Navigating the complex world of student loans can feel overwhelming, but understanding your options is crucial for financial success. This SoFi private student loan review delves into the details, examining interest rates, repayment flexibility, customer service, and eligibility requirements. We’ll compare SoFi to other major lenders, helping you make an informed decision about whether SoFi is the right choice for your financial needs.

This review aims to provide a comprehensive overview of SoFi’s student loan offerings, addressing key aspects such as loan terms, fees, and the overall borrower experience. We will analyze both the advantages and potential drawbacks, equipping you with the knowledge to confidently assess if SoFi aligns with your individual circumstances and borrowing goals.

Interest Rates and Fees

SoFi private student loans offer competitive interest rates, but it’s crucial to understand the associated costs before borrowing. This section will detail SoFi’s interest rate structure, compare them to other lenders, and clarify the various fees you might encounter. Understanding these factors is key to making an informed borrowing decision.

SoFi’s interest rates are variable, meaning they fluctuate based on market conditions. This differs from fixed-rate loans, where the interest rate remains constant throughout the loan term. While this variability presents some risk, it also allows for the potential of lower rates compared to fixed-rate options, particularly in periods of low interest rates. The rates are also influenced by several factors, including your creditworthiness, loan amount, and repayment term. A strong credit history typically results in a more favorable interest rate.

SoFi Interest Rates Compared to Other Lenders

SoFi’s interest rates are generally competitive with other major private student loan lenders like Sallie Mae, Discover, and Citizens Bank. However, the exact rates offered vary depending on the borrower’s credit profile and the prevailing market conditions. Direct comparison requires checking the current rates offered by each lender, as these fluctuate. It is recommended to obtain personalized rate quotes from multiple lenders to find the best option for your circumstances.

SoFi Private Student Loan Fees

Several fees are associated with SoFi private student loans. These fees can impact the overall cost of borrowing, so it’s essential to understand them fully.

SoFi does not charge origination fees. This is a significant advantage compared to some competitors who charge a percentage of the loan amount upfront. However, late payment fees can be substantial and are applied if a payment is missed. Additionally, there are no prepayment penalties, meaning you can pay off your loan early without incurring extra charges. This flexibility can be beneficial if you receive unexpected income or wish to accelerate your repayment.

Factors Influencing SoFi Interest Rates

Several factors determine the interest rate you receive on a SoFi private student loan. Your credit score is a primary factor; a higher credit score typically leads to a lower interest rate. The loan amount also plays a role; larger loan amounts might be associated with slightly higher rates. Finally, the repayment term significantly influences the interest rate; longer repayment terms generally result in higher interest rates due to the increased borrowing time.

SoFi Interest Rates by Loan Term and Credit Score

The following table provides a sample representation of potential interest rates. Remember that these are illustrative examples and actual rates may vary based on individual circumstances and market conditions. It’s crucial to obtain a personalized quote from SoFi for accurate rate information.

| Credit Score | 5-Year Term | 10-Year Term | 15-Year Term |

|---|---|---|---|

| 750+ (Excellent) | 6.00% – 7.00% | 7.00% – 8.00% | 8.00% – 9.00% |

| 700-749 (Good) | 7.00% – 8.00% | 8.00% – 9.00% | 9.00% – 10.00% |

| 650-699 (Fair) | 8.00% – 9.00% | 9.00% – 10.00% | 10.00% – 11.00% |

Repayment Options and Flexibility

SoFi offers a range of repayment options designed to accommodate various financial situations and borrower needs. Understanding these options is crucial for managing your student loan debt effectively and minimizing long-term costs. The flexibility offered by SoFi extends beyond simple repayment schedules, encompassing options for borrowers experiencing temporary financial hardship.

SoFi’s repayment options primarily revolve around the loan’s interest rate type: fixed or variable. Fixed-rate loans provide predictable monthly payments throughout the loan term, offering stability in budgeting. Variable-rate loans, on the other hand, have interest rates that adjust periodically based on market conditions. This can lead to fluctuating monthly payments, potentially resulting in lower payments initially but with the risk of higher payments later. The choice between fixed and variable rates depends on individual risk tolerance and financial projections.

Fixed-Rate and Variable-Rate Loans

SoFi provides both fixed and variable-rate private student loans. Fixed-rate loans offer predictable monthly payments, simplifying budgeting. The interest rate remains constant throughout the loan’s term, shielding borrowers from rate fluctuations. Variable-rate loans, however, have interest rates that change based on market indices. This could lead to lower initial payments but potentially higher payments in the future. Borrowers should carefully consider their risk tolerance and long-term financial outlook when choosing between these options. For example, a borrower anticipating a significant income increase might find a variable-rate loan more advantageous, while a borrower seeking predictable expenses might prefer a fixed-rate loan.

Forbearance and Deferment Options

SoFi offers forbearance and deferment programs to assist borrowers experiencing temporary financial difficulties. Forbearance allows borrowers to temporarily suspend or reduce their monthly payments, while deferment postpones payments entirely. Both options provide short-term relief, but interest may still accrue during forbearance, increasing the total loan amount over time. Deferment, in certain cases, may suspend interest accrual. Eligibility criteria and specific terms vary depending on the circumstances. For instance, a borrower experiencing unemployment might qualify for a forbearance or deferment period. It is crucial to contact SoFi directly to explore available options and understand the implications for their individual loan.

Income-Driven Repayment Plans

SoFi doesn’t directly offer income-driven repayment (IDR) plans in the same way as federal student loan programs. However, SoFi actively works with borrowers to explore options for managing their payments based on their income. This might involve customized repayment plans negotiated on a case-by-case basis, potentially including extended repayment terms or reduced monthly payments. Eligibility is determined on a case-by-case basis, considering factors such as income, expenses, and overall financial situation. A borrower facing significant financial challenges could contact SoFi to discuss potential options for a more manageable repayment schedule.

Repayment Path Flowchart

[Imagine a flowchart here. The flowchart would begin with a “Start” box, branching to “Choose Loan Type” (Fixed or Variable). Each branch would then lead to “Standard Repayment” with a box showing the typical monthly payment calculation. From “Standard Repayment,” a branch would lead to “Financial Hardship?” A “Yes” answer would branch to “Forbearance/Deferment Options,” showing the options and their respective consequences (interest accrual, payment suspension). A “No” answer would lead to a “Successful Repayment” end box. From “Financial Hardship?”, a “No” branch would also lead to “Income-Based Repayment Plan?” A “Yes” would lead to a “Customized Repayment Plan” box detailing the process of working with SoFi to adjust payments, while a “No” would lead to “Successful Repayment”. Finally, all paths leading to “Successful Repayment” would converge into a single “End” box.]

Customer Service and User Experience

SoFi’s private student loan offerings are only as good as the experience borrowers have throughout the entire process, from initial application to final repayment. A positive user experience, coupled with responsive and helpful customer service, is crucial for building trust and ensuring customer satisfaction. This section examines both the positive and negative aspects of SoFi’s customer service and the overall ease of use of their loan application process.

SoFi’s reputation for customer service is mixed. While many borrowers praise the company’s streamlined online platform and readily available support channels, others have reported difficulties reaching representatives or experiencing delays in resolving issues. The overall experience appears to depend on individual circumstances and the specific issue encountered.

SoFi Customer Service Experiences

Positive experiences often involve quick responses to inquiries via online chat or email, efficient loan processing, and proactive communication from SoFi representatives regarding account updates and repayment options. For example, many users report positive experiences with the online chat feature, praising its immediate availability and helpfulness in addressing simple questions. Conversely, negative experiences frequently include long wait times on the phone, difficulties navigating the online portal, and inconsistent responses from customer service representatives. Some borrowers have reported challenges resolving billing errors or obtaining necessary documentation, resulting in frustration and delays.

SoFi Private Student Loan Application Process

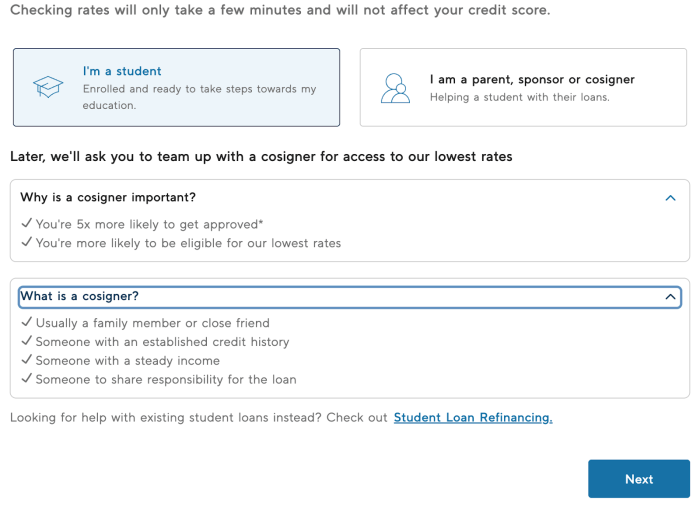

Applying for a SoFi private student loan is generally considered a straightforward process. The online application is intuitive and requires the submission of basic personal and financial information. Pre-qualification is available, allowing prospective borrowers to check their eligibility without impacting their credit score. However, some users have reported challenges uploading required documents or navigating the application’s various sections. These challenges often stem from technical issues or unclear instructions, leading to delays in processing the application. The speed of the approval process can also vary, depending on factors such as the completeness of the application and the borrower’s creditworthiness.

SoFi Customer Support Channels

SoFi offers multiple channels for customer support. These include a 24/7 online chat feature accessible through their website, a dedicated phone number for customer service inquiries, and an email support system. While the online chat is often praised for its immediate responsiveness, the phone support can experience longer wait times, particularly during peak hours. Email support, while convenient, may result in slower response times compared to the other channels. The effectiveness of each channel can vary depending on the complexity of the issue and the availability of support representatives.

Tips for a Successful SoFi Loan Experience

Before applying, carefully review the loan terms and conditions, ensuring you understand the interest rates, fees, and repayment options. Gather all necessary documentation before starting the application to expedite the process. Utilize the online chat feature for quick answers to simple questions. If you encounter any difficulties, contact SoFi through multiple channels to increase your chances of a timely resolution. Maintain clear and consistent communication with SoFi representatives, providing all necessary information promptly. Keep accurate records of all communications and transactions related to your loan. Explore SoFi’s resources, such as FAQs and online tutorials, to address common questions and concerns.

Comparison with Other Lenders

Choosing a private student loan lender involves careful consideration of several factors. While SoFi is a popular choice, it’s crucial to compare its offerings with those of other major players in the market to determine the best fit for your individual financial situation and borrowing needs. This comparison focuses on Sallie Mae and Discover, two prominent competitors, highlighting key differences in interest rates, fees, repayment options, and customer service.

This section presents a direct comparison of SoFi, Sallie Mae, and Discover private student loans, using real-world examples to illustrate the differences. It is important to note that interest rates and fees can change, and it’s always advisable to check the lenders’ websites for the most up-to-date information.

Interest Rates and Fees Comparison

The interest rate you’ll receive is a crucial factor influencing the overall cost of your loan. It’s typically determined by your creditworthiness, the loan’s term, and the current market conditions. Fees, such as origination fees, can also add to the total cost.

| Feature | SoFi | Sallie Mae | Discover |

|---|---|---|---|

| Interest Rates (Example) | Variable rates typically ranging from 4.00% to 13.99% APR; fixed rates also available. | Variable and fixed rates available; specific ranges vary based on creditworthiness and loan terms. A borrower with excellent credit might secure a rate around 6%, while a borrower with fair credit might see a rate closer to 10%. | Variable and fixed rates offered, similar to Sallie Mae, with the range dependent on credit score and loan terms. Rates might range from 5% to 12% APR. |

| Origination Fees | Typically no origination fees. | May charge origination fees; these can vary depending on the loan type and amount. For example, a fee of 1% to 4% of the loan amount is possible. | Generally no origination fees, similar to SoFi. |

| Late Payment Fees | Fees apply for late payments; exact amounts should be verified on their website. | Late payment fees are charged; specific amounts are detailed in the loan agreement. Late payment fees can significantly increase the overall cost of the loan. | Late payment fees are applicable; specific details are available in the loan documents. |

Repayment Options and Flexibility Comparison

The repayment options and flexibility offered by each lender can significantly impact your ability to manage your student loan debt effectively.

| Feature | SoFi | Sallie Mae | Discover |

|---|---|---|---|

| Repayment Plans | Offers various repayment plans, including fixed-rate and variable-rate options, along with potential for forbearance and deferment in specific circumstances. | Provides a range of repayment plans, including standard, graduated, and extended repayment options. Specific details on forbearance and deferment are available on their website. | Offers several repayment plans, including graduated and extended options, with provisions for forbearance and deferment under certain conditions. |

| Autopay Discounts | Often offers interest rate discounts for automatic payments. | May offer discounts for autopay; check their current offerings for details. | May provide interest rate reductions for automatic payments; verify current details on their website. |

| Forbearance and Deferment | Offers forbearance and deferment options under specific circumstances, such as unemployment or financial hardship. | Provides forbearance and deferment programs; eligibility requirements are clearly Artikeld in their loan agreements. | Offers forbearance and deferment options to borrowers facing temporary financial difficulties. |

Customer Service and User Experience Comparison

The quality of customer service and the ease of use of the lender’s online platform are essential considerations.

| Feature | SoFi | Sallie Mae | Discover |

|---|---|---|---|

| Customer Service Channels | Offers various customer service channels, including phone, email, and online chat. Known for generally responsive customer service. | Provides multiple channels for customer support; however, wait times might vary. | Offers multiple avenues for customer support, including phone, email, and online resources. |

| Online Platform | Generally considered user-friendly with a well-designed online platform for managing loans. | Offers an online platform for managing accounts; user experience varies based on individual experiences. | Provides a user-friendly online platform for managing student loans. |

| Account Management Tools | Provides comprehensive tools for tracking payments, viewing statements, and managing loan details. | Offers tools for managing accounts; specific features may vary. | Provides robust account management tools for borrowers. |

SoFi’s Additional Financial Products

SoFi’s offerings extend far beyond student loan refinancing. They’ve built a comprehensive ecosystem of financial products designed to cater to various stages of a customer’s financial journey, creating potential benefits and synergies for their student loan borrowers. This interconnectedness can simplify financial management and potentially lead to cost savings.

SoFi offers a range of personal loans for various purposes, from debt consolidation to home improvements. These loans often come with competitive interest rates and flexible repayment terms. They also provide mortgages, aiming to assist borrowers in purchasing a home, and have an active investing platform, encompassing brokerage accounts, robo-advisors, and retirement planning tools. This diversified approach allows SoFi to offer a one-stop shop for many financial needs.

Benefits for SoFi Student Loan Borrowers

The availability of these additional services presents several advantages for SoFi student loan borrowers. For example, individuals successfully managing their student loan repayments might find it convenient to consolidate other high-interest debts using a SoFi personal loan, potentially lowering their overall monthly payments and improving their credit score. Similarly, once their student loans are under control, they may find SoFi’s mortgage services a helpful resource for homeownership. Finally, the investing platform offers a straightforward way to start building wealth and planning for long-term financial security, a crucial step post-graduation.

Synergies and Cross-Selling Opportunities

SoFi strategically leverages its diverse product portfolio to create synergistic relationships between services. A prime example is the potential for cross-selling. A customer refinancing their student loans might be proactively presented with information about SoFi’s personal loans or investing services, leveraging the established relationship and trust. This approach simplifies the financial decision-making process for customers, potentially increasing customer loyalty and driving revenue for SoFi. The company also uses data-driven insights to personalize offers, tailoring recommendations to individual customer needs and financial goals. For instance, a borrower nearing the end of their student loan repayment might receive targeted marketing about mortgage options, demonstrating a seamless transition to the next phase of their financial life.

Illustrative Example

Let’s consider a hypothetical scenario to illustrate the potential costs associated with a SoFi private student loan. We’ll examine the impact of different interest rates and repayment terms on the total cost of borrowing $30,000. This example uses hypothetical rates and fees; actual rates and fees will vary based on individual creditworthiness and market conditions.

This example will demonstrate how different loan terms affect the overall cost. We will explore two scenarios: a shorter repayment period with a slightly higher interest rate and a longer repayment period with a lower interest rate. This will highlight the trade-offs involved in choosing a repayment plan.

Loan Scenario: $30,000 Loan

Imagine a student borrowing $30,000 from SoFi for their education. We’ll analyze two possible scenarios, assuming no origination fees for simplicity (though these would be factored into real-world calculations).

Scenario 1: 10-Year Repayment at 7% Interest

In this scenario, the borrower chooses a 10-year repayment plan with a fixed interest rate of 7%. The monthly payment would be approximately $350. Over the 10-year period, the total interest paid would be roughly $12,000, resulting in a total repayment of approximately $42,000. This demonstrates the significant impact of interest accumulation over time, even with a relatively moderate interest rate.

Scenario 2: 15-Year Repayment at 6.5% Interest

Now, let’s consider a 15-year repayment plan with a slightly lower fixed interest rate of 6.5%. The monthly payment would be approximately $260, significantly lower than the 10-year plan. However, the total interest paid over 15 years would be approximately $16,500, leading to a total repayment of approximately $46,500. While the monthly payment is smaller, the longer repayment period results in a higher total cost due to the extended interest accrual.

Comparison of Scenarios

| Scenario | Loan Amount | Interest Rate | Repayment Term | Approximate Monthly Payment | Approximate Total Interest Paid | Approximate Total Repayment |

|---|---|---|---|---|---|---|

| 1 | $30,000 | 7% | 10 years | $350 | $12,000 | $42,000 |

| 2 | $30,000 | 6.5% | 15 years | $260 | $16,500 | $46,500 |

This table summarizes the key differences between the two scenarios. It clearly shows that while a longer repayment term reduces the monthly payment, it significantly increases the total cost of the loan due to the higher accumulated interest. The choice between these scenarios depends on the borrower’s individual financial circumstances and priorities. A borrower might prioritize lower monthly payments, even if it means paying more interest overall. Conversely, a borrower might prioritize paying off the loan faster, even if it means higher monthly payments.

Potential Drawbacks and Limitations

While SoFi offers many attractive features for private student loan borrowers, it’s crucial to acknowledge potential drawbacks. Understanding these limitations will help prospective borrowers make informed decisions and assess whether SoFi aligns with their specific financial circumstances and risk tolerance. Not all borrowers will find SoFi to be the ideal lender, and certain situations may highlight the limitations of their offerings.

SoFi’s private student loans, like any financial product, carry inherent risks. These risks are amplified by factors such as interest rate fluctuations, the borrower’s creditworthiness, and the overall economic climate. Understanding these potential downsides is vital to avoid unexpected financial strain.

Interest Rate Volatility

SoFi’s interest rates, while often competitive, are variable and subject to change based on market conditions. This means your monthly payments could increase unexpectedly if interest rates rise. For example, a borrower who locked in a low rate during a period of low interest rates might see their rate increase significantly if the Federal Reserve raises the federal funds rate. This uncertainty can make budgeting challenging and potentially lead to difficulties in repayment if income doesn’t keep pace with the increased interest expense. Fixed-rate loans from other lenders might offer greater predictability in this regard.

Eligibility Requirements

SoFi’s stringent eligibility requirements can exclude borrowers with less-than-perfect credit scores or limited income. For instance, applicants with a low credit score or a history of missed payments might be denied a loan or offered less favorable terms compared to borrowers with stronger credit profiles. This can create a barrier to access for students who might need financial assistance but don’t meet SoFi’s criteria. Other lenders may offer more flexible eligibility requirements, making them a more accessible option for certain borrowers.

Limited Loan Amounts

The maximum loan amount offered by SoFi may not be sufficient to cover the total cost of education for all borrowers. Students pursuing expensive degrees or those attending high-cost institutions might find that SoFi’s loan limits fall short of their needs. This necessitates exploring other loan options or alternative funding sources to bridge the gap, potentially leading to a more complex borrowing strategy. Borrowers should carefully compare loan amounts offered by various lenders to ensure they can meet their educational financing needs.

Lack of Federal Loan Benefits

SoFi private student loans do not offer the same benefits and protections as federal student loans. Federal loans often include income-driven repayment plans, loan forgiveness programs, and deferment options during periods of financial hardship. Private loans, including those from SoFi, typically lack these crucial protections, leaving borrowers more vulnerable to financial difficulties if unforeseen circumstances arise. Borrowers should carefully weigh the trade-offs between the potential benefits of lower interest rates and the lack of federal protections.

Wrap-Up

Ultimately, the decision of whether to choose SoFi for your private student loans depends on your unique financial situation and priorities. While SoFi offers competitive interest rates and flexible repayment options, careful consideration of fees, eligibility requirements, and customer service experiences is essential. This review has provided a thorough examination of SoFi’s offerings, allowing you to weigh the pros and cons and make a well-informed choice that best serves your long-term financial well-being.

FAQ Overview

What credit score is needed for SoFi student loans?

SoFi’s minimum credit score requirement isn’t publicly stated, but generally, a good to excellent credit score (670 or higher) significantly improves your chances of approval and securing favorable interest rates.

Can I refinance my federal student loans with SoFi?

No, SoFi currently does not refinance federal student loans. Their private student loan refinancing options are limited to private student loans.

What happens if I miss a payment on my SoFi student loan?

Missing payments will result in late fees and can negatively impact your credit score. Contact SoFi immediately if you anticipate difficulty making a payment to explore potential options like forbearance or deferment.

Does SoFi offer any student loan forgiveness programs?

SoFi itself does not offer loan forgiveness programs. Loan forgiveness programs are typically government-sponsored and are not applicable to private student loans.