Navigating the complexities of student loan debt can feel overwhelming, but understanding the power of student loan simulators is a crucial first step towards financial freedom. These tools offer a dynamic way to visualize different repayment scenarios, explore various savings strategies, and ultimately make informed decisions about managing your student loan debt effectively. By leveraging the insights provided by a save simulator student loan tool, you can gain a clearer picture of your financial future and develop a personalized plan to minimize your long-term costs.

This guide delves into the world of student loan simulators, exploring their features, benefits, and limitations. We’ll examine different savings strategies, analyze the impact of various repayment plans, and provide practical steps to enhance your financial literacy and manage your student loans effectively. Ultimately, the goal is to empower you with the knowledge and tools necessary to confidently navigate the student loan landscape.

Types of Student Loan Savings Strategies

Saving for student loans requires a proactive approach, and understanding various strategies can significantly impact your financial future. Effective planning can minimize the burden of loan repayment and allow for greater financial flexibility after graduation. This section Artikels several key strategies, highlighting their benefits and drawbacks to help you make informed decisions.

Student Loan Savings Strategies Overview

Several approaches can help reduce the overall cost and burden of student loans. These strategies range from proactive saving before college to strategic repayment methods after graduation. Careful consideration of your individual circumstances and financial goals is crucial in choosing the most suitable approach.

| Strategy Name | Description | Pros | Cons |

|---|---|---|---|

| Saving Before College | Actively saving money before starting college to reduce the amount of loans needed. This could involve part-time jobs, summer employment, or family contributions. | Reduces loan amounts, leading to lower interest payments and faster repayment. Provides a greater sense of financial independence. | Requires discipline and consistent saving over an extended period. May limit other opportunities during high school or before college. |

| Scholarships and Grants | Pursuing scholarships and grants from various sources (colleges, organizations, etc.) to offset tuition costs. | Reduces or eliminates the need for loans, saving significantly on interest payments. Frees up funds for other expenses. | Competitive application process. Requires research and effort to find suitable opportunities. Availability may be limited. |

| Part-time Employment During College | Working part-time while studying to cover some educational expenses or reduce the reliance on loans. | Reduces loan burden. Provides valuable work experience. | Can impact academic performance if workload is too heavy. Limits time for studying and extracurricular activities. May reduce opportunities for internships or other enriching experiences. |

| High-Yield Savings Accounts | Saving money in high-yield savings accounts to earn interest and accumulate funds for loan repayment. | Earn interest on savings, potentially offsetting some loan interest. Provides a readily accessible emergency fund. | Interest rates may fluctuate. Returns might not always outpace inflation or loan interest rates. |

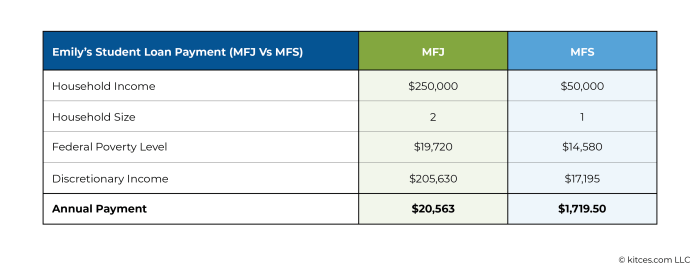

| Income-Driven Repayment Plans | Choosing a repayment plan that bases monthly payments on your income. | Lower monthly payments, making repayment more manageable, especially during periods of lower income. | May result in longer repayment periods and higher overall interest payments. |

| Refinancing Student Loans | Refinancing existing loans to secure a lower interest rate from a different lender. | Lower monthly payments and reduced total interest paid over the life of the loan. | Requires a good credit score. May involve fees. Locking in a lower rate could be beneficial only if the interest rate drops significantly. |

Visual Representation of Long-Term Financial Impact

A line graph could effectively illustrate the long-term financial impact of different saving approaches. The x-axis would represent time (in years), and the y-axis would represent the total amount owed (including principal and accumulated interest). Multiple lines would represent different strategies: one for a scenario with minimal pre-college saving and maximum loan borrowing, another for a scenario with significant pre-college savings, and a third illustrating the impact of utilizing scholarships and grants. A legend would clearly label each line. The graph would visually demonstrate how early saving and alternative funding sources lead to a faster reduction in debt and a significant decrease in overall interest paid over the loan’s lifetime. For example, the line representing “maximum loan borrowing” would show a steep upward curve initially, followed by a slow decline as repayments are made. Conversely, the “significant pre-college savings” line would start lower and decrease more rapidly. The line representing “scholarships and grants” would likely show the fastest and steepest decline. This visual comparison clearly highlights the long-term financial benefits of proactive saving and exploring alternative funding options.

Exploring Additional Resources and Tools

Navigating the complexities of student loan repayment can feel overwhelming, but numerous resources exist to guide you through the process. Understanding where to find reliable information and utilizing available tools is crucial for effective student loan management and achieving financial well-being. This section explores reputable websites, practical tools, and strategies for evaluating information credibility.

Reputable Websites and Organizations Offering Student Loan Advice

Several organizations and websites provide valuable information and tools to help students manage their student loan debt. These resources offer a range of services, from educational materials to interactive calculators and personalized advice. Accessing these resources can significantly improve your understanding of repayment options and strategies.

- The Federal Student Aid website (studentaid.gov): This is the official website for the U.S. Department of Education’s Federal Student Aid program. It offers comprehensive information on federal student loans, including repayment plans, loan forgiveness programs, and resources for borrowers facing financial hardship. The site provides clear explanations of loan terms and offers tools to estimate monthly payments and track loan progress.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that provides free and low-cost credit counseling services. They offer resources on student loan management, debt consolidation, and budgeting. Their counselors can help you create a personalized repayment plan and navigate potential financial challenges.

- Consumer Financial Protection Bureau (CFPB): The CFPB is an independent agency that protects consumers’ financial rights. They offer educational materials on student loans, including information on avoiding scams and understanding your rights as a borrower. Their website includes resources to help you understand your loan terms and options.

Types of Information and Tools Available Online

The resources listed above offer a variety of tools and information to assist in student loan management. These include:

- Loan repayment calculators: These tools allow you to estimate your monthly payments based on your loan amount, interest rate, and repayment plan.

- Amortization schedules: These schedules detail the breakdown of your loan payments, showing how much of each payment goes towards principal and interest over time.

- Financial literacy resources: Many websites offer educational materials on budgeting, saving, and financial planning, which are essential for effective debt management.

- Debt consolidation information: Resources are available to help you understand the process of consolidating multiple student loans into a single loan, potentially simplifying repayment.

- Loan forgiveness program information: Detailed explanations of eligibility requirements and application processes for various loan forgiveness programs are provided.

Evaluating the Credibility of Online Student Loan Information

It is crucial to critically evaluate the information you find online regarding student loan management. Not all sources are created equal, and some may offer misleading or inaccurate advice.

- Check the source’s authority: Look for information from reputable organizations, government agencies, or well-established financial institutions. Be wary of sites with unknown authorship or those promoting specific products without clear disclosure.

- Look for unbiased information: Avoid sites that appear to be promoting a particular product or service without providing objective information. Reputable sources will present information fairly and transparently.

- Verify information from multiple sources: Don’t rely on a single source. Compare information from several reputable websites to ensure accuracy and consistency.

- Be wary of promises that sound too good to be true: Beware of schemes promising quick fixes or unrealistic loan repayment solutions.

Practical Steps for Effective Student Loan Debt Management

Effective student loan management requires proactive steps and consistent effort. The following steps can significantly improve your ability to repay your loans efficiently and minimize financial stress.

- Create a budget: Track your income and expenses to understand where your money is going. This will help you identify areas where you can reduce spending and allocate more funds towards loan repayment.

- Explore repayment options: Research different repayment plans (standard, graduated, income-driven, etc.) to find one that best fits your financial situation.

- Prioritize high-interest loans: Focus on paying down loans with the highest interest rates first to minimize the total interest paid over time.

- Automate payments: Set up automatic payments to ensure you consistently make your payments on time and avoid late fees.

- Consider refinancing: If your credit score has improved, explore refinancing options to potentially lower your interest rate and monthly payments.

- Communicate with your loan servicer: If you experience financial hardship, contact your loan servicer to explore options such as forbearance or deferment.

Closure

Successfully managing student loan debt requires a proactive approach, combining financial literacy with the strategic use of available resources. By understanding the nuances of different repayment plans, exploring various savings strategies, and utilizing student loan simulators, you can significantly reduce your overall loan burden and achieve your long-term financial goals. Remember, informed decision-making is key; utilize the tools and information provided to create a personalized plan that works for your unique circumstances. Taking control of your student loan debt is an investment in your future financial well-being.

Query Resolution

What if I can’t afford my student loan payments?

Contact your loan servicer immediately. They can help you explore options like deferment, forbearance, or income-driven repayment plans.

How often should I check my student loan account?

At least monthly, to monitor payments, interest accrual, and account details.

Are there tax benefits for student loan interest?

Yes, in many countries, you may be able to deduct the interest you paid on your student loans from your taxable income.

What is the difference between a subsidized and unsubsidized loan?

Subsidized loans don’t accrue interest while you’re in school (under certain conditions), while unsubsidized loans do.