Navigating the world of student loans can be daunting, and choosing the right lender is crucial. Sallie Mae, a prominent player in the student loan market, has garnered a significant amount of online feedback. This analysis delves into Sallie Mae student loan reviews, examining customer experiences across various aspects of the loan process, from application to repayment. We’ll explore both positive and negative experiences to provide a balanced and informative overview.

This in-depth review considers customer service interactions, repayment plan flexibility, interest rates and fees, the application process itself, and overall borrower satisfaction. By analyzing a wide range of reviews, we aim to provide prospective borrowers with a realistic understanding of what to expect when dealing with Sallie Mae.

Sallie Mae Customer Service Experiences

Navigating the complexities of student loan repayment often requires interaction with the lender’s customer service. Sallie Mae, being one of the largest student loan providers in the US, receives a wide range of feedback regarding its customer service channels and responsiveness. This section analyzes both positive and negative experiences reported by borrowers, examining the efficiency and effectiveness of various communication methods.

Sallie Mae Customer Service: Positive Interactions

Many positive customer service experiences reported online highlight the helpfulness and efficiency of Sallie Mae representatives. Several borrowers have praised the representatives’ knowledge and ability to quickly resolve issues, such as processing payment adjustments or providing clear explanations of loan terms. For example, some reviews mention receiving prompt and accurate information regarding deferment options and successfully navigating the process with the assistance of a knowledgeable representative. These positive interactions often lead to increased borrower satisfaction and trust in the company.

Sallie Mae Customer Service: Negative Interactions

Conversely, a significant number of negative reviews detail frustrating experiences with Sallie Mae’s customer service. Long wait times on the phone are frequently cited, along with difficulties reaching a live representative. Some borrowers report receiving conflicting information from different representatives, leading to confusion and further delays in resolving their issues. Instances of unhelpful or dismissive representatives have also been documented, leaving borrowers feeling frustrated and unsupported. The lack of clear and concise communication, particularly regarding complex repayment plans, is another recurring complaint. One common complaint revolves around difficulty in getting ahold of the right department to address specific concerns.

Sallie Mae Customer Service: Channel Efficiency Comparison

Sallie Mae offers several customer service channels, including phone, email, and online chat. While the online chat option is often praised for its convenience and speed, especially for simple inquiries, phone support frequently receives criticism for its long wait times and potential difficulties connecting with a knowledgeable representative. Email support, while providing a written record of communication, is often perceived as slower than other methods, with responses sometimes taking several days or even weeks. The overall efficiency varies greatly depending on the complexity of the issue and the chosen communication channel.

Sallie Mae Customer Service: Exceeding and Falling Short of Expectations

Several instances demonstrate Sallie Mae’s customer service both exceeding and falling short of expectations. Positive experiences often involve representatives going above and beyond to assist borrowers, proactively offering solutions and providing exceptional support. For example, a borrower struggling with unexpected financial hardship might receive personalized guidance and assistance in exploring repayment options. In contrast, negative experiences frequently involve a lack of empathy, inadequate problem-solving, and a failure to address borrower concerns effectively. This often results in increased borrower stress and dissatisfaction, negatively impacting their overall perception of Sallie Mae. The inconsistency in service quality across different representatives and channels is a significant concern.

Repayment Options and Flexibility

Sallie Mae offers a range of repayment plans designed to accommodate varying financial situations and borrower needs. However, the flexibility and ease of navigating these options have been subjects of both praise and criticism from borrowers. Understanding the available plans and their associated pros and cons is crucial for effective loan management.

Sallie Mae’s repayment plans cater to different income levels and financial circumstances. While some borrowers find the options helpful in managing their debt, others express frustration with the complexity of the plans or the perceived lack of flexibility in adapting to unexpected life changes. Online reviews highlight both positive and negative experiences, providing valuable insights into the practical application of these plans.

Sallie Mae Repayment Plan Comparison

The following table summarizes the key features of several Sallie Mae repayment plans, based on user feedback. It’s important to note that individual experiences may vary, and the suitability of a specific plan depends heavily on individual financial circumstances.

| Repayment Plan | Pros (Based on Reviews) | Cons (Based on Reviews) | Flexibility |

|---|---|---|---|

| Standard Repayment | Simple, predictable monthly payments. | High monthly payments can be challenging for some borrowers. Limited flexibility. | Low; difficult to modify. |

| Extended Repayment | Lower monthly payments than standard repayment. | Longer repayment period leads to higher total interest paid. May not be available for all loans. | Moderate; modification may require documentation. |

| Graduated Repayment | Payments start low and gradually increase over time. | Payments can become significantly higher later in the repayment period. | Moderate; modification may require documentation. |

| Income-Driven Repayment (IDR) | Monthly payments are based on income and family size, making them more manageable for borrowers with lower incomes. | Payments may not cover all accrued interest, potentially leading to loan balance growth. Complex application process. | High; annual recertification required. Potentially easier to modify than other plans. |

Modifying Repayment Plans

The process of modifying a Sallie Mae repayment plan varies depending on the plan and the reason for the modification. While some borrowers report a relatively straightforward process, particularly with income-driven plans requiring annual recertification, others describe difficulties in contacting customer service or obtaining approvals for changes. Delays in processing requests and a lack of clear communication are common complaints. The availability of online tools and resources for managing repayment plans also influences the overall ease of modification. Successful modification often requires thorough documentation supporting the need for a change, such as proof of income or significant life events.

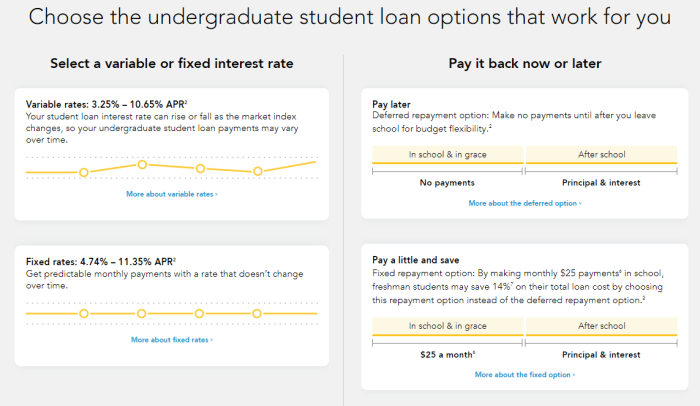

Interest Rates and Fees

Understanding the interest rates and fees associated with Sallie Mae student loans is crucial for borrowers to effectively manage their debt. This section will examine borrower experiences regarding interest rates, compare them to those of competitors, and explore instances of unexpected fees and Sallie Mae’s communication practices.

Sallie Mae’s interest rates, like those of other lenders, are variable and depend on several factors, including creditworthiness, loan type, and prevailing market conditions. This means that rates can fluctuate over the life of the loan, potentially impacting the total repayment amount.

Interest Rate Experiences

Many online reviews reveal a range of experiences with Sallie Mae’s interest rates. Some borrowers report receiving rates that aligned with their expectations based on their credit profiles, while others express dissatisfaction with rates perceived as higher than those offered by competing lenders. For example, one review mentioned receiving a 7% interest rate on a federal student loan, which they considered acceptable given their credit history. Another review highlighted a borrower who felt their rate of 9% was excessively high compared to offers from other institutions, prompting them to explore refinancing options. These varied experiences emphasize the importance of careful comparison shopping before selecting a student loan provider.

Comparison with Other Lenders

Reviews frequently compare Sallie Mae’s interest rates to those of other prominent student loan providers, such as Discover, SoFi, and private lenders. The comparison often depends on individual borrower circumstances and the specific loan product. Some reviews indicate that Sallie Mae’s rates were competitive in certain situations, while others found more favorable rates with alternative lenders. Direct comparisons are difficult without specific loan details, but the general consensus suggests a need for thorough research to secure the most advantageous interest rate.

Unexpected Fees

Several reviews mention encountering unexpected fees, although these are often associated with specific actions or circumstances. For example, some borrowers report late payment fees, which are standard across most lending institutions. Others have noted fees associated with loan consolidation or deferment requests. Clear communication from Sallie Mae regarding all potential fees is essential for borrowers to avoid unexpected charges and effectively budget for repayment.

Communication of Interest Rate Changes and Fee Structures

Borrowers’ experiences with Sallie Mae’s communication regarding interest rate changes and fee structures are varied. Some report receiving timely and clear notifications of any changes, while others express frustration with a lack of transparency or timely communication. Effective communication is vital to allow borrowers to adjust their repayment plans as needed and avoid penalties or unexpected costs. Reviews suggest that proactive communication from Sallie Mae, detailing potential rate fluctuations and outlining all associated fees, could significantly improve borrower satisfaction and financial planning.

Loan Application and Approval Process

Applying for a Sallie Mae student loan involves several steps, and the overall experience, according to user reviews, is a mixed bag. While some find the process straightforward, others report significant challenges. This section will detail the typical application steps, assess the clarity of the process, highlight common issues, and suggest improvements based on user feedback.

Many users describe the application process as generally manageable, but also point out areas where improvements could significantly enhance the borrower experience. The overall clarity and ease of understanding vary depending on individual circumstances and prior experience with loan applications.

Steps Involved in the Sallie Mae Loan Application Process

The application process generally follows these steps, as reported by users: Creating an account, providing personal and financial information, selecting a loan program, completing the FAFSA (Free Application for Federal Student Aid), submitting the application, and undergoing a credit check and approval process. The specific requirements and steps may vary depending on the type of loan and the applicant’s circumstances. Some applicants report a smoother process if they have pre-approved their application through a pre-qualification step, which can provide a clear picture of their eligibility before fully committing.

Clarity and Ease of Understanding the Application Process

User reviews suggest a mixed experience regarding the clarity of the application process. While many find the instructions relatively easy to follow, others report difficulty navigating the website or understanding specific requirements. The complexity can vary depending on factors such as the applicant’s level of financial literacy and prior experience with loan applications. Some users praise the helpfulness of Sallie Mae’s customer service representatives in clarifying ambiguities, while others describe frustrations with the lack of readily available and clear information. The online help resources are described by some as insufficient and others as adequate, depending on the specific issue.

Common Issues Encountered During the Application and Approval Process

- Website Navigation Difficulties: Several users reported difficulties navigating the Sallie Mae website, finding specific information, or completing certain sections of the application.

- Confusing Terminology and Jargon: The use of complex financial terminology can be confusing for applicants unfamiliar with loan applications.

- Lengthy Application Process: The overall application process is sometimes described as lengthy and time-consuming, requiring significant effort to complete.

- Inconsistent Communication: Users report inconsistencies in communication from Sallie Mae, with delays in receiving updates or responses to inquiries.

- Unexpected Requirements: Some applicants encounter unexpected requirements during the application process, leading to delays or rejections.

- Technical Glitches: Technical problems with the online application portal have been reported by some users.

Potential Improvements to the Application Process

Based on user feedback, several improvements could be made to enhance the Sallie Mae loan application process. These include simplifying the website navigation, using clearer and more concise language, streamlining the application process, improving communication with applicants, providing more proactive support, and enhancing the overall user experience. For example, a more intuitive online portal with improved search functionality could address navigation difficulties. A glossary of terms could help clarify financial jargon. Adding progress indicators and estimated completion times could improve the user experience. Finally, improving response times to applicant inquiries and providing regular updates on the application status could enhance communication.

Overall Borrower Satisfaction

Sallie Mae, as one of the largest student loan providers in the US, garners a mixed bag of reviews from borrowers. While many praise aspects of their service, significant criticism also exists, painting a complex picture of overall borrower satisfaction. Analyzing aggregated reviews reveals a trend of experiences varying widely depending on individual circumstances and the specific services utilized.

Borrower sentiment towards Sallie Mae is demonstrably influenced by factors such as the ease of the application process, the clarity and fairness of fees and interest rates, and the responsiveness and helpfulness of customer service representatives. A significant portion of negative reviews center around difficulties encountered during repayment, including unexpected fees, unclear communication, and perceived inflexibility in repayment plan options. Conversely, positive reviews frequently highlight the user-friendly online platform, the availability of various repayment plans, and the overall efficiency of the loan disbursement process.

Distribution of Positive and Negative Reviews

To visualize the distribution of positive and negative reviews, imagine a bar graph. The horizontal axis represents the spectrum of review sentiment, ranging from extremely negative to extremely positive. The vertical axis represents the number of reviews falling within each sentiment category. A substantial portion of the bar would fall within the “neutral” category, indicating a significant number of borrowers having neither overwhelmingly positive nor negative experiences. A moderately sized portion of the bar would extend into the “positive” range, representing satisfied borrowers. A smaller, but still noticeable, portion would extend into the “negative” range, reflecting the experiences of dissatisfied borrowers. This visual representation illustrates the mixed nature of borrower sentiment, with no single dominant trend.

Frequently Praised Aspects of Sallie Mae

Positive reviews frequently highlight Sallie Mae’s user-friendly online platform, making account management and repayment straightforward. Many borrowers appreciate the variety of repayment options offered, allowing for customization based on individual financial situations. The generally efficient loan disbursement process, ensuring timely access to funds, also receives considerable praise. Finally, some borrowers commend Sallie Mae’s proactive communication, keeping them informed throughout the loan lifecycle.

Frequently Criticized Aspects of Sallie Mae

Conversely, negative feedback frequently targets Sallie Mae’s customer service. Many borrowers report difficulties reaching representatives, experiencing long wait times, and receiving unhelpful or inconsistent information. Concerns surrounding interest rates and fees, particularly unexpected charges, are also prevalent. A significant number of negative reviews cite a lack of flexibility in repayment plans, leaving borrowers feeling trapped in difficult financial situations. Finally, the complexity of navigating Sallie Mae’s website and various repayment options contributes to negative experiences for some borrowers.

Factors Contributing to High and Low Borrower Satisfaction

High levels of borrower satisfaction are strongly correlated with positive customer service experiences, clear and transparent communication regarding fees and interest rates, and a user-friendly online platform. Conversely, low levels of satisfaction are frequently linked to negative customer service interactions, unexpected fees, inflexible repayment options, and a lack of clarity in communication regarding loan terms and conditions. The absence of personalized support and difficulty in navigating the repayment process also contribute significantly to negative experiences. For example, a borrower struggling with unexpected job loss might experience low satisfaction due to a lack of available hardship options or difficulty in contacting customer service for assistance. In contrast, a borrower with a straightforward repayment plan and consistently positive interactions with customer service would likely report high satisfaction.

Final Review

Ultimately, the Sallie Mae student loan experience, as reflected in numerous online reviews, presents a mixed bag. While some borrowers praise the company’s repayment options and straightforward application process, others express frustration with customer service responsiveness and unexpected fees. A thorough understanding of both the positive and negative aspects, as detailed in this analysis, empowers prospective borrowers to make informed decisions and manage their expectations effectively. Careful consideration of individual financial circumstances and a comparison with alternative lenders remain crucial steps in the student loan selection process.

Frequently Asked Questions

What happens if I miss a Sallie Mae payment?

Missing a payment can lead to late fees and negatively impact your credit score. Contact Sallie Mae immediately to explore options like forbearance or deferment to avoid further penalties.

Can I refinance my Sallie Mae student loans?

Yes, you can refinance your Sallie Mae loans with another lender. Refinancing might lower your interest rate, but it could also impact your eligibility for federal loan forgiveness programs. Carefully weigh the pros and cons before refinancing.

How does Sallie Mae handle co-signers?

Sallie Mae often requires a co-signer, especially for students with limited credit history. The co-signer shares responsibility for repayment, so their creditworthiness is a significant factor in loan approval.

What types of student loans does Sallie Mae offer?

Sallie Mae offers various student loan options, including federal and private loans, catering to undergraduate and graduate students. The specific options available will depend on your individual circumstances and eligibility.