Navigating the complex world of student loan repayment can feel overwhelming, but understanding the available options and developing a strategic plan is crucial for long-term financial well-being. This guide explores various strategies to save money, manage debt effectively, and ultimately achieve student loan freedom. We’ll delve into federal and private loan programs, income-driven repayment plans, loan forgiveness opportunities, and practical budgeting tips to help you create a personalized repayment strategy.

From understanding the nuances of interest rates and repayment terms to mastering effective budgeting techniques and exploring government assistance programs, this resource provides a holistic approach to student loan management. We’ll equip you with the knowledge and tools to make informed decisions, minimize your debt burden, and build a secure financial future.

Exploring Savings Strategies for Student Loan Repayment

Tackling student loan debt requires a strategic approach to saving and budgeting. This section Artikels practical strategies to accelerate repayment and achieve financial freedom sooner. By implementing these techniques, you can significantly reduce your loan burden and improve your overall financial well-being.

Budgeting and Saving for Student Loan Repayment

Creating a realistic budget is the cornerstone of effective student loan repayment. This involves carefully tracking income and expenses to identify areas where savings can be maximized. A comprehensive budget considers all income sources and allocates funds towards essential expenses, loan payments, and savings goals. Careful monitoring allows for adjustments as needed, ensuring that loan repayment remains a priority.

Sample Monthly Budget

The following sample budget illustrates how to allocate funds for student loan payments. Remember that this is a template; your specific budget will depend on your individual income and expenses.

| Income | Amount |

|---|---|

| Net Monthly Salary | $3000 |

| Expenses | Amount |

| Housing (Rent/Mortgage) | $1000 |

| Utilities | $200 |

| Food | $400 |

| Transportation | $200 |

| Student Loan Payment | $500 |

| Savings (Emergency Fund/Loan Prepayment) | $300 |

| Other Expenses (Entertainment, etc.) | $400 |

This budget prioritizes student loan repayment with a significant allocation, while also maintaining savings for emergencies and potential extra loan payments. Adjusting the “Other Expenses” category provides flexibility for managing unexpected costs.

Automating Student Loan Payments

Automating student loan payments offers several key benefits. By setting up automatic payments, you eliminate the risk of missed payments, which can negatively impact your credit score and potentially lead to late fees. Furthermore, automation simplifies the repayment process, freeing up time and mental energy for other financial goals. Consistent, on-time payments demonstrate financial responsibility and can improve your creditworthiness.

Savings Vehicles for Student Loan Repayment

Several savings vehicles can effectively support student loan repayment. High-yield savings accounts offer competitive interest rates and easy accessibility to funds for extra loan payments. Certificates of deposit (CDs) provide higher interest rates over a fixed term, making them suitable for longer-term savings goals. The choice depends on your individual financial situation and risk tolerance; a diversified approach, using both high-yield savings accounts and CDs, can be highly effective.

Income-Driven Repayment Plans

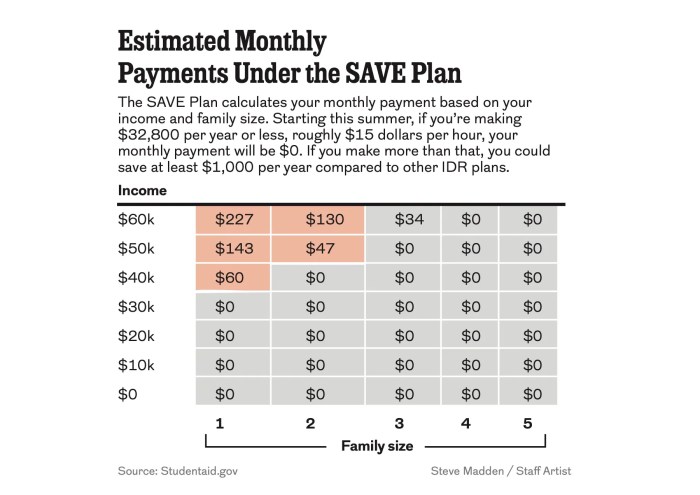

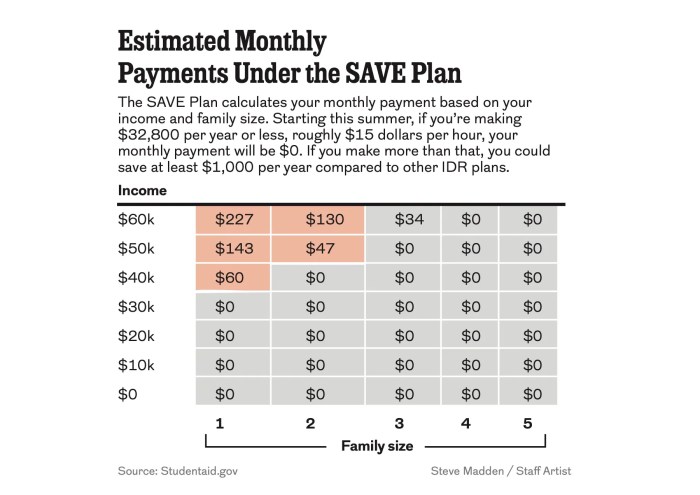

Income-driven repayment (IDR) plans offer a lifeline to student loan borrowers struggling with high monthly payments. These plans adjust your monthly payment based on your income and family size, making repayment more manageable. Understanding the nuances of each plan is crucial for selecting the best option for your individual financial circumstances.

Available Income-Driven Repayment Plans

The federal government offers several IDR plans, each with its own eligibility criteria and payment calculation methods. These plans are designed to help borrowers avoid delinquency and default while still working towards eventual loan forgiveness. The specific plans available may change over time, so it’s important to check the latest information from the Department of Education or your loan servicer. Common plans include Income-Driven Repayment (IDR), Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

Comparison of Income-Driven Repayment Plans

While all IDR plans tie payments to income, key differences exist in eligibility requirements, payment calculation formulas, and loan forgiveness provisions. For instance, some plans may have higher income thresholds for eligibility, while others may offer faster paths to loan forgiveness after a specified period of repayment. Understanding these distinctions is critical in choosing a plan that aligns with your long-term financial goals. The complexity of these calculations makes it highly recommended to use the official government calculators or consult a financial advisor.

Applying for and Qualifying for an Income-Driven Repayment Plan

The application process generally involves completing a form provided by your loan servicer, which requires documentation of your income and family size. This typically includes tax returns and proof of household members. Eligibility is determined based on factors such as your income, family size, and loan type. Meeting the income requirements is a key aspect of qualification, as these plans are intended for borrowers with demonstrably lower incomes relative to their loan burden. You’ll need to recertify your income annually to maintain your eligibility. Failure to recertify can result in your plan being terminated and reverting to a standard repayment plan.

Key Differences in Income-Driven Repayment Plans

- Income-Based Repayment (IBR): Generally offers lower monthly payments than standard plans, but may lead to higher total interest paid over the life of the loan. Forgiveness is possible after 25 years of repayment for undergraduate loans and 20 years for graduate loans.

- Pay As You Earn (PAYE): Caps monthly payments at 10% of discretionary income, with forgiveness after 20 years of payments.

- Revised Pay As You Earn (REPAYE): Similar to PAYE, but includes both undergraduate and graduate loans in the calculation. Forgiveness is possible after 20 or 25 years, depending on loan type.

- Income-Driven Repayment (IDR): This is an umbrella term encompassing IBR, PAYE, and REPAYE. It’s important to understand the specifics of each plan within the IDR category.

Government Programs and Loan Forgiveness

Navigating the complexities of student loan repayment can be daunting, but several government programs offer assistance and potential pathways to loan forgiveness. Understanding the eligibility requirements, limitations, and potential benefits and drawbacks of these programs is crucial for effective financial planning. This section will explore these programs in detail.

Eligibility Requirements and Limitations of Government Programs

Government programs designed to assist with student loan repayment, such as Income-Driven Repayment (IDR) plans and loan forgiveness programs, often have specific eligibility criteria. These typically include factors like income, loan type, and employment in specific fields. For instance, eligibility for Public Service Loan Forgiveness (PSLF) requires working full-time for a qualifying government or non-profit organization and making 120 qualifying monthly payments under an IDR plan. Limitations can include caps on the amount of loan forgiveness, restrictions on the types of loans eligible, and the length of time required to qualify. Failure to meet all requirements meticulously can result in ineligibility for forgiveness, even after years of payments. It is imperative to carefully review the specific program guidelines for the most up-to-date information.

Professions Eligible for Loan Forgiveness Programs

Several professions are eligible for loan forgiveness programs, primarily those considered to serve the public good. The Public Service Loan Forgiveness (PSLF) program, for example, benefits individuals working full-time for government organizations (federal, state, local) or non-profit organizations. Specific examples include teachers, nurses, social workers, and members of the armed forces. Other programs might focus on specific fields like primary care physicians or teachers in underserved areas, offering targeted loan forgiveness incentives to attract and retain professionals in these critical roles. Eligibility varies depending on the specific program and the employer.

Benefits and Drawbacks of Pursuing Loan Forgiveness

The primary benefit of pursuing loan forgiveness is the potential to eliminate a significant portion or even all of your student loan debt. This can dramatically improve your financial well-being, freeing up resources for other financial goals like saving for a home, investing, or paying off other debts. However, drawbacks exist. The process can be lengthy and complex, requiring meticulous documentation and adherence to strict guidelines. Moreover, pursuing loan forgiveness often involves years of lower monthly payments under an IDR plan, potentially delaying the payoff of your loans and accumulating more interest in the long run. Furthermore, changes in government policy could affect the availability or terms of loan forgiveness programs, introducing uncertainty into your long-term financial planning.

Steps Involved in Applying for Student Loan Forgiveness

Successfully applying for student loan forgiveness requires careful planning and attention to detail. The process varies depending on the specific program, but generally involves these steps:

- Confirm Eligibility: Thoroughly review the eligibility requirements of the specific loan forgiveness program you are considering.

- Consolidate Loans (if necessary): Some programs require consolidation of your federal student loans into a Direct Consolidation Loan.

- Choose an Income-Driven Repayment Plan: Enroll in an IDR plan that aligns with your income and repayment goals.

- Make Qualifying Payments: Make consistent and timely payments for the required number of months under the chosen IDR plan. Ensure your payments are accurately tracked.

- Maintain Employment: Maintain employment in a qualifying position for the duration of the repayment period.

- Submit the Forgiveness Application: Complete and submit the appropriate application form and required documentation to your loan servicer.

- Monitor the Process: Track the progress of your application and follow up with your loan servicer as needed.

Financial Planning and Long-Term Strategies

Integrating student loan repayment into your overall financial plan is crucial for long-term financial health. Failing to do so can lead to missed opportunities and unnecessary stress. A holistic approach ensures that loan repayment aligns with other significant financial goals, preventing one area from overshadowing others. This section explores strategies for effective integration and prioritization.

Successfully managing student loan debt requires a comprehensive financial plan that considers all aspects of your financial life. This includes not only repayment strategies but also saving for retirement, purchasing a home, and building a strong credit history. Prioritization and strategic planning are key to navigating these often-competing goals.

Incorporating Student Loan Repayment into a Comprehensive Financial Plan

A well-structured financial plan typically involves budgeting, saving, investing, and debt management. Student loan repayment should be a core component of the budgeting process, treated as a non-negotiable expense similar to rent or utilities. This necessitates creating a realistic budget that allocates sufficient funds for loan payments while still allowing for savings and other essential expenses. For example, a young professional might allocate 20% of their post-tax income to student loan repayment, 10% to retirement savings, and 5% to an emergency fund. This allocation demonstrates a commitment to debt reduction while simultaneously securing their financial future. Regularly reviewing and adjusting this budget based on income changes and financial goals is vital.

Prioritizing Student Loan Repayment Alongside Other Financial Goals

Balancing student loan repayment with other significant financial objectives requires careful prioritization. One common approach involves using the debt snowball or debt avalanche method. The debt snowball method focuses on paying off the smallest debt first for motivation, while the debt avalanche method prioritizes paying off the debt with the highest interest rate first to minimize overall interest paid. For instance, someone might prioritize paying off high-interest credit card debt before focusing solely on student loans. Simultaneously, they could contribute to a retirement account to take advantage of employer matching programs, while also setting aside a small amount for a down payment on a house. The key is to create a plan that balances immediate debt reduction with long-term financial security.

Managing Student Loan Debt While Building Credit

Building a strong credit history is crucial for accessing favorable interest rates on future loans and securing financial products. While student loan payments contribute positively to credit scores, it’s important to manage other aspects of credit responsibly. This includes maintaining low credit utilization ratios (the amount of credit used compared to the total available credit), paying all bills on time, and avoiding unnecessary debt accumulation. Using credit cards responsibly, paying off balances in full each month, and avoiding excessive applications for new credit are vital strategies. These actions demonstrate creditworthiness and contribute to a higher credit score, opening up more opportunities in the future.

Long-Term Financial Implications of Different Student Loan Repayment Strategies

Different repayment strategies significantly impact long-term finances. Choosing an income-driven repayment plan might extend the repayment period, reducing monthly payments but increasing total interest paid over time. Conversely, aggressive repayment strategies, like paying extra towards the principal balance each month, will shorten the repayment period and reduce the total interest paid, freeing up funds sooner for other financial goals. For example, someone choosing a standard repayment plan might pay off their loan in 10 years, while someone opting for an income-driven plan might take 20-25 years. The long-term financial implications include not only the total amount paid but also the opportunity cost of the money tied up in loan repayment versus being invested elsewhere.

Illustrating the Impact of Interest

Understanding how interest affects your student loan debt is crucial for effective repayment planning. The longer you delay repayment, or the less you pay each month, the more interest will accrue, significantly increasing your total loan balance. This ultimately extends the repayment period and increases the overall cost of your education.

Interest capitalization, where unpaid interest is added to your principal loan balance, further exacerbates this issue. This means you’ll be paying interest on interest, compounding the debt. Ignoring this aspect can lead to substantial long-term financial burdens.

Visual Representation of Debt Growth

To illustrate the impact of interest, consider a simple line graph. The x-axis represents time (in years), and the y-axis represents the total loan balance. One line represents the growth of a $30,000 loan with a standard repayment plan (let’s assume a 6% interest rate). This line will show a steady upward trend, with the slope increasing over time due to compounding interest. A second line represents the same loan but with an aggressive repayment strategy—for instance, paying an extra $100 per month. This line will also show an upward trend, but the slope will be significantly less steep, demonstrating the power of extra payments in minimizing interest accumulation. The difference between the two lines visually demonstrates the substantial savings achieved through aggressive repayment.

Examples of Long-Term Costs of Delayed Repayment

Let’s consider two scenarios:

Scenario 1: A borrower with a $30,000 loan at 6% interest makes only the minimum monthly payments. After 10 years, they might still owe a substantial portion of the original loan, having paid significantly more in interest than principal. Their total repayment could exceed $45,000, a 50% increase over the original loan amount.

Scenario 2: A borrower with the same loan aggressively repays the loan by making extra payments, potentially paying it off within 5 years. Their total repayment would be significantly lower, perhaps around $35,000, limiting the impact of interest accumulation.

This stark contrast highlights the substantial long-term financial consequences of delaying repayment or making only minimum payments. The extra time spent repaying translates to a much larger overall cost, potentially impacting future financial goals like homeownership or retirement savings.

Impact of Interest Capitalization

Imagine a $20,000 loan with a 5% interest rate. If a borrower makes only minimum payments for a year, unpaid interest will be capitalized. This means that accumulated interest is added to the principal, increasing the loan balance. For example, if the accrued interest is $1000, the new principal becomes $21,000. Subsequent interest calculations are then based on this higher principal, leading to even faster debt growth. This illustrates how interest capitalization significantly accelerates the growth of student loan debt.

Closing Summary

Successfully managing student loan debt requires proactive planning, informed decision-making, and a commitment to consistent repayment. By understanding the various programs, strategies, and potential pitfalls Artikeld in this guide, you can create a personalized plan that aligns with your financial goals and sets you on a path towards financial independence. Remember to leverage available resources and seek professional advice when needed to navigate this crucial aspect of your financial journey.

Query Resolution

What is the difference between federal and private student loans?

Federal loans are offered by the government and generally offer more flexible repayment options and protections for borrowers. Private loans are from banks or credit unions and often have higher interest rates and stricter terms.

Can I consolidate my student loans?

Yes, consolidating multiple loans into one can simplify repayment, potentially lowering your monthly payment. However, this may result in a longer repayment period and higher overall interest paid.

What if I can’t afford my student loan payments?

Contact your loan servicer immediately. They can help explore options like deferment, forbearance, or an income-driven repayment plan.

How does loan forgiveness work?

Loan forgiveness programs typically require working in specific public service jobs for a set number of years. Eligibility criteria and forgiveness amounts vary significantly depending on the program.