The weight of student loan debt can feel insurmountable, casting a long shadow over future plans. But for those who successfully navigate the repayment journey, reaching a zero student loan balance represents a monumental achievement – a powerful symbol of resilience, financial discipline, and a brighter future. This exploration delves into the emotional, financial, and societal aspects of achieving this significant milestone, offering insights and strategies for those striving towards debt-free living.

From the exhilaration of finally eliminating debt to the long-term implications for financial planning and overall well-being, the journey to a zero student loan balance is a transformative experience. We will examine various repayment strategies, explore the impact on long-term financial goals, and address the broader societal implications of student loan debt. This guide aims to equip readers with the knowledge and resources to effectively manage their student loan debt and achieve financial freedom.

The Emotional Impact of Achieving a Zero Student Loan Balance

The achievement of a zero student loan balance is a significant milestone, triggering a complex array of emotions that extend far beyond simple financial relief. This momentous occasion marks not just the end of a financial burden, but also a turning point in an individual’s life, impacting their mental well-being and future outlook.

Reaching this point often involves a prolonged period of diligent effort, sacrifice, and potentially, considerable stress. The resulting emotional impact is therefore multifaceted and deeply personal, varying significantly depending on individual circumstances and the journey undertaken to achieve this goal.

A Spectrum of Emotions

The emotional response to eliminating student loan debt is rarely singular. Individuals may experience a potent mix of feelings. Relief is often the most prominent, a palpable sense of lightness and freedom from the constant pressure of looming repayments. However, this relief may be intertwined with feelings of exhilaration, accomplishment, and even a sense of validation for the hard work invested. Conversely, some may also experience a period of adjustment, potentially feeling a sense of loss as the structure and routine of repayment are removed, or even a lingering anxiety about future financial stability. The intensity and specific mix of these emotions vary greatly from person to person.

Long-Term Psychological Effects of Eliminating Student Loan Debt

The psychological benefits of eliminating student loan debt can be substantial and long-lasting. Reduced stress and anxiety are common, leading to improved mental health and overall well-being. The absence of this constant financial pressure can free up mental resources, allowing individuals to focus on other aspects of their lives, such as career advancement, personal relationships, and pursuing personal goals. This newfound freedom can foster a sense of empowerment and control over one’s life, contributing to increased self-esteem and confidence. The long-term impact can be seen in improved sleep quality, decreased instances of depression and anxiety, and a greater sense of optimism about the future.

Emotional Journeys Across Debt Levels

The emotional journey varies significantly based on the initial debt level. Someone with a small loan balance might experience a sense of relief and accomplishment relatively quickly. In contrast, individuals burdened with substantial debt may experience a more gradual, layered emotional shift. Initially, the reduction of the debt might bring a sense of hope and progress, gradually building to intense relief and exhilaration as the final payment approaches. This prolonged journey can deepen the sense of accomplishment and create a stronger foundation for future financial stability. The weight of the debt can be so significant that the emotional release upon its elimination is profoundly impactful.

Fictional Narratives Illustrating Emotional Impact

Consider Anya, a young teacher who diligently repaid her relatively modest student loans over three years. Her feeling of relief was immense, but also accompanied by a quiet pride in her financial discipline. Then there’s David, a physician who faced a substantial six-figure debt. His journey was marked by periods of intense stress and self-doubt, punctuated by moments of hope with each loan payment. Reaching zero felt like a monumental victory, a testament to his resilience and hard work, triggering a powerful wave of emotional release and renewed confidence. Finally, imagine Maria, a single mother who juggled multiple jobs while repaying her loans. Her achievement was a testament to her perseverance and strength, a deeply emotional moment filled with pride, relief, and a profound sense of accomplishment. Each of these narratives illustrates the unique and powerful emotional impact of achieving a zero student loan balance.

Financial Strategies for Reaching a Zero Student Loan Balance

Achieving a zero student loan balance requires a strategic and disciplined approach. This involves understanding various repayment options, creating a personalized plan, and potentially exploring debt consolidation. The key is to develop a sustainable strategy that aligns with your financial situation and goals.

Different Repayment Strategies

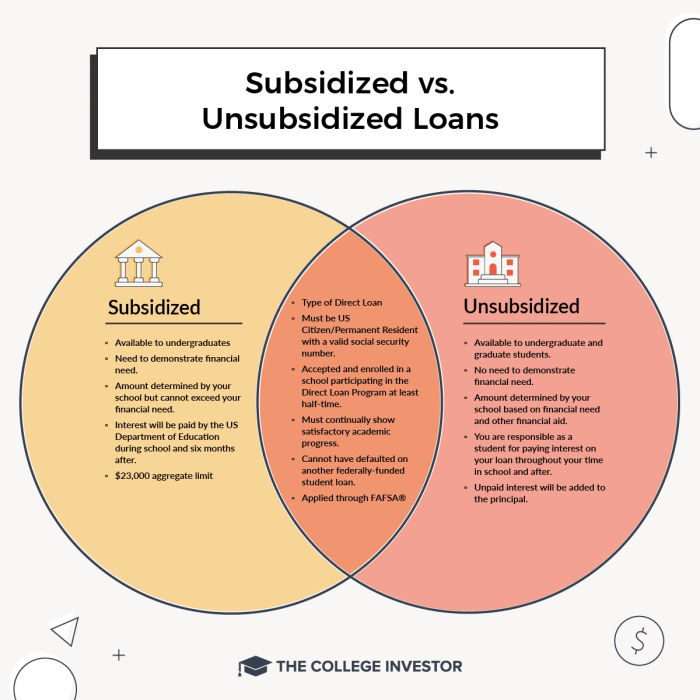

Several repayment strategies can help accelerate your journey to a zero balance. Income-driven repayment plans (IDR) adjust your monthly payments based on your income and family size. These plans often extend the repayment period, reducing monthly payments but increasing total interest paid. The snowball method prioritizes paying off the smallest loan first, regardless of interest rate, providing a psychological boost of early wins. The avalanche method, conversely, prioritizes paying off the loan with the highest interest rate first, minimizing the total interest paid over time. Each approach has its advantages and disadvantages depending on individual circumstances.

Creating a Personalized Debt Repayment Plan

Developing a personalized debt repayment plan involves several key steps. First, list all your student loans, including the principal balance, interest rate, and minimum monthly payment. Next, choose a repayment strategy (IDR, snowball, or avalanche). Then, create a realistic budget that allocates funds for loan repayment, while also covering essential expenses and saving for emergencies. Regularly monitor your progress and adjust your plan as needed, reflecting any changes in your income or expenses. Finally, consider automating your loan payments to ensure consistent and timely repayments.

Debt Consolidation Options: Pros and Cons

Debt consolidation involves combining multiple loans into a single loan, often with a lower interest rate or more manageable monthly payment. Pros include simplified repayment, potentially lower interest rates, and a potentially shorter repayment period. Cons include the possibility of higher overall interest paid if the consolidation loan’s interest rate isn’t significantly lower, and the risk of losing the benefits of certain federal loan programs. Careful consideration is needed before pursuing debt consolidation.

Sample Budget Demonstrating Effective Savings and Debt Allocation

A sample budget might allocate 50% of income to essential expenses (housing, food, transportation), 20% to debt repayment (student loans and other debts), 10% to savings (emergency fund and long-term goals), and 20% to discretionary spending (entertainment, dining out). This allocation is an example and needs adjustments based on individual income and expenses. The key is to prioritize debt repayment while maintaining a comfortable living standard and building a financial safety net.

Comparison of Repayment Plans

| Repayment Plan | Monthly Payment (Example) | Total Interest Paid (Estimate) | Time to Payoff (Estimate) |

|---|---|---|---|

| Standard Repayment | $500 | $10,000 | 10 years |

| Income-Driven Repayment (IDR) | $300 | $15,000 | 20 years |

| Snowball Method | Variable | $12,000 | 12 years |

| Avalanche Method | Variable | $9,000 | 8 years |

Note: These are example figures and actual amounts will vary based on loan amounts, interest rates, and individual circumstances. Consult a financial advisor for personalized advice.

The Impact on Future Financial Planning After Reaching a Zero Balance

Achieving a zero student loan balance is a significant milestone, freeing up substantial funds and dramatically altering your financial trajectory. This newfound financial flexibility opens doors to previously unattainable long-term goals and allows for more strategic wealth building. The positive impact extends beyond simply having more disposable income; it fundamentally reshapes your approach to financial planning.

Eliminating student loan debt significantly impacts your ability to pursue major long-term financial goals. The monthly payments, often substantial, represent a significant outflow of cash that can hinder savings and investment strategies. By eliminating this burden, you immediately increase your disposable income, allowing for more aggressive saving and investing. This translates to faster progress towards significant milestones such as homeownership and a comfortable retirement.

Homeownership and Retirement Planning

The absence of student loan debt dramatically improves your chances of homeownership. Lenders view student loan debt as a significant liability, impacting your debt-to-income ratio (DTI), a crucial factor in mortgage approval. A lower DTI, achieved by eliminating student loan debt, increases your likelihood of securing a mortgage with favorable terms. Furthermore, the freed-up cash flow can be directly allocated towards a down payment, accelerating the home-buying process. Similarly, the extra funds available after paying off student loans can be significantly invested towards retirement. This increased contribution to retirement accounts, whether 401(k)s or IRAs, leads to a larger nest egg and a more secure retirement. For example, someone paying $500 a month on student loans could instead contribute that amount to a retirement account, potentially generating significant returns over several decades.

Strategies for Building Wealth and Investing

With the student loan burden removed, you can implement more aggressive wealth-building strategies. This could involve increasing contributions to retirement accounts, investing in index funds or ETFs, exploring real estate investment opportunities, or starting a business. Diversification across asset classes is key to mitigating risk and maximizing returns. A sound investment strategy should align with your risk tolerance and long-term financial goals. For example, investing a portion of your freed-up funds in a low-cost, diversified index fund provides broad market exposure and the potential for long-term growth with relatively low risk.

Building an Emergency Fund

Establishing a robust emergency fund is paramount after paying off student loans. This fund acts as a financial safety net, protecting you from unexpected expenses like medical bills, car repairs, or job loss. Financial experts generally recommend having 3-6 months’ worth of living expenses saved in an easily accessible account. This provides a cushion against unforeseen circumstances, preventing you from falling back into debt. For instance, if your monthly expenses are $3,000, aiming for a $9,000-$18,000 emergency fund would provide substantial financial security.

Improved Credit Scores and Opportunities

Eliminating student loan debt significantly improves your credit score. Student loans constitute a substantial portion of your credit utilization, and paying them off reduces this ratio, directly impacting your credit score. A higher credit score unlocks several benefits, including lower interest rates on future loans (such as mortgages, auto loans, or personal loans), better terms on credit cards, and potentially even lower insurance premiums. This positive credit feedback loop further enhances your financial standing and opens doors to more favorable financial opportunities.

Societal and Economic Implications of Student Loan Debt Elimination

The elimination or significant reduction of student loan debt carries profound societal and economic implications, impacting various sectors and demographic groups differently. Understanding these potential effects is crucial for policymakers and individuals alike as they navigate the complex landscape of higher education financing. While widespread debt forgiveness offers the potential for immediate economic stimulus and improved social mobility, it also presents significant challenges and potential unintended consequences.

The elimination of student loan debt would likely have a significant impact on consumer spending and economic growth. Millions of borrowers would suddenly have increased disposable income, potentially leading to a surge in consumer spending on goods and services. This increased demand could stimulate economic growth, creating jobs and boosting business revenues. However, the magnitude of this effect is debated, with some economists arguing that the impact would be relatively muted, as borrowers might prioritize saving or paying down other debts. Others contend that the effect would be substantial, particularly for younger borrowers who are more likely to spend any extra income. The actual outcome would depend on several factors, including the size of the debt forgiveness program, the distribution of the forgiven debt across different income levels, and prevailing macroeconomic conditions.

Consumer Spending and Economic Growth

A large-scale student loan forgiveness program could inject a significant amount of money into the economy. For example, if $1 trillion in student loan debt were forgiven, that amount would immediately become available for borrowers to spend. This could lead to increased demand for various goods and services, stimulating economic activity in numerous sectors, from retail and hospitality to housing and automotive industries. This increased demand could in turn lead to job creation and higher wages, further fueling economic growth. Conversely, a less aggressive approach, such as targeted loan forgiveness or income-driven repayment plans, might have a more modest, though potentially more sustainable, impact on consumer spending and economic growth. The precise economic impact will hinge on how borrowers choose to utilize their newfound disposable income.

Potential Challenges and Unintended Consequences

While the prospect of stimulating economic growth is appealing, widespread student loan forgiveness also presents potential challenges. One major concern is the potential for inflation. A sudden influx of cash into the economy could increase aggregate demand, outpacing the economy’s capacity to produce goods and services, leading to price increases. Another concern is the potential for moral hazard. Forgiving existing debt could incentivize future borrowers to take on more debt, knowing that there’s a possibility of forgiveness in the future. This could lead to unsustainable levels of student loan debt in the long term. Furthermore, the distribution of benefits from student loan forgiveness is not uniform. High-income borrowers are more likely to benefit disproportionately, potentially exacerbating income inequality.

Economic Impact Across Different Demographic Groups

The economic impact of student loan forgiveness would not be evenly distributed across different demographic groups. For example, Black and Hispanic borrowers tend to have higher levels of student loan debt relative to their income compared to white borrowers. Therefore, they would potentially see a larger immediate boost to their disposable income, which could have significant positive effects on their financial well-being and community development. However, the long-term effects are complex and require careful consideration. While increased disposable income can lead to improved financial stability, it’s important to consider factors like access to financial literacy resources and the potential for increased consumer debt if proper financial management is not implemented. A well-designed forgiveness program would need to account for these disparities and ensure that the benefits are broadly distributed and contribute to reducing existing inequalities.

Advice and Resources for Individuals Striving for a Zero Balance

Achieving a zero student loan balance requires a strategic and disciplined approach. This section provides valuable resources, practical tips, and actionable steps to guide you on your journey to financial freedom. Understanding your options and avoiding common pitfalls is crucial for successful debt repayment.

Reputable Financial Resources and Websites

Numerous reputable organizations offer guidance on debt management. These resources provide valuable tools and information to help individuals navigate the complexities of student loan repayment. Utilizing these resources can significantly improve your chances of successfully eliminating your debt.

- The National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that provides financial education and credit counseling services. They can help you create a budget, develop a debt management plan, and negotiate with creditors.

- Consumer Financial Protection Bureau (CFPB): The CFPB is a government agency that protects consumers’ financial rights. Their website offers resources on student loans, debt management, and other financial topics.

- NerdWallet: This personal finance website provides tools and articles on various financial topics, including student loan repayment strategies and refinancing options.

- Student Loan Hero: This website offers resources specifically focused on student loan repayment, including calculators, articles, and guides.

Improving Financial Literacy and Budgeting Skills

Effective budgeting is fundamental to successful debt repayment. Understanding your income, expenses, and developing a realistic budget are essential steps. Enhancement of financial literacy empowers you to make informed decisions about your finances.

Creating a detailed budget, tracking your spending, and identifying areas where you can cut back are crucial. Consider using budgeting apps or spreadsheets to monitor your progress and stay organized. Exploring free online courses or workshops on personal finance can significantly improve your understanding of financial concepts.

Common Mistakes to Avoid During Debt Repayment

Avoiding common mistakes can significantly streamline the debt repayment process and prevent setbacks. Understanding these pitfalls can save you time, money, and stress.

- Ignoring your debt: Failing to actively manage your student loans can lead to increased interest charges and potential default.

- Not creating a budget: Without a budget, it’s difficult to track your spending and allocate funds effectively towards debt repayment.

- Making only minimum payments: Minimum payments often barely cover the interest, leaving the principal balance largely untouched.

- Taking on new debt: Accumulating additional debt while repaying student loans can significantly hinder your progress.

- Ignoring your credit score: A poor credit score can limit your options for refinancing or consolidating your loans.

Navigating Difficult Conversations with Lenders or Creditors

Communication is key when dealing with lenders or creditors. Knowing how to approach these conversations effectively can prevent misunderstandings and potentially lead to more favorable repayment terms.

Prepare for these conversations by gathering relevant documentation, such as your loan agreements and payment history. Maintain a calm and respectful demeanor, clearly explaining your situation and outlining your proposed solution. Consider documenting all conversations in writing for your records.

Actionable Steps for Achieving a Zero Balance

A structured approach is vital for successful debt repayment. These steps provide a roadmap to guide you through the process.

- Create a detailed budget: Track your income and expenses to understand your financial situation.

- Explore repayment options: Investigate options such as income-driven repayment plans or refinancing.

- Prioritize high-interest debt: Focus on paying down loans with the highest interest rates first.

- Automate payments: Set up automatic payments to ensure consistent and timely repayments.

- Increase your income: Explore opportunities to earn extra income to accelerate debt repayment.

- Seek professional help: Consider consulting a financial advisor or credit counselor for personalized guidance.

Visual Representation of the Journey to a Zero Balance

A powerful way to visualize the progress toward eliminating student loan debt is through a line graph charting the balance over time. This visual representation offers a clear and motivating picture of the journey, highlighting the impact of consistent repayment. The graph provides a tangible record of financial progress, making the seemingly abstract goal of a zero balance more concrete and attainable.

The graph would utilize a simple yet effective design. The horizontal axis represents time, typically measured in months or years, showing the progression from the initial loan balance to the eventual zero point. The vertical axis represents the outstanding loan balance, starting at the highest point (the initial loan amount) and gradually decreasing to zero. Each data point on the graph would represent the loan balance at a specific point in time, clearly showing the reduction in debt. The line connecting these points would illustrate the overall trend of debt reduction. Different colors could be used to differentiate between various repayment strategies or periods if multiple approaches were used (e.g., standard repayment vs. accelerated repayment).

Data Points and Their Significance

The data points themselves are crucial. Each point reflects a specific balance at a given time, showcasing the tangible impact of consistent payments. For instance, a data point showing a balance of $20,000 after one year, followed by $15,000 after two years, visually demonstrates the success of the repayment plan. This quantifiable representation provides a clear sense of accomplishment and reinforces the motivation to continue. Significant milestones, such as halving the initial balance, could be highlighted with annotations on the graph for added emphasis. The final data point, representing a zero balance, would be a powerful visual culmination of the entire repayment journey.

Demonstrating the Impact of Consistent Repayment

The line graph’s primary strength lies in its ability to clearly demonstrate the impact of consistent repayment efforts. A steady, downward sloping line indicates consistent progress, providing visual confirmation of the effectiveness of the chosen repayment strategy. In contrast, a fluctuating or less steep line would visually represent inconsistent payments or periods where progress stalled, offering valuable insights for future repayment planning. This visual representation not only tracks progress but also serves as a powerful tool for motivation and adjustment of repayment strategies if needed. For example, a comparison could be made between a scenario of consistent, on-time payments versus a scenario with missed payments, showing the stark difference in the rate of debt reduction and the time it takes to reach a zero balance.

Last Word

Reaching a zero student loan balance is more than just a number; it’s a testament to dedication, planning, and a commitment to financial well-being. The journey may be challenging, but the rewards – both financial and emotional – are substantial. By understanding the strategies, navigating the potential pitfalls, and leveraging available resources, individuals can confidently pursue their financial goals and embark on a future free from the burden of student loan debt. The path to financial freedom begins with a single, determined step towards a zero balance.

Commonly Asked Questions

What if I can’t afford my student loan payments?

Contact your loan servicer immediately. They can discuss options like income-driven repayment plans or deferment/forbearance to temporarily lower or pause payments.

How does paying off student loans affect my credit score?

On-time payments significantly improve your credit score. Paying off the loan entirely boosts your score further by reducing your debt-to-credit ratio.

Can I consolidate my student loans?

Yes, consolidation combines multiple loans into one, potentially simplifying repayment and lowering your monthly payment. However, it might extend the repayment period and increase total interest paid. Carefully weigh the pros and cons before consolidating.

What are some common mistakes to avoid when repaying student loans?

Common mistakes include ignoring your loans, making minimum payments only, not creating a budget, and not exploring all repayment options.