Navigating the world of student loans can feel like traversing a complex maze, especially when understanding the intricacies of interest rates. This guide delves into the specifics of Sallie Mae student loan rates, providing clarity on factors influencing costs, available loan types, and comparison points against other lenders. We’ll equip you with the knowledge to make informed decisions about your financial future.

From eligibility requirements and the application process to repayment strategies and potential risks, we aim to demystify the process and empower you to manage your student loan debt effectively. Understanding Sallie Mae’s offerings, including fixed versus variable rates and diverse repayment plans, is crucial for responsible borrowing. This comprehensive overview will serve as your roadmap to successfully navigating the complexities of Sallie Mae student loans.

Understanding Sallie Mae Student Loan Rates

Sallie Mae, a prominent private student loan provider, offers various loan options to help students finance their education. Understanding the factors that influence their interest rates is crucial for borrowers to make informed decisions and secure the best possible terms. This section will delve into the intricacies of Sallie Mae student loan rates, providing a clear picture of what to expect.

Factors Influencing Sallie Mae Student Loan Interest Rates

Several key factors determine the interest rate a borrower receives from Sallie Mae. These include the borrower’s creditworthiness, the type of loan, the loan amount, and the repayment term. A strong credit history typically results in lower interest rates, reflecting a lower perceived risk for the lender. The type of loan, such as a private student loan versus a parent loan, also plays a significant role. Larger loan amounts may also command higher rates due to increased risk for Sallie Mae. Finally, longer repayment terms often translate to higher interest rates due to the extended period of time the lender is at risk.

Sallie Mae Student Loan Types and Associated Rates

Sallie Mae offers a range of student loan products, each with its own interest rate structure. These typically include private student loans for undergraduate and graduate studies, parent loans, and refinancing options. The specific interest rate for each loan type is determined by the factors mentioned above, and it’s important to note that rates are subject to change based on market conditions. For the most up-to-date information, it’s always advisable to check directly with Sallie Mae or refer to their official website. While precise rate ranges aren’t consistently published and are subject to change, it is important to note that private loans generally have higher interest rates than federal loans.

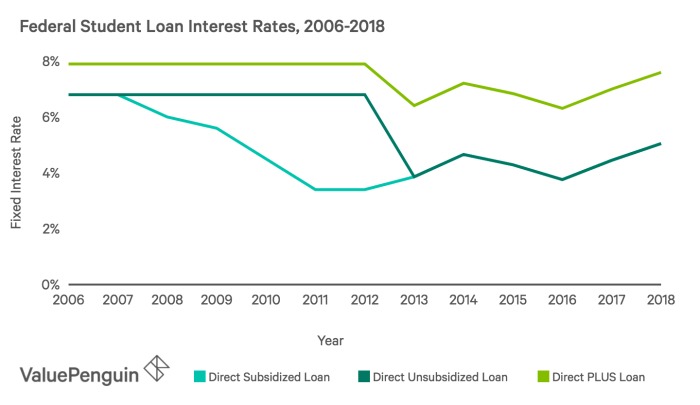

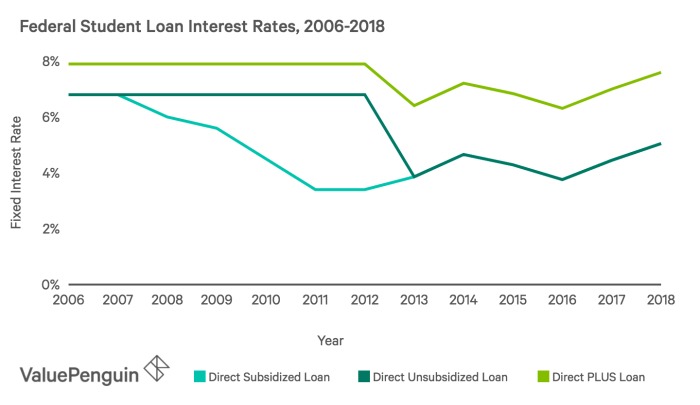

Comparison of Sallie Mae Rates with Other Federal and Private Loan Providers

Comparing Sallie Mae’s rates with those of other lenders, both federal and private, is essential for finding the most competitive option. Federal student loans, such as those offered through the government’s Direct Loan program, typically have lower, fixed interest rates compared to private loans. However, federal loans have eligibility requirements and may not cover the full cost of education. Private loan providers like Sallie Mae, Discover, and others offer varying rates based on individual creditworthiness and other factors. Direct comparison requires checking current rates from each lender, as they fluctuate regularly. It is crucial to compare not only the interest rate but also fees, repayment terms, and other loan features to make a fully informed decision.

Comparison of Fixed vs. Variable Interest Rates Offered by Sallie Mae

Sallie Mae, like many lenders, offers both fixed and variable interest rate options. Understanding the differences is vital for selecting the most suitable loan.

| Feature | Fixed Interest Rate | Variable Interest Rate |

|---|---|---|

| Rate | Stays the same throughout the loan term. | Fluctuates based on market index changes. |

| Predictability | Highly predictable monthly payments. | Monthly payments can change over time. |

| Risk | Lower risk of unexpected payment increases. | Higher risk of increased payments if interest rates rise. |

| Potential Savings | May not offer the lowest initial rate. | Potentially lower initial rate if market rates are low. |

Repayment Options and Strategies

Successfully navigating Sallie Mae student loan repayment requires understanding the available options and developing a robust repayment strategy. Choosing the right plan and implementing effective management techniques can significantly impact your financial well-being and accelerate your debt payoff journey. This section details Sallie Mae’s repayment plans and provides strategies for effective debt management.

Sallie Mae offers a range of repayment plans designed to accommodate varying financial situations and borrower needs. The choice of plan significantly influences monthly payments, overall repayment time, and the total interest paid. Careful consideration of your income, expenses, and long-term financial goals is crucial in selecting the most suitable option.

Sallie Mae Repayment Plan Options

Understanding the nuances of each Sallie Mae repayment plan is essential for informed decision-making. The following Artikels key features of the common plans, enabling borrowers to compare and contrast their suitability.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It’s straightforward but may result in higher monthly payments compared to other options. The benefit lies in its simplicity and predictable payment schedule.

- Graduated Repayment Plan: Payments start low and gradually increase over time, typically over a 10-year period. This can be beneficial for borrowers anticipating income growth, allowing for manageable payments in the early years. However, the total interest paid might be higher than with a standard plan due to the longer repayment period and increasing payments.

- Extended Repayment Plan: This plan extends the repayment period beyond 10 years, typically up to 25 years, resulting in lower monthly payments. The trade-off is that significantly more interest will accrue over the extended repayment period. This option is suitable for borrowers who need immediate affordability but are willing to pay substantially more in interest over the long term.

- Income-Driven Repayment (IDR) Plans: These plans tie monthly payments to your income and family size. Payments are recalculated periodically, offering flexibility for those experiencing income fluctuations. While monthly payments are lower, the repayment period is often longer, leading to higher overall interest payments. Specific IDR plans offered may vary, so checking directly with Sallie Mae is crucial.

Strategies for Effective Student Loan Debt Management

Beyond choosing a suitable repayment plan, proactive debt management strategies are essential for successful repayment. These strategies aim to minimize interest costs, accelerate debt payoff, and reduce financial stress.

- Budgeting and Expense Tracking: Creating a detailed budget to identify areas for savings and prioritize loan payments is fundamental. Tracking expenses helps in identifying unnecessary spending and frees up funds for debt reduction.

- Prioritizing High-Interest Loans: Focus on paying down loans with the highest interest rates first to minimize overall interest paid. This strategy, often referred to as the “avalanche method,” can save a considerable amount over the long term.

- Making Extra Payments: Whenever possible, make extra payments towards your principal loan balance. Even small extra payments can significantly reduce the overall repayment time and interest accrued. Consider making bi-weekly payments instead of monthly to accelerate repayment.

- Refinancing: Explore refinancing options to potentially secure a lower interest rate, reducing monthly payments and the total amount paid. This option requires careful comparison of refinancing offers and ensuring it aligns with your long-term financial goals. It’s crucial to check the terms and conditions carefully before refinancing.

- Seeking Professional Advice: If you are struggling to manage your student loan debt, consider seeking guidance from a financial advisor or credit counselor. They can provide personalized advice and strategies tailored to your specific circumstances.

Customer Service and Support

Navigating the complexities of student loans can sometimes feel overwhelming, and having access to reliable and responsive customer support is crucial. Sallie Mae, as one of the largest student loan servicers in the US, offers a variety of channels to assist borrowers throughout their loan journey. Understanding these options and how to effectively utilize them can significantly improve your experience.

Sallie Mae provides multiple avenues for customer service, ensuring accessibility for a wide range of users. Their commitment to providing support is reflected in the various methods available, each designed to cater to different preferences and levels of urgency.

Contact Methods

Sallie Mae offers several ways to connect with their customer service representatives. These options allow borrowers to choose the method that best suits their needs and comfort level. They strive to provide prompt and helpful assistance through each channel.

- Phone Support: Sallie Mae maintains a dedicated phone line staffed by representatives who can answer questions, address concerns, and assist with various loan-related matters. The wait times can vary depending on the time of day and the volume of calls, but generally, customers report a reasonable response time.

- Online Chat: For quicker resolutions to less complex issues, a live chat feature is available on the Sallie Mae website. This allows for immediate interaction with a representative without the need for a phone call. This is particularly useful for simple questions or account inquiries.

- Email: Sallie Mae also provides an email address for customers to send inquiries. While this method might not provide an immediate response, it’s suitable for less urgent matters or for situations where a detailed written record of the communication is preferred. Expect a response within a few business days.

- Secure Messaging: Within the Sallie Mae online account portal, borrowers can send secure messages to their assigned representatives. This method is convenient for tracking ongoing conversations and ensuring secure communication of sensitive information.

Hypothetical Customer Support Experiences

Imagine needing to understand your repayment options. Using the online chat feature, you quickly connect with a representative who explains the different plans available, outlining the pros and cons of each to help you make an informed decision. Or, perhaps you’ve experienced a billing error. By calling their phone support line, you can speak directly with a representative who investigates the issue, rectifies the error, and provides you with a corrected statement. These are just two examples showcasing the potential for positive interactions.

Dispute Resolution

If a dispute arises regarding your loan, Sallie Mae has a formal process for resolving the issue. This typically involves submitting a written complaint outlining the details of the problem and supporting documentation. Sallie Mae is required to respond within a specific timeframe according to regulatory guidelines. If the issue remains unresolved after following Sallie Mae’s internal dispute resolution process, borrowers can escalate the complaint to relevant regulatory agencies.

Navigating the Sallie Mae Website

The Sallie Mae website is designed to be user-friendly, allowing borrowers to access key information and manage their accounts efficiently. The homepage typically features prominent links to login to your account, explore repayment options, and find contact information. The site also has a robust search function to quickly locate specific information. Within your account, you’ll find details about your loan balance, payment history, and upcoming payments. Important documents, such as your loan promissory note, can usually be downloaded directly from your account dashboard. For those needing help, the site also includes a comprehensive FAQ section addressing frequently asked questions.

Final Conclusion

Securing a student loan is a significant financial commitment, and choosing the right lender with the right rates is paramount. This guide has explored the key aspects of Sallie Mae student loan rates, providing a framework for understanding the associated costs, application process, repayment options, and potential risks. By carefully considering the information presented, you can make well-informed decisions that align with your financial goals and contribute to a smoother path towards debt management and repayment.

Question & Answer Hub

What are the consequences of missing a Sallie Mae loan payment?

Late payments can result in late fees, negatively impact your credit score, and potentially lead to loan default, with serious financial repercussions.

Can I refinance my Sallie Mae student loans?

Yes, you may be able to refinance your Sallie Mae loans with another lender, potentially securing a lower interest rate. However, refinancing might affect your repayment terms.

How does Sallie Mae’s customer service compare to other lenders?

Customer service experiences vary. It’s advisable to research reviews and assess the accessibility of their support channels before applying.

What types of documentation are needed for a Sallie Mae loan application?

Required documentation typically includes proof of income, enrollment verification, and possibly co-signer information, depending on your eligibility.