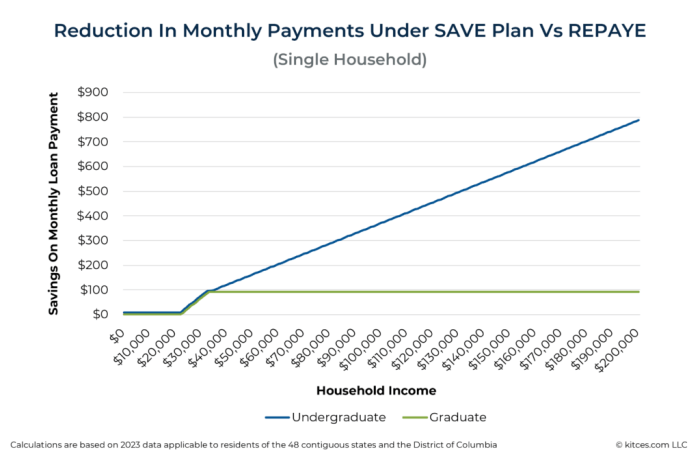

Several income-driven repayment (IDR) plans, including ICR (Income-Contingent Repayment), PAYE (Pay As You Earn), andIBR (Income-Based Repayment), offer loan forgiveness after a set period. While the specific requirements and timelines vary across these plans, the core principle remains the same: payments are adjusted based on your income and family size, leading to potential loan forgiveness after a significant number of years. REPAYE generally offers lower monthly payments than some other IDR plans, but it may also have a longer repayment period. The exact differences depend on individual circumstances and income levels. Choosing the best plan depends on your individual financial situation and long-term goals. For instance, someone with a consistently low income might benefit more from REPAYE’s potentially lower monthly payments, while someone anticipating a significant income increase may find another plan more advantageous.

Potential Drawbacks and Challenges of REPAYE

While REPAYE offers a potentially attractive path to student loan repayment, it’s crucial to understand its limitations. Not every borrower will find REPAYE to be the optimal repayment plan, and unforeseen circumstances can significantly impact its effectiveness. Careful consideration of the potential drawbacks is essential before committing to this plan.

REPAYE’s benefits are contingent on several factors, and its structure can present challenges for some borrowers. Understanding these potential pitfalls can help individuals make informed decisions about their repayment strategy and avoid unexpected difficulties.

Interest Accrual and Loan Balance Growth

A significant drawback of REPAYE is the potential for interest to accrue, particularly if your monthly payment doesn’t cover the accruing interest. This can lead to your loan balance growing over time, even while making regular payments. For example, a borrower with a high interest rate and a low income might find their payments barely cover the interest, resulting in a slowly increasing loan balance. This is especially problematic if income remains low for an extended period.

Income-Driven Repayment Limitations

REPAYE’s reliance on your adjusted gross income (AGI) means that fluctuations in your income directly impact your monthly payment. Periods of unemployment or reduced income can lead to increased monthly payments later, potentially creating financial strain. For instance, a borrower who experiences a job loss might face a significantly higher payment amount once their income recovers, creating a sudden financial burden. Furthermore, income-driven repayment plans, including REPAYE, generally do not account for large, unexpected expenses like medical bills or home repairs.

Forgiveness and Discharge Challenges

While loan forgiveness is a major selling point of REPAYE, achieving it requires consistent payments over a considerable period (often 20 or 25 years), maintaining eligibility throughout, and navigating the complexities of the forgiveness application process. Delays or denials in the forgiveness application process are common, and borrowers may face unexpected challenges in proving their eligibility. Moreover, even after meeting the requirements, receiving forgiveness is not guaranteed, and the process can be lengthy and complicated. This uncertainty and the extended timeframe to forgiveness can be a significant deterrent for some.

Unexpected Life Changes and Their Impact

Life events like marriage, divorce, having children, or unexpected job losses can dramatically impact income and ability to repay. REPAYE, while designed to be flexible, doesn’t always accommodate these sudden changes seamlessly. A borrower who experiences a major life event leading to a significant income reduction might find themselves struggling to make even the adjusted, lower payments. This can result in delinquency, negatively impacting their credit score and potentially leading to more serious consequences.

Comparison with Other Income-Driven Repayment Plans

Choosing the right income-driven repayment (IDR) plan for your federal student loans can significantly impact your monthly payments and the eventual forgiveness of your debt. While REPAYE offers several attractive features, it’s crucial to compare it with other IDR plans—Income-Contingent Repayment (ICR), Pay As You Earn (PAYE), and Income-Based Repayment (IBR)—to determine which best suits your individual financial circumstances. Understanding the nuances of each plan is key to making an informed decision.

Understanding the differences between REPAYE, ICR, PAYE, and IBR requires careful consideration of several factors. Each plan has unique eligibility criteria, payment calculation methods, and forgiveness requirements. The optimal choice depends heavily on factors such as your income, loan type, and family size.

Key Differences Between Income-Driven Repayment Plans

The following table summarizes the key differences between REPAYE, ICR, PAYE, and IBR. Note that eligibility requirements and specific details can change, so always consult the official federal student aid website for the most up-to-date information.

| Plan Name | Eligibility | Payment Calculation | Forgiveness Requirements |

|---|---|---|---|

| REPAYE | Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans for graduate or professional studies, and some FFEL loans consolidated into Direct Consolidation Loans. | 10% of discretionary income; payment capped at what you would pay under a 10-year standard repayment plan. | 20 or 25 years (depending on loan type and consolidation date), depending on remaining balance after 20 or 25 years of payments. |

| ICR | Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans, and FFEL Program loans consolidated into Direct Consolidation Loans. | Either 20% of discretionary income or a fixed payment amount calculated over 12 years, whichever is less. | 25 years of payments; remaining balance forgiven. |

| PAYE | Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans for graduate or professional studies, and some FFEL loans consolidated into Direct Consolidation Loans. (Note: PAYE is no longer accepting new borrowers, but existing borrowers can remain in the plan.) | 10% of discretionary income; payment capped at what you would pay under a 10-year standard repayment plan. | 20 years of payments; remaining balance forgiven. |

| IBR | Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans for graduate or professional studies, and some FFEL loans consolidated into Direct Consolidation Loans. (Note: There are two versions of IBR; the original IBR and the revised IBR. Eligibility and payment calculations differ slightly.) | Either 10% or 15% of discretionary income, depending on loan origination date; payment capped at what you would pay under a 10-year standard repayment plan. | 20 or 25 years of payments; remaining balance forgiven. |

Illustrative Scenario: Choosing an IDR Plan

Let’s consider two borrowers: Alice, a recent graduate with a low income and high loan balance, and Bob, a high-earning professional with a moderate loan balance. Alice might find REPAYE or PAYE beneficial due to their low payment caps, potentially keeping her monthly payments manageable despite her high debt. Bob, on the other hand, might prefer ICR or IBR to potentially pay off his loans faster, even if his payments are higher, due to his higher income. His higher income could lead to faster loan forgiveness under ICR or IBR, compared to the longer repayment periods under REPAYE or PAYE.

Pros and Cons of Each Plan Relative to REPAYE

REPAYE offers a relatively simple payment calculation and potentially lower monthly payments compared to ICR in some situations. However, ICR might offer faster loan forgiveness for higher earners. PAYE, while similar to REPAYE in payment calculation, is no longer accepting new borrowers. IBR presents a similar structure to REPAYE but with different income percentages depending on loan origination date. The choice hinges on individual circumstances and financial projections. A careful analysis of each plan’s features and their impact on a borrower’s long-term financial picture is essential.

Impact of REPAYE on Long-Term Financial Planning

REPAYE, while offering significant relief for student loan borrowers, undeniably impacts long-term financial planning. The lower monthly payments can free up cash flow for other priorities, but the extended repayment period and potential for loan forgiveness also have implications for saving, investing, and overall wealth accumulation. Understanding these effects is crucial for making informed financial decisions.

REPAYE’s influence on long-term financial goals is multifaceted. Lower monthly payments initially provide more disposable income, allowing borrowers to allocate funds towards savings, investments, or paying down other debts. However, the extended repayment period means that interest continues to accrue, potentially increasing the total amount repaid over the loan’s lifespan. This longer repayment timeline also impacts the timeline for achieving significant financial milestones, such as buying a home or retiring comfortably. Careful budgeting and financial planning are essential to navigate these complexities effectively.

Incorporating REPAYE Payments into Financial Planning

Successful financial planning with REPAYE requires incorporating the monthly payment amount into a comprehensive budget. This involves projecting the payment amount over the repayment period, accounting for potential interest accrual, and factoring in the possibility of loan forgiveness. Budgeting tools and financial advisors can be invaluable resources in creating a realistic and sustainable plan. Borrowers should also consider creating an emergency fund to handle unexpected expenses, preventing them from falling behind on their student loan payments. This proactive approach mitigates potential disruptions to long-term financial goals.

Long-Term Financial Implications of Loan Forgiveness under REPAYE

Loan forgiveness under REPAYE, while potentially offering substantial financial relief, also carries long-term financial implications. The forgiven amount is considered taxable income in the year it’s forgiven, potentially leading to a significant tax liability. Borrowers should plan for this potential tax burden by setting aside funds or adjusting their tax withholdings. Furthermore, the forgiveness can impact future financial decisions, such as qualifying for certain loans or benefits, as the forgiven amount may affect credit scores. Thorough planning and consultation with a tax professional are highly recommended to navigate the tax implications of loan forgiveness.

Hypothetical Example of REPAYE’s Impact on Long-Term Financial Health

Consider Sarah, a recent graduate with $50,000 in student loan debt. Under a standard repayment plan, her monthly payment might be $600, leaving limited funds for savings and investments. With REPAYE, her monthly payment might be reduced to $300, freeing up $300 monthly. Over 10 years, this extra $300 per month could accumulate to approximately $36,000 if invested conservatively, potentially offsetting some of the extra interest paid due to the longer repayment period. However, if Sarah’s income increases significantly, her payments would also increase, potentially impacting her ability to save and invest as much as initially planned. This example highlights the need for flexibility and adaptability in financial planning when using income-driven repayment plans like REPAYE. Careful consideration of potential income fluctuations is essential.

Last Word

Successfully managing student loan debt requires careful planning and a thorough understanding of available repayment options. The REPAYE plan, while offering potential benefits like lower monthly payments and loan forgiveness, necessitates a careful evaluation of your individual financial circumstances. By weighing the pros and cons, comparing REPAYE to alternative IDR plans, and incorporating its implications into your broader financial strategy, you can chart a course towards responsible debt management and long-term financial security. Remember to consult with a financial advisor for personalized guidance tailored to your unique situation.

FAQ Overview

What happens if my income changes during the REPAYE repayment period?

Your monthly payment will be recalculated based on your adjusted income. You’ll need to update your income information with your loan servicer.

Can I switch from another IDR plan to REPAYE?

Yes, you can generally switch between IDR plans, but there may be limitations depending on your specific circumstances and loan types. Check with your loan servicer for details.

What are the tax implications of loan forgiveness under REPAYE?

Currently, forgiven amounts under IDR plans, including REPAYE, are generally not considered taxable income. However, this is subject to change, so it’s wise to consult a tax professional.

How long does it take to apply for REPAYE?

The application process varies, but generally involves completing an online application and providing necessary documentation. Processing time can range from a few weeks to several months.