Navigating the complex world of student loans requires careful planning and a thorough understanding of eligibility criteria. Securing funding for higher education is a significant undertaking, impacting not only immediate financial stability but also long-term financial well-being. This guide delves into the intricacies of student loan eligibility, offering strategies for saving and maximizing your chances of approval, whether you’re pursuing federal or private loan options.

From understanding the FAFSA process and exploring various federal aid programs to comparing private loan providers and managing repayment strategies, we aim to equip you with the knowledge and tools to make informed decisions about your student loan journey. We’ll explore factors influencing eligibility, such as credit history and co-signers, and provide practical tips for saving effectively for college expenses.

Factors Affecting Loan Eligibility

Securing a student loan hinges on several key factors. Lenders assess applicants rigorously to determine their creditworthiness and ability to repay the loan. Understanding these factors is crucial for prospective borrowers to increase their chances of approval. This section details common reasons for loan application rejections and explores the role of credit history and co-signers in the eligibility process.

Common Reasons for Student Loan Application Rejection

Several factors can lead to a student loan application being denied. These often stem from a combination of financial history and the applicant’s demonstrated ability to manage debt. Lenders carefully examine several aspects of an applicant’s profile before making a decision.

Impact of Credit History on Loan Eligibility

A strong credit history significantly influences loan eligibility. Lenders view a positive credit history – characterized by consistent on-time payments and low credit utilization – as a strong indicator of responsible financial behavior. Conversely, a poor credit history, marked by late payments, defaults, or high debt-to-income ratios, can severely impact the chances of loan approval or result in higher interest rates. For example, an applicant with a history of missed credit card payments might be deemed a higher risk and therefore denied a loan, or offered one with less favorable terms. A FICO score, a widely used credit scoring system, often plays a central role in this assessment. A higher FICO score generally indicates a lower risk to the lender.

The Role of Co-signers in Improving Eligibility Chances

A co-signer is an individual who agrees to share responsibility for repaying the loan if the primary borrower defaults. Including a co-signer with a strong credit history can significantly improve the chances of loan approval, especially for applicants with limited or damaged credit. The co-signer essentially acts as a guarantor, mitigating the lender’s risk. This is particularly helpful for students who lack a substantial credit history or have a low credit score. The co-signer’s creditworthiness becomes a key factor in the lender’s decision-making process.

Examples of Ineligible Borrowers

Certain situations can render an applicant ineligible for a student loan. For instance, borrowers with a history of bankruptcy or significant outstanding debts might face rejection. Similarly, applicants who fail to provide accurate or complete information on their application may also be deemed ineligible. Another example is an applicant who is unable to demonstrate sufficient income or assets to support loan repayment. These situations highlight the importance of transparency and financial responsibility in the loan application process.

Managing Student Loan Debt

Successfully navigating student loan repayment requires understanding the various repayment options and the potential consequences of default. Effective management can significantly impact your financial future, allowing you to build wealth and achieve your long-term financial goals. This section Artikels strategies for responsible loan management.

Repayment Strategies

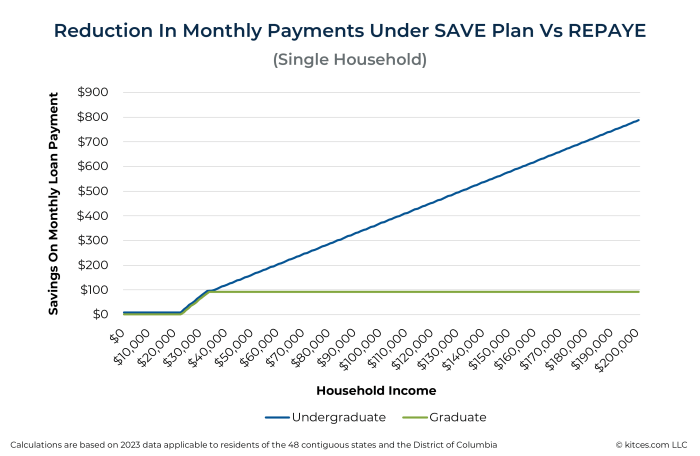

Several repayment plans cater to different financial situations. The standard repayment plan involves fixed monthly payments over a 10-year period. Income-driven repayment plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, tie your monthly payments to your income and family size. These plans typically extend the repayment period to 20 or 25 years, resulting in lower monthly payments but potentially higher total interest paid over the life of the loan. Deferment and forbearance offer temporary pauses in repayment, but interest may still accrue during these periods, increasing your total debt. Choosing the right plan depends on your individual financial circumstances and long-term goals.

Consequences of Loan Default

Failing to make timely student loan payments results in default, triggering serious consequences. These include damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. Default can also impact your ability to rent an apartment, purchase a home, or even secure certain jobs. The severity of the consequences depends on the loan amount and the length of the default. It is crucial to prioritize repayment to avoid these potentially devastating financial repercussions.

Applying for Loan Forgiveness Programs

Several loan forgiveness programs exist, offering the potential to eliminate a portion or all of your student loan debt. These programs typically have specific eligibility requirements, such as working in public service or teaching in underserved areas. The application process usually involves completing a detailed application form, providing documentation to verify employment and income, and submitting proof of loan eligibility. Each program has its own application process and requirements, so it’s essential to thoroughly research the specific program you are applying for. These programs often have limited funding, and the application process can be lengthy and complex.

Long-Term Impact of Repayment Plans on Total Interest Paid

Imagine a graph with two lines representing total interest paid over time. The first line, representing the standard 10-year repayment plan, starts high and slopes steeply downwards, indicating a rapid decrease in interest paid as the loan is repaid quickly. The total interest paid is relatively low. The second line, representing an income-driven repayment plan (e.g., 20-year IBR), starts lower and slopes gently downwards, indicating lower monthly payments but a much slower repayment rate. The line extends further to the right, illustrating a significantly longer repayment period. This line ends much higher than the first, showcasing the substantial accumulation of interest over the extended repayment term. For example, a $30,000 loan at 5% interest could result in approximately $5,000 in interest paid under a standard plan versus potentially $15,000 or more under an income-driven plan. This illustrates the trade-off between lower monthly payments and increased total interest paid over time. The choice depends on prioritizing immediate affordability versus minimizing long-term interest costs.

Ultimate Conclusion

Successfully securing student loans hinges on proactive planning, a clear understanding of eligibility requirements, and a strategic approach to managing debt. By carefully considering the factors discussed – from saving strategies and FAFSA completion to choosing suitable loan types and repayment plans – you can significantly increase your chances of accessing the funding you need for higher education and build a sound financial foundation for the future. Remember, informed decisions today lead to a more secure financial tomorrow.

General Inquiries

What is the difference between federal and private student loans?

Federal loans are offered by the government and generally have more favorable terms and repayment options. Private loans are from banks and credit unions, often requiring a credit check and potentially higher interest rates.

What happens if I default on my student loans?

Defaulting on student loans can have severe consequences, including damage to your credit score, wage garnishment, and difficulty obtaining future loans or credit.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it usually involves a private lender and may not be suitable for all borrowers.

How can I improve my chances of getting a student loan?

Maintain a good credit score, have a co-signer if needed, and thoroughly complete the loan application with accurate information.