Navigating the complexities of higher education often involves the significant financial commitment of student loans. Understanding the nuances of interest rates, repayment plans, and the long-term implications of borrowing is crucial for responsible financial planning. This guide delves into the various types of student loans, providing a clear picture of the financial landscape facing students and recent graduates.

From federal subsidized and unsubsidized loans to the diverse offerings from private lenders, we’ll explore the key differences in interest rates, repayment terms, and associated fees. We’ll also examine strategies for managing student loan debt effectively, including budgeting, consolidation, and refinancing options, empowering you to make informed decisions about your financial future.

Types of Student Interest Loans

Navigating the world of student loans can feel overwhelming, but understanding the different types available is crucial for making informed financial decisions. This section will break down the key distinctions between federal and private student loans, providing a clearer picture of your options.

Student loans are broadly categorized into federal and private loans, each with its own set of characteristics impacting interest rates, repayment terms, and eligibility.

Federal Student Loans

Federal student loans are offered by the U.S. government through various programs. These loans generally offer more favorable terms than private loans, including lower interest rates and flexible repayment options. They are also subject to consumer protection regulations, offering greater borrower safeguards.

| Loan Type | Lender | Interest Rate Information | Repayment Options |

|---|---|---|---|

| Subsidized Federal Stafford Loan | U.S. Department of Education | Interest rate set annually by the government; interest does not accrue while the student is enrolled at least half-time. | Standard, graduated, extended, income-driven repayment plans. |

| Unsubsidized Federal Stafford Loan | U.S. Department of Education | Interest rate set annually by the government; interest accrues from the time the loan is disbursed, regardless of enrollment status. | Standard, graduated, extended, income-driven repayment plans. |

| Federal PLUS Loan (Graduate/Parent) | U.S. Department of Education | Interest rate set annually by the government; generally higher than Stafford Loans. | Standard, graduated, extended, income-driven repayment plans. |

Subsidized vs. Unsubsidized Federal Student Loans

The key difference between subsidized and unsubsidized federal Stafford Loans lies in interest accrual. With subsidized loans, the government pays the interest while the borrower is enrolled at least half-time in school and during certain grace periods. Unsubsidized loans, however, accrue interest from the time the loan is disbursed, meaning the borrower is responsible for all accumulated interest. This can significantly impact the total loan amount owed upon graduation.

Private Student Loans

Private student loans are offered by banks, credit unions, and other private lenders. These loans typically have higher interest rates and less flexible repayment options compared to federal loans. Eligibility is often based on creditworthiness, requiring a co-signer if the borrower lacks a sufficient credit history.

| Loan Type | Lender (Example) | Interest Rate Information | Repayment Options |

|---|---|---|---|

| Private Student Loan | Sallie Mae, Discover, Citizens Bank | Variable or fixed rates, determined by the lender based on creditworthiness; generally higher than federal loan rates. | Standard, graduated, potentially other lender-specific options. |

It’s important to note that private loan terms vary significantly among lenders. Borrowers should carefully compare offers from multiple lenders before selecting a private student loan.

Interest Rates and Fees

Understanding the interest rates and fees associated with student loans is crucial for responsible borrowing and financial planning. These costs significantly impact the total amount you’ll repay, so it’s essential to carefully consider them before taking out a loan. The information below provides a clearer picture of these financial aspects.

Factors Influencing Student Loan Interest Rates

Several factors contribute to the interest rate you’ll receive on your student loan. Your credit score plays a significant role; a higher credit score generally translates to a lower interest rate, reflecting a lower perceived risk to the lender. The type of loan also matters; federal student loans typically offer lower interest rates than private loans due to government backing and subsidies. Finally, the repayment plan you choose can indirectly influence your rate. While the interest rate itself doesn’t change based on the repayment plan, choosing a longer repayment term may seem cheaper initially but will result in paying significantly more interest overall.

Comparison of Interest Rates Across Loan Types

The interest rates for student loans vary depending on the type of loan and the lender. It’s important to shop around and compare offers before making a decision.

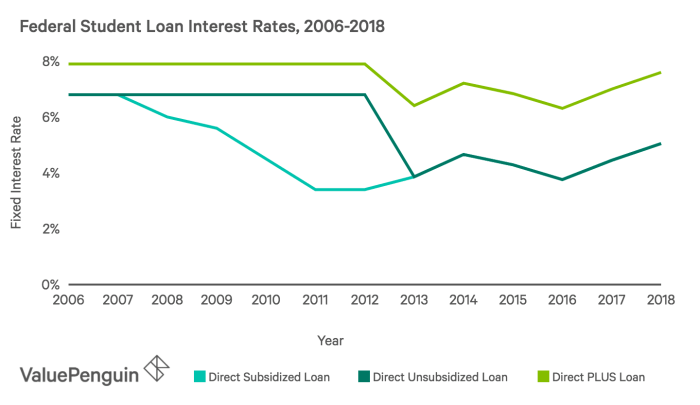

- Federal Subsidized Loans: These loans typically have lower interest rates than unsubsidized loans because the government pays the interest while you’re in school. Average interest rates fluctuate yearly, but generally remain lower than other options. For example, in a recent year, the average interest rate might have been around 4.5%.

- Federal Unsubsidized Loans: Interest begins accruing on these loans as soon as they’re disbursed, even while you’re still studying. Expect a slightly higher average interest rate than subsidized loans. For instance, in the same recent year, the average rate might have been approximately 5.5%.

- Federal PLUS Loans: These loans are for parents or graduate students, and often come with slightly higher interest rates than undergraduate loans. An example might be an average interest rate around 6.5% in a given year.

- Private Student Loans: These loans are offered by private lenders and typically have variable interest rates that can fluctuate based on market conditions. Rates can be significantly higher than federal loan rates and are largely dependent on your creditworthiness. Average rates can vary widely, potentially ranging from 7% to 15% or even higher.

Student Loan Fees

In addition to interest, various fees are associated with student loans. Understanding these fees is crucial for budgeting and managing your loan repayment effectively.

- Origination Fees: These are fees charged by the lender when the loan is processed and disbursed. The amount varies depending on the lender and loan type. For federal loans, origination fees are usually deducted from the loan amount before it’s disbursed to the borrower.

- Late Payment Fees: If you miss a loan payment, you’ll likely incur a late payment fee. These fees can add up significantly over time and negatively impact your credit score. The exact amount of the fee depends on the lender.

- Prepayment Penalties: Some private student loans may include prepayment penalties, which are fees charged if you pay off the loan early. However, most federal student loans do not have prepayment penalties, making early repayment a financially sound strategy.

Repayment Options and Plans

Understanding your repayment options is crucial for successfully managing your student loans. Choosing the right plan can significantly impact your monthly payments and overall repayment timeline. Several plans cater to different financial situations and priorities.

Different repayment plans offer varying levels of flexibility and affordability. The best option depends on your individual circumstances, including your income, debt amount, and financial goals. Let’s explore the common repayment plans available.

Standard Repayment Plan

The standard repayment plan is the most common option. It involves fixed monthly payments over a 10-year period. This plan offers predictable payments, allowing for budgeting and timely repayment. However, monthly payments might be higher compared to other plans.

Graduated Repayment Plan

A graduated repayment plan starts with lower monthly payments that gradually increase over time. This can be beneficial for borrowers who anticipate higher income in the future. While initially more manageable, the payments become progressively larger.

Extended Repayment Plan

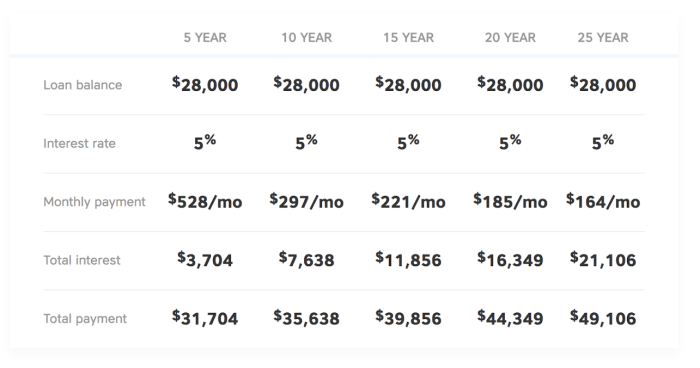

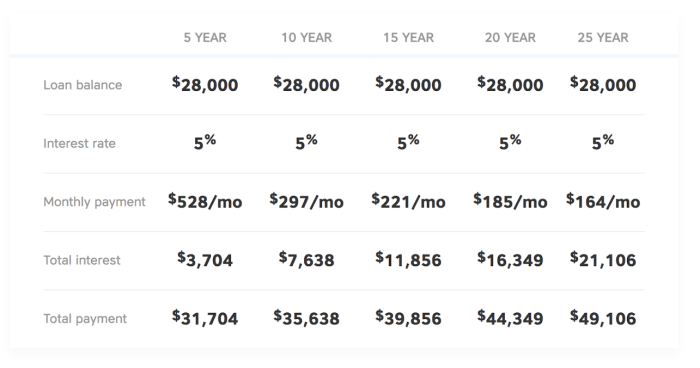

This plan extends the repayment period beyond the standard 10 years, typically up to 25 years. This lowers monthly payments but results in paying significantly more interest over the life of the loan. It’s generally suitable for borrowers with higher loan balances.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) link your monthly payments to your income and family size. Several types of IDR plans exist, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans offer lower monthly payments, often making them more manageable during periods of lower income. However, they often extend the repayment period, leading to higher total interest paid.

Sample Repayment Schedule

The following table illustrates a hypothetical repayment schedule for a $30,000 student loan with a 5% interest rate, showcasing the differences between Standard, Graduated, and Income-Driven repayment plans (Income-Driven is a simplified example, actual payments vary greatly depending on income and plan type).

| Month | Payment Amount (Standard Plan) | Payment Amount (Graduated Plan) | Payment Amount (Income-Driven Plan) |

|---|---|---|---|

| 1 | $316 | $200 | $150 |

| 12 | $316 | $225 | $150 |

| 24 | $316 | $250 | $150 |

| 36 | $316 | $275 | $150 |

| 60 | $316 | $325 | $150 |

| 120 | $316 | $400 | $150 |

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe consequences. These include damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. In some cases, it can even lead to legal action. It is crucial to prioritize repayment and explore available options if facing financial difficulties.

Managing Student Loan Debt

Successfully navigating student loan debt requires a proactive and strategic approach. Understanding your repayment options and employing effective management techniques can significantly reduce stress and accelerate your journey to financial freedom. This section Artikels key strategies to help you effectively manage your student loan debt and minimize its long-term impact.

Effective management of student loan debt involves a multifaceted approach encompassing budgeting, debt consolidation, and refinancing. Each strategy offers unique benefits and should be considered based on individual financial circumstances and goals. Careful planning and consistent effort are crucial for achieving optimal results.

Budgeting Strategies for Student Loan Repayment

Developing a realistic budget is paramount to successful student loan repayment. This involves tracking income and expenses meticulously to identify areas for savings and allocate funds towards loan payments. A well-structured budget provides a clear picture of your financial situation, enabling informed decision-making and preventing overspending. Consider using budgeting apps or spreadsheets to simplify the process and monitor progress effectively. Prioritizing loan payments within your budget ensures consistent repayment and minimizes the risk of delinquency.

Debt Consolidation

Debt consolidation involves combining multiple student loans into a single loan with a potentially lower interest rate or more manageable repayment terms. This simplification can streamline the repayment process and reduce administrative burden. However, it’s crucial to carefully compare the terms of any consolidation loan before proceeding, ensuring it aligns with your financial goals and doesn’t inadvertently extend your repayment period or increase your overall interest paid. For example, a federal Direct Consolidation Loan might offer a simplified repayment process but may not lower your interest rate.

Student Loan Refinancing

Student loan refinancing involves replacing your existing student loans with a new loan from a private lender. The primary benefit is often a lower interest rate, leading to lower monthly payments and reduced total interest paid over the life of the loan. However, refinancing can come with drawbacks. For instance, you might lose access to federal loan benefits like income-driven repayment plans or deferment options. Before refinancing, thoroughly compare interest rates, fees, and repayment terms from multiple lenders to find the most favorable option. It’s also vital to assess your creditworthiness and ensure you meet the lender’s eligibility criteria. For example, a borrower with excellent credit might qualify for a significantly lower interest rate compared to a borrower with a lower credit score.

Tips for Minimizing Interest Payments and Accelerating Loan Repayment

Several strategies can significantly reduce interest payments and expedite loan repayment. Implementing these tips can save you considerable money over the long term and help you achieve financial independence sooner.

- Make extra payments whenever possible. Even small additional payments can significantly reduce the principal balance and shorten the repayment period.

- Prioritize high-interest loans. Focus on paying down loans with the highest interest rates first to minimize the overall interest paid.

- Explore autopay options. Many lenders offer discounts for enrolling in automatic payments, reducing your monthly payment amount.

- Refinance to a lower interest rate. As discussed previously, refinancing can dramatically reduce interest costs if you qualify for a lower rate.

- Consider income-driven repayment plans (if applicable). These plans adjust your monthly payments based on your income and family size, making them more manageable in the short term.

Benefits and Drawbacks of Student Loan Refinancing

Refinancing student loans presents both advantages and disadvantages that borrowers should carefully weigh before making a decision.

| Benefit | Drawback |

|---|---|

| Potentially lower interest rates, leading to lower monthly payments and reduced total interest paid. | Loss of federal loan benefits such as income-driven repayment plans and deferment options. |

| Simplified repayment with a single monthly payment. | Higher risk if you have a poor credit score, as you may not qualify for favorable terms. |

| Potential for a shorter repayment term. | May require a higher credit score compared to maintaining federal loans. |

The Impact of Student Loans on Students

Student loans can significantly impact a student’s financial well-being, extending far beyond graduation. Understanding the long-term implications is crucial for responsible borrowing and effective financial planning. The weight of debt can influence major life decisions and shape financial stability for years to come.

The potential long-term financial implications of student loans are substantial. High interest rates can quickly escalate the total amount owed, leading to a larger debt burden than initially anticipated. This increased debt can delay major life milestones, such as homeownership, starting a family, or even retirement planning. Furthermore, the consistent monthly payments required can strain a graduate’s budget, potentially limiting opportunities for savings and investments. The impact extends beyond personal finances; high debt levels can also affect credit scores, making it harder to secure loans for cars, mortgages, or even credit cards in the future.

The Effect of High Interest Rates and Loan Balances on Post-Graduation Financial Planning

High interest rates and substantial loan balances significantly hinder post-graduation financial planning. For instance, a graduate with a $50,000 loan at a 7% interest rate will pay significantly more over the life of the loan than someone with the same principal but a lower interest rate. This increased cost directly impacts the ability to save for a down payment on a house, invest in retirement accounts, or build an emergency fund. The monthly payments themselves consume a considerable portion of a graduate’s income, leaving less disposable income for other essential expenses and lifestyle choices. This financial constraint can lead to delayed gratification and a slower accumulation of wealth. Consider a recent graduate earning $50,000 annually; a substantial student loan payment can drastically reduce their savings capacity, potentially delaying retirement planning by several years.

A Descriptive Illustration of the Financial Burden of Student Loan Debt

Imagine Sarah, a recent college graduate with a $40,000 student loan debt at a 6% interest rate. Her monthly payment is approximately $400. This represents a significant portion of her post-graduate income, especially considering other living expenses such as rent, utilities, and groceries. Sarah’s financial burden manifests in several ways. She has had to delay purchasing a car, opting for public transportation instead. Travel plans are limited to budget-friendly options, and she has postponed any thoughts of buying a home. Social activities are also impacted; she has to carefully budget for entertainment, foregoing some outings with friends to manage her debt payments. Sarah’s lifestyle reflects the common sacrifices made by many graduates grappling with substantial student loan debt. She diligently makes her monthly payments to avoid default, but the financial strain is undeniable, influencing her short-term and long-term financial goals. This scenario highlights the real-world impact of student loans on the lifestyle and financial well-being of recent graduates.

Government Regulations and Policies

Student loans in the United States are heavily regulated by the federal government, aiming to balance access to higher education with responsible lending practices and borrower protection. These regulations impact various aspects of the loan lifecycle, from application and disbursement to repayment and default. Understanding these policies is crucial for both borrowers and lenders.

The federal government’s role in overseeing student loan programs is multifaceted. Several agencies play significant parts in this complex system. The Department of Education (ED) is the primary agency, responsible for administering federal student aid programs, including the disbursement of funds, establishing eligibility criteria, and enforcing regulations. Other agencies, such as the Consumer Financial Protection Bureau (CFPB), play a supporting role by monitoring lenders for compliance and protecting borrowers from predatory practices. The interplay between these agencies ensures a degree of oversight and accountability within the student loan system.

Government Agencies Involved in Student Loan Oversight

The Department of Education’s Federal Student Aid office manages the majority of federal student loan programs. They set the rules for eligibility, disbursement, and repayment. The CFPB, while not directly involved in loan disbursement, focuses on protecting consumers from unfair, deceptive, or abusive practices by lenders. Finally, independent auditing and review processes contribute to accountability and transparency within the system. These checks and balances aim to minimize fraud and ensure responsible lending practices.

Recent Legislative Changes Affecting Student Loan Forgiveness and Repayment

The landscape of student loan forgiveness and repayment assistance is constantly evolving due to legislative changes. Recent alterations have significantly impacted borrowers.

- Expansion of Income-Driven Repayment (IDR) Plans: Recent legislation has broadened eligibility for IDR plans, allowing more borrowers to make smaller monthly payments based on their income. This reduces the immediate financial burden on many borrowers.

- Temporary COVID-19 Relief Measures: During the COVID-19 pandemic, several temporary measures were implemented, including pauses on payments and interest accrual. While these measures have largely expired, they illustrate the government’s capacity to respond to economic crises affecting borrowers.

- Targeted Loan Forgiveness Programs: Certain programs offer loan forgiveness for specific professions (e.g., public service) or for borrowers who meet particular criteria (e.g., borrowers with disabilities). These programs aim to incentivize specific career paths or address hardship cases.

- Increased Scrutiny of Private Loan Practices: Increased regulatory oversight of private student loan lenders has led to stricter rules and greater consumer protection. This aims to prevent predatory lending practices that can harm borrowers.

Closure

Successfully managing student loan debt requires proactive planning and a comprehensive understanding of available options. By carefully considering loan types, interest rates, and repayment strategies, students can mitigate the long-term financial burden and pave the way for a secure financial future. Remember that seeking professional financial advice can provide personalized guidance tailored to your unique circumstances.

Query Resolution

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default, with serious consequences like wage garnishment.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it might involve switching from a federal to a private loan, losing potential federal protections.

What is the difference between a subsidized and unsubsidized loan?

Subsidized loans don’t accrue interest while you’re in school (under certain conditions), while unsubsidized loans accrue interest from the time the loan is disbursed.

How long does it typically take to repay student loans?

The repayment period varies depending on the loan type and repayment plan, ranging from 10 to 25 years or more.