Navigating the complexities of student loan financing can feel overwhelming. Understanding the various loan types, repayment options, and long-term financial implications is crucial for responsible borrowing. A student aid loan calculator serves as an invaluable tool, empowering students and families to make informed decisions about their educational funding. This guide explores the functionality of these calculators, providing insights into their effective use and the broader financial planning context.

We’ll delve into the mechanics of student loan calculators, examining the input parameters (loan amount, interest rate, repayment period) and their impact on overall costs. Different calculator types – federal versus private – will be compared, along with the various repayment plans available. Beyond the calculations, we’ll address the importance of budgeting, financial literacy, and seeking professional advice to ensure long-term financial well-being.

Understanding Student Aid Loan Calculators

Student aid loan calculators are invaluable tools for prospective and current students navigating the complexities of financing their education. These calculators provide a quick and easy way to estimate monthly payments, total interest paid, and the overall cost of borrowing for different loan scenarios. Understanding how to use these tools effectively can significantly impact financial planning and responsible borrowing.

Student aid loan calculators help you understand the financial implications of borrowing for higher education. By inputting key details about your loans, you can generate projections of your repayment schedule and total cost. This allows for informed decision-making about loan amounts and repayment strategies.

Types of Student Loan Calculators

Several types of student loan calculators exist, each designed to address specific needs. Federal loan calculators focus on loans provided by the government, offering details on repayment plans specific to these programs. Private loan calculators, on the other hand, address loans from banks and other private lenders, reflecting the variable interest rates and terms commonly associated with these options. Some calculators even offer combined functionalities, allowing users to input both federal and private loan information for a comprehensive overview of their debt.

Input Parameters for Student Loan Calculators

Accurate input is crucial for receiving reliable projections. Common input parameters include the total loan amount borrowed, the annual interest rate (often expressed as a percentage), and the loan repayment period (typically expressed in months or years). Other parameters may include loan origination fees, grace periods (the time before repayment begins), and the chosen repayment plan (e.g., standard, extended, income-driven). Incorporating all relevant details leads to more precise estimations.

Sample Student Loan Calculator User Interface

The following table illustrates a simplified user interface for a student loan calculator. This design prioritizes clarity and ease of use, focusing on essential input fields and relevant calculated outputs. A responsive design would adapt the table layout seamlessly across different screen sizes.

| Input Parameter | Input Value | Calculated Result | Explanation |

|---|---|---|---|

| Loan Amount | $20,000 | $20,000 | The principal amount borrowed. |

| Annual Interest Rate | 5% | 5% | The annual interest rate charged on the loan. |

| Repayment Period (Years) | 10 | 120 Months | The total time allotted for loan repayment. |

| Monthly Payment | $212.47 | $212.47 | The estimated monthly payment amount. |

| Total Interest Paid | $5,496.40 | $5,496.40 | The total interest accumulated over the repayment period. |

| Total Repayment Amount | $25,496.40 | $25,496.40 | The total amount repaid, including principal and interest. |

Factors Affecting Loan Repayment

Understanding the factors that influence your student loan repayment is crucial for effective financial planning. Several key elements interact to determine your monthly payment amount, the total interest accrued, and the overall cost of your loan. This section will explore these factors and their impact on your repayment journey.

Loan Amount and Interest Rate

The principal loan amount – the initial sum borrowed – directly affects your monthly payment. A larger loan necessitates higher monthly payments, even with the same interest rate and repayment plan. The interest rate, representing the cost of borrowing, significantly impacts the total interest paid over the loan’s life. Higher interest rates lead to substantially larger total repayment amounts. For example, a $20,000 loan at 5% interest will accrue less total interest over 10 years than the same loan at 7% interest.

Repayment Plan Options

Different repayment plans offer varying monthly payment amounts and loan durations. A standard repayment plan typically involves fixed monthly payments over a 10-year period. An extended repayment plan stretches the repayment period, lowering monthly payments but increasing the total interest paid due to the longer repayment duration. Income-driven repayment plans (IDR) adjust monthly payments based on your income and family size. While offering lower monthly payments, IDR plans often extend the repayment period significantly, potentially leading to higher overall interest costs. For example, a borrower on a standard plan might pay off their loan in 10 years, while someone on an IDR plan might take 20 or more years, paying significantly more interest.

Interest Capitalization

Interest capitalization occurs when accrued interest is added to the principal loan balance. This increases the principal amount on which future interest is calculated, effectively accelerating the growth of your debt. For example, if you have unpaid interest at the end of a grace period, that interest is capitalized. This means you’ll be paying interest on that interest going forward, leading to a larger total repayment amount. Failing to make payments regularly increases the likelihood of capitalization and significantly impacts the final loan cost.

Financial Consequences of Default

Defaulting on your student loans has severe financial consequences.

- Damaged Credit Score: A default will severely damage your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future.

- Wage Garnishment: The government can garnish your wages to recover the debt, leading to a significant reduction in your disposable income.

- Tax Refund Offset: Your tax refund can be seized to repay your defaulted loans.

- Difficulty Obtaining Federal Financial Aid: Future access to federal student aid may be denied.

- Collection Agency Involvement: Your debt may be transferred to a collection agency, which will aggressively pursue repayment, potentially impacting your personal and professional life.

- Legal Action: In extreme cases, legal action may be taken against you, leading to further financial and legal repercussions.

Using a Student Aid Loan Calculator Effectively

Student loan calculators are invaluable tools for navigating the complexities of repayment. Understanding how to use them effectively is crucial for making informed decisions about your financial future and avoiding potential pitfalls. By accurately inputting your loan details and exploring different repayment scenarios, you can gain a clear picture of your potential repayment costs and develop a manageable repayment strategy.

Accurate use of a student loan calculator hinges on providing precise information. This includes the principal loan amount, interest rate, repayment period, and any applicable fees. Inaccuracies in these inputs will lead to inaccurate projections. Furthermore, it’s vital to consider long-term financial implications, such as the impact of loan repayment on future savings goals, and to factor in potential changes in income or expenses.

Interpreting Calculator Output

The output of a student loan calculator typically presents several key pieces of information. This includes the total amount repaid, the monthly payment amount, and the total interest paid over the life of the loan. Understanding these figures is essential for comparing different loan options and choosing the most suitable plan. For example, a calculator might show that a longer repayment period results in lower monthly payments, but significantly higher total interest paid over time. Conversely, a shorter repayment period leads to higher monthly payments but lower overall interest costs. By carefully analyzing these trade-offs, you can make an informed decision that aligns with your financial capabilities and long-term goals.

Comparing Different Loan Offers

A step-by-step guide for effectively using a student loan calculator to compare loan offers is crucial for informed decision-making.

- Gather Loan Details: Collect all necessary information for each loan offer, including the principal loan amount, interest rate (APR), loan term (repayment period), and any associated fees.

- Input Data into Calculator: Enter the specific details of each loan offer into the student loan calculator, one at a time. Ensure accuracy in inputting each variable.

- Compare Results: After inputting each loan’s details, carefully review and compare the calculator’s output. Pay close attention to the total interest paid, the monthly payment amount, and the total amount repaid for each loan option.

- Consider Long-Term Implications: Analyze how each repayment scenario will affect your overall financial health. Will it significantly impact your ability to save for retirement, purchase a home, or achieve other financial goals?

- Make an Informed Decision: Based on your comparison and analysis, select the loan offer that best suits your financial situation and long-term goals. Remember, the lowest monthly payment isn’t always the best option if it results in significantly higher total interest payments.

Illustrative Example: Comparing Two Loan Offers

Let’s say you have two loan offers: Loan A with a principal of $20,000, a 6% interest rate, and a 10-year repayment term; and Loan B with the same principal, a 7% interest rate, and a 15-year repayment term. Inputting these details into a student loan calculator would reveal that Loan A has higher monthly payments but significantly lower total interest paid over its life compared to Loan B. Loan B, while having lower monthly payments, will ultimately cost considerably more due to the extended repayment period and higher interest rate. This example highlights the importance of using a calculator to visualize the long-term financial consequences of different loan options.

Beyond the Calculator

While a student loan calculator provides crucial estimates, it’s only one piece of the financial puzzle. Successfully managing student loan debt requires a broader financial strategy that incorporates budgeting, financial literacy, and potentially professional guidance. Understanding these additional aspects is vital for long-term financial well-being.

A comprehensive approach to managing student loan debt goes beyond simply calculating repayment amounts. Effective planning involves understanding your overall financial picture, setting realistic financial goals, and actively working towards them. This includes creating a budget, building good credit, and exploring various debt management strategies.

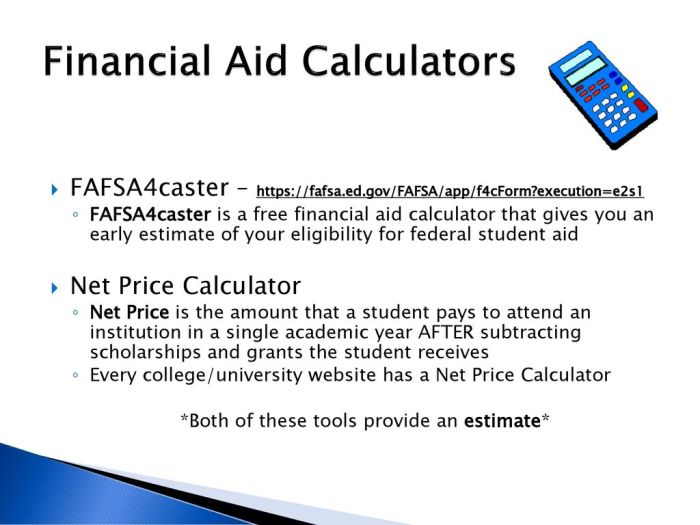

Additional Financial Resources and Tools

Utilizing a student loan calculator is a great first step, but supplementing this with other resources enhances your financial planning. These tools offer different perspectives and provide a more holistic view of your financial situation.

- Budgeting Apps: Mint, YNAB (You Need A Budget), and Personal Capital offer features to track income, expenses, and create personalized budgets, helping you visualize your spending habits and identify areas for savings.

- Credit Monitoring Services: Credit Karma, Experian, and Equifax offer free credit reports and scores, allowing you to track your credit health and identify potential issues that could impact your ability to secure loans or favorable interest rates in the future.

- Financial Literacy Websites: The Consumer Financial Protection Bureau (CFPB) and the National Foundation for Credit Counseling (NFCC) provide valuable information and resources on managing debt, budgeting, and improving your financial literacy.

The Importance of Budgeting and Financial Literacy

Budgeting is the cornerstone of responsible financial management. A well-structured budget allows you to allocate funds for essential expenses, student loan payments, and savings, preventing overspending and ensuring consistent loan repayments. Financial literacy empowers you to make informed decisions regarding your finances, understand interest rates, and navigate various repayment options effectively. Without a solid understanding of personal finance, managing student loan debt can become significantly more challenging. For example, understanding compound interest allows you to appreciate the impact of making extra payments towards your principal.

The Benefits of Seeking Professional Financial Advice

While many resources are available online, seeking professional financial advice can provide personalized guidance and tailored strategies. A financial advisor can help you create a comprehensive financial plan, optimize your repayment strategy, and address any unique financial circumstances you may face. They can also help you navigate complex financial products and avoid potentially costly mistakes. This is particularly beneficial for those with high loan balances or complex financial situations. For instance, a financial advisor can help you explore options like income-driven repayment plans or loan refinancing to reduce your monthly payments or total interest paid.

Visual Representation of Loan Amount, Interest Rate, and Repayment Period

The relationship between loan amount, interest rate, and repayment period can be visualized using a three-dimensional bar chart.

The X-axis represents the loan amount (e.g., $10,000, $20,000, $30,000). The Y-axis represents the interest rate (e.g., 4%, 6%, 8%). The Z-axis represents the total repayment amount over the loan’s lifetime. Each bar would represent a specific combination of loan amount and interest rate, with its height corresponding to the total repayment amount for a given repayment period (e.g., 10 years, 15 years). A longer repayment period would generally result in a higher total repayment amount due to accumulated interest, even with a lower interest rate. Conversely, a shorter repayment period would lead to a lower total repayment but higher monthly payments. The chart would clearly illustrate how these three factors interact to determine the overall cost of borrowing. For example, a $20,000 loan at 6% interest over 10 years would have a significantly higher total repayment amount compared to the same loan at 4% interest over the same period.

Types of Student Loans and Their Impact

Understanding the different types of student loans available is crucial for making informed borrowing decisions. The choice between federal and private loans, and the subsequent management of these loans, significantly impacts a borrower’s financial future. This section explores the key differences between these loan types, the implications of co-signing, and the potential benefits and drawbacks of loan consolidation.

Federal vs. Private Student Loans

Federal student loans are offered by the U.S. government and generally come with more borrower protections than private loans. These protections often include flexible repayment plans, income-driven repayment options, and loan forgiveness programs in certain circumstances. Private student loans, on the other hand, are offered by banks, credit unions, and other private lenders. They typically have stricter eligibility requirements and may offer less flexible repayment terms. Key differences include interest rates (generally lower for federal loans), repayment options, and the availability of deferment or forbearance. For example, a federal loan might offer a graduated repayment plan, allowing for lower payments initially, whereas a private loan might only offer a standard repayment plan. The absence of government oversight also means that private loan terms can be significantly less favorable to the borrower in case of financial hardship.

Co-signing Student Loans

Co-signing a student loan means another person agrees to be responsible for the debt if the primary borrower (the student) defaults. This can significantly improve the chances of loan approval, especially for students with limited or poor credit history. However, it also carries considerable risk for the co-signer. If the student fails to make payments, the co-signer becomes fully responsible for the entire debt. This can negatively impact the co-signer’s credit score and financial stability. It’s crucial for both the student and co-signer to fully understand the implications before agreeing to co-sign a loan. For example, a co-signer might be responsible for thousands of dollars in debt if the student is unable to repay their loans after graduation.

Student Loan Consolidation

Student loan consolidation involves combining multiple federal student loans into a single loan with a new interest rate and repayment schedule. This can simplify repayment by reducing the number of monthly payments and potentially lowering the overall interest rate. However, it’s essential to carefully evaluate the terms of the consolidated loan before proceeding. Consolidating federal loans into a new federal loan usually maintains access to federal repayment programs, whereas consolidating federal loans into a private loan might eliminate those benefits. For example, consolidating high-interest private loans into a single lower-interest federal loan could save money in the long run, but consolidating already low-interest federal loans might not offer significant advantages.

Student Loan Decision-Making Flowchart

A flowchart depicting the decision-making process for choosing a student loan would begin with assessing the student’s financial need and credit history. This would lead to a decision point: Do you qualify for federal student loans? If yes, the process would continue to explore the different federal loan programs (Subsidized, Unsubsidized, PLUS loans) and their terms. If no, the process would move to exploring private loan options, considering interest rates, repayment terms, and the need for a co-signer. Each step would involve evaluating the pros and cons of each option, considering factors like total cost, repayment schedule, and available protections. The final decision would be based on a thorough understanding of the individual’s financial situation and long-term goals. The flowchart would visually represent this process, using decision diamonds and process boxes to clearly illustrate the steps involved.

Conclusive Thoughts

Mastering the art of student loan management is a journey, not a destination. While a student aid loan calculator provides invaluable insights into repayment scenarios, it’s essential to remember that it’s only one piece of the puzzle. Proactive financial planning, informed decision-making, and seeking expert guidance when needed are all crucial components in navigating the complexities of student loan debt and achieving long-term financial success. By understanding the factors influencing loan repayment and leveraging available resources, you can confidently chart a course towards a financially secure future.

Helpful Answers

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payment, but it’s important to compare offers carefully.

What are income-driven repayment plans?

These plans base your monthly payment on your income and family size, potentially resulting in lower payments but extending the repayment period.

How does interest capitalization work?

Interest capitalization adds unpaid interest to your principal loan balance, increasing the total amount you owe.