Navigating the complexities of higher education financing as an international student can feel daunting. Securing funding for your American dream often requires exploring various loan options, and Sallie Mae frequently emerges as a key player. This guide delves into the intricacies of Sallie Mae loans specifically designed for international students, offering a comprehensive overview of eligibility, application processes, repayment strategies, and alternative financing solutions. Understanding these nuances empowers you to make informed decisions about your financial future.

From eligibility requirements and loan types to repayment plans and potential pitfalls, we aim to equip you with the knowledge necessary to confidently approach the process of securing a Sallie Mae loan. We’ll also explore alternative funding options and provide practical financial planning advice to help you manage your education expenses effectively. This guide serves as your roadmap to successfully navigating the financial landscape of studying in the United States.

Eligibility Criteria for International Students

Sallie Mae does not directly offer loans to international students. Therefore, the eligibility criteria discussed below refer to the general requirements international students need to meet to secure financing from alternative lenders who may partner with Sallie Mae for loan servicing or other related services. It’s crucial to understand that the specific requirements will vary depending on the lender and the student’s individual circumstances.

International students seeking education loans in the United States typically face a more stringent application process compared to their domestic counterparts. This is primarily due to the increased risk perceived by lenders in relation to repayment capabilities and potential immigration-related complications.

Required Documentation for Loan Applications

Securing a loan as an international student usually requires a more extensive collection of documents compared to domestic applicants. This is to ensure the lender has sufficient information to assess the risk and verify the applicant’s identity and financial situation. Lenders will generally request proof of enrollment, financial statements, immigration status documentation, and possibly a co-signer’s financial information. Specific documentation requirements can vary significantly between lenders. For example, some may require a detailed breakdown of tuition fees and living expenses, while others may focus more on the applicant’s credit history (if available). Furthermore, the type of visa held by the international student will also influence the documentation required.

Comparison of Eligibility Criteria: International vs. Domestic Students

The primary difference lies in the availability of co-signers and credit history. Domestic students often have access to co-signers (typically parents or relatives) with established credit in the US, which significantly improves their chances of loan approval. International students may struggle to find a US-based co-signer with sufficient creditworthiness. Moreover, international students might not have a US-based credit history, making it harder for lenders to assess their credit risk. Domestic students, on the other hand, usually have a readily available credit history that lenders can use for assessment. Additional factors such as the length of stay in the US and the type of visa held will also be carefully evaluated by lenders.

Determining Eligibility: A Step-by-Step Guide

Determining eligibility for an education loan as an international student involves a thorough assessment of your financial situation and documentation. First, you should identify potential lenders who cater to international students. Second, thoroughly review each lender’s specific eligibility requirements, paying close attention to the required documentation. Third, meticulously gather all the necessary documentation, ensuring accuracy and completeness. Fourth, carefully complete the loan application, providing truthful and accurate information. Fifth, follow up with the lender to understand the status of your application. Finally, carefully review all loan terms and conditions before accepting the loan. This process necessitates meticulous planning and attention to detail, as each lender will have its unique criteria and application process.

Loan Types and Interest Rates

Sallie Mae offers several loan options designed to assist international students with financing their education in the United States. Understanding the different loan types and their associated interest rates is crucial for making informed financial decisions. Choosing the right loan can significantly impact your overall borrowing costs and repayment schedule.

While Sallie Mae doesn’t directly offer loans to international students in the same way they do to US citizens, they can be a valuable resource for finding private lenders who do. This means that the specific loan types available and their terms will vary depending on the lender you choose through Sallie Mae’s platform. Therefore, the information below provides a general overview of the factors influencing interest rates and repayment for international student loans obtained through private lenders. It’s essential to carefully review the terms and conditions of any loan offer before accepting it.

Interest Rates and Loan Terms for International Students

Interest rates for international student loans are typically higher than those for domestic students. This reflects the increased risk lenders perceive when lending to borrowers who are not US citizens and may have different credit histories and repayment patterns. The following table illustrates a hypothetical comparison of potential loan types and their associated terms. Remember that actual rates and terms will vary depending on the lender and your individual financial profile.

| Loan Type | Interest Rate (Example Range) | Repayment Terms (Example) | Fees (Example) |

|---|---|---|---|

| Private Loan (Variable) | 7% – 12% | 5-15 years | Origination fee (1%-4%) |

| Private Loan (Fixed) | 8% – 13% | 5-15 years | Origination fee (1%-4%) |

| Consolidation Loan | Based on weighted average of existing loans | Varies based on existing loan terms | Potential origination or processing fees |

Note: The interest rates and fees presented are illustrative examples and may not reflect current market conditions. Always check with the specific lender for the most up-to-date information.

Factors Influencing Interest Rates

Several factors contribute to the interest rate an international student will receive on a private loan. Lenders assess these factors to determine the level of risk associated with lending to you.

- Credit History: A strong credit history, even if it’s from your home country, can positively influence your interest rate. Lenders look for evidence of responsible borrowing and repayment.

- Co-signer: Having a US citizen or permanent resident co-sign your loan can significantly reduce your interest rate. The co-signer assumes responsibility for repayment if you are unable to make payments.

- Loan Amount and Term: Larger loan amounts and longer repayment terms generally result in higher interest rates due to increased risk for the lender.

- Institution and Program: The prestige of the university you are attending and the specific program you are enrolled in may play a role, although this influence is less direct than the other factors.

Impact of Fluctuating Exchange Rates

Fluctuating exchange rates can significantly impact international students’ loan repayment. If the value of your home currency decreases relative to the US dollar, your loan payments will become more expensive in your home currency. For example, if you borrow in US dollars but earn income in your home currency, a weakening home currency means each dollar repayment will require a larger amount of your home currency.

Conversely, if your home currency strengthens against the US dollar, your repayments will become cheaper. It’s advisable to consider the potential impact of currency fluctuations when budgeting for loan repayment. Careful financial planning and potentially hedging strategies might be necessary to mitigate the risks associated with exchange rate volatility.

Application Process and Required Documents

Applying for a Sallie Mae loan as an international student involves several steps and requires careful preparation of necessary documentation. This section details the application process and Artikels the required documents to ensure a smooth and efficient application experience. Understanding these requirements upfront will help you navigate the process effectively.

Required Documents for Sallie Mae Loan Application

Gathering the correct documentation is crucial for a successful Sallie Mae loan application. Incomplete applications can lead to delays. The following checklist Artikels the essential documents you will need. It is advisable to have these readily available before starting the application process.

- Completed Sallie Mae loan application form.

- Passport (valid and showing your visa status).

- Acceptance letter from your U.S. college or university.

- I-20 form (Certificate of Eligibility for Nonimmigrant Student Status).

- Proof of financial resources to cover living expenses and other educational costs not covered by the loan (e.g., bank statements, scholarship letters, financial aid awards).

- Transcript of your previous academic records (translated into English if necessary).

- Co-signer information (if required) including their credit report and financial documentation.

Sallie Mae Loan Application Process Flowchart

The application process can be visualized as a flowchart. Imagine a diagram starting with “Begin Application” and branching into steps involving document preparation, online application submission, and finally, loan approval or denial. Each step would be clearly indicated with connecting arrows.

(Note: A visual flowchart cannot be created within this text-based format. However, the steps described below provide the equivalent information.)

Step-by-Step Application Process

The application process is divided into several distinct stages to facilitate understanding.

Stage 1: Pre-Application Preparation

This initial stage involves gathering all the necessary documents listed above. Thoroughly review the requirements and ensure you have accurate and complete copies of each document. This step is critical to avoid delays later in the process.

Stage 2: Online Application Submission

Once you have all your documents prepared, you will complete the Sallie Mae online application. Carefully fill out all sections of the application, ensuring accuracy in all provided information. You will need to upload electronic copies of your supporting documents during this stage.

Stage 3: Verification and Processing

After submitting your application, Sallie Mae will review your information and supporting documents. This process involves verifying your identity, academic standing, and financial capacity to repay the loan. This stage typically takes several weeks.

Stage 4: Loan Approval or Denial

Sallie Mae will notify you of their decision regarding your loan application. If approved, you will receive details regarding the loan terms, disbursement schedule, and repayment plan. If denied, you will receive an explanation of the reasons for denial.

Repayment Options and Strategies

Successfully navigating the repayment of your Sallie Mae loan after graduation requires careful planning and understanding of the available options. Choosing the right repayment plan depends on your individual financial circumstances and post-graduation employment situation. This section Artikels the various repayment options and strategies to help you manage your loan effectively.

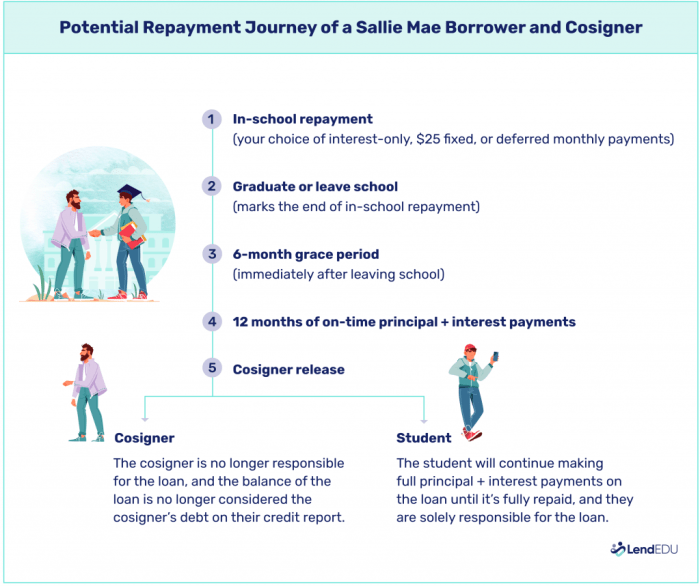

Sallie Mae Repayment Plans

Sallie Mae offers several repayment plans designed to accommodate varying financial situations. Understanding the differences between these plans is crucial for selecting the most suitable option. Each plan offers a different balance between monthly payments and total interest paid over the life of the loan.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It offers predictable payments but may result in higher total interest paid compared to other plans. This is a good option for those with stable income and a preference for predictable budgeting.

- Graduated Repayment Plan: This plan starts with lower monthly payments that gradually increase over time. This can be helpful in the initial years after graduation when income may be lower. However, the increasing payments might become challenging later on.

- Extended Repayment Plan: This plan extends the repayment period beyond 10 years, reducing monthly payments but increasing the total interest paid. This option is suitable for those with lower incomes or higher debt burdens. It might be beneficial to consider this plan if you need lower monthly payments to manage your finances more effectively.

- Income-Driven Repayment (IDR) Plans: These plans (if available for international students – eligibility should be independently verified) base your monthly payment on your income and family size. Payments are typically lower than standard plans, but the repayment period is extended, potentially leading to higher total interest. This option offers flexibility for those experiencing fluctuating income.

Effective Repayment Strategies for International Students

International students often face unique financial challenges, such as adjusting to a new country’s cost of living and potential visa restrictions on employment. Therefore, proactive repayment strategies are crucial.

Creating a realistic budget that accounts for all expenses, including loan repayments, is the first step. Exploring options for additional income, such as part-time work (within visa regulations), is highly recommended. Prioritizing high-interest loans for faster repayment can save significant money on interest in the long run. Regularly reviewing your budget and adjusting your repayment plan as needed can help you stay on track.

Consequences of Defaulting on a Sallie Mae Loan

Defaulting on a Sallie Mae loan has serious repercussions. These include damage to your credit score, impacting future borrowing opportunities, such as mortgages, credit cards, and even car loans. Sallie Mae may pursue legal action to recover the debt, which can involve wage garnishment or the seizure of assets. Furthermore, your ability to obtain a visa or work permit in the future might be compromised. The long-term financial and personal consequences of default are significant and should be avoided at all costs.

Alternatives to Sallie Mae Loans

Securing funding for higher education in the US as an international student can present unique challenges. While Sallie Mae is a well-known option, it’s crucial to explore alternative financing avenues to find the best fit for your individual circumstances and financial profile. Several other lenders and funding sources cater specifically to international students, each with its own set of advantages and disadvantages. Comparing these options allows for a more informed decision-making process.

Exploring alternatives to Sallie Mae loans broadens your access to potentially more favorable interest rates, repayment terms, and overall financial flexibility. Understanding the nuances of each option is key to selecting the most suitable financing solution for your educational journey.

International Student Loan Providers

Several financial institutions specialize in providing loans to international students studying in the US. These institutions often have different eligibility requirements, interest rates, and repayment options compared to Sallie Mae. Examples include Prodigy Finance, MPOWER Financing, and Ascent Funding. These lenders typically assess creditworthiness based on factors beyond a traditional credit history, often considering academic performance, future earning potential, and co-signer availability.

Comparison of Sallie Mae and Alternative Loan Providers

The following table summarizes key features of Sallie Mae and some prominent alternative lenders for international students. Note that specific terms and conditions are subject to change, and it’s vital to check directly with each lender for the most up-to-date information.

| Feature | Sallie Mae | Prodigy Finance | MPOWER Financing | Ascent Funding |

|---|---|---|---|---|

| Eligibility Requirements | US co-signer typically required | Strong academic record, future earning potential | Academic performance, co-signer may be an option | Credit history (if available), academic performance |

| Interest Rates | Variable, dependent on creditworthiness | Variable, competitive rates | Variable, competitive rates | Variable, competitive rates |

| Loan Amounts | Varies, subject to creditworthiness | Varies, based on need and eligibility | Varies, based on need and eligibility | Varies, based on need and eligibility |

| Repayment Options | Standard repayment plans, deferment options | Flexible repayment plans | Flexible repayment plans, deferment options | Flexible repayment plans |

Pros and Cons of Alternative Financing Options

Each alternative loan provider offers a unique set of advantages and disadvantages. For instance, Prodigy Finance often emphasizes its focus on graduate students in high-demand fields, potentially offering more favorable terms to individuals in those programs. MPOWER Financing’s willingness to consider applicants without a US credit history is a significant advantage for many international students. However, interest rates and repayment terms can vary significantly across these lenders, requiring careful comparison. It’s also important to consider factors such as fees, application processes, and customer service when making a decision. Always review the fine print before committing to any loan.

Financial Planning and Budgeting for International Students

Securing funding for your education as an international student requires careful financial planning and budgeting. Understanding your expenses and managing your Sallie Mae loan effectively are crucial for a successful academic journey and a smooth transition into post-graduate life. This section will guide you through creating a realistic budget and provide strategies for responsible financial management.

Creating a comprehensive budget is essential for navigating the financial complexities of studying abroad. It allows you to anticipate expenses, track your spending, and make informed decisions about your finances. A well-structured budget can help prevent debt accumulation and ensure you can meet your financial obligations, including your Sallie Mae loan repayments.

Sample Budget Template

A realistic budget should encompass all your anticipated expenses. Remember that this is a template, and your specific needs may vary. Adjust the categories and amounts to accurately reflect your personal circumstances.

- Tuition: This includes tuition fees, registration fees, and any other academic-related charges.

- Housing: This covers rent, utilities (electricity, water, internet), and any other housing-related costs. Consider whether you’ll be living on campus, in a shared apartment, or privately.

- Food: Factor in grocery expenses, eating out, and any meal plans you may have.

- Transportation: This includes costs associated with commuting to school, travelling for leisure, and potential costs of international travel home.

- Loan Repayment (if applicable): Allocate a portion of your budget for Sallie Mae loan repayments, considering your repayment plan and interest rates.

- Books and Supplies: Include the cost of textbooks, stationery, and other educational materials.

- Health Insurance: Factor in the cost of your health insurance premiums.

- Personal Expenses: This covers clothing, entertainment, personal care, and other miscellaneous expenses.

- Emergency Fund: It’s crucial to build an emergency fund to cover unexpected expenses, such as medical emergencies or unexpected travel costs.

Importance of Financial Planning Before and During Loan Repayment

Financial planning is crucial both before and during the loan repayment period. Before taking out a loan, thoroughly research your options and compare interest rates and repayment terms to ensure you choose the most suitable loan for your circumstances. During your studies, diligently track your expenses against your budget, identify areas for potential savings, and consider part-time employment to supplement your income and reduce your reliance on loans. Once you start repaying your loan, prioritize timely payments to avoid late fees and negative impacts on your credit score. Creating a realistic repayment plan aligned with your post-graduation income projections is vital for managing your debt effectively.

Tips and Strategies for Effective Financial Management

Effective financial management requires discipline and proactive planning. Here are some strategies to ensure you stay on top of your finances:

- Track your spending: Use budgeting apps or spreadsheets to monitor your income and expenses regularly.

- Create a realistic budget: Allocate funds for each expense category and stick to your plan as much as possible.

- Explore part-time employment opportunities: Supplement your income to help cover expenses and reduce your loan burden.

- Prioritize loan repayments: Make timely payments to avoid late fees and maintain a good credit score.

- Seek financial advice: Consult with a financial advisor or your university’s financial aid office for personalized guidance.

- Explore scholarships and grants: Continuously seek additional funding opportunities to reduce your reliance on loans.

- Avoid unnecessary expenses: Identify areas where you can cut back on spending without compromising your well-being.

Understanding Loan Terms and Conditions

Navigating the terms and conditions of a Sallie Mae loan is crucial for international students. Understanding these details ensures you are aware of your responsibilities and can make informed financial decisions. This section will clarify key aspects of the loan agreement to help you manage your borrowing effectively.

Interest Rates and Accrual

Sallie Mae loans for international students, like domestic loans, typically have variable interest rates. This means the rate can fluctuate based on market conditions. Understanding how interest accrues is vital. Interest begins accruing from the moment the loan is disbursed, even before your repayment period begins. The longer you defer repayment, the more interest will accumulate, ultimately increasing the total amount you owe. For example, a $10,000 loan with a 7% interest rate will accrue approximately $700 in interest during the first year if no payments are made. This compounding interest can significantly impact the overall cost of your education.

Repayment Schedules and Deferment Options

Sallie Mae offers various repayment plans, such as standard, graduated, and extended repayment options. Each plan has a different monthly payment amount and repayment period. The standard plan typically involves fixed monthly payments over a set period (e.g., 10 years). Graduated plans start with lower payments and gradually increase over time. Extended plans stretch the repayment period longer, resulting in lower monthly payments but higher overall interest paid. Deferment options allow you to temporarily postpone payments under certain circumstances, such as during further education or periods of unemployment. However, interest continues to accrue during deferment, adding to your total loan balance.

Late Payment Fees and Penalties

Making timely payments is crucial. Late payments can result in late fees, which can add up quickly and significantly impact your overall loan cost. Repeated late payments may also affect your credit score, potentially hindering future borrowing opportunities. Sallie Mae typically Artikels specific late payment policies in the loan agreement, including the amount of the fee and the grace period allowed before a late payment is assessed. For instance, a $25 late fee for each missed payment could easily accumulate to hundreds of dollars over the loan’s lifetime.

Default and its Consequences

Loan default occurs when you fail to make payments for an extended period. The consequences of defaulting on a Sallie Mae loan are severe. They can include damage to your credit score, wage garnishment, and legal action. Defaulting on a student loan can significantly impact your financial future, making it difficult to obtain credit, rent an apartment, or even secure employment in certain fields. Understanding the specific terms regarding default and the steps to take to avoid it is critical.

Prepayment Options and Penalties

Sallie Mae generally does not charge prepayment penalties. This means you can pay off your loan early without incurring extra fees. Prepaying your loan can save you money on interest in the long run. However, it’s important to carefully review your loan agreement to ensure there are no hidden fees or restrictions related to early repayment. A detailed comparison of repayment plans and the potential savings from early repayment should be considered.

Remember to carefully read your loan agreement and contact Sallie Mae directly if you have any questions or concerns about the terms and conditions.

End of Discussion

Securing funding for your education as an international student requires careful planning and research. While Sallie Mae loans offer a viable pathway, it’s crucial to understand the terms, conditions, and available alternatives. By thoroughly evaluating your eligibility, exploring different loan types and repayment options, and developing a robust financial plan, you can confidently pursue your academic goals in the US. Remember to explore all avenues and choose the financing solution that best aligns with your individual circumstances and financial capabilities. This proactive approach will contribute significantly to a successful and financially manageable educational journey.

Essential FAQs

What is the maximum loan amount I can borrow through Sallie Mae?

The maximum loan amount depends on several factors, including your program of study, cost of attendance, and creditworthiness. It’s best to check Sallie Mae’s website or contact them directly for personalized information.

Do I need a co-signer for a Sallie Mae loan as an international student?

Often, yes. Sallie Mae may require a US-based co-signer with good credit history to guarantee the loan. However, this isn’t always mandatory; eligibility criteria vary.

What happens if I cannot repay my Sallie Mae loan?

Defaulting on a Sallie Mae loan can have serious consequences, including damage to your credit score, potential legal action, and difficulty obtaining future loans. Contact Sallie Mae immediately if you anticipate repayment challenges to explore options like deferment or forbearance.

Can I use a Sallie Mae loan for living expenses?

Yes, Sallie Mae loans can cover various educational expenses, including tuition, fees, books, and living expenses. The loan amount will depend on your overall cost of attendance.