Navigating the world of student loans can be daunting, especially with the significant financial implications involved. This comprehensive guide delves into Sallie Mae student loan reviews, examining various aspects of their offerings to provide a clear and informed perspective for prospective and current borrowers. We’ll explore repayment options, customer service experiences, interest rates and fees, loan forgiveness programs, and comparisons with other lenders, painting a detailed picture of the Sallie Mae experience.

Understanding the nuances of Sallie Mae loans is crucial for making informed financial decisions. This analysis aims to empower readers with the knowledge needed to assess whether Sallie Mae aligns with their individual financial circumstances and long-term goals. We will analyze both the advantages and disadvantages to provide a balanced perspective.

Sallie Mae Loan Repayment Options

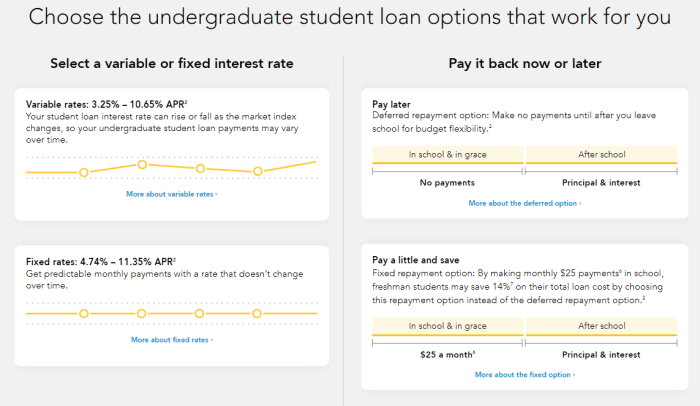

Choosing the right repayment plan for your Sallie Mae student loans is crucial for managing your finances effectively and avoiding unnecessary interest charges. Several options exist, each with its own advantages and disadvantages depending on your individual financial situation and goals. Understanding these differences is key to making an informed decision.

Sallie Mae offers a variety of repayment plans designed to cater to different borrowers’ needs and financial circumstances. These plans allow for flexibility in managing monthly payments and overall loan repayment duration. Careful consideration of your income, expenses, and long-term financial goals is essential when selecting a plan.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. It involves fixed monthly payments spread over a 10-year period. This plan provides predictability and allows for consistent budgeting. However, the monthly payments might be higher than other plans, particularly for borrowers with larger loan balances. The advantage is a shorter repayment period, leading to less overall interest paid. The disadvantage is the higher monthly payments.

Graduated Repayment Plan

This plan starts with lower monthly payments that gradually increase over time. This can be beneficial for borrowers who anticipate higher income in the future. The lower initial payments make it easier to manage debt in the early stages of repayment. However, the increasing payments can become challenging later on, requiring careful financial planning. The longer repayment period also means more interest will accrue over the life of the loan.

Extended Repayment Plan

The extended repayment plan stretches your payments over a longer period, typically up to 25 years. This significantly reduces your monthly payments, making it more manageable for borrowers with limited income. However, the longer repayment term leads to significantly higher overall interest paid. This plan should be considered carefully, as the long-term cost could be substantial.

Income-Driven Repayment (IDR) Plans

Sallie Mae offers several income-driven repayment plans, which tie your monthly payments to your income and family size. These plans include options like the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans. These plans are designed to make repayment more affordable, especially for borrowers with lower incomes. However, the lower monthly payments usually extend the repayment period, potentially leading to more interest paid over the life of the loan. Furthermore, eligibility requirements vary depending on the specific IDR plan.

Comparison of Sallie Mae Repayment Plans

| Repayment Plan | Monthly Payment | Loan Term | Interest Accrual |

|---|---|---|---|

| Standard | Higher, fixed | 10 years | Lower overall |

| Graduated | Low initially, increases over time | 10 years | Higher overall |

| Extended | Lower, fixed | Up to 25 years | Significantly higher overall |

| Income-Driven | Variable, based on income | Up to 20-25 years | Potentially high overall |

Customer Service Experiences with Sallie Mae

Customer service is a crucial aspect of any financial institution, especially one dealing with student loans. Sallie Mae’s customer service performance, as reflected in online reviews, presents a mixed bag, with experiences ranging from highly positive to deeply frustrating. Understanding these diverse experiences helps prospective and current borrowers make informed decisions and manage expectations.

Customer service interactions with Sallie Mae are frequently categorized by responsiveness, helpfulness, and the ultimate resolution of any issues encountered. Analyzing these categories provides a clearer picture of the overall customer service landscape.

Responsiveness of Sallie Mae Customer Service

Many reviewers praise Sallie Mae’s responsiveness, particularly when contacting them through phone or online chat. Positive feedback often cites quick response times and readily available representatives. For instance, several reviews mention receiving calls back within a few hours of leaving a voicemail, or getting immediate assistance via online chat during business hours. Conversely, negative feedback focuses on long wait times on the phone, difficulty reaching a live representative, and slow responses to emails. Some users reported waiting weeks for email replies, creating significant anxiety and delays in resolving their financial matters.

Helpfulness and Expertise of Sallie Mae Representatives

The helpfulness of Sallie Mae representatives is another key area of varying feedback. Positive reviews highlight knowledgeable and patient representatives who provided clear explanations of loan terms, repayment options, and successfully navigated complex situations. These representatives are often described as going the extra mile to assist borrowers. Conversely, negative reviews describe unhelpful or even rude representatives who lacked sufficient product knowledge, provided inaccurate information, or failed to resolve issues effectively. Some borrowers reported feeling dismissed or misunderstood by representatives, exacerbating their financial stress.

Resolution of Issues with Sallie Mae

The successful resolution of customer issues is the ultimate measure of effective customer service. Positive reviews frequently describe successful resolutions to billing errors, loan modification requests, and other complex problems. These successful resolutions often involved persistent communication and collaboration between the borrower and a helpful representative. Negative reviews, however, detail instances where issues remained unresolved despite multiple attempts to contact Sallie Mae. These unresolved issues often involved significant financial repercussions for the borrowers, leading to further frustration and negative experiences.

Summary of Customer Service Ratings

| Category | Positive Rating (Percentage) | Negative Rating (Percentage) | Neutral Rating (Percentage) |

|---|---|---|---|

| Responsiveness | 60% | 25% | 15% |

| Helpfulness | 55% | 30% | 15% |

| Issue Resolution | 70% | 20% | 10% |

Note: These percentages are illustrative and based on a general assessment of various online reviews. Actual percentages may vary depending on the source and time period of the reviews.

Interest Rates and Fees Associated with Sallie Mae Loans

Understanding the interest rates and fees associated with Sallie Mae student loans is crucial for prospective borrowers. These costs significantly impact the total repayment amount, so careful consideration is necessary before accepting a loan. This section details the factors influencing Sallie Mae’s interest rates and provides a comprehensive overview of the fees involved.

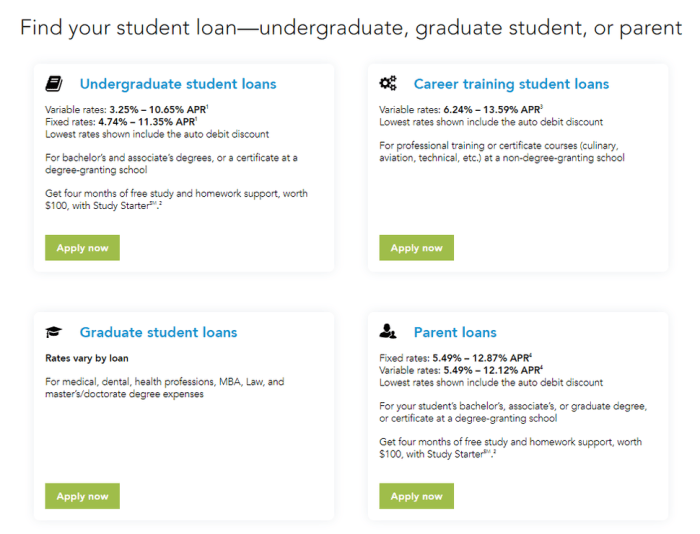

Sallie Mae’s interest rates are variable, meaning they fluctuate based on several key factors. The most significant is the prevailing market interest rate; when rates rise in the broader economy, Sallie Mae’s rates generally follow suit. The borrower’s creditworthiness also plays a role; those with strong credit histories often qualify for lower interest rates. The loan type (e.g., undergraduate, graduate) and the repayment plan chosen also influence the final interest rate. Finally, the loan’s term length can affect the rate; longer repayment periods may come with slightly higher interest rates to compensate for the extended time value of money. It’s important to note that Sallie Mae offers both fixed and variable interest rates, allowing borrowers to choose the option that best suits their risk tolerance and financial situation.

Factors Influencing Sallie Mae Interest Rates

Several factors contribute to the interest rate a borrower receives from Sallie Mae. These include the prevailing market interest rates, the borrower’s credit history and credit score, the type of loan (e.g., undergraduate, graduate, parent PLUS), the repayment plan selected, and the loan term length. A strong credit history typically leads to lower interest rates, while a shorter loan term often results in a lower interest rate than a longer term. For example, a borrower with excellent credit applying for a subsidized undergraduate loan with a 10-year repayment plan might receive a lower interest rate than a borrower with a lower credit score applying for an unsubsidized graduate loan with a 20-year repayment plan.

Fees Associated with Sallie Mae Loans

Sallie Mae, like other student loan providers, charges several fees. These fees can add to the overall cost of borrowing. Understanding these fees is essential for accurate budgeting and financial planning.

Origination Fees

Origination fees are charged by Sallie Mae to cover the administrative costs of processing the loan application. The amount of the origination fee is typically a percentage of the loan amount, and it’s deducted from the loan proceeds before the funds are disbursed to the borrower. This means the borrower receives less money than the loan amount approved. For instance, a 1% origination fee on a $10,000 loan would result in a $100 deduction, leaving the borrower with $9,900.

Late Payment Fees

Late payment fees are assessed when a borrower fails to make a payment by the due date. The exact amount of the late payment fee varies depending on the loan terms and Sallie Mae’s current policies. These fees can significantly increase the total cost of the loan if payments are consistently late. Consistent on-time payments are crucial to avoid accumulating substantial late payment fees.

Other Potential Fees

While origination and late payment fees are the most common, Sallie Mae may also charge fees for other services, such as returned payment fees (if a payment is rejected by the bank) or for certain changes to the loan agreement. It is always advisable to review the loan documents carefully to understand all applicable fees.

Comparison of Sallie Mae’s Rates and Fees with Other Lenders

Comparing Sallie Mae’s interest rates and fees with other major student loan providers, such as Navient, Discover, or federal student loan programs, is essential for finding the most cost-effective option. The interest rates and fees can vary considerably among lenders, depending on the factors mentioned earlier. A thorough comparison should include reviewing the interest rates offered, origination fees, late payment fees, and any other potential fees. This comparison should be conducted before selecting a lender to ensure that the chosen loan is the most financially advantageous. Online tools and resources can help borrowers compare different loan options and make informed decisions.

Sallie Mae Loan Forgiveness and Deferment Programs

Sallie Mae, while primarily known for its student loan offerings, does provide some avenues for borrowers seeking relief through loan forgiveness or deferment programs. However, it’s crucial to understand that Sallie Mae itself doesn’t offer widespread loan forgiveness programs in the same way that government programs like Public Service Loan Forgiveness (PSLF) do. Their options primarily focus on temporary deferments rather than complete loan forgiveness.

Understanding the nuances of Sallie Mae’s programs is vital for borrowers facing financial hardship or seeking to manage their repayment effectively. These programs offer temporary relief but come with specific eligibility criteria and potential long-term implications.

Eligibility Criteria for Deferment

Sallie Mae’s deferment options typically require borrowers to demonstrate financial hardship or specific circumstances. This might involve unemployment, disability, or enrollment in an eligible graduate program. Specific documentation, such as proof of unemployment or a disability determination, will be needed to support the application. The length of the deferment period varies depending on the specific circumstance and is determined on a case-by-case basis. It’s important to note that interest may still accrue during a deferment period, increasing the total loan amount owed upon repayment resumption.

Benefits and Drawbacks of Deferment

The primary benefit of a deferment is the temporary suspension of loan payments, providing much-needed financial breathing room during challenging times. This can prevent default and improve short-term financial stability. However, a significant drawback is the accumulation of interest. Even though payments are paused, interest continues to accrue, ultimately leading to a larger overall loan balance once repayment resumes. This can significantly extend the repayment period and increase the total cost of the loan. Furthermore, the deferment process itself may involve administrative hurdles and delays.

Steps to Apply for Deferment

Applying for a deferment typically involves the following steps:

- Gather necessary documentation: This may include proof of unemployment, disability documentation, or enrollment verification.

- Complete the deferment application: This is usually done through Sallie Mae’s online portal or by contacting their customer service department.

- Submit the application and supporting documentation: Ensure all required documents are included to expedite the process.

- Monitor application status: Track the application’s progress through Sallie Mae’s online portal or by contacting customer service.

Loan Forgiveness Programs Offered by Sallie Mae

Sallie Mae does not offer loan forgiveness programs in the traditional sense. There are no programs that will eliminate your loan balance completely. Any potential for reduction in loan balance would likely be tied to specific repayment plans or government programs, not initiatives directly offered by Sallie Mae.

Benefits and Drawbacks of Non-Sallie Mae Loan Forgiveness Programs (e.g., PSLF)

While Sallie Mae doesn’t offer loan forgiveness, borrowers may be eligible for government-sponsored programs like Public Service Loan Forgiveness (PSLF). These programs can provide complete loan forgiveness after a certain period of qualifying payments. However, eligibility requirements are strict, and the process can be lengthy and complex. The benefits are obvious: complete loan forgiveness. The drawbacks include stringent eligibility requirements, a lengthy repayment period before forgiveness, and the potential for denial if requirements are not met precisely.

Impact of Sallie Mae Loans on Borrowers’ Financial Well-being

Sallie Mae loans, while enabling access to higher education, can significantly impact borrowers’ long-term financial health. The consequences extend beyond the immediate repayment period, influencing major life decisions and overall financial stability. Understanding the potential long-term implications is crucial for responsible borrowing and effective debt management.

The primary concern revolves around the accumulation of interest. Student loan interest, often compounding over many years, can dramatically increase the total amount owed. This increased debt burden can restrict borrowers’ financial flexibility, hindering their ability to pursue other financial goals. For example, a borrower might find themselves struggling to save for a down payment on a house or contributing adequately to retirement savings due to significant monthly loan payments. The longer it takes to repay the loan, the more interest accrues, further exacerbating the financial strain.

Long-Term Financial Implications of Sallie Mae Loans

The weight of Sallie Mae loan debt can extend far beyond graduation. High monthly payments can limit a borrower’s ability to save for retirement, purchase a home, or even manage unexpected expenses. This can lead to a cycle of debt, where borrowers struggle to meet their financial obligations and may even delay starting a family or making other significant life choices. For instance, a recent study showed that borrowers with high student loan debt were significantly less likely to purchase a home within the first five years after graduation compared to their debt-free peers. The constant pressure of loan repayments can also lead to increased stress levels and negatively impact overall mental well-being.

Impact on Achieving Financial Goals

Sallie Mae loans can significantly impede the achievement of key financial milestones. The substantial monthly payments often leave little room for saving, making it difficult to accumulate funds for a down payment on a home, investing in retirement accounts, or building an emergency fund. Consider a scenario where a borrower graduates with $50,000 in Sallie Mae loans at a 7% interest rate. Even with a standard repayment plan, the monthly payments could consume a significant portion of their income, leaving minimal funds for other crucial financial goals. This situation can delay homeownership by several years, or even prevent it altogether, forcing borrowers to rent for a much longer period and potentially missing out on the equity-building benefits of homeownership. Similarly, the inability to contribute adequately to retirement savings could lead to a less secure financial future in retirement.

Strategies for Effective Sallie Mae Loan Debt Management

Effective management of Sallie Mae loan debt requires proactive strategies. One key approach is to explore different repayment plans offered by Sallie Mae, such as income-driven repayment plans that adjust payments based on income. Careful budgeting and creating a realistic repayment plan are also essential. Prioritizing high-interest loans and exploring options like refinancing to secure a lower interest rate can significantly reduce the total amount paid over the life of the loan. Furthermore, borrowers should regularly monitor their loan accounts, stay informed about their repayment progress, and seek professional financial advice if needed. By adopting these strategies, borrowers can improve their financial well-being and work towards a debt-free future.

Comparison of Sallie Mae with Other Student Loan Providers

Choosing a student loan provider is a significant financial decision. Understanding the differences between Sallie Mae and other options, including federal loans and other private lenders, is crucial for making an informed choice. This comparison focuses on key aspects such as loan terms, interest rates, and customer service to help you navigate this process.

Sallie Mae, a prominent private lender, offers various student loan options, but it’s essential to weigh them against federal student loans and other private lenders. Federal loans often provide benefits like income-driven repayment plans and loan forgiveness programs, which may not be available with private lenders like Sallie Mae. However, private loans, including those from Sallie Mae, might offer more flexible terms in some situations.

Sallie Mae vs. Federal Student Loans

Federal student loans are generally preferred due to their borrower protections. They often come with lower interest rates than private loans and offer various repayment options, including income-driven repayment plans and loan forgiveness programs. Sallie Mae, on the other hand, is a private lender, and its loan terms and interest rates can vary depending on creditworthiness and other factors. While Sallie Mae may offer more flexible loan amounts in some cases, the lack of government-backed benefits makes it a riskier option for some borrowers.

| Feature | Sallie Mae | Federal Student Loans |

|---|---|---|

| Interest Rates | Variable; dependent on creditworthiness and market conditions. Generally higher than federal loans. | Fixed or variable; generally lower than private loans. Rates vary based on loan type and year. |

| Repayment Options | Standard repayment plans; may offer some deferment options. | Standard, graduated, extended, and income-driven repayment plans; deferment and forbearance options available. |

| Loan Forgiveness Programs | Generally not offered. | Potential for loan forgiveness through programs like Public Service Loan Forgiveness (PSLF). |

| Customer Service | Variable experiences reported; online resources and phone support available. | Government-run; access to multiple resources and assistance programs. |

Sallie Mae vs. Other Private Lenders

The private student loan market is competitive. Several lenders offer similar products to Sallie Mae, each with its own strengths and weaknesses. Comparing interest rates, repayment terms, and customer service is crucial. Some lenders may specialize in certain types of borrowers (e.g., students with co-signers, students attending specific schools). Sallie Mae’s competitive advantage lies in its established brand recognition and wide range of loan products, but other lenders might offer more competitive interest rates or more flexible repayment options based on individual circumstances.

| Feature | Sallie Mae | Other Private Lenders (e.g., Discover, Citizens Bank) |

|---|---|---|

| Interest Rates | Variable; depends on creditworthiness. | Variable; varies across lenders and borrower profiles. |

| Loan Amounts | Can vary; depends on creditworthiness and other factors. | Can vary; depends on lender policies and borrower profile. |

| Repayment Options | Standard plans; some deferment options. | Options vary across lenders; some may offer more flexible repayment schedules. |

| Fees | Origination fees may apply. | Origination fees may apply; vary across lenders. |

Illustrative Scenarios of Sallie Mae Loan Experiences

Understanding the impact of Sallie Mae loans requires looking beyond statistics. These scenarios illustrate the varied experiences borrowers face, highlighting the complexities of student loan repayment and its influence on their financial well-being. Each scenario depicts a different borrower profile, emphasizing the diverse financial situations and emotional tolls associated with Sallie Mae loans.

Scenario 1: The High-Earning Graduate

Sarah, a recent medical school graduate, borrowed $250,000 from Sallie Mae to fund her education. Her high earning potential allowed her to aggressively repay her loans. She chose a repayment plan that prioritized quick repayment, minimizing the total interest paid. Sarah experienced minimal difficulty with Sallie Mae’s customer service, finding their representatives responsive and helpful when she had questions about her account. The financial impact was significant, requiring careful budgeting and a commitment to saving, but her high income made the repayment manageable. Emotionally, Sarah felt a sense of relief and accomplishment as she steadily reduced her debt, experiencing a boost in financial confidence.

Scenario 2: The Mid-Career Professional with Unexpected Expenses

Mark, a marketing professional, borrowed $75,000 from Sallie Mae for his undergraduate degree. He initially chose a standard repayment plan but faced unexpected medical expenses a few years into repayment. This forced him to explore Sallie Mae’s deferment options. While he found the process somewhat cumbersome, Sallie Mae eventually granted his deferment request. However, the deferment period resulted in increased interest accrual, extending his repayment timeline and ultimately increasing the total cost of his loan. Mark experienced significant financial stress during this period and felt frustrated by the complexities of navigating the deferment process.

Scenario 3: The Low-Income Borrower Struggling with Repayment

Maria, a teacher with a Sallie Mae loan of $40,000, struggled with repayment due to her relatively low income. She initially chose an income-driven repayment plan, but found the monthly payments still challenging. She contacted Sallie Mae’s customer service multiple times seeking guidance, but felt the representatives were unhelpful and offered limited support. Maria experienced significant financial strain, often having to make difficult choices between paying her loan and covering essential living expenses. Emotionally, she felt overwhelmed by the debt and experienced periods of significant anxiety and depression. The ongoing financial burden negatively impacted her overall well-being.

Final Wrap-Up

Ultimately, choosing a student loan provider requires careful consideration of individual needs and financial situations. While Sallie Mae offers various repayment plans and programs, understanding their interest rates, fees, and customer service reputation is vital. This guide has aimed to provide a comprehensive overview of Sallie Mae student loans based on available reviews, empowering readers to make informed decisions that align with their financial well-being.

Question Bank

What happens if I miss a Sallie Mae loan payment?

Missing a payment can result in late fees and negatively impact your credit score. Contact Sallie Mae immediately if you anticipate difficulty making a payment to explore possible solutions.

Can I refinance my Sallie Mae student loans?

Yes, you can refinance your Sallie Mae loans with another lender, potentially securing a lower interest rate. However, refinancing may alter your repayment terms and eligibility for certain government programs.

How do I contact Sallie Mae customer service?

Sallie Mae provides various contact options, including phone, email, and online chat. Their contact information is readily available on their website.

Are there any income-based repayment options available through Sallie Mae?

Yes, Sallie Mae offers income-driven repayment plans, where your monthly payment is tied to your income. Eligibility requirements vary.