Navigating the complexities of student loan debt can feel overwhelming, but understanding how student loan interest works is the first step towards financial freedom. This guide explores various strategies to minimize interest payments, from making extra principal payments to exploring government programs and refinancing options. We’ll delve into the intricacies of interest calculations, different repayment plans, and the long-term financial implications of your choices, empowering you to make informed decisions about your student loan repayment journey.

We’ll cover practical budgeting tips, the benefits of scholarships and grants, and the importance of developing a comprehensive long-term financial plan. By the end, you’ll have a clearer understanding of how to effectively manage your student loans and pave the way for a brighter financial future.

Understanding Student Loan Interest

Navigating the world of student loans requires a solid understanding of how interest works. This knowledge empowers you to make informed decisions about repayment and ultimately, save money. Understanding the different types of interest, how it’s calculated, and the factors that influence it are crucial steps in managing your student loan debt effectively.

Types of Student Loan Interest Rates

Student loans typically come with either fixed or variable interest rates. A fixed interest rate remains constant throughout the life of the loan, providing predictable monthly payments. In contrast, a variable interest rate fluctuates based on a benchmark index, such as the prime rate or LIBOR (London Interbank Offered Rate, though its use is declining). This means your monthly payments could change over time, potentially increasing or decreasing depending on market conditions. Choosing between a fixed and variable rate depends on your risk tolerance and predictions about future interest rate movements. Generally, fixed rates offer more predictability, while variable rates might offer lower initial interest costs if rates remain low.

Factors Influencing Student Loan Interest Rates

Several factors determine the interest rate you’ll receive on your student loan. These include your creditworthiness (for private loans), the type of loan (federal vs. private), the loan’s term length, and the prevailing economic conditions. For federal student loans, your interest rate is often tied to the market rate at the time you borrow. Private lenders, however, consider your credit score, debt-to-income ratio, and overall financial history when setting your rate. A higher credit score and a lower debt-to-income ratio typically translate to a lower interest rate. Economic conditions, like inflation and overall interest rate trends, also influence the rates offered by both federal and private lenders.

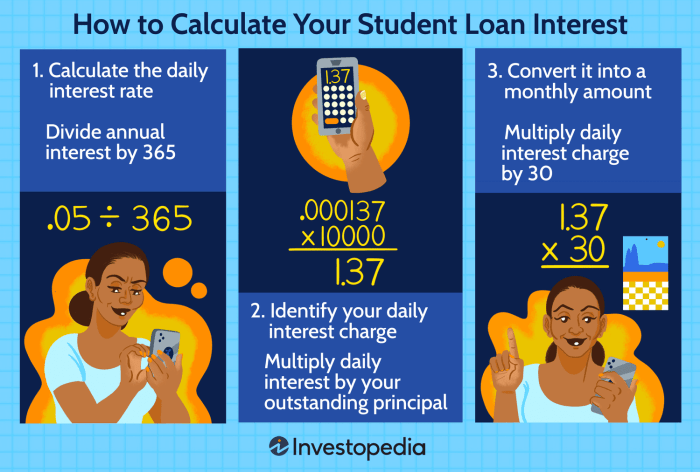

Student Loan Interest Calculation and Accrual

Student loan interest is typically calculated daily on your outstanding principal balance. This daily interest is then added to your principal, a process known as capitalization or compounding. The more frequently interest is compounded, the faster your debt grows. For example, if your interest rate is 5% and your outstanding balance is $10,000, the daily interest is approximately $1.37 ($10,000 * 0.05 / 365). This daily interest accumulates over time, increasing your total debt. Understanding this compounding effect is critical for effective loan management. The total interest accrued over the loan’s lifetime significantly impacts your overall repayment cost.

Comparison of Student Loan Interest Rates

The following table provides a general comparison of interest rates for various federal and private student loans. Note that these are average rates and can vary based on the factors mentioned previously. Actual rates may differ based on the lender and the borrower’s individual circumstances.

| Loan Type | Interest Rate Type | Average Interest Rate (Example) | Repayment Options |

|---|---|---|---|

| Federal Subsidized Loan | Fixed | 4.5% | Standard, Graduated, Income-Driven |

| Federal Unsubsidized Loan | Fixed | 5.0% | Standard, Graduated, Income-Driven |

| Federal PLUS Loan (Graduate/Parent) | Fixed | 7.5% | Standard, Extended |

| Private Student Loan | Fixed or Variable | 6.0% – 12.0% | Variable, depending on lender |

Strategies to Minimize Interest Payments

Minimizing student loan interest is crucial for long-term financial health. Strategic repayment approaches can significantly reduce the total amount paid over the life of the loan, freeing up funds for other financial goals. This section explores effective strategies to achieve this.

Extra Principal Payments

Making extra principal payments on your student loans accelerates the repayment process and substantially reduces the total interest paid. Each extra payment directly reduces the loan’s principal balance, lowering the amount on which interest accrues in subsequent months. Even small, consistent extra payments can make a considerable difference over time. For example, consider a $30,000 loan at 7% interest with a 10-year repayment plan. Adding just $100 per month to the regular payment would shave approximately two years off the repayment period and save thousands in interest. The impact is amplified when these extra payments are made early in the loan’s life, as interest accrues on a larger principal balance initially.

Student Loan Refinancing

Refinancing your student loans involves replacing your existing loans with a new loan from a different lender, often at a lower interest rate. This can significantly reduce your monthly payments and the total interest paid over the loan’s life. However, it’s crucial to carefully compare offers from multiple lenders, considering fees and the overall cost. For example, refinancing from a 7% interest rate to a 4% interest rate on a $40,000 loan could save thousands of dollars in interest over the repayment term. It’s important to note that refinancing might not be suitable for all borrowers; factors like credit score and loan type play a crucial role in determining eligibility and the potential benefits.

Student Loan Repayment Plans

Several repayment plans are available, each impacting the total interest paid differently. The Standard Repayment Plan involves fixed monthly payments over 10 years. The Extended Repayment Plan extends the repayment period to up to 25 years, reducing monthly payments but increasing total interest paid. Income-Driven Repayment (IDR) plans base monthly payments on your income and family size, potentially resulting in lower monthly payments but extending the repayment period and increasing overall interest costs. The choice of plan depends on individual financial circumstances and priorities. A careful comparison of the total interest paid under each plan is essential before making a decision.

Sample Amortization Schedule

The following table illustrates the impact of different repayment strategies on a $20,000 loan at 6% interest:

| Month | Standard Repayment (10 years) | Standard + $100 Extra (10 years) | Extended Repayment (20 years) |

|---|---|---|---|

| 1 | $222.04 (Principal: $110.27, Interest: $111.77) | $322.04 (Principal: $210.27, Interest: $111.77) | $126.03 (Principal: $43.74, Interest: $82.29) |

| 12 | $222.04 (Principal: $127.22, Interest: $94.82) | $322.04 (Principal: $227.22, Interest: $94.82) | $126.03 (Principal: $54.18, Interest: $71.85) |

| … | … | … | … |

| 120 | $222.04 (Principal: $222.04, Interest: $0.00) | $0.00 (Loan Paid Off Early) | $126.03 (Principal: $101.21, Interest: $24.82) |

| Total Interest Paid | $4,644.80 | $Approximately $3,000 | $12,246.00 |

Note: This is a simplified example and actual figures may vary based on specific loan terms and payment schedules. The “Standard + $100 Extra” column is illustrative and the exact figures would depend on the loan’s amortization schedule and the precise timing of extra payments. A full amortization schedule can be generated using online calculators or spreadsheet software.

Government Programs and Initiatives

Navigating the complexities of student loan repayment can be daunting, but several government programs are designed to ease the burden and help borrowers manage their debt effectively. These programs offer various forms of assistance, from adjusting repayment schedules to potentially forgiving a portion or all of the loan. Understanding these options is crucial for borrowers seeking to minimize interest payments and ultimately achieve financial stability.

Understanding the nuances of these programs requires careful consideration of eligibility criteria and specific program details. It’s important to regularly review the official government websites for the most up-to-date information and any changes in regulations.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan payments more manageable by basing monthly payments on your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans typically extend the repayment period, resulting in higher total interest paid over the life of the loan. However, the lower monthly payments can prevent borrowers from defaulting and provide crucial financial breathing room. For example, a borrower with a high debt load and a low income might find an IDR plan significantly reduces their monthly payment, even if it means paying more interest overall. The trade-off often favors financial stability over minimizing total interest.

Loan Forgiveness Programs

Several loan forgiveness programs exist, offering partial or complete loan forgiveness under specific circumstances. These programs are often targeted towards borrowers working in public service or specific professions. Eligibility criteria vary widely depending on the program. For instance, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of federal student loans after 120 qualifying monthly payments while working full-time for a qualifying employer. Teacher Loan Forgiveness programs offer forgiveness for teachers who meet certain requirements, such as teaching in low-income schools for a specific number of years. These programs are designed to incentivize individuals to pursue careers in public service and high-need areas.

List of Government Programs

- Income-Based Repayment (IBR): Calculates monthly payments based on income and family size; longer repayment period, resulting in higher total interest.

- Pay As You Earn (PAYE): Similar to IBR, with payments capped at 10% of discretionary income.

- Revised Pay As You Earn (REPAYE): A modified PAYE plan with potentially lower monthly payments and forgiveness after 20 or 25 years.

- Income-Contingent Repayment (ICR): Monthly payments are based on income and loan amount; repayment period can be up to 25 years.

- Public Service Loan Forgiveness (PSLF): Forgives remaining federal student loan debt after 120 qualifying payments while working full-time for a qualifying employer.

- Teacher Loan Forgiveness: Forgives a portion of federal student loans for teachers who meet specific requirements, such as teaching in low-income schools.

Budgeting and Financial Planning

Effective budgeting and financial planning are crucial for successfully managing student loan repayment while maintaining a healthy financial life. A well-structured plan allows you to prioritize loan payments alongside essential living expenses, preventing financial stress and ensuring timely repayment. This section will Artikel strategies for creating and maintaining such a plan.

Sample Student Loan Repayment Budget

Creating a realistic budget involves carefully tracking income and expenses. The following example demonstrates a potential monthly budget allocation for someone repaying student loans:

| Income | Amount |

|---|---|

| Net Monthly Salary | $3000 |

| Expenses | Amount |

| Rent/Mortgage | $1000 |

| Utilities (Electricity, Water, Gas) | $200 |

| Groceries | $300 |

| Transportation | $200 |

| Student Loan Payment | $500 |

| Other Expenses (Entertainment, Savings, etc.) | $800 |

| Total Expenses | $3000 |

This budget shows a scenario where student loan repayment takes a significant portion of the monthly income. Remember to adjust the amounts based on your individual circumstances. The “Other Expenses” category is crucial and should include savings for emergencies and future goals.

Tracking Student Loan Payments and Interest Accrual

Effective tracking of student loan payments and interest accrual is vital for staying organized and on top of your repayment schedule. Several methods can be employed:

Many loan servicers provide online portals that allow you to view your loan balance, payment history, and interest accrual. Regularly logging into these portals is essential. Additionally, creating a spreadsheet or using budgeting apps can offer a comprehensive overview of your financial situation, including student loan details. This allows you to visually monitor your progress and identify any potential issues early on. Note that interest accrual calculations can vary depending on the loan type and repayment plan.

Long-Term Financial Planning Including Student Loan Repayment

Incorporating student loan repayment into a comprehensive long-term financial plan is crucial for long-term financial health. This plan should consider factors such as career goals, retirement planning, and major life events (like buying a house or starting a family). A long-term plan helps you visualize how student loan repayment fits within your overall financial objectives and allows you to adjust your budget and repayment strategy as needed. For example, someone aiming for early retirement might prioritize aggressive student loan repayment to free up more funds for investments later in life.

Creating a Personalized Student Loan Repayment Plan

Developing a personalized student loan repayment plan requires careful consideration of several factors. First, gather all relevant information about your loans, including interest rates, balances, and repayment terms. Then, assess your current financial situation, including income, expenses, and savings. Based on this information, you can explore different repayment options, such as standard repayment, extended repayment, income-driven repayment plans, or refinancing. Finally, choose the plan that best aligns with your financial goals and risk tolerance, regularly reviewing and adjusting the plan as your circumstances change. This might involve setting realistic goals, such as aiming for a specific percentage of debt reduction each year.

Financial Aid and Scholarships

Securing financial aid and scholarships is a crucial step in managing student loan debt and minimizing the accumulation of interest. By effectively utilizing these resources, students can significantly reduce their reliance on loans, thereby lowering their overall borrowing and future interest payments. This section explores various types of financial aid, the application process, and provides examples to illustrate their impact.

Types of Financial Aid

Financial aid encompasses a range of resources designed to assist students in funding their education. These resources can significantly reduce or even eliminate the need for student loans, ultimately saving students considerable amounts of money on interest payments over the life of the loan. Understanding the different types of aid available is essential for effective financial planning.

The Scholarship and Grant Application Process

The application process for scholarships and grants varies depending on the awarding institution or organization. Generally, it involves completing an application form, providing academic transcripts, and often submitting essays or letters of recommendation. Some scholarships require specific qualifications or demonstrate financial need, while others are merit-based. Thorough research and careful preparation are key to a successful application. Many online resources and college financial aid offices provide guidance and support throughout the process.

Examples of Financial Aid

Several types of financial aid are commonly available to students. These include federal grants, such as Pell Grants, which are awarded based on financial need and do not need to be repaid. State grants, offered by individual states, also provide financial assistance. Institutional grants are provided directly by colleges and universities, often based on academic merit or financial need. Scholarships, awarded by various organizations and foundations, can be merit-based, need-based, or based on specific criteria such as major or extracurricular activities.

Financial Aid Summary Table

| Aid Type | Source | Application Process |

|---|---|---|

| Pell Grant | Federal Government (FAFSA) | Completing the Free Application for Federal Student Aid (FAFSA) |

| State Grant | State Government | Varies by state; typically involves a state-specific application |

| Institutional Grant | College or University | Usually applied for through the college’s financial aid office; often requires a separate application |

| Merit-Based Scholarship | Various Organizations, Foundations, Colleges | Varies widely; often involves essays, transcripts, and recommendations |

| Need-Based Scholarship | Various Organizations, Foundations, Colleges | Varies widely; often involves demonstrating financial need through documentation |

Impact of Interest on Long-Term Finances

Understanding the impact of student loan interest is crucial for long-term financial well-being. Unpaid interest significantly affects your creditworthiness and overall financial health, potentially leading to considerable hardship if not managed effectively. Failing to address this issue can have far-reaching consequences, impacting your ability to secure loans, rent an apartment, or even get a job in some cases.

Student loan interest, if left unpaid, accrues over time, increasing the principal amount you owe. This snowball effect can dramatically increase the total cost of your education, significantly exceeding the initial loan amount. The longer the debt remains outstanding, the more substantial this effect becomes, potentially delaying major life milestones like homeownership or starting a family.

Impact of Unpaid Interest on Credit Scores

Unpaid student loan interest negatively impacts your credit score. Late payments or defaults are reported to credit bureaus, lowering your credit rating. A lower credit score makes it harder to obtain future loans (like mortgages or auto loans) at favorable interest rates. It can also affect your ability to rent an apartment, secure certain jobs, or even obtain insurance at competitive prices. For example, a credit score below 670 might result in significantly higher interest rates on a mortgage, adding thousands of dollars to the overall cost of a home.

Long-Term Financial Implications of High Student Loan Debt

High student loan debt can significantly constrain long-term financial goals. A large portion of your income may be dedicated to loan repayments, limiting your ability to save for retirement, invest in other opportunities, or handle unexpected expenses. This can lead to financial stress and delay major life decisions, such as purchasing a home, starting a family, or pursuing further education. For instance, someone burdened with $100,000 in student loan debt might struggle to save for a down payment on a house, potentially delaying homeownership for many years.

Managing Student Loan Debt to Avoid Long-Term Financial Hardship

Effective management of student loan debt is key to avoiding long-term financial hardship. Strategies include creating a realistic budget that prioritizes loan repayment, exploring income-driven repayment plans, and considering loan refinancing options to potentially lower interest rates. Consolidating multiple loans into a single loan can simplify repayment and potentially reduce the overall interest paid. Seeking guidance from a financial advisor can provide personalized strategies based on your individual circumstances.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe consequences. Your credit score will be severely damaged, making it difficult to secure future credit. Wage garnishment, tax refund offset, and even legal action can be pursued by the lender to recover the debt. Furthermore, defaulting can impact your ability to obtain government benefits or certain professional licenses. In some cases, the default can also affect your ability to travel internationally. The long-term financial and personal repercussions of defaulting on student loans are significant and should be avoided at all costs.

Epilogue

Successfully managing student loan interest requires proactive planning and a commitment to understanding your repayment options. By implementing the strategies discussed—from understanding interest calculations and exploring government assistance programs to creating a realistic budget and seeking additional financial aid—you can significantly reduce the overall cost of your student loans and achieve long-term financial well-being. Remember, taking control of your student loan debt empowers you to build a secure financial future.

Detailed FAQs

What happens if I miss a student loan payment?

Missing payments can negatively impact your credit score, lead to late fees, and potentially result in default, which has serious financial consequences.

Can I deduct student loan interest from my taxes?

In some cases, yes. Check the current IRS guidelines for eligibility and limitations on the student loan interest deduction.

What is the difference between forbearance and deferment?

Forbearance temporarily suspends or reduces your payments, while deferment postpones payments altogether. Both can impact your loan’s overall cost.

How often is student loan interest calculated?

Interest is typically calculated daily or monthly, depending on your loan servicer. The interest is then added to your principal balance.