The decision of how to finance higher education is a pivotal moment for students. Student choice student loans, while offering access to vital funds, present a complex landscape of options that can significantly shape a student’s financial future. Understanding the nuances of federal versus private loans, interest rates, repayment plans, and the long-term implications of debt is crucial for making informed decisions. This exploration delves into the factors influencing student loan selection, the importance of financial literacy, and the role institutions play in guiding students toward responsible borrowing.

From the initial application process to the long-term effects on career choices and financial stability, the impact of student loan debt extends far beyond graduation. This examination aims to equip students with the knowledge and understanding needed to navigate the complexities of student loan financing, empowering them to make informed choices that align with their individual circumstances and long-term financial goals.

The Impact of Student Choice on Loan Selection

Choosing the right student loan can significantly impact a student’s financial future. The decision is complex, influenced by numerous factors that extend beyond the simple interest rate. Understanding these factors is crucial for making informed choices and avoiding potential financial hardship down the line.

Factors Influencing Student Loan Choices

Several key factors influence a student’s loan selection. Academic program choice plays a significant role, as longer programs like medical school often necessitate larger loan amounts. Career aspirations also heavily influence borrowing decisions; students pursuing high-earning professions may be more willing to take on larger debts, anticipating higher future income to manage repayment. Furthermore, individual financial situations, including family income and existing debt, significantly affect the type and amount of loans a student can realistically obtain and manage.

The Impact of Interest Rates and Repayment Plans

Differing interest rates and repayment plans substantially affect student decision-making. Lower interest rates translate to lower overall borrowing costs, making loans more manageable. Repayment plans, such as graduated repayment (lower payments initially, increasing over time) or income-driven repayment (payments based on income), cater to different financial situations and repayment capabilities. Students often prioritize loan options offering lower interest rates and flexible repayment schedules aligned with their projected post-graduation income. For example, a student anticipating a lower-paying job after graduation might favor an income-driven repayment plan, while a student expecting a higher salary might opt for a shorter repayment period to minimize interest accrual.

Federal versus Private Student Loans: A Comparison

Federal and private student loans differ significantly in their advantages and disadvantages. Federal loans generally offer more borrower protections, including income-driven repayment plans and loan forgiveness programs for certain professions. However, federal loan amounts may be limited, and interest rates can fluctuate. Private loans, on the other hand, may offer higher loan amounts and potentially lower interest rates for borrowers with excellent credit. Yet, they often lack the same borrower protections as federal loans, and may come with more stringent eligibility requirements. Choosing between federal and private loans requires careful consideration of individual circumstances and risk tolerance.

Comparison of Student Loan Types

| Loan Type | Interest Rates | Repayment Terms | Eligibility Criteria |

|---|---|---|---|

| Federal Subsidized Loan | Variable, set by the government; generally lower than private loans. | Standard 10-year repayment, with options for extended repayment plans. | Demonstrated financial need; enrollment in an eligible educational program. |

| Federal Unsubsidized Loan | Variable, set by the government; generally lower than private loans. | Standard 10-year repayment, with options for extended repayment plans. | Enrollment in an eligible educational program. |

| Private Student Loan | Variable, determined by the lender based on creditworthiness; can be higher than federal loans. | Vary depending on the lender; typically shorter repayment terms than federal loans. | Good to excellent credit history; co-signer may be required. |

Student Understanding of Loan Terms and Conditions

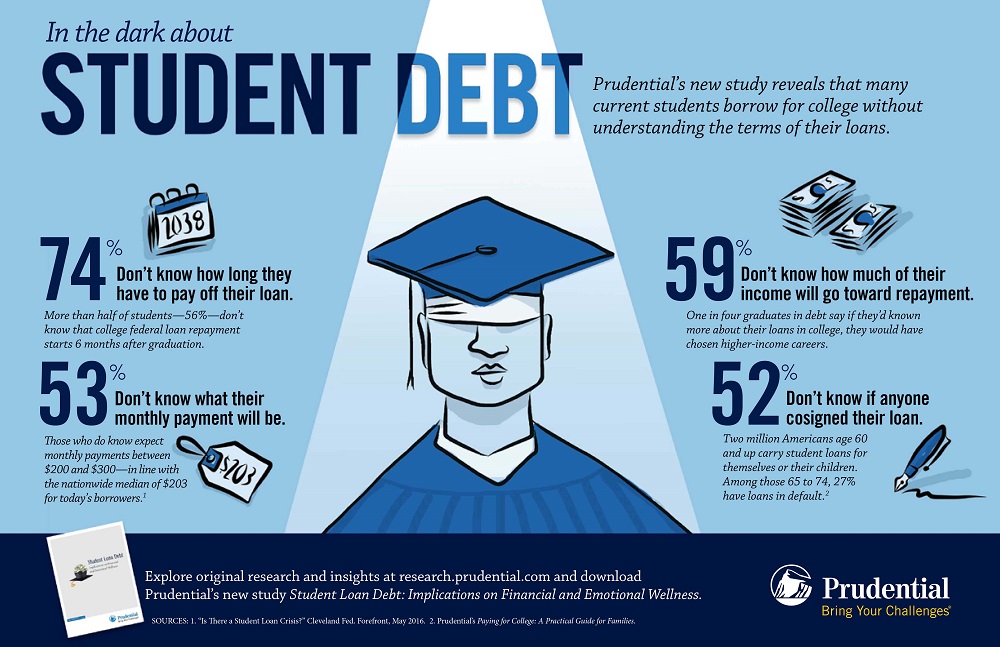

Navigating the complexities of student loans can be challenging, especially for young adults entering higher education. A lack of understanding regarding loan terms and conditions frequently leads to poor financial decisions with long-term consequences. This section explores common misconceptions, illustrative scenarios, and the crucial role of financial literacy in mitigating these risks.

Many students underestimate the true cost of borrowing for their education. This misunderstanding stems from a lack of familiarity with loan terminology, repayment schedules, and the impact of interest accumulation. Furthermore, the emotional weight of securing funding for education can sometimes overshadow the need for careful consideration of loan details.

Common Misconceptions Regarding Student Loan Repayment

Students often harbor several misconceptions about student loan repayment. A prevalent misunderstanding involves the belief that monthly payments will remain consistently low throughout the repayment period. In reality, payments can fluctuate based on interest rates and the chosen repayment plan. Another common misconception is that the total amount borrowed is the only figure that matters. Students frequently overlook the significant impact of accumulated interest, which can substantially increase the total amount repaid. Finally, some believe that defaulting on loans has minimal consequences. However, defaulting can lead to severely damaged credit scores, wage garnishment, and difficulty securing future loans or financial products.

Examples of Poor Loan Choices Due to Lack of Understanding

Consider a scenario where a student takes out the maximum amount of unsubsidized loans each year without fully comprehending the implications of accruing interest. This could result in a significantly larger debt burden upon graduation, limiting their post-graduation options and financial stability. Another example involves a student selecting an extended repayment plan without considering the increased total interest paid over the loan’s lifetime. While the lower monthly payments initially seem attractive, the higher overall cost can outweigh the short-term benefits. Finally, a lack of understanding of loan forgiveness programs could lead a student to forgo pursuing a career in public service or a non-profit sector, despite being eligible for loan forgiveness, which could significantly reduce their long-term debt.

The Importance of Financial Literacy Education for Prospective Borrowers

Financial literacy education is paramount in empowering prospective borrowers to make informed decisions. Comprehensive programs should cover budgeting, understanding credit scores, exploring various loan options, and the long-term consequences of debt. Institutions of higher education should integrate financial literacy into their orientation programs and offer workshops and resources that guide students through the process of selecting and managing student loans. Government agencies and non-profit organizations also play a vital role in providing accessible and reliable financial literacy resources to students.

Key Terms and Concepts Students Should Understand Before Taking Out Loans

Understanding key terms is crucial for making responsible borrowing decisions. Before taking out student loans, students should familiarize themselves with the following:

- Principal: The original amount of the loan borrowed.

- Interest: The cost of borrowing money, expressed as a percentage.

- Interest Rate: The annual percentage rate (APR) charged on the loan.

- Repayment Plan: The schedule for making loan payments.

- Subsidized Loan: A loan where the government pays the interest while the student is in school.

- Unsubsidized Loan: A loan where interest accrues from the time the loan is disbursed.

- Loan Deferment: A temporary postponement of loan payments.

- Loan Forbearance: A temporary reduction in loan payments.

- Default: Failure to make loan payments according to the agreed-upon terms.

- Credit Score: A numerical representation of an individual’s creditworthiness.

The Role of Institutional Guidance in Loan Selection

Educational institutions play a pivotal role in shaping students’ understanding of and approach to student loan borrowing. Their guidance, or lack thereof, significantly impacts students’ financial well-being long after graduation. Providing accurate, unbiased information and fostering responsible borrowing habits are crucial aspects of a university’s commitment to student success.

Institutions have a responsibility to provide accurate and unbiased information about student loans. This includes clearly explaining different loan types (federal vs. private), interest rates, repayment options, and the potential long-term financial implications of borrowing. Failing to do so can leave students vulnerable to predatory lending practices and overwhelming debt.

Effective Strategies for Promoting Responsible Borrowing

Institutions can actively promote responsible borrowing through various strategies. These initiatives aim to equip students with the knowledge and tools necessary to make informed decisions about their financing. A multifaceted approach is key to success.

- Mandatory Financial Literacy Workshops: These workshops could cover budgeting, understanding credit scores, and comparing loan options. Interactive exercises and real-life case studies can enhance engagement and learning.

- Online Resources and Tools: User-friendly websites and online calculators can provide students with personalized loan estimations and repayment scenarios, allowing them to explore different borrowing amounts and their associated costs.

- Individualized Financial Counseling: Offering one-on-one sessions with financial aid counselors allows students to address specific questions and concerns related to their individual circumstances. This personalized approach can significantly improve understanding and reduce anxiety.

- Partnerships with Financial Institutions: Collaborating with reputable financial institutions can provide students access to unbiased financial education and potentially more favorable loan terms.

Potential Conflicts of Interest in Institutional Advice

While institutions strive for unbiased guidance, potential conflicts of interest can arise. For example, institutions might receive commissions or incentives from certain lenders for recommending their loans. This could lead to biased advice, prioritizing the institution’s financial gain over the student’s best interest. Another conflict could arise if the institution heavily promotes its own loan programs, potentially overlooking more beneficial options available elsewhere. Transparency is crucial to mitigate these conflicts.

Sample Informational Brochure: Responsible Loan Management

[A visual description of a brochure follows. The brochure is tri-fold, with a vibrant, approachable design. The cover features a headline: “Take Control of Your Finances: A Guide to Responsible Student Loan Management.” The inside panels are organized into clear sections with concise text and visuals. ]

Panel 1: Understanding Your Loans This section explains the different types of student loans (federal subsidized and unsubsidized, federal PLUS loans, private loans), highlighting the key differences in interest rates, repayment terms, and eligibility requirements. A simple table comparing loan types is included.

Panel 2: Budgeting and Repayment Planning This section emphasizes the importance of creating a realistic budget, tracking expenses, and exploring different repayment plans (standard, graduated, income-driven). A sample budget worksheet and a link to online repayment calculators are provided.

Panel 3: Avoiding Loan Traps and Seeking Help This section warns against predatory lenders and offers advice on how to identify and avoid them. It also provides contact information for financial aid counselors and other resources available to students who need assistance managing their loans. A QR code linking to helpful online resources is included.

Long-Term Financial Implications of Student Loan Choices

The decisions students make regarding their student loans have far-reaching consequences that extend well beyond graduation. Understanding the long-term financial implications of these choices is crucial for navigating the complexities of repayment and achieving long-term financial stability. Failing to adequately consider these factors can lead to significant financial hardship and limit future opportunities.

Potential Long-Term Financial Impact of Different Loan Repayment Strategies

Choosing a repayment strategy significantly impacts the total amount paid and the length of the repayment period. For example, the standard repayment plan typically involves fixed monthly payments over 10 years. However, income-driven repayment plans adjust payments based on income and family size, potentially extending the repayment period to 20 or even 25 years. While income-driven plans offer lower monthly payments initially, they often result in paying significantly more interest over the life of the loan. Conversely, aggressive repayment strategies, such as making extra payments or refinancing to a lower interest rate, can lead to substantial savings on interest and faster loan payoff. This ultimately frees up funds for other financial goals.

Impact of Student Loan Debt on Major Life Decisions

Student loan debt can significantly influence major life decisions like homeownership and starting a family. High levels of debt can negatively impact credit scores, making it difficult to qualify for a mortgage or secure favorable interest rates. Similarly, the financial burden of loan repayments can delay or prevent individuals from saving for a down payment, impacting their ability to purchase a home. Starting a family also becomes more challenging with substantial loan repayments to manage. The added financial strain of childcare, healthcare, and other family-related expenses can exacerbate the difficulties of managing student loan debt.

Financial Implications of Choosing Different Career Paths in Relation to Student Loan Burdens

The choice of career path has a direct correlation with the ability to manage student loan debt. High-paying professions often offer more financial flexibility to manage loan repayments, allowing for faster payoff and minimizing the long-term financial burden. Conversely, individuals pursuing careers with lower earning potential may struggle to make timely payments, potentially leading to loan default or extended repayment periods. This highlights the importance of considering future earning potential when choosing a career path and making educational decisions. Careful planning and consideration of loan amounts relative to expected post-graduation income are vital.

Hypothetical Case Study: Responsible vs. Irresponsible Loan Management

Consider two individuals, Sarah and John, both graduating with $50,000 in student loan debt. Sarah diligently researches repayment options, choosing an aggressive repayment plan and making extra payments whenever possible. She prioritizes budgeting and minimizing unnecessary expenses. Within seven years, Sarah pays off her loans, significantly reducing her long-term financial burden and freeing up resources for investments and savings. John, on the other hand, makes minimum payments and fails to budget effectively. He makes poor financial decisions, accumulating additional debt. After ten years, John still owes a substantial amount, facing significant financial strain and limited opportunities for long-term financial goals such as homeownership or investing. This illustrates the stark contrast between responsible and irresponsible loan management and its lasting consequences.

Government Policies and Their Influence on Student Choice

Government policies significantly shape the student loan landscape, influencing borrowing behavior and long-term financial outcomes for students. These policies, ranging from loan forgiveness programs to interest rate adjustments and repayment plan options, create a complex environment that impacts students’ decisions about higher education financing. Understanding the nuances of these policies is crucial for both students and policymakers alike.

Impact of Loan Forgiveness Programs on Student Borrowing Behavior

Loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) program and various income-driven repayment (IDR) plans, aim to alleviate the burden of student loan debt. These programs can incentivize students to borrow more, knowing that a portion of their debt may be forgiven under specific circumstances. For example, the PSLF program, while intended to incentivize public service, has faced criticism for its complex eligibility requirements, leading to lower-than-expected forgiveness rates. This demonstrates a potential unintended consequence: students may borrow more believing they will qualify for forgiveness, only to find the process far more challenging than anticipated. Research suggests that the existence of such programs can influence borrowing decisions, potentially leading to increased overall debt levels. However, the effect is complex and depends on factors such as student awareness of the programs, their eligibility criteria, and the perceived likelihood of forgiveness.

Unintended Consequences of Government Interventions in the Student Loan Market

Government interventions, while often well-intentioned, can have unforeseen consequences. For instance, subsidized interest rates, designed to make loans more affordable, can lead to increased demand and higher overall borrowing, potentially inflating tuition costs. Similarly, overly generous loan forgiveness programs might discourage responsible borrowing behavior, as students might perceive less risk in taking on larger loans. A further unintended consequence could be the creation of moral hazard, where borrowers take on more risk than they would otherwise, knowing that the government might bail them out. The complex interplay between government policies and student behavior necessitates careful consideration of potential unintended consequences.

Influence of Interest Rates and Loan Repayment Plans on Student Choices

Changes in interest rates directly impact the cost of borrowing. Lower interest rates make loans more attractive, potentially leading to increased borrowing. Conversely, higher interest rates can discourage borrowing, leading students to explore alternative funding options or reconsider their educational plans. The availability of various repayment plans, such as graduated repayment, income-driven repayment, and extended repayment, also influences student choices. Income-driven repayment plans, for example, can make loans more manageable for borrowers with lower post-graduation incomes, but they can also extend the repayment period and increase the total interest paid over the life of the loan. Students must carefully weigh the trade-offs between immediate affordability and long-term cost implications when choosing a repayment plan.

Current Landscape of Government Regulations Surrounding Student Loans

The regulatory landscape governing student loans is complex and constantly evolving. Federal agencies, primarily the Department of Education, oversee various aspects of student lending, including eligibility criteria, loan disbursement, repayment options, and default management. Regulations concerning private student loans are less stringent than those for federal loans, leading to a diverse range of loan products with varying terms and conditions. The regulatory framework also addresses issues such as borrower protections, fraud prevention, and the management of loan defaults. Understanding the intricacies of these regulations is crucial for students to make informed borrowing decisions and navigate the complexities of the student loan system.

Ultimate Conclusion

Ultimately, responsible management of student choice student loans hinges on a multifaceted approach. Students must cultivate financial literacy, proactively seek guidance from educational institutions and financial advisors, and carefully consider the long-term financial ramifications of their borrowing decisions. By understanding the various loan types, repayment options, and potential consequences, students can navigate the complexities of higher education financing and build a secure financial future. A well-informed approach to student loans empowers individuals to pursue their educational aspirations while mitigating the potential risks associated with long-term debt.

FAQs

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, or deferment. Unsubsidized loans accrue interest throughout your entire loan period.

Can I refinance my student loans?

Yes, refinancing can lower your interest rate and monthly payments, but it often involves private lenders and may lose federal protections.

What happens if I don’t repay my student loans?

Defaulting on student loans has serious consequences, including wage garnishment, tax refund offset, and damage to your credit score.

What is loan forgiveness?

Loan forgiveness programs, such as those for public service, can eliminate some or all of your student loan debt under specific conditions.

How can I improve my credit score while paying off student loans?

Make on-time payments consistently, keep credit utilization low, and maintain a diverse credit history (if applicable).