Navigating the complexities of higher education often involves understanding the intricacies of student financing. Student government loans, a cornerstone of funding for many students, offer a crucial pathway to achieving academic goals. However, the various loan types, application processes, repayment plans, and potential for forgiveness can be overwhelming. This guide provides a clear and concise overview, empowering students to make informed decisions about their financial future.

From understanding the differences between Federal Stafford, PLUS, and Perkins loans to mastering the FAFSA application and exploring repayment options, this resource aims to demystify the process. We’ll also delve into strategies for managing loan debt effectively, minimizing interest payments, and avoiding the pitfalls of default. Ultimately, the goal is to equip students with the knowledge and tools to successfully navigate the landscape of student government loans.

Types of Student Government Loans

Understanding the different types of federal student loans is crucial for planning your higher education financing. Choosing the right loan depends on your financial need, credit history, and educational goals. This section details the key features of the most common federal student loan programs.

Federal Stafford Loans

Federal Stafford Loans are subsidized and unsubsidized loans offered to eligible undergraduate and graduate students. Subsidized Stafford Loans don’t accrue interest while you’re in school, during grace periods, or during deferment periods. Unsubsidized Stafford Loans, however, accrue interest throughout these periods. Eligibility is determined by your financial need as demonstrated by your FAFSA (Free Application for Federal Student Aid). Repayment typically begins six months after graduation or leaving school. Interest rates are set annually by the government and are generally lower than private loan interest rates.

Federal PLUS Loans

Federal PLUS Loans are loans available to parents of dependent undergraduate students and to graduate students. Unlike Stafford Loans, PLUS Loans are not need-based, meaning creditworthiness is a primary factor in eligibility. Borrowers must pass a credit check, and those with adverse credit history may still qualify but with a higher interest rate or a required endorser. Interest rates are generally higher than Stafford Loans and accrue interest from the time the loan is disbursed. Repayment plans are similar to Stafford Loans, with options available to manage monthly payments.

Perkins Loans

Perkins Loans are need-based federal student loans with extremely low, fixed interest rates. These loans are offered by participating colleges and universities to undergraduate and graduate students with exceptional financial need. The funds are limited, and eligibility is determined by the institution. Repayment typically begins nine months after graduation or leaving school, and borrowers often have options for loan forgiveness under certain circumstances, such as working in public service.

| Loan Type | Interest Rate | Eligibility | Repayment Options |

|---|---|---|---|

| Federal Stafford Loan (Subsidized & Unsubsidized) | Variable, set annually by the government; generally lower than PLUS loans | Undergraduate and graduate students; financial need assessment required for subsidized loans | Standard, graduated, extended, income-driven repayment plans |

| Federal PLUS Loan | Variable, set annually by the government; generally higher than Stafford loans | Parents of dependent undergraduate students and graduate students; credit check required | Standard, graduated, extended, income-driven repayment plans |

| Perkins Loan | Fixed, very low interest rate | Undergraduate and graduate students; exceptional financial need; limited funds; school-based eligibility | Standard, graduated, income-sensitive repayment plans; potential for loan forgiveness |

Applying for Student Government Loans

Securing funding for higher education often involves navigating the complexities of student loan applications. Understanding the process and required documentation is crucial for a smooth and successful application. This section details the application procedures for various government student loans, emphasizing the pivotal role of the Free Application for Federal Student Aid (FAFSA).

The application process for government student loans generally involves completing the FAFSA and potentially additional forms depending on the specific loan type. The FAFSA is a free application that determines your eligibility for federal student aid, including grants, scholarships, and loans. Information provided on the FAFSA is used to calculate your Expected Family Contribution (EFC), a key factor in determining your financial need and the amount of aid you may receive. Accurate and complete information is paramount to ensure you receive the appropriate level of funding.

The Free Application for Federal Student Aid (FAFSA)

The FAFSA is the cornerstone of the federal student aid process. It gathers essential financial information from both the student and their family (if applicable) to determine eligibility for federal student aid programs. This information includes tax returns, income details, and assets. The FAFSA data is used to calculate the student’s EFC, which is then compared to the cost of attendance at the chosen institution to determine the amount of financial aid needed. The application is available online and typically opens in October for the following academic year. Students should complete the FAFSA as early as possible to ensure timely processing of their aid package.

Step-by-Step Application Guide for Federal Student Loans

Completing the application process efficiently requires a structured approach. Following these steps will help streamline the process and increase the chances of a successful application.

- Gather Required Documentation: Before starting the application, gather necessary documents, including tax returns (both yours and your parents’ if you are a dependent student), W-2 forms, social security numbers, and bank statements. Having this information readily available will expedite the process.

- Complete the FAFSA: Access the FAFSA website and carefully complete the online application. Double-check all information for accuracy, as errors can delay processing. Utilize the help features on the website if you encounter any difficulties.

- Submit the FAFSA: Once completed, electronically submit the FAFSA. You will receive a Student Aid Report (SAR) confirming your submission and providing a summary of the information you provided.

- Review Your SAR: Carefully review your SAR for accuracy. Contact the FAFSA office if you need to make corrections or have any questions.

- Accept Your Loan Offer: Once your school receives your FAFSA information and processes your application, you’ll receive a financial aid offer outlining the types and amounts of aid you’ve been awarded. Carefully review the terms and conditions and accept the loan offer according to your school’s instructions.

- Complete Master Promissory Note (MPN): For federal student loans, you’ll need to sign a Master Promissory Note (MPN). This legally binds you to repay the loan according to the terms and conditions.

- Complete Entrance Counseling: Before receiving your first loan disbursement, you’ll likely need to complete entrance counseling, which provides important information about loan repayment and your responsibilities as a borrower.

Repayment of Student Government Loans

Understanding your repayment options is crucial after graduating and beginning your professional life. Choosing the right repayment plan can significantly impact your monthly budget and the total amount of interest you pay over the life of your loan. Several plans are available, each with its own set of advantages and disadvantages. Careful consideration of your financial circumstances is essential to make an informed decision.

Standard Repayment Plan

The standard repayment plan is a fixed monthly payment spread over a 10-year period. This plan offers predictability and the fastest path to loan payoff, minimizing the total interest paid. However, the fixed monthly payments can be substantial, potentially straining your budget, especially in the early stages of your career.

Extended Repayment Plan

This plan extends the repayment period to a maximum of 25 years, significantly reducing the monthly payment amount compared to the standard plan. This can ease the financial burden, especially for borrowers with higher loan balances. The downside is that you’ll pay considerably more in interest over the longer repayment period.

Graduated Repayment Plan

The graduated repayment plan starts with lower monthly payments that gradually increase over time. This can be beneficial for borrowers anticipating increased income in the future, providing relief during the initial years after graduation. However, the increasing payments can become challenging to manage later in the repayment period, and the total interest paid will likely be higher than with the standard plan.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) base your monthly payment on your income and family size. Several types of IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans offer more flexibility and affordability, especially for borrowers with lower incomes. However, they typically extend the repayment period, leading to higher total interest paid over the life of the loan. Some plans may also require forgiveness of the remaining balance after a certain number of years, but this often depends on factors like the type of loan and the plan selected. There are income thresholds to qualify for these plans.

Comparison of Repayment Plans

The following table compares the four repayment plans under different scenarios. Note that these are illustrative examples and actual amounts will vary based on loan amount, interest rate, and individual circumstances.

| Repayment Plan | Loan Amount ($10,000 Example) | Monthly Payment (Approximate) | Loan Term (Years) | Total Interest Paid (Approximate) |

|---|---|---|---|---|

| Standard | $10,000 | $100 | 10 | $2,000 |

| Extended | $10,000 | $40 | 25 | $6,000 |

| Graduated (Year 1) | $10,000 | $60 | 10 | $3,500 |

| Income-Driven (Example, assuming low income) | $10,000 | $30 | 20-25 | $7,000+ |

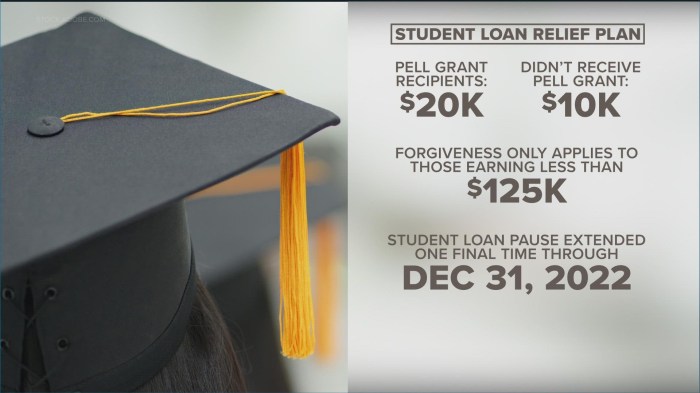

Loan Forgiveness and Cancellation Programs

Navigating the complexities of student loan repayment can be daunting. Fortunately, several government programs exist to offer relief through loan forgiveness or cancellation, providing opportunities for borrowers to reduce or eliminate their debt under specific circumstances. These programs, while beneficial, have specific eligibility requirements and limitations that must be carefully considered.

Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness (PSLF) program is designed to incentivize individuals pursuing careers in public service. It offers forgiveness of the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying employer.

Eligibility for PSLF requires employment by a government organization or a non-profit 501(c)(3) organization. The application process involves consolidating your federal student loans into a Direct Consolidation Loan, certifying your employment with your employer, and submitting annual certifications to confirm continued employment. The benefit is the potential complete cancellation of your student loan debt, significantly reducing the long-term financial burden. However, a drawback is the lengthy 10-year commitment required to reach the 120 payment threshold, and any interruption in employment or failure to meet the strict eligibility criteria can jeopardize forgiveness.

Teacher Loan Forgiveness

The Teacher Loan Forgiveness program provides partial loan forgiveness for teachers who meet specific requirements. This program forgives up to $17,500 in qualified student loan debt for teachers who have completed five years of full-time teaching in a low-income school or educational service agency.

To be eligible, teachers must have received a subsidized or unsubsidized Federal Stafford Loan, or a Federal Grad PLUS Loan. They must teach full-time for five consecutive academic years in a low-income school or educational service agency, and they must apply for forgiveness through the Federal Student Aid website. The benefit is a substantial reduction in loan debt for teachers dedicating their careers to underserved communities. However, the program’s limitations include the requirement to teach in designated low-income schools, and the forgiveness amount is capped, meaning it may not cover the entire loan balance for some borrowers.

Managing Student Loan Debt

Successfully navigating student loan debt requires proactive planning and consistent effort. Understanding your repayment options and developing a realistic budget are crucial steps toward financial freedom. This section provides practical strategies for managing your student loans effectively and minimizing their long-term impact.

Effective management of student loan debt hinges on a well-structured budget and a clear understanding of your repayment options. Prioritizing loan repayment while maintaining a healthy lifestyle requires careful planning and discipline. Strategies like minimizing interest payments and exploring loan forgiveness programs can significantly reduce the overall cost and duration of repayment.

Budgeting for Loan Repayment

Creating a comprehensive budget is essential for managing student loan debt. This involves tracking your income and expenses, identifying areas for potential savings, and allocating sufficient funds for loan repayment. Failing to budget adequately can lead to missed payments, penalties, and increased overall debt. A realistic budget considers both your necessary expenses and your financial goals, allowing you to balance immediate needs with long-term financial health.

A sample budget might look like this:

- Income: $3,000 per month (after taxes)

- Essential Expenses:

- Rent/Mortgage: $1,000

- Utilities (electricity, water, gas): $200

- Groceries: $300

- Transportation: $200

- Health Insurance: $100

- Loan Repayment: $500 (This amount should be adjusted based on your loan terms and repayment plan)

- Savings: $200 (This can be adjusted based on your financial goals)

- Other Expenses (entertainment, dining out, etc.): $500 (This should be carefully monitored and adjusted as needed)

Minimizing Interest Payments

Interest payments can significantly increase the total cost of your student loans. Strategies to minimize these payments include making extra principal payments, refinancing your loans at a lower interest rate, and exploring income-driven repayment plans. Each of these strategies requires careful consideration and may involve trade-offs. For example, refinancing may lower your monthly payment but extend the repayment period, while income-driven plans may reduce your monthly payment but potentially increase the total amount paid over the life of the loan.

Accelerating Loan Repayment

Several strategies can accelerate your loan repayment. Making extra payments beyond the minimum monthly amount is a direct way to reduce the principal balance and shorten the repayment period. Exploring loan refinancing options, consolidating multiple loans, and utilizing the avalanche or snowball methods can further contribute to faster repayment. The avalanche method prioritizes paying off the loan with the highest interest rate first, while the snowball method focuses on paying off the smallest loan first to build momentum. Both methods can be effective depending on individual preferences and financial situations.

The Impact of Student Loan Debt on Students

The weight of student loan debt extends far beyond the immediate cost of tuition. It casts a long shadow over students’ financial futures, impacting major life decisions and potentially hindering long-term economic well-being. Understanding these impacts is crucial for both individuals navigating the complexities of higher education and policymakers striving to create a more equitable system.

Student loan debt can significantly influence a graduate’s financial trajectory, often for decades. The burden of monthly repayments can limit career choices, forcing graduates to prioritize higher-paying jobs, even if those jobs aren’t aligned with their passions or long-term goals. This can lead to feelings of dissatisfaction and reduced overall life satisfaction. Furthermore, the substantial debt can delay or prevent major life milestones like homeownership, marriage, and starting a family. The financial strain can also impact retirement planning, making it challenging to save adequately for the future and potentially leading to a less secure retirement.

Impact on Career Choices

The pressure to repay student loans often compels graduates to prioritize higher-paying jobs, even if those jobs are not their preferred career path. For example, a recent graduate with significant debt might forgo a fulfilling but lower-paying position in the non-profit sector and instead accept a higher-paying, but less personally satisfying, job in finance. This can lead to long-term career dissatisfaction and potentially limit opportunities for personal and professional growth. This phenomenon is particularly pronounced among students from lower socioeconomic backgrounds who may have relied more heavily on loans to finance their education.

Delayed Homeownership

The significant monthly payments associated with student loans can make it incredibly difficult to save for a down payment on a house. The large debt burden often pushes homeownership further into the future, impacting individuals’ ability to build equity and wealth. For instance, a young professional with $100,000 in student loan debt might find it challenging to save enough for a down payment, potentially delaying homeownership by several years compared to their peers without such debt. This delay in homeownership can have ripple effects, limiting access to wealth building through property appreciation and impacting family formation.

Challenges in Retirement Planning

Student loan debt can severely impact retirement savings. The substantial monthly payments leave less disposable income available for retirement contributions, potentially jeopardizing financial security in later life. Consider a scenario where a graduate allocates a significant portion of their income to student loan repayments, leaving limited funds for 401(k) contributions or other retirement investments. This can result in a smaller retirement nest egg and a less comfortable retirement, potentially requiring individuals to work longer than planned.

Societal Consequences of High Student Loan Debt

High levels of student loan debt have significant societal consequences. It can hinder economic growth by reducing consumer spending and investment. The burden of debt can also exacerbate existing inequalities, disproportionately affecting low-income students and students of color who often borrow more and face greater challenges in repaying their loans. Moreover, high student debt levels can contribute to social unrest and dissatisfaction, as individuals struggle to achieve financial stability and meet their life goals. The strain on individuals and families translates to broader societal challenges.

Examples of Financial Challenges

A case study of a recent graduate with $75,000 in student loan debt illustrates the significant financial strain. With monthly payments consuming a substantial portion of their income, this graduate finds it difficult to save for a down payment on a home, build an emergency fund, or contribute adequately to retirement savings. Another example is a teacher with a large student loan debt who is forced to work extra jobs to meet their monthly payments, leading to burnout and reduced time for family and personal pursuits. These examples highlight the pervasive impact of student loan debt on individuals’ financial well-being and overall quality of life.

Understanding Interest Rates and Loan Terms

Navigating the world of student loans requires a solid grasp of interest rates and loan terms. These factors significantly impact the total cost of your education and your long-term financial health. Understanding how they work empowers you to make informed decisions and plan effectively for repayment.

Understanding how interest accrues is crucial for managing your student loan debt effectively. This section will clarify the mechanics of interest rates and loan terms, providing examples to illustrate their impact on your overall repayment.

Compound Interest and its Impact

Compound interest is the interest calculated on both the principal amount and the accumulated interest from previous periods. It’s essentially “interest on interest,” and it can significantly increase the total cost of a loan over time. The more frequently interest is compounded (e.g., daily, monthly), the faster your debt grows. For example, imagine a $10,000 loan with a 5% annual interest rate compounded annually. After one year, you’ll owe $500 in interest. However, in the second year, the interest is calculated not just on the original $10,000, but also on the accumulated $500 interest, leading to a slightly higher interest payment. This effect continues year after year, resulting in a substantially larger total repayment amount than the initial loan principal. The longer the loan term, the more pronounced the effect of compound interest.

Interest Rate Determination and Influencing Factors

Several factors influence the interest rate you’ll receive on your student loan. These include your credit history (if applicable), the type of loan (federal or private), the loan’s repayment term, and prevailing market interest rates. Lenders assess your creditworthiness to determine the risk associated with lending you money. A strong credit history often translates to a lower interest rate, reflecting lower risk for the lender. Federal student loans generally offer lower, fixed interest rates compared to private loans, which often have variable interest rates that fluctuate with market conditions. Longer repayment terms typically result in lower monthly payments but higher overall interest costs due to the extended period of accruing interest. Finally, the prevailing market interest rates play a significant role. When market interest rates are high, lenders tend to charge higher interest rates on loans, and vice-versa.

Illustrative Examples of Interest Rate and Loan Term Impact

Let’s consider two scenarios to illustrate the impact of different interest rates and loan terms.

Scenario 1: A $20,000 loan with a 4% interest rate over 10 years would result in a significantly lower total repayment amount compared to…

Scenario 2: …a $20,000 loan with a 7% interest rate over 15 years. Even though the monthly payments in Scenario 2 might seem smaller initially, the extended repayment period and higher interest rate will ultimately lead to a much larger total repayment amount. This difference highlights the importance of carefully considering both the interest rate and the loan term when choosing a student loan. It is crucial to perform a thorough cost-benefit analysis before deciding on a specific loan option. Using online loan calculators can help estimate the total repayment cost under different scenarios.

Defaulting on Student Loans

Defaulting on your student loans has serious and long-lasting consequences that can significantly impact your financial future. Understanding these repercussions and the available options for avoiding default is crucial for responsible loan management. Failure to repay your loans can lead to a cascade of negative effects, impacting your creditworthiness, employment prospects, and overall financial well-being.

The consequences of defaulting on student loans are severe and far-reaching. Ignoring your loan obligations can result in a damaged credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Furthermore, your wages may be garnished, meaning a portion of your paycheck will be directly seized by the government to repay the debt. Your tax refunds may also be offset, meaning the government will intercept your tax refund to apply it towards your outstanding loan balance. These actions can severely restrict your financial flexibility and create significant hardship.

Consequences of Student Loan Default

Defaulting on student loans results in a significantly damaged credit score, making it harder to secure future loans, rent an apartment, or even get a job. Wage garnishment, where a portion of your earnings is legally seized, can severely limit your disposable income. Tax refund offset involves the government intercepting your tax refund to pay down your debt. These consequences can create a cycle of financial difficulty that is challenging to overcome. For example, a borrower who defaults might find themselves unable to secure a mortgage to buy a house, or forced to accept lower-paying jobs due to their impaired credit. The financial burden can extend beyond the individual, impacting their family and overall quality of life.

Options for Borrowers Facing Payment Difficulties

Several options exist to help borrowers struggling to make their student loan payments. Deferment postpones payments temporarily, usually due to specific circumstances like unemployment or enrollment in school. Forbearance allows for temporary suspension or reduction of payments, often with accruing interest. Loan rehabilitation is a program that allows borrowers to bring their defaulted loans back into good standing by making a series of on-time payments. These programs offer temporary relief and provide an opportunity to avoid the severe consequences of default. Choosing the appropriate option depends on the individual’s circumstances and the type of loan they have. It is advisable to contact your loan servicer to explore available options.

Impact of Default: A Hypothetical Case Study

Consider Maria, a recent college graduate with significant student loan debt. Due to unexpected job loss and medical expenses, she falls behind on her loan payments. After several missed payments, her loans enter default. Her credit score plummets, making it difficult to secure a new job or rent an apartment. Wage garnishment significantly reduces her already limited income. She faces constant stress and anxiety due to the mounting debt and the limitations it places on her life. This situation illustrates how defaulting on student loans can have a devastating impact on an individual’s financial stability and overall well-being. Maria’s story highlights the importance of proactive loan management and seeking help when facing financial difficulties.

Final Review

Securing a higher education is a significant investment, and understanding student government loans is paramount to responsible financial planning. This guide has provided a framework for navigating the complexities of loan types, applications, repayment, and forgiveness programs. By carefully considering the information presented and proactively managing their debt, students can confidently pursue their educational aspirations without undue financial burden. Remember to explore all available resources and seek professional advice when needed to ensure a successful path toward financial well-being.

Expert Answers

What happens if I can’t make my loan payments?

Several options exist, including deferment (temporarily postponing payments), forbearance (reducing or suspending payments), and loan rehabilitation (re-establishing good standing). Contact your loan servicer immediately to explore these possibilities.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple loans into a single loan with a new interest rate and repayment plan. This can simplify repayment but may not always lower your overall cost.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or during deferment. Unsubsidized loans accrue interest from the time they’re disbursed.

How long does it take to repay student loans?

Repayment timelines vary depending on the loan type and repayment plan chosen. Standard repayment plans typically span 10 years, but other options offer longer terms.