Securing a student loan can be a pivotal step towards higher education, but navigating the process requires a clear understanding of the eligibility criteria and application procedures. This guide unravels the complexities of student loan requirements, providing a comprehensive overview of the various factors involved, from initial eligibility checks to repayment strategies. We will explore the differences between federal and private loans, the importance of understanding loan terms, and alternative funding options to help you make informed decisions about financing your education.

From age and residency requirements to credit scores and financial documentation, we’ll cover all the essential aspects of loan eligibility. We’ll then delve into the various types of student loans available, their associated interest rates and repayment plans, and the application process itself. Finally, we’ll offer practical advice on managing student loan debt effectively and avoiding common pitfalls.

Eligibility Criteria for Student Loans

Securing a student loan involves meeting specific eligibility requirements, which vary depending on the type of loan (federal or private) and the lending institution. Understanding these criteria is crucial for a successful application. This section details the key aspects of student loan eligibility.

Age Requirements for Student Loan Applicants

Most student loan programs don’t have a strict upper age limit. The primary focus is on the applicant’s enrollment status in an eligible educational program. While there might be age restrictions for certain grant programs, most loan programs prioritize the student’s academic pursuit rather than their chronological age. However, some private lenders might consider age as a factor in their risk assessment, potentially influencing interest rates or loan terms.

Residency Requirements for Student Loans

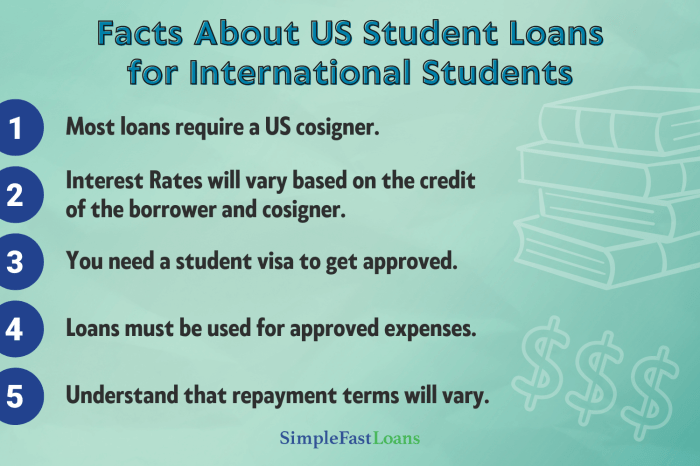

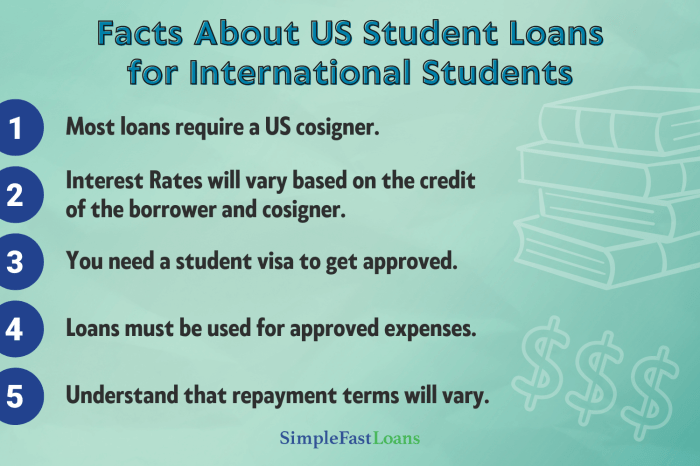

Residency requirements for student loans differ significantly between countries and even within a country’s various loan programs. For instance, in the United States, federal student loans generally require U.S. citizenship or permanent residency. However, eligibility for state-based programs might have more stringent residency requirements, potentially demanding a certain period of in-state residency prior to application. Similarly, other countries will have their own specific residency stipulations, often requiring citizenship or proof of legal residency within the nation. International students may find accessing loans more challenging, often requiring co-signers or specific sponsorship arrangements.

Credit Score Requirements for Student Loans

Credit score requirements vary substantially between federal and private student loans. Federal student loans typically don’t require a credit history or a minimum credit score, focusing instead on enrollment verification and financial need assessment. In contrast, private student loans often necessitate a minimum credit score, often ranging from 660 to 700 or higher, depending on the lender’s risk tolerance. A higher credit score generally translates to more favorable loan terms, such as lower interest rates. Applicants with limited or poor credit history may find it difficult to secure private loans without a co-signer with a strong credit profile.

Documentation to Prove Financial Need for Student Loans

Demonstrating financial need is often a crucial aspect of the student loan application process, particularly for federal loans. Acceptable documentation typically includes tax returns (for both the student and their parents, if applicable), bank statements, pay stubs, and documentation of other sources of income or financial aid received. The Free Application for Federal Student Aid (FAFSA) in the United States is a prime example of a form that gathers comprehensive financial information to determine eligibility for federal student aid, including loans. Private lenders may also request similar documentation, though their specific requirements may differ.

Comparison of Eligibility Criteria: Federal vs. Private Student Loans

| Criteria | Federal Loans | Private Loans | Notes |

|---|---|---|---|

| Credit Score | Not Required | Typically Required (660-700+ often needed) | Higher scores often lead to better terms. |

| Citizenship/Residency | US Citizenship or Permanent Residency (generally) | Varies by lender; may require US citizenship or residency, or international student status with specific co-signer requirements. | Specific requirements depend on the lender and loan program. |

| Enrollment Status | Enrollment in an eligible educational program | Enrollment in an eligible educational program | Verification of enrollment is essential for both types. |

| Financial Need | Often assessed; may influence loan amount. | Generally not a primary factor; creditworthiness is more heavily weighted. | Federal loans often have need-based components. |

| Co-signer | Usually not required | Often required for applicants with limited or poor credit history | A co-signer assumes responsibility for loan repayment if the borrower defaults. |

Types of Student Loans and Their Features

Choosing the right student loan is crucial for managing your education costs and future finances. Understanding the various types of loans available, their features, and the implications of different repayment options is essential for making informed decisions. This section will clarify the key distinctions between federal and private loans, highlighting the advantages and disadvantages of each.

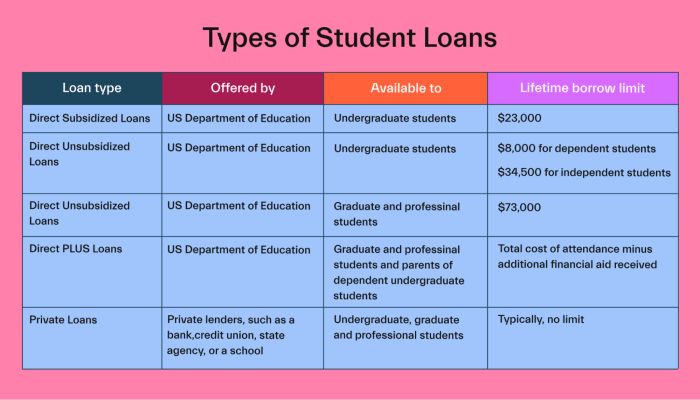

Subsidized vs. Unsubsidized Federal Student Loans

The primary difference between subsidized and unsubsidized federal student loans lies in interest accrual. With subsidized loans, the government pays the interest while you’re in school at least half-time, during grace periods, and during periods of deferment. Unsubsidized loans, however, begin accruing interest from the moment the loan is disbursed, regardless of your enrollment status. This means you’ll owe more in the long run with an unsubsidized loan if you don’t make interest payments while in school. The interest rate for both subsidized and unsubsidized loans is set annually by the government and is typically lower than private loan interest rates.

Interest Rates and Repayment Plans

Federal student loan interest rates are fixed, meaning they don’t change over the life of the loan. Private loan interest rates, on the other hand, are variable, meaning they can fluctuate based on market conditions. This variability introduces an element of uncertainty into repayment calculations. Repayment plans for federal loans offer various options, including standard, graduated, extended, and income-driven repayment plans. Each plan has different monthly payment amounts and overall repayment periods, allowing borrowers to tailor their repayment schedule to their financial circumstances. For example, an income-driven repayment plan bases monthly payments on a percentage of your discretionary income, potentially leading to lower monthly payments but a longer repayment period. Private loan repayment plans are typically less flexible and often have shorter repayment terms.

Federal vs. Private Student Loans

Federal student loans generally offer more borrower protections, including flexible repayment options, deferment and forbearance possibilities, and loan forgiveness programs under certain circumstances. Private loans, offered by banks and credit unions, often have higher interest rates and fewer protections. The approval process for federal loans is generally based on financial need and enrollment status, while private loans often require a credit check and a co-signer, particularly for students with limited or no credit history. A key advantage of federal loans is their accessibility and government backing, providing a safety net for borrowers. Private loans can be a viable option for borrowers who have exhausted their federal loan limits, but careful consideration of the interest rates and repayment terms is essential.

Impact of Loan Deferment and Forbearance

Deferment and forbearance are temporary pauses in loan repayments. Deferment typically applies to federal loans and postpones both principal and interest payments under specific circumstances, such as returning to school or experiencing unemployment. Forbearance, applicable to both federal and private loans, temporarily reduces or suspends payments but usually continues interest accrual. While these options offer temporary relief, they can significantly impact long-term repayment costs due to accumulated interest. For example, deferring payments for several years can substantially increase the total amount owed at the end of the repayment period. Borrowers should carefully weigh the short-term benefits against the potential long-term financial consequences.

Types of Student Loans: A Summary

Understanding the key features of different loan types is essential for making informed borrowing decisions. Below is a summary highlighting key characteristics:

- Federal Subsidized Loans: Lower interest rates, government pays interest while in school (at least half-time), generally more favorable repayment options.

- Federal Unsubsidized Loans: Lower interest rates than private loans, interest accrues from disbursement, available to all students regardless of financial need.

- Federal PLUS Loans (Parent/Graduate): Available to parents of undergraduate students and graduate students, credit check required, higher interest rates than subsidized/unsubsidized loans.

- Private Student Loans: Variable interest rates (often higher than federal loans), less flexible repayment options, may require a co-signer, no government protections.

The Application and Approval Process

Securing a student loan involves navigating a specific application and approval process, varying slightly depending on whether you’re applying for a federal or private loan. Understanding these processes is crucial for a smooth and successful application. This section details the steps involved, required documentation, and factors influencing approval.

Federal Student Loan Application (FAFSA)

The Free Application for Federal Student Aid (FAFSA) is the gateway to federal student loans. Completing the FAFSA accurately and completely is essential for determining your eligibility for federal aid, including grants, scholarships, and loans. The process involves providing detailed financial information about yourself and your family.

The steps involved in completing the FAFSA are straightforward but require careful attention to detail. First, you’ll need to create an FSA ID, which acts as your digital signature. Then, you’ll gather necessary financial information, including tax returns, W-2s, and bank statements. You’ll input this data into the FAFSA form online, ensuring accuracy to avoid delays. Finally, you’ll submit your application and wait for processing, which typically takes several weeks.

Documentation Needed for Student Loan Applications

Supporting documentation plays a vital role in the loan application process. Lenders use this documentation to verify the information you provide and assess your creditworthiness. The specific documents required may vary slightly depending on the lender and the type of loan, but generally include:

A comprehensive list of commonly requested documents includes: proof of identity (driver’s license, passport), Social Security number, tax returns (for both the student and parents, if applicable), bank statements, proof of enrollment (acceptance letter from the educational institution), and information regarding other financial aid received. Private loan applications may also require credit reports and details of your employment history.

Private Student Loan Application Process

Applying for a private student loan typically involves a more extensive process compared to federal loans. Private lenders assess your creditworthiness more rigorously, considering your credit history, income, and debt-to-income ratio.

A step-by-step guide might look like this: First, research and compare loan offers from different private lenders. Next, pre-qualify to get an estimate of your potential loan terms. Then, complete the formal application, providing all the necessary documentation. After submission, the lender will review your application and assess your creditworthiness. Finally, if approved, you’ll receive loan terms, and you’ll need to sign the loan agreement.

Factors Considered in Loan Application Assessment

Lenders employ a multi-faceted approach to evaluate student loan applications. They analyze several key factors to determine the applicant’s creditworthiness and ability to repay the loan.

These factors include credit score (for private loans), income and employment history, debt-to-income ratio, academic standing (GPA), and the type and amount of loan requested. Federal loans consider factors like the student’s financial need and dependency status. A strong credit history and stable income significantly increase the chances of approval. Applicants with a history of missed payments or high debt levels may face difficulties in securing a loan.

Student Loan Application and Approval Process Flowchart

The following describes a typical student loan application and approval process flowchart.

The flowchart begins with the Application Submission. This leads to Documentation Review by the lender. The lender then performs a Credit Check (for private loans). Next is Eligibility Determination, followed by Loan Approval or Denial. If approved, the process moves to Loan Agreement Signing and finally Disbursement of Funds. If denied, the applicant might be given an opportunity to Appeal the decision or explore alternative funding options.

Repayment Options and Strategies

Successfully navigating student loan repayment requires understanding the available options and developing a sound repayment strategy. Choosing the right plan and implementing effective management techniques can significantly impact your financial well-being. Failing to do so can lead to serious consequences.

Standard Repayment Plans

Standard repayment plans typically involve fixed monthly payments over a 10-year period. This option provides a predictable payment schedule and the quickest route to loan payoff. However, monthly payments can be higher compared to other plans, potentially straining your budget, especially in the early stages of your career.

Extended Repayment Plans

Extended repayment plans offer longer repayment periods, usually up to 25 years. This results in lower monthly payments, making them more manageable for borrowers with limited income. The trade-off is that you’ll pay significantly more in interest over the life of the loan.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) link your monthly payment to your income and family size. Several IDR plans exist, each with its own formula for calculating payments. These plans are designed to make repayment more affordable, especially during periods of lower income. However, they often extend the repayment period significantly, leading to higher overall interest costs. Examples include the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans.

Strategies for Managing Student Loan Debt Effectively

Effective student loan management involves budgeting, prioritizing payments, and exploring options for reducing your debt burden. Creating a detailed budget that includes your loan payments is crucial. Prioritizing loan payments, particularly those with higher interest rates, can help minimize the total interest paid. Consider exploring options like refinancing or seeking assistance from government programs. Building a strong credit score can also improve your options for managing your loans.

Consequences of Loan Default

Defaulting on your student loans has severe consequences. These include damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. Default can significantly impact your financial future, making it challenging to secure housing, employment, or even a car loan. It is crucial to proactively manage your loans to avoid default.

Loan Consolidation

Loan consolidation combines multiple student loans into a single loan with a new interest rate and repayment schedule. The benefits include simplifying repayment with a single monthly payment and potentially lowering your monthly payment (though this depends on the new interest rate). However, consolidation may result in a longer repayment period and higher overall interest paid, especially if you secure a higher interest rate. Careful consideration of the terms and conditions is crucial before consolidating your loans.

Example Monthly Payments Under Different Repayment Plans

| Plan Type | Monthly Payment Example | Total Interest Paid |

|---|---|---|

| Standard (10-year) | $500 | $10,000 |

| Extended (25-year) | $250 | $30,000 |

| Income-Driven (Variable) | $200 (Year 1), $300 (Year 5) | $25,000 (estimated) |

Understanding Loan Terms and Conditions

Navigating the world of student loans requires a clear understanding of the terms and conditions involved. Failing to grasp these crucial details can lead to unforeseen financial burdens down the line. This section clarifies key terminology and highlights important considerations to ensure you make informed decisions.

Key Loan Terminology

Understanding the terminology used in student loan agreements is paramount. This section defines several critical terms that will frequently appear in your loan documents. Familiarizing yourself with these terms will significantly improve your comprehension of the loan agreement.

- Principal: This is the original amount of money borrowed. It’s the base amount you owe before interest accrues.

- Interest: This is the cost of borrowing money. Lenders charge interest as a percentage of the principal, and it increases the total amount you owe over time.

- APR (Annual Percentage Rate): This is the annual interest rate, including fees, expressed as a percentage. It represents the true cost of borrowing over a year, providing a more comprehensive view than the interest rate alone.

- Grace Period: This is the period after graduation or leaving school before you are required to begin making loan repayments. The length of the grace period varies depending on the loan type and lender.

The Importance of Thoroughly Reading the Loan Agreement

Before signing any student loan agreement, it’s absolutely crucial to read the entire document carefully. This includes understanding the repayment schedule, interest rates, fees, and any other conditions. Overlooking even a small detail can have significant long-term financial consequences. Don’t hesitate to seek clarification from the lender if anything is unclear.

Common Pitfalls to Avoid When Taking Out Student Loans

Borrowing more than necessary is a common mistake. Carefully assess your financial needs and explore alternative funding options, such as scholarships and grants, before resorting to loans. Avoid taking out multiple loans with varying interest rates and repayment terms, as this can complicate your repayment strategy. Also, be aware of hidden fees and charges. Scrutinize the fine print for any unexpected costs.

The Implications of Co-signing a Student Loan

Co-signing a student loan means you are legally responsible for repaying the loan if the primary borrower defaults. This carries significant risk, as your credit score will be impacted if the borrower fails to make payments. Consider the implications carefully before agreeing to co-sign. If the borrower defaults, you become liable for the full amount of the loan, potentially causing significant financial strain.

The Impact of Different Interest Rates on Total Loan Cost

Different interest rates dramatically affect the total cost of a student loan. Consider these scenarios:

| Scenario | Loan Amount | Interest Rate | Loan Term (Years) | Approximate Total Repayment |

|---|---|---|---|---|

| Scenario 1 (Low Interest) | $20,000 | 4% | 10 | $23,750 (estimate) |

| Scenario 2 (High Interest) | $20,000 | 8% | 10 | $30,000+ (estimate) |

Note: These are simplified examples and do not include fees or compounding interest. Actual repayment amounts may vary. The difference in total repayment between a 4% and an 8% interest rate over 10 years is substantial, highlighting the importance of securing the lowest possible interest rate. A seemingly small difference in interest rate can lead to thousands of dollars in additional costs over the life of the loan.

Financial Aid and Alternative Funding Sources

Securing funding for higher education often involves a multifaceted approach that extends beyond student loans. Grants, scholarships, and alternative funding options play a crucial role in minimizing loan debt and making college more accessible. Understanding these options and how to incorporate them into a comprehensive financial plan is essential for successful financial management during and after your studies.

The Role of Grants and Scholarships in Reducing Loan Dependence

Grants and scholarships represent non-repayable forms of financial aid. Grants are typically awarded based on financial need, while scholarships are often merit-based, recognizing academic achievement, athletic prowess, or other talents. By securing grants and scholarships, students can significantly reduce their reliance on loans, potentially lowering the overall cost of their education and the subsequent burden of loan repayment. For example, a student awarded a $5,000 scholarship will need to borrow $5,000 less, resulting in lower monthly payments and less overall interest accrued. The earlier a student begins searching for these opportunities, the greater their chances of securing funding.

Other Potential Funding Sources for Higher Education

Beyond grants and scholarships, several alternative funding avenues exist to support higher education. Work-study programs offer part-time employment opportunities on campus, allowing students to earn money while pursuing their studies. These programs often provide flexible scheduling to accommodate academic commitments. Additionally, some students may receive financial support from family members or private sponsorships. Parents may contribute directly, or individuals or organizations may provide targeted funding for specific programs or students. Finally, some institutions offer institutional aid in the form of grants or scholarships specific to their students.

Advantages and Disadvantages of Alternative Funding Sources

| Funding Source | Advantages | Disadvantages |

|---|---|---|

| Work-Study | Earns income, builds experience, flexible scheduling | Limited earning potential, may impact study time |

| Family Contributions | Significant financial support, reduced loan burden | Potential family strain, may limit student independence |

| Private Sponsorships | Can be substantial, may cover specific needs | Competitive application process, may be limited availability |

| Institutional Aid | Specific to the institution, may be need-based or merit-based | Availability varies between institutions, competitive |

Creating a Budget that Incorporates Student Loan Payments

A realistic budget is crucial for managing student loan payments effectively. This should include all income sources (including work-study earnings) and expenses (tuition, housing, food, transportation, etc.). It’s important to allocate a specific amount for loan repayments each month, starting as soon as possible, even if the repayment period begins later. Consider using budgeting apps or spreadsheets to track income and expenses. For example, a student earning $1,000 per month with $500 in expenses could allocate $200 for loan repayment and $300 for other needs, leaving a buffer of $200. This ensures consistent payments and avoids potential financial difficulties later.

A simple budgeting formula is: Income – Expenses = Amount Available for Loan Repayment and Savings.

Resources for Finding Grants and Scholarships

Finding grants and scholarships requires proactive searching. Several online resources can assist in this process. Websites such as Fastweb, Scholarships.com, and Peterson’s provide searchable databases of scholarship opportunities. Additionally, many professional organizations and community groups offer scholarships to students pursuing specific fields of study. The federal government also provides resources and information about federal grant programs. It’s important to thoroughly research eligibility requirements and deadlines for each opportunity.

Epilogue

Successfully navigating the student loan landscape requires careful planning and a thorough understanding of the process. By understanding the eligibility criteria, exploring different loan options, and developing a sound repayment strategy, you can confidently finance your education and achieve your academic goals. Remember to carefully review loan agreements, explore alternative funding sources, and seek professional advice when needed to make informed decisions that align with your financial situation.

Commonly Asked Questions

What happens if I don’t repay my student loan?

Failure to repay your student loan can lead to serious consequences, including damage to your credit score, wage garnishment, and potential legal action.

Can I get a student loan if I have bad credit?

While a good credit score increases your chances of approval and securing favorable terms, some lenders offer student loans to borrowers with less-than-perfect credit. You may need a co-signer or face higher interest rates.

What is the difference between a grace period and a deferment?

A grace period is a temporary period after graduation where loan repayment is not required. A deferment is a postponement of loan payments due to specific circumstances, such as unemployment or further education.

How can I reduce my student loan interest?

Consider refinancing your loans to a lower interest rate if possible. Making extra payments towards your principal can also significantly reduce the total interest paid over the life of the loan.