Securing funding for higher education is a significant step, and understanding the Stafford Student Loan application process is crucial for prospective students. This guide unravels the intricacies of applying for Stafford loans, from eligibility criteria to repayment options, providing a clear and concise pathway to financial aid.

We will explore the various types of Stafford loans, the vital role of the FAFSA form, and the importance of understanding repayment plans and potential challenges. This comprehensive overview aims to empower students with the knowledge needed to confidently navigate the application process and secure the financial support they need to pursue their educational goals.

Understanding the Stafford Student Loan Application Process

Securing a Stafford student loan can significantly ease the financial burden of higher education. Understanding the application process, however, is crucial for a smooth and successful experience. This section Artikels the key steps involved, clarifies the differences between loan types, and provides guidance on gathering necessary documentation.

Stafford Loan Application Steps

The Stafford loan application process generally involves several key steps. First, you must complete the Free Application for Federal Student Aid (FAFSA). This application determines your eligibility for federal student aid, including Stafford loans. Next, your school’s financial aid office will process your FAFSA and notify you of your loan eligibility and award. You will then need to accept your loan offer and complete loan counseling, usually online. Finally, the loan funds will be disbursed to your school to cover tuition and fees, and potentially other educational expenses, according to your school’s disbursement schedule. It’s important to carefully review all communications from your school and the loan servicer throughout this process.

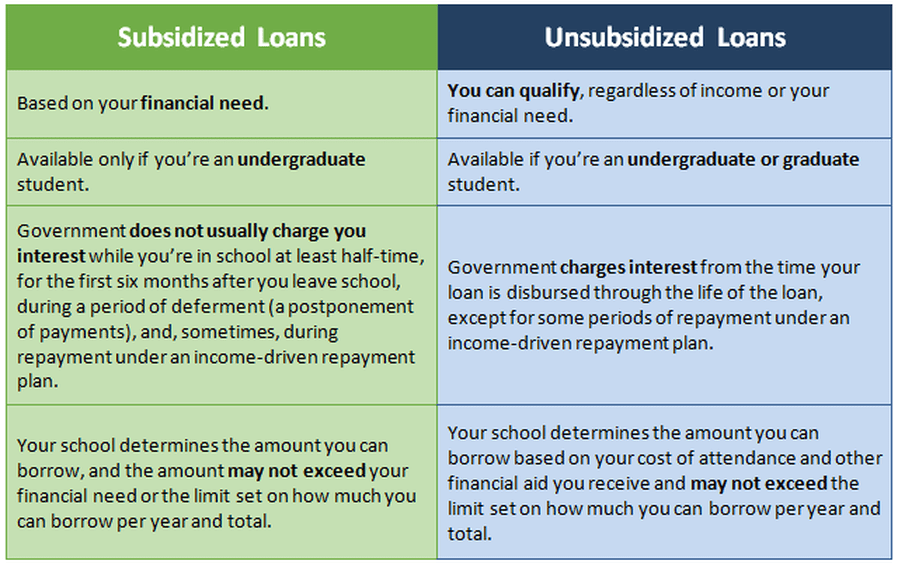

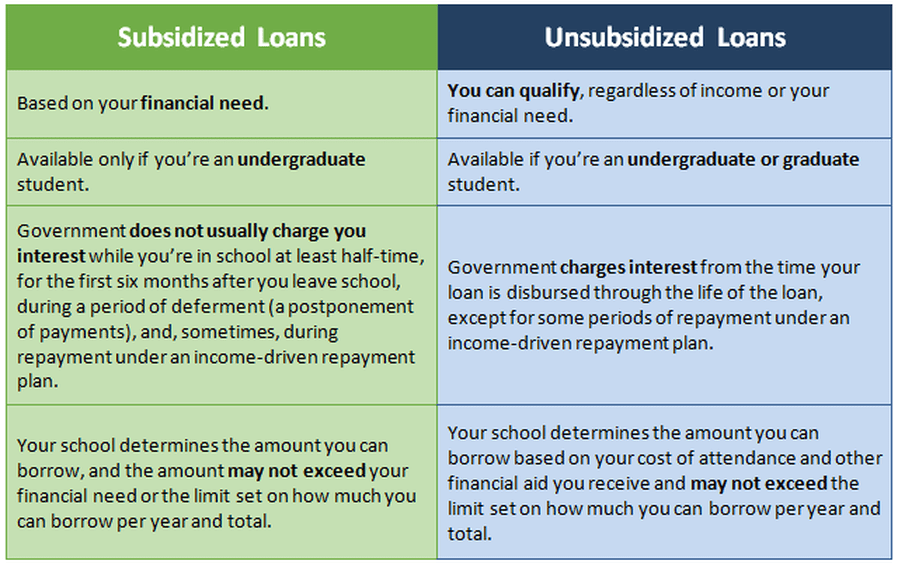

Subsidized vs. Unsubsidized Stafford Loans

Stafford loans are offered in two main types: subsidized and unsubsidized. Subsidized Stafford loans are need-based; the government pays the interest while you’re in school at least half-time, during grace periods, and during deferment periods. Unsubsidized Stafford loans are not need-based; interest accrues from the moment the loan is disbursed, regardless of your enrollment status. Understanding this difference is crucial for budgeting and planning repayment. For example, a student receiving a subsidized loan might not have to worry about accumulating interest during their studies, while a student with an unsubsidized loan would need to factor in interest charges from the loan’s disbursement.

Gathering Required Documentation

Successfully completing your Stafford loan application requires compiling several essential documents. This preparation is critical to avoid delays in processing your application. You will need to provide accurate information and supporting documentation to verify your identity, financial information, and enrollment status.

Checklist of Essential Documents

Before starting your application, gather the following:

- Social Security Number

- Driver’s License or State-Issued ID

- Federal Tax Returns (yours and your parents’, if applicable)

- W-2 forms (yours and your parents’, if applicable)

- Bank statements

- Proof of enrollment (acceptance letter from your school)

Stafford Loan Application Process Flowchart

The following describes a visual representation of the Stafford loan application process:

The flowchart would begin with a “Start” box. An arrow would then lead to a box labeled “Complete FAFSA.” Another arrow would point to a box labeled “School Processes FAFSA.” Following this, an arrow would lead to a box indicating “Loan Eligibility Determined.” Next, an arrow would point to a box showing “Accept Loan Offer and Complete Counseling.” Another arrow would lead to a “Loan Disbursement” box. Finally, an arrow would point to an “End” box. This visual representation clearly shows the sequential steps involved in the application process.

Eligibility Criteria for Stafford Loans

Securing a Stafford loan hinges on meeting specific eligibility requirements. These criteria ensure that the loan program effectively supports students who demonstrate a genuine need for financial assistance to pursue their education. Understanding these requirements is crucial for a successful application.

Credit History’s Role in Stafford Loan Eligibility

Credit history, surprisingly, doesn’t directly determine Stafford loan eligibility for undergraduate students. The federal government recognizes that many undergraduate students lack extensive credit histories. However, for graduate students and Parent PLUS loans, a credit check is performed, and a poor credit history might impact approval. Lenders assess credit reports to evaluate the applicant’s financial responsibility and ability to repay the loan. Factors like late payments, bankruptcies, and high debt-to-income ratios can negatively affect approval chances. For those with less-than-perfect credit, exploring co-signers or alternative loan options might be necessary.

Enrollment Status and Loan Eligibility

Maintaining satisfactory academic progress (SAP) is a critical requirement for Stafford loan eligibility. This typically means meeting minimum grade point average (GPA) requirements and completing a certain number of credits per academic year as defined by the institution. Students who are enrolled at least half-time are generally eligible. Enrollment status verification is often a key part of the disbursement process, ensuring that funds are released only to students actively pursuing their education. Failure to meet SAP requirements can result in loan suspension or termination.

Undergraduate vs. Graduate Stafford Loan Eligibility

While both undergraduate and graduate students can apply for Stafford loans, there are some key differences. Undergraduate students are typically eligible for subsidized and unsubsidized Stafford loans, while graduate students are primarily eligible for unsubsidized loans. Subsidized loans have the advantage of not accruing interest while the student is enrolled at least half-time and during grace periods. Unsubsidized loans, on the other hand, accrue interest from the time the loan is disbursed. Graduate students may also have higher loan limits than undergraduate students. Both groups must meet the general eligibility criteria, including U.S. citizenship or eligible non-citizen status and enrollment in an eligible educational program.

Summary of Stafford Loan Eligibility Criteria

| Criterion | Undergraduate Students | Graduate Students | Explanation |

|---|---|---|---|

| U.S. Citizenship/Eligible Non-Citizen Status | Required | Required | Must be a U.S. citizen or eligible non-citizen to qualify. |

| Enrollment Status | At least half-time | At least half-time | Must be enrolled at least half-time in an eligible program. |

| Satisfactory Academic Progress (SAP) | Required | Required | Must meet minimum GPA and credit completion requirements. |

| Credit History | Not a factor | Affects approval | Credit check performed for graduate students; poor credit can impact approval. |

| Loan Type | Subsidized and Unsubsidized | Primarily Unsubsidized | Subsidized loans don’t accrue interest while in school; unsubsidized loans do. |

Completing the FAFSA Form

The Free Application for Federal Student Aid (FAFSA) is the gateway to federal student financial aid, including Stafford Loans. Accurately and completely filling out this form is crucial for determining your eligibility for various forms of financial assistance. Understanding the process and providing accurate information will ensure you receive the aid you’re entitled to.

The FAFSA is an online application requiring information about you, your parents (if you are a dependent student), your income, and your assets. The information you provide is used to calculate your Expected Family Contribution (EFC), a measure of your family’s ability to pay for college. Your EFC, along with the cost of attendance at your chosen school, determines your financial need and the amount of federal student aid you may receive.

FAFSA Section Completion Guidance

The FAFSA is divided into several sections, each requiring specific information. Providing accurate and up-to-date information in each section is paramount. Inaccuracies can delay or even prevent the processing of your application.

For example, the student information section requires details such as your Social Security number, date of birth, and current mailing address. The parent information section (if applicable) requires similar information for both parents. You will also need to provide information regarding your high school and any post-secondary institutions you’ve attended. The financial information section requests details about your and your parents’ income, assets, and tax information. It is essential to consult your tax returns and other financial documents to ensure accuracy.

Importance of Accurate Information

The accuracy of the information you provide on the FAFSA is of utmost importance. Providing inaccurate or outdated information can lead to delays in processing your application, a reduction in the amount of financial aid you receive, or even the denial of your application altogether. Federal agencies conduct verification processes to ensure the accuracy of the information submitted. Discrepancies can lead to further investigation and delays. It is always better to take the time to accurately complete the form than to risk potential consequences.

Correcting Errors on the FAFSA Form

If you discover an error on your FAFSA after submitting it, you can correct it online through your FAFSA account. You will need your FSA ID to access and make corrections. The FAFSA website provides clear instructions on how to amend your application. It’s advisable to make corrections as soon as possible to avoid any delays in processing your application. Depending on the nature of the error, you may need to provide supporting documentation to verify the correction.

Tracking FAFSA Application Status

After submitting your FAFSA, you can track its status online through your FAFSA account. The website will provide updates on the processing of your application, including its completion date and whether any additional information is required. Regularly checking your FAFSA status allows you to stay informed and address any issues promptly. You can also access your Student Aid Report (SAR), which summarizes the information you provided on the FAFSA and your calculated EFC.

Loan Repayment Options and Considerations

Understanding your repayment options is crucial after receiving your Stafford loan. Choosing the right plan significantly impacts your monthly payments and the total interest you pay over the life of the loan. Failing to understand these options can lead to unnecessary financial strain.

The federal government offers several repayment plans designed to accommodate various financial situations. Each plan differs in terms of monthly payment amounts, loan repayment periods, and total interest paid. The optimal choice depends on your individual income, expenses, and long-term financial goals. Careful consideration of these factors is essential before selecting a repayment plan.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most Stafford loan borrowers. Under this plan, you make fixed monthly payments over a 10-year period. While this plan offers a relatively short repayment timeframe, it often results in higher monthly payments compared to other options. This plan is suitable for borrowers who prioritize a quicker loan payoff and are comfortable with potentially higher monthly expenses.

For example, a $20,000 loan at a 5% interest rate would have a monthly payment of approximately $212 under the standard plan, resulting in a total repayment of around $25,400.

Extended Repayment Plan

The Extended Repayment Plan provides longer repayment terms, reducing monthly payments. This plan extends the repayment period to up to 25 years, depending on the loan balance. While the monthly payments are lower, you’ll end up paying significantly more interest over the life of the loan. This plan is a good choice for borrowers with lower incomes or those who want to manage their monthly budget more effectively, even at the cost of higher overall interest payments.

Using the same $20,000 loan example at 5% interest, the monthly payment on a 25-year extended plan would be approximately $110, but the total repayment would exceed $33,000.

Graduated Repayment Plan

The Graduated Repayment Plan starts with lower monthly payments that gradually increase every two years. This approach is beneficial for borrowers anticipating income growth, as their payments align more closely with their earning potential over time. However, the initial low payments can create a false sense of financial ease, and the later, higher payments might become challenging to manage if income doesn’t increase as expected.

For instance, the initial monthly payment on a $20,000 loan at 5% interest might start around $90 but could rise to over $200 within a few years.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) base your monthly payment on your income and family size. These plans include the Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) plans. Monthly payments are typically lower than under other plans, and any remaining loan balance may be forgiven after 20 or 25 years, depending on the specific plan. However, forgiveness may result in tax implications, and the longer repayment period leads to significantly higher total interest paid.

IDR plans are best suited for borrowers with lower incomes or significant financial responsibilities. The exact monthly payment and forgiveness timelines will vary based on individual circumstances and the chosen plan.

Summary of Repayment Plan Options

The following bullet points summarize the key features of each Stafford loan repayment plan. Remember to consult the official government website for the most up-to-date information and specific details.

- Standard Repayment: 10-year repayment, fixed monthly payments, lowest total interest paid.

- Extended Repayment: Up to 25-year repayment, lower monthly payments, highest total interest paid.

- Graduated Repayment: Payments increase every two years, initially lower payments, but potentially higher later payments.

- Income-Driven Repayment (IDR): Payments based on income and family size, lower monthly payments, potential loan forgiveness (with tax implications), highest total interest paid.

Understanding Loan Deferment and Forbearance

Navigating the complexities of student loan repayment can be challenging. Fortunately, there are options available to help borrowers manage their payments during periods of financial hardship or other qualifying circumstances. Loan deferment and forbearance are two such options, offering temporary pauses or reductions in loan payments. Understanding the differences and application processes is crucial for responsible loan management.

Circumstances for Loan Deferment

Deferment allows borrowers to temporarily postpone their student loan payments without accruing interest on subsidized loans (interest will continue to accrue on unsubsidized loans). Eligibility criteria typically include unemployment, enrollment in school at least half-time, or experiencing economic hardship. Specific requirements vary depending on the type of loan and the lender. For instance, a borrower who recently lost their job might qualify for deferment based on documented unemployment, while a graduate student returning to school could qualify based on their enrollment status. Verification of these circumstances is generally required through supporting documentation.

Applying for Loan Deferment or Forbearance

The application process generally involves contacting your loan servicer. This is the company responsible for managing your student loans. You’ll need to complete an application form, providing documentation to support your request. This documentation might include proof of unemployment, enrollment verification from your school, or financial statements demonstrating economic hardship. The servicer will review your application and notify you of their decision. Processing times can vary, so it’s important to apply well in advance of when you anticipate needing the deferment or forbearance.

Impact of Deferment or Forbearance on Loan Repayment

While deferment and forbearance offer temporary relief, it’s important to understand their long-term impact. Deferment, for subsidized loans, pauses payments without accumulating additional interest. However, for unsubsidized loans, interest will continue to accrue during the deferment period, increasing the total amount owed. Forbearance, on the other hand, typically allows for reduced payments or a temporary suspension of payments, but interest usually continues to accrue during this period for both subsidized and unsubsidized loans, leading to a larger overall loan balance. This means that the total repayment amount will likely be higher after a period of deferment or forbearance. Careful planning is essential to manage the eventual increased repayment burden.

Comparison of Deferment and Forbearance

Deferment and forbearance, while both providing temporary relief from loan payments, differ significantly. Deferment is generally granted based on specific qualifying circumstances like unemployment or enrollment in school, while forbearance is often granted based on demonstrated financial hardship. Deferment for subsidized loans prevents interest from accruing, whereas forbearance typically allows interest to continue accumulating on both subsidized and unsubsidized loans. The length of deferment is often predetermined by the qualifying circumstance, while forbearance periods are typically determined by the borrower’s circumstances and the loan servicer’s discretion.

Conditions for Deferment and Forbearance

| Feature | Deferment | Forbearance |

|---|---|---|

| Eligibility Criteria | Specific circumstances (e.g., unemployment, school enrollment, economic hardship) | Financial hardship, demonstrated inability to make payments |

| Interest Accrual (Subsidized Loans) | No interest accrual | Interest accrues |

| Interest Accrual (Unsubsidized Loans) | Interest accrues | Interest accrues |

| Length of Period | Often predetermined by the qualifying circumstance | Determined by borrower’s circumstances and loan servicer |

Potential Challenges and Solutions in the Application Process

Applying for Stafford student loans can present several hurdles for students. Understanding these potential difficulties and having strategies in place to overcome them is crucial for a smooth and successful application process. This section will Artikel common challenges, provide solutions, and highlight available resources to assist students.

Common Application Challenges

Many students encounter difficulties navigating the application process. These difficulties often stem from a lack of understanding of the requirements, technical issues, or unexpected circumstances. For instance, incomplete or inaccurate information on the FAFSA form is a frequent problem, leading to delays or application rejection. Another common issue is the inability to access necessary documentation, such as tax returns or transcripts. Finally, financial complexities or unexpected life events can significantly impact the application process.

Solutions and Strategies for Overcoming Challenges

Proactive planning and preparation are key to avoiding many application challenges. Students should begin the process well in advance of deadlines, allowing ample time to gather necessary documents and complete the FAFSA accurately. Utilizing online resources and tutorials can help clarify any confusion regarding the application requirements. Seeking assistance from school financial aid offices or trusted advisors is strongly recommended. For students facing financial difficulties, exploring options such as scholarships or grants alongside Stafford loans should be considered. In situations involving missing or inaccurate information, prompt contact with the relevant institutions (schools, tax agencies, etc.) is essential to rectify the issue swiftly.

Available Resources to Assist Students

Numerous resources are available to support students throughout the application process. Most colleges and universities have dedicated financial aid offices staffed with professionals who can provide guidance and assistance. These offices often offer workshops, individual consultations, and online resources to help students navigate the application process. Additionally, the Federal Student Aid website (studentaid.gov) provides comprehensive information, FAQs, and tools to simplify the process. Many non-profit organizations and community colleges also offer free financial aid counseling services.

Situations Requiring Additional Assistance

Students facing exceptional circumstances may require more extensive support. This includes students with disabilities, those experiencing homelessness, or those who are victims of domestic violence. These students may need assistance navigating additional forms or documentation requirements. Financial aid offices are equipped to handle these situations and connect students with relevant resources and support services. They can also assist students in understanding and accessing any special accommodations or waivers that may be available. The process may require more time and patience, but the support systems are in place to ensure these students receive the assistance they need.

Troubleshooting Guide for Common Application Issues

| Problem | Solution |

|---|---|

| Incomplete or inaccurate FAFSA information | Review the FAFSA carefully, correct errors, and resubmit. Contact the financial aid office for assistance. |

| Missing documentation (tax returns, transcripts) | Request official copies from the relevant institutions. Allow sufficient processing time. |

| Technical difficulties accessing the FAFSA website | Clear browser cache and cookies. Try a different browser or device. Contact the Federal Student Aid help desk. |

| Denial of application | Review the denial letter carefully. Understand the reasons for denial. Contact the financial aid office to discuss options and appeals. |

| Delays in processing | Check the application status online. Contact the financial aid office for updates. |

Visual Representation of the Application Process

A visual representation of the Stafford student loan application process can be best understood as a flowchart, illustrating the sequential steps and decision points involved. This approach provides a clear and concise overview, allowing applicants to easily navigate the process.

The flowchart would begin with the “Start” node, clearly indicating the initiation of the application. The next step would be completing the FAFSA (Free Application for Federal Student Aid) form, depicted as a large box with the FAFSA logo. This box would have an arrow pointing to a decision node labeled “FAFSA Approved?”. If yes, an arrow leads to the next step: “Loan Application Submission”. If no, the flowchart would branch to a box detailing potential reasons for rejection and guidance on addressing them, ultimately looping back to FAFSA completion.

Stafford Loan Application Flowchart

The “Loan Application Submission” box would then connect to a “Loan Processing” box, showing the period where the application is reviewed by the lender. Following this, a decision node would appear, “Loan Approved?”. A “Yes” branch would lead to the “Loan Disbursement” box, depicting the funds being released to the student’s account. A “No” branch would lead to a box outlining potential reasons for rejection and options for appeal or reconsideration, possibly looping back to the application submission stage. Finally, the flowchart would conclude with an “End” node. Each box could contain brief descriptions of the processes involved, and the overall flow would be visually clear and easy to follow, utilizing arrows to indicate the progression through each stage.

Visual Representation of Stafford Loan Types

A visual representation comparing the different types of Stafford loans could utilize a table. This allows for a clear side-by-side comparison of key features.

Stafford Loan Type Comparison Table

The table would have columns for “Loan Type,” “Interest Rate,” “Repayment Options,” “Eligibility Requirements,” and “Key Differences.” Each row would represent a different type of Stafford loan (e.g., Subsidized, Unsubsidized, PLUS). The “Interest Rate” column would show the current or average interest rates for each loan type, highlighting the potential differences. The “Repayment Options” column would Artikel the various repayment plans available for each loan type. The “Eligibility Requirements” column would specify the criteria that students must meet to qualify for each loan type, including factors like credit history for PLUS loans. Finally, the “Key Differences” column would concisely summarize the major distinctions between the loan types, emphasizing aspects like interest accrual during school (Subsidized vs. Unsubsidized) and parental eligibility (PLUS loans). This table would provide a concise and easily digestible overview of the different Stafford loan options, enabling students to make informed decisions.

Wrap-Up

Successfully navigating the Stafford Student Loan application process requires careful planning and a thorough understanding of the requirements and options available. By following the steps Artikeld in this guide, and proactively addressing potential challenges, students can confidently secure the financial resources necessary to achieve their academic aspirations. Remember to utilize available resources and seek assistance when needed – your educational journey is an investment worth pursuing.

Commonly Asked Questions

What is the difference between subsidized and unsubsidized Stafford loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or while in deferment. Unsubsidized loans accrue interest throughout the loan’s life.

What happens if I make a mistake on my FAFSA application?

You can correct errors online through the FAFSA website. Instructions for corrections are usually provided within the application itself.

Can I appeal a loan denial?

Yes, you can usually appeal a loan denial by providing additional documentation or explaining extenuating circumstances. Contact your school’s financial aid office for guidance.

What happens if I can’t make my loan payments?

Contact your loan servicer immediately. They can discuss options like deferment, forbearance, or income-driven repayment plans to help you manage your payments.

Where can I find my loan servicer information?

Your loan servicer information is usually available through the National Student Loan Data System (NSLDS) website or your school’s financial aid office.