Navigating the complexities of higher education often involves confronting the significant financial hurdle of student loans. Understanding student loan aggregate limits is crucial for prospective and current students alike, as these limits directly impact borrowing capacity and long-term financial well-being. This exploration delves into the definition, implications, and management strategies surrounding these crucial borrowing constraints.

From the historical context and evolving regulations to the practical strategies for responsible borrowing, we aim to provide a comprehensive overview. We’ll examine how government policies, economic conditions, and individual financial planning interact to shape the student loan landscape and ultimately influence the educational journeys of countless individuals.

Definition and Explanation of Student Loan Aggregate Limits

Student loan aggregate limits represent the maximum amount of money a borrower can receive in federal student loans throughout their entire education. These limits are designed to prevent excessive borrowing and ensure responsible debt management for students. Understanding these limits is crucial for planning your educational financing effectively.

Aggregate limits differ from individual loan limits for each academic year. While individual limits cap the amount you can borrow per year, aggregate limits cap your total borrowing across all years of study. Exceeding these limits can have significant financial consequences, making it vital to be aware of and adhere to them.

Types of Aggregate Limits

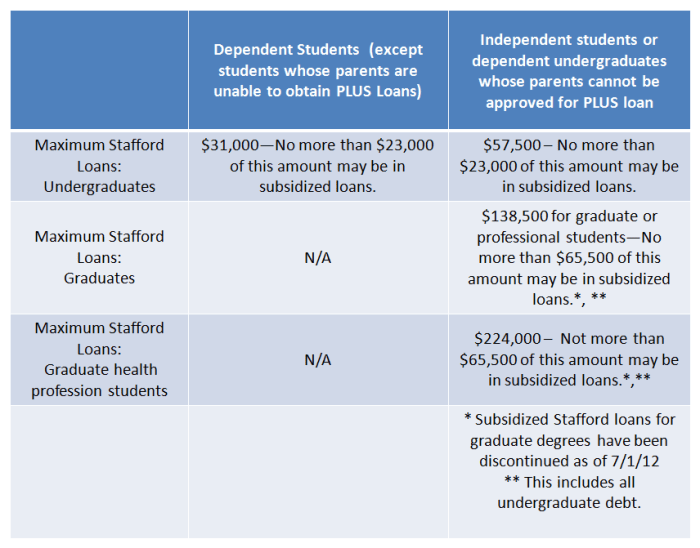

Federal student loans have aggregate limits set by the federal government. These limits vary based on factors like dependency status (dependent or independent student), enrollment status (undergraduate or graduate), and the type of loan (e.g., subsidized or unsubsidized Stafford Loans, PLUS Loans). Private student loans, on the other hand, do not have a federally mandated aggregate limit. Lenders set their own lending criteria, often based on creditworthiness and the borrower’s ability to repay. While some private lenders might have internal limits, there isn’t a universal cap like with federal loans.

Historical Context and Evolution of Aggregate Limits

The history of aggregate limits is tied to the evolution of federal student loan programs. Initially, loan limits were less restrictive. However, growing concerns about student loan debt burdens led to the implementation and subsequent adjustments of aggregate limits. Over time, these limits have been periodically reviewed and adjusted based on factors such as inflation, rising tuition costs, and changing economic conditions. For example, the aggregate limits have been increased in recent years to reflect the escalating cost of higher education. These adjustments aim to strike a balance between ensuring access to education and preventing excessive borrowing.

Rationale Behind Imposing Aggregate Limits

The primary rationale behind imposing aggregate limits on student loans is to promote responsible borrowing and mitigate the risk of overwhelming student loan debt. By setting limits, the government aims to discourage students from borrowing more than they realistically need or can repay. This helps to protect both borrowers and the overall financial stability of the student loan system. Excessive borrowing can lead to significant financial hardship after graduation, potentially impacting credit scores, employment prospects, and overall financial well-being. Aggregate limits are a key tool in preventing such outcomes and encouraging careful financial planning for higher education.

Factors Influencing Aggregate Limits

Student loan aggregate limits, the maximum amount a borrower can receive across all federal student loan programs, are not arbitrary figures. Several interconnected factors influence these limits, impacting borrowers’ access to higher education funding. Understanding these factors is crucial for both borrowers planning their education and policymakers aiming for a fair and effective student loan system.

Several key elements determine the aggregate limits for federal student loans. These limits are not static; they are regularly reviewed and adjusted based on a variety of economic and political considerations.

Government Policies and Regulations

Government policies play a dominant role in setting aggregate limits. These limits are established through legislation and regulations enacted by Congress and implemented by agencies like the Department of Education. The underlying philosophy behind these policies often balances the need to make higher education accessible with concerns about responsible lending and the overall health of the student loan market. For instance, increases in aggregate limits might be tied to rising tuition costs or shifts in the national economy, while decreases might reflect efforts to curb rising student loan debt levels. The political climate also plays a significant role; changes in administration or shifts in political priorities can lead to adjustments in these limits.

Variations Across Lending Institutions

While federal student loan programs have aggregate limits set by the government, the landscape is more nuanced when considering private student loans. Private lenders often have their own lending criteria and limits, which may vary significantly based on factors such as the borrower’s creditworthiness, co-signer availability, and the specific loan program offered. These private loan limits are generally lower than federal loan aggregate limits and are not subject to the same governmental oversight. Therefore, a borrower’s total borrowing capacity can be considerably less than the federal aggregate limit if they rely on a combination of federal and private loans.

Economic Conditions and Their Impact

Economic conditions significantly influence aggregate limits. Periods of economic expansion might see increases in aggregate limits to reflect rising tuition costs and increased demand for higher education. Conversely, during economic downturns or periods of high inflation, there may be pressure to reduce or freeze aggregate limits to mitigate the risk of increased student loan defaults and to control the overall cost to taxpayers. For example, following the 2008 financial crisis, there were discussions and adjustments to student loan programs, including potential changes to aggregate limits, to address the economic instability. Similarly, periods of high inflation could lead to calls for restraint in increasing aggregate limits to prevent further exacerbating inflationary pressures.

Impact of Aggregate Limits on Students and Borrowers

Student loan aggregate limits, while designed to prevent excessive borrowing, can significantly impact students’ educational and career choices and create substantial financial challenges for borrowers. Understanding these impacts is crucial for both prospective students and those already navigating the complexities of student loan repayment.

Reaching the aggregate limit can force students to make difficult decisions regarding their education.

Consequences of Reaching the Aggregate Limit

Reaching the aggregate loan limit means a student cannot borrow any further to finance their education, regardless of their need. This can lead to several consequences. Students might need to reduce their course load, potentially extending the time to graduation and increasing overall educational costs. They may be forced to attend a less expensive institution, potentially sacrificing preferred program quality or location. Finally, they might have to take on part-time jobs, reducing the time available for studies and potentially impacting academic performance. These constraints can create significant stress and uncertainty.

Impact on Educational Choices and Career Paths

Aggregate limits can significantly influence a student’s educational path. For example, a student aiming for a high-demand, high-cost field like medicine or engineering might find their options severely limited if they hit the aggregate limit before completing their education. This could lead to a change in career aspirations, opting for a less expensive but potentially less rewarding field. The inability to pursue desired postgraduate studies due to borrowing restrictions is another potential consequence. This limitation can impact earning potential and long-term career trajectory.

Challenges Faced by Borrowers Exceeding Aggregate Limits

Borrowers who, despite the limits, find themselves needing more funds for their education might resort to private loans, which often come with significantly higher interest rates and less favorable repayment terms. This can lead to a considerably larger overall debt burden and a longer repayment period. The added financial strain can also impact other life decisions, such as purchasing a home or starting a family. The inability to access sufficient funds for education due to aggregate limits can, in some cases, force students to drop out before completing their degree, resulting in lost educational investment and limited future employment opportunities.

Financial Implications: Aggregate Limit vs. No Limit

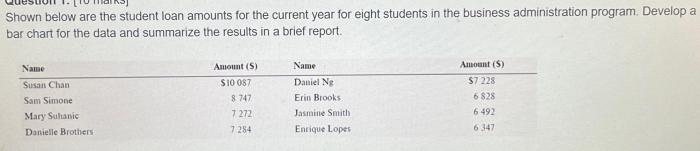

The following table illustrates the potential financial disparities between hitting the aggregate limit and not. These are illustrative examples and actual figures will vary based on loan terms, interest rates, and repayment plans.

| Scenario | Monthly Payment | Total Interest Paid | Long-Term Financial Impact |

|---|---|---|---|

| Hit Aggregate Limit, Requires Private Loans | $1500 | $100,000 | Significant debt burden, potential for financial hardship, limited investment opportunities. |

| Did Not Hit Aggregate Limit | $800 | $40,000 | Manageable debt, greater financial flexibility, better investment opportunities. |

Strategies for Managing Student Loan Debt within Aggregate Limits

Effectively managing student loan debt requires careful planning and proactive strategies, especially when considering aggregate borrowing limits. Understanding these limits and employing sound financial practices are crucial for minimizing long-term financial strain. This section Artikels practical steps to navigate the complexities of student loan debt while staying within established aggregate limits.

Step-by-Step Guide to Managing Borrowing within Aggregate Limits

Careful planning is essential to avoid exceeding your aggregate loan limits. This involves understanding your educational goals, exploring cost-effective options, and tracking your borrowing consistently. The following steps provide a structured approach to managing your borrowing.

- Determine Your Educational Needs and Costs: Before applying for any loans, thoroughly research the total cost of your education, including tuition, fees, room and board, and other expenses. Compare costs across different institutions and programs to find the most financially viable option.

- Explore Funding Sources Beyond Loans: Maximize grants, scholarships, and work-study opportunities to reduce your reliance on loans. Many institutions offer financial aid resources; utilize these to minimize your borrowing needs.

- Track Your Borrowing: Keep meticulous records of all loan applications, approvals, and disbursement amounts. Regularly monitor your aggregate loan balance to ensure you’re not approaching the limit.

- Prioritize Needs Over Wants: Differentiate between essential educational expenses and non-essential spending. Focus your borrowing on covering necessary costs and avoid unnecessary debt.

- Create a Realistic Budget: Develop a detailed budget that accounts for all income and expenses. This will help you understand your financial capacity and inform your borrowing decisions.

- Regularly Review Your Financial Plan: Your financial situation may change over time. Regularly review your budget and loan repayment plan to adjust as needed, ensuring your plan remains realistic and sustainable.

Alternative Financing Options When Aggregate Limits Are Reached

Reaching your aggregate loan limit doesn’t necessarily mean the end of your educational pursuits. Several alternative financing options can help bridge the funding gap.

- Private Loans: Private student loans are offered by banks and credit unions. However, these often come with higher interest rates and less favorable repayment terms than federal loans. Thoroughly compare options before considering private loans.

- Income Share Agreements (ISAs): ISAs are a form of financing where investors provide funding in exchange for a percentage of your future income for a set period. This can be a viable option, but it’s crucial to understand the terms and potential long-term implications.

- Crowdfunding Platforms: Platforms like GoFundMe allow individuals to solicit donations from friends, family, and the broader community to help fund their education. This approach requires significant effort in outreach and fundraising.

- Part-Time Employment: Working part-time during your studies can supplement your financial resources and reduce your reliance on loans. This allows for a more manageable debt load upon graduation.

Best Practices for Budgeting and Financial Planning

Proactive budgeting and financial planning are vital to avoid exceeding your aggregate loan limits. These practices contribute to responsible borrowing and long-term financial well-being.

Creating a detailed budget involves meticulously tracking all income and expenses. This allows for a clear understanding of your financial situation and helps identify areas where you can reduce spending or increase income. A realistic budget should include essential expenses like housing, food, transportation, and utilities, along with educational costs and loan repayments. Regularly reviewing and adjusting the budget based on changing circumstances is crucial for maintaining financial stability.

Creating a Realistic Repayment Plan

Developing a comprehensive repayment plan is crucial to effectively manage student loan debt. This involves understanding different repayment options, considering your income and expenses, and prioritizing timely payments.

Federal student loans offer various repayment plans, such as standard, graduated, extended, and income-driven repayment plans. Choosing the right plan depends on individual circumstances and financial capabilities. Income-driven repayment plans, for example, adjust monthly payments based on income and family size. It’s advisable to explore all available options and select the plan that best aligns with your financial situation. Prioritizing timely payments is crucial to avoid late fees and negative impacts on your credit score.

Future Trends and Potential Changes to Aggregate Limits

Predicting the future of student loan aggregate limits requires considering current trends in higher education costs, economic conditions, and evolving government policies. These factors interact in complex ways, making definitive predictions challenging, but several plausible scenarios can be Artikeld. The interplay between rising tuition, fluctuating economic situations, and shifts in political priorities will significantly shape the landscape of student loan borrowing in the years to come.

The rising cost of higher education is a primary driver influencing potential changes to aggregate limits. As tuition and fees continue to increase, exceeding the rate of inflation, the demand for student loans will likely remain high. This increased demand, coupled with concerns about student debt burdens, could prompt policymakers to either increase aggregate limits to keep pace with rising costs or to implement alternative strategies to address affordability. Economic downturns, on the other hand, might lead to a tightening of lending standards and a potential decrease in aggregate limits to mitigate risks associated with loan defaults.

Impact of Evolving Economic Conditions

Economic fluctuations significantly influence student loan policies. During periods of economic growth, the government might be more inclined to increase aggregate limits, reflecting a more expansive fiscal policy. Conversely, during recessions or periods of high inflation, a more conservative approach may be adopted, potentially leading to a freeze or even a reduction in aggregate limits. For example, during the 2008 financial crisis, there were significant discussions about student loan reform, including potential changes to borrowing limits, reflecting the government’s concern about the overall economic stability and the potential for increased loan defaults. The current high inflation rate could similarly lead to stricter regulations and potentially lower aggregate limits in the future.

Potential Policy Changes Affecting Aggregate Limits

Several policy changes could dramatically alter future aggregate limits. Increased government investment in need-based financial aid could lessen the reliance on loans, potentially reducing the need for high aggregate limits. Conversely, a shift towards performance-based funding models for higher education institutions could lead to further tuition increases, potentially necessitating higher aggregate limits to ensure student access. Furthermore, changes to loan repayment programs, such as income-driven repayment plans, could indirectly affect aggregate limits by influencing the perceived risk associated with higher borrowing. The introduction of new loan forgiveness programs, such as those targeted at specific professions or borrowers with high debt burdens, could also affect the need for adjustments to aggregate limits.

Potential Timeline for Future Adjustments

Predicting specific dates for changes is inherently speculative, but a plausible timeline could unfold as follows: In the short term (next 2-3 years), we might see a cautious approach, with potential minor adjustments to aggregate limits based on inflation rates and economic indicators. In the medium term (5-7 years), a more significant reassessment of aggregate limits is likely, driven by a more comprehensive review of higher education costs and student debt burdens. This might include larger adjustments, potentially upwards if tuition continues to rise rapidly, or downwards if economic conditions deteriorate. In the long term (10+ years), significant policy changes regarding higher education financing could lead to fundamental alterations in the structure of student loan programs and the concept of aggregate limits altogether. This could involve a shift towards more grant-based aid or a fundamental restructuring of the higher education system.

Illustrative Examples of Aggregate Limit Impacts

Understanding the impact of student loan aggregate limits requires examining real-world scenarios. These examples highlight the challenges faced by students who reach their borrowing limits and illustrate how these limits affect different socioeconomic groups.

Scenario: Reaching the Aggregate Limit Early

Imagine Sarah, a highly motivated pre-med student. She excels academically and aims for a prestigious medical school. However, the high cost of tuition at her chosen undergraduate institution, coupled with her family’s limited financial resources, means she relies heavily on federal student loans. By her junior year, Sarah reaches her aggregate loan limit. This leaves her facing a significant challenge: she needs additional funding to complete her undergraduate degree and to apply for medical school, where tuition is even higher. Potential solutions include exploring scholarships, grants, and private loans (which often come with higher interest rates and less favorable terms), working part-time, or transferring to a less expensive institution. This situation demonstrates how aggregate limits can impede educational advancement for high-achieving students from less affluent backgrounds.

Hypothetical Student’s Financial Situation

Let’s consider John, a student pursuing a four-year engineering degree. He borrows the maximum amount allowed each year, resulting in the following loan profile:

Year 1: $10,000 at 5% interest

Year 2: $12,000 at 5.5% interest

Year 3: $12,000 at 6% interest

Year 4: $12,000 at 6.5% interest

Upon graduation, John owes a total of $46,000. Assuming a 10-year standard repayment plan, his monthly payment would be approximately $500, not including any accrued interest. If John had been unable to borrow the full amount due to aggregate limits, he would likely need to work more during his studies, potentially delaying his graduation or impacting his academic performance.

The key financial implication for John is the significant debt burden he carries upon graduation, impacting his ability to save for a down payment on a house, invest, or manage other significant life expenses. The aggregate loan limit directly influenced the amount of debt he accumulated.

Impact of Aggregate Limit Changes on Socioeconomic Groups

A decrease in aggregate loan limits would disproportionately affect students from lower socioeconomic backgrounds. These students often rely more heavily on federal loans to finance their education. Reducing the available loan amount would force many to either forgo higher education entirely, attend less expensive (and potentially lower-quality) institutions, or take on a greater amount of private debt with potentially unfavorable terms. Conversely, an increase in aggregate limits could make higher education more accessible to these students, but it could also contribute to increased overall student loan debt. The optimal level of aggregate limits involves a complex balancing act between promoting access to higher education and managing the overall risk of student loan debt.

Last Point

Successfully navigating the complexities of student loan aggregate limits requires careful planning, informed decision-making, and a proactive approach to debt management. By understanding the factors that influence these limits, the potential consequences of exceeding them, and the available strategies for responsible borrowing, students can make well-informed choices that align with their educational goals and long-term financial stability. Ultimately, responsible borrowing and proactive financial planning are key to a successful educational journey.

FAQ

What happens if I exceed my aggregate loan limit?

Exceeding your aggregate limit typically means your loan application will be denied for additional funds. You may need to explore alternative financing options, such as scholarships, grants, or private loans (though these often come with higher interest rates).

Are aggregate limits the same for all lenders?

No, aggregate limits vary significantly between federal and private lenders. Federal loan programs have specific aggregate limits set by the government, while private lenders establish their own limits based on various factors, including creditworthiness and the student’s financial profile.

Can I refinance my student loans to lower my monthly payments?

Yes, refinancing can potentially lower your monthly payments, but be aware that this might extend the repayment period and ultimately increase the total interest paid over the life of the loan. Carefully weigh the pros and cons before refinancing.

How often are aggregate limits reviewed and adjusted?

Aggregate limits are typically reviewed and adjusted periodically by government agencies or lending institutions, often in response to changes in economic conditions, educational costs, or government policy.