Navigating the complexities of student loan repayment can feel overwhelming. The decision of whether to prioritize paying off student loans or pursuing other financial goals requires careful consideration of various factors. This guide explores the multifaceted aspects of student loan debt management, helping you make informed decisions aligned with your individual financial circumstances and long-term aspirations.

From understanding the nuances of federal versus private loans and their associated interest rates to crafting a personalized budget and exploring alternative investment opportunities, we delve into the practical strategies necessary for effective debt management. We also examine the long-term financial implications of different repayment approaches, empowering you to make choices that optimize your financial well-being.

Understanding Your Student Loan Debt

Navigating the complexities of student loan repayment can feel overwhelming. Understanding the different types of loans, their associated interest rates and repayment terms, and the overall cost is crucial for effective financial planning. This section provides a clear overview to help you gain control of your student loan debt.

Federal vs. Private Student Loans

Federal student loans are offered by the U.S. government and generally offer more borrower protections than private loans. Private student loans, on the other hand, are provided by banks and other private lenders. Key differences include eligibility requirements, interest rates, repayment options, and the availability of deferment and forbearance programs. Federal loans typically have more flexible repayment options and are subject to stricter regulations designed to protect borrowers.

Interest Rates and Repayment Terms

Interest rates for both federal and private student loans vary depending on several factors, including the type of loan, creditworthiness (for private loans), and the prevailing market interest rates. Federal loans often have fixed interest rates, while private loans may offer fixed or variable rates. Repayment terms, usually spanning 10-25 years, are also dependent on the loan type and lender. For example, a federal Direct Subsidized Loan might have a fixed interest rate of 4.99% and a standard 10-year repayment plan, whereas a private loan could have a variable rate of 6-8% and a 15-year repayment plan.

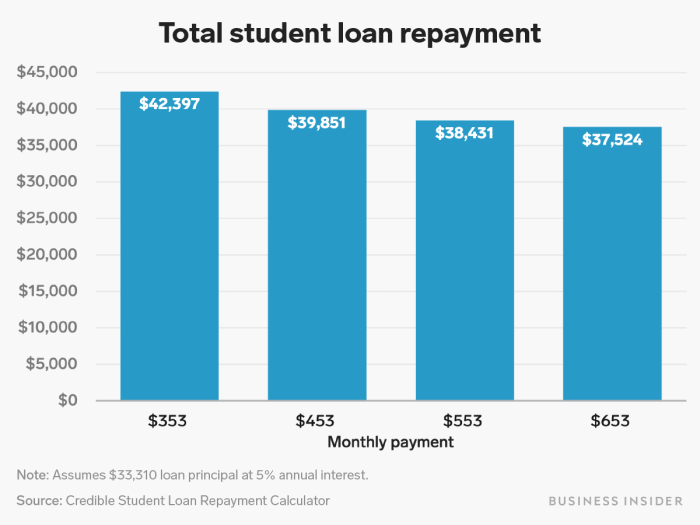

Calculating Total Loan Repayment Costs

Calculating the total cost of your student loans involves understanding the principal amount borrowed, the interest rate, and the repayment period. A simple way to estimate this is using an amortization calculator readily available online. However, a manual calculation can also be performed.

Total Repayment Cost = Principal + (Principal x Interest Rate x Loan Term)

For instance, a $20,000 loan with a 5% annual interest rate over 10 years would have a total repayment cost of approximately $26,000. This is a simplified calculation; actual repayment costs may vary slightly due to compounding interest. More accurate estimations require considering the specific repayment schedule, which often includes monthly payments.

Student Loan Repayment Plan Comparison

Understanding the various repayment plans available is critical in managing your student loan debt. Choosing the right plan depends on your financial situation and repayment goals.

| Repayment Plan | Pros | Cons | Best For |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payments; pays off loan quickly | Higher monthly payments; may be difficult for some borrowers | Borrowers with stable income and ability to make higher payments |

| Graduated Repayment Plan | Lower initial payments; payments increase over time | Higher payments later; may not be suitable for long-term financial planning | Borrowers anticipating income increases; those needing lower payments initially |

| Income-Driven Repayment Plan | Payments based on income and family size; potential for loan forgiveness | May take longer to repay; interest may accrue, increasing the total cost | Borrowers with lower income or significant financial challenges |

| Extended Repayment Plan | Lower monthly payments; longer repayment period | Higher total interest paid; longer time to become debt-free | Borrowers needing significantly lower monthly payments |

Assessing Your Financial Situation

Before deciding whether to aggressively pay down your student loans, a thorough assessment of your overall financial health is crucial. Understanding your current income, expenses, and overall financial stability will help you make an informed decision that aligns with your broader financial goals. This involves creating a realistic budget and exploring strategies to increase income or reduce expenses.

Creating a Personal Budget

A personal budget is a detailed plan outlining your expected income and expenses over a specific period, typically a month. This provides a clear picture of your cash flow, highlighting areas where you can potentially save money or increase income. To create one, begin by listing all sources of income, including your salary, any part-time jobs, investments, or other regular income streams. Then, meticulously track all your expenses, categorizing them into essential and non-essential spending. This can be done manually using a spreadsheet or notebook, or with budgeting apps that automatically categorize transactions. Accuracy is paramount; underestimating expenses can lead to inaccurate budgeting.

Identifying and Prioritizing Essential vs. Non-Essential Spending

Essential expenses are those necessary for survival and well-being, such as housing, food, utilities, transportation, and healthcare. Non-essential expenses are discretionary purchases, like entertainment, dining out, subscriptions, and luxury items. Prioritizing essential expenses ensures basic needs are met before allocating funds to non-essential items. For example, if you’re struggling to meet your minimum monthly payments on your student loans, you might need to cut back on non-essential spending to free up cash flow.

Strategies for Increasing Income

Increasing your income provides more financial flexibility to manage student loan debt. Consider exploring various avenues to supplement your current income. A side hustle, such as freelance work, gig economy jobs (like driving for a ride-sharing service), or selling goods online, can generate extra cash. Additionally, actively seeking a promotion at your current job can lead to a salary increase. Negotiating a higher salary during a job search is another effective strategy. Remember to factor in the time commitment and potential tax implications of any additional income source.

Methods for Reducing Monthly Expenses

Reducing monthly expenses frees up more money to allocate towards student loan repayment. Analyze your spending habits and identify areas where you can cut back. This might involve negotiating lower rates with service providers (like internet or phone), switching to cheaper alternatives (e.g., generic brands), reducing subscription services, or cooking at home more often instead of eating out. Tracking your spending for a month can reveal unexpected expenses, highlighting opportunities for cost reduction. For example, you may find that you are spending more on coffee than anticipated, allowing you to make a conscious effort to reduce this expenditure.

Exploring Debt Management Strategies

Choosing the right strategy for tackling your student loan debt is crucial for minimizing interest payments and achieving faster repayment. Several methods exist, each with its own advantages and disadvantages, depending on your financial situation and personal preferences. Understanding these methods and their implications will empower you to make informed decisions about your repayment journey.

Debt Repayment Methods: Avalanche and Snowball

The avalanche and snowball methods are two popular approaches to student loan repayment. The avalanche method prioritizes paying off the loan with the highest interest rate first, regardless of the loan balance. This method minimizes the total interest paid over the life of the loans. The snowball method, conversely, focuses on paying off the loan with the smallest balance first, regardless of the interest rate. This approach offers psychological benefits as the borrower experiences quicker wins, boosting motivation.

Avalanche Method Example: Let’s say you have two loans: Loan A with a $10,000 balance and a 7% interest rate, and Loan B with a $5,000 balance and a 4% interest rate. Using the avalanche method, you would prioritize Loan A, making extra payments to pay it off as quickly as possible. Once Loan A is repaid, you would then focus all your extra payments on Loan B.

Snowball Method Example: Using the same loans, the snowball method would prioritize Loan B due to its smaller balance. Paying off Loan B first provides a sense of accomplishment and can motivate continued repayment efforts on Loan A.

Negotiating with Lenders for Better Repayment Terms

Negotiating with your student loan lenders can potentially lead to more manageable repayment terms. This may involve exploring options such as income-driven repayment plans, loan consolidation, or forbearance. Before initiating negotiations, thoroughly document your financial situation, including income, expenses, and any extenuating circumstances. Clearly articulate your financial hardship and propose specific, realistic repayment options. Maintain a professional and respectful tone throughout the communication process. Keep detailed records of all communication with your lenders. Consider seeking assistance from a non-profit credit counseling agency for guidance in navigating this process.

Resources for Borrowers Facing Financial Hardship

Numerous resources are available to assist borrowers facing financial hardship. These include:

The National Foundation for Credit Counseling (NFCC): The NFCC offers free or low-cost credit counseling services, helping borrowers create a budget and develop a debt management plan. They can also assist in negotiating with lenders.

The U.S. Department of Education: The Department of Education provides information on various repayment plans, including income-driven repayment plans and options for borrowers experiencing financial hardship. Their website offers resources and tools to help manage student loans.

Student Loan Ombudsmen: Many states and universities have student loan ombudsmen who can advocate on behalf of borrowers facing challenges. They can help navigate the complexities of the student loan system and resolve disputes with lenders.

Local Non-Profit Organizations: Many local non-profit organizations offer financial literacy workshops and one-on-one counseling to help individuals manage their debt.

Long-Term Financial Planning

Paying off your student loans significantly impacts your long-term financial health, influencing major life goals like homeownership and retirement. A strategic approach to loan repayment can free up considerable resources, accelerating your progress toward these milestones. Understanding this impact is crucial for making informed financial decisions.

Successfully navigating student loan repayment requires a forward-thinking approach that integrates it into your broader financial strategy. This involves considering the trade-offs between aggressive repayment and other financial priorities, like saving for a down payment or investing for retirement. A well-defined plan helps you balance these competing needs and achieve a comfortable financial future.

Homeownership and Retirement Savings

Aggressive student loan repayment can free up substantial funds for other significant financial goals. For instance, by prioritizing loan repayment, you can reduce your debt burden and improve your credit score, making it easier to qualify for a mortgage and secure a favorable interest rate on a home loan. Similarly, early repayment can release more money for retirement savings, allowing you to contribute more to retirement accounts and potentially benefit from compounding returns over a longer period. Consider a scenario where someone aggressively pays off their $50,000 student loan in 3 years instead of 10. That extra $20,000 a year (approximately, depending on the original repayment plan) could be directed towards a down payment, resulting in significantly faster homeownership. Alternatively, this money could be invested, potentially yielding substantially higher returns by retirement age.

Building an Emergency Fund While Managing Student Loan Debt

Building an emergency fund is crucial regardless of your student loan situation. However, it can feel challenging when juggling loan payments. A practical approach involves allocating a small, consistent amount each month to an emergency fund, even if it means slightly extending your loan repayment period. Start small; even $50-$100 per month adds up. Prioritize building a 3-6 month emergency fund covering essential living expenses before focusing solely on aggressive loan repayment. This safeguards against unexpected job loss or medical expenses, preventing further financial strain.

Impact of Different Repayment Scenarios on Long-Term Net Worth

The following description Artikels a bar graph illustrating the impact of different student loan repayment strategies on long-term net worth. The horizontal axis represents time in years (0-30), and the vertical axis represents net worth (in thousands of dollars). Three bars are displayed for each year:

Bar 1 (Standard Repayment): This bar represents a scenario where the individual follows the standard repayment plan, with a relatively slow decrease in debt and a slower increase in net worth. The initial net worth is negative (reflecting the student loan debt), gradually increasing over time as the debt is repaid and assets are accumulated.

Bar 2 (Accelerated Repayment): This bar depicts a scenario where the individual makes extra payments toward their student loans, resulting in faster debt repayment and a quicker increase in net worth. The net worth starts at the same negative value as Bar 1 but rises significantly faster due to the accelerated debt reduction.

Bar 3 (Minimum Repayment + Investment): This bar illustrates a scenario where the individual makes only minimum payments and simultaneously invests a portion of their income. While debt reduction is slower, the investment growth gradually surpasses the debt, leading to a net worth that increases steadily, potentially overtaking the accelerated repayment scenario over a longer period.

The graph clearly shows that while accelerated repayment leads to a faster increase in net worth in the short term, a combination of minimum payments and consistent investment can lead to higher net worth in the long term, assuming favorable investment returns.

Importance of Financial Planning and Professional Advice

Developing a comprehensive financial plan is essential for successfully managing student loan debt and achieving long-term financial goals. This plan should include a realistic budget, a detailed debt repayment strategy, and a clear roadmap for saving and investing. Seeking professional financial advice, particularly from a certified financial planner, can be invaluable. A financial planner can provide personalized guidance tailored to your specific circumstances, helping you create a plan that aligns with your financial goals and risk tolerance. They can also offer insights into various investment strategies and help you navigate complex financial decisions.

Outcome Summary

Ultimately, the decision of whether or not to aggressively pay off student loans hinges on a thorough assessment of your individual financial situation, risk tolerance, and long-term goals. By carefully weighing the potential benefits of early repayment against the opportunities presented by alternative investments, you can develop a personalized strategy that aligns with your unique circumstances. Remember, seeking professional financial advice can provide invaluable guidance in navigating this crucial financial decision.

FAQ Corner

What if I can’t afford my student loan payments?

Contact your loan servicer immediately. They may offer forbearance, deferment, or income-driven repayment plans to help manage your payments.

Can I refinance my student loans?

Yes, but carefully compare interest rates and terms from multiple lenders. Refinancing federal loans may eliminate certain benefits.

What is the best debt repayment method?

The “best” method (avalanche or snowball) depends on your personality and financial goals. Avalanche minimizes total interest, while snowball improves motivation.

How can I improve my credit score while paying off student loans?

Make on-time payments consistently, keep credit utilization low, and maintain a diverse credit history.