Navigating the complexities of student loan debt can feel overwhelming, but refinancing offers a potential pathway to lower monthly payments and reduced overall interest. This guide focuses specifically on Sallie Mae student loan refinancing, exploring its intricacies and helping you determine if it’s the right financial strategy for your circumstances. We’ll examine eligibility criteria, compare rates and terms with competitors, and delve into the potential benefits and drawbacks to equip you with the knowledge to make an informed decision.

Understanding the process involves analyzing your current loan situation, researching available refinancing options, and carefully comparing interest rates, repayment terms, and potential long-term financial implications. This in-depth analysis will enable you to make a sound judgment about whether refinancing with Sallie Mae, or another lender, aligns with your individual financial goals.

Understanding Sallie Mae Student Loan Refinancing

Sallie Mae student loan refinancing offers a way to consolidate multiple federal and/or private student loans into a single, new loan with potentially more favorable terms. This can simplify repayment, lower your monthly payments, and potentially save you money on interest over the life of the loan. However, it’s crucial to understand the process and its implications before making a decision.

The Sallie Mae Student Loan Refinancing Process

The Sallie Mae refinancing process involves several key steps. First, you’ll need to check your eligibility. Then, you’ll need to gather your financial information, including your credit score, income, and existing loan details. Next, you’ll apply online through Sallie Mae’s website, providing the necessary documentation. Sallie Mae will then review your application and provide a decision. If approved, you’ll sign the loan documents, and your new loan will replace your existing loans. The entire process, from application to disbursement, typically takes several weeks.

Sallie Mae Refinancing Eligibility Requirements

To be eligible for Sallie Mae student loan refinancing, you generally need to meet specific criteria. These typically include having a good credit history, a stable income, and a minimum loan amount. Sallie Mae will assess your creditworthiness, income, and debt-to-income ratio to determine your eligibility. Specific requirements can vary, so it’s best to check Sallie Mae’s website for the most up-to-date information. Generally, a higher credit score improves your chances of approval and can lead to better interest rates. Co-signers may be an option for applicants who don’t meet the minimum requirements independently.

Comparison of Sallie Mae Refinancing with Other Lenders

Sallie Mae competes with several other lenders in the student loan refinancing market. These lenders may offer different interest rates, repayment terms, and fees. Comparing offers from multiple lenders is essential to ensure you secure the best possible terms. Factors to consider when comparing include the interest rate, loan fees, repayment options (fixed vs. variable), and the lender’s customer service reputation. Some lenders may specialize in refinancing federal loans, while others focus on private loans. A thorough comparison will allow you to choose the option that best aligns with your financial situation and goals. For example, one lender might offer a lower interest rate but higher fees, while another might have a higher interest rate but lower fees. The total cost of the loan over its lifetime should be the deciding factor.

Applying for Sallie Mae Refinancing: A Step-by-Step Guide

Applying for Sallie Mae refinancing is a straightforward online process. First, you’ll need to create an account on the Sallie Mae website. Then, you’ll need to provide information about your existing student loans, including the lenders, loan amounts, and interest rates. You’ll also need to provide personal and financial information, such as your income, employment history, and credit score. Sallie Mae will then run a credit check and assess your application. If approved, you’ll receive a loan offer outlining the terms and conditions. After reviewing the offer, you’ll need to electronically sign the loan documents. Once the documents are signed, Sallie Mae will disburse the funds and pay off your existing loans. It is crucial to carefully review all documents before signing to ensure you understand the terms and conditions.

Interest Rates and Loan Terms

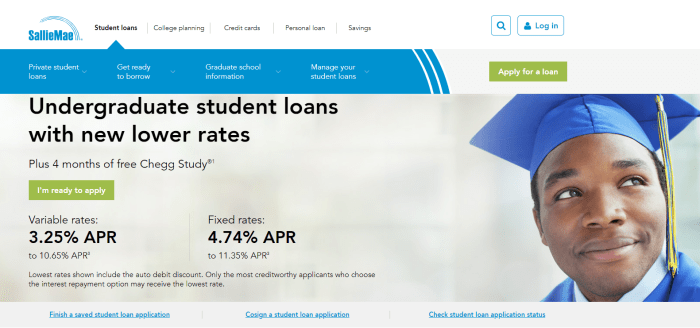

Sallie Mae student loan refinancing offers borrowers the opportunity to consolidate their federal and/or private student loans into a single, potentially lower-interest loan. Understanding the interest rates and loan terms is crucial for making an informed decision. This section will detail the factors influencing Sallie Mae’s interest rates and the various repayment options available.

Sallie Mae’s interest rates for refinancing are variable, meaning they fluctuate based on market conditions. They are also personalized, reflecting your individual creditworthiness and the specifics of your loan application. While specific rates are not publicly advertised and change constantly, they generally range from a low of approximately 4% to a high of over 10% for the most recent data available. This wide range highlights the importance of maintaining a good credit score and a strong financial profile to secure the best possible interest rate.

Factors Influencing Sallie Mae Interest Rates

Several key factors determine the interest rate Sallie Mae offers. These include your credit score, debt-to-income ratio, loan amount, and the type of loans being refinanced. A higher credit score generally translates to a lower interest rate, as it signals lower risk to the lender. Similarly, a lower debt-to-income ratio suggests greater financial stability, resulting in a more favorable rate. The amount of the loan and the type of loans being refinanced also influence interest rates; larger loan amounts might come with slightly higher rates, and refinancing federal loans might carry different rate implications than refinancing private loans.

Loan Terms (Repayment Periods)

Sallie Mae offers a range of loan terms, typically from 5 to 20 years. Shorter loan terms result in higher monthly payments but less interest paid over the life of the loan. Conversely, longer loan terms lead to lower monthly payments but result in a higher total interest paid. The choice of loan term should be carefully considered based on your individual financial situation and repayment capabilities. It’s important to balance affordability with the long-term cost of interest.

Interest Rates and Loan Terms Comparison by Credit Score

The following table illustrates a hypothetical example of how interest rates and loan terms might vary based on credit score. Remember that these are illustrative examples and actual rates offered by Sallie Mae will vary based on numerous factors, and this data should not be considered a guarantee of rates. It’s always best to check with Sallie Mae directly for current rates and terms.

| Credit Score Range | Interest Rate (Example – Variable) | Loan Term Options (Years) | Approximate Monthly Payment (on $30,000 loan) |

|---|---|---|---|

| 750-850 (Excellent) | 5.0% | 5, 10, 15, 20 | $566 (5yr), $320 (10yr), $233 (15yr), $185 (20yr) |

| 700-749 (Good) | 6.5% | 5, 10, 15, 20 | $607 (5yr), $348 (10yr), $254 (15yr), $200 (20yr) |

| 650-699 (Fair) | 8.0% | 10, 15, 20 | $385 (10yr), $281 (15yr), $222 (20yr) |

| Below 650 (Poor) | 10.0% or Higher | 15, 20 | $320 (15yr), $250 (20yr) or Higher |

Benefits and Drawbacks of Refinancing with Sallie Mae

Refinancing your student loans with Sallie Mae can offer significant advantages, but it’s crucial to weigh these against potential drawbacks before making a decision. Understanding the intricacies of both the benefits and risks is key to making an informed choice that aligns with your individual financial situation. This section will explore the potential upsides and downsides of Sallie Mae refinancing, comparing it to maintaining your original loan terms.

Refinancing with Sallie Mae presents several opportunities to improve your financial outlook. Lower interest rates are a primary attraction, potentially saving you thousands of dollars over the life of your loan. Streamlining multiple loans into a single, manageable payment simplifies repayment and improves budgeting. Additionally, Sallie Mae may offer flexible repayment options to better suit your changing financial circumstances.

Advantages of Sallie Mae Student Loan Refinancing

Lower interest rates are often the most compelling reason for refinancing. By securing a lower interest rate, borrowers can significantly reduce the total amount they pay over the life of their loan. For example, a borrower with $50,000 in student loans at 7% interest could save thousands of dollars by refinancing to a 5% rate. This reduction in interest translates directly to lower monthly payments and faster loan payoff. The simplification of multiple loans into a single monthly payment streamlines budgeting and reduces the administrative burden of managing several different loan accounts. This can provide significant peace of mind and alleviate the stress associated with tracking multiple payments. Finally, the availability of various repayment plans, such as extended repayment terms, can provide much-needed flexibility during periods of financial strain. This adaptability allows borrowers to tailor their repayment schedule to their current income and expenses.

Disadvantages and Risks of Sallie Mae Student Loan Refinancing

While refinancing offers several advantages, potential drawbacks must also be considered. A significant risk is losing access to federal student loan benefits, such as income-driven repayment plans and loan forgiveness programs. These programs offer crucial protection for borrowers who experience financial hardship. Once federal loans are refinanced into a private loan, these safeguards are generally lost. Furthermore, the approval process can be competitive, and borrowers with less-than-perfect credit may find it challenging to secure favorable terms. A higher interest rate than expected, or even rejection, could negate the potential benefits of refinancing. Finally, the terms of the new loan should be carefully reviewed, as some lenders may impose prepayment penalties or other fees that can offset any savings from a lower interest rate.

Comparison: Refinancing with Sallie Mae vs. Keeping Original Loans

The decision to refinance with Sallie Mae versus keeping your original loans hinges on a careful assessment of your individual circumstances. If you have federal loans with favorable interest rates and are eligible for income-driven repayment plans or loan forgiveness programs, refinancing may not be beneficial. However, if you have high interest rates on federal or private loans and are confident in your ability to maintain consistent payments, refinancing could lead to significant savings. Consider your credit score, financial stability, and long-term financial goals before making a decision.

Pros and Cons of Sallie Mae Refinancing

Before making a decision, consider the following:

- Pros: Lower interest rates, simplified payments, potential for flexible repayment options, potentially faster loan payoff.

- Cons: Loss of federal loan benefits, potential for higher interest rates than expected, possibility of prepayment penalties or other fees, risk of rejection if credit score is not high enough.

Alternatives to Sallie Mae Refinancing

Sallie Mae is a well-known player in the student loan refinancing market, but it’s not the only option. Several other lenders offer competitive refinancing programs, each with its own strengths and weaknesses. Exploring these alternatives is crucial to finding the best fit for your individual financial situation and goals. Choosing the right lender can significantly impact your monthly payments and overall loan repayment process.

Alternative Lenders for Student Loan Refinancing

Several reputable lenders offer student loan refinancing options. Examples include SoFi, Earnest, and Discover. These lenders often compete with Sallie Mae by offering various features designed to attract borrowers. Careful comparison of their offerings is essential before making a decision.

Comparison of Sallie Mae with Other Lenders

While Sallie Mae offers competitive interest rates and flexible repayment options, other lenders may provide superior benefits depending on your circumstances. For example, SoFi often emphasizes its customer service and community features, while Earnest might offer more personalized loan options based on individual credit profiles. Discover, known for its credit cards, may appeal to those already comfortable with their brand and services. A direct comparison of interest rates, fees, and repayment terms is vital before committing to a refinancing plan. Consider factors such as loan amounts, credit scores, and co-signers, as these can influence the terms offered by different lenders.

Situations Where Sallie Mae Might Not Be the Best Option

Sallie Mae might not be the ideal choice for everyone. Borrowers with excellent credit scores might find more favorable interest rates from competitors like SoFi or Earnest. Individuals needing flexible repayment options, such as income-driven repayment plans, may find better solutions with lenders specializing in these features. If you have a complex financial situation or require specific loan terms, seeking personalized advice from a financial advisor is strongly recommended before making a decision. Additionally, those with lower credit scores may find it challenging to secure favorable rates with Sallie Mae compared to lenders with more flexible underwriting criteria.

Comparison Table of Key Features

| Feature | Sallie Mae | SoFi | Earnest | Discover |

|---|---|---|---|---|

| Minimum Credit Score | Generally requires a good credit score (Specific requirements vary) | Generally requires a good credit score (Specific requirements vary) | Generally requires a good credit score (Specific requirements vary) | Generally requires a good credit score (Specific requirements vary) |

| Interest Rates | Competitive, varies based on creditworthiness | Competitive, varies based on creditworthiness | Competitive, varies based on creditworthiness | Competitive, varies based on creditworthiness |

| Repayment Options | Offers various repayment terms | Offers various repayment terms, including flexible options | Offers various repayment terms, potentially including income-driven plans | Offers various repayment terms |

| Fees | May include origination fees; check for specifics | May include origination fees; check for specifics | May include origination fees; check for specifics | May include origination fees; check for specifics |

Financial Impact and Planning

Refinancing your Sallie Mae student loans can significantly impact your finances, both in the short and long term. Understanding these potential effects is crucial before making a decision. Careful planning and consideration of your current financial situation are essential to ensure refinancing aligns with your overall financial goals.

Refinancing can alter your monthly payments and the total interest you pay over the life of your loan. Lower interest rates, a common benefit of refinancing, typically result in lower monthly payments and a reduced total interest paid. Conversely, choosing a longer repayment term might lower your monthly payment, but it could lead to paying significantly more interest overall. For example, refinancing a $30,000 loan from a 7% interest rate to a 5% interest rate could save thousands of dollars in interest over the loan’s life, even if the repayment term remains the same. However, extending the repayment term from 10 years to 15 years at the same interest rate, while lowering monthly payments, will increase the total interest paid.

Assessing Your Financial Situation Before Refinancing

Before you refinance, a thorough assessment of your current financial health is paramount. This involves evaluating your income, expenses, debt levels (including other loans and credit card debt), and emergency fund. A stable income and manageable debt-to-income ratio are crucial factors to consider. If your income is unpredictable or you have high levels of existing debt, refinancing might increase your financial risk. For instance, someone with a variable income and several high-interest credit cards might find refinancing difficult to manage, especially if interest rates rise. A comprehensive budget can help you determine if your financial situation can accommodate the new loan terms.

Long-Term Financial Implications of Refinancing

The long-term effects of refinancing extend beyond your monthly payment. Consider the impact on your credit score. A hard credit inquiry associated with the refinancing process can temporarily lower your score. Furthermore, refinancing might affect your ability to access other forms of credit in the future. It’s essential to carefully weigh the potential benefits against these long-term consequences. For example, if you plan to buy a house soon, a significant change in your debt profile could influence your eligibility for a mortgage.

Strategies for Managing Student Loan Debt After Refinancing

Effective management of your student loans post-refinancing is key to avoiding future financial strain. This includes consistently making on-time payments, monitoring your loan balance regularly, and exploring options for accelerating repayment, such as making extra payments when possible. Budgeting and financial planning tools can be invaluable in tracking your progress and ensuring you stay on track. Automating your payments can help prevent missed payments and late fees. Regularly reviewing your budget and making adjustments as needed can ensure your loan repayment remains manageable alongside other financial obligations.

Illustrative Scenarios

Understanding the potential benefits and drawbacks of Sallie Mae student loan refinancing requires examining specific situations. The following scenarios illustrate how refinancing can be advantageous or disadvantageous, depending on individual circumstances. Remember that these are hypothetical examples and your own situation may differ.

Beneficial Refinancing Scenario

Let’s imagine Sarah, a recent graduate with $50,000 in federal student loans at a 6.8% interest rate. Her monthly payment is approximately $600. She has a stable job with a good credit score (750), qualifying her for a Sallie Mae refinance loan at 4.5% interest. By refinancing, Sarah could lower her monthly payment to roughly $450, saving $150 per month. Over the life of the loan, this could save her thousands of dollars in interest. The lower interest rate also reduces the total amount she needs to repay. This scenario demonstrates a clear financial benefit from refinancing. The reduction in monthly payments also provides Sarah with increased financial flexibility.

Detrimental Refinancing Scenario

Consider Mark, who also has $50,000 in student loans, but his are a mix of federal and private loans with varying interest rates. Some loans are subsidized, meaning the government pays the interest while he’s in school. His average interest rate is 7%. He’s considering refinancing with Sallie Mae at 5%. While this seems like a small improvement, Mark is also losing the benefits of his federal loans, including potential income-driven repayment plans and loan forgiveness programs. Furthermore, if his financial situation were to change unexpectedly (job loss, unexpected medical expenses), he would no longer have the protections offered by federal loan programs. In this instance, the small interest rate reduction doesn’t outweigh the loss of crucial federal loan benefits. The potential financial risk of losing those benefits outweighs the slight savings.

Scenario Where Refinancing is Not Chosen

Consider Maria, who has $30,000 in federal student loans at a 5% interest rate. She is eligible to refinance, but she recently changed careers and is pursuing a professional certification. She anticipates a significant income increase in the near future. Maria decides to maintain her current federal loans because she can afford the current payments and anticipates the increased income will allow her to pay off the loan faster without refinancing. She prioritizes keeping the benefits and protections of her federal loans over a potentially small interest rate reduction. Her strategy is to leverage her future income increase to aggressively pay down the debt.

Final Conclusion

Ultimately, the decision to refinance your Sallie Mae student loans should be a well-considered one, based on a thorough understanding of your financial situation and a careful comparison of available options. By weighing the potential benefits against the risks and considering the long-term financial implications, you can make a choice that best supports your financial well-being. Remember to explore all available resources and, if needed, seek professional financial advice before making any final decisions.

FAQ Explained

What credit score is needed for Sallie Mae refinancing?

While Sallie Mae doesn’t publicly state a minimum credit score, a higher score generally leads to better interest rates. A good credit history is essential.

Can I refinance federal student loans with Sallie Mae?

No, Sallie Mae primarily refinances private student loans. Refinancing federal loans may impact your eligibility for federal loan forgiveness programs.

What happens if I miss a payment after refinancing?

Missing payments can negatively impact your credit score and may lead to penalties or increased interest rates. Contact Sallie Mae immediately if you anticipate difficulty making a payment.

How long does the Sallie Mae refinancing process take?

The application and approval process typically takes several weeks, depending on the volume of applications and the completeness of your provided information.