Navigating the complexities of student loan debt can feel overwhelming, but understanding your options is key to financial freedom. This guide focuses on Sallie Mae student loan consolidation, exploring its eligibility criteria, the application process, and the potential benefits and drawbacks. We’ll delve into how Sallie Mae consolidation compares to federal options, offering insights into managing your consolidated loans and the long-term financial implications.

From understanding the required documentation to navigating different repayment plans, we aim to provide a comprehensive overview. We’ll also examine potential impacts on future financial aid and illustrate scenarios where consolidation proves beneficial or detrimental. Ultimately, this resource empowers you to make informed decisions about your student loan debt.

Sallie Mae Loan Consolidation Eligibility

Sallie Mae offers loan consolidation to simplify student loan repayment. However, eligibility depends on several factors, including your loan types, income, and credit history. Understanding these requirements is crucial before applying. This section details the specific criteria you need to meet to be considered for Sallie Mae loan consolidation.

Eligibility for Sallie Mae loan consolidation primarily hinges on the type of loans you possess and your creditworthiness. While Sallie Mae doesn’t explicitly state minimum income requirements, a strong credit history is generally necessary for approval, particularly for private loan consolidation. The process and requirements may differ slightly depending on the specific consolidation program offered.

Basic Eligibility Requirements

To be eligible for Sallie Mae loan consolidation, you must have at least one eligible Sallie Mae private student loan. You’ll need to be the primary borrower on these loans and be in good standing (meaning you’re not significantly delinquent on your payments). Furthermore, you must be a U.S. citizen or permanent resident. Specific loan types eligible for consolidation are detailed below.

Income Requirements and Credit Score Considerations

Sallie Mae doesn’t publicly advertise specific income thresholds for loan consolidation. However, a strong credit history is a significant factor in approval. A higher credit score generally increases your chances of approval and might also lead to more favorable interest rates. Lenders assess credit risk, and a poor credit history suggests a higher risk of default. Therefore, improving your credit score before applying is advisable. Individuals with excellent credit scores may receive better terms than those with fair or poor credit.

Impact of Loan Types on Eligibility

Sallie Mae primarily consolidates its own private student loans. Federal student loans are generally not eligible for consolidation through Sallie Mae. You can only consolidate Sallie Mae private student loans with other Sallie Mae private student loans. Consolidating federal loans typically requires using a federal loan consolidation program offered by the government, not Sallie Mae.

Comparison of Eligibility Criteria for Different Sallie Mae Consolidation Programs

Sallie Mae may offer various consolidation programs, each potentially having slightly different eligibility criteria. For example, certain programs might require a minimum loan balance or a specific repayment history. It’s essential to carefully review the terms and conditions of each program before applying to ensure you meet all the necessary requirements. These details are usually available on the Sallie Mae website or through their customer service representatives. Direct comparison of specific programs is difficult without accessing the current, real-time offerings on their site, as program details are subject to change.

The Consolidation Process with Sallie Mae

Consolidating your Sallie Mae student loans can simplify your repayment by combining multiple loans into a single monthly payment. This process, while generally straightforward, requires careful attention to detail and understanding of the steps involved. This section Artikels the application procedure, necessary documentation, and typical processing timeline.

Sallie Mae Loan Consolidation Application Steps

The Sallie Mae loan consolidation application is primarily handled online through their website. The process is designed to be user-friendly, guiding you through each stage. However, careful preparation beforehand will streamline the application considerably.

- Account Creation/Login: Begin by creating a Sallie Mae account or logging into your existing one. This is the central hub for managing your loan information and submitting your application.

- Loan Selection: Select the eligible loans you wish to consolidate. You’ll review a list of your loans and choose which ones to include in the consolidated loan. It’s crucial to verify the accuracy of this information.

- Application Completion: Complete the online application form, providing accurate personal and financial information. This includes details such as your current address, employment status, and Social Security number.

- Document Upload: Upload the required documentation (detailed below). Ensure all documents are clear, legible, and in the correct format to avoid delays.

- Review and Submission: Thoroughly review your application before submitting it. Once submitted, you cannot make changes without contacting Sallie Mae directly.

- Confirmation: After submission, you will receive a confirmation number and further instructions regarding the next steps in the process.

Required Documentation for Sallie Mae Loan Consolidation

Providing complete and accurate documentation is vital for a smooth and efficient consolidation process. Missing or incomplete documentation will likely delay the approval of your application.

- Government-Issued Photo ID: This verifies your identity and is a standard requirement for all financial transactions.

- Social Security Number: Your SSN is needed to link your application to your credit history and loan information.

- Proof of Income: This might include pay stubs, tax returns, or other documentation demonstrating your income. This is used to determine your repayment ability.

- Bank Statements (Optional but Recommended): Providing bank statements can strengthen your application by demonstrating your financial stability.

Sallie Mae Loan Consolidation Processing Timeline

The processing time for a Sallie Mae loan consolidation application can vary. While Sallie Mae aims for a relatively quick turnaround, several factors can influence the processing speed. Expect a timeframe ranging from a few weeks to a couple of months.

Several factors can impact processing time, including the complexity of your loan portfolio, the accuracy and completeness of your application, and the volume of applications Sallie Mae is currently processing. It is always advisable to submit your application well in advance of any anticipated deadlines.

Flowchart of the Sallie Mae Loan Consolidation Process

The following describes a simplified flowchart representing the key stages. Note that this is a general representation and the specific steps might vary slightly.

The flowchart would visually represent the process as follows: Start -> Account Creation/Login -> Loan Selection -> Application Completion -> Document Upload -> Review and Submission -> Confirmation -> Processing -> Approval/Denial -> Loan Disbursement/Notification. Each stage would be represented by a box, with arrows indicating the flow from one stage to the next. Decision points, such as Approval/Denial, would be represented by diamonds.

Benefits and Drawbacks of Sallie Mae Consolidation

Consolidating your student loans with Sallie Mae can offer several advantages, but it’s crucial to weigh these against potential downsides before making a decision. Understanding the impact on your interest rate, repayment terms, and credit score is essential for making an informed choice.

Sallie Mae loan consolidation simplifies the repayment process by combining multiple federal and private student loans into a single monthly payment. This can lead to improved financial organization and potentially lower monthly payments, depending on the chosen repayment plan. However, it’s important to carefully review the terms of the consolidated loan to ensure it aligns with your financial goals.

Advantages and Disadvantages of Sallie Mae Loan Consolidation

The following table summarizes the key benefits and drawbacks to consider when deciding whether to consolidate your student loans with Sallie Mae.

| Benefit | Description | Drawback | Description |

|---|---|---|---|

| Simplified Repayment | One monthly payment instead of multiple, making budgeting easier. | Potentially Higher Total Interest Paid | A longer repayment term may result in paying more interest over the life of the loan, even if monthly payments are lower. |

| Potentially Lower Monthly Payments | Extending the repayment term can lower your monthly payment amount, providing short-term financial relief. | Longer Repayment Term | A longer repayment period means it takes longer to become debt-free, potentially delaying other financial goals. |

| Fixed Interest Rate (for some loans) | A fixed interest rate offers predictability and protects against future interest rate increases. | Loss of Benefits from Certain Loan Programs | Consolidation may eliminate eligibility for certain federal loan forgiveness programs or income-driven repayment plans. |

| Improved Financial Organization | Managing a single loan is simpler than juggling multiple loans. | Potential for Increased Interest Rate | While some consolidations offer a fixed rate, the new rate might be higher than your lowest existing rate, leading to increased overall interest paid. |

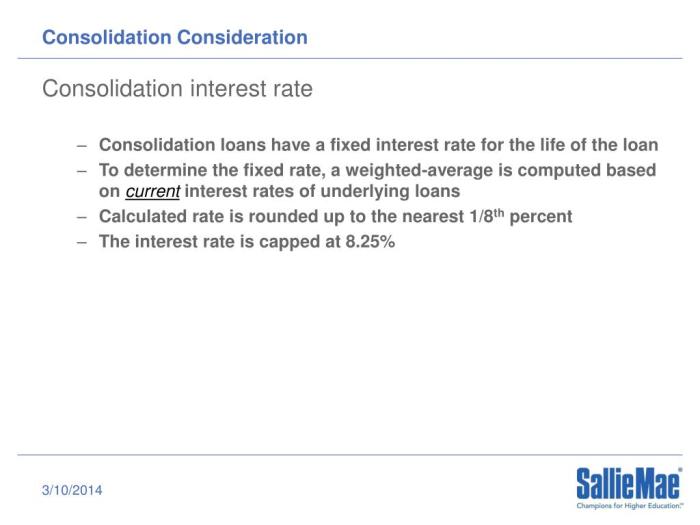

Interest Rates and Repayment Terms

Before consolidating, carefully compare your current interest rates and repayment terms with those offered by Sallie Mae’s consolidation program. For example, you might have several loans with varying interest rates—some fixed, some variable. Consolidation might result in a single, fixed interest rate that is higher than your lowest existing rate, leading to a higher total interest paid over the life of the loan. Similarly, extending your repayment term to lower your monthly payment will increase the total interest you pay. A shorter repayment term will result in higher monthly payments but will allow you to pay off your debt faster and pay less interest overall. It’s vital to analyze the total cost of the loan over its lifetime before deciding.

Impact on Credit Score

The impact of Sallie Mae loan consolidation on your credit score is complex and depends on several factors. While consolidating multiple accounts into one can potentially improve your credit utilization ratio (the amount of credit used compared to the total credit available), it can also negatively affect your average credit age if you close the original accounts. Furthermore, a hard inquiry on your credit report during the application process can temporarily lower your score. The long-term effect will depend on how responsibly you manage your consolidated loan. Consistent on-time payments after consolidation will generally have a positive effect on your credit score.

Sallie Mae Consolidation vs. Federal Consolidation

Choosing between Sallie Mae and federal student loan consolidation can significantly impact your repayment journey. Both options offer the convenience of combining multiple loans into a single monthly payment, but they differ substantially in terms of interest rates, fees, and available benefits. Understanding these key distinctions is crucial for making an informed decision that aligns with your financial goals.

The primary difference lies in the lender. Federal consolidation uses your existing federal student loans and combines them under a new federal loan, managed by the Department of Education. Sallie Mae, on the other hand, is a private lender, and their consolidation program is for private loans held by them. This fundamental difference leads to variations in the terms and conditions offered.

Interest Rates and Fees

Interest rates for federal student loan consolidation are typically fixed and based on a weighted average of your existing loan interest rates. There are no additional fees for federal consolidation. In contrast, Sallie Mae consolidation loans typically come with a fixed interest rate, determined by your creditworthiness and market conditions. However, Sallie Mae may charge fees for processing the consolidation, which can add to the overall cost. These fees can vary depending on the loan amount and your specific circumstances. For example, a borrower with a higher credit score might qualify for a lower interest rate and potentially lower fees compared to a borrower with a lower credit score. The overall interest rate might be higher than the weighted average of your previous loans, resulting in higher overall repayment costs compared to federal consolidation.

Repayment Options

Federal student loan consolidation offers various repayment plans, including income-driven repayment (IDR) plans, which adjust your monthly payment based on your income and family size. These plans can significantly reduce your monthly payments, though it might extend the repayment period and increase the total interest paid over the life of the loan. Sallie Mae, being a private lender, typically offers standard repayment plans with fixed monthly payments, often without income-driven options. The flexibility in repayment plans offered by federal consolidation provides a crucial advantage for borrowers who anticipate changes in their financial situation. For example, a new graduate might benefit from an IDR plan initially, then switch to a standard plan once their income increases.

Key Differences Summarized

The following list highlights the key differences between Sallie Mae and federal student loan consolidation:

- Lender: Federal consolidation is through the Department of Education; Sallie Mae consolidation is through a private lender.

- Loan Types: Federal consolidation is for federal loans; Sallie Mae consolidation is for Sallie Mae private loans.

- Interest Rates: Federal consolidation uses a weighted average of existing rates; Sallie Mae rates are based on creditworthiness.

- Fees: Federal consolidation has no fees; Sallie Mae may charge origination or other fees.

- Repayment Plans: Federal consolidation offers various plans, including income-driven options; Sallie Mae typically offers standard repayment plans only.

Long-Term Repayment Costs

The choice between federal and Sallie Mae consolidation significantly affects long-term repayment costs. Federal consolidation, with its potential for lower interest rates and flexible repayment plans, often leads to lower overall interest paid and potentially shorter repayment periods. Sallie Mae consolidation, while convenient for consolidating private loans, might result in higher overall costs due to potentially higher interest rates and fees, coupled with less flexible repayment options. For instance, a borrower with $30,000 in federal loans might save thousands of dollars over the life of the loan by choosing federal consolidation compared to consolidating those same loans through a private lender with higher interest rates and fees. This difference becomes even more pronounced over longer repayment periods.

Managing Consolidated Loans with Sallie Mae

Successfully consolidating your student loans with Sallie Mae is only the first step; effectively managing your new loan is crucial for timely repayment and avoiding financial strain. This section Artikels key aspects of managing your consolidated Sallie Mae loan, from understanding repayment options to accessing your account information and contacting customer service.

Sample Repayment Schedule

A sample repayment schedule depends heavily on the loan amount, interest rate, and chosen repayment plan. Let’s consider an example: Assume a consolidated loan of $30,000 with a 7% annual interest rate and a 10-year repayment plan (120 months). The monthly payment would be approximately $360. This is a simplified example, and actual payments may vary slightly due to compounding interest. A detailed amortization schedule, outlining each month’s payment, principal reduction, and interest accrued, is typically available online through your Sallie Mae account. This schedule shows a clear breakdown of how your payments are applied over the life of the loan. It’s important to note that this is just an example; your individual repayment schedule will differ based on your specific loan terms.

Repayment Plan Options

Sallie Mae offers various repayment plans to accommodate different financial situations. These plans generally include: Standard Repayment (fixed monthly payments over a set period), Extended Repayment (longer repayment term, resulting in lower monthly payments but higher total interest paid), Graduated Repayment (payments start low and gradually increase over time), and Income-Driven Repayment (payments are calculated based on your income and family size). Choosing the right plan depends on your financial circumstances and long-term goals. Carefully consider the trade-offs between lower monthly payments and increased total interest paid when making your selection. Sallie Mae’s website provides detailed information and calculators to help you compare options.

Accessing Account Information and Managing Payments Online

Managing your Sallie Mae loan is primarily done through their online account portal. This portal allows you to view your loan details, including your balance, payment history, and upcoming payment due dates. You can also make payments online through various methods such as electronic bank transfers, debit cards, or credit cards. The online portal provides a convenient and efficient way to monitor your loan and ensure timely payments. Regularly checking your account online ensures you stay informed about your loan status and avoid any potential late payment fees. Sallie Mae typically sends email and/or text message reminders prior to payment due dates as well.

Contacting Sallie Mae Customer Service

Sallie Mae offers multiple channels for contacting customer service if you need assistance. These include phone support, email, and a secure messaging system through your online account. Their website provides contact information and hours of operation. For complex issues or if you prefer a personalized approach, a phone call might be the most effective method. For routine inquiries or updates, the online messaging system may provide a quicker response. Keeping your contact information up-to-date in your online profile will ensure you receive timely responses to your inquiries.

Potential Impacts on Financial Aid

Consolidating your student loans with Sallie Mae can have significant implications for your future financial aid eligibility. The impact isn’t always straightforward and depends on several factors, including the type of aid you’re seeking and your overall financial situation. Understanding these potential effects is crucial before making a consolidation decision.

Consolidation alters your loan portfolio, impacting how lenders and financial aid institutions view your debt. This can affect your eligibility for future federal student aid programs, such as Pell Grants or subsidized loans, as well as private loan options and even scholarships based on financial need. The changes are primarily related to how your debt is reported and the overall picture of your financial health presented to aid providers.

Impact on Future Federal Student Aid

The federal government uses a complex formula to determine student aid eligibility. This formula considers several factors, including your Expected Family Contribution (EFC) and your current debt load. Consolidating your loans with a private lender like Sallie Mae, instead of through the federal government’s Direct Consolidation Loan program, can complicate this calculation. Because the consolidated loan is now a private loan, it may not be factored into the federal aid calculations in the same way as a federal loan would be. This could result in a lower eligibility for future federal grants or loans, particularly if your debt-to-income ratio increases after consolidation. For example, a student consolidating multiple federal loans into a single Sallie Mae loan might find their eligibility for a subsidized Stafford loan reduced in their graduate program due to the change in loan status.

Impact on Graduate School Funding and Other Aid

Graduate programs often offer their own financial aid packages, which can include fellowships, assistantships, and loans. These packages often consider the applicant’s existing debt. Consolidating loans might affect the amount of aid offered, particularly if the consolidation results in a higher monthly payment or a longer repayment period. Similarly, some scholarships and grants consider a student’s overall financial need, and consolidating loans with Sallie Mae might negatively affect this assessment. For instance, a student aiming for a prestigious graduate program with limited funding may find their chances reduced if their consolidated loan increases their perceived financial burden.

Reporting Requirements Related to Loan Consolidation

After consolidating your loans with Sallie Mae, you’ll need to report the consolidated loan on any future financial aid applications. This is crucial for maintaining accuracy in your financial aid profile. Failure to accurately report your loan information can lead to sanctions, including the loss of future financial aid. You’ll typically report the loan amount, interest rate, and monthly payment on forms like the Free Application for Federal Student Aid (FAFSA). The lender, Sallie Mae, will provide the necessary documentation to support this reporting. Accurate and timely reporting ensures that your financial aid eligibility is properly assessed. Inaccurate reporting could lead to an overestimation or underestimation of your financial need, potentially resulting in reduced or increased aid.

Illustrative Examples of Consolidation Scenarios

Understanding the potential benefits and drawbacks of Sallie Mae loan consolidation requires examining real-world scenarios. The following examples illustrate situations where consolidation proves advantageous and others where it might be less so. These examples are hypothetical but reflect common borrower situations.

Beneficial Consolidation Scenario: Streamlining Multiple High-Interest Loans

Imagine Sarah, a recent graduate with three student loans: a federal subsidized loan at 4.5%, a federal unsubsidized loan at 6.8%, and a private Sallie Mae loan at 9%. Each loan has a different repayment schedule and interest accrual, making tracking and managing them challenging. Her monthly payments are spread across three separate bills, creating a complex financial picture. Consolidating these loans with Sallie Mae into a single loan with a lower, fixed interest rate (let’s say 7%) simplifies her finances significantly. The single monthly payment is easier to manage, and the lower interest rate, though slightly higher than her lowest existing rate, saves her money over the life of the loan compared to continuing with the high-interest private loan. The consolidation process involves applying online through Sallie Mae, providing necessary documentation, and waiting for approval. Once approved, the new consolidated loan replaces her existing three loans, streamlining her payments and reducing overall interest costs.

Detrimental Consolidation Scenario: Extending Loan Term and Increasing Total Interest Paid

Consider David, who has two federal student loans with low interest rates (3% and 4%). He’s tempted by Sallie Mae’s consolidation offer, which promises a single, simplified payment. However, consolidating extends his repayment term significantly. While the monthly payment decreases, the longer repayment period leads to a substantial increase in total interest paid over the life of the loan. David’s initial low interest rates would have allowed him to pay off his loans quickly, but the consolidation locks him into a longer-term loan, ultimately costing him more in the long run. In this case, while the consolidation simplifies the repayment process, it negatively impacts his overall financial outcome. The process itself is similar to Sarah’s; however, the long-term financial consequences are less favorable. The lower monthly payment comes at the expense of significantly higher total interest paid.

Last Recap

Consolidating your student loans with Sallie Mae presents a significant financial decision. Careful consideration of your individual circumstances, including your loan types, credit score, and future financial aid needs, is crucial. By weighing the potential benefits—such as simplified repayment—against the potential drawbacks—like potentially higher interest rates—you can confidently determine if consolidation aligns with your long-term financial goals. Remember to thoroughly research all available options and seek professional financial advice if needed.

Top FAQs

What happens to my original loan terms after consolidation?

Your original loan terms are replaced by a single new loan with a new interest rate and repayment schedule.

Can I consolidate federal and private loans together with Sallie Mae?

Generally, Sallie Mae only consolidates private student loans. Federal loans typically require federal consolidation programs.

What if I miss a payment on my consolidated Sallie Mae loan?

Missing payments can negatively impact your credit score and may lead to late fees and potential default.

How long does the Sallie Mae consolidation process take?

Processing times vary, but generally expect several weeks. Check Sallie Mae’s website for current estimates.

Does Sallie Mae offer different repayment plans for consolidated loans?

Yes, Sallie Mae typically offers various repayment plans, such as fixed-payment and graduated repayment options. Check their website for details.