Navigating the world of student loans can be daunting, especially understanding the intricacies of interest rates. This guide delves into the specifics of SoFi student loan interest rates, providing a comprehensive overview of current rates, historical trends, and the factors influencing your individual rate. We’ll explore how credit score, loan amount, and repayment plans impact the cost of borrowing, and compare SoFi’s offerings to those of other major lenders. Understanding these factors is crucial for making informed decisions about financing your education.

From fixed versus variable rates to refinancing options and the impact of fees, we aim to demystify the process and empower you to choose the best loan option for your financial situation. We’ll also provide practical examples and hypothetical scenarios to illustrate how different factors can influence your overall loan cost. By the end of this guide, you’ll have a clearer understanding of SoFi’s student loan interest rates and how to minimize your borrowing costs.

Current Sofi Student Loan Interest Rates

Sofi offers a range of student loan products with varying interest rates. These rates are competitive within the market, but the specific rate offered to an individual borrower depends on several factors. Understanding these factors and how they influence your rate is crucial for securing the best possible financing for your education.

It’s important to note that interest rates are subject to change and the information below reflects current rates as of October 26, 2023. Always check Sofi’s website for the most up-to-date information before making any decisions.

Sofi Student Loan Interest Rate Comparison

The following table provides a general comparison of Sofi’s current student loan interest rates. Keep in mind that these are examples and your actual rate will depend on your creditworthiness and other factors detailed below.

| Loan Type | Fixed APR Range | Variable APR Range | Notes |

|---|---|---|---|

| Undergraduate | 4.99% – 12.99% | 4.99% – 12.99% | Rates may vary based on creditworthiness and other factors. |

| Graduate | 5.99% – 12.99% | 5.99% – 12.99% | Rates may vary based on creditworthiness and other factors. |

| Parent | 6.99% – 12.99% | 6.99% – 12.99% | Rates may vary based on creditworthiness and other factors. Generally higher rates than undergraduate and graduate loans. |

Factors Influencing Sofi Student Loan Interest Rates

Several factors contribute to the interest rate Sofi assigns to a student loan application. Understanding these factors can help borrowers improve their chances of securing a lower rate.

These factors typically include, but are not limited to: credit history, credit score, debt-to-income ratio, loan amount, and the type of loan (undergraduate, graduate, or parent).

A strong credit history and high credit score are generally associated with lower interest rates. Similarly, a lower debt-to-income ratio can also positively influence the rate offered. Larger loan amounts might also lead to slightly higher rates in some cases.

Comparison with Other Major Student Loan Providers

Sofi’s student loan interest rates are generally competitive with other major providers such as Sallie Mae, Discover, and federal student loan programs. However, a direct comparison is difficult due to variations in loan terms, eligibility criteria, and the ever-changing market conditions. It is recommended that borrowers compare offers from multiple lenders to find the best option for their individual financial situation.

For example, while Sofi might offer attractive rates for borrowers with excellent credit, another lender might provide more favorable terms for those with less-than-perfect credit. A thorough comparison across various providers is essential for securing the most advantageous loan terms.

Interest Rate Changes Over Time

Sofi student loan interest rates, like those of other lenders, haven’t remained static over the past five years. Several factors influence these rates, creating a dynamic picture of borrowing costs for students. Understanding these fluctuations is crucial for borrowers to make informed decisions about their loan options. This section will explore the historical trends, underlying reasons, and significant events that have shaped Sofi’s student loan interest rate landscape.

The following provides an overview of how Sofi’s student loan interest rates have changed over the past five years. While precise historical data for all Sofi loan products isn’t publicly available on a granular level, general trends can be observed and analyzed based on publicly available information and industry reports.

Historical Trend of Sofi Student Loan Interest Rates

Imagine a line graph depicting Sofi’s average student loan interest rates over the past five years. The y-axis represents the interest rate (as a percentage), and the x-axis represents the year, broken down into quarters or even months if more detailed data were available. The line itself would likely show some fluctuation. For instance, we might see a relatively flat period, followed by a slight upward trend during a period of rising interest rates generally in the economy, then perhaps a leveling off or even a slight decrease if economic conditions improve and the Federal Reserve lowers its benchmark interest rate. Significant economic events, like changes in the Federal Funds Rate or periods of economic uncertainty, would likely be reflected in the graph as noticeable shifts in the line’s direction. The graph would not show a perfectly smooth line; instead, it would illustrate a dynamic relationship between economic conditions and Sofi’s lending practices. The overall shape would likely reflect broader economic trends, mirroring the general direction of interest rates in the market.

Factors Influencing Sofi’s Student Loan Interest Rates

Several factors contribute to the fluctuations observed in Sofi’s student loan interest rates. These include prevailing market interest rates, the creditworthiness of borrowers, Sofi’s own operating costs, and the level of competition in the student loan market. For example, when the Federal Reserve increases its benchmark interest rate, it generally becomes more expensive for lenders like Sofi to borrow money, which, in turn, may lead to higher interest rates on student loans. Conversely, if the Federal Reserve lowers rates, Sofi may be able to offer lower rates to borrowers. Additionally, a borrower’s credit score and overall financial profile significantly impact the interest rate they receive. A strong credit history often qualifies a borrower for a lower interest rate. Finally, competitive pressures from other lenders can influence Sofi’s pricing strategies. To remain competitive, Sofi might adjust its rates based on what other lenders are offering.

Significant Events Impacting Sofi’s Interest Rates

Significant economic events, such as periods of high inflation or recession, often influence Sofi’s student loan interest rates. For example, during periods of high inflation, the Federal Reserve typically raises interest rates to combat inflation. This directly affects the cost of borrowing for lenders like Sofi, potentially leading to higher student loan interest rates. Conversely, during economic downturns, the Federal Reserve may lower interest rates to stimulate economic growth, potentially leading to lower student loan interest rates. Changes in government regulations regarding student lending could also impact Sofi’s rates. Any significant shifts in the overall financial market, such as major stock market fluctuations or changes in investor confidence, could indirectly influence the interest rates offered by Sofi.

Factors Affecting Individual Interest Rates

Several key factors influence the interest rate a borrower receives on a SoFi student loan. Understanding these factors can help borrowers strategize to potentially secure a lower rate. These factors interact in complex ways, so it’s crucial to consider their combined effect.

Your credit score, loan amount, chosen repayment plan, and whether you have a co-signer all play significant roles in determining your final interest rate. A higher credit score generally leads to a lower interest rate, while a larger loan amount might result in a slightly higher rate. Similarly, the repayment plan you select and the presence of a co-signer can also impact the interest rate you are offered.

Credit Score’s Influence on Interest Rates

Your credit score is a major determinant of your interest rate. Lenders use your credit history to assess your creditworthiness – a higher score indicates a lower risk of default, thus qualifying you for a lower interest rate. Conversely, a lower credit score signals higher risk, resulting in a higher interest rate.

- Excellent Credit (750+): May qualify for the lowest interest rates offered.

- Good Credit (700-749): Likely to receive a competitive interest rate, though potentially slightly higher than those with excellent credit.

- Fair Credit (650-699): May face higher interest rates, and loan approval may be subject to stricter requirements.

- Poor Credit (Below 650): Will likely face significantly higher interest rates, or may even be denied a loan altogether.

Loan Amount’s Impact on Interest Rates

While not always a direct correlation, larger loan amounts can sometimes be associated with slightly higher interest rates. This is because lenders perceive a greater risk with larger loan balances. However, this effect is often less significant than the impact of credit score.

- Smaller Loan Amounts (e.g., $10,000): Might receive a slightly lower interest rate due to lower perceived risk.

- Larger Loan Amounts (e.g., $50,000+): Might receive a slightly higher interest rate, though this difference is often marginal compared to credit score influence.

Repayment Plan’s Effect on Interest Rates

The repayment plan you choose can affect your interest rate, although this impact is typically less pronounced than credit score or loan amount. Some plans might offer incentives for choosing longer repayment terms, but these often come with the trade-off of paying more in interest overall.

- Shorter Repayment Terms: May not directly impact interest rates but will lead to higher monthly payments.

- Longer Repayment Terms: May not always lower interest rates, but will result in lower monthly payments and increased total interest paid.

Co-Signer’s Role in Securing Lower Rates

Having a co-signer with excellent credit can significantly improve your chances of securing a lower interest rate. The co-signer essentially guarantees the loan, reducing the lender’s risk. This can be particularly beneficial for borrowers with limited or imperfect credit histories.

- Borrower with Poor Credit + Co-signer with Excellent Credit: May qualify for a significantly lower interest rate than if applying without a co-signer.

- Borrower with Good Credit + Co-signer with Excellent Credit: May still benefit from a slightly lower rate, though the impact might be less pronounced.

Hypothetical Case Study: Interest Rate Variation

Let’s consider a hypothetical borrower, Alex, applying for a $30,000 student loan.

- Scenario 1: Alex has excellent credit (780), chooses a standard repayment plan, and applies without a co-signer. Alex might receive an interest rate of around 5.0%.

- Scenario 2: Alex has fair credit (660), chooses a standard repayment plan, and applies without a co-signer. Alex might receive an interest rate of around 7.5%.

- Scenario 3: Alex has fair credit (660), chooses a standard repayment plan, and applies *with* a co-signer who has excellent credit (800). Alex might receive an interest rate of around 6.0%.

This case study illustrates how different factors can lead to a significant range of interest rates for the same borrower, emphasizing the importance of improving credit score and considering a co-signer.

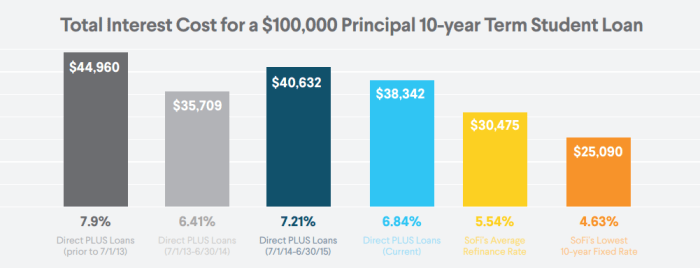

Refinancing Options and Interest Rates

Refinancing your student loans can be a strategic move to lower your monthly payments and potentially save money on interest over the life of your loan. This section compares Sofi’s refinancing options with those of other providers, Artikels the benefits and drawbacks, and provides a step-by-step guide to the Sofi refinancing process. Understanding these factors is crucial for making an informed decision about whether refinancing is right for you.

Sofi is a popular choice for student loan refinancing, but it’s important to compare its offerings to those of other lenders to ensure you’re getting the best possible rate. Interest rates are highly individualized and depend on several factors, including credit score, income, loan amount, and the type of loan being refinanced. Therefore, it is crucial to shop around and compare offers from multiple lenders before making a decision.

Sofi Refinancing Compared to Other Providers

The following table compares Sofi’s refinancing options with those of other prominent lenders. Note that interest rates are subject to change and are only examples. Always check the lender’s website for the most up-to-date information.

| Lender | Typical Interest Rate Range (Variable) | Typical Interest Rate Range (Fixed) | Notable Features |

|---|---|---|---|

| Sofi | 4.00% – 13.00% | 4.50% – 14.00% | Competitive rates, autopay discount, flexible repayment options |

| Earnest | 4.25% – 13.50% | 4.75% – 14.50% | Strong customer service, various repayment options |

| CommonBond | 4.50% – 14.00% | 5.00% – 15.00% | Focus on social impact, flexible repayment plans |

| LendKey | 4.75% – 14.50% | 5.25% – 15.50% | Partners with many credit unions and banks, diverse loan options |

Disclaimer: Interest rates are subject to change and are based on typical ranges. Individual rates will vary based on creditworthiness and other factors. Always check with the lender for the most current information.

Benefits and Drawbacks of Refinancing with Sofi

Refinancing with Sofi, or any lender, offers potential benefits, but also carries potential drawbacks. Carefully weighing these aspects is essential before proceeding.

Benefits: Lower monthly payments, lower interest rates (potentially), simplification of loan management (consolidating multiple loans), access to additional features like autopay discounts.

Drawbacks: Loss of federal student loan benefits (e.g., income-driven repayment plans, forbearance, deferment), potential for higher interest rates if your credit score is low, risk of higher overall interest paid if you extend the loan term, additional fees may apply.

Sofi Student Loan Refinancing Process

Refinancing your student loans through Sofi involves a straightforward process. However, it’s important to ensure you meet the eligibility requirements before starting.

- Check Eligibility: Review Sofi’s eligibility requirements, which typically include credit score, income, and debt-to-income ratio thresholds.

- Pre-qualification: Complete a pre-qualification application to get an estimated interest rate without impacting your credit score.

- Application: Submit a full application, providing required documentation such as tax returns, pay stubs, and student loan information.

- Approval and Loan Terms: If approved, review the loan terms, including interest rate, repayment schedule, and fees. Ensure you fully understand the terms before accepting.

- Loan Disbursement: Once you accept the loan terms, Sofi will disburse the funds to pay off your existing student loans.

Understanding APR and Fees

Understanding the Annual Percentage Rate (APR) and associated fees is crucial for accurately assessing the true cost of a Sofi student loan. While the interest rate represents the cost of borrowing, the APR incorporates additional fees, providing a more comprehensive picture of the loan’s overall expense. This section will clarify the distinction and detail the potential fees involved.

The APR for a Sofi student loan encompasses the interest rate plus any applicable fees, expressed as an annual percentage. It’s a standardized measure that allows for easy comparison between different loan offers. Unlike the simple interest rate, the APR reflects the total cost of borrowing over the loan’s lifetime, offering a more accurate representation of the loan’s true cost. For example, a loan with a 7% interest rate might have a slightly higher APR if origination fees are included. This difference becomes increasingly significant with larger loan amounts and longer repayment periods.

Sofi Student Loan Fees

Sofi generally charges an origination fee for its student loans. This fee is a percentage of the loan amount and is deducted upfront. The exact percentage can vary depending on the loan terms and applicant’s creditworthiness. Late payment fees are also a possibility if payments are not made on time. These fees can add considerably to the total cost of the loan over its lifespan. Understanding these fees and their potential impact is crucial for budgeting and financial planning.

Calculating the Total Cost of a Sofi Student Loan

Calculating the total cost requires considering both interest and fees. The calculation involves determining the total interest paid over the loan’s lifetime and adding any applicable fees (origination and late payment fees).

Total Cost = (Principal Amount + Total Interest Paid) + Origination Fee + Late Payment Fees (if applicable)

For instance, consider a $20,000 Sofi student loan with a 7% interest rate and a 1% origination fee, amortized over 10 years. The origination fee would be $200 ($20,000 * 0.01). Using a loan amortization calculator (readily available online), we can determine the total interest paid over the 10-year period. Let’s assume, for this example, the total interest paid is $7,000. If no late payments occur, the total cost of the loan would be $27,200 ($20,000 + $7,000 + $200). However, adding even one or two late payment fees could significantly increase this final amount. Therefore, consistent on-time payments are essential to minimize the total cost.

Closing Summary

Securing student loans requires careful consideration of various factors, and interest rates play a significant role in the overall cost of borrowing. This guide has provided a detailed analysis of SoFi student loan interest rates, exploring current rates, historical trends, and the factors that influence individual rates. By understanding the impact of credit score, loan amount, and repayment plans, borrowers can make informed decisions to minimize their long-term costs. Remember to compare SoFi’s offerings with other lenders and explore refinancing options to potentially secure more favorable terms. Ultimately, informed decision-making is key to managing student loan debt effectively.

Clarifying Questions

What is the difference between a fixed and variable interest rate for SoFi student loans?

A fixed interest rate remains constant throughout the loan term, while a variable rate fluctuates based on market conditions. Fixed rates offer predictability, while variable rates may offer lower initial rates but carry more risk.

Can I get a SoFi student loan without a co-signer?

Yes, but your interest rate may be higher without a co-signer, as it increases the lender’s risk.

How often does SoFi adjust its interest rates?

SoFi adjusts its interest rates periodically, typically reflecting changes in the market. Check their website for the most current rates.

What happens if I miss a payment on my SoFi student loan?

Missing payments will negatively impact your credit score and may result in late payment fees. Contact SoFi immediately if you anticipate difficulty making a payment.