Navigating the complexities of student loan repayment can be challenging, especially when dealing with 1099 forms. Understanding the tax implications of receiving a 1099 for student loan forgiveness or repayment is crucial for responsible financial planning. This guide clarifies the process, providing examples and insights to help you manage your tax obligations effectively. We’ll explore various scenarios, different forgiveness programs, and the intricacies of completing the 1099-NEC form correctly.

From identifying which forgiveness programs trigger 1099 reporting to comparing the tax implications of different repayment plans, we aim to demystify the process. We will also delve into potential tax deductions and the impact of state taxes, offering a comprehensive overview to empower you to make informed decisions.

Tax Implications of 1099 Income for Students

Receiving a 1099 form for student loan forgiveness or repayment can significantly impact your tax liability. Understanding these implications is crucial for accurate tax filing and avoiding potential penalties. This section will clarify the tax treatment of such income and provide examples to illustrate the process.

Reporting 1099 Income from Student Loan Programs

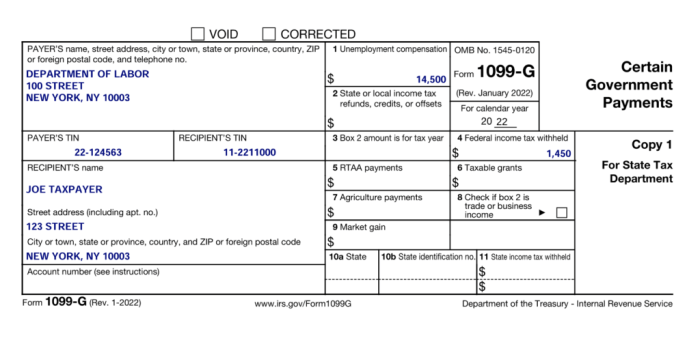

The IRS considers student loan forgiveness or repayment received as taxable income. This means that the amount forgiven or repaid that is reported on your 1099-C (Cancellation of Debt) or similar form must be included in your gross income when filing your federal tax return. You will report this income on Form 1040, Schedule 1 (Additional Income and Adjustments to Income). Accurate record-keeping of all relevant documentation, including the 1099 form, is essential for a smooth tax filing process. Failure to report this income can lead to penalties and interest charges.

Examples of Tax Implications for Student Loan Forgiveness

Let’s consider a few scenarios:

Scenario 1: A student receives $10,000 in student loan forgiveness. This $10,000 is considered taxable income and will be added to their other income when calculating their overall tax liability. Their tax owed will depend on their total income and applicable tax bracket.

Scenario 2: A student has $20,000 in student loan debt forgiven through a public service loan forgiveness program. This $20,000 is also considered taxable income. However, depending on their other income, they may be able to deduct certain expenses or utilize tax credits to potentially offset the tax burden.

Scenario 3: A student receives $5,000 in student loan repayment assistance. Similar to the previous scenarios, this $5,000 is considered taxable income and must be reported.

Tax Brackets and Their Effect on 1099 Income from Student Loan Programs

The amount of tax you owe on your 1099 income from student loan programs depends heavily on your tax bracket. Higher income generally leads to a higher tax rate. The following table illustrates this:

| Tax Bracket | Tax Rate (Example – Subject to Change) | $10,000 Forgiveness Tax | $20,000 Forgiveness Tax |

|---|---|---|---|

| 10% | 10% | $1,000 | $2,000 |

| 12% | 12% | $1,200 | $2,400 |

| 22% | 22% | $2,200 | $4,400 |

| 24% | 24% | $2,400 | $4,800 |

Note: This table provides example tax rates and calculations for illustrative purposes only. Actual tax rates and calculations will vary depending on the applicable tax year, individual circumstances, and the total taxable income. Consult a tax professional for personalized advice. Tax laws are subject to change.

Student Loan Forgiveness Programs and 1099 Reporting

Student loan forgiveness programs, while offering significant financial relief, can have unexpected tax implications. The key factor determining whether you receive a 1099-C (Cancellation of Debt) is whether the forgiven amount is considered income. This depends largely on the specific program and your individual circumstances. Understanding these nuances is crucial for accurate tax reporting and avoiding potential penalties.

Types of Student Loan Forgiveness Programs and 1099 Reporting

Different student loan forgiveness programs have varying rules regarding taxability. Some programs, such as those based on public service or income-driven repayment plans reaching their completion, may result in the forgiven debt being considered taxable income, triggering a 1099-C. Others, like those related to total and permanent disability, generally do not. The distinction hinges on whether the forgiveness is considered a “discharge of indebtedness,” which is generally taxable.

Tax Liability Associated with Student Loan Forgiveness

If your student loan forgiveness is considered taxable income, you will receive a 1099-C form reporting the forgiven amount. This amount is added to your gross income and is subject to federal income tax. The tax liability will depend on your overall income and applicable tax bracket. In some cases, you may also owe state income tax on the forgiven amount. It’s important to note that you may be able to reduce your tax liability through deductions or credits, but these will need to be explored on a case-by-case basis.

Examples of 1099-C Reporting for Student Loan Forgiveness

Let’s consider two scenarios:

Scenario 1: A teacher participates in the Public Service Loan Forgiveness (PSLF) program and has $20,000 in student loans forgiven after 10 years of qualifying employment. This forgiven amount is likely considered taxable income and will be reported on a 1099-C. They will need to report this $20,000 as income on their tax return, potentially increasing their tax liability.

Scenario 2: An individual becomes totally and permanently disabled and has their student loans discharged under a disability discharge program. In this case, the forgiven amount is generally not considered taxable income and will not be reported on a 1099-C. No tax liability arises from the loan forgiveness.

Important Considerations for Accurate Reporting

Accurate reporting of forgiven student loan debt is crucial. Carefully review any 1099-C form you receive and ensure the information is accurate. If you disagree with the amount reported, contact the lender or the IRS immediately. Seek professional tax advice if you are unsure how to report the forgiven amount on your tax return. Understanding the specifics of your forgiveness program and its tax implications can help you avoid potential penalties and ensure accurate tax filing.

Understanding the 1099-NEC Form for Student Loan Income

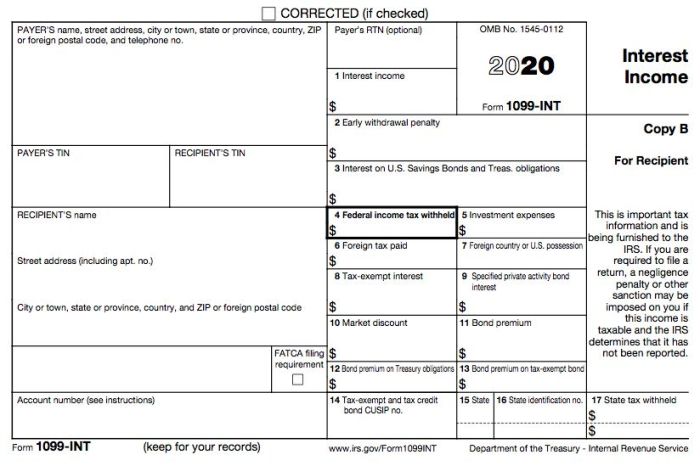

The 1099-NEC form, or Nonemployee Compensation, is used to report payments made to independent contractors. While unusual for student loan income, it’s possible you might receive a 1099-NEC if you’ve received payments for services related to your studies, such as teaching assistant work or freelance tutoring, and the payer classifies you as an independent contractor rather than an employee. Understanding this form is crucial for accurate tax reporting.

Information Required on a 1099-NEC for Student Loan Income

The information required on a 1099-NEC for student loan-related income is similar to that required for other types of 1099-NEC income. This includes your name, address, and taxpayer identification number (TIN), usually your Social Security Number (SSN). The payer (the entity making the payment) will also provide their information, including their name, address, and Employer Identification Number (EIN). Crucially, the form must accurately reflect the total amount of payments received during the tax year. This amount is reported in Box 1, and is the figure you will use when filing your taxes. There is also a space for reporting federal income tax withheld (Box 4), though this is less common with 1099-NEC forms related to student work.

Penalties for Incorrectly Reporting Income on a 1099-NEC

Incorrectly reporting income on a 1099-NEC can lead to significant penalties from the IRS. These penalties can include interest charges on unpaid taxes, fines, and even criminal prosecution in cases of intentional tax evasion. The severity of the penalty depends on factors such as the amount of unreported income, the intent behind the misreporting, and the taxpayer’s history of compliance. For example, underreporting income by $10,000 could result in significant penalties including interest on the unpaid tax liability, as well as potential penalties for the underreporting itself. It’s always best to seek professional tax advice if you’re unsure about how to accurately report your income.

Step-by-Step Guide on Filling Out a 1099-NEC Form for Student Loan Related Income

While less common, if you receive a 1099-NEC for student loan related income, here’s a step-by-step guide. Remember, this form is typically completed by the payer, not the recipient.

- Verify the Information: Carefully check all the information provided on the 1099-NEC to ensure accuracy. This includes your name, address, TIN, and the amount reported in Box 1.

- Review for Completeness: Ensure all necessary boxes are filled in correctly and completely. Missing or incorrect information can delay processing and lead to complications.

- Keep a Copy for Your Records: Retain a copy of the 1099-NEC for your tax records. This is crucial for preparing your tax return and for auditing purposes.

- Use the Information to File Your Taxes: Use the information from the 1099-NEC, specifically Box 1, when completing your tax return (Form 1040). Report this income as “Other Income” on Schedule 1 (Additional Income and Adjustments to Income).

Sample 1099-NEC Form with Fictional Data

The following is a sample 1099-NEC form with fictional data for illustrative purposes. Remember, this is an example only, and your actual 1099-NEC will contain your specific information and income details.

| Box Number | Description | Amount |

|---|---|---|

| 1 | Nonemployee compensation | $5,000 |

| 2 | Federal income tax withheld | $0 |

| 3 | Social Security wages | $0 |

| 4 | Social Security tax withheld | $0 |

| 5 | Medicare wages | $0 |

| 6 | Medicare tax withheld | $0 |

| 7 | State/local income tax withheld | $0 |

| Payer Name | Example University | |

| Payer EIN | 12-3456789 | |

| Recipient Name | Jane Doe | |

| Recipient SSN | XXX-XX-XXXX |

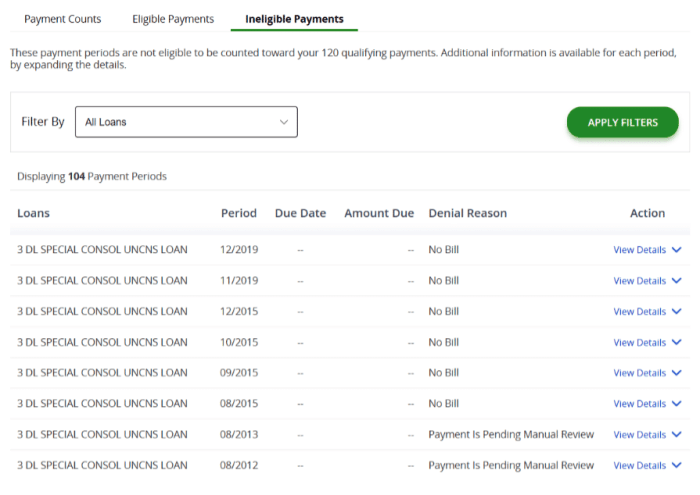

Comparison of Student Loan Repayment Plans and Tax Implications

Choosing a student loan repayment plan significantly impacts your monthly budget and, importantly, your tax liability. While the loan payments themselves aren’t directly tax-deductible (with some limited exceptions for certain professions), the method of repayment influences your overall tax situation through its effect on your income and therefore your tax bracket. Understanding these nuances is crucial for effective financial planning.

Different repayment plans affect your taxable income in subtle yet significant ways. Income-driven repayment (IDR) plans, for example, base your monthly payment on your income and family size, potentially leading to lower payments in the short term. Standard repayment plans, conversely, involve fixed payments over a set period, regardless of income fluctuations. This difference directly impacts your disposable income and consequently, your tax liability.

Income-Driven Repayment (IDR) Plans and Tax Implications

IDR plans, such as ICR, PAYE, REPAYE, andIBR, are designed to make student loan repayment more manageable by adjusting payments based on your income. Because your monthly payment is lower, more of your income remains available for other expenses, potentially reducing your tax burden in the short term. However, the lower payments often extend the repayment period, leading to higher total interest paid over the life of the loan. This increased interest is not tax-deductible, and it might push your total loan repayment cost significantly higher compared to a standard plan. Furthermore, any forgiven loan amount at the end of the repayment term under IDR plans may be considered taxable income, potentially resulting in a substantial tax bill in the future.

Standard Repayment Plans and Tax Implications

Standard repayment plans involve fixed monthly payments over a 10-year period. While the monthly payment is typically higher than under IDR plans, this results in paying off the loan faster and ultimately paying less interest overall. The higher monthly payments mean less disposable income, which could potentially lower your taxable income and your tax bracket in some cases, although this is highly dependent on individual circumstances. However, there is no potential for future tax liability from loan forgiveness as there is with IDR plans.

Comparison Table: Student Loan Repayment Plans and Tax Implications

| Repayment Plan | Monthly Payment | Total Interest Paid | Tax Implications |

|---|---|---|---|

| Standard Repayment | Higher, fixed | Lower | Potentially lower taxable income due to higher payments, no forgiveness tax liability. |

| Income-Driven Repayment (IDR) | Lower, income-based | Higher | Potentially higher taxable income due to lower payments, potential for significant tax liability from loan forgiveness. |

Impact of Repayment Plan Choice on Overall Tax Burden

The choice between a standard repayment plan and an IDR plan significantly influences your overall tax burden. A standard plan leads to higher monthly payments but lower total interest paid and no tax liability from loan forgiveness. An IDR plan, conversely, offers lower monthly payments but often results in significantly higher total interest and a potential large tax bill upon loan forgiveness. The best option depends on your individual financial circumstances, risk tolerance, and long-term financial goals. For instance, someone with a high income and a short-term horizon might prefer the standard plan to minimize overall interest paid. Conversely, someone with a low income and a longer-term horizon might choose an IDR plan to manage monthly expenses, even if it means potentially higher overall costs and a future tax liability.

Potential Tax Deductions Related to Student Loan Payments

While receiving 1099 income for student work might seem straightforward, there are potential tax deductions that can lessen your tax burden. It’s crucial to understand these deductions to minimize your tax liability. Remember to consult a tax professional for personalized advice, as eligibility for deductions depends on individual circumstances and changes in tax law.

The Internal Revenue Service (IRS) offers several deductions that could be relevant to individuals earning income from 1099 work while simultaneously managing student loan debt. However, it’s important to note that not all deductions apply universally and some have income limitations. Proper record-keeping is essential to successfully claim any deductions.

Student Loan Interest Deduction

This deduction allows taxpayers to deduct the amount of interest they paid on qualified student loans during the tax year. The amount deductible is limited, and it phases out for higher income earners. For example, in 2023, a single filer could deduct the full amount of interest paid if their modified adjusted gross income (MAGI) was below $85,000. This deduction is claimed on Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits). To claim this deduction, you must have paid interest on qualified education loans and itemize your deductions instead of taking the standard deduction. It’s important to note that the deduction is for the interest paid, not the principal amount of the loan.

Deduction for Education Expenses

While not directly related to student loan *payments*, deductions for educational expenses can indirectly benefit those paying off student loans. If you are pursuing further education, certain expenses like tuition and fees may be deductible as an above-the-line deduction, reducing your adjusted gross income (AGI). A lower AGI can potentially impact the phase-out range for other deductions, including the student loan interest deduction. This deduction is claimed on Form 1040, Schedule 1. The requirements for claiming this deduction include attending an eligible educational institution and meeting specific criteria regarding the purpose of the education.

Itemized Deductions

If your total itemized deductions exceed the standard deduction amount, you may benefit from itemizing. Itemizing allows you to deduct various expenses, potentially including those related to your student loan situation, such as unreimbursed job-related expenses, which may be relevant if your 1099 work is directly related to your studies or future career. The overall strategy of itemizing versus taking the standard deduction depends on your individual financial circumstances.

Potential Tax Deductions Relevant to Student Loan Payments

Understanding the potential tax deductions can significantly impact your overall tax liability. Careful record-keeping and understanding the specific requirements for each deduction are key.

- Student Loan Interest Deduction: Allows a deduction for interest paid on qualified student loans. Income limits apply.

- Deduction for Education Expenses: Allows deductions for certain educational expenses, potentially lowering your AGI and impacting other deductions.

- Itemized Deductions: Claiming itemized deductions, which may include job-related expenses or other relevant deductions, can result in a lower tax liability than taking the standard deduction.

Impact of State Taxes on 1099 Income from Student Loans

Receiving a 1099-NEC for student loan income means you’ll need to consider not only federal taxes but also state taxes. Many states impose income taxes, and the amount you owe will depend on your state of residence and the specific provisions of that state’s tax code. This can significantly impact your net income after federal taxes are accounted for.

State tax laws vary considerably regarding the taxation of student loan income. Generally, 1099 income, including payments from student loan forgiveness programs, is considered taxable income at the state level in most states. However, there are exceptions and nuances that depend on the specifics of the program and the state’s tax regulations. For instance, some states may offer tax credits or deductions related to student loan payments, while others may not. The implications can be complex and require careful consideration.

State Tax Laws Varying Concerning Student Loan Forgiveness

While the federal government offers various student loan forgiveness programs, the tax implications at the state level can differ significantly. Some states may consider forgiven student loan debt as taxable income, while others may not. This inconsistency across states necessitates careful review of each state’s specific tax laws regarding student loan forgiveness. For example, a state might exempt forgiven amounts from certain income-driven repayment plans but tax those from other programs. This variance highlights the importance of consulting state tax guidelines directly or seeking professional tax advice.

Examples of State Tax Impact on Net Income

Let’s illustrate with a hypothetical example. Suppose a student receives $10,000 in student loan forgiveness under a federal program. After paying federal income taxes, they might have $7,000 remaining. However, if their state of residence taxes forgiven student loan amounts, they could face an additional state tax liability, reducing their net income further. For instance, a 5% state income tax would result in an additional $500 tax, leaving them with $6,500. In contrast, a state with no tax on forgiven student loan debt would allow them to retain the full $7,000.

State Tax Implications for Different States

| State | Taxability of Student Loan Forgiveness | Potential Tax Credits/Deductions | Example Tax Rate (Illustrative) |

|---|---|---|---|

| California | Generally taxable | None specific to student loan forgiveness | 9.3% (top bracket) |

| Florida | Not taxable | None | 0% |

| New York | Generally taxable | None specific to student loan forgiveness | 6.49% (top bracket) |

| Texas | Not taxable | None | 0% |

*Note: Tax laws are subject to change. This table provides a simplified overview and should not be considered exhaustive or legal advice. Consult a tax professional or your state’s tax agency for the most up-to-date and accurate information.*

Final Conclusion

Successfully navigating the tax implications of student loan 1099s requires a clear understanding of the relevant regulations and procedures. By carefully considering the information presented here—from accurately completing 1099-NEC forms to exploring potential tax deductions and the impact of state taxes—you can ensure compliance and optimize your financial position. Remember to consult with a qualified tax professional for personalized advice tailored to your specific circumstances.

Commonly Asked Questions

What if I received a 1099-NEC but didn’t receive any student loan forgiveness?

Contact the issuer of the 1099-NEC immediately to clarify the reason for the reporting. Incorrect reporting should be addressed promptly.

Are there penalties for filing a 1099 incorrectly?

Yes, penalties for incorrect reporting can include fines and interest charges. Accurate and timely filing is essential.

Can I deduct student loan interest payments even if I received a 1099 for forgiveness?

The deductibility of student loan interest depends on several factors, including your adjusted gross income and the type of loan. Consult a tax professional for personalized guidance.

How do I find my state’s specific tax rules regarding student loan forgiveness?

Consult your state’s tax agency website or a tax professional for specific rules and regulations in your state.