Securing higher education often involves navigating the complex landscape of student financing. Stafford Loans, a cornerstone of federal student aid, offer a crucial pathway to academic success. Understanding their intricacies, however, is paramount to responsible borrowing and effective financial planning. This guide delves into the nuances of Stafford Loans, providing a clear and concise overview to empower students in making informed decisions about their financial future.

From eligibility criteria and loan types to the application process and repayment strategies, we explore every facet of Stafford Loans. We aim to demystify the process, equipping students with the knowledge to confidently manage their student loan debt and achieve their educational goals without unnecessary financial strain. This comprehensive resource offers practical advice and actionable steps to navigate the complexities of Stafford Loans effectively.

Stafford Loan Eligibility

Securing a Stafford Loan, a federal student loan program, hinges on meeting specific eligibility requirements. These requirements vary depending on whether you’re pursuing an undergraduate or graduate degree and whether you’re applying for a subsidized or unsubsidized loan. Understanding these criteria is crucial for a smooth application process.

Undergraduate Stafford Loan Eligibility

To be eligible for an undergraduate Stafford Loan, you must be enrolled at least half-time in an eligible degree program at a participating institution. This means you must be pursuing a bachelor’s degree, associate’s degree, or other eligible undergraduate credential at a college or university approved by the Department of Education. You must also be a U.S. citizen or eligible non-citizen, possess a valid Social Security number, and maintain satisfactory academic progress as defined by your school. Finally, you must complete the Free Application for Federal Student Aid (FAFSA).

Graduate Stafford Loan Eligibility

Eligibility for graduate Stafford Loans mirrors that of undergraduate loans, with some key differences. You must be enrolled at least half-time in an eligible graduate or professional degree program at a participating institution. This includes master’s degrees, doctoral degrees, and other eligible graduate-level programs. The requirements for U.S. citizenship or eligible non-citizen status, a valid Social Security number, and satisfactory academic progress remain the same. Completion of the FAFSA is also mandatory.

Subsidized vs. Unsubsidized Loan Eligibility

Both subsidized and unsubsidized Stafford Loans share many eligibility requirements. However, a key difference lies in the interest accrual. For subsidized loans, the government pays the interest while you’re in school at least half-time, during grace periods, and during periods of deferment. Eligibility for subsidized loans is based on demonstrated financial need, as determined by your FAFSA information. Unsubsidized loans, on the other hand, accrue interest from the time the loan is disbursed, regardless of your enrollment status or financial need. Anyone meeting the basic eligibility requirements for Stafford Loans can receive an unsubsidized loan.

Determining Stafford Loan Eligibility: A Step-by-Step Guide

1. Complete the FAFSA: This application gathers the necessary financial information to determine your eligibility for federal student aid, including Stafford Loans.

2. Enroll at least half-time: Confirm your enrollment status at an eligible institution.

3. Maintain satisfactory academic progress: Check with your school to understand their specific requirements.

4. Meet citizenship requirements: Ensure you are a U.S. citizen or eligible non-citizen.

5. Provide a valid Social Security number: This is necessary for processing your application.

6. Review your financial aid award letter: Your school will notify you of your eligibility and the amount of aid offered.

Stafford Loan Eligibility Summary

| Student Type | Enrollment Status | Financial Need (Subsidized) | Other Requirements |

|---|---|---|---|

| Undergraduate | At least half-time in eligible program | Demonstrated need (for subsidized loans) | U.S. citizen or eligible non-citizen, valid SSN, satisfactory academic progress, completed FAFSA |

| Graduate | At least half-time in eligible program | Demonstrated need (for subsidized loans) | U.S. citizen or eligible non-citizen, valid SSN, satisfactory academic progress, completed FAFSA |

Types of Stafford Loans

Stafford Loans are a crucial source of funding for higher education, but understanding the nuances between the two main types—subsidized and unsubsidized—is essential for effective financial planning. Choosing the right loan type can significantly impact your overall borrowing costs and repayment schedule.

The key difference lies in whether the federal government pays the interest while you’re in school, during grace periods, or during deferment. This seemingly small detail can translate into substantial savings over the life of the loan.

Subsidized vs. Unsubsidized Stafford Loans

Subsidized and unsubsidized Stafford Loans both offer federal student loan funding, but they differ significantly in interest accrual and repayment responsibilities. Understanding these differences is vital for responsible borrowing and minimizing long-term costs.

The following table highlights the key differences between subsidized and unsubsidized Stafford Loans:

| Feature | Subsidized Stafford Loan | Unsubsidized Stafford Loan |

|---|---|---|

| Interest Accrual During Deferment | The government pays the interest while you’re in school at least half-time, during grace periods, and during certain deferment periods. | Interest accrues from the time the loan is disbursed until it’s repaid, even during deferment periods. This interest is capitalized (added to the principal balance). |

| Eligibility | Based on financial need, as determined by the Free Application for Federal Student Aid (FAFSA). | Available to undergraduate and graduate students regardless of financial need. |

| Interest Rates | The interest rate is set by the government annually and is generally lower than unsubsidized loans. | The interest rate is set by the government annually and is generally higher than subsidized loans. |

| Repayment | Repayment begins six months after graduation or leaving school. | Repayment begins six months after graduation or leaving school. |

| Loan Disbursement | Funds are disbursed directly to the school to cover tuition and fees, and any remaining amount is paid directly to the student. | Funds are disbursed directly to the school to cover tuition and fees, and any remaining amount is paid directly to the student. The process is generally the same for both loan types. |

Examples of Situations Favoring Subsidized Loans

A subsidized loan is preferable when a student demonstrates financial need and qualifies for the program. This means the government will cover interest charges while the student is enrolled at least half-time, during grace periods, and under certain deferment circumstances. For instance, a low-income student pursuing a degree might find a subsidized loan significantly reduces their overall debt burden compared to an unsubsidized loan. Another example would be a student who anticipates needing to defer their loan payments due to unforeseen circumstances. The government’s interest payment during deferment prevents the debt from growing unnecessarily.

Loan Application Process

Applying for a Stafford Loan involves several key steps designed to ensure you receive the financial assistance you need for your education. The process is largely managed online through the Federal Student Aid website, making it convenient and accessible. Understanding these steps will help you navigate the application smoothly and efficiently.

The application process for a Stafford Loan begins with completing the Free Application for Federal Student Aid (FAFSA). This form collects necessary information to determine your eligibility for federal student aid, including Stafford Loans. Your FAFSA data is then sent to your chosen school(s), which will use it to determine your financial aid package. After this, you will be notified of your loan eligibility and the steps to accept your loan offer.

Required Documents for Stafford Loan Application

The FAFSA itself is the primary document required. However, depending on your individual circumstances and the lender’s requirements, you may need to provide additional supporting documentation. This might include tax returns, bank statements, or proof of citizenship. It’s crucial to keep your financial documents organized throughout the process.

The Federal Student Aid Website (studentaid.gov)

The Federal Student Aid website, studentaid.gov, serves as the central hub for all aspects of the Stafford Loan application. This website houses the FAFSA form, provides detailed information about eligibility requirements, and allows you to track the status of your application. It’s a valuable resource for understanding the entire process and accessing helpful guides and tutorials.

Completing the Free Application for Federal Student Aid (FAFSA)

Completing the FAFSA is the first and most critical step in the Stafford Loan application process. The form requires information about you, your parents (if you are a dependent student), your income, and your assets. Accurate and complete information is essential for a successful application. The website provides clear instructions and helpful tips to guide you through the process. You’ll need your Social Security number, federal tax information (yours and your parents’), and your school’s Federal School Code. Once completed and submitted, the information is processed, and your eligibility for federal aid is determined.

Stafford Loan Application Process Flowchart

A simplified flowchart would depict the process as follows:

1. Start: Begin by visiting studentaid.gov.

2. FAFSA Completion: Complete the Free Application for Federal Student Aid (FAFSA) form online.

3. FAFSA Submission: Submit the completed FAFSA.

4. School Processing: Your chosen school processes your FAFSA data to determine your eligibility.

5. Loan Offer: Receive a loan offer from your school (if eligible).

6. Loan Acceptance: Accept the loan offer (if applicable).

7. Loan Disbursement: The loan funds are disbursed to your school according to the school’s schedule.

8. End: The loan application process is complete. You are now responsible for repayment according to the terms of your loan.

Loan Repayment Options

Understanding your repayment options is crucial for successfully managing your Stafford Loan debt. Choosing the right plan can significantly impact your monthly payments and overall repayment timeline. Several plans are available, each with its own set of advantages and disadvantages. Careful consideration of your financial situation and long-term goals is essential in making this important decision.

Standard Repayment Plan

The Standard Repayment Plan is the default option for Stafford Loans. It involves fixed monthly payments over a 10-year period. This plan offers the shortest repayment timeframe, leading to less interest paid overall. However, the fixed monthly payments can be substantial, potentially straining your budget, especially in the early years after graduation. For example, a $30,000 loan might result in a monthly payment of around $300, depending on the interest rate.

Extended Repayment Plan

The Extended Repayment Plan offers longer repayment terms, stretching the loan repayment period to up to 25 years. This lowers the monthly payment, making it more manageable for borrowers with limited income or significant financial obligations. However, the extended repayment period means you’ll pay significantly more in interest over the life of the loan. Using the same $30,000 loan example, the monthly payment could be reduced to approximately $150, but the total interest paid would be considerably higher.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) tie your monthly payment to your income and family size. These plans include options like the Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) plans. IDRs offer lower monthly payments, making them attractive for borrowers with lower incomes or unexpected financial hardships. However, they often result in longer repayment periods (potentially 20-25 years) and may lead to higher total interest paid. For instance, a borrower earning a modest income might see their monthly payment significantly reduced under an IDR plan, but their loan could remain outstanding for many years.

Factors Influencing Repayment Plan Choice

Several factors should be considered when choosing a repayment plan. These include your current income, expected future income, other financial obligations, and your risk tolerance. Borrowers with higher incomes might prefer the Standard Repayment Plan to minimize total interest paid, while those with lower incomes might opt for an IDR to manage monthly expenses more effectively. Long-term financial planning and understanding the trade-offs between monthly payment amounts and total interest paid are crucial in making an informed decision.

Comparison of Repayment Plans

| Repayment Plan | Repayment Term | Monthly Payment (Example: $30,000 Loan) | Total Interest Paid (Approximate) |

|---|---|---|---|

| Standard | 10 years | ~$300 | ~$10,000 – $15,000 (depending on interest rate) |

| Extended | Up to 25 years | ~$150 | ~$25,000 – $35,000 (depending on interest rate) |

| Income-Driven | Up to 20-25 years | Variable (based on income) | Variable (potentially high) |

Understanding Interest Rates and Fees

Understanding the interest rates and fees associated with your Stafford Loan is crucial for effective financial planning during and after your studies. Knowing how these costs impact your overall loan repayment is key to avoiding unexpected expenses and managing your debt effectively.

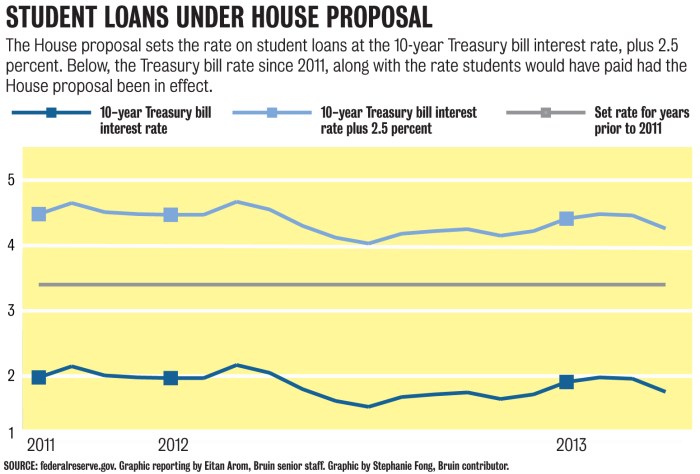

Stafford Loan interest rates are determined by the U.S. Department of Education and are set annually for each loan disbursement period. The rates are influenced by a variety of economic factors, including prevailing market interest rates and the overall health of the economy. These rates are typically fixed for the life of the loan, meaning they won’t change once your loan is disbursed, providing a level of predictability in your repayment plan. However, it is important to note that the interest rate will vary depending on whether you have a subsidized or unsubsidized loan, and the loan’s disbursement date.

Factors Influencing Interest Rates

Several key factors influence the interest rate you’ll receive on your Stafford Loan. The most significant factor is the type of loan – subsidized loans typically have lower interest rates than unsubsidized loans. The year in which the loan is disbursed also plays a role; interest rates are set annually and can fluctuate based on economic conditions. Your credit history is not a factor in determining the interest rate on federal Stafford Loans.

Interest Accrual

Interest begins to accrue on unsubsidized Stafford Loans from the date of disbursement. For subsidized loans, interest accrual begins after the grace period. Let’s consider an example: Suppose you have a $10,000 unsubsidized Stafford Loan with a 5% annual interest rate. After one year, the accrued interest would be $500 ($10,000 x 0.05). If this interest is not paid during your studies, it is capitalized, meaning it is added to your principal loan balance, increasing the total amount you owe. This means that in subsequent years, interest will accrue on the larger principal balance, leading to a larger total repayment amount over time.

Associated Fees

While Stafford Loans themselves don’t have origination fees (fees charged by the lender for processing the loan), there might be other fees associated with your loan, depending on your loan servicer. These fees are typically minimal and are clearly Artikeld in your loan documents. It’s always advisable to review your loan documents carefully to understand any applicable fees.

Impact of Interest Rates on Loan Repayment

Imagine two scenarios: Scenario A: A $10,000 loan with a 4% interest rate, and Scenario B: A $10,000 loan with a 7% interest rate. Both loans have a 10-year repayment plan. A visual representation would show two lines on a graph. The x-axis would represent the repayment period (in years), and the y-axis would represent the total amount owed. Scenario A’s line would show a gentler upward slope, reflecting slower interest accrual and a smaller total repayment amount. Scenario B’s line would have a steeper upward slope, illustrating faster interest accrual and a significantly larger total repayment amount. This clearly demonstrates how even a small difference in interest rates can significantly impact the total cost of the loan over time. This visual emphasizes the importance of understanding and managing interest rates to minimize the overall cost of borrowing.

Managing Stafford Loan Debt

Successfully navigating Stafford loan debt requires proactive planning and consistent effort. Understanding your repayment options and developing sound financial habits are crucial to minimizing stress and achieving timely repayment. This section Artikels strategies for effective debt management, budgeting tips, and resources available to support you throughout the process.

Strategies for Effective Stafford Loan Debt Management

Effective management hinges on a multi-pronged approach encompassing budgeting, prioritizing repayment, and leveraging available resources. A well-structured budget, combined with a clear understanding of your loan terms and repayment options, allows for a strategic and manageable repayment plan. Seeking assistance from financial aid offices or credit counseling agencies can provide valuable guidance and support.

Budgeting and Prioritizing Loan Repayment

Creating a realistic budget is paramount. This involves tracking all income and expenses to identify areas for potential savings. Prioritize loan repayment within your budget, considering factors like interest rates and loan terms. Higher-interest loans generally warrant prioritizing repayment to minimize overall interest costs. For example, if you have a loan with a 7% interest rate and another with 4%, focusing on the 7% loan first will save you money in the long run. Allocate a specific amount each month towards loan repayment, treating it as a non-negotiable expense.

Avoiding Common Mistakes in Loan Management

Several common mistakes can hinder effective loan management. Deferring payments without a clear plan can lead to accumulating interest and increasing the overall loan balance. Ignoring communication from your loan servicer can result in missed payments and potential penalties. Failing to explore repayment options, such as income-driven repayment plans, can lead to unnecessary financial strain. Finally, neglecting to track loan balances and payment history can create uncertainty and make managing your debt more challenging.

Resources Available to Assist with Loan Repayment

Numerous resources exist to assist with loan repayment. Your loan servicer can provide information on repayment plans, deferments, and forbearances. The National Student Loan Data System (NSLDS) offers a centralized location to view your loan information. Federal government websites, such as StudentAid.gov, provide comprehensive information on loan management and repayment options. Additionally, non-profit credit counseling agencies can offer free or low-cost guidance on debt management strategies.

Sample Budget Demonstrating Effective Loan Repayment Strategies

| Income | Amount |

|---|---|

| Monthly Salary | $3000 |

| Expenses | Amount |

| Rent | $1000 |

| Groceries | $300 |

| Transportation | $200 |

| Utilities | $150 |

| Stafford Loan Payment (High Interest Loan) | $350 |

| Stafford Loan Payment (Low Interest Loan) | $200 |

| Savings | $200 |

| Other Expenses | $500 |

This sample budget allocates a significant portion of income towards loan repayment, prioritizing the higher-interest loan. The remaining income is allocated to essential expenses and savings, demonstrating a balanced approach to financial management. Remember that this is a sample; your budget will need to reflect your individual income and expenses.

Last Recap

Successfully navigating the Stafford Loan process requires careful planning and a thorough understanding of the various loan types, eligibility requirements, and repayment options. By diligently completing the FAFSA, understanding interest accrual, and exploring available repayment plans, students can minimize financial burdens and focus on their academic pursuits. Remember to leverage available resources and seek guidance when needed to make informed decisions that align with your long-term financial well-being. Ultimately, a well-informed approach to Stafford Loans empowers students to pursue higher education with confidence and financial responsibility.

FAQ Section

What is the difference between subsidized and unsubsidized Stafford Loans?

Subsidized loans don’t accrue interest while you’re in school (at least half-time), during grace periods, or in deferment. Unsubsidized loans accrue interest from the time they’re disbursed.

Can I consolidate my Stafford Loans?

Yes, you can consolidate multiple Stafford Loans into a single Direct Consolidation Loan, potentially simplifying repayment.

What happens if I don’t repay my Stafford Loan?

Failure to repay can lead to negative consequences, including damage to your credit score, wage garnishment, and tax refund offset.

Are there any penalties for early repayment of a Stafford Loan?

Generally, there are no penalties for early repayment of Stafford Loans, but check your loan terms to be sure.

How do I contact the Department of Education regarding my Stafford Loan?

You can contact the Federal Student Aid office through their website, studentaid.gov, or by phone.