The landscape of student loan financing is often complex, with varying structures impacting borrowers significantly. Understanding “slabs” in the context of student loans is crucial for prospective students and their families. These slabs, representing different loan tiers based on factors like loan amount, interest rate, and repayment period, can drastically affect the overall cost of higher education and long-term financial well-being. This exploration delves into the intricacies of slabs student loans, examining their impact, government regulations, alternative financing options, and potential solutions to navigate this challenging financial terrain.

This analysis will provide a comprehensive overview of the various types of student loan slabs, comparing their features across different lending institutions. We will explore the long-term financial implications of choosing loans with varying slab structures, highlighting potential benefits and drawbacks. Furthermore, we will examine government policies and regulations impacting these structures and explore alternative financing options to assist students in making informed decisions.

Understanding “Slabs Student Loans”

Student loan slabs refer to a tiered system where interest rates and loan amounts are categorized into different brackets or “slabs” based on factors such as the borrower’s income, creditworthiness, the course of study, or the institution attended. This system impacts the overall cost of borrowing and the repayment schedule for students. Understanding these slabs is crucial for making informed decisions about financing your education.

Defining Student Loan Slabs and Their Implications

In the context of student loans, “slabs” represent distinct categories of loan terms, primarily differentiated by interest rates. Higher slabs generally correspond to higher interest rates, reflecting a higher perceived risk for the lender. Borrowers in higher slabs will pay significantly more in interest over the life of the loan, increasing their total repayment cost. Conversely, lower slabs offer more favorable terms, resulting in lower overall costs. The slab assigned to a borrower influences not only the interest rate but may also affect the loan amount available and the repayment period options.

Types of Student Loan Slabs and Associated Interest Rates

Various types of student loan slabs exist, and their interest rates are determined by a combination of factors. These factors can include: the type of institution (public vs. private), the course of study (undergraduate vs. postgraduate), the borrower’s credit history, and the lender’s risk assessment. For example, loans for postgraduate studies might fall into higher slabs with higher interest rates compared to undergraduate loans, reflecting the generally higher earning potential post-graduation. Similarly, loans with longer repayment periods may also fall into higher slabs. Specific interest rates vary considerably across institutions and change periodically based on market conditions.

Comparison of Slab Structures Across Lending Institutions

Different lending institutions, including banks and government agencies, often employ varying slab structures. Some may offer a broader range of slabs with finer gradations in interest rates, providing more tailored options for borrowers. Others may use a simpler structure with fewer slabs. Direct comparison requires reviewing the specific terms and conditions of each institution’s loan offerings. The availability of subsidized or unsubsidized loans also differs across lenders, impacting the overall cost and repayment plan. Furthermore, some institutions might prioritize certain criteria over others when assigning borrowers to specific slabs. For instance, one institution might place more emphasis on credit score, while another might give more weight to the borrower’s income.

Comparison Table of Key Student Loan Slab Features

| Loan Amount | Interest Rate | Repayment Period | Eligibility Criteria |

|---|---|---|---|

| $10,000 – $25,000 | 4.5% – 6.5% | 5-10 years | Good credit score, specific course of study |

| $25,001 – $50,000 | 6.5% – 8.5% | 10-15 years | Average credit score, certain income level |

| $50,001 – $75,000 | 8.5% – 10.5% | 15-20 years | Lower credit score, specific income level |

| >$75,000 | 10.5% + | 20+ years | May require co-signer, specific financial documentation |

*Note: The interest rates and eligibility criteria presented are illustrative examples and will vary significantly depending on the lender, the borrower’s profile, and prevailing market conditions. Always consult the specific loan terms and conditions before making a decision.*

Impact of Slab Structures on Borrowers

Understanding the structure of student loan repayment plans, specifically those utilizing a slab system, is crucial for borrowers to make informed financial decisions. Different slab structures directly impact the overall cost of borrowing and have significant long-term financial implications. This section explores how varying slab structures affect borrowers and the choices they make.

Different slab structures influence the overall cost of borrowing primarily through interest rates and repayment schedules. A slab system typically categorizes loan amounts into tiers, each with a different interest rate. Higher loan amounts often fall into higher interest rate slabs, leading to increased total interest payments over the life of the loan. Conversely, lower loan amounts may benefit from lower interest rates within the lower slabs. The repayment schedule, often linked to the loan amount and the chosen slab, also affects the total cost. Longer repayment periods reduce monthly payments but increase the total interest paid, while shorter periods increase monthly payments but decrease overall interest.

Effect of Interest Rate Slabs on Total Loan Cost

The interest rate assigned to a loan based on its size significantly impacts the final cost. For instance, a student borrowing $50,000 might fall into a higher interest rate slab than a student borrowing $20,000. This difference in interest rates can translate into thousands of dollars in additional interest paid over the repayment period. Let’s assume a 5% interest rate for the lower slab and a 7% interest rate for the higher slab, with both loans having a 10-year repayment period. The higher interest rate would result in considerably higher total repayments. Accurate calculations require considering the specific loan terms and amortization schedules provided by the lender. This emphasizes the importance of carefully considering the interest rate implications of different slab structures before selecting a loan.

Long-Term Financial Implications of Varying Slab Structures

The choice of a loan with a specific slab structure has long-term consequences for a borrower’s financial health. A higher interest rate slab, resulting from a larger loan amount, could lead to a longer period of debt, impacting future financial goals like homeownership or investment. The additional interest payments can also limit a borrower’s ability to save or invest, affecting their long-term financial security. Conversely, choosing a loan with a lower interest rate slab, even if it means borrowing a smaller amount, can significantly improve a borrower’s long-term financial outlook. This might allow for quicker debt repayment, freeing up funds for other priorities.

Benefits and Drawbacks of Different Slab Systems

Slab systems offer both advantages and disadvantages. A potential benefit is the predictability; borrowers know exactly what interest rate they will pay based on their loan amount. This transparency can aid in financial planning. However, a drawback is the potential for disproportionately higher interest rates for larger loans, making it more challenging for students needing significant funding to manage their debt. Another drawback is the inflexibility; the system doesn’t account for individual circumstances, such as unexpected financial hardship.

Influence of Slab Structures on Borrowing Decisions

Slab structures directly influence borrowing decisions. Students might choose to borrow a slightly smaller amount to fall into a lower interest rate slab, even if it means delaying certain educational expenses. Conversely, some students might prioritize obtaining the necessary funding, accepting the higher interest rate associated with a larger loan amount in a higher slab. This decision-making process highlights the trade-off between the convenience of sufficient funding and the long-term financial implications of higher interest rates. The optimal strategy depends on the individual student’s financial situation, risk tolerance, and long-term financial goals.

Government Policies and Regulations

Government policies play a crucial role in shaping the landscape of student loan systems, significantly influencing their accessibility, affordability, and overall impact on higher education. These policies dictate not only the structure of repayment plans but also the eligibility criteria, interest rates, and overall availability of loans. The interaction between government regulation and the private sector in student lending creates a complex dynamic that affects millions of students.

Government interventions are frequently implemented to increase access to higher education, particularly for disadvantaged groups. These interventions often manifest as direct subsidies, loan guarantees, and income-based repayment programs. The aim is to mitigate the financial barriers to higher education, thereby promoting social mobility and economic growth. Effective government policy must balance the need for accessible higher education with the fiscal responsibility of managing public funds.

Examples of Government Interventions to Enhance Student Loan Accessibility

Many governments employ various strategies to improve student loan accessibility. For instance, some countries offer need-based grants or scholarships to supplement loans, reducing the overall borrowing burden for low-income students. Others provide loan forgiveness programs for those who pursue careers in public service or specific high-demand fields, incentivizing students to enter these professions. Furthermore, government-backed loan guarantee programs lessen the risk for lenders, encouraging them to offer more favorable loan terms. These interventions can include interest rate subsidies, which effectively lower the cost of borrowing for students. For example, the United States federal government offers subsidized Stafford loans with lower interest rates than unsubsidized loans, helping students from lower socioeconomic backgrounds. The UK government’s tuition fee loan system, while controversial, is another example of government intervention, directly funding universities and offering loans to students with repayment tied to income levels.

Impact of Government Regulations on Higher Education Affordability

Government regulations, while aiming to improve affordability, can also have unintended consequences. Strict regulations on interest rates, for example, may make it less profitable for lenders to participate in the student loan market, potentially reducing the overall availability of funds. Conversely, a lack of regulation could lead to predatory lending practices, harming students with high-interest rates and unfavorable repayment terms. The optimal level of government intervention is a constant balancing act between ensuring access and preventing financial exploitation. Overly burdensome regulations can stifle innovation in the student loan market, while insufficient regulation can expose students to significant financial risks.

Hypothetical Policy Change: Income-Contingent Repayment with a Graduation Incentive

One potential policy change to improve the student loan system could be a comprehensive income-contingent repayment plan combined with a graduation incentive. This plan would link monthly repayments to a borrower’s post-graduation income, ensuring affordability regardless of their chosen career path. Specifically, repayments would be capped at a percentage of disposable income (e.g., 10%), with any remaining debt forgiven after a set number of years (e.g., 25 years). To further incentivize timely graduation, a small percentage of the total loan principal could be forgiven upon successful completion of a degree within a reasonable timeframe. This approach would directly address the affordability issue, reducing the risk of long-term debt burdens while encouraging efficient use of educational resources. The predicted effect is a reduction in loan defaults, increased access to higher education, and a more equitable distribution of educational opportunities. This model could be adjusted based on individual country’s economic factors and educational priorities, incorporating factors such as cost of living and average graduate salaries. Similar income-driven repayment plans exist in various countries, providing evidence for the feasibility of such a model.

Alternatives and Solutions

Navigating the complexities of student loan repayment can be daunting. Fortunately, numerous alternatives exist, and proactive strategies can mitigate the challenges posed by slab structures. This section explores viable options and solutions to help students manage their educational debt effectively.

Understanding the limitations of traditional student loans is crucial to exploring alternative financing. While these loans provide access to higher education, their rigid structures and potential for high interest rates can create significant long-term financial burdens. Exploring alternative avenues can provide greater flexibility and potentially lower overall costs.

Alternative Financing Options for Higher Education

Several avenues exist beyond traditional student loans to finance higher education. These options offer varying degrees of flexibility and risk, and careful consideration is essential before selecting a path.

- Scholarships and Grants: These forms of financial aid do not need to be repaid. Many scholarships are merit-based, rewarding academic achievement or specific skills, while grants are often need-based, assisting students from low-income families. Extensive research and diligent application are key to securing these funds.

- Part-Time Employment: Working part-time during studies can significantly reduce reliance on loans. This strategy allows students to cover immediate expenses, reducing the overall loan amount needed. Careful time management is crucial to balance work and academic commitments.

- Savings and Family Contributions: Utilizing personal savings or receiving financial support from family members can minimize loan dependence. This approach emphasizes proactive financial planning and family support networks.

- Employer-Sponsored Tuition Assistance Programs: Many employers offer tuition assistance programs to their employees, either fully or partially covering educational costs. This benefit can significantly reduce or eliminate the need for student loans, particularly for those pursuing job-relevant degrees.

- Private Loans: While offering greater flexibility than federal loans, private loans often come with higher interest rates and less stringent borrower protections. Careful comparison of interest rates and terms from different lenders is vital.

Comparison of Financing Methods

A direct comparison of financing methods highlights their respective strengths and weaknesses, aiding in informed decision-making. This comparison focuses on key aspects such as interest rates, repayment terms, and eligibility requirements.

| Financing Method | Advantages | Disadvantages |

|---|---|---|

| Federal Student Loans | Government-backed, various repayment plans, potential for loan forgiveness programs | Interest rates can be relatively high, lengthy repayment periods |

| Private Student Loans | Potentially higher borrowing limits, more flexible repayment options in some cases | Higher interest rates, less borrower protection, stricter eligibility requirements |

| Scholarships and Grants | No repayment required, can significantly reduce overall educational costs | Highly competitive, requires extensive application process |

| Part-time Employment | Reduces loan burden, provides valuable work experience | Can limit time for studies, potential for reduced academic performance if not managed effectively |

Solutions to Address Challenges of Slab Structures

The complexities of slab-structured student loans present significant challenges. Addressing these requires a multi-pronged approach, combining regulatory reforms with improved borrower education and support.

- Increased Transparency and Simplified Loan Structures: Clearer communication regarding loan terms and repayment schedules is essential. Simplifying the loan structure itself can improve borrower understanding and reduce confusion.

- Government Regulations for Fairer Interest Rates: Government intervention to regulate interest rates and prevent predatory lending practices can protect borrowers from excessive debt burdens.

- Improved Financial Literacy Programs: Educating students about responsible borrowing and effective financial management strategies is crucial in preventing future debt crises.

- Negotiation and Refinancing Options: Facilitating avenues for borrowers to negotiate with lenders or refinance their loans at lower interest rates can significantly alleviate financial strain.

Resources and Support Systems for Student Loan Repayment

Numerous resources and support systems exist to assist students facing difficulties with student loan repayments. Accessing these resources can provide critical guidance and prevent default.

- National Student Loan Data System (NSLDS): This system provides a central location to access information about federal student loans.

- Federal Student Aid (FSA): The FSA website offers comprehensive information and resources on federal student loans and repayment options.

- Student Loan Counseling Services: Many non-profit organizations and government agencies provide free or low-cost counseling services to help students manage their student loan debt.

- Debt Consolidation and Management Companies: While these companies can offer assistance, it’s essential to carefully research and compare their services to avoid potential scams or unfavorable terms.

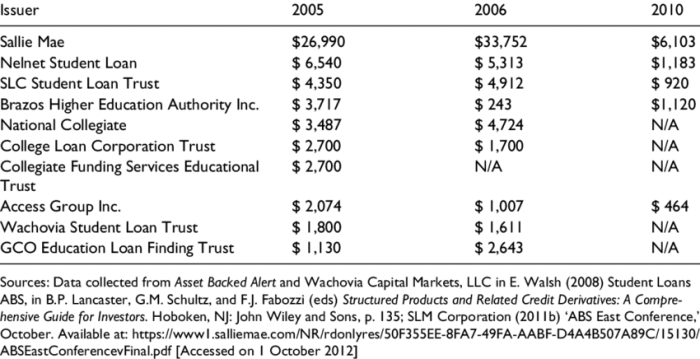

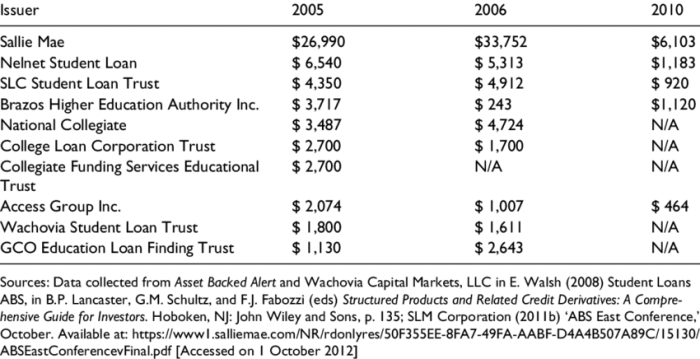

Visual Representation of Data

Visualizations are crucial for understanding the complex landscape of student loan slabs. By representing the data graphically, we can readily identify trends and patterns that might otherwise be obscured in numerical tables. The following visualizations illustrate the distribution of loan amounts and the relationship between loan slab and repayment period.

Distribution of Student Loan Amounts Across Slabs

This visualization would take the form of a histogram. The horizontal axis (x-axis) would represent the different loan amount slabs, clearly labeled with the minimum and maximum values for each slab (e.g., $0-$10,000, $10,001-$20,000, $20,001-$30,000, and so on). The vertical axis (y-axis) would represent the frequency or number of student loans falling within each slab. Each bar in the histogram would represent a loan slab, with its height corresponding to the number of loans in that slab. A key insight might be a skewed distribution, showing a larger concentration of loans in lower amount slabs, indicating a higher number of students borrowing smaller amounts. The histogram would clearly show the relative proportions of loans across different amount ranges, allowing for a quick visual assessment of the overall distribution.

Relationship Between Loan Slab and Repayment Period

A scatter plot would effectively illustrate the relationship between loan slab and repayment period. The x-axis would represent the loan amount slab (as defined above), and the y-axis would represent the repayment period in years (e.g., 5 years, 10 years, 15 years, etc.). Each data point on the scatter plot would represent a single loan, with its x-coordinate indicating the loan amount slab and its y-coordinate indicating the repayment period. A trend line could be added to the scatter plot to highlight any potential correlation between loan amount and repayment duration. For instance, a positive correlation would suggest that larger loan amounts tend to have longer repayment periods. The title of the chart would be “Loan Slab vs. Repayment Period,” and a clear legend would define the axes and any symbols used. The data points would be clearly visible, allowing for a visual assessment of the relationship between the two variables. For example, a cluster of points in the upper right quadrant would indicate a high number of large loans with long repayment terms.

Closing Summary

Successfully navigating the complexities of slabs student loans requires careful consideration of various factors, including loan amount, interest rates, repayment periods, and eligibility criteria. Understanding the long-term financial implications of different slab structures is paramount. By carefully weighing the benefits and drawbacks of each option, and exploring alternative financing solutions when necessary, students can make informed decisions that minimize their financial burden and pave the way for a successful future. This analysis serves as a foundational resource for those seeking to understand and effectively manage their student loan debt.

Frequently Asked Questions

What are the common eligibility criteria for different student loan slabs?

Eligibility criteria vary depending on the lender and the specific loan slab. Factors such as credit score, income, academic performance, and enrollment status are frequently considered.

How do I choose the best student loan slab for my needs?

Consider your overall borrowing needs, your ability to repay the loan, and the long-term financial implications of different interest rates and repayment periods. Comparing offers from multiple lenders is crucial.

What happens if I fail to make my student loan repayments?

Failure to make repayments can lead to penalties, including late fees, damage to your credit score, and potential legal action by the lender. Contact your lender immediately if you anticipate difficulties making payments.

Are there any government programs that can help with student loan repayments?

Many governments offer programs such as income-driven repayment plans, loan forgiveness programs, and deferment or forbearance options. Research the programs available in your region.