Navigating the complexities of student loan interest rates can feel overwhelming, especially with a major lender like Sallie Mae. Understanding the factors that influence these rates—from your creditworthiness to the loan type—is crucial for responsible borrowing and long-term financial planning. This guide provides a comprehensive overview of Sallie Mae student loan interest rates, helping you make informed decisions about your education funding.

We’ll explore the various types of Sallie Mae loans and their associated interest rates, providing historical context and comparing them to offerings from other federal and private lenders. We’ll also delve into practical aspects like interest calculation, repayment strategies, and the potential long-term financial impact of your choices. By the end, you’ll have a clearer understanding of how to manage your Sallie Mae student loan debt effectively.

Understanding Sallie Mae Student Loan Interest Rates

Sallie Mae, while no longer a government-sponsored entity, remains a significant player in the private student loan market. Understanding their interest rates is crucial for prospective borrowers seeking to finance their education. Interest rates are a key factor determining the total cost of a student loan, and Sallie Mae’s rates, like those of other lenders, are subject to various influences.

Sallie Mae Student Loan Interest Rates: Influencing Factors

Several factors contribute to the interest rate a borrower receives on a Sallie Mae student loan. Creditworthiness is paramount; borrowers with strong credit histories, as demonstrated by credit scores and responsible debt management, typically qualify for lower rates. The loan type itself also plays a role; private loans generally carry higher interest rates than federal loans due to the higher risk for the lender. The loan term impacts the rate; longer repayment periods often come with higher interest rates to compensate the lender for the extended time value of money. Finally, prevailing market interest rates also influence Sallie Mae’s rates, reflecting broader economic conditions. When overall interest rates rise, so too do student loan rates.

Sallie Mae Student Loan Types and Interest Rates

Sallie Mae offers various private student loan products, each with its own interest rate structure. These loans are not subsidized, meaning interest accrues from the moment the funds are disbursed. Specific interest rates are not publicly listed by Sallie Mae and are determined on a case-by-case basis based on the borrower’s creditworthiness and other factors mentioned previously. Generally, Sallie Mae’s private student loans have higher interest rates than federal student loans. Borrowers should carefully compare rates from multiple lenders before committing to a loan. A hypothetical example could illustrate this: a borrower with excellent credit might receive a rate of 6% on a Sallie Mae loan, while a borrower with a less-than-perfect credit history might receive a rate closer to 10%. This highlights the importance of establishing and maintaining a strong credit profile before applying for a student loan.

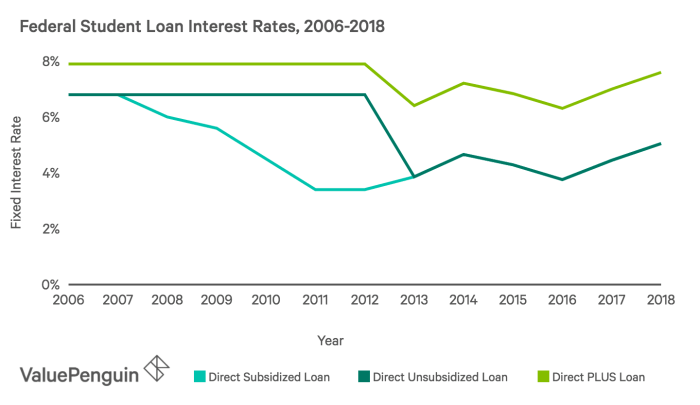

Historical Overview of Sallie Mae Student Loan Interest Rate Changes

Sallie Mae’s interest rates have fluctuated over time, mirroring changes in the broader financial market. During periods of low interest rates, such as the years following the 2008 financial crisis, Sallie Mae’s rates tended to be lower. Conversely, during periods of economic uncertainty or rising inflation, rates have generally increased. Tracking historical interest rate data from reputable financial sources provides insight into these trends. For example, comparing data from 2010 to 2023 would reveal a noticeable fluctuation, with rates generally lower in the early 2010s and higher in more recent years. Precise historical rate data is not consistently available publicly from Sallie Mae itself, however, financial news and data aggregation sites often track these changes.

Comparison of Sallie Mae Interest Rates to Other Lenders

Sallie Mae’s interest rates are generally competitive within the private student loan market, but it’s essential to compare them to other lenders, both private and federal. Federal student loans, such as those offered through the Department of Education, typically have lower interest rates than private loans. However, federal loans often have stricter eligibility requirements. Private lenders, including Sallie Mae, offer more flexibility but usually at a higher interest rate. A direct comparison requires obtaining rate quotes from multiple lenders, as the final interest rate offered will depend on the individual borrower’s credit profile and loan terms. For example, a borrower might compare Sallie Mae’s rates to those offered by Discover Student Loans, Citizens Bank, or other institutions, focusing on the APR (Annual Percentage Rate) to ensure a comprehensive comparison of the total cost of borrowing.

Interest Rate Calculation and Application

Understanding how Sallie Mae calculates interest and applies it to your loan is crucial for managing your debt effectively. This section details the process of calculating monthly payments, the mechanics of interest capitalization, and how interest rates influence the overall loan cost.

Sallie Mae uses a standard amortization formula to calculate your monthly student loan payments. This formula considers the loan’s principal amount, the interest rate, and the loan’s term (length). The calculation distributes the loan’s principal and accrued interest across the entire repayment period, ensuring consistent monthly payments.

Monthly Payment Calculation

The exact formula is complex, but it essentially divides the loan into a series of equal payments. Each payment covers a portion of the principal and the interest that has accrued on the remaining balance since the last payment. Early payments consist mostly of interest, while later payments progressively pay off more of the principal. Many online calculators and Sallie Mae’s own website provide tools to easily determine monthly payments based on the loan’s specific terms.

Interest Capitalization

Interest capitalization is the process of adding accumulated unpaid interest to the principal balance of your loan. This typically occurs when you are in a grace period or during periods of deferment or forbearance. For example, if you have accrued $500 in interest during a deferment period, that $500 would be added to your principal balance, increasing the total amount you owe. This means you’ll be paying interest on that accumulated interest going forward, significantly increasing the total cost of your loan over time. It’s important to understand that capitalization increases the total amount you ultimately repay.

Interest Rate’s Impact on Total Loan Cost

The interest rate directly impacts the total cost of your Sallie Mae loan. A higher interest rate means you’ll pay more in interest over the life of the loan, even if your monthly payment remains the same. A lower interest rate results in lower overall interest payments. For example, a loan with a 7% interest rate will accrue significantly more interest over 10 years than a loan with a 4% interest rate, leading to a much higher total repayment amount.

Example Loan Payment Scenarios

The following table illustrates how loan amount, interest rate, and loan term affect monthly payments. These are illustrative examples and actual payments may vary slightly depending on the specific loan terms and Sallie Mae’s calculations.

| Loan Amount | Interest Rate | Loan Term (Years) | Approximate Monthly Payment |

|---|---|---|---|

| $10,000 | 5% | 10 | $106 |

| $20,000 | 7% | 10 | $230 |

| $30,000 | 6% | 15 | $250 |

| $15,000 | 4% | 5 | $275 |

Managing and Reducing Interest Payments

Effectively managing your Sallie Mae student loan interest payments is crucial for minimizing your overall debt burden and achieving financial freedom sooner. Understanding your repayment options and proactively employing strategies to reduce interest costs can significantly impact your long-term financial well-being. This section will explore various strategies to manage and reduce your interest payments, along with the potential consequences of neglecting timely payments.

Strategies for Reducing Sallie Mae Student Loan Interest Payments

Several strategies can help borrowers reduce the amount of interest they pay on their Sallie Mae student loans. These strategies focus on minimizing the principal balance more quickly and, consequently, reducing the total interest accrued over the loan’s lifetime.

- Make extra payments: Even small, additional payments can significantly reduce the principal balance and shorten the loan repayment term, ultimately saving on interest. For example, an extra $50 payment each month could save thousands of dollars in interest over the life of the loan.

- Refinance your loans: If interest rates have fallen since you initially took out your loans, refinancing with a lower interest rate can substantially reduce your monthly payments and total interest paid. However, carefully consider the terms and fees associated with refinancing before making a decision.

- Explore income-driven repayment plans: These plans adjust your monthly payments based on your income and family size. While they may extend your repayment period, they can lower your monthly payments, making them more manageable in the short term.

Sallie Mae Repayment Plan Benefits and Drawbacks

Sallie Mae offers various repayment plans, each with its own advantages and disadvantages. Choosing the right plan depends on individual financial circumstances and goals.

| Repayment Plan | Benefits | Drawbacks |

|---|---|---|

| Standard Repayment | Simple, fixed monthly payments | Higher monthly payments, may not be affordable for all borrowers |

| Graduated Repayment | Lower initial payments that gradually increase | Higher payments later in the repayment term, potential for difficulty managing increasing payments |

| Extended Repayment | Lower monthly payments over a longer repayment period | Accumulates more interest over the loan’s lifetime |

| Income-Driven Repayment | Payments based on income and family size | Longer repayment period, potential for remaining balance forgiveness after 20-25 years (depending on the plan and eligibility), may result in higher overall interest paid |

Consequences of Late or Missed Sallie Mae Loan Payments

Failing to make timely payments on your Sallie Mae student loans can have serious financial consequences.

- Late fees: Sallie Mae will charge late fees for missed payments, adding to your overall debt.

- Negative impact on credit score: Late payments are reported to credit bureaus, significantly damaging your credit score, making it harder to obtain loans, credit cards, or even rent an apartment in the future.

- Loan default: Repeated missed payments can lead to loan default, resulting in wage garnishment, tax refund offset, and difficulty obtaining future credit.

- Collection agencies: Sallie Mae may turn your account over to collections agencies, which can aggressively pursue payment and further damage your credit.

Resources for Borrowers Struggling with Sallie Mae Loan Payments

Several resources are available to assist borrowers facing difficulties with their Sallie Mae student loan payments.

- Sallie Mae’s customer service: Contact Sallie Mae directly to discuss your situation and explore possible options, such as deferment or forbearance.

- National Foundation for Credit Counseling (NFCC): The NFCC offers free and low-cost credit counseling services to help borrowers create a budget and manage their debt.

- Student Loan Borrower Assistance websites: Many websites provide information and resources on managing student loan debt, including repayment options and debt relief programs.

The Impact of Interest Rates on Borrowers

Understanding the nuances of student loan interest rates is crucial for long-term financial well-being. High interest rates significantly impact borrowers, potentially hindering their ability to achieve financial goals and creating considerable financial strain. This section explores the multifaceted effects of these rates on borrowers’ lives.

High interest rates on student loans have profound long-term financial implications. The longer it takes to repay the loan, the more interest accrues, leading to a substantially larger total repayment amount than the original principal. This snowball effect can significantly delay major life milestones, such as buying a home, starting a family, or investing in retirement.

Long-Term Financial Implications of High Interest Rates

The cumulative effect of high interest rates can be staggering. Consider a scenario where two borrowers each take out a $30,000 student loan. Borrower A secures a loan with a 5% interest rate, while Borrower B receives a loan with a 10% interest rate. Both borrowers opt for a 10-year repayment plan. Over the life of the loan, Borrower A will pay significantly less in interest than Borrower B, resulting in a considerable difference in their total repayment costs. This difference highlights the importance of securing the lowest possible interest rate when taking out student loans.

Hypothetical Scenario Illustrating Interest Rate Impact

Let’s illustrate this with a concrete example. Imagine two individuals, both graduating with $30,000 in student loan debt. One borrows at a 6% interest rate, while the other borrows at a 9% interest rate. Both choose a standard 10-year repayment plan. Using a loan amortization calculator (widely available online), we can see that the borrower with the 6% interest rate will pay approximately $3,774 more in total interest over the life of the loan than the borrower with the 9% rate. This represents a substantial increase in the total cost of their education.

Interest Rates’ Influence on Achieving Financial Goals

High interest rates can significantly impact a borrower’s ability to achieve various financial goals. The substantial monthly payments required for high-interest loans can limit the amount of money available for savings, investments, or other crucial financial needs. This could delay homeownership, prevent sufficient retirement savings, or limit the ability to invest in other growth opportunities. The constant pressure of debt repayment can create significant financial stress and constrain future opportunities.

Psychological Effects of High Student Loan Debt and Interest Burdens

The weight of substantial student loan debt, particularly when compounded by high interest rates, can have significant psychological consequences. Borrowers may experience chronic stress, anxiety, and even depression. The feeling of being perpetually burdened by debt can negatively impact mental well-being, affecting relationships, career choices, and overall life satisfaction. The constant pressure to repay the loan can lead to feelings of hopelessness and limit opportunities for personal growth and fulfillment.

Future Trends and Predictions

Predicting future Sallie Mae student loan interest rates requires considering several interconnected factors. While precise forecasting is impossible, analyzing current economic trends and historical data allows for reasonable estimations of potential future scenarios. These predictions should be viewed as possibilities, not certainties, and are subject to change based on unforeseen economic shifts.

Interest rate fluctuations are influenced by a complex interplay of economic indicators. The Federal Reserve’s monetary policy plays a crucial role, as interest rate adjustments by the Fed often ripple through the entire financial system, impacting borrowing costs for various institutions, including Sallie Mae. Inflation rates also significantly influence interest rates; high inflation typically leads to higher interest rates to curb borrowing and spending. Government regulations and policies pertaining to student loan programs also directly affect Sallie Mae’s ability to set rates.

Factors Influencing Future Interest Rate Changes

Several key factors will likely shape future Sallie Mae student loan interest rates. These include the overall health of the economy, inflation levels, the Federal Reserve’s monetary policy decisions, and the demand for student loans. For example, a period of robust economic growth might lead to increased competition among lenders, potentially lowering interest rates. Conversely, a recession could cause rates to rise as lenders seek to mitigate risk. Government intervention, such as changes in student loan forgiveness programs or increased funding for higher education, could also impact interest rates. The level of student loan defaults also plays a role; a higher default rate could lead to lenders increasing rates to offset potential losses.

The Impact of Economic Conditions on Sallie Mae Loan Interest Rates

Economic conditions exert a powerful influence on Sallie Mae’s interest rates. During periods of economic expansion, when inflation is low and unemployment is low, interest rates tend to be lower. Lenders are more willing to offer competitive rates to attract borrowers. Conversely, during economic downturns or recessions, characterized by high unemployment and inflation, interest rates often increase. This is because lenders perceive a higher risk of borrowers defaulting on their loans. The 2008 financial crisis serves as a prime example, where the increased risk of defaults led to significantly higher interest rates on various types of loans, including student loans. The current inflationary environment presents a similar challenge, where increased inflation is leading to interest rate hikes.

A Possible Future Scenario

Imagine a scenario five years from now. The economy has experienced a period of moderate growth, followed by a period of slower growth due to global uncertainties. Inflation has been successfully managed, but remains higher than the pre-pandemic levels. The Federal Reserve has maintained a relatively tight monetary policy, keeping interest rates slightly elevated. In this context, Sallie Mae student loan interest rates might hover around 6-8%, slightly higher than the current average, reflecting the increased risk associated with slower economic growth and persistent inflation. This scenario is plausible given the current economic climate and the ongoing uncertainty surrounding global economic stability. However, unforeseen events could significantly alter this prediction.

End of Discussion

Successfully managing Sallie Mae student loan interest rates requires proactive planning and a thorough understanding of the loan terms. By carefully considering the factors influencing interest rates, exploring different repayment options, and employing effective budgeting strategies, borrowers can minimize their long-term costs and pave the way for a brighter financial future. Remember, seeking guidance from financial advisors or utilizing the resources available to borrowers can make a significant difference in your journey towards debt freedom.

Q&A

What happens if I miss a Sallie Mae student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default, with serious financial consequences.

Can I refinance my Sallie Mae student loan to a lower interest rate?

Yes, refinancing is a possibility, but it depends on your credit score and current interest rates. Shop around and compare offers from different lenders.

How often are Sallie Mae interest rates adjusted?

Sallie Mae’s interest rates are typically fixed for the life of the loan, but variable rates are sometimes offered. The terms of your specific loan agreement will detail how your rate is determined and if it can change.

What are the different repayment plans available for Sallie Mae loans?

Sallie Mae offers various repayment plans, including standard, graduated, extended, and income-driven repayment options. Choosing the right plan depends on your individual financial situation.