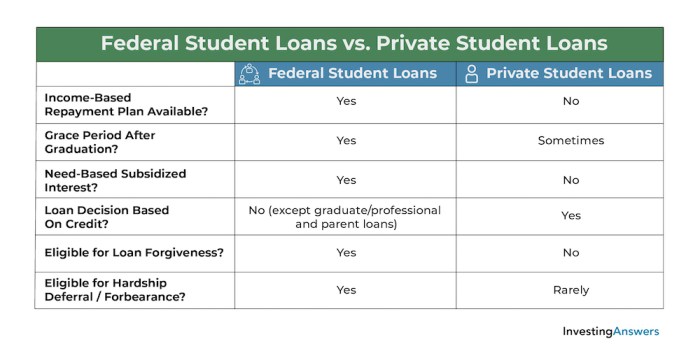

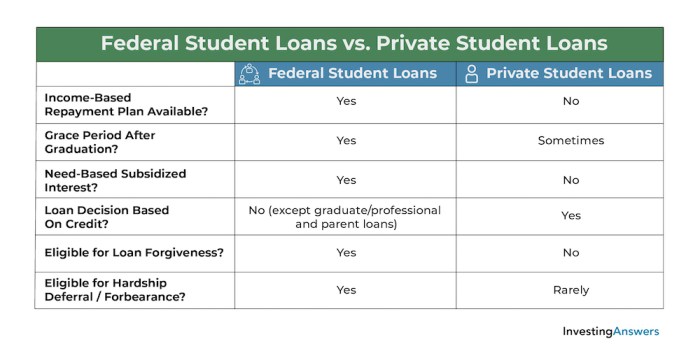

Navigating the world of student loans can feel overwhelming, but understanding the fundamentals is crucial for a secure financial future. From choosing between federal and private loans to managing repayment strategies and exploring government assistance programs, this guide provides a clear and concise overview of the essential aspects of student loan financing. We’ll demystify the terminology, explore various repayment options, and help you make informed decisions about your educational funding.

This guide aims to equip you with the knowledge necessary to approach student loan debt strategically. We’ll cover everything from the application process and eligibility requirements to long-term financial implications and debt management techniques. By the end, you’ll have a solid grasp of student loan basics, empowering you to make responsible choices that align with your financial goals.

Understanding Loan Terms and Repayment

Navigating the world of student loans requires a solid grasp of key terms and the various repayment options available. Understanding these aspects is crucial for effectively managing your debt and minimizing its long-term impact on your finances. This section will clarify common loan terms and explore different repayment scenarios.

Key Loan Terms

Several terms are fundamental to understanding your student loan obligations. Principal refers to the original amount of money borrowed. Interest is the cost of borrowing money, calculated as a percentage of the principal. A grace period is a timeframe after graduation or leaving school before loan repayment begins. Deferment is a temporary postponement of loan payments, often granted under specific circumstances like unemployment or further education. Understanding these terms is vital for responsible loan management.

Repayment Scenarios and Their Impact

Different repayment plans significantly affect the total cost of your loans. For example, consider two scenarios: Scenario A involves a standard repayment plan with a 10-year term, leading to higher monthly payments but lower overall interest paid. Scenario B might involve an extended repayment plan (e.g., 20 years), resulting in lower monthly payments but significantly higher total interest paid over the loan’s lifetime. The choice depends on individual financial circumstances and priorities. A shorter repayment period minimizes total interest paid but necessitates larger monthly payments. Conversely, a longer repayment period reduces monthly burdens but increases the overall cost of borrowing.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe consequences. This includes damage to your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, where a portion of your paycheck is seized to repay the debt, is another possibility. The government may also take further collection actions, such as seizing tax refunds or other assets. Avoiding default is paramount to maintaining your financial well-being.

Common Student Loan Repayment Options

Choosing the right repayment plan is crucial for managing your student loan debt effectively. Several options are available, each with its own characteristics.

- Standard Repayment Plan: Fixed monthly payments over a 10-year period. This option offers the shortest repayment term, minimizing overall interest paid but demanding higher monthly payments.

- Extended Repayment Plan: Spreads payments over a longer period (up to 25 years), resulting in lower monthly payments but significantly higher total interest paid.

- Graduated Repayment Plan: Payments start low and gradually increase over time. This option provides initial affordability but leads to higher payments later in the repayment period.

- Income-Driven Repayment (IDR) Plans: Monthly payments are based on your income and family size. Several IDR plans exist (e.g., ICR, PAYE, REPAYE), each with its own eligibility requirements and payment calculation methods. These plans often lead to loan forgiveness after a certain number of years, but the total interest paid can be substantial.

Managing Student Loan Debt

Successfully navigating student loan debt requires proactive planning and consistent effort. Understanding your repayment options and developing effective budgeting strategies are crucial for minimizing stress and ensuring timely payments. This section will explore practical strategies for managing your student loans and avoiding potential pitfalls.

Budgeting and Managing Student Loan Payments

Creating a realistic budget is the cornerstone of effective student loan management. This involves carefully tracking your income and expenses to identify areas where you can save and allocate funds towards your loan payments. Prioritizing loan payments and building an emergency fund are also key components of a robust financial plan. Failing to budget adequately can lead to missed payments, impacting your credit score and potentially incurring late fees.

Tips for Avoiding Student Loan Debt

While student loans can be a necessary tool for accessing higher education, minimizing your reliance on them is a prudent financial strategy. This can involve exploring scholarships and grants, working part-time during your studies, and carefully choosing a program that aligns with your career goals and affordability. Consider attending a less expensive institution, exploring community college options, or opting for a shorter degree program to reduce overall costs. Proactive planning before enrolling in higher education can significantly reduce the amount of debt accumulated.

Loan Consolidation and Refinancing

Loan consolidation combines multiple student loans into a single loan, simplifying repayment. This can result in a lower monthly payment, although it may extend the repayment period and potentially increase the total interest paid. Refinancing involves replacing your existing loans with a new loan, often at a lower interest rate. This can save money over the life of the loan, but it’s crucial to compare offers carefully and understand the terms and conditions before refinancing. Both consolidation and refinancing can be beneficial under specific circumstances, but thorough research and careful consideration are essential.

Sample Budget Incorporating Student Loan Payments

A well-structured budget helps allocate funds effectively. Below is a sample budget showing how to incorporate student loan payments. Remember that this is a template, and your specific budget will depend on your individual income and expenses.

| Income | Amount | Expenses | Amount |

|---|---|---|---|

| Monthly Salary | $3000 | Rent/Mortgage | $1000 |

| Part-time Job | $500 | Groceries | $400 |

| Transportation | $200 | ||

| Utilities | $150 | ||

| Student Loan Payment | $350 | ||

| Savings | $200 | ||

| Total Income | $3500 | Total Expenses | $3500 |

Government Programs and Resources

Navigating the complexities of student loan repayment can be daunting, but thankfully, several government programs offer assistance and potential pathways to loan forgiveness. Understanding these options is crucial for borrowers seeking to manage their debt effectively. This section Artikels key government programs and resources available to help alleviate the burden of student loan debt.

The federal government provides various programs designed to make student loan repayment more manageable. These programs offer different approaches, each with its own eligibility criteria, benefits, and drawbacks. Careful consideration of individual circumstances is essential to determine which program, if any, is the most suitable.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly student loan payments based on your income and family size. Several IDR plans exist, including the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE) plans. Eligibility requirements vary slightly between plans, but generally involve demonstrating financial need and enrolling in the plan within a specific timeframe. The application process typically involves completing a form online through the student loan servicer’s website, providing income documentation (tax returns, pay stubs), and potentially family size information. The benefits include lower monthly payments, potentially leading to loan forgiveness after 20 or 25 years of qualifying payments, depending on the plan. However, drawbacks include potentially paying more interest over the life of the loan and a longer repayment period.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program offers complete loan forgiveness after 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying government or non-profit organization. To qualify, borrowers must have Direct Loans, work for a qualifying employer, and make consistent, on-time payments under an IDR plan. The application process involves verifying employment and payment history with the appropriate agencies. The benefit is complete loan forgiveness, significantly reducing or eliminating student loan debt. However, the drawbacks include a lengthy 10-year commitment to qualifying employment and adherence to strict payment requirements; failure to meet these conditions can result in the loss of forgiveness.

Teacher Loan Forgiveness Program

This program provides partial loan forgiveness for teachers who have completed five years of full-time service in low-income schools or educational service agencies. Borrowers must meet specific requirements regarding teaching experience and the type of school or agency where they work. The application process involves submitting documentation of teaching experience and employment verification. The benefit is a reduction in student loan debt, incentivizing individuals to pursue careers in education. However, the forgiveness amount is capped, and borrowers may not qualify for the full amount of their loans.

Reputable Websites and Resources for Student Loan Borrowers

Finding reliable information about student loan repayment can be challenging. Here are some trustworthy sources:

Accessing accurate and up-to-date information is vital for making informed decisions about your student loans. These websites provide comprehensive resources, tools, and support to help you navigate the complexities of student loan repayment.

- StudentAid.gov (Federal Student Aid): The official website for the U.S. Department of Education’s Federal Student Aid program.

- National Student Loan Data System (NSLDS): A central database that provides information about your federal student loans.

- Your Student Loan Servicer’s Website: Each servicer has its own website with specific information about your loans and repayment options.

- The Consumer Financial Protection Bureau (CFPB): Offers resources and tools to help consumers understand and manage their debt.

Impact of Student Loans on Future Finances

Student loans, while essential for many pursuing higher education, carry significant long-term financial implications. Understanding these implications is crucial for making informed decisions about borrowing and managing debt effectively throughout your life. The weight of student loan debt can profoundly influence your financial trajectory, impacting everything from your credit score to major life purchases.

Student loan debt significantly impacts your financial future in several key ways. The monthly payments represent a recurring expense that reduces disposable income, potentially affecting your ability to save for other goals like retirement or a down payment on a home. Furthermore, the interest accrued over time can substantially increase the total amount owed, leading to a larger overall financial burden.

Credit Scores and Future Borrowing

Student loan debt directly affects your credit score. Consistent on-time payments contribute positively, while missed or late payments negatively impact your creditworthiness. A lower credit score can limit your access to future credit, such as mortgages, auto loans, or even credit cards, potentially at higher interest rates. For example, someone with a lower credit score due to student loan mismanagement might find it significantly harder to secure a mortgage to buy a house, even if they have a sufficient income. This could mean delaying major life purchases or settling for less favorable terms.

Impact on Major Life Decisions

The presence of substantial student loan debt can significantly influence major life decisions, particularly those involving large purchases. For instance, buying a house requires a good credit score and a manageable debt-to-income ratio. A large student loan payment can drastically reduce disposable income, making it difficult to save for a down payment and meet the requirements for a mortgage. Similarly, starting a family might be delayed due to the financial constraints imposed by student loan repayments. Consider a young couple aiming to buy a home; their ability to save for a down payment and qualify for a mortgage is directly affected by their monthly student loan payments. A larger loan balance and higher interest rates further complicate this.

Illustrative Representation of Long-Term Financial Impact

Imagine a graph charting two lines: one representing the growth of assets (savings, investments) over time, and the other representing the outstanding balance of student loan debt. In a scenario without significant student loan debt, the asset line grows steadily, potentially surpassing the debt line within a reasonable timeframe. Conversely, in a scenario with substantial student loan debt, the debt line remains high for an extended period, potentially slowing or even preventing significant growth in assets. The gap between the asset line and the debt line visually represents the financial impact of the loan, highlighting the potential for delayed financial goals like retirement savings or homeownership. The longer the debt persists, the more pronounced the impact on long-term financial well-being.

Concluding Remarks

Successfully managing student loan debt requires careful planning and a proactive approach. By understanding the different loan types, repayment options, and available resources, you can create a sustainable repayment plan that minimizes financial strain. Remember to utilize available government programs and seek professional advice when needed. Taking control of your student loan debt empowers you to achieve your financial aspirations without unnecessary burden.

Questions Often Asked

What happens if I miss a student loan payment?

Missing payments can result in late fees, damage to your credit score, and ultimately, loan default. Contact your loan servicer immediately if you anticipate difficulties making a payment to explore options like deferment or forbearance.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, it’s crucial to compare offers from multiple lenders and understand the terms before refinancing, as it may affect your eligibility for certain government programs.

What is the difference between deferment and forbearance?

Deferment temporarily postpones your payments, and under certain circumstances, interest may not accrue. Forbearance also temporarily suspends payments, but interest typically continues to accrue.

How can I improve my chances of loan forgiveness?

Eligibility for loan forgiveness programs is highly specific. Explore programs like Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans to determine if you qualify. Meeting specific employment requirements and income thresholds is crucial.