Navigating the complexities of student loan repayment and tax filing can feel overwhelming, especially when considering the implications of filing jointly versus separately. The decision of whether to file separate tax returns while managing student loan debt significantly impacts your tax liability, eligibility for repayment plans, and even future financial aid opportunities. This guide explores the multifaceted considerations involved in making this crucial decision.

Understanding your income, debt, and repayment plan is paramount. Your spouse’s income, your student loan debt amount, and the type of repayment plan you’re on all play a role in determining the most advantageous filing status. Furthermore, the long-term financial consequences, including credit scores and future loan applications, must be carefully weighed. This comprehensive analysis will equip you with the knowledge to make an informed choice that aligns with your financial goals.

Understanding Your Income and Debt

Choosing between filing your taxes jointly or separately as a married couple can significantly impact your tax liability, especially when student loan debt is involved. This decision hinges on a careful consideration of your combined income, individual incomes, and the amount of student loan debt you carry. Understanding these factors is crucial for optimizing your tax situation.

The tax benefits of filing jointly versus separately are not universally the same for all couples. While joint filing often leads to lower overall tax liability due to utilizing a more favorable tax bracket, this isn’t always the case, particularly when one spouse has significantly higher income than the other or substantial student loan debt. Separate filing might offer advantages in specific situations.

Spouse’s Income Impact on Tax Liability

Your spouse’s income directly influences your overall tax liability, regardless of your filing status. A higher-earning spouse can push your combined income into a higher tax bracket when filing jointly, resulting in a larger tax bill. Conversely, if your spouse has a lower income, joint filing may provide more tax benefits through deductions and credits that are dependent on income thresholds. Separate filing, however, isolates each spouse’s income, potentially placing them in lower tax brackets individually, even if the combined income would place them in a higher bracket jointly. For example, if one spouse earns $100,000 and the other earns $10,000, filing separately might result in lower taxes than filing jointly, especially if significant deductions or credits are available for the lower-earning spouse.

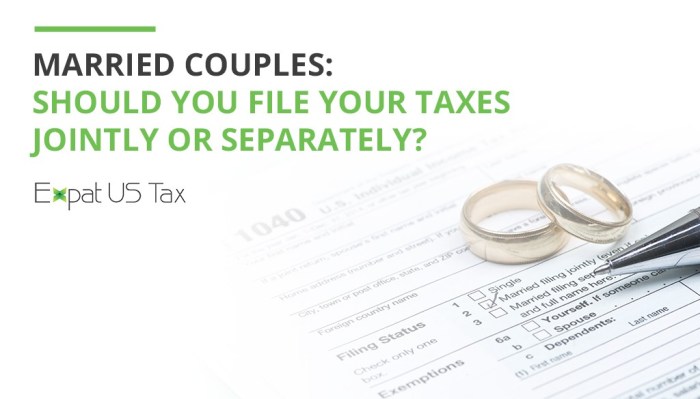

Student Loan Debt’s Influence on Tax Deductions and Credits

Student loan interest payments can offer a valuable tax deduction, potentially reducing your taxable income. However, the deduction is subject to certain limitations. For example, the amount you can deduct is capped, and your modified adjusted gross income (MAGI) may impact your eligibility. Furthermore, the deduction is claimed on your individual return, not your joint return. This means that even when filing jointly, each spouse will claim their individual student loan interest deduction separately, if eligible. The availability of other tax credits, like the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC), also depends on factors like your income and filing status, potentially affecting your decision between joint and separate filing.

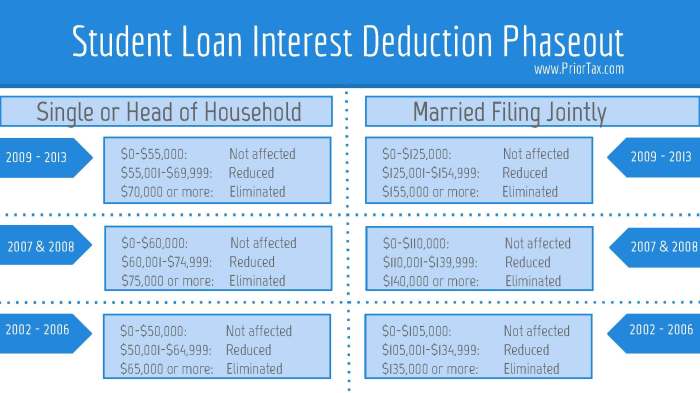

Comparison of Potential Tax Savings

The following table illustrates a simplified comparison of potential tax savings under different filing statuses. Remember, these are examples and your actual tax situation will depend on your specific circumstances and the applicable tax laws. Consult a tax professional for personalized advice.

| Scenario | Joint Filing (Estimated Tax) | Separate Filing (Estimated Tax) | Tax Savings (Separate Filing) |

|---|---|---|---|

| Spouse A: $60,000 income, $2,000 student loan interest | $10,000 | $4,500 (Spouse A) + $2,000 (Spouse B) = $6,500 | $3,500 |

| Spouse A: $80,000 income, $0 student loan interest; Spouse B: $20,000 income, $3,000 student loan interest | $15,000 | $6,000 (Spouse A) + $3,500 (Spouse B) = $9,500 | $5,500 |

| Spouse A: $40,000 income, $1,000 student loan interest; Spouse B: $40,000 income, $1,000 student loan interest | $8,000 | $3,000 (Spouse A) + $3,000 (Spouse B) = $6,000 | $2,000 |

Analyzing Your Student Loan Repayment Plans

Choosing between filing jointly or separately on your taxes significantly impacts your student loan repayment options, particularly those tied to your income. Understanding how your filing status affects your eligibility and payment amounts is crucial for minimizing your long-term debt burden. This section will detail the implications of different filing statuses on various income-driven repayment (IDR) plans.

Income-Driven Repayment Plans and Filing Status

Your filing status—married filing jointly, married filing separately, or single—directly influences your adjusted gross income (AGI), a key factor in determining your eligibility and monthly payment amount under IDR plans. Filing separately generally results in a higher AGI for each spouse compared to filing jointly, potentially impacting eligibility and leading to higher monthly payments. This is because the income is not combined, leading to potentially higher individual AGIs.

Impact of Filing Status on IDR Plan Eligibility

Eligibility criteria for income-driven repayment plans often hinge on your AGI. While specific income thresholds vary depending on the plan and the number of dependents, filing separately can push your AGI above the eligibility limits for some plans. This could exclude you from lower monthly payments, lengthening your repayment timeline and increasing the total interest paid over the life of your loans. Conversely, filing jointly might allow you to qualify for an IDR plan that would otherwise be inaccessible if filing separately.

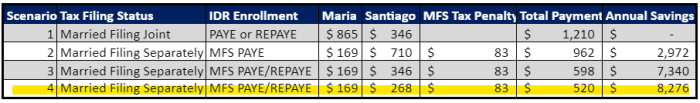

Examples of Separate Filing’s Impact on Monthly Payments

Let’s consider two hypothetical scenarios: Sarah and John each have $30,000 in student loans. If they file jointly, their combined AGI might qualify them for the PAYE plan with a significantly reduced monthly payment. However, if they file separately, their individual AGIs might exceed the PAYE plan’s income limits, forcing them into a standard repayment plan with substantially higher monthly payments. In another scenario, imagine Maria, who has $25,000 in student loans. Filing separately might push her above the income threshold for ICR, resulting in higher payments than if she filed jointly.

Income-Driven Repayment Plan Eligibility Criteria

Below is a summary of eligibility criteria for some common IDR plans, highlighting the potential differences based on filing status. Remember that these are simplified examples and actual eligibility requirements are subject to change and may involve additional factors beyond AGI.

- Income-Based Repayment (IBR): Generally requires a lower AGI for eligibility than standard repayment. Filing jointly often leads to a lower AGI and higher chances of qualification. Separate filing could result in ineligibility or higher payments.

- Pay As You Earn (PAYE): Similar to IBR, a lower AGI improves chances of qualification. Filing jointly is generally advantageous. Separate filing may result in ineligibility or higher payments.

- Revised Pay As You Earn (REPAYE): Similar to PAYE and IBR; joint filing generally offers better outcomes than separate filing.

- Income-Contingent Repayment (ICR): This plan often has less stringent income requirements than other IDR plans, but separate filing can still impact the payment amount, potentially increasing it.

Exploring the Implications for Financial Aid

Filing your taxes separately or jointly can significantly impact your eligibility for future financial aid, both for yourself and your spouse. This decision affects how the government and educational institutions assess your financial need, influencing the amount of aid you may receive. Understanding these implications is crucial before making your choice.

The primary factor affected by your filing status is your Expected Family Contribution (EFC). The EFC is a measure of your family’s financial strength, calculated using the information provided on the Free Application for Federal Student Aid (FAFSA). A lower EFC generally translates to higher eligibility for need-based financial aid, such as grants and subsidized loans. Filing separately can alter your EFC, potentially increasing or decreasing it depending on your individual financial circumstances. For example, if one spouse has significantly higher income than the other, filing separately might lower the overall EFC for the spouse with lower income, increasing their access to aid. Conversely, if both spouses have comparable incomes, filing jointly might provide a more favorable EFC.

Impact of Filing Status on EFC

The FAFSA uses a complex formula to calculate the EFC, considering factors like income, assets, family size, and number of students in college. When filing separately, the FAFSA will assess each spouse’s financial information independently. This means that the EFC calculation for each spouse will only reflect their individual income and assets, not the combined income and assets of the household. This can be beneficial if one spouse has a significantly lower income than the other. For instance, a spouse who is a full-time student with limited income may see a considerable reduction in their EFC when filing separately, compared to filing jointly with a high-earning spouse. Conversely, if both spouses have high incomes, filing jointly may result in a lower EFC than filing separately, as the formula may consider the overall household resources more favorably.

Influence on Grant and Scholarship Eligibility

Your filing status can indirectly influence your access to grants and scholarships. Many grants and scholarships are need-based, meaning the amount awarded is directly tied to the applicant’s EFC. Therefore, a lower EFC resulting from filing separately could increase the amount of grant money or the likelihood of receiving a scholarship. However, some scholarships consider household income, so filing separately might not always be advantageous. It’s crucial to review the specific criteria of each grant or scholarship application to determine the optimal filing status. For example, a scholarship specifically designed for single parents might benefit from separate filing to highlight the financial strain on the individual applicant.

Advantages and Disadvantages of Separate Filing for Future Financial Aid

Understanding the potential benefits and drawbacks is vital for informed decision-making.

- Advantage: Potentially lower EFC for a spouse with lower income, leading to increased eligibility for need-based aid.

- Advantage: May improve eligibility for certain need-based grants and scholarships designed for individuals, not households.

- Disadvantage: May result in a higher EFC if both spouses have high incomes, reducing access to need-based aid.

- Disadvantage: Some scholarships and grants may consider household income, negating the benefits of separate filing.

- Disadvantage: Could complicate the application process for certain types of aid requiring joint financial information.

Considering the Long-Term Financial Picture

Filing your taxes separately as a student can have significant long-term financial consequences that extend beyond your immediate repayment plan. Understanding these potential impacts is crucial for making an informed decision. While separate filing might offer short-term benefits, it’s vital to weigh these against the potential long-term drawbacks to your credit and borrowing power.

The primary concern revolves around your credit score and its impact on future loan applications. Separate filing can affect your individual credit history, potentially lowering your credit score if one spouse has significantly better credit than the other. This is because lenders often consider your credit history as a whole when evaluating loan applications. A lower credit score can lead to higher interest rates on future loans, such as mortgages, auto loans, and even personal loans, increasing your overall borrowing costs.

Credit Score Impact and Future Loan Applications

A lower credit score resulting from separate filing can significantly impact your ability to secure favorable loan terms. For instance, consider two individuals applying for a mortgage. One has a high credit score built on years of responsible financial management, while the other has a lower score due to separate filing that negatively impacted their individual credit history. The individual with the higher score will likely qualify for a lower interest rate, resulting in substantial savings over the life of the loan. Similarly, someone with a lower credit score might be denied a loan altogether or forced to accept a much smaller loan amount. The cumulative effect of higher interest rates and potentially smaller loan amounts can create a significant financial burden.

Impact on Overall Credit Profile

Separate filing can create a more complex credit profile, potentially making it harder for lenders to assess your creditworthiness accurately. Lenders look for consistency and a clear picture of your financial history. Separate filing can obscure this picture, especially if one spouse has a significantly different credit history than the other. This complexity can lead to more stringent lending criteria or a higher likelihood of loan denial. Moreover, building a strong credit history takes time and consistent responsible financial behavior. Separate filing, if it negatively impacts your individual credit score, can impede the process of establishing a robust credit profile that will serve you well in the future.

Long-Term Financial Outcome Comparison

The following table compares potential long-term financial outcomes under different filing statuses. These are illustrative examples and actual results may vary based on individual circumstances and credit history.

| Filing Status | Potential Credit Score Impact | Mortgage Qualification | Auto Loan Interest Rate |

|---|---|---|---|

| Jointly | Potentially higher, leveraging both credit histories | Higher likelihood of approval, potentially lower interest rates | Potentially lower interest rates |

| Separately (Positive Credit History) | Minimal impact, potentially maintaining individual high scores | Similar qualification to joint filing | Similar interest rates to joint filing |

| Separately (Negative Credit History) | Potentially lower score for one or both individuals | Lower likelihood of approval, potentially higher interest rates | Potentially higher interest rates |

State and Local Tax Implications

Filing your taxes jointly or separately can significantly impact your state and local tax liability. The decision hinges on your individual circumstances, considering your income levels, deductions, and any applicable state-specific programs. Understanding these implications is crucial for optimizing your tax burden and maximizing potential benefits.

State tax laws vary considerably, influencing the choice between joint and separate filing. Factors like state tax brackets, deductions, and credits can significantly alter your overall tax liability depending on your filing status. Moreover, some states offer programs or benefits that are contingent on filing status, further complicating the decision.

State Tax Brackets and Deductions

State income tax brackets are structured differently than federal brackets, and they also vary by state. Filing jointly often results in a higher combined income, potentially pushing you into a higher tax bracket than if you filed separately. Conversely, separate filing might allow you to benefit from lower tax brackets, especially if one spouse has significantly higher income than the other. Similarly, deductions and credits available at the state level may be affected by filing status. For instance, a state might offer a deduction for married couples filing jointly that isn’t available to those filing separately, or vice versa. The specific rules and amounts vary widely depending on the state.

Examples of State Tax Implications

Consider two hypothetical scenarios in California and New York. In California, a couple with combined income placing them in the highest tax bracket might find that filing separately results in lower overall taxes due to the progressive nature of the state’s tax system. However, in New York, which has a different tax structure, the same couple might find that joint filing is more advantageous due to specific deductions or credits only available to joint filers. These are simplified examples, and the optimal filing status will depend on the specifics of each couple’s financial situation.

State-Specific Programs and Benefits

Several states offer programs or benefits that are influenced by filing status. These can include things like tax credits for low-to-moderate-income families, property tax relief programs, or eligibility for certain healthcare subsidies. For example, some states may offer a larger child tax credit to joint filers than to those filing separately. Conversely, some programs may be income-based and therefore influenced by the filing status which impacts reported income. Always check with your state’s tax agency for specific details on programs and benefits.

State Tax Implications Table

| State | Joint Filing Implications | Separate Filing Implications | Relevant State Programs/Benefits |

|---|---|---|---|

| California | May result in higher tax bracket, but potential for higher deductions or credits. | May result in lower tax bracket, but potentially fewer deductions or credits. | California Earned Income Tax Credit (CalEITC), Property Tax Postponement Program. |

| New York | Potential for higher combined deductions or credits. | May result in lower tax liability if incomes are significantly different. | New York State Child and Dependent Care Credit, STAR (School Tax Relief) program (eligibility impacted by income). |

| Texas | No state income tax, so filing status has no direct impact on state income tax. | No state income tax, so filing status has no direct impact on state income tax. | Property tax exemptions may vary based on household income and filing status. |

Concluding Remarks

Ultimately, the decision of whether to file separately or jointly for student loans is highly personal and depends on your unique financial circumstances. By carefully considering the tax implications, the impact on your repayment plan, and the potential consequences for future financial aid and long-term financial health, you can make a well-informed choice. Remember to consult with a tax professional or financial advisor for personalized guidance tailored to your specific situation.

Key Questions Answered

Can I switch filing statuses from year to year?

Yes, you can choose to file jointly or separately each tax year, depending on which is more advantageous for your financial situation.

Does filing separately affect my eligibility for loan forgiveness programs?

It can, depending on the specific program and income thresholds. Consult the program guidelines for details.

Will filing separately affect my spouse’s credit score?

Generally, filing status does not directly impact your spouse’s credit score, but your individual financial decisions (like taking on debt) will.

What if my spouse has no income? Should I still file separately?

Even if your spouse has no income, filing separately might still be beneficial depending on your individual income and tax bracket. Compare both scenarios to see.