Navigating the complexities of higher education financing in Florida can feel overwhelming. This guide provides a clear and concise overview of Florida’s student loan programs, encompassing eligibility criteria, repayment options, and available assistance programs. We’ll explore the legal landscape governing student loans in the state, offering insights into borrower protections and relevant regulations. Understanding these aspects is crucial for Florida students and graduates seeking to manage their student loan debt effectively.

From understanding the various loan programs offered by the state to exploring avenues for loan forgiveness and repayment assistance, this resource aims to empower Florida residents to make informed decisions about their student loan journey. We’ll delve into the economic implications of student loan debt on Florida’s workforce and economy, highlighting initiatives designed to mitigate its impact. Through real-life case studies, we’ll showcase the diverse experiences of Florida student loan borrowers, providing relatable examples and valuable lessons learned.

Florida Student Loan Programs

The State of Florida doesn’t directly offer its own student loan programs in the same way the federal government does. Instead, Florida focuses on grant programs and financial aid resources to assist students in paying for higher education. While there aren’t state-sponsored loans with specific names and applications like “Florida Student Loan Program A” or “Florida Student Loan Program B,” understanding the available financial aid options is crucial for Florida students. This information will clarify the resources available through the state to help fund education.

Available Financial Aid Resources for Florida Students

Florida offers various financial aid options to help students afford college. These options include grants, scholarships, and work-study programs, all administered through the Florida Student Financial Aid (FSA) website. These resources are vital for reducing the need for student loans and making college more accessible. The application process typically involves completing the Free Application for Federal Student Aid (FAFSA).

Florida’s Role in Federal Student Loan Programs

While Florida doesn’t have its own loan programs, it plays a significant role in facilitating access to federal student loan programs. The state actively promotes the use of federal loans and provides resources to help students understand and apply for them. This includes providing information about eligibility requirements, loan amounts, and repayment plans. Florida’s commitment to federal loan programs ensures students have access to a broader range of funding options.

Comparison of Federal Student Loan Programs Available to Florida Residents

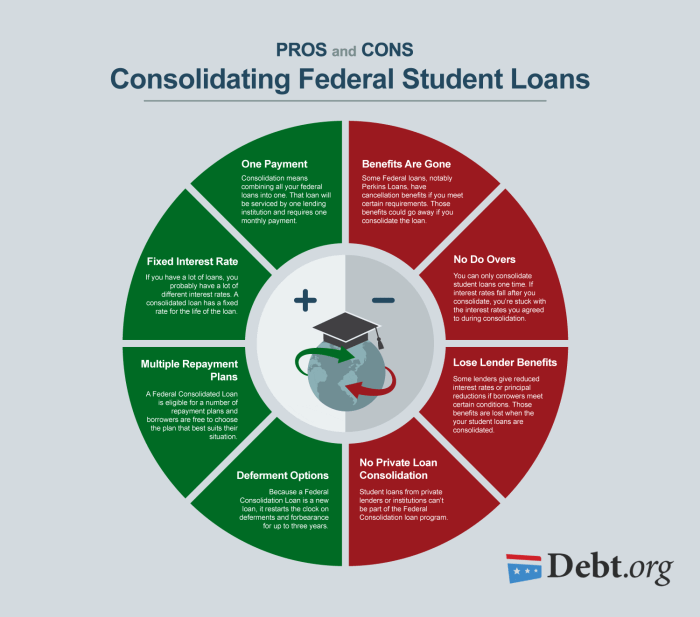

Florida residents have access to the same federal student loan programs as students in other states. These programs include Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for parents and graduate students), and Direct Consolidation Loans. Interest rates and repayment terms for these loans are determined by the federal government and vary depending on the loan type, the student’s credit history (for PLUS loans), and the year the loan was disbursed. For the most up-to-date information on interest rates and repayment terms, it’s essential to consult the official website of the Federal Student Aid (FSA). A sample comparison (note: these rates are subject to change and are for illustrative purposes only; check the official FSA website for current rates) might show a Direct Subsidized Loan having a lower interest rate than a Direct Unsubsidized Loan, and a Direct PLUS Loan potentially having a higher rate due to its credit-based assessment. Repayment options include standard repayment plans, graduated repayment plans, extended repayment plans, and income-driven repayment plans.

Application Process for Federal Student Loans

The application process for federal student loans begins with completing the FAFSA. This form collects information about the student’s financial situation and academic goals. Once the FAFSA is processed, students will receive a Student Aid Report (SAR) summarizing their eligibility for federal aid. Based on this report, students can then apply for the specific federal student loan programs for which they qualify. Required documentation may include tax returns, W-2 forms, and other financial records. Deadlines for FAFSA submission vary each year; it is crucial to check the FSA website for the most up-to-date deadlines.

| Program Name | Eligibility Requirements | Loan Amount Limits | Repayment Options |

|---|---|---|---|

| Direct Subsidized Loan | Demonstrated financial need, enrolled at least half-time | Varies based on cost of attendance and financial need | Standard, Graduated, Extended, Income-Driven |

| Direct Unsubsidized Loan | Enrolled at least half-time | Varies based on cost of attendance | Standard, Graduated, Extended, Income-Driven |

| Direct PLUS Loan | Credit check required; parent or graduate student | Cost of attendance minus other aid | Standard, Extended |

| Direct Consolidation Loan | Have multiple federal student loans | Total amount of existing loans | Standard, Graduated, Extended, Income-Driven |

Loan Forgiveness and Repayment Assistance Programs in Florida

Navigating student loan repayment can be challenging, but Florida offers several programs designed to alleviate the burden for its residents. These programs provide varying degrees of assistance, from loan forgiveness opportunities to flexible repayment plans. Understanding the eligibility criteria and application processes is crucial for borrowers seeking relief.

Unfortunately, Florida does not currently have state-sponsored loan forgiveness programs specifically targeted at Florida residents. While the federal government offers several loan forgiveness programs (such as Public Service Loan Forgiveness and Teacher Loan Forgiveness), eligibility often hinges on factors beyond simply being a Florida resident. These federal programs generally require specific types of employment and sustained repayment periods.

Federal Loan Forgiveness Programs Applicable to Florida Residents

While Florida lacks state-specific loan forgiveness programs, Florida residents can still benefit from various federal programs. It’s essential to thoroughly research the eligibility requirements for each program, as they often have stringent criteria.

- Public Service Loan Forgiveness (PSLF): Requires 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a government organization or a non-profit organization. Eligibility is dependent on the type of loan and the employer.

- Teacher Loan Forgiveness: For teachers who have completed five years of full-time service in a low-income school or educational service agency. Specific requirements exist concerning the type of loan and the nature of the teaching position.

- Income-Driven Repayment (IDR) Plans: These plans are not forgiveness programs per se, but they can significantly reduce monthly payments based on income and family size, potentially leading to loan forgiveness after 20 or 25 years, depending on the plan. Eligibility is based on income and family size.

Income-Driven Repayment Plans in Florida

Income-driven repayment (IDR) plans are a crucial resource for borrowers struggling with student loan repayments. These plans adjust monthly payments based on your income and family size, making them more manageable for those facing financial hardship. Several IDR plans are available through the federal government, and borrowers can choose the plan that best suits their individual circumstances.

The impact of IDR plans can be substantial. Lower monthly payments free up funds for other essential expenses, reducing financial stress and improving overall financial stability. While IDR plans don’t erase the debt, they can make repayment significantly more achievable and potentially lead to loan forgiveness after a significant repayment period.

Applying for Repayment Assistance in Florida

The process for applying for repayment assistance, such as an IDR plan, is primarily handled through the federal student aid system. Florida does not have a separate state-level application process for these federal programs.

The following flowchart illustrates the general process:

(Note: A visual flowchart would be included here in a real document. The flowchart would depict the steps: 1. Determine eligibility for an IDR plan; 2. Gather necessary documentation (income verification, family size information); 3. Apply online through the Federal Student Aid website (StudentAid.gov); 4. Review and accept the repayment plan; 5. Make monthly payments according to the adjusted plan.)

State-Specific Regulations and Laws Governing Student Loans

Navigating the world of student loans in Florida requires understanding the specific regulations and laws that govern borrowing, lending, and repayment. These state-level rules complement federal regulations and offer additional protections or stipulations for borrowers. This section will Artikel key aspects of Florida’s student loan landscape.

Florida, like other states, has implemented various laws and regulations to protect student borrowers and ensure responsible lending practices. While the core principles align with federal guidelines, certain aspects are uniquely defined at the state level. Understanding these differences is crucial for both borrowers and lenders.

Key Florida Regulations and Laws Governing Student Loans

Several key regulations and laws in Florida directly impact student loan borrowers. These laws aim to protect borrowers from predatory lending practices and ensure transparency in the loan process. While not exhaustive, the following list highlights some significant aspects:

- Florida’s Deceptive and Unfair Trade Practices Act: This act prohibits deceptive and unfair practices in the student loan industry, providing a legal recourse for borrowers who believe they have been misled or mistreated by lenders.

- State-Specific Licensing and Registration Requirements for Lenders: Florida maintains specific licensing and registration requirements for institutions providing student loans within the state. This regulatory framework helps ensure that lenders meet certain standards of competence and ethical conduct.

- Collection Practices: Florida, like many states, has laws governing the collection practices of student loan servicers. These laws aim to prevent harassment and ensure fair treatment of borrowers during the collection process.

- Disclosure Requirements: Florida mandates specific disclosures from lenders regarding loan terms, fees, and repayment options. This transparency is designed to empower borrowers to make informed decisions.

Legal Protections Afforded to Florida Student Loan Borrowers

Florida’s legal framework offers several key protections for student loan borrowers. These protections are designed to prevent predatory lending and ensure fair treatment throughout the loan lifecycle.

Borrowers are protected from unfair lending practices through laws like the Deceptive and Unfair Trade Practices Act. They also benefit from state-mandated disclosures that ensure transparency in loan terms and conditions. Additionally, regulations governing collection practices help prevent abusive debt collection methods.

Comparison of Florida’s Student Loan Regulations with Other States

While many states share similar goals in regulating student loans, the specific approaches and legal frameworks vary. Some states may have stricter regulations on interest rates or collection practices than others. For instance, some states have implemented specific programs to help borrowers struggling with student loan debt, while others may have more stringent licensing requirements for lenders.

A direct comparison requires a detailed analysis of each state’s specific legislation, which is beyond the scope of this overview. However, it’s important to note that the overall aim across states is generally consistent: to protect borrowers and promote responsible lending practices. Differences primarily lie in the specific mechanisms and enforcement employed to achieve these goals.

Resources and Support for Florida Student Loan Borrowers

Navigating the complexities of student loan repayment can be challenging. Fortunately, numerous resources are available to Florida residents facing difficulties with their student loans. These resources offer a range of services, from financial counseling and repayment assistance to information about state-specific regulations and available forgiveness programs. Understanding these options is crucial for borrowers seeking to manage their debt effectively and avoid default.

Directory of Resources for Florida Student Loan Borrowers

The following table provides a directory of organizations offering assistance to Florida student loan borrowers. It’s important to note that services and contact information may change, so it’s recommended to verify details directly with the organization before seeking assistance.

| Organization Name | Contact Information | Services Offered |

|---|---|---|

| Florida Department of Education | Website: [Insert Florida Department of Education Website Address] Phone: [Insert Florida Department of Education Phone Number] |

Information on state student loan programs, repayment plans, and resources. |

| Federal Student Aid (FSA) | Website: studentaid.gov Phone: 1-800-4-FED-AID (1-800-433-3243) |

Information on federal student loans, repayment plans, income-driven repayment, loan forgiveness programs (e.g., Public Service Loan Forgiveness), and loan consolidation. |

| National Foundation for Credit Counseling (NFCC) | Website: [Insert NFCC Website Address] Phone: [Insert NFCC Phone Number or a general helpline number] |

Financial counseling, debt management plans, credit counseling, and budgeting assistance. They can help borrowers explore options and create a repayment strategy. |

| Consumer Credit Counseling Service (CCCS) | Website: [Insert CCCS Website Address] Phone: [Insert CCCS Phone Number or a general helpline number] |

Similar services to NFCC, offering debt management plans and financial education. They may also provide referrals to other relevant resources. |

| Local Non-profit Credit Counseling Agencies | (Information varies by location; search online for “credit counseling [your city/county, Florida]”) | Often offer free or low-cost financial counseling and debt management services tailored to local needs. |

Financial Assistance and Counseling Services for Struggling Borrowers

Many organizations provide financial assistance and counseling services to borrowers experiencing difficulty repaying their student loans. These services can include:

Financial counseling helps borrowers understand their financial situation, create a budget, and explore different repayment options. Counselors can provide personalized guidance based on individual circumstances and financial goals. This can be particularly helpful for borrowers who feel overwhelmed by their debt or unsure of how to proceed.

Repayment assistance programs may offer temporary or permanent reductions in monthly payments, extended repayment periods, or even loan forgiveness under specific circumstances. Eligibility requirements vary depending on the program and the type of loan.

Debt management plans help borrowers consolidate multiple debts into a single monthly payment, often at a lower interest rate. This can simplify repayment and make it more manageable. However, it’s crucial to carefully review the terms and conditions of any debt management plan before enrolling.

Loan forgiveness programs, while limited, offer the possibility of having a portion or all of a student loan balance forgiven under certain conditions, such as working in public service or teaching in underserved areas. These programs typically have strict eligibility requirements and application processes.

Illustrative Examples of Student Loan Experiences in Florida

Understanding the diverse realities of student loan debt in Florida requires examining individual experiences. The following case studies highlight the challenges and coping mechanisms employed by borrowers navigating the complexities of repayment. These examples are not exhaustive but serve to illustrate the broad spectrum of situations faced by Florida residents.

Case Study 1: The Aspiring Teacher

Maria, a recent graduate of the University of South Florida with a degree in Elementary Education, accumulated approximately $40,000 in federal student loans during her four years of study. She secured a teaching position in a low-income school district in Miami-Dade County, earning a starting salary of $42,000 annually. While grateful for her job, Maria quickly realized the significant burden of her student loan debt. Her monthly payments, even under an income-driven repayment plan, consumed a substantial portion of her income, leaving little room for savings, investments, or other financial goals. She found herself constantly stressed about making ends meet, often foregoing necessary expenses to prioritize loan repayments. Maria’s emotional well-being suffered, and she considered delaying major life decisions such as buying a home or starting a family due to her financial constraints. She actively sought resources such as financial counseling and explored options for loan forgiveness programs specific to teachers in Florida.

Case Study 2: The Entrepreneur

David, a graduate of Florida International University with a degree in Business Administration, took out both federal and private student loans totaling $75,000 to fund his education. After graduation, he decided to pursue his entrepreneurial dreams by starting his own tech company in Orlando. In the early years, his income was inconsistent, making consistent student loan payments challenging. He experienced periods of delinquency, resulting in negative impacts on his credit score. The emotional toll of juggling business challenges with the pressure of student loan debt was significant, causing him considerable stress and anxiety. David eventually found success with his company, but the financial burden of his student loans significantly delayed his ability to invest in his business’s growth and his personal financial security. He eventually consolidated his loans to achieve a lower interest rate and extended repayment term, providing some much-needed financial breathing room.

Case Study 3: The Unexpected Medical Emergency

Sarah, a graduate of Florida State University with a degree in Nursing, had diligently repaid her $30,000 in student loans for several years. She was on track to pay off her debt within a reasonable timeframe. However, an unexpected medical emergency for a family member resulted in significant out-of-pocket medical expenses. Sarah had to temporarily halt her student loan payments to cover these critical costs. This unexpected financial setback caused significant emotional distress and threatened her previously stable financial situation. She worked with her loan servicer to explore options such as forbearance or deferment to manage her payments during this challenging period. This experience underscored the vulnerability of borrowers to unforeseen circumstances and the importance of having a financial safety net to mitigate the impact of such events.

Summary

Successfully managing student loan debt requires proactive planning and a thorough understanding of available resources. This guide has provided a comprehensive overview of the Florida student loan landscape, equipping readers with the knowledge to navigate the system effectively. By understanding the various programs, assistance options, and legal protections available, Florida students and graduates can approach their financial future with greater confidence and clarity. Remember to utilize the resources and support networks detailed within this guide to ensure a smoother and more manageable repayment process.

General Inquiries

What happens if I can’t make my student loan payments?

Contact your loan servicer immediately. They can discuss options like deferment, forbearance, or income-driven repayment plans to help you manage your payments.

Are there any penalties for early repayment of my Florida student loan?

Generally, there are no penalties for early repayment, but it’s always best to check your loan agreement for specific terms.

Can I consolidate my multiple Florida student loans?

Yes, loan consolidation may be possible. Check with your loan servicer or a financial advisor to determine the best approach for your situation.

Where can I find more information about Florida’s student loan programs?

The Florida Department of Education website is a good starting point for comprehensive information.