Navigating the complexities of student loan repayment can feel overwhelming. The sheer volume of debt, coupled with varying interest rates and repayment options, often leaves borrowers unsure of the best approach. This guide explores the crucial question of whether prioritizing high-interest loans is the most financially sound strategy, weighing the merits against alternative methods and considering individual circumstances.

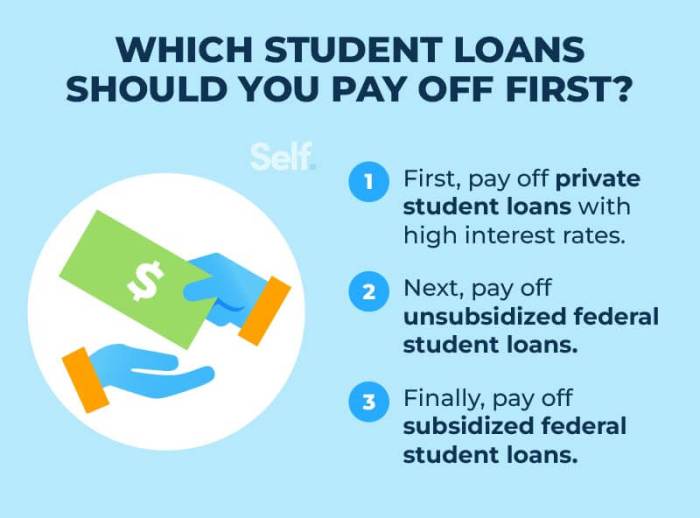

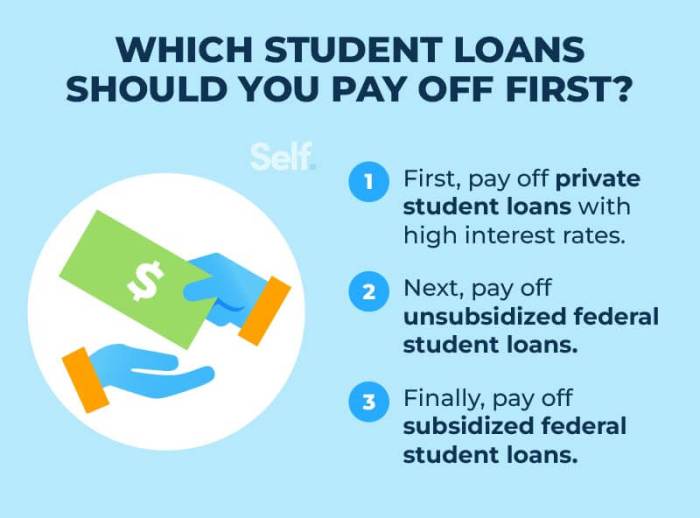

Understanding the nuances of different loan types, such as federal versus private loans and subsidized versus unsubsidized loans, is the first step. This understanding informs the choice between repayment strategies like the debt avalanche method (tackling the highest interest first) and the debt snowball method (paying off the smallest debt first). We will delve into the advantages and disadvantages of each, exploring the financial and psychological implications.

Understanding Interest Rates and Loan Types

Navigating the world of student loan repayment can be complex, largely due to the variations in interest rates and loan types. Understanding these differences is crucial for making informed decisions about repayment strategies and minimizing long-term costs. This section will clarify the impact of interest rates, detail the various loan types, and illustrate the financial consequences of different interest rate structures.

Interest rates significantly influence how quickly your loan balance decreases and the total amount you ultimately repay. A higher interest rate means more of your monthly payment goes towards interest, leaving less to pay down the principal. This results in a longer repayment timeline and a substantially higher total cost. Conversely, a lower interest rate allows a larger portion of your monthly payment to reduce the principal, leading to faster repayment and lower overall interest paid.

Student Loan Types and Interest Rate Structures

Student loans are broadly categorized into federal and private loans. Federal loans are offered by the U.S. government, while private loans come from banks and other private lenders. Within these categories, there are further distinctions.

Federal student loans include subsidized and unsubsidized loans. Subsidized loans typically do not accrue interest while the borrower is in school at least half-time, during grace periods, or during periods of deferment. Unsubsidized loans, however, accrue interest from the time the loan is disbursed, regardless of the borrower’s enrollment status. Interest rates for federal loans are set annually by the government and generally tend to be lower than those for private loans.

Private student loans, on the other hand, have variable interest rates that fluctuate with market conditions. These rates are typically higher than federal loan rates and are determined by the lender’s assessment of the borrower’s creditworthiness. The terms and conditions of private loans can also vary significantly between lenders.

Comparing Total Interest Paid

The total interest paid over the life of a loan is directly affected by the interest rate. A higher interest rate dramatically increases the total cost. For example, a $30,000 loan with a 5% interest rate over 10 years will result in significantly less total interest paid compared to the same loan with a 10% interest rate over the same period. This difference can amount to thousands of dollars. Careful consideration of the interest rate is vital when choosing a repayment plan and prioritizing which loans to tackle first.

Sample Loan Repayment Comparison

The following table illustrates the differences in monthly payments and total interest paid for a $20,000 loan with varying interest rates and a 10-year repayment period. These figures are for illustrative purposes and do not account for potential fees or changes in interest rates.

| Loan Type | Interest Rate | Monthly Payment (approx.) | Total Interest Paid (approx.) |

|---|---|---|---|

| Federal Subsidized | 4.5% | $205 | $4,600 |

| Federal Unsubsidized | 6% | $222 | $6,640 |

| Private | 8% | $249 | $9,880 |

| Private (High Risk) | 12% | $291 | $15,480 |

Financial Factors to Consider

Before deciding on a student loan repayment strategy, a comprehensive assessment of your overall financial picture is crucial. Ignoring other financial obligations can lead to unforeseen difficulties and hinder your progress towards financial stability. This section will explore how various financial factors influence the decision of prioritizing high-interest student loans.

Prioritizing high-interest debt often involves a trade-off. While strategically advantageous, it might temporarily impact other areas of your financial life. Careful consideration of your entire financial landscape is essential to make an informed and sustainable choice.

Other Significant Financial Obligations

Your existing financial commitments significantly influence the feasibility of aggressively paying down high-interest student loans. A large mortgage, a substantial car loan, or high-interest credit card debt can complicate the process. For example, if you have a high-interest credit card balance accruing significant interest daily, it might be more financially prudent to tackle that debt first, even if your student loans have higher interest rates. This is because the compounding effect of high-interest credit card debt can quickly outweigh the benefits of focusing solely on student loans. Similarly, neglecting mortgage payments can lead to foreclosure, a far more severe consequence than delayed student loan repayment. A balanced approach, considering all debts, is key.

Budgeting and Prioritizing Debt Repayment

Creating a realistic budget is fundamental to effective debt management. A comprehensive budget allows you to visualize your income and expenses, revealing areas where you can cut back to allocate more funds towards debt repayment. Popular budgeting methods include the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment), the zero-based budget (allocating every dollar), and envelope budgeting (cash-based system). Once a budget is established, prioritizing debt repayment often involves employing strategies like the debt snowball (paying off the smallest debt first for motivation) or the debt avalanche (paying off the highest-interest debt first for financial efficiency). The choice between these methods depends on individual preferences and financial circumstances. For example, someone with multiple small debts might find the debt snowball method more motivating, while someone focused on minimizing long-term interest costs might prefer the debt avalanche.

Emergency Funds and Savings Goals

Before aggressively paying down student loans, it’s crucial to have an emergency fund. This fund acts as a safety net for unexpected expenses, such as medical bills or car repairs, preventing further debt accumulation. A generally recommended emergency fund size is 3-6 months of living expenses. Furthermore, neglecting savings goals, such as retirement contributions or down payments on a house, can hinder long-term financial well-being. Prioritizing student loans while neglecting these crucial savings goals could lead to future financial instability. For example, failing to save for retirement could significantly impact your financial security in later life, outweighing the short-term benefits of rapid student loan repayment.

Potential Financial Consequences

Choosing one repayment method over another has potential consequences. Focusing solely on high-interest student loans while neglecting other high-interest debts can lead to increased overall interest payments in the long run. Conversely, neglecting high-interest student loans might result in a larger principal balance due to compounding interest. Furthermore, late or missed payments on any debt can negatively impact your credit score, making it harder to secure loans or credit in the future, and potentially increasing interest rates on future borrowing. A delayed repayment strategy might also mean a longer period of debt, impacting financial flexibility and potentially delaying significant life goals like homeownership or starting a family. Careful planning and consideration of all potential outcomes are vital.

Assessing Personal Circumstances

Paying off student loans strategically requires a deep understanding of your individual financial situation and comfort level with risk. The optimal approach isn’t a one-size-fits-all solution; it depends heavily on your personal circumstances and financial goals. Ignoring these factors can lead to unnecessary stress and potentially hinder your long-term financial well-being.

Risk Tolerance and Repayment Strategy

Your risk tolerance significantly impacts your repayment strategy. Individuals with a high risk tolerance might be more comfortable with aggressive repayment plans, potentially prioritizing high-interest loans even if it means temporarily sacrificing other financial goals. This strategy aims to minimize long-term interest payments, but it requires a stable income and the willingness to endure potential short-term financial strain. Conversely, those with low risk tolerance may prefer a more conservative approach, focusing on smaller, manageable payments to avoid overwhelming debt and maintain financial stability. This might involve paying off smaller loans first to build momentum and confidence, even if it means paying more interest in the long run. The choice hinges on your comfort level with potential financial setbacks. For example, someone with a high-risk tolerance might aggressively pay down high-interest debt, even if it means delaying saving for a down payment on a house. A low-risk-tolerant individual might prioritize saving for the down payment first, even if it means paying more interest on their loans.

Impact of Income Changes on Repayment Plans

Unexpected income changes, whether positive or negative, can significantly disrupt your repayment plan. Job loss necessitates immediate adjustments, potentially requiring forbearance or deferment options offered by your loan servicer. This can temporarily halt payments but will likely accrue additional interest. Conversely, a salary increase provides an opportunity to accelerate repayment, potentially redirecting the extra funds towards high-interest loans to minimize overall interest paid. For instance, a sudden job loss might force someone to temporarily postpone their student loan payments and focus on essential living expenses. Conversely, a significant salary raise could enable someone to make larger loan payments or even pay off their debt entirely. Planning for such contingencies is crucial for maintaining financial stability.

Psychological Impact of Debt Repayment Focus

The psychological impact of focusing on high-interest debt versus smaller debts is substantial. Tackling high-interest loans first offers the satisfaction of minimizing long-term costs, but it can be demotivating if the payoff period remains lengthy. Paying off smaller debts quickly provides a sense of accomplishment and momentum, potentially motivating continued repayment efforts. The psychological benefits of consistently achieving smaller goals can be substantial in maintaining motivation and avoiding burnout. For example, paying off a smaller credit card debt quickly might provide a psychological boost that encourages someone to tackle larger loans with renewed determination. Conversely, the seemingly slow progress of paying off a large, high-interest loan might lead to frustration and demotivation.

Personal Financial Goals and Repayment Priorities

Personal financial goals significantly influence repayment priorities. Saving for a down payment on a house or retirement often competes with aggressive student loan repayment. Balancing these priorities requires careful consideration and potentially compromises. Prioritizing homeownership might necessitate a slower student loan repayment, while delaying homeownership could allow for faster debt reduction. For instance, someone prioritizing early retirement might allocate a larger portion of their income towards retirement savings, even if it means slower student loan repayment. Conversely, someone focused on immediate homeownership might prioritize saving for a down payment, even if it means paying more interest on their student loans. A well-rounded financial plan considers all long-term goals.

Refinancing Options

Refinancing your student loans can be a strategic move to potentially lower your monthly payments and save money over the life of your loans. It involves replacing your existing student loans with a new loan from a different lender, often at a more favorable interest rate. However, it’s crucial to carefully weigh the potential benefits against the risks before making a decision.

Refinancing essentially involves applying for a new loan to pay off your existing student loans. The new loan typically comes with a different interest rate, loan term, and repayment plan. Lenders assess your creditworthiness and financial situation to determine the terms they offer. Successful refinancing can lead to lower monthly payments, a shorter repayment period, or both, resulting in significant long-term savings. However, it’s important to remember that refinancing isn’t always the best option for everyone.

Interest Rates and Terms Offered by Different Lenders

Different lenders offer varying interest rates and loan terms for student loan refinancing. These rates are influenced by factors such as your credit score, income, debt-to-income ratio, and the type of loan being refinanced. For example, a lender might offer a 5% interest rate to a borrower with excellent credit and a stable income, while a borrower with a lower credit score might receive a rate closer to 8%. Loan terms, typically ranging from 5 to 20 years, also affect the monthly payment amount. A shorter loan term results in higher monthly payments but less interest paid overall, while a longer term means lower monthly payments but higher total interest paid. Comparing offers from multiple lenders is crucial to securing the most favorable terms. You can use online comparison tools or contact lenders directly to obtain personalized quotes.

Potential Risks and Drawbacks of Refinancing

While refinancing can offer significant benefits, it’s important to be aware of potential drawbacks. One major risk is losing access to federal student loan benefits, such as income-driven repayment plans or loan forgiveness programs. If you refinance your federal loans into a private loan, you will no longer be eligible for these programs. Additionally, if your credit score deteriorates after refinancing, you may find it difficult to secure favorable terms in the future. The process of refinancing itself can also involve fees and costs, which should be factored into your decision. Finally, locking into a fixed interest rate might not be advantageous if interest rates subsequently fall.

Step-by-Step Guide to Researching and Applying for Student Loan Refinancing

- Check Your Credit Report: Review your credit report for errors and take steps to improve your score if necessary. A higher credit score typically qualifies you for better interest rates.

- Compare Lenders and Rates: Research multiple lenders, comparing interest rates, fees, and loan terms. Consider using online comparison tools to streamline the process.

- Pre-qualify for Loans: Pre-qualifying allows you to see what rates you might qualify for without impacting your credit score.

- Gather Necessary Documents: Collect all required documents, such as proof of income, tax returns, and student loan statements.

- Complete the Application: Carefully fill out the application and submit all required documentation.

- Review Loan Documents: Before signing, thoroughly review all loan documents to ensure you understand the terms and conditions.

- Close on the Loan: Once you’ve accepted the loan offer, the lender will process the loan and disburse the funds to pay off your existing student loans.

Visual Representation of Repayment Scenarios

Visual aids can significantly enhance understanding when comparing different student loan repayment strategies. Charts and graphs provide a clear and concise way to see the impact of various approaches on both the remaining loan balance and the total interest paid. This allows for a more informed decision-making process.

Avalanche Method: Remaining Balance Bar Chart

A bar chart visualizing the avalanche method would display the remaining balance of each loan over time. The horizontal axis would represent time, perhaps in months or years, while the vertical axis would represent the outstanding loan balance. Each loan would be represented by a different colored bar. Initially, the bars would be long, reflecting the original loan amounts. As payments progress, focusing first on the highest interest rate loan, the corresponding bar would decrease more rapidly than others. Over time, the bars representing higher-interest loans would shorten considerably faster than those with lower interest rates. The chart would clearly illustrate the faster reduction of debt when prioritizing high-interest loans. For example, a chart might show Loan A (10% interest, $10,000 initial balance) decreasing much faster than Loan B (5% interest, $5,000 initial balance), despite Loan B having a smaller initial balance. The visual representation would emphasize the efficiency of the avalanche method in minimizing overall interest paid.

Comparison of Avalanche and Snowball Methods: Total Interest Paid Line Graph

A line graph comparing the avalanche and snowball methods would effectively demonstrate the difference in total interest paid over time. The horizontal axis would again represent time, while the vertical axis would show the cumulative interest paid. Two lines would be plotted: one for the avalanche method and one for the snowball method. The avalanche method line would generally show a lower cumulative interest paid over time compared to the snowball method, particularly in the earlier stages of repayment. This is because the avalanche method tackles the most expensive debt first, resulting in less interest accruing overall. However, the psychological benefit of the snowball method (seeing quick wins by paying off smaller loans first) might lead to increased motivation, potentially offsetting some of the initial interest savings. The graph would clearly illustrate the trade-off between financial efficiency (avalanche) and psychological motivation (snowball). For instance, the graph might show that after five years, the avalanche method resulted in $5,000 in interest paid, while the snowball method resulted in $6,000. This visual comparison would aid in understanding the long-term financial implications of each strategy.

Final Review

Ultimately, the decision of whether to prioritize high-interest student loans hinges on a careful assessment of your individual financial situation, risk tolerance, and long-term goals. While the debt avalanche method often leads to lower overall interest payments, the debt snowball method can provide crucial psychological momentum. By considering your financial obligations, potential income changes, and personal aspirations, you can develop a tailored repayment plan that aligns with your unique circumstances and maximizes your chances of achieving financial freedom.

Commonly Asked Questions

What if I can’t afford the minimum payments on all my loans?

Contact your loan servicers immediately. They may offer forbearance or deferment options, temporarily suspending or reducing payments. Explore income-driven repayment plans if eligible.

Should I consolidate my student loans before deciding on a repayment strategy?

Consolidation simplifies payments but may not always be beneficial. It often results in a weighted average interest rate, potentially increasing your overall interest paid if you had high-interest loans and low-interest loans. Carefully compare the new interest rate to your current rates before consolidating.

How often should I review my repayment plan?

Regularly review your plan (at least annually) to account for changes in income, expenses, and financial goals. Life circumstances can significantly impact your ability to stick to a specific strategy.