Navigating the complexities of student loan debt can feel overwhelming, especially when understanding the often-misunderstood concept of accrued interest. This seemingly simple term holds significant weight in determining the ultimate cost of your education. Understanding how interest accrues, the factors influencing its growth, and strategies for managing it are crucial for responsible financial planning and long-term well-being.

This guide provides a comprehensive overview of student loan accrued interest, demystifying the process and equipping you with the knowledge to make informed decisions about your repayment strategy. We will explore various loan types, repayment plans, and the long-term financial implications of accrued interest, empowering you to take control of your debt and build a secure financial future.

Understanding Accrued Interest on Student Loans

Accrued interest on student loans represents the accumulated interest charges that build up over time on your outstanding loan balance. Understanding how this interest accrues is crucial for effective loan management and minimizing your overall repayment costs. This section will detail the mechanics of interest accrual, highlight differences between subsidized and unsubsidized loans, and illustrate the impact of various factors on the total interest paid.

Interest Accrual Mechanics

Student loan interest accrues daily on your outstanding principal balance. The daily interest is calculated by dividing the annual interest rate by 365 (or 366 for leap years) and multiplying the result by your current loan balance. This daily interest is then added to your principal, increasing the amount on which future interest is calculated. This process compounds over time, meaning you pay interest on previously accrued interest, leading to a snowball effect. The more you owe, the more interest accrues each day. The higher your interest rate, the faster your debt grows.

Subsidized vs. Unsubsidized Loans: Interest Accrual During Deferment

A key distinction lies in how interest accrues on subsidized and unsubsidized federal student loans during periods of deferment (a temporary postponement of loan payments) or grace periods (the period after graduation before repayment begins). With subsidized loans, the government pays the interest that accrues during deferment or grace periods, as long as you meet certain eligibility requirements. However, with unsubsidized loans, interest continues to accrue during these periods, and this interest is added to your principal balance, increasing the total amount you owe. This means that the total amount you eventually repay on an unsubsidized loan will be significantly higher than the original loan amount.

Impact of Interest Rates and Loan Amounts on Accrued Interest

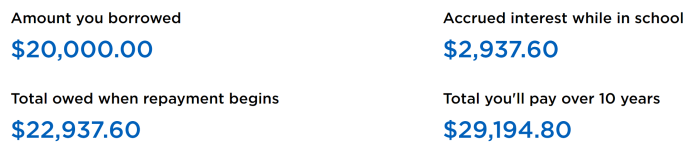

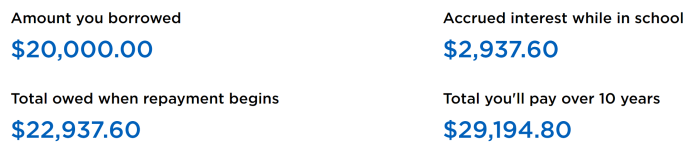

Let’s consider two scenarios to illustrate the impact of different interest rates and loan amounts on accrued interest.

Scenario 1: A $10,000 loan with a 5% annual interest rate will accrue approximately $500 in interest over one year. If the interest is not paid, it will be added to the principal balance, leading to a larger interest accrual in subsequent years.

Scenario 2: A $20,000 loan with a 7% annual interest rate will accrue approximately $1400 in interest over the same year. The higher loan amount and interest rate significantly increase the total accrued interest. This illustrates the importance of choosing a loan with a low interest rate and minimizing the loan amount you borrow.

Impact of Repayment Plans on Accrued Interest

The choice of repayment plan significantly impacts the total interest paid and the overall repayment time. Different plans involve varying monthly payments, which affect the speed at which the principal is reduced and, consequently, the amount of interest accrued.

| Repayment Plan | Monthly Payment | Total Interest Paid | Total Time to Repayment |

|---|---|---|---|

| Standard 10-Year Plan | $200 (Example) | $4,000 (Example) | 10 years |

| Extended 25-Year Plan | $100 (Example) | $12,000 (Example) | 25 years |

| Income-Driven Repayment Plan | Variable (Based on income) | Variable (Potentially higher than standard) | Up to 20-25 years |

| Graduated Repayment Plan | Starts low, increases over time | Potentially high due to longer repayment and compounding | 10 years |

Note: The figures in the table are illustrative examples and will vary significantly depending on the loan amount, interest rate, and individual circumstances. It is crucial to consult your loan servicer for accurate figures relating to your specific loan.

Factors Influencing Accrued Interest

Several key factors interact to determine the amount of accrued interest on your student loans. Understanding these factors is crucial for effective financial planning and minimizing your overall loan repayment burden. The primary influences include the interest rate, the principal loan balance, the repayment plan chosen, and the impact of any deferments or forbearances. Capitalization, a process of adding accrued interest to the principal loan balance, significantly affects the total interest paid over the life of the loan.

Interest Rate

The interest rate is the percentage of your loan balance charged as interest each year. A higher interest rate directly translates to a faster accumulation of accrued interest. For example, a loan with a 7% interest rate will accrue interest more quickly than a loan with a 4% interest rate, assuming all other factors remain constant. Fluctuations in interest rates over the life of the loan can significantly impact the total amount owed. If interest rates rise during a period of deferment or forbearance, the subsequent capitalization will result in a larger principal balance and, therefore, higher future interest payments.

Loan Balance

The principal loan balance, the original amount borrowed, is another major factor. A larger loan balance leads to higher interest accrual. This is because the interest calculation is a percentage of the outstanding balance. For instance, a 5% interest rate on a $50,000 loan will accrue more interest than the same rate on a $25,000 loan. Therefore, borrowing only the amount necessary for education is a prudent financial strategy.

Repayment Plan

The repayment plan you choose directly impacts the amount of interest accrued. A longer repayment plan, while resulting in lower monthly payments, will generally lead to higher total interest paid over the life of the loan. Conversely, a shorter repayment plan, with higher monthly payments, will typically result in lower total interest paid. For example, a 10-year repayment plan will accrue less interest than a 20-year repayment plan for the same loan amount and interest rate. Careful consideration of the trade-offs between monthly payments and total interest paid is essential when selecting a repayment plan.

Loan Capitalization

Loan capitalization occurs when accrued interest is added to the principal loan balance. This increases the principal amount on which future interest is calculated, leading to a snowball effect where interest accrues on a larger and larger balance. For example, if $1,000 in interest accrues during a deferment period and is then capitalized, the principal balance increases by $1,000. Future interest calculations will then be based on this larger principal, resulting in a higher total interest paid over the life of the loan. Understanding capitalization is critical for minimizing long-term costs.

Deferments and Forbearances

Deferments and forbearances are temporary pauses in loan repayment. While offering short-term relief, they allow interest to continue accruing on the loan balance. This accrued interest, unless paid during the deferment or forbearance period, is often capitalized at the end of the period, leading to a larger principal balance and increased future interest payments. The longer the deferment or forbearance, the more interest accrues, significantly impacting the total cost of the loan. A deferment or forbearance may be necessary in certain circumstances, but borrowers should be aware of the long-term consequences.

Impact of Interest Rate Fluctuations

Interest rate fluctuations over time significantly impact the final loan amount. For instance, consider two scenarios: Scenario A involves a fixed interest rate of 5% throughout the loan term. Scenario B involves a 4% rate for the first 2 years, increasing to 7% for the remaining term. While the initial rate in Scenario B is lower, the later increase will likely lead to a higher total interest paid compared to the consistent 5% rate in Scenario A. This illustrates the importance of understanding potential interest rate changes and their impact on long-term repayment costs. Predicting future interest rate fluctuations is impossible, but understanding this dynamic is crucial for effective financial planning.

Strategies for Managing Accrued Interest

Accrued interest on student loans can significantly increase the total amount you owe. Understanding and implementing effective strategies to minimize this interest is crucial for responsible debt management and achieving financial freedom sooner. This section Artikels practical steps and approaches to manage and reduce your accrued student loan interest.

Step-by-Step Guide to Minimizing Accrued Interest

Effectively minimizing accrued interest involves a proactive approach encompassing several key steps. Following these steps will help you gain control over your student loan debt and reduce the overall cost.

- Understand Your Loan Terms: Carefully review your loan documents to understand your interest rate, repayment plan, and grace period. Knowing these details empowers you to make informed decisions.

- Explore Repayment Options: Investigate different repayment plans offered by your loan servicer. Income-driven repayment plans may lower your monthly payments, though you’ll likely pay more interest over the life of the loan. Standard repayment plans typically have higher monthly payments but lower total interest paid.

- Make Extra Payments: Whenever possible, make extra payments towards your principal balance. This directly reduces the amount of interest that accrues over time. Even small extra payments can significantly impact your total interest paid.

- Prioritize High-Interest Loans: If you have multiple student loans with varying interest rates, prioritize making extra payments on the loans with the highest interest rates first. This is a strategic approach to maximize your interest savings.

- Consider Refinancing: Refinancing might lower your interest rate, resulting in lower monthly payments and less interest paid overall. However, carefully weigh the pros and cons before making a decision (discussed further below).

Comparison of Repayment Strategies

Different repayment strategies offer varying trade-offs between monthly payment amounts and total interest paid. Choosing the right strategy depends on your individual financial situation and priorities.

| Repayment Strategy | Monthly Payment | Total Interest Paid | Pros | Cons |

|---|---|---|---|---|

| Standard Repayment | Higher | Lower | Faster loan payoff, less total interest | Higher monthly payments may be challenging |

| Extended Repayment | Lower | Higher | Lower monthly payments | Longer repayment period, more total interest |

| Income-Driven Repayment | Variable (based on income) | Higher | Lower monthly payments based on income | Longer repayment period, potential for loan forgiveness but with tax implications |

Resources for Managing Student Loan Debt

Several resources are available to assist borrowers in managing their student loan debt and interest. These resources offer valuable support and guidance throughout the repayment process.

- Your Loan Servicer: Your loan servicer is your primary point of contact for all things related to your student loans. They can answer questions, provide repayment options, and help you navigate the repayment process.

- National Student Loan Data System (NSLDS): NSLDS provides a centralized database of your federal student loan information, allowing you to track your loans and understand your repayment options.

- StudentAid.gov: This website offers comprehensive information about federal student aid, including repayment plans, loan forgiveness programs, and other resources.

- Nonprofit Credit Counseling Agencies: These agencies provide free or low-cost credit counseling and can help you develop a debt management plan.

Refinancing Student Loans: Pros and Cons

Refinancing student loans can be a viable option for lowering your interest rate, but it’s crucial to understand the potential benefits and drawbacks before proceeding.

| Pros | Cons |

|---|---|

| Lower interest rate, resulting in lower monthly payments and less total interest paid over the life of the loan. Potentially simplifies repayment by consolidating multiple loans into one. | May lose benefits associated with federal student loans, such as income-driven repayment plans or loan forgiveness programs. Requires a credit check and approval, and may not be available to everyone. The refinancing process itself can take time. |

The Impact of Accrued Interest on Long-Term Financial Planning

Accrued interest on student loans significantly impacts long-term financial health, extending far beyond the initial loan amount. Understanding its effects on credit scores, future borrowing, and overall financial stability is crucial for effective financial planning. Ignoring accrued interest can lead to substantial financial burdens over time, hindering the achievement of long-term financial goals.

Accrued Interest’s Effect on Credit Scores

High levels of accrued interest, particularly when leading to delinquency or default, negatively impact credit scores. Lenders view consistent, timely payments as a sign of responsible financial behavior. Conversely, missed payments due to unmanaged accrued interest damage creditworthiness, potentially impacting future access to loans, credit cards, and even rental applications. The impact on credit scores can persist for years, making it more difficult to secure favorable loan terms or financial products in the future.

Long-Term Financial Consequences of High Accrued Interest

High accrued interest dramatically increases the total cost of a student loan. The longer the loan remains unpaid or only partially paid, the more interest accumulates, compounding the debt and delaying repayment. This can lead to a significant increase in the overall loan amount, potentially stretching repayment timelines and impacting the ability to save for other financial goals, such as a down payment on a house or retirement. This snowball effect can trap borrowers in a cycle of debt, limiting their financial flexibility and opportunities.

Impact of Accrued Interest on Future Borrowing Opportunities

A history of struggling with student loan debt, particularly due to high accrued interest, can make it challenging to secure future loans. Lenders assess creditworthiness based on several factors, and a poor credit history resulting from unmanaged student loan debt can lead to higher interest rates, stricter lending terms, or outright loan rejection. This can impact future financial decisions, such as purchasing a home, starting a business, or consolidating high-interest debt. The limitations imposed by a poor credit history can have far-reaching consequences for future financial well-being.

Hypothetical Scenario Illustrating the Financial Burden of High Accrued Interest

Let’s consider a hypothetical scenario involving a $30,000 student loan with a 7% annual interest rate. Without any payments during the grace period and assuming simple interest, the accrued interest would significantly increase the loan balance over time.

A graph depicting this scenario would show two lines: one representing the initial loan balance ($30,000) remaining constant, and the other showing the loan balance including accrued interest. After 10 years, the loan balance with accrued interest would be substantially higher than the initial amount. For example, if we assume simple interest calculation, it would be approximately $41,000 (assuming no principal repayment). After 20 years, this amount would grow even further, potentially reaching well over $50,000 under the same simple interest assumption and no principal repayment. The difference between the two lines visually demonstrates the exponential growth of the loan balance due to accumulated interest over time. This stark contrast highlights the importance of managing accrued interest to avoid a crippling debt burden. The actual figures would vary based on the interest rate, compounding frequency, and any repayments made, but the overall trend of increasing debt burden remains consistent.

Government Regulations and Student Loan Interest

Understanding the government’s role in regulating student loan interest is crucial for borrowers navigating the complexities of repayment. Federal regulations dictate interest rates, calculation methods, and available assistance programs, significantly impacting borrowers’ long-term financial health.

Government regulations concerning student loan interest rates are multifaceted and evolve over time. The federal government sets interest rates for federal student loans, which are typically lower than private loan interest rates. These rates are often tied to market indices, meaning they fluctuate based on economic conditions. The calculation of accrued interest is generally based on the daily outstanding principal balance, meaning interest is calculated and added to the principal daily. This compounding effect can accelerate debt growth if not managed effectively.

Federal Student Loan Interest Rate Determination

Federal student loan interest rates are not static; they change annually and are determined by a formula based on the 10-year Treasury note yield. The specific formula and the resulting rate vary depending on the loan type (e.g., subsidized, unsubsidized, graduate PLUS loans) and the loan disbursement year. For example, the interest rate for a subsidized Stafford loan might be lower than that for an unsubsidized Stafford loan in the same year. The Department of Education publishes these rates annually, providing transparency for prospective borrowers. This allows borrowers to compare rates and plan accordingly. Understanding the methodology behind rate determination empowers borrowers to make informed decisions about their loan selection and repayment strategy.

Historical Trends in Student Loan Interest Rates

Over the past few decades, student loan interest rates have exhibited variability, reflecting broader economic trends and government policies. During periods of low inflation and low Treasury yields, interest rates on federal student loans have generally been lower. Conversely, during times of economic uncertainty or higher inflation, these rates have tended to rise. For instance, rates were relatively low in the early 2010s but increased in subsequent years. This variability highlights the importance of monitoring interest rate trends and understanding their potential impact on long-term repayment costs. Borrowers should be aware that past trends are not necessarily indicative of future performance.

Potential Legislative Changes Impacting Student Loan Interest

The landscape of student loan interest is subject to ongoing political and legislative discussion. Proposals for legislative changes frequently focus on interest rate caps, income-driven repayment plans, and loan forgiveness programs. While predicting future changes with certainty is impossible, observing current legislative debates and proposed bills can offer insights into potential shifts in government policy. For example, discussions regarding potential forgiveness programs could significantly impact the amount of interest accrued over the life of a loan. Staying informed about legislative developments is essential for borrowers to anticipate and adapt to potential changes in their repayment responsibilities.

Government Programs Assisting with Accrued Interest Management

Several government programs aim to assist borrowers in managing accrued interest. Income-driven repayment plans (IDRs) adjust monthly payments based on income and family size, potentially reducing the amount of interest accrued over time. Deferment and forbearance options can temporarily suspend payments, though interest may still accrue during these periods, depending on the loan type. These programs are designed to provide financial relief and prevent borrowers from falling further behind on their loan obligations. However, it is crucial for borrowers to understand the implications of each program, including the potential long-term effects on total repayment costs. Careful consideration of available options is necessary to make informed decisions about managing accrued interest effectively.

Last Word

Successfully managing student loan accrued interest requires proactive planning and a thorough understanding of the factors at play. By carefully considering your loan type, repayment options, and the long-term financial consequences, you can develop a strategy that minimizes interest charges and sets you on a path toward financial freedom. Remember to utilize available resources and consider seeking professional advice to navigate this crucial aspect of your financial journey.

FAQ Resource

What happens if I don’t pay my student loan interest?

Unpaid interest will be capitalized, meaning it’s added to your principal loan balance, increasing the amount you owe and the total interest you’ll pay over the life of the loan.

Can I pay off just the accrued interest?

Yes, you can make payments specifically to cover the accrued interest. This prevents capitalization but may not reduce your principal balance unless you pay more than the interest accrued.

How often is interest calculated on student loans?

Interest is typically calculated daily on most federal student loans and then added to your balance monthly.

What is loan capitalization?

Loan capitalization is the process of adding unpaid interest to your principal loan balance. This increases your principal and future interest payments.