Navigating the complex world of student loans and taxes can feel overwhelming, especially with the various deduction possibilities, forgiveness programs, and repayment plans available. Understanding the tax implications of your student loans is crucial for responsible financial planning and maximizing your tax benefits. This guide provides a clear overview of key aspects to help you manage your student loan debt effectively within the tax system.

From claiming the student loan interest deduction to understanding the tax consequences of loan forgiveness programs, we’ll explore the intricacies of how student loans interact with your annual tax obligations. We’ll also delve into strategies for minimizing your tax burden and incorporating student loan repayment into a comprehensive financial plan. Whether you’re currently repaying loans or planning for future education expenses, this information is designed to empower you with the knowledge to make informed decisions.

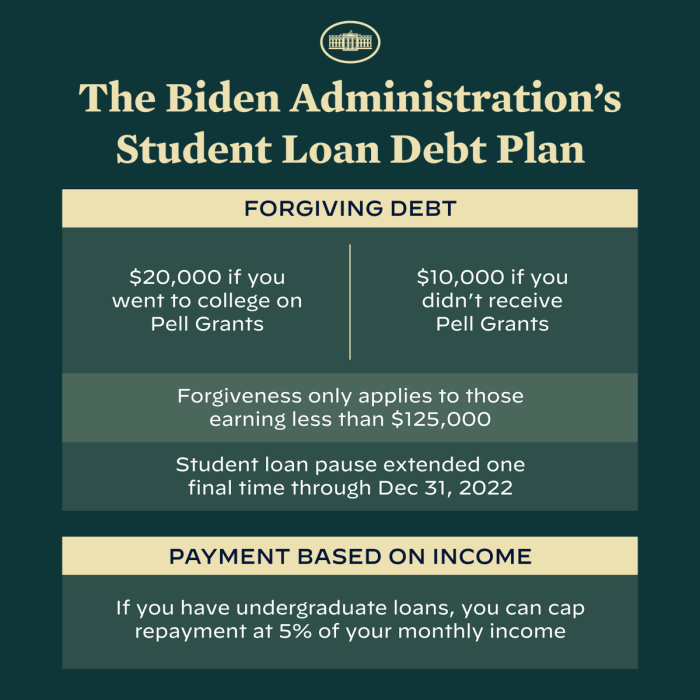

Tax Implications of Loan Forgiveness Programs

Student loan forgiveness programs, while offering financial relief, often come with significant tax consequences. Understanding these implications is crucial for borrowers to effectively manage their finances and minimize potential tax liabilities. Forgiveness isn’t truly “free” money; the Internal Revenue Service (IRS) generally considers the forgiven amount as taxable income in the year it’s forgiven.

Tax Treatment of Forgiven Student Loan Debt

Forgiven student loan debt is typically treated as taxable income under current IRS guidelines. This means the amount of debt forgiven is added to your gross income for the tax year in which the forgiveness occurs, potentially pushing you into a higher tax bracket and increasing your overall tax liability. This applies to various forgiveness programs, including the Public Service Loan Forgiveness (PSLF) program and income-driven repayment (IDR) plans. The forgiven amount is reported to both the borrower and the IRS on a Form 1099-C, Cancellation of Debt. Failure to report this income can lead to penalties and interest from the IRS.

Tax Implications of the Public Service Loan Forgiveness (PSLF) Program

The PSLF program forgives the remaining balance of federal student loans after 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a government or non-profit organization. While the program offers significant long-term financial benefits, borrowers should be aware that the forgiven amount is considered taxable income. For example, if $50,000 of student loan debt is forgiven under PSLF, the borrower will need to report this $50,000 as income on their tax return for that year, potentially impacting their tax bracket and resulting in a substantial tax bill.

Tax Implications of Income-Driven Repayment (IDR) Plans

IDR plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), adjust monthly payments based on income and family size. After a specific period (often 20 or 25 years), any remaining loan balance may be forgiven. Similar to PSLF, this forgiven amount is considered taxable income in the year of forgiveness. The tax implications can be substantial, especially for borrowers with significant loan balances. For instance, if a borrower has $75,000 remaining after 25 years on an IDR plan, this amount will be considered taxable income.

Strategies for Minimizing the Tax Burden from Loan Forgiveness

Several strategies can help minimize the tax burden associated with student loan forgiveness. Careful financial planning is key. One approach is to make estimated tax payments throughout the year to avoid a large tax bill at the end of the year. This helps spread the tax burden more evenly. Another strategy is to adjust withholdings from your paycheck to account for the anticipated tax liability. Additionally, taxpayers may be able to deduct certain expenses, potentially lowering their overall taxable income. Finally, consulting with a tax professional is highly recommended to explore all available options and develop a personalized tax plan.

Illustrative Flowchart: Tax Implications of Loan Forgiveness

The following describes a flowchart illustrating the tax implications. The flowchart would begin with a “Start” box. The next box would ask: “Was student loan debt forgiven?” A “Yes” branch would lead to a box stating: “Report forgiven amount as income on Form 1099-C.” A “No” branch would lead to an “End” box. The “Report forgiven amount as income on Form 1099-C” box would then branch to a box asking: “Did you make estimated tax payments?” A “Yes” branch would lead to a box stating: “Review tax liability.” A “No” branch would lead to a box recommending making estimated tax payments to avoid penalties. The “Review tax liability” box would lead to an “End” box. This flowchart visually represents the key decision points and actions involved in the tax implications of student loan forgiveness.

Student Loan Repayment and Tax Withholding

Student loan payments can significantly impact your tax situation, affecting both your tax withholding and your annual refund. Understanding how these payments interact with your taxes is crucial for accurate tax preparation and avoiding potential penalties. This section will explore the relationship between student loan repayment and tax withholding, highlighting the tax implications of different repayment plans and providing a step-by-step guide to adjusting your withholding accordingly.

Student loan interest payments are generally tax-deductible, offering a potential tax benefit. However, the amount you can deduct is limited, and the deduction might not be worthwhile for everyone. Furthermore, the impact of your repayment plan on your tax liability depends on several factors, including your income, your repayment plan type, and your overall tax bracket.

Tax Withholding and Student Loan Payments

The amount of federal income tax withheld from your paycheck is based on several factors, including your filing status, the number of allowances you claim, and your pre-tax deductions. Adding student loan payments to your pre-tax deductions can reduce your taxable income, potentially leading to a lower tax liability and a larger refund. Conversely, if you don’t adjust your withholding to account for your student loan payments, you might find yourself owing more at tax time. Accurate withholding is essential to avoid penalties and ensure a smooth tax filing process.

Tax Benefits of Different Repayment Plans

Different student loan repayment plans have varying impacts on your annual tax liability. For example, an income-driven repayment (IDR) plan, where your monthly payment is based on your income and family size, might result in lower annual payments, thus leaving more money available for other financial goals. However, it might also result in a higher total interest paid over the life of the loan, negating some of the immediate tax benefits of lower annual payments. Conversely, a standard repayment plan might involve higher monthly payments but lower overall interest paid, which could have long-term tax advantages. The optimal plan depends on your individual financial circumstances and long-term goals.

Adjusting Tax Withholding for Student Loan Payments

Adjusting your tax withholding to account for student loan payments is a straightforward process. You can do this by completing a new Form W-4, Employee’s Withholding Certificate, and submitting it to your employer. This form allows you to specify additional pre-tax deductions, including student loan payments.

- Gather necessary information: Collect your student loan payment information, including the amount of your monthly payment and the total annual payment.

- Obtain Form W-4: You can download Form W-4 from the IRS website (irs.gov).

- Complete Section 2: This section allows you to claim additional withholdings based on other sources of income or deductions. Carefully calculate the annual amount of your student loan payments and add this amount to your other pre-tax deductions.

- Submit the form: Provide the completed Form W-4 to your employer.

It is important to note that changes to your W-4 will affect your paycheck within a few pay periods. If you over-adjust, you might end up with too little withheld, leading to a tax liability at the end of the year. Conversely, under-adjusting could result in a larger refund than necessary.

Examples of Repayment Schedules and Tax Liability

Let’s consider two scenarios:

Scenario 1: Standard Repayment Plan

Assume an individual has a $50,000 student loan with a 10-year repayment plan at a 5% interest rate. Their annual student loan payment is approximately $6,000. This would reduce their taxable income, potentially lowering their overall tax liability and resulting in a larger refund or smaller tax bill.

Scenario 2: Income-Driven Repayment Plan

The same individual, with the same loan amount, opts for an income-driven repayment plan. Their annual payment might be significantly lower, say $3,000, due to their income level. While this reduces their immediate tax liability, the overall interest paid over the life of the loan will be higher, affecting their long-term tax implications. The tax benefits are more complex and require careful consideration of both the short-term and long-term financial implications.

Accurate calculation of the tax impact requires considering individual tax brackets and other income sources. These examples are for illustrative purposes only and do not constitute financial advice.

Ending Remarks

Successfully managing your student loan debt while optimizing your tax situation requires careful planning and understanding. By familiarizing yourself with the available deductions, credits, and the tax implications of different repayment and forgiveness options, you can significantly reduce your tax liability and build a strong financial future. Remember to consult with a tax professional for personalized advice tailored to your specific circumstances. Proactive planning is key to navigating this landscape successfully.

FAQ

What if I don’t itemize? Can I still deduct student loan interest?

No, the student loan interest deduction is an itemized deduction. If you take the standard deduction, you cannot claim this deduction.

How long can I deduct student loan interest?

You can deduct student loan interest for as long as you are paying interest on qualified education loans, regardless of when you took out the loans.

Are all student loan forgiveness programs taxed the same?

No. Tax treatment varies depending on the program. Some programs, like PSLF, may result in forgiven amounts being taxed as income, while others may not.

Can I claim the American Opportunity Tax Credit and the Lifetime Learning Credit in the same year?

No, you can only claim one of these credits per tax year, per student.