Navigating the world of student loans can be daunting, especially in a province as diverse as British Columbia. Understanding the various programs, eligibility criteria, and repayment options is crucial for students aiming to finance their education successfully. This guide provides a clear and concise overview of student loan programs in BC, empowering students to make informed decisions about their financial future.

From application processes and required documentation to managing debt and exploring government assistance, we cover all the essential aspects of BC student loans. We also delve into the potential consequences of defaulting and explore options for loan forgiveness or cancellation, offering practical strategies for effective debt management and financial planning.

Government Assistance and Support Programs

Navigating the complexities of student loan repayment can be challenging, especially during periods of financial hardship. Fortunately, several government assistance programs are available to British Columbia (BC) student loan borrowers to alleviate financial strain and prevent default. These programs offer various forms of support, ranging from repayment assistance plans to debt forgiveness options, depending on individual circumstances. Understanding the eligibility criteria and application processes for these programs is crucial for accessing the necessary support.

BC Student Loan Repayment Assistance Plan (RAP)

The BC Student Loan Repayment Assistance Plan provides temporary relief to borrowers experiencing financial difficulties. This program adjusts repayment amounts based on income and family size, ensuring affordability. Eligibility is determined by assessing the borrower’s gross annual income and the number of dependents. Applicants must demonstrate a genuine inability to meet their current repayment obligations. The application process involves completing an online application form through the StudentAid BC website, providing supporting documentation such as income tax returns and proof of dependents. Successful applicants receive a revised repayment schedule reflecting their reduced monthly payment amount. For example, a borrower with a low income and multiple dependents might see their monthly payments significantly reduced, making repayment manageable.

BC Student Loan Forgiveness Program

The BC Student Loan Forgiveness Program offers partial or complete loan forgiveness to borrowers who meet specific criteria, often related to working in specific professions or geographic locations. Eligibility is based on factors such as the borrower’s chosen profession (e.g., teaching in underserved areas, working in healthcare in rural communities), years of service, and the location of employment. The application process typically involves submitting an application form along with proof of employment, professional licenses, and other relevant documentation demonstrating fulfillment of the program’s requirements. A successful application might lead to a significant reduction or even complete elimination of the outstanding loan balance. For instance, a teacher who worked for ten years in a remote community might qualify for substantial loan forgiveness.

Deferment and Forbearance Options

Deferment and forbearance are temporary pauses in loan repayment. Deferment is typically granted to borrowers facing specific circumstances such as unemployment or disability. Forbearance is granted for temporary financial hardship. Eligibility for both requires documentation proving the qualifying circumstances. The application process usually involves submitting a request along with supporting documentation (e.g., proof of unemployment, medical documentation). A successful application results in a temporary suspension of loan payments, giving the borrower time to recover financially. A borrower experiencing unemployment due to illness might receive a deferment, while one facing unexpected medical expenses might receive forbearance.

Managing Student Loan Debt

Successfully navigating student loan repayment requires a proactive and organized approach. Understanding your loan terms, developing a realistic budget, and consistently employing sound financial strategies are crucial for avoiding default and achieving financial stability. This section Artikels key strategies for effective student loan debt management.

Effective Student Loan Debt Management Strategies

Effective management involves a multifaceted approach encompassing understanding your loan details, exploring repayment options, and prioritizing responsible financial habits. Knowing your interest rates, repayment terms, and total loan amount is the first step. Then, consider different repayment plans offered by the lender, such as graduated repayment (lower payments initially, increasing over time) or income-driven repayment (payments based on your income). Finally, actively monitor your credit score, as this impacts future borrowing opportunities.

The Importance of Budgeting and Financial Planning

A well-structured budget is fundamental to successful student loan repayment. Budgeting allows you to track your income and expenses, identifying areas where you can save and allocate funds towards your loan payments. Financial planning goes beyond budgeting; it involves setting long-term financial goals, such as saving for a down payment on a house or investing for retirement. By integrating loan repayment into a comprehensive financial plan, you can prioritize your debt reduction while simultaneously working towards other financial aspirations. Failing to plan can lead to missed payments and accumulation of interest, hindering progress.

Tips for Avoiding Loan Default

Loan default has severe consequences, impacting your credit score and potentially leading to wage garnishment or legal action. To avoid default, prioritize consistent on-time payments. Establish an automatic payment system to ensure timely payments. Communicate with your lender immediately if you anticipate difficulty making payments; they may offer forbearance or deferment options. Regularly review your budget and adjust as needed to ensure you can comfortably meet your loan obligations. Consider exploring options like loan consolidation or refinancing to potentially lower your monthly payments.

Sample Budget for a Student Repaying a BC Student Loan

This budget is an example and needs to be adjusted to reflect individual circumstances. Assume a student with a monthly net income of $2,500 and a BC student loan payment of $500.

| Category | Amount ($) |

|---|---|

| Student Loan Payment | 500 |

| Rent/Mortgage | 800 |

| Groceries | 300 |

| Transportation | 200 |

| Utilities | 150 |

| Phone/Internet | 75 |

| Savings | 200 |

| Entertainment/Personal | 275 |

| Total Expenses | 2700 |

Note: This budget shows a deficit of $200. This highlights the importance of regularly reviewing and adjusting your budget to ensure you are not overspending. Possible adjustments could include reducing entertainment expenses or finding cheaper accommodation.

Consequences of Defaulting on Student Loans

Defaulting on your student loans carries significant and long-lasting consequences that extend far beyond simply owing money. It can severely impact your financial well-being and future opportunities. Understanding these potential repercussions is crucial for responsible loan management.

Defaulting on a BC student loan, specifically, will trigger a series of actions designed to recover the outstanding debt. These actions can be financially and legally damaging, potentially affecting your credit score, employment prospects, and even your ability to own a home.

Impact on Credit Rating and Future Borrowing Opportunities

A student loan default is reported to the credit bureaus, significantly damaging your credit score. This negative mark remains on your credit report for seven years, making it difficult to obtain loans, credit cards, or even rent an apartment. Lenders view individuals with defaulted loans as high-risk borrowers, leading to higher interest rates or outright loan denials. For example, someone with a defaulted loan might find themselves paying significantly more for a mortgage or being unable to secure a car loan, even years after the default. The lower credit score will also impact your ability to secure favorable insurance rates.

Legal Ramifications of Loan Default

The legal consequences of student loan default can be severe. The government can garnish your wages, seize a portion of your tax refund, or even pursue legal action to recover the debt. In some cases, this may involve wage garnishment where a percentage of your earnings is automatically deducted to repay the loan. Additionally, your assets, such as bank accounts or property, may be at risk of seizure. The legal fees associated with these actions can further exacerbate your financial burden. For instance, a court judgment against you could result in additional costs and fees, making the original debt even more substantial.

Potential Financial Repercussions of Default

The financial repercussions of defaulting on student loans can be devastating. Beyond the original debt, you will likely face late fees, collection agency fees, and potentially even legal fees. These added costs can quickly escalate the amount owed, significantly impacting your financial stability. For example, a $10,000 loan could easily balloon to $20,000 or more with accumulated fees and interest. This can lead to significant financial hardship, making it challenging to meet basic living expenses and achieve financial goals. The inability to secure future credit can further limit opportunities for financial growth and stability. It could also affect your ability to purchase a home or start a business, impacting your long-term financial well-being.

Student Loan Forgiveness and Cancellation Programs

Student loan forgiveness and cancellation programs in British Columbia are relatively limited compared to some other jurisdictions. While there isn’t a broad-based forgiveness program at the provincial level, certain circumstances may allow for loan reduction or cancellation through specific government initiatives or individual hardship cases. It’s crucial to understand that eligibility criteria are strict, and the application process can be complex.

Eligibility Requirements for Loan Forgiveness or Cancellation

Eligibility for any potential loan forgiveness or cancellation in BC hinges on demonstrating significant financial hardship or exceptional circumstances. This often requires extensive documentation to prove inability to repay the loan due to factors beyond the borrower’s control. These factors might include long-term illness, disability, or job loss resulting in sustained unemployment. The specific criteria can vary depending on the program or individual case review by the government. There is no single, easily accessible list of all qualifying circumstances.

The Application Process for Loan Forgiveness or Cancellation

The application process for student loan forgiveness or cancellation is not standardized. It typically involves submitting a detailed application form, providing extensive documentation supporting the claim of hardship, and potentially undergoing an interview process with a government representative. This documentation might include medical records, employment history, tax returns, and financial statements. The process can be lengthy and require considerable effort from the applicant.

Examples of Situations Where Loan Forgiveness Might Be Granted

Loan forgiveness in BC is generally considered on a case-by-case basis. One example might be a borrower who experiences a prolonged period of severe illness resulting in a complete loss of income and an inability to meet their repayment obligations for an extended time. Another example could involve a borrower who experienced a catastrophic event, such as a significant house fire or natural disaster, that led to substantial financial losses and long-term unemployment. In such cases, a compelling case for hardship can be presented to the government for consideration. It’s important to note that even with strong evidence, forgiveness is not guaranteed.

Comparing BC Student Loans with Other Provinces

Navigating the Canadian student loan landscape can be complex, with each province offering unique programs. Understanding the differences between these programs is crucial for students in making informed decisions about their financing options. This section compares and contrasts the British Columbia student loan program with those offered in other provinces, highlighting key differences in eligibility, interest rates, and repayment plans.

Eligibility Criteria Across Provinces

Provincial student loan programs generally share some common eligibility requirements, such as Canadian citizenship or permanent residency, enrollment in a designated educational institution, and demonstration of financial need. However, specific criteria can vary significantly. For instance, some provinces may have stricter income thresholds for eligibility or different definitions of “financial need.” BC may consider factors such as parental income while others may focus solely on the student’s income and assets. Some provinces might offer programs specifically tailored to certain demographics, such as Indigenous students or students with disabilities, leading to variations in eligibility. The application processes themselves also differ in complexity and required documentation.

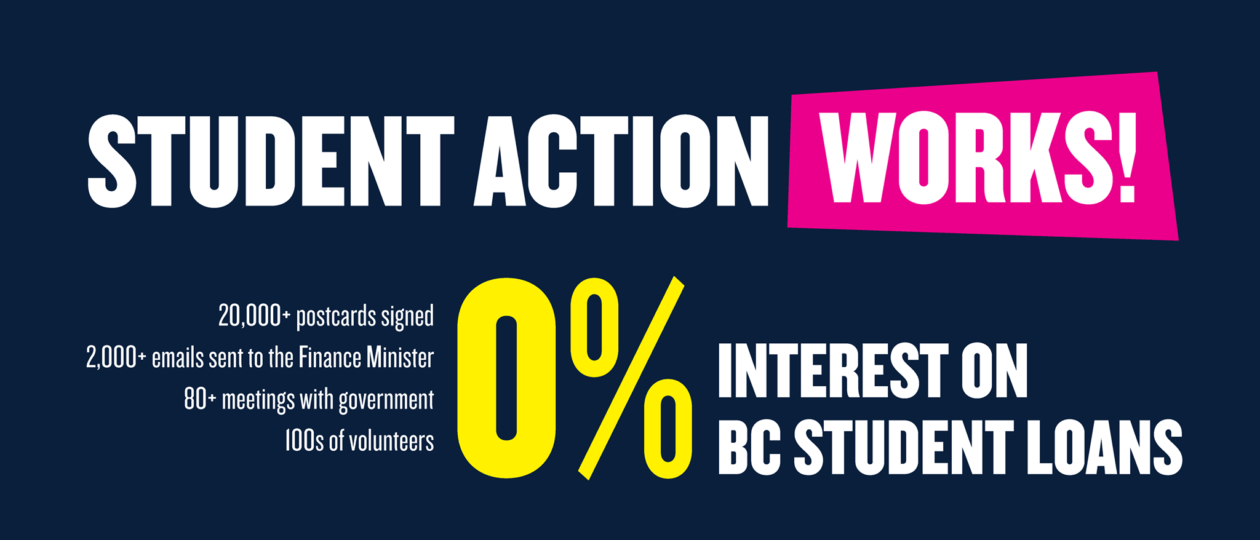

Interest Rates and Repayment Plans

Interest rates on student loans fluctuate based on prevailing market conditions and are set by the federal government. However, the grace period—the time after graduation before repayment begins—and repayment plan options can vary by province. Some provinces may offer more flexible repayment plans, such as income-contingent repayment, where monthly payments are adjusted based on the borrower’s income. Others might have stricter repayment schedules. BC’s interest rates will be comparable to other provinces, but the specific repayment options and grace periods might differ, impacting the overall cost and manageability of the loan for borrowers. The length of time to repay the loan, as well as any penalties for late payments, can also differ.

Advantages and Disadvantages of Provincial Programs

Each province’s student loan program has its own set of advantages and disadvantages. For example, a province might offer particularly generous grants or bursaries in addition to loans, reducing the overall debt burden. Conversely, another province might have a less favorable interest rate or stricter repayment terms. A province with a robust income-contingent repayment plan may be advantageous for students anticipating lower post-graduation earnings. Conversely, a province with a shorter grace period might place more immediate financial pressure on recent graduates. Thorough research is vital to weigh these factors and choose the program best suited to individual circumstances.

Comparison Table of Provincial Student Loan Programs

| Province | Eligibility Criteria Highlights | Interest Rate (Example – Subject to Change) | Repayment Plan Options |

|---|---|---|---|

| British Columbia | Canadian citizenship/PR, enrollment in eligible institution, demonstrated financial need (parental income considered) | Prime + 2.5% (Example) | Standard, Income-Contingent (details vary) |

| Ontario | Canadian citizenship/PR, enrollment in eligible institution, demonstrated financial need (specific income thresholds) | Prime + 2.5% (Example) | Standard, Income-Contingent (details vary) |

| Quebec | Canadian citizenship/PR, enrollment in eligible institution, demonstrated financial need (specific income thresholds) | Prime + 2% (Example) | Standard, Income-Contingent (details vary) |

| Alberta | Canadian citizenship/PR, enrollment in eligible institution, demonstrated financial need (focus on student income) | Prime + 2.5% (Example) | Standard, Income-Contingent (details vary) |

*Note: Interest rates are examples and subject to change. Eligibility criteria and repayment plan details should be verified with the respective provincial government websites.*

Last Recap

Securing a student loan in British Columbia is a significant step towards achieving educational goals. By understanding the intricacies of the various programs, applying strategically, and planning for responsible repayment, students can effectively manage their debt and build a strong financial foundation. This guide aims to equip students with the knowledge and resources needed to navigate this process confidently and successfully.

FAQs

What happens if I lose my job while repaying my student loan?

Most student loan programs offer deferment options for borrowers experiencing temporary financial hardship, such as job loss. Contact the student loan provider to discuss your options.

Can I consolidate my student loans?

Consolidation options may be available depending on the type of loans you have. Check with the BC student loan provider to explore potential consolidation options.

What is the difference between a subsidized and an unsubsidized loan?

Subsidized loans generally don’t accrue interest while you’re in school, whereas unsubsidized loans do. The availability of subsidized loans may vary depending on the program.

What are the consequences of late payments?

Late payments can result in penalties, increased interest charges, and potentially damage your credit score. Contact your loan provider immediately if you anticipate difficulty making payments.