The decision to stop paying student loans is a significant one, fraught with both immediate and long-term consequences. This exploration delves into the multifaceted implications of this choice, examining the legal ramifications, financial repercussions, and the often-overlooked emotional toll. We will navigate the complexities of navigating loan servicers, exploring alternative solutions, and understanding the broader societal impact of student loan debt.

From understanding the potential for wage garnishment and credit damage to exploring options like income-driven repayment plans and debt consolidation, we aim to provide a comprehensive overview. We will also address the psychological burden of significant debt and offer resources for coping with the stress involved.

The Legal Ramifications of Stopping Student Loan Payments

Defaulting on student loans carries significant legal and financial consequences. Understanding these ramifications is crucial for borrowers considering ceasing payments. Failure to make payments as agreed upon can lead to a cascade of negative effects impacting credit scores, financial stability, and even future employment prospects.

Potential Legal Consequences of Default

Ceasing student loan payments without a legally approved deferment or forbearance plan results in default. This has several serious legal consequences. Your credit score will plummet, making it difficult to obtain loans, credit cards, or even rent an apartment. The government or your loan servicer can garnish your wages, seize your tax refunds, and even take legal action to levy your bank accounts. Furthermore, default can impact your ability to obtain professional licenses in some fields. The specific consequences vary depending on the type of loan (federal or private) and the amount owed. For federal loans, the Department of Education has extensive powers to pursue collection. For private loans, collection agencies may be employed, leading to aggressive collection tactics.

Loan Servicer Collection Methods

Loan servicers and government agencies employ various collection methods to recover defaulted student loan debt. These methods can range from sending numerous letters and phone calls to more aggressive actions. Wage garnishment involves a portion of your paycheck being automatically deducted to repay the debt. Tax refund offset diverts your tax refund directly to the loan servicer. Bank levy allows the government to seize funds directly from your bank account. Legal action, including lawsuits, may be taken to obtain a court judgment and further enforce collection. These actions can significantly disrupt your financial life and lead to substantial additional fees and penalties.

Negotiating with Loan Servicers for Alternative Payment Plans

Negotiating with your loan servicer for an alternative payment plan is a crucial step in avoiding default. The process typically begins by contacting your loan servicer directly to discuss your financial situation. Be prepared to provide documentation supporting your claim of financial hardship, such as pay stubs, tax returns, or medical bills. Explain your circumstances clearly and honestly, proposing a realistic repayment plan that aligns with your current financial capabilities. Explore options like income-driven repayment plans (IDR), which adjust your monthly payments based on your income and family size. Be persistent and document all communication with the loan servicer. If your initial proposal is rejected, you may need to revise your plan or seek assistance from a non-profit credit counseling agency.

Comparison of Repayment Options

| Repayment Option | Advantages | Disadvantages | Eligibility |

|---|---|---|---|

| Standard Repayment | Fixed monthly payments, predictable payoff timeline | High monthly payments, may be unaffordable for some | All federal student loans |

| Income-Driven Repayment (IDR) | Lower monthly payments based on income, potential loan forgiveness after 20-25 years | Longer repayment timeline, may result in higher total interest paid | All federal student loans |

| Extended Repayment | Lower monthly payments than standard repayment | Longer repayment timeline, may result in higher total interest paid | All federal student loans |

| Graduated Repayment | Lower initial payments, gradually increasing over time | Payments increase over time, may become unaffordable later | All federal student loans |

The Financial Impact of Halting Student Loan Payments

Choosing to stop making student loan payments carries significant and long-lasting financial consequences. Defaulting on these loans can severely damage your creditworthiness and impact your ability to secure future financial opportunities. Understanding these repercussions is crucial before making such a decision.

The ramifications of student loan default extend far beyond a simple missed payment. Defaulting triggers a cascade of negative events that can significantly hinder your financial well-being for years to come. These consequences are not easily reversed and can make it exceptionally difficult to rebuild your financial stability.

Credit Score Damage

Defaulting on student loans will dramatically lower your credit score. This score is a crucial factor in determining your eligibility for various financial products, including mortgages, auto loans, and even credit cards. A significantly lower credit score translates to higher interest rates on future borrowing, meaning you’ll pay substantially more over the life of any loan. The impact on your credit report will remain for seven years, significantly impacting your ability to access favorable credit terms for an extended period. For example, someone with a credit score of 750 might see that drop to below 600, resulting in a significantly higher interest rate on a future mortgage.

Wage Garnishment

The government has the authority to garnish your wages to recover defaulted student loan debt. This means a portion of your paycheck will be automatically deducted to satisfy the debt. Wage garnishment can severely limit your disposable income, making it challenging to meet your daily expenses and save for the future. The amount garnished can be substantial, depending on your income and the amount of the defaulted loan. This can lead to financial hardship and difficulty in managing essential living costs.

Impact on Future Borrowing

A defaulted student loan significantly impacts your ability to secure future loans. Lenders view defaults as a high risk, making it extremely difficult to qualify for mortgages, auto loans, or even personal loans. Even if you are approved, the interest rates will likely be significantly higher than those offered to individuals with a clean credit history. This can prevent you from making major life purchases such as a home or a car, significantly impacting your financial and personal well-being. For instance, an individual attempting to secure a mortgage after a student loan default may be denied outright or offered a loan with an interest rate several percentage points higher, leading to thousands of dollars in extra costs over the life of the loan.

Interest Capitalization

When a student loan is in default, interest continues to accrue. This accrued interest is often capitalized, meaning it’s added to the principal balance of the loan. This increases the total amount owed, making the debt even harder to repay. Let’s consider a hypothetical scenario: Suppose you have a $20,000 defaulted student loan with a 7% interest rate. After one year of non-payment, the accrued interest would be $1400. If this interest is capitalized, your new principal balance becomes $21,400. The next year’s interest will be calculated on this higher amount, leading to an even larger increase in the total debt. This snowball effect can quickly lead to an unmanageable debt burden.

Resources for Managing Student Loan Debt

Understanding your options is critical to managing your student loan debt effectively. Several resources can provide assistance:

Several government agencies and non-profit organizations offer guidance and support for individuals struggling with student loan repayment. These resources can help you explore options such as income-driven repayment plans, loan consolidation, and deferment or forbearance. Utilizing these services can help you navigate the complexities of student loan repayment and potentially avoid default.

- The Federal Student Aid website (studentaid.gov): This website provides comprehensive information on federal student loans, repayment options, and resources for borrowers.

- The National Foundation for Credit Counseling (NFCC): The NFCC offers free and low-cost credit counseling services, including assistance with student loan debt management.

- Your loan servicer: Contacting your loan servicer directly can help you understand your repayment options and explore potential solutions to avoid default.

Exploring Alternative Solutions to Student Loan Debt

Navigating the complexities of student loan debt often requires exploring options beyond simply making payments. Several strategies can alleviate the burden and potentially lead to a more manageable repayment plan. Understanding these alternatives is crucial for borrowers seeking long-term financial stability.

Many programs and strategies exist to help borrowers manage their student loan debt. These options vary in their eligibility requirements, benefits, and potential drawbacks, necessitating careful consideration based on individual circumstances. Effective debt management involves a multifaceted approach, encompassing both external resources and internal financial planning.

Loan Forgiveness Programs and Consolidation Options

Loan forgiveness programs, while limited in scope and eligibility, offer the potential for complete or partial debt cancellation. These programs often target specific professions (e.g., teachers, public service workers) or individuals who meet specific income requirements. For example, the Public Service Loan Forgiveness (PSLF) program forgives remaining federal student loan debt after 120 qualifying monthly payments under an income-driven repayment plan. Consolidation, on the other hand, combines multiple loans into a single loan with a potentially lower monthly payment. However, this might extend the repayment period, leading to higher overall interest paid. The benefits of consolidation include simplified payment management, but the drawbacks may include a potentially higher total interest paid over the life of the loan.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust monthly payments based on a borrower’s income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans offer lower monthly payments than standard repayment plans, potentially making them more manageable for borrowers with lower incomes. However, IDR plans often result in a longer repayment period and potentially higher total interest paid over the life of the loan due to the extended repayment timeline. For instance, a borrower on an IBR plan might have a significantly lower monthly payment but may end up paying considerably more in interest over 25 years compared to a 10-year standard repayment plan.

Resources and Strategies for Struggling Borrowers

Numerous resources are available to assist borrowers facing difficulties. Federal Student Aid (FSA) provides comprehensive information on repayment plans, loan forgiveness programs, and other assistance options. Non-profit credit counseling agencies offer free or low-cost guidance on budgeting, debt management, and exploring available repayment options. These agencies can help borrowers create a personalized debt management plan and negotiate with lenders for more favorable repayment terms. Furthermore, exploring options such as deferment or forbearance (temporary suspension of payments) can provide short-term relief, although interest may still accrue during these periods. It’s important to understand the terms and conditions of these options before utilizing them.

Budgeting and Financial Planning for Improved Debt Management

Effective budgeting and financial planning are critical for managing student loan debt. Creating a detailed budget that tracks income and expenses helps identify areas where spending can be reduced to allocate more funds toward loan payments. Financial planning tools, such as budgeting apps and spreadsheets, can assist in tracking progress and making informed financial decisions. Prioritizing high-interest debt and exploring debt avalanche or snowball methods can accelerate repayment and reduce overall interest paid. For example, the debt avalanche method prioritizes paying off the loan with the highest interest rate first, while the debt snowball method focuses on paying off the smallest loan first to build momentum and motivation. By combining effective budgeting with strategic debt repayment methods, borrowers can significantly improve their financial situation and accelerate their journey toward becoming debt-free.

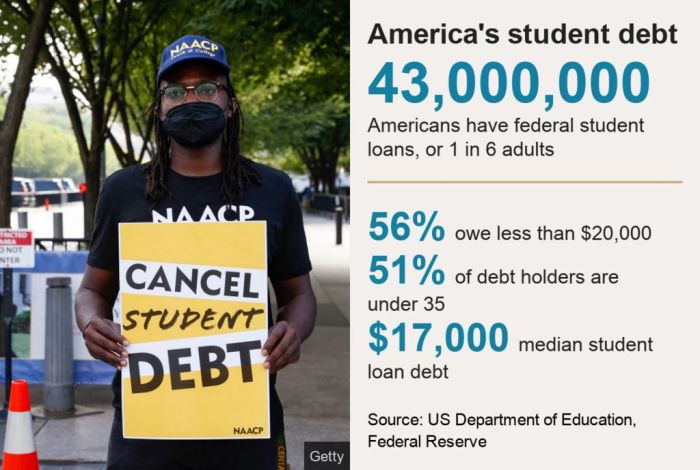

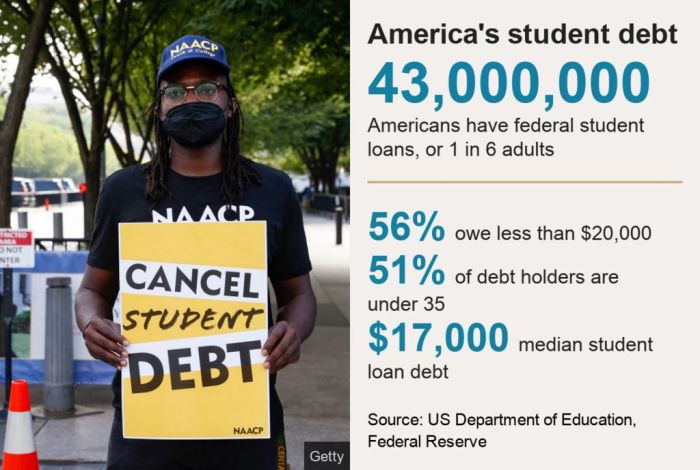

The Social and Economic Implications of Student Loan Debt

The crippling weight of student loan debt extends far beyond individual finances, significantly impacting social well-being and hindering overall economic growth. This debt acts as a drag on the economy, limiting consumer spending, delaying major life decisions, and perpetuating cycles of inequality. Understanding these far-reaching consequences is crucial for developing effective solutions.

The accumulation of substantial student loan debt significantly affects individual financial well-being. Borrowers often face difficulties in managing monthly payments, leading to financial stress and impacting their ability to save for retirement, emergencies, or other long-term goals. This financial strain can negatively affect mental health and overall quality of life. The constant pressure of loan repayments can limit opportunities for career advancement, entrepreneurship, and investment in personal development.

Impact on Life Milestones

High levels of student loan debt present considerable challenges for individuals aiming to achieve key life milestones. Homeownership, a cornerstone of the American Dream, becomes significantly more difficult to attain when a large portion of income is allocated to loan repayments. Similarly, starting a family is often delayed or forgone due to the financial burden of student loans, impacting family formation and population growth. Delayed marriage and parenthood are common consequences, with ripple effects on social structures and community development. For example, a recent study showed that individuals with over $50,000 in student loan debt were 20% less likely to purchase a home within five years of graduation compared to their debt-free counterparts.

Correlation Between Student Loan Debt and Socioeconomic Indicators

The following infographic illustrates the correlation between student loan debt and several key socioeconomic indicators.

Infographic Description: The infographic is a bar chart comparing average student loan debt levels across different income brackets. The x-axis represents income brackets (e.g., $0-$25,000, $25,000-$50,000, $50,000-$75,000, $75,000+), and the y-axis represents average student loan debt in thousands of dollars. The bars visually demonstrate a clear negative correlation: as income increases, average student loan debt tends to decrease, although it remains substantial even in higher income brackets. Additional data points included as smaller charts within the main bar chart illustrate the correlation between student loan debt and homeownership rates, marriage rates, and average savings. These smaller charts use a similar bar graph format, visually demonstrating lower rates of homeownership, marriage, and savings for individuals with higher student loan debt. The overall visual design employs a muted color palette to convey seriousness and employs clear, easy-to-understand labels.

Policy Recommendations to Address the Student Loan Debt Crisis

Addressing the student loan debt crisis requires a multifaceted approach involving both immediate relief and long-term systemic changes.

The following policy recommendations are crucial for mitigating the negative social and economic consequences of student loan debt:

- Increased funding for need-based grants and scholarships to reduce reliance on loans.

- Expansion of income-driven repayment plans to make monthly payments more affordable.

- Loan forgiveness programs targeted at specific professions or borrowers facing extreme hardship.

- Regulations to curb excessive tuition increases at colleges and universities.

- Investment in affordable higher education options, such as community colleges and online learning platforms.

- Improved financial literacy programs to educate students about responsible borrowing and debt management.

The Psychological Impact of Student Loan Debt

The weight of significant student loan debt extends far beyond the financial realm, profoundly impacting the mental and emotional well-being of borrowers. The constant pressure of repayment, coupled with the potential for financial instability, can lead to a range of debilitating psychological challenges, affecting overall quality of life and long-term mental health.

The stress associated with managing substantial student loan debt can manifest in various ways. Borrowers may experience heightened anxiety, persistent feelings of overwhelm, and difficulty concentrating on other aspects of their lives. Sleep disturbances, decreased appetite, and even physical symptoms like headaches and digestive issues are common. The pervasive nature of this financial burden can significantly impact self-esteem, fostering feelings of failure, shame, and hopelessness, particularly when repayment seems insurmountable. These feelings are often exacerbated by the societal pressure to achieve financial success and the perception that student loan debt represents a personal failing. The fear of default and its potential consequences – damaged credit, wage garnishment, and legal action – further intensifies the psychological burden.

Emotional and Mental Health Challenges

Student loan debt is strongly correlated with increased rates of depression and anxiety. Studies have shown a direct link between the level of debt and the severity of mental health symptoms. The constant worry about repayment can lead to chronic stress, which, over time, can negatively impact cardiovascular health and the immune system. The feeling of being trapped in a cycle of debt can lead to feelings of helplessness and a diminished sense of control over one’s life. This can manifest in difficulties forming and maintaining healthy relationships, as the stress of debt can strain personal connections. Furthermore, the inability to pursue personal goals or make major life decisions, such as buying a home or starting a family, due to financial constraints, contributes to feelings of frustration and resentment.

Coping Mechanisms and Available Resources

Effective coping mechanisms are crucial for managing the psychological toll of student loan debt. These include prioritizing self-care practices such as regular exercise, sufficient sleep, and mindful meditation. Connecting with a supportive network of friends, family, or support groups can provide emotional relief and practical advice. Seeking professional help from a therapist or counselor specializing in financial stress is also highly beneficial. Many therapists offer sliding-scale fees based on income, making mental health care more accessible. Financial counseling services can help borrowers develop a realistic repayment plan and explore debt management strategies, reducing the emotional burden associated with financial uncertainty.

Long-Term Psychological Effects of Student Loan Default

Defaulting on student loans can have devastating long-term psychological consequences. Beyond the immediate financial repercussions, the stigma associated with default can significantly impact self-esteem and create a sense of shame and failure. The constant fear of legal action and collection efforts can lead to chronic anxiety and sleep disturbances. The inability to access credit or secure future financial opportunities can limit life choices and contribute to feelings of hopelessness and despair. The impact on relationships can also be significant, as the financial strain and emotional distress can put a strain on personal connections. These long-term effects can significantly hinder overall well-being and impede personal growth and achievement.

Mental Health Resources for Individuals Struggling with Student Loan Debt

Several organizations offer resources and support for individuals struggling with the psychological impact of student loan debt. These include:

- The National Alliance on Mental Illness (NAMI): Provides support groups, educational resources, and referrals to mental health professionals.

- The Jed Foundation: Focuses on protecting emotional health and preventing suicide among young adults, including those burdened by student loan debt.

- The American Psychological Association (APA): Offers a directory of mental health professionals and resources for managing stress and anxiety.

- The National Foundation for Credit Counseling (NFCC): Provides financial counseling and debt management services, often incorporating mental health support.

It’s crucial to remember that seeking help is a sign of strength, not weakness. Accessing available resources can significantly improve mental well-being and facilitate a more manageable path towards financial stability.

Closure

Ultimately, the decision of whether or not to stop paying student loans is deeply personal and requires careful consideration of the potential risks and rewards. While defaulting can have severe financial and emotional consequences, understanding the available options and resources is crucial for making an informed choice. This exploration has aimed to provide the necessary information to empower individuals to navigate this complex situation effectively and responsibly.

Helpful Answers

What happens if I miss a student loan payment?

Missing a payment can lead to late fees, damage to your credit score, and ultimately, default. Contact your loan servicer immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Can I negotiate my student loan payments?

Yes, you can often negotiate with your loan servicer to create a more manageable repayment plan. This might involve an income-driven repayment plan or a temporary period of forbearance.

What is income-driven repayment?

Income-driven repayment plans base your monthly payments on your income and family size. They can result in lower monthly payments, but you may end up paying more interest over the life of the loan.

Are there any programs that can help me pay off my student loans?

Several programs exist, including loan forgiveness programs for specific professions (e.g., public service) and income-driven repayment plans. Research these options to see if you qualify.