The weight of student loan debt in the United States is a significant concern, impacting millions of individuals and the nation’s economy. This pervasive issue affects borrowers across diverse demographics, influencing major life decisions and long-term financial stability. Understanding the current landscape of student loan debt, available repayment options, and the broader economic implications is crucial for both borrowers and policymakers alike.

This analysis delves into the multifaceted nature of the student loan crisis, examining statistical trends, exploring various repayment plans, and evaluating the impact on personal finances and the national economy. We will also review government policies, potential solutions, and offer a reasoned perspective on the future trajectory of student loan debt in America.

Current Student Loan Debt Landscape

The student loan debt crisis in the United States is a significant economic and social issue, impacting millions of borrowers and contributing to broader economic inequality. Understanding the current landscape requires examining the overall debt burden, its distribution across various demographics, and the characteristics of different loan types.

The total amount of student loan debt in the United States is staggering. While precise figures fluctuate, it consistently remains in the trillions of dollars. Millions of Americans are burdened by student loan payments, impacting their ability to save for retirement, purchase homes, and build financial security. The average loan amount varies depending on factors like the degree pursued and the institution attended, but generally reflects a substantial financial commitment.

Student Loan Debt Demographics

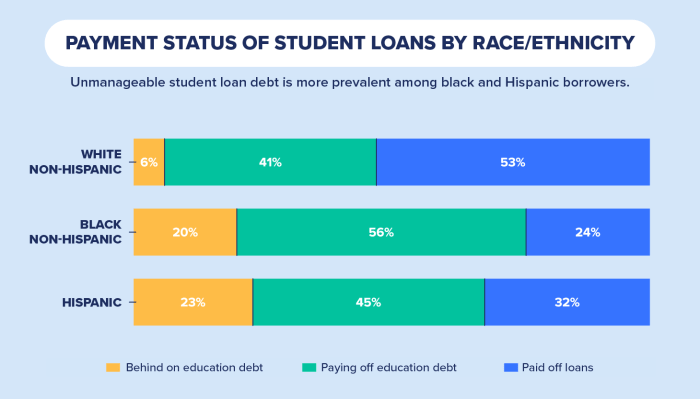

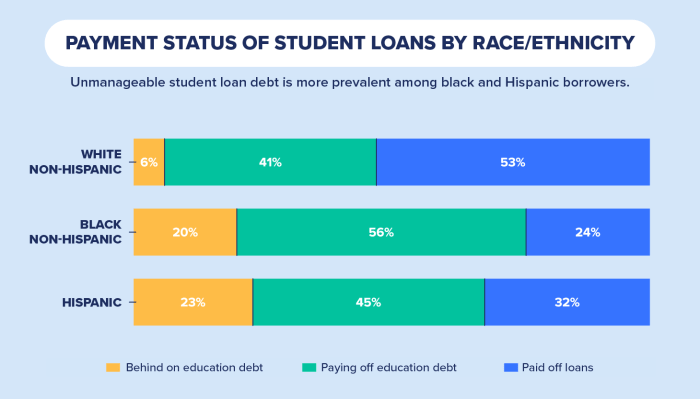

The distribution of student loan debt is not uniform across the population. Several demographic factors significantly influence both the amount of debt accrued and the challenges faced in repayment. The following table illustrates these disparities:

| Demographic | Average Debt | Percentage of Borrowers | Relevant Trends |

|---|---|---|---|

| Age 25-34 | $37,500 (estimated) | High | This age group carries a disproportionately large share of the debt, often facing challenges balancing loan repayment with career establishment and family formation. |

| Lower Income Households | Varies greatly, but often higher relative to income | Significant | Borrowers from lower-income households may face greater difficulty repaying loans due to limited financial resources and fewer opportunities for high-paying jobs. |

| Graduate Degree Holders | Significantly higher than undergraduate borrowers | Growing | The pursuit of advanced degrees often involves substantial additional borrowing, leading to higher overall debt burdens. |

| Minority Groups | Often higher than white borrowers | Significant | Systemic inequalities in access to higher education and career opportunities contribute to higher debt levels for minority borrowers. |

Types of Student Loans and Repayment

Student loans are broadly categorized into federal and private loans. Federal loans, offered by the government, generally offer more favorable terms and repayment options than private loans, which are provided by banks and other financial institutions.

Federal student loans typically include subsidized and unsubsidized loans, with varying interest rates and repayment plans (Standard, Graduated, Extended, Income-Driven Repayment). Subsidized loans do not accrue interest while the borrower is in school, whereas unsubsidized loans accrue interest throughout the loan term. Income-Driven Repayment plans adjust monthly payments based on the borrower’s income and family size.

Private student loans, on the other hand, have more variable interest rates, often higher than federal loan rates, and may offer fewer repayment options. The terms and conditions of private loans are determined by the lender and can be significantly less favorable for borrowers. Understanding the differences between these loan types is crucial for making informed borrowing decisions and navigating the repayment process effectively.

Repayment Plans and Options

Navigating the complexities of student loan repayment can feel overwhelming. Understanding the various repayment plans available is crucial to managing your debt effectively and minimizing long-term costs. Choosing the right plan depends on your individual financial situation, income, and long-term goals.

Several income-driven repayment (IDR) plans are designed to make monthly payments more manageable by basing them on your discretionary income. These plans offer varying degrees of loan forgiveness after a set period of qualifying payments, but they also come with trade-offs, such as potentially longer repayment periods and higher overall interest paid.

Income-Driven Repayment Plans

Several income-driven repayment plans are available to federal student loan borrowers. The specific details and eligibility requirements can vary, so it’s important to check the Federal Student Aid website for the most up-to-date information. However, some common plans include:

- Income-Driven Repayment (IDR): This is a general term encompassing several plans. Payments are calculated based on your income and family size.

- Pay As You Earn (PAYE): Your monthly payment is calculated as 10% of your discretionary income. After 20 years of qualifying payments, any remaining balance is forgiven.

- Revised Pay As You Earn (REPAYE): Similar to PAYE, but it includes both undergraduate and graduate loans in the calculation. Forgiveness is also available after 20 or 25 years, depending on loan type.

- Income-Based Repayment (IBR): This plan offers two versions (IBR and ICR). Payments are based on your income and loan amount, with forgiveness potentially available after 20 or 25 years.

- Income-Contingent Repayment (ICR): Payments are calculated based on your income and family size, with a repayment period of up to 25 years. Any remaining balance may be forgiven after 25 years.

Comparison of Repayment Plans

Choosing the right repayment plan involves weighing the benefits and drawbacks of each option. Factors to consider include monthly payment amount, total interest paid, and the potential for loan forgiveness.

For example, an income-driven plan might result in lower monthly payments, making it easier to manage your budget. However, the extended repayment period can lead to significantly higher total interest paid over the life of the loan. Conversely, a standard repayment plan might have higher monthly payments but a shorter repayment period, resulting in less interest paid overall. Loan forgiveness is a significant benefit of IDR plans, but it’s crucial to understand the long-term implications, including the potential tax liability on forgiven amounts.

Hypothetical Repayment Scenario

Let’s consider a borrower with $50,000 in student loans and an annual income of $40,000. The following table illustrates how different repayment plans might affect their monthly payments and total repayment costs (Note: These are simplified examples and actual payments may vary based on individual circumstances and current interest rates. Consult the Federal Student Aid website for accurate calculations.):

| Repayment Plan | Estimated Monthly Payment | Estimated Total Repayment (over 20 years) |

|---|---|---|

| Standard Repayment | $300 | $72,000 |

| PAYE | $100 | $24,000 (with potential forgiveness of remaining balance) |

| REPAYE | $150 | $36,000 (with potential forgiveness of remaining balance) |

Impact of Student Loan Debt on Individuals and the Economy

The burden of student loan debt extends far beyond the monthly payment, significantly impacting borrowers’ financial well-being and shaping macroeconomic trends. The sheer scale of this debt affects individuals’ ability to achieve key financial milestones and influences broader economic indicators, creating a ripple effect throughout the economy.

The weight of student loan repayments can severely restrict borrowers’ financial freedom. This impacts their ability to save for the future, purchase a home, and adequately plan for retirement. The persistent pressure of loan repayments often forces difficult choices, diverting funds that could otherwise be invested in long-term growth and security.

Effects on Personal Finances

Student loan debt frequently delays or prevents major life milestones. The considerable monthly payments often leave little room for savings, making homeownership a distant prospect for many. For example, a recent study showed that borrowers with significant student loan debt are significantly less likely to own a home compared to their debt-free counterparts. This financial strain also impacts retirement planning; the necessity of prioritizing loan repayments often reduces contributions to retirement accounts, potentially jeopardizing financial security in later life. Furthermore, building an emergency fund becomes a challenge, leaving borrowers vulnerable to unforeseen financial difficulties.

Influence on Life Decisions

The presence of substantial student loan debt significantly influences major life decisions. Delaying marriage or starting a family is a common consequence, as the added financial burden can feel insurmountable. Career choices may also be affected, with borrowers potentially prioritizing higher-paying jobs over those aligned with their passions, if the latter offer lower salaries and do not adequately offset loan repayments. The need to manage student loan debt can create stress and uncertainty, impacting overall well-being and mental health.

Macroeconomic Implications

High levels of student loan debt exert a considerable influence on the macroeconomic landscape. The substantial repayments divert consumer spending away from other sectors of the economy, hindering overall economic growth. This reduced consumer spending can negatively impact businesses and industries that rely on consumer demand. Furthermore, the accumulation of student loan debt contributes to overall financial instability, as it represents a significant portion of household debt. This can create systemic risk and potentially trigger wider financial crises if borrowers are unable to manage their repayments, leading to defaults and economic uncertainty. For instance, the high default rates observed in certain periods highlight the vulnerability of the economy to a widespread student loan debt crisis.

Government Policies and Initiatives Related to Student Loans

The student loan debt crisis in the United States has prompted numerous government interventions over the past two decades. These policies, while aiming to alleviate the burden on borrowers, have varied in their effectiveness and have evolved in response to changing economic conditions and political priorities. Understanding these policies is crucial to assessing the overall impact on borrowers and the economy.

The federal government’s role in student lending is extensive, encompassing loan origination, disbursement, and repayment programs. These programs are designed to make higher education more accessible, but their impact on individual borrowers and the broader economy is a subject of ongoing debate. The effectiveness of these programs hinges on several factors, including the design of repayment plans, the availability of income-driven repayment options, and the overall economic climate.

Key Federal Policies and Programs

The federal government offers a range of programs designed to assist students in financing their education and managing their debt. These include the Federal Perkins Loan Program, the Federal Stafford Loan Program (subsidized and unsubsidized), and the Federal PLUS Loan Program for parents and graduate students. Beyond these direct loan programs, the government also offers various repayment plans, such as income-driven repayment (IDR) plans and loan forgiveness programs for specific professions, like teaching and public service. These programs are administered by the Department of Education and aim to balance the goal of making higher education affordable with the need for responsible lending practices.

Comparison of Past and Present Government Initiatives

Historically, government initiatives focused primarily on expanding access to student loans with less emphasis on comprehensive repayment assistance. Early programs primarily offered fixed repayment plans, often leaving borrowers struggling to manage debt in the face of economic downturns or unexpected life events. More recent initiatives, however, have placed greater emphasis on income-driven repayment plans, which tie monthly payments to a borrower’s income and often lead to loan forgiveness after a specified period of repayment. While IDR plans have been lauded for offering more flexibility and affordability, they have also been criticized for their complexity and potential for extending the repayment period significantly, increasing the total interest paid over the life of the loan. For example, the shift from primarily fixed-repayment plans to the broader adoption of income-driven repayment represents a notable change in approach. The long-term effectiveness of these newer approaches is still being evaluated.

Timeline of Government Policies (2003-2023)

The following timeline highlights significant changes in federal student loan policies over the past two decades:

| Year | Policy Change/Event | Description |

|---|---|---|

| 2003 | Creation of the College Cost Reduction and Access Act | Increased Pell Grant funding and made several changes to student loan programs, including the introduction of more income-driven repayment options. |

| 2007-2008 | Financial Crisis and its impact on student loan borrowers | The financial crisis impacted employment prospects for recent graduates, leading to increased loan defaults and a heightened focus on repayment assistance programs. |

| 2009 | American Recovery and Reinvestment Act | Provided significant funding for student aid, including loan forgiveness programs and increased Pell Grant funding. |

| 2010 | The Health Care and Education Reconciliation Act of 2010 | Made further adjustments to student loan programs, including changes to income-driven repayment plans. |

| 2015 | Expansion of Income-Driven Repayment (IDR) plans | Several improvements and modifications were made to existing IDR plans to enhance their accessibility and affordability. |

| 2020-2023 | COVID-19 Pandemic and Student Loan Payment Pause | The pandemic led to a series of temporary pauses on student loan payments, highlighting the vulnerability of borrowers during economic uncertainty. Subsequent proposals for broad loan forgiveness were also debated extensively. |

Potential Solutions and Future Outlook

The student loan debt crisis demands immediate and comprehensive solutions. While the current landscape is complex, several potential avenues exist for mitigating the burden and preventing future escalation. These range from targeted relief programs to fundamental reforms of the higher education financing system itself. Ignoring the problem carries significant long-term risks for both individuals and the national economy.

The severity of the student loan debt crisis necessitates a multi-pronged approach. A solely reactive strategy, focused only on addressing existing debt, is insufficient. Proactive measures are crucial to prevent a recurrence and to ensure future generations have access to affordable higher education without accumulating crippling debt. This requires a holistic examination of the current system, from tuition costs to repayment options.

Loan Forgiveness Programs and Targeted Relief

Loan forgiveness programs, while controversial, offer direct relief to borrowers. The potential benefits include immediate economic stimulus for borrowers, allowing them to increase spending and investment. However, the cost to taxpayers is substantial, and such programs often face criticism for potentially disproportionately benefiting higher earners. A more targeted approach, focusing on borrowers facing extreme hardship or those in specific fields with high social value (e.g., teachers, nurses), could offer a more equitable and fiscally responsible solution. For example, a program forgiving a portion of loans for borrowers working in public service for a set number of years could incentivize entry into critical professions while controlling costs.

Interest Rate Reductions and Repayment Reform

Lowering interest rates on student loans would directly reduce the overall cost of borrowing, making repayment more manageable for borrowers. This could be coupled with reforms to repayment plans, such as extending repayment terms or implementing income-driven repayment (IDR) plans that tie monthly payments to a borrower’s income. The success of IDR plans hinges on their accessibility and clarity, ensuring borrowers understand their options and can easily enroll. However, lower interest rates may require government subsidies, impacting the national budget. Successfully implementing these changes requires careful consideration of their fiscal implications and the need for transparent communication to borrowers.

Reforms to Higher Education Financing

Addressing the root causes of the student loan debt crisis requires fundamental reforms to the higher education financing system. This includes exploring alternative funding models, such as increased government grants and scholarships, to reduce reliance on loans. Investing in affordable community colleges and vocational training programs can provide accessible and less expensive pathways to skilled employment, reducing the need for expensive four-year degrees. Furthermore, greater transparency in tuition costs and financial aid packages is essential to empower students to make informed decisions about their education. Examples of successful models could be drawn from other countries with robust public funding for higher education, analyzing their effectiveness and applicability to the US context.

Long-Term Consequences of Inaction

Failure to address the student loan debt crisis will have significant long-term consequences. The economy could suffer from reduced consumer spending and investment as borrowers struggle to repay their loans. This could hinder economic growth and exacerbate income inequality. Furthermore, the burden of student loan debt can delay major life milestones, such as homeownership and starting a family, impacting individual well-being and societal progress. The potential for widespread defaults could destabilize the financial system, similar to the subprime mortgage crisis, though on a different scale. The long-term effects could also include a decline in higher education enrollment, impacting national competitiveness and innovation.

Prediction for the Future of Student Loan Debt

Predicting the future of student loan debt is challenging, but current trends suggest a continued rise in outstanding debt unless significant policy changes are implemented. Without substantial reforms, the crisis will likely worsen, leading to increased defaults and economic stagnation. However, the implementation of effective solutions, such as those discussed above, could significantly alter this trajectory. The political landscape and economic conditions will play a crucial role in shaping the future of student loan debt, making accurate prediction difficult. However, proactive and comprehensive policy changes offer the best chance of mitigating the crisis and ensuring a more sustainable and equitable higher education financing system.

Epilogue

Navigating the complexities of student loan debt requires a comprehensive understanding of the available resources and options. While the challenges are substantial, proactive engagement with repayment strategies, coupled with informed policy decisions, can mitigate the long-term consequences of this pervasive issue. Ultimately, a multi-pronged approach addressing both individual financial planning and broader systemic reforms is necessary to alleviate the burden of student loan debt and foster a more equitable future for borrowers.

Q&A

What happens if I default on my student loans?

Defaulting on federal student loans can lead to wage garnishment, tax refund offset, and damage to your credit score, making it difficult to obtain loans or credit in the future.

Can I consolidate my student loans?

Yes, consolidating federal student loans simplifies repayment by combining multiple loans into one. However, this may not always lower your interest rate.

Are there any programs for loan forgiveness?

Several income-driven repayment plans offer loan forgiveness after a set number of payments, while other programs, like Public Service Loan Forgiveness (PSLF), may forgive loans for those working in public service.

What is the difference between federal and private student loans?

Federal loans offer more borrower protections and repayment options, while private loans often have higher interest rates and fewer protections.