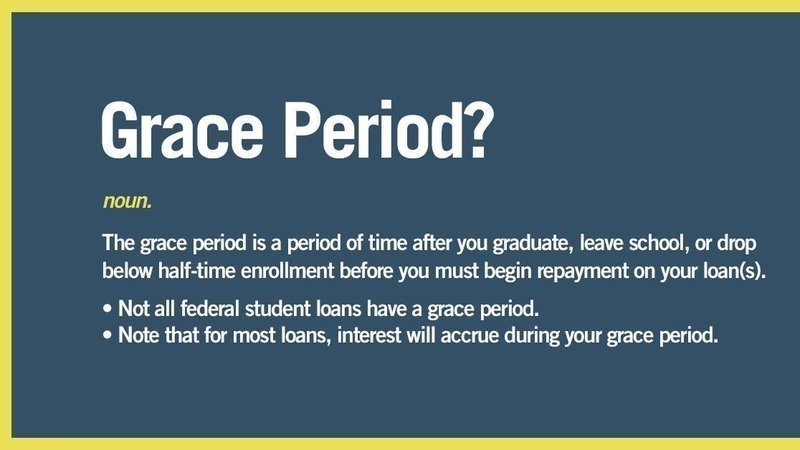

Navigating the complexities of student loan repayment can feel daunting, but understanding the 12-month grace period is a crucial first step. This period, offered after graduation or leaving school, provides a temporary reprieve before repayment begins. However, it’s not a free pass; interest often accrues during this time, potentially increasing your overall debt. This guide will illuminate the nuances of this grace period, helping you make informed decisions about your financial future.

We’ll explore eligibility requirements, interest implications, repayment plan options, and the consequences of default. Understanding these factors empowers you to develop a proactive repayment strategy, minimizing financial stress and ensuring a smoother transition into post-graduate life. We’ll cover both federal and private loan scenarios, providing a comprehensive overview to suit various circumstances.

Understanding the 12-Month Grace Period

The 12-month grace period on federal student loans provides a crucial buffer after graduation or leaving school before repayment begins. Understanding its intricacies is essential for effective financial planning and avoiding potential penalties. This section clarifies eligibility, details loan types covered, and guides you through determining your grace period start date. A comparison table helps illustrate the variations across different loan programs.

Eligibility for a 12-Month Grace Period

Eligibility for a 12-month grace period primarily depends on the type of student loan and your enrollment status. Generally, federal student loan borrowers who meet certain criteria, such as graduating, leaving school, or dropping below half-time enrollment, are eligible. Private loan grace periods, if offered, often have different eligibility requirements specified by the lender. It’s crucial to review your loan documents carefully to confirm your eligibility. Specific requirements may vary based on the loan program and lender.

Student Loan Types with 12-Month Grace Periods

Most federal student loans, including Direct Subsidized Loans, Direct Unsubsidized Loans, and Federal Stafford Loans, typically offer a 12-month grace period. However, Parent PLUS Loans and Graduate PLUS Loans have different repayment terms and may not follow the standard 12-month grace period. Private student loans may or may not offer a grace period; the terms vary greatly depending on the lender and the specific loan agreement. Always check your loan documents for details on your specific grace period.

Determining Your Grace Period Start Date

Pinpointing your grace period’s start date requires careful attention to your academic status. For federal loans, the grace period generally begins the day after you cease to be enrolled at least half-time. This means that if you graduate in May, your grace period starts the following June. If you withdraw from school during a semester, the grace period begins the day after your withdrawal date. For private loans, the start date is usually defined in your loan agreement; consult your lender if you are unsure.

Comparison of Grace Period Rules Across Loan Programs

The following table summarizes the key differences in grace period rules across various federal and private student loan programs. Remember that this is a general overview, and specific terms can vary depending on the lender and the year the loan was disbursed. Always refer to your loan documents for precise details.

| Loan Type | Grace Period Length | Interest Accrual During Grace Period | Repayment Plan Options |

|---|---|---|---|

| Federal Direct Subsidized Loan | 12 months | No (Subsidized) | Standard, Income-Driven |

| Federal Direct Unsubsidized Loan | 12 months | Yes | Standard, Income-Driven |

| Federal Parent PLUS Loan | No grace period | Yes | Standard |

| Private Student Loan (Example) | Varies (0-6 months or more) | Usually Yes | Varies by lender |

Interest Accrual During the Grace Period

Understanding how interest accrues during your student loan grace period is crucial for managing your debt effectively. While you don’t have to make payments during this 12-month period, interest continues to accumulate on your loan balance. This means your overall debt will grow larger by the end of the grace period, even if you haven’t made any payments.

The implications of this interest accrual are significant. The longer the loan remains unpaid, the more interest will accumulate, leading to a larger principal balance when repayment begins. This ultimately means you’ll end up paying more in interest over the life of the loan, potentially extending your repayment timeline and increasing the overall cost. This is further exacerbated by the effect of compounding interest.

Compounded Interest’s Impact

Compound interest is the interest calculated not only on the original principal but also on the accumulated interest. Imagine it like a snowball rolling downhill – it starts small, but grows larger and larger as it gathers more snow (interest). This effect can significantly increase your total loan amount over time. For example, a $10,000 loan with a 5% annual interest rate will accrue $500 in simple interest in one year. However, if that $500 interest is added to the principal, the following year’s interest will be calculated on $10,500, resulting in even more interest accrued. The longer the grace period, the greater the impact of compounding.

Strategies for Minimizing Interest Accumulation

Several strategies can help minimize interest accumulation during the grace period. One is to make interest-only payments. This means paying only the interest that accrues each month, keeping your principal balance unchanged. While this doesn’t reduce the principal, it prevents the balance from growing as rapidly. Another strategy, if financially feasible, is to make payments exceeding the interest amount, thereby reducing the principal balance. Even small extra payments can significantly reduce the total interest paid over the life of the loan. Finally, exploring loan refinancing options during the grace period may allow you to secure a lower interest rate, thereby reducing future interest costs.

Hypothetical Scenario: Interest-Only vs. No Payments

Let’s consider a hypothetical scenario. Suppose you have a $20,000 student loan with a 6% annual interest rate. During a 12-month grace period:

Scenario 1: No payments are made. At a 6% annual interest rate, approximately $1200 in interest will accrue over the year. By the end of the grace period, your loan balance will be approximately $21,200.

Scenario 2: Interest-only payments are made. Monthly interest payments would be approximately $100 ($1200/12 months). Making these payments prevents the principal balance from growing, keeping it at $20,000. While you still pay $1200 in interest, you avoid the compounding effect seen in Scenario 1. This results in lower overall interest paid compared to not making any payments during the grace period. This difference becomes increasingly significant with larger loan amounts and higher interest rates.

Repayment Plan Options After the Grace Period

Once your 12-month grace period ends, you’ll need to start making payments on your student loans. Choosing the right repayment plan is crucial to managing your debt effectively and avoiding delinquency. Several options exist, each with its own advantages and disadvantages, and the best choice will depend on your individual financial circumstances.

Understanding the different repayment plan options allows borrowers to make informed decisions that align with their financial capabilities and long-term goals. Careful consideration of income, expenses, and loan amount is essential in selecting a suitable repayment plan.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. It typically involves fixed monthly payments over a 10-year period. This plan offers the shortest repayment timeframe, leading to less interest paid over the life of the loan. However, monthly payments can be significantly higher than other plans, potentially straining your budget. For example, a $30,000 loan with a 5% interest rate would result in approximately $330 monthly payments under a standard plan. This might be manageable for someone with a stable, high income.

Extended Repayment Plan

The extended repayment plan offers longer repayment terms, usually up to 25 years. This significantly reduces monthly payments compared to the standard plan, making it more manageable for borrowers with lower incomes or higher debt burdens. However, the extended repayment period leads to substantially higher total interest paid over the loan’s lifetime. Using the same $30,000 loan example, the monthly payment could drop to around $160, but the total interest paid would be considerably more. This option might suit someone with a lower income or significant other financial obligations.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) tie your monthly payments to your income and family size. Several types of IDRs exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans generally result in lower monthly payments than standard or extended plans, especially during periods of lower income. However, they often extend the repayment period to 20 or 25 years, resulting in higher total interest paid. For instance, someone earning a modest income might find their monthly payments significantly reduced under an IDR, even if it means paying more interest in the long run. This is particularly beneficial for individuals facing financial hardship or career transitions.

Choosing the Right Repayment Plan

The choice of repayment plan depends heavily on individual financial situations. A high-income earner with a manageable debt load might prefer the standard repayment plan to minimize interest payments. Conversely, a low-income borrower with a substantial debt burden might find an income-driven repayment plan more suitable, prioritizing affordability over minimizing total interest paid. Careful consideration of your current financial situation, future income projections, and long-term financial goals is crucial in making an informed decision.

Consequences of Defaulting After the Grace Period

Failing to make your student loan payments after the grace period concludes can lead to serious and long-lasting negative consequences that significantly impact your financial well-being. Defaulting on your student loans triggers a chain reaction of events that can make it difficult to secure future loans, rent an apartment, or even obtain certain jobs. Understanding these potential repercussions is crucial to proactively managing your student loan debt.

Defaulting on your federal student loans results in several immediate and long-term repercussions. Your loan will be referred to collections, and the lender will report the default to credit bureaus, causing a significant drop in your credit score. This will make it harder to get loans, credit cards, or even rent an apartment in the future. Furthermore, wage garnishment, tax refund offset, and even the inability to renew your professional licenses are all possible outcomes of default. The government may also pursue legal action to recover the debt. The specific consequences can vary depending on the type of loan and the lender, but the overall impact on your financial life is consistently severe.

Loan Rehabilitation

Loan rehabilitation is a process designed to help borrowers who have defaulted on their federal student loans restore their accounts to good standing. This involves making nine on-time payments within 20 months. Once this is achieved, the default status is removed from the borrower’s credit report, and the loan is reinstated to its original terms. However, it is important to note that while rehabilitation removes the default from your credit report, it does not erase the history of the default. The negative impact on your credit score may persist for several years, although it will gradually improve over time as new positive credit information is established. This process is a valuable tool for those seeking to repair their credit and regain financial stability after a period of hardship.

Options for Borrowers Facing Financial Hardship

Several options are available to borrowers struggling to make their student loan payments. These include income-driven repayment plans, which adjust your monthly payments based on your income and family size. Deferment and forbearance programs can temporarily postpone or reduce your payments during periods of financial difficulty. It’s crucial to contact your loan servicer promptly to explore these options before defaulting. They can explain your eligibility for these programs and help you navigate the application process. Early intervention is key to preventing default and its severe consequences. Ignoring the problem will only exacerbate the situation.

Handling Student Loan Default: A Flowchart

The following flowchart illustrates the typical progression of events when a borrower defaults on their student loan:

[Imagine a flowchart here. The flowchart would begin with “Student Loan Grace Period Ends,” branching to “Payments Made” (leading to “Loan in Good Standing”) and “Payments Missed” (leading to “Default”). The “Default” branch would then further branch into “Contact Loan Servicer,” leading to options like “Income-Driven Repayment,” “Deferment/Forbearance,” or “Loan Rehabilitation.” If these options are unsuccessful, the flowchart would lead to “Wage Garnishment,” “Tax Refund Offset,” and “Legal Action.”]

Planning for Repayment

Successfully navigating student loan repayment requires careful planning and proactive budgeting. Understanding your financial situation and developing a realistic repayment strategy are crucial steps to avoid delinquency and manage your debt effectively. This section will guide you through effective budgeting techniques, provide a sample budget, and offer tips for staying organized throughout the repayment process.

Effective budgeting is the cornerstone of successful student loan repayment. By carefully tracking income and expenses, you can create a budget that allocates sufficient funds for your loan payments while still allowing for essential living expenses and some discretionary spending. This proactive approach minimizes stress and ensures timely payments.

Budgeting Techniques for Student Loan Repayment

Creating a budget involves identifying your monthly income and all your monthly expenses. Start by listing all sources of income, such as your salary, part-time job earnings, or any other regular income streams. Then, meticulously list all your expenses, categorizing them into needs (housing, food, transportation, utilities) and wants (entertainment, dining out, subscriptions). Use a budgeting app or spreadsheet to track your spending habits for a month or two before creating your budget to get an accurate picture of your financial situation. Once you have a clear understanding of your income and expenses, you can determine how much you can realistically allocate towards your student loan payments each month.

Sample Budget Template

A sample budget might look like this:

| Income | Amount |

|---|---|

| Monthly Salary | $3000 |

| Total Income | $3000 |

| Expenses | Amount |

| Housing | $1000 |

| Food | $500 |

| Transportation | $200 |

| Utilities | $150 |

| Student Loan Payment | $300 |

| Savings | $200 |

| Other Expenses | $650 |

| Total Expenses | $3000 |

This is a simplified example; your actual budget will depend on your individual circumstances. Remember to adjust the amounts to reflect your specific income and expenses. The key is to create a budget that is both realistic and sustainable.

Tracking Loan Payments and Staying Organized

Staying organized is vital for successful loan repayment. Several strategies can help you track your payments and avoid missed payments. Utilize online banking features to set up automatic payments. This ensures timely payments and eliminates the risk of forgetting. Alternatively, create a dedicated spreadsheet or use a budgeting app to record your payment history, due dates, and amounts paid. Consider setting reminders on your phone or calendar to alert you of upcoming payment deadlines. Maintaining meticulous records allows you to monitor your progress and identify any potential issues early on.

Resources for Managing Student Loan Debt

Several resources are available to assist borrowers in managing their student loan debt. Your loan servicer is a primary resource; they can provide information about your loan terms, repayment options, and assistance programs. The National Foundation for Credit Counseling (NFCC) offers free or low-cost credit counseling services that can help you create a budget and develop a debt management plan. Additionally, many universities and colleges provide financial aid offices that offer guidance and support to their alumni. These offices can offer valuable resources and advice on managing student loan debt. Exploring these options can provide much-needed support and guidance during the repayment process.

Deferment and Forbearance Options

Navigating student loan repayment can be challenging, and sometimes borrowers need temporary relief. Deferment and forbearance are two programs designed to provide this assistance, offering pauses or reductions in loan payments under specific circumstances. Understanding the differences between them is crucial for making informed decisions.

Deferment and forbearance are both options that temporarily postpone or reduce your student loan payments, but they differ significantly in their eligibility criteria, implications, and how they affect your loan. Both can offer crucial financial breathing room, but choosing the right option depends on your individual situation.

Circumstances Qualifying for Deferment or Forbearance

Eligibility for deferment or forbearance hinges on specific circumstances. Deferment is typically granted for situations such as returning to school at least half-time, experiencing unemployment, or facing economic hardship. Forbearance, on the other hand, is often granted for a broader range of reasons, including temporary financial difficulties or medical emergencies. Specific requirements and documentation vary depending on the lender and the type of loan. It’s important to contact your loan servicer directly to understand your options and eligibility.

Comparison of Deferment and Forbearance

While both offer temporary relief from loan payments, key differences exist. Deferment often prevents interest from accruing on subsidized federal loans, whereas interest usually continues to accrue during forbearance on both subsidized and unsubsidized loans. This can lead to a significantly larger loan balance after the deferment or forbearance period ends. Additionally, the application process and required documentation may differ.

Application Process for Deferment and Forbearance

The application process typically involves contacting your loan servicer directly. You’ll need to provide documentation supporting your claim for deferment or forbearance, such as proof of enrollment in school, unemployment documentation, or medical bills. The servicer will review your application and notify you of their decision. The timeframe for approval can vary. It’s recommended to apply well in advance of when you anticipate needing the relief.

Summary of Deferment and Forbearance

| Feature | Deferment | Forbearance |

|---|---|---|

| Eligibility Criteria | Specific circumstances like returning to school, unemployment, or economic hardship (often requires documentation). | Broader range of reasons, including temporary financial difficulties or medical emergencies (often requires documentation). |

| Interest Accrual (Federal Loans) | Usually does not accrue on subsidized loans; may accrue on unsubsidized loans. | Usually accrues on both subsidized and unsubsidized loans. |

| Impact on Loan Balance | Loan balance may remain the same (for subsidized loans with no interest accrual). | Loan balance increases due to accumulated interest. |

| Length of Period | Varies depending on the reason and type of loan; often limited to specific periods. | Varies depending on the reason and lender; often can be extended in increments. |

| Application Process | Requires documentation supporting eligibility; submitted to loan servicer. | Requires documentation supporting eligibility; submitted to loan servicer. |

| Consequences of Non-payment during the period | Depending on loan type, there may be consequences of non-payment. | Depending on loan type, there may be consequences of non-payment. |

Final Summary

Successfully managing your student loans requires careful planning and a thorough understanding of the available resources. The 12-month grace period offers a valuable window of opportunity to prepare for repayment, but failing to plan effectively can lead to significant financial burdens. By understanding the intricacies of interest accrual, repayment options, and potential consequences of default, you can develop a personalized strategy that aligns with your financial capabilities and long-term goals. Remember to utilize the available resources and seek professional advice when needed to ensure a successful repayment journey.

Clarifying Questions

What happens if I don’t make payments during the grace period?

Interest will continue to accrue on your loan balance, increasing the total amount you owe. This can significantly impact your overall repayment costs.

Can I extend my grace period?

Generally, grace periods are not extendable. However, you might qualify for deferment or forbearance under specific circumstances, such as unemployment or economic hardship. Check with your loan servicer for details.

What if I’m still in school during my grace period?

Your grace period typically begins six months after you cease at least half-time enrollment. Specific timelines depend on your loan type and lender.

How do I find my loan servicer?

Your loan servicer’s contact information is usually available on your loan documents or through the National Student Loan Data System (NSLDS).