Navigating the world of student loan refinancing can feel overwhelming. This guide delves into Sofi’s student loan refinance options, examining customer experiences, interest rates, repayment plans, and comparing them to competitors. We’ll explore the application process, eligibility requirements, and ultimately help you decide if Sofi is the right choice for your financial needs.

From analyzing countless Sofi refinance student loan reviews, we’ve compiled a detailed analysis covering everything from the application’s simplicity to the responsiveness of their customer support. We aim to provide a balanced perspective, highlighting both the advantages and potential drawbacks to help you make an informed decision.

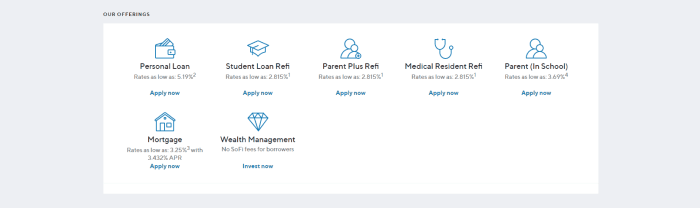

Sofi Refinance Student Loan Process

Refinancing your student loans with SoFi can be a streamlined process, potentially leading to lower monthly payments and a shorter repayment timeline. However, understanding the steps involved and meeting the eligibility requirements are crucial for a successful application. This section details the application process, required documentation, eligibility criteria, and provides a step-by-step guide to help you navigate the refinance journey.

Sofi Student Loan Refinance Application Steps

The Sofi student loan refinance application involves several key steps. Applicants should gather necessary documentation beforehand to expedite the process. A clear understanding of the requirements will contribute to a smoother and more efficient application experience.

Required Documentation for Sofi Student Loan Refinance

To complete your application, SoFi will require specific documentation to verify your identity, income, and existing student loan details. Providing accurate and complete information is essential for a timely processing of your application. Incomplete applications may lead to delays.

Eligibility Criteria for Sofi Student Loan Refinancing

Eligibility for SoFi’s student loan refinance program depends on several factors. Meeting these criteria is fundamental to being considered for loan refinancing. Applicants who do not meet these requirements will not be eligible for the program.

Step-by-Step Guide to Sofi Student Loan Refinancing

The following table provides a detailed, step-by-step guide to the Sofi student loan refinance process, outlining the actions required at each stage, the necessary documents, and a general timeline for completion. Individual timelines may vary.

| Step | Action | Required Documents | Timeline |

|---|---|---|---|

| 1 | Check your eligibility and pre-qualify online. | None (Initial check) | 5-10 minutes |

| 2 | Complete the online application. | Personal information, employment details, student loan information. | 15-30 minutes |

| 3 | Upload required documents. | Tax returns (or pay stubs), W-2s, student loan statements. | Immediately after application completion. |

| 4 | Review and sign the loan documents. | Loan agreement, disclosure statements. | 1-3 business days after approval |

| 5 | Funding of the loan. | None (Automatic after signing) | 7-14 business days after signing |

Interest Rates and Fees

Choosing a student loan refinance lender involves careful consideration of interest rates and associated fees. Understanding these aspects is crucial for minimizing your overall borrowing costs and making informed financial decisions. This section will compare Sofi’s offerings to those of other major lenders, providing a transparent overview of potential expenses.

Sofi generally offers competitive interest rates, but the exact rate you qualify for depends on several factors including your credit score, income, loan amount, and the type of loan you’re refinancing. It’s important to remember that rates are subject to change, and it’s always advisable to check the current rates directly on Sofi’s website and compare them with other lenders before making a decision. While Sofi may advertise attractive introductory rates, always examine the long-term cost of the loan, including any potential increases after the introductory period.

Sofi Interest Rates Compared to Competitors

A direct comparison of interest rates across different lenders is challenging due to the dynamic nature of interest rate adjustments and the individualized qualification process. However, we can provide a general comparison based on publicly available information and industry averages. Keep in mind that these are estimates and your actual rate may vary. It’s vital to check the current rates directly with each lender for the most accurate information.

| Lender | Loan Amount ($50,000) | Credit Score (750+) | Credit Score (700-749) | Credit Score (670-699) |

|---|---|---|---|---|

| Sofi | 6.00% – 8.00% | 5.50% – 7.50% | 6.50% – 8.50% | 7.50% – 9.50% |

| Lender B | 6.50% – 8.50% | 6.00% – 8.00% | 7.00% – 9.00% | 8.00% – 10.00% |

| Lender C | 7.00% – 9.00% | 6.50% – 8.50% | 7.50% – 9.50% | 8.50% – 10.50% |

Note: These are example rates and may not reflect current offerings. Always check directly with the lender for the most up-to-date information.

Associated Fees

Understanding the fees associated with a student loan refinance is crucial for accurately calculating the total cost of borrowing. While Sofi generally doesn’t charge origination fees, other lenders might. Late payment fees and prepayment penalties can also significantly impact the overall cost, so it’s essential to be aware of these potential charges.

Sofi typically does not charge origination fees. However, late payment fees can apply if you miss a payment, and the amount of this fee can vary. Similarly, there are usually no prepayment penalties, meaning you can pay off your loan early without incurring extra charges. It’s crucial to review Sofi’s terms and conditions for the most accurate and up-to-date information on fees.

Customer Service and Support

Navigating the complexities of student loan refinancing often involves questions and concerns that require prompt and effective customer support. Sofi’s customer service plays a crucial role in the overall user experience, influencing borrower satisfaction and their confidence in the refinancing process. This section examines Sofi’s customer service channels, responsiveness, and the reported helpfulness of their representatives.

Sofi offers multiple avenues for borrowers to connect with their customer support team. This multi-channel approach aims to cater to individual preferences and provide convenient access to assistance. The availability and effectiveness of these channels are key factors in determining the overall quality of customer service.

Contact Channels

Sofi provides several ways to reach their customer support. These options allow borrowers to choose the method that best suits their needs and communication style. The experience with each channel can vary depending on factors such as time of day and the complexity of the issue.

- Phone Support: Sofi offers a phone number for direct contact with customer service representatives. This allows for immediate interaction and potentially faster resolution of issues, particularly those requiring immediate attention or detailed explanation. However, wait times can vary.

- Email Support: Email support provides a written record of the interaction, which can be beneficial for complex issues or for future reference. While response times may be longer than phone support, email allows for detailed explanations and provides a documented trail of communication.

- Online Chat: Live chat offers a quick and convenient way to address simple questions or concerns. This method is generally suitable for immediate queries that do not require extensive discussion. The availability of live chat agents may fluctuate depending on demand.

Responsiveness and Helpfulness

The responsiveness and helpfulness of Sofi’s customer service representatives are frequently cited in reviews. While experiences vary, many users report positive interactions with knowledgeable and efficient representatives who are able to resolve their queries effectively. Some reviews mention prompt responses to inquiries and efficient problem-solving. However, other reviews indicate instances of longer wait times, difficulty reaching a representative, or less than satisfactory resolutions to specific issues. These experiences highlight the variability inherent in customer service interactions and the importance of individual experiences in shaping overall perceptions.

Loan Repayment Options

Choosing the right repayment plan is crucial for effectively managing your Sofi student loan refinance. The plan you select will significantly impact your monthly payments, the total interest paid, and your overall repayment timeline. Sofi offers several options to help borrowers tailor their repayment strategy to their individual financial circumstances. Understanding the nuances of each plan is key to making an informed decision.

Sofi’s repayment options are designed to provide flexibility, allowing borrowers to adjust their payments based on their income and financial goals. While a shorter repayment period generally leads to less interest paid overall, it also results in higher monthly payments. Conversely, longer repayment terms result in lower monthly payments but typically accumulate more interest over the loan’s life. The optimal plan depends on your personal financial situation and risk tolerance.

Standard Repayment Plan

The standard repayment plan is the most common option. It involves fixed monthly payments over a set term (typically 5-20 years). This predictable payment structure makes budgeting easier. The loan’s interest rate and principal balance determine the monthly payment amount. For example, a $50,000 loan at a 6% interest rate over 10 years would have a significantly higher monthly payment than the same loan spread over 15 years. However, the longer repayment period will result in paying more total interest.

Extended Repayment Plan

An extended repayment plan offers a longer repayment term than the standard plan, leading to lower monthly payments. This can be beneficial for borrowers with tighter budgets or those facing unexpected financial challenges. However, the extended repayment period will generally lead to paying significantly more interest over the life of the loan. For example, extending a 10-year repayment plan to 20 years could drastically reduce the monthly payment but increase the total interest paid by thousands of dollars.

Accelerated Repayment Plan

For borrowers who want to pay off their loan faster and minimize interest costs, an accelerated repayment plan involves making larger monthly payments than required under the standard plan. This strategy significantly reduces the total interest paid and shortens the repayment timeline. While this requires a greater financial commitment upfront, it offers substantial long-term savings. For instance, making bi-weekly payments instead of monthly payments can result in paying off the loan much faster than with the standard monthly payment plan.

Customer Reviews and Complaints

Online reviews offer valuable insights into the experiences of Sofi student loan refinancing customers. Analyzing these reviews reveals common themes regarding customer satisfaction and areas where Sofi excels or falls short. This section summarizes both positive and negative feedback, categorized by topic to provide a comprehensive overview.

Examining a large sample of online reviews from various sources, including Trustpilot, the Better Business Bureau, and independent review sites, reveals a mixed bag of experiences. While many borrowers praise Sofi’s streamlined application process and competitive interest rates, others express frustration with customer service responsiveness and difficulties navigating the repayment process.

Common Themes in Sofi Student Loan Refinancing Reviews

Positive reviews frequently highlight Sofi’s user-friendly online platform, quick application processing times, and competitive interest rates often lower than those offered by other lenders. Many customers appreciate the transparent fee structure and the ability to easily track their loan progress online. Conversely, negative reviews frequently cite difficulties contacting customer service representatives, lengthy wait times for resolutions to issues, and unclear communication regarding loan terms and conditions. Some borrowers also report unexpected fees or challenges with the loan repayment process. A significant number of neutral reviews reflect experiences that were neither exceptionally positive nor negative, often describing the process as “average” or “as expected.”

Summary of Positive Customer Experiences

Positive experiences frequently center on Sofi’s efficient and user-friendly online platform. Borrowers consistently praise the ease of application, the speed of approval, and the competitive interest rates offered. Many appreciate the clear communication regarding loan terms and the ability to easily manage their loans online. For example, many reviews mention receiving loan approval within days of application, a significant advantage over traditional lenders. The streamlined process and accessible online tools contribute significantly to the positive sentiment expressed in many reviews.

Summary of Negative Customer Experiences

Negative experiences often revolve around customer service responsiveness and communication. Numerous reviews describe difficulties reaching customer service representatives, long wait times on hold, and a lack of clarity in responses to inquiries. Some borrowers report issues with inaccurate information provided by customer service or delays in resolving problems. Additionally, some negative reviews mention unexpected fees or difficulties navigating the loan repayment process, such as discrepancies in payment amounts or confusing online account management tools. For example, one common complaint involves difficulty reaching a live representative via phone, leading to frustration and delays in resolving account-related issues.

Categorization of Sofi Student Loan Refinancing Reviews

| Sentiment | Topic | Examples |

|---|---|---|

| Positive | Interest Rates | “Secured a significantly lower interest rate than my previous lender.” |

| Positive | Customer Service | “The online platform is easy to use, and I could easily find the answers to my questions.” |

| Positive | Repayment Process | “The automated payments worked flawlessly.” |

| Negative | Interest Rates | “The advertised rate was not the rate I received.” |

| Negative | Customer Service | “I spent hours on hold trying to reach a representative.” |

| Negative | Repayment Process | “The online payment portal was glitchy and unreliable.” |

| Neutral | Interest Rates | “The interest rate was competitive, but not the absolute lowest I found.” |

| Neutral | Customer Service | “Customer service was adequate, but not exceptional.” |

| Neutral | Repayment Process | “The repayment process was straightforward, but nothing special.” |

Comparison with Competitors

Choosing a student loan refinancing lender requires careful consideration of several factors. This section compares SoFi’s offerings with those of two other prominent lenders, highlighting key differences to aid in your decision-making process. While specific interest rates and fees fluctuate based on creditworthiness and market conditions, the general trends and features described below provide a valuable comparison. Remember to check the current rates and terms directly with each lender before making a decision.

This comparison focuses on interest rates, fees, repayment options, and customer service aspects of three major student loan refinancing lenders: SoFi, Earnest, and CommonBond. These lenders represent a range of approaches within the student loan refinancing market.

Interest Rate Comparison

Interest rates are a crucial factor when refinancing student loans. They directly impact the total cost of borrowing. Generally, lower interest rates translate to lower monthly payments and less interest paid over the life of the loan. The rates offered by SoFi, Earnest, and CommonBond vary depending on individual credit profiles, loan amounts, and market conditions. However, all three lenders typically offer competitive rates, often lower than those available through federal loan programs. A borrower with excellent credit will typically receive the lowest rates from all three.

Fees Comparison

Fees associated with refinancing can significantly impact the overall cost. These fees can include origination fees, late payment fees, and prepayment penalties. SoFi generally does not charge origination fees, while Earnest and CommonBond may have varying fee structures. It is essential to carefully review the fee schedule of each lender before proceeding with refinancing. Understanding these fees helps in accurately comparing the total cost of borrowing across different lenders.

Repayment Options Comparison

Flexible repayment options are vital for managing student loan debt effectively. SoFi, Earnest, and CommonBond offer various repayment plans, including fixed-rate and variable-rate options, and may also offer options like income-driven repayment plans, though these are not as common in private refinancing as they are in federal programs. The availability and specifics of these plans will depend on individual eligibility and the lender’s policies. Consider your financial situation and choose a repayment plan that aligns with your long-term financial goals.

Customer Service and Support Comparison

The quality of customer service and support can significantly influence the borrowing experience. SoFi, Earnest, and CommonBond generally provide online support through their websites and mobile apps, with varying levels of phone support and personalized assistance. Comparing customer reviews and ratings from reputable sources can offer insights into the responsiveness and helpfulness of each lender’s customer service team. This aspect is crucial, as efficient and responsive customer service can be vital during the loan process and throughout the repayment period.

Comparative Chart

| Lender | Interest Rate (Example Range) | Fees (Example) | Repayment Options |

|---|---|---|---|

| SoFi | 4.00% – 10.00% (Variable) | Typically No Origination Fee | Fixed-rate, Variable-rate |

| Earnest | 4.50% – 11.00% (Variable) | Potential Origination Fee (check specifics) | Fixed-rate, Variable-rate, Income-Based (May Vary) |

| CommonBond | 4.25% – 10.50% (Variable) | Potential Origination Fee (check specifics) | Fixed-rate, Variable-rate |

Eligibility Requirements and Credit Score Impact

Securing a Sofi student loan refinance requires meeting specific criteria. Your creditworthiness plays a significant role in determining not only your approval but also the interest rate you’ll receive. Understanding these factors is crucial for a successful application.

Eligibility for Sofi’s student loan refinancing program hinges on several key factors. A strong credit history is paramount, but other elements, such as your income and the type of student loans you wish to refinance, also influence your chances of approval.

Specific Eligibility Requirements

To be eligible for Sofi student loan refinancing, applicants generally need to meet several requirements. These typically include being a U.S. citizen or permanent resident, having a minimum credit score (this varies but is generally good to excellent), possessing a stable income, and having at least one eligible student loan to refinance. The specific minimum credit score and income requirements are not publicly fixed and can change. Sofi may also consider factors like your debt-to-income ratio (DTI) and the length of your credit history. It’s always best to check Sofi’s official website for the most up-to-date requirements.

Credit Score’s Impact on Interest Rates and Loan Approval

Your credit score significantly impacts both your chances of approval and the interest rate you’ll receive. A higher credit score generally translates to a lower interest rate, resulting in substantial savings over the life of the loan. For example, an applicant with a credit score of 750 might qualify for a significantly lower interest rate compared to an applicant with a score of 650. Conversely, a lower credit score could lead to rejection or significantly higher interest rates, potentially making the refinance less appealing or even unaffordable. In essence, a good credit score is your strongest asset in the refinancing process.

Improving Credit Score for Better Loan Terms

Improving your credit score takes time and consistent effort. Several strategies can positively impact your score. These include paying all bills on time, consistently, and keeping credit utilization low (the amount of credit you use compared to your total available credit). Aim to keep your credit utilization below 30%. Additionally, maintaining a diverse credit history (a mix of credit cards and loans) and avoiding opening numerous new accounts in a short period can improve your score. Regularly checking your credit report for errors and disputing any inaccuracies is also crucial. Consider using a credit monitoring service to track your progress and identify areas for improvement. Over time, consistent responsible financial behavior will lead to a higher credit score, opening doors to more favorable loan terms.

Potential Benefits and Drawbacks

Refinancing your student loans with SoFi can offer significant advantages, but it’s crucial to weigh these benefits against potential drawbacks before making a decision. Understanding both sides of the equation will empower you to make an informed choice that aligns with your financial goals. This section will explore the potential upsides and downsides of refinancing with SoFi, providing a balanced perspective to guide your decision-making process.

Benefits of Refinancing Student Loans with SoFi

Refinancing student loans with SoFi can lead to several positive outcomes, primarily centered around lower monthly payments and reduced overall interest costs. These advantages can significantly improve your financial health and accelerate your path to debt freedom.

- Lower Monthly Payments: By extending the loan term or securing a lower interest rate, refinancing can result in significantly lower monthly payments, freeing up cash flow for other financial priorities.

- Lower Interest Rate: If your credit score has improved since you initially took out your student loans, refinancing can allow you to secure a lower interest rate, leading to substantial savings over the life of the loan.

- Simplified Repayment: Consolidating multiple student loans into a single SoFi loan can streamline the repayment process, making it easier to manage your debt.

- Potential for Additional Benefits: SoFi often offers additional benefits to borrowers, such as unemployment protection, which can provide a safety net during periods of job loss.

Drawbacks and Risks of Refinancing Student Loans with SoFi

While refinancing offers many potential benefits, it’s essential to acknowledge the associated risks. These risks can significantly impact your financial situation if not carefully considered.

- Loss of Federal Loan Benefits: Refinancing federal student loans with a private lender like SoFi means losing access to federal loan benefits such as income-driven repayment plans, deferment, and forbearance options. This can be particularly risky if you anticipate facing financial hardship in the future.

- Higher Interest Rates (Potential): While refinancing often leads to lower rates, it’s not guaranteed. If your credit score is poor or your financial situation has worsened, you may end up with a higher interest rate than your current federal loans.

- Longer Repayment Term: Choosing a longer repayment term to lower your monthly payments can ultimately lead to paying more in interest over the life of the loan.

- Impact on Credit Score (Potential): The refinancing process itself can temporarily impact your credit score, although this is usually temporary and should recover quickly.

Comparison of Pros and Cons

The following table summarizes the key advantages and disadvantages of refinancing student loans with SoFi, providing a clear comparison to aid in your decision-making process.

| Pros | Cons |

|---|---|

| Lower monthly payments | Loss of federal loan benefits |

| Lower interest rate (potentially) | Potential for higher interest rates |

| Simplified repayment | Longer repayment term (potentially) |

| Additional benefits (e.g., unemployment protection) | Potential temporary impact on credit score |

Concluding Remarks

Refinancing student loans is a significant financial decision. This comprehensive review of Sofi’s offerings provides a clear picture of their strengths and weaknesses based on real customer experiences and detailed analysis of their rates and services. By understanding the nuances of the process and comparing Sofi to its competitors, you can confidently choose the best path toward financial freedom.

Helpful Answers

What credit score is needed to refinance with Sofi?

While Sofi doesn’t publicly state a minimum credit score, a good to excellent credit score significantly improves your chances of approval and securing favorable interest rates.

Can I refinance private and federal loans together with Sofi?

Yes, Sofi allows refinancing of both federal and private student loans, though there are considerations regarding the loss of federal loan benefits.

What happens if I miss a payment on my Sofi refinanced loan?

Late payment fees apply, and your credit score will be negatively impacted. Contact Sofi immediately if you anticipate difficulties making a payment to explore options.

How long does the Sofi refinance application process take?

The application process can vary, but many users report a relatively quick turnaround time, often within a few weeks from application to funding.