Navigating the world of student loans can be daunting, but understanding your options is key to a successful financial future. SchoolsFirst Federal Credit Union offers a range of student loan products designed to help students and their families finance their education. This guide delves into the specifics of SchoolsFirst student loans, comparing them to other lenders and outlining various repayment strategies to ensure you’re well-informed throughout the borrowing process.

We’ll explore eligibility requirements, application procedures, interest rates, and available repayment plans. We’ll also examine real-world examples of both successful and unsuccessful debt management, providing valuable insights into responsible borrowing and financial planning. By the end, you’ll have a clearer understanding of whether SchoolsFirst student loans are the right choice for your educational journey.

SchoolsFirst Federal Credit Union Student Loan Overview

SchoolsFirst Federal Credit Union offers student loan products designed to help members finance their education. These loans are primarily aimed at educators and those affiliated with the education system, leveraging the credit union’s focus on serving this community. Understanding the specifics of their offerings is crucial for prospective borrowers to determine if SchoolsFirst is the right choice for their financial needs.

SchoolsFirst Student Loan Products

SchoolsFirst offers a range of student loan options, though the precise details and availability can change. It’s essential to check their website for the most current information. Generally, they provide loans to cover tuition, fees, books, and other education-related expenses. These loans may include both undergraduate and graduate loan options, potentially with varying repayment terms and interest rates depending on the borrower’s creditworthiness and the type of loan. Specific product names and details should be confirmed directly with SchoolsFirst.

Eligibility Criteria for SchoolsFirst Student Loans

To be eligible for a SchoolsFirst student loan, applicants typically need to be a member of the credit union. Membership often involves meeting specific criteria, such as working in the education field or having a connection to an eligible group. Borrowers will also need to meet certain credit and income requirements, demonstrating their ability to repay the loan. Specific requirements regarding credit score, income level, and debt-to-income ratio should be obtained from SchoolsFirst directly. The application process may also involve providing documentation such as proof of enrollment and a budget demonstrating responsible financial management.

SchoolsFirst Student Loan Application Process and Required Documentation

The application process usually involves completing an online application form on the SchoolsFirst website. Applicants will need to provide personal information, details about their education, and financial information. Required documentation may include proof of enrollment, transcripts, tax returns, pay stubs, and potentially a co-signer’s information if required. It is crucial to thoroughly review the application instructions and gather all necessary documents before beginning the application process to ensure a smooth and efficient experience. Processing times vary depending on the completeness of the application and supporting documentation.

Comparison of SchoolsFirst Student Loan Interest Rates with Other Major Lenders

Interest rates, loan terms, and fees vary significantly among lenders. The following table provides a sample comparison; however, it is crucial to consult the lenders directly for the most up-to-date information, as rates are subject to change. This table is for illustrative purposes only and does not constitute financial advice.

| Lender | Interest Rate (Variable/Fixed Example) | Loan Term (Example) | Fees (Example) |

|---|---|---|---|

| SchoolsFirst FCU | 4.5% – 7.5% Variable | 5-15 years | Origination fee may apply |

| Sallie Mae | 5.0% – 10.0% Variable | 10-20 years | Origination fee may apply |

| Discover | 6.0% – 11.0% Variable | 5-10 years | Origination fee may apply |

Repayment Options and Features

SchoolsFirst Federal Credit Union offers a variety of repayment plans designed to accommodate different financial situations and budgets. Choosing the right plan is crucial for managing your student loan debt effectively and avoiding delinquency. Understanding the features and implications of each option will empower you to make informed decisions about your repayment strategy.

Standard Repayment Plan

The Standard Repayment Plan is the most common option. It involves fixed monthly payments spread over a 10-year period. This plan provides a predictable payment schedule and allows for consistent debt reduction. However, monthly payments may be higher compared to other plans with longer repayment terms. The benefit lies in its simplicity and quicker payoff, minimizing the total interest paid over the loan’s life. The drawback is the potentially higher monthly payment burden.

Extended Repayment Plan

For borrowers seeking lower monthly payments, the Extended Repayment Plan offers a longer repayment period, typically up to 25 years. This results in lower monthly payments but significantly increases the total interest paid over the life of the loan. This plan is beneficial for borrowers with limited immediate income or those facing other significant financial obligations. The trade-off is a longer repayment timeline and a substantially higher total interest cost.

Income-Driven Repayment Plans

SchoolsFirst may offer income-driven repayment plans, though the specifics would need to be confirmed directly with them. These plans typically base monthly payments on a percentage of your discretionary income. If your income is low, your payments may be very low or even $0. However, any remaining balance after a set period (often 20 or 25 years) may be forgiven, but this forgiveness is considered taxable income. It’s crucial to understand the implications of potential tax liabilities associated with loan forgiveness under these plans.

Deferment and Forbearance

Applying for a deferment or forbearance can provide temporary relief from making loan payments. Deferment postpones payments while forbearance reduces or temporarily suspends payments. Eligibility criteria vary depending on the circumstances, such as unemployment or enrollment in school. Borrowers must submit an application along with supporting documentation to SchoolsFirst to request deferment or forbearance. While these options offer temporary relief, interest may still accrue on unsubsidized loans during deferment or forbearance periods, increasing the total amount owed.

Loan Consolidation and Refinancing

SchoolsFirst may offer options for loan consolidation or refinancing, allowing borrowers to combine multiple student loans into a single loan with potentially a more favorable interest rate. Consolidation simplifies repayment by reducing the number of monthly payments. Refinancing, on the other hand, could lower the interest rate, potentially reducing the overall cost of the loan. However, it’s essential to carefully compare interest rates and fees before consolidating or refinancing to ensure it’s financially beneficial. Eligibility criteria for these options will depend on SchoolsFirst’s current offerings.

Customer Service and Support

SchoolsFirst Federal Credit Union’s customer service is a critical component of the overall student loan borrowing experience. Effective and responsive support can significantly impact borrower satisfaction and their ability to navigate the loan process successfully. Conversely, poor customer service can lead to frustration and negative perceptions of the institution. This section examines the available channels, shares borrower experiences, and identifies areas for potential improvement.

SchoolsFirst offers several channels for student loan borrowers to access customer service. These typically include phone support, online messaging or chat features through their website or mobile app, and email correspondence. The availability and responsiveness of these channels can vary depending on factors such as time of day and staffing levels. Many borrowers also report using the online resources available on the SchoolsFirst website to find answers to frequently asked questions before needing to contact customer service directly.

Borrower Experiences with SchoolsFirst Customer Service

Borrower experiences with SchoolsFirst’s customer service are varied, reflecting the general range of experiences found with any large financial institution. While many borrowers report positive interactions, others describe challenges. The following points highlight both positive and negative experiences shared by borrowers:

- Positive Experiences: Many borrowers praise the helpfulness and knowledge of SchoolsFirst representatives. Some specifically mention representatives who went above and beyond to assist with complex issues or to provide clear and concise explanations of loan terms and repayment options. Others appreciate the ease of contacting customer service through multiple channels and the generally quick response times.

- Negative Experiences: Some borrowers have reported long wait times on the phone, difficulty reaching a live representative, or inconsistent responses across different communication channels. Others describe experiences where representatives lacked the knowledge or authority to address their concerns effectively. In some instances, borrowers have reported challenges navigating the online portal or accessing necessary information.

Areas for Improvement in SchoolsFirst Student Loan Customer Service

Based on borrower feedback and general best practices in customer service, several areas could be improved to enhance the overall borrower experience. These areas represent opportunities for SchoolsFirst to strengthen its customer support and improve borrower satisfaction.

- Reduced Wait Times: Implementing strategies to reduce wait times for phone support, such as increased staffing during peak hours or improved call routing systems, would significantly improve borrower satisfaction. This might also include offering callback options to avoid prolonged periods of waiting on hold.

- Improved Online Resources: Expanding and improving the online resources available to borrowers, including FAQs, tutorials, and troubleshooting guides, could reduce the number of calls and emails to customer service. A more user-friendly online portal with enhanced search capabilities would also be beneficial.

- Enhanced Representative Training: Providing comprehensive training to customer service representatives on all aspects of student loans, including complex repayment plans and troubleshooting common issues, would ensure that borrowers receive consistent and accurate information. Regular updates on policy changes and new procedures are also crucial.

- Proactive Communication: Implementing a system for proactive communication with borrowers, such as sending reminders about upcoming payments or changes to loan terms, could prevent many issues before they arise. This could also include personalized guidance based on individual borrower circumstances.

SchoolsFirst Student Loan vs. Other Lenders

Choosing the right student loan can significantly impact your financial future. Understanding the differences between SchoolsFirst Federal Credit Union student loans and other options available is crucial for making an informed decision. This section compares SchoolsFirst loans with federal student loans and private loans from other major lenders, highlighting key differences to aid your selection process.

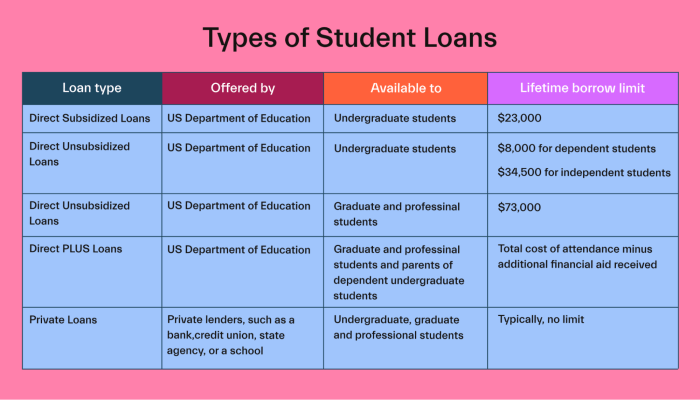

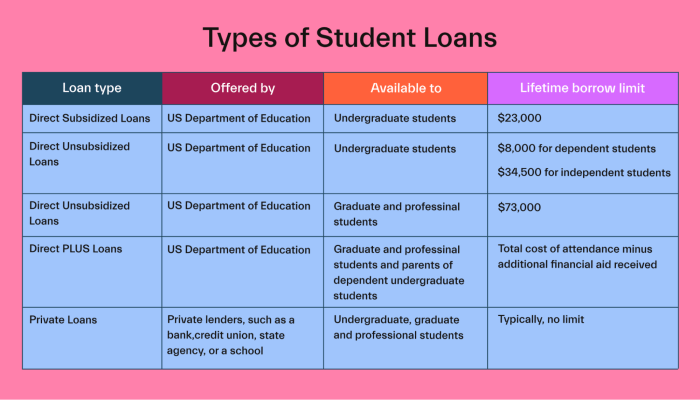

SchoolsFirst Student Loans Compared to Federal Student Loans

SchoolsFirst offers private student loans, while federal student loans are government-backed. This fundamental difference impacts several aspects, including interest rates, repayment options, and eligibility requirements. Federal student loans typically offer lower, fixed interest rates and various income-driven repayment plans, making them more accessible and potentially less risky for borrowers. SchoolsFirst loans, being private, may have variable interest rates that fluctuate with market conditions, potentially leading to higher overall costs. Furthermore, eligibility for federal loans is often broader, encompassing a wider range of students and academic programs. SchoolsFirst’s eligibility criteria might be more restrictive.

SchoolsFirst Student Loans Compared to Private Student Loans from Other Lenders

The competitive landscape of private student loans includes several major players. Comparing SchoolsFirst to these lenders requires a careful examination of interest rates, fees, repayment options, and customer service. While SchoolsFirst may offer competitive rates for certain borrowers, other lenders might provide more flexible repayment plans or additional benefits, such as loan forgiveness programs or co-signer release options. It’s essential to compare offers from multiple lenders before making a decision, as interest rates and terms can vary significantly. Customer service responsiveness and ease of communication also play a vital role in choosing a lender.

Key Differences Between Student Loan Providers

| Feature | SchoolsFirst | Lender A (Example: Sallie Mae) | Lender B (Example: Discover) |

|---|---|---|---|

| Interest Rate | Variable or Fixed (depending on loan type and borrower profile); check their website for current rates. | Variable or Fixed (check lender’s website for current rates); may offer different rates based on creditworthiness. | Variable or Fixed (check lender’s website for current rates); may offer discounts for autopay. |

| Repayment Options | Standard repayment, possibly including options like extended repayment terms (specific details should be checked on their website). | Standard, graduated, extended, and potentially income-driven repayment plans (specific details vary and should be verified on their website). | Standard, graduated, and potentially other options (check lender’s website for current offerings). |

| Customer Service | Available via phone, email, and potentially online chat; response times and overall customer satisfaction should be researched independently. | Multiple channels including phone, email, online chat, and potentially in-person support at branches (availability and quality vary). | Online resources, phone support, and potentially email support; independent reviews should be consulted to assess customer service quality. |

*Note: Interest rates and repayment options are subject to change. The examples provided for Lender A and Lender B are illustrative and should not be taken as definitive representations of their current offerings. Always check the lender’s website for the most up-to-date information.*

Impact of SchoolsFirst Student Loans on Borrowers

SchoolsFirst student loans, like any other form of borrowing, can significantly influence a borrower’s long-term financial well-being, both positively and negatively. The ultimate impact depends largely on factors such as the loan amount, interest rate, repayment plan chosen, and the borrower’s ability to manage their finances effectively. Careful planning and responsible borrowing practices are crucial for maximizing the positive effects and minimizing potential negative consequences.

The successful management of SchoolsFirst student loan debt often involves a proactive approach to repayment. This includes understanding the terms of the loan agreement, exploring various repayment options to find the most suitable plan, and creating a realistic budget that prioritizes loan repayment. A commitment to consistent on-time payments helps maintain a positive credit history, which can be beneficial when applying for future loans, credit cards, or even renting an apartment. Furthermore, borrowers who diligently pay off their loans early can save significantly on interest payments, reducing the overall cost of their education.

Successful Strategies for Managing SchoolsFirst Student Loan Debt

Effective management of SchoolsFirst student loan debt frequently involves a combination of strategies. For instance, some borrowers successfully consolidate their loans into a single payment, simplifying the repayment process and potentially lowering their monthly payment amount. Others prioritize higher-interest loans for faster repayment, minimizing the overall interest paid. Careful budgeting and tracking expenses are also key components, allowing borrowers to identify areas where they can reduce spending and allocate more funds towards loan repayment. Finally, consistent communication with SchoolsFirst’s customer service can help borrowers address any issues promptly and explore available options for managing their debt. For example, a borrower facing temporary financial hardship might explore deferment or forbearance options to avoid default.

Unsuccessful Strategies for Managing SchoolsFirst Student Loan Debt

Conversely, neglecting loan repayment or consistently making late payments can have serious negative consequences. Late payments can result in increased interest charges, negatively impacting the borrower’s credit score and making it more difficult to obtain future loans or credit. Ignoring communication from SchoolsFirst regarding outstanding payments can lead to collection efforts, which can further damage credit and result in additional fees. Failing to explore available repayment options or seeking assistance when facing financial difficulties can escalate the situation, potentially leading to loan default and long-term financial hardship. For example, a borrower who avoids contact with their lender and misses several payments could face wage garnishment or legal action.

Resources Available to Borrowers Struggling with Repayment

SchoolsFirst offers several resources to assist borrowers experiencing difficulty repaying their loans. These resources may include options such as deferment, forbearance, or income-driven repayment plans. Deferment temporarily postpones payments, while forbearance reduces or modifies payments. Income-driven repayment plans adjust monthly payments based on the borrower’s income and family size. Borrowers should proactively contact SchoolsFirst’s customer service department to discuss their financial situation and explore available options. Additionally, external resources like non-profit credit counseling agencies can provide guidance and support in developing a personalized debt management plan. These agencies can help borrowers create a budget, negotiate with creditors, and explore other options for managing their debt.

Illustrative Scenarios

Understanding the potential outcomes of managing a SchoolsFirst student loan can be greatly enhanced by examining specific scenarios. These examples illustrate both successful debt management and the challenges faced by borrowers who struggle, highlighting the importance of proactive planning and utilizing available resources.

Successful Student Loan Management

Sarah, a recent graduate with a $30,000 SchoolsFirst student loan at a 6% interest rate, chose a 10-year repayment plan. She meticulously budgeted her expenses, prioritizing loan repayment. She consistently made her monthly payments on time, avoiding late fees and penalties. She also took advantage of SchoolsFirst’s online tools to track her progress and ensure she remained on track. By the end of the 10-year period, Sarah successfully repaid her loan in full, incurring total interest payments of approximately $7,500. This proactive approach allowed her to maintain a strong credit score and focus on other financial goals, such as saving for a down payment on a house or investing. Her diligent repayment strategy resulted in a positive financial future, enabling her to build wealth and financial stability.

Struggling Student Loan Management and Recovery

Mark, also a recent graduate, faced a more challenging situation. His $40,000 SchoolsFirst loan, at a 7% interest rate, coupled with unexpected job loss, led to missed payments. His credit score suffered, impacting his ability to secure future loans or even rent an apartment. Recognizing the severity of his situation, Mark immediately contacted SchoolsFirst’s customer service department. He explored available options, including forbearance, which temporarily reduced his monthly payments. He also actively sought employment, securing a part-time job while attending career workshops to improve his job prospects. After securing a stable, higher-paying job, Mark worked with SchoolsFirst to consolidate his loan into a more manageable repayment plan. Although he ultimately paid more in interest over a longer repayment period (approximately $15,000 over 15 years), he avoided default and gradually rebuilt his credit score. This demonstrates the importance of proactive communication with the lender and the availability of resources to help borrowers navigate difficult financial situations.

Long-Term Financial Outcomes Comparison

| Borrower | Initial Loan Amount | Interest Rate | Repayment Plan | Total Interest Paid | Repayment Timeline | Credit Score Impact |

|---|---|---|---|---|---|---|

| Sarah | $30,000 | 6% | 10-year | ~$7,500 | 10 years | Positive; maintained high credit score |

| Mark | $40,000 | 7% | 15-year (after restructuring) | ~$15,000 | 15 years | Initially negative; gradually improved after proactive measures |

The comparison highlights the significant long-term financial differences. Sarah’s proactive approach resulted in lower overall interest payments and a strong credit history, setting her up for future financial success. Mark’s initial struggles led to higher interest payments and a temporary negative impact on his credit, but his proactive engagement with SchoolsFirst and his commitment to resolving his financial difficulties allowed him to recover and rebuild his financial stability, albeit over a longer period. This illustrates that while setbacks can occur, proactive problem-solving and communication with the lender can significantly mitigate negative long-term financial consequences.

Conclusive Thoughts

Securing a quality education often requires significant financial investment. SchoolsFirst student loans provide a potential avenue for funding, but careful consideration of interest rates, repayment options, and long-term financial implications is crucial. This guide has provided a comprehensive overview, equipping you with the knowledge to make informed decisions and effectively manage your student loan debt. Remember to thoroughly research all available options and consider seeking financial guidance to tailor a plan that aligns with your individual circumstances and financial goals.

FAQ Compilation

What are the income requirements for SchoolsFirst student loans?

SchoolsFirst doesn’t explicitly state minimum income requirements, but eligibility depends on creditworthiness and ability to repay. A co-signer might be required for those with limited or no credit history.

Can I refinance my existing student loans with SchoolsFirst?

SchoolsFirst offers refinancing options, but eligibility criteria vary. Check their website for current details on loan amounts, interest rates, and required documentation.

What happens if I miss a student loan payment?

Late payments negatively impact your credit score and can incur late fees. Contact SchoolsFirst immediately to explore options like deferment or forbearance to avoid default.

Does SchoolsFirst offer any hardship programs?

Yes, SchoolsFirst offers various programs to assist borrowers facing financial hardship. Contact their customer service department to discuss available options.