Navigating the student loan cancellation application process can feel overwhelming, a complex maze of paperwork and eligibility requirements. This guide aims to simplify that journey, providing a clear understanding of the steps involved, the necessary documentation, and potential pitfalls to avoid. Whether you’re exploring forgiveness programs or seeking to understand the application process, this resource offers a comprehensive overview to empower you throughout the application process.

From understanding the various types of student loan forgiveness programs and their eligibility criteria to mastering the application system and addressing potential challenges, we cover all aspects. We’ll examine successful and unsuccessful applications, providing valuable insights and practical advice to increase your chances of a positive outcome. This guide is designed to be your comprehensive companion, equipping you with the knowledge and confidence to successfully navigate this often-daunting process.

Understanding the Application Process

Applying for student loan cancellation can seem daunting, but understanding the process and required documentation significantly increases your chances of success. This section will guide you through each step, providing clarity and addressing common pitfalls.

Typical Steps Involved in a Student Loan Cancellation Application

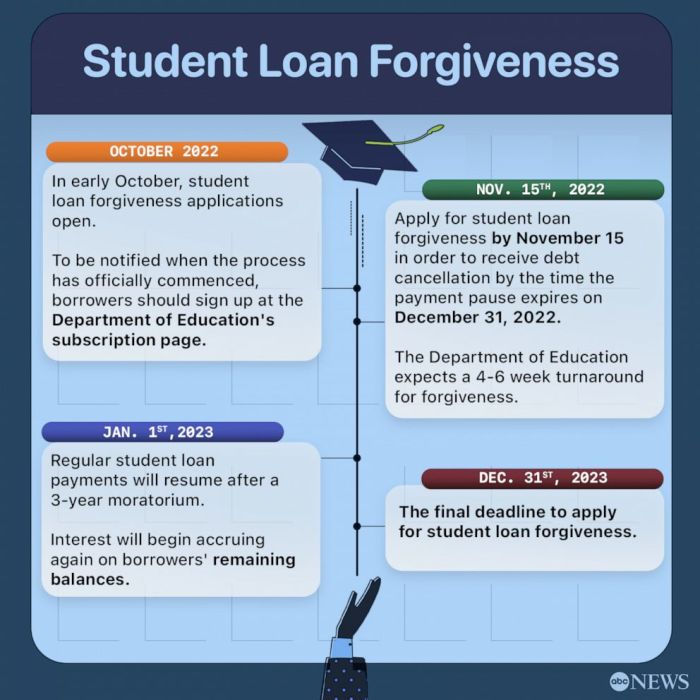

The application process generally involves several key steps. First, you’ll need to identify the specific cancellation program you’re eligible for (e.g., Public Service Loan Forgiveness, Teacher Loan Forgiveness). Next, you’ll gather all the necessary documentation. Then, you’ll complete the application form accurately and thoroughly. Finally, you’ll submit your application and follow up as needed. The exact steps and timelines may vary depending on the program and your lender.

Required Documentation for a Successful Application

Compiling the correct documentation is crucial. This typically includes your federal student loan information (loan numbers, servicer details), proof of income, employment verification (especially for income-driven repayment plans or forgiveness programs), and any other documentation specific to the program you’re applying for (e.g., teaching certification for Teacher Loan Forgiveness). Missing or incomplete documentation is a major cause of application delays or rejection. It’s advisable to keep meticulous records of all your loan-related documents.

Step-by-Step Guide for Completing the Application Form

The application form itself will vary depending on the program. However, common elements include personal information, loan details, employment history, and income information. Carefully review all instructions, ensuring accuracy in every field. Double-check all information before submitting. If you encounter any difficulties, contact the relevant agency or your loan servicer for assistance. Keep a copy of the completed form for your records.

Common Reasons for Application Rejection and Mitigation Strategies

Applications are often rejected due to incomplete information, inaccurate data, or failure to meet program eligibility requirements. For example, missing employment verification or failing to meet the required years of public service under PSLF can lead to rejection. To mitigate these risks, thoroughly review all eligibility requirements, meticulously gather and verify all documentation, and carefully complete the application form, seeking assistance if needed. Addressing these issues proactively significantly improves the chances of a successful application.

Flowchart Illustrating the Application Process

Imagine a flowchart with these boxes and connecting arrows:

Box 1: Identify Eligible Cancellation Program.

Arrow to Box 2: Gather Required Documentation (Loan information, Income verification, Employment verification, Program-specific documents).

Arrow to Box 3: Complete Application Form (Personal info, Loan details, Employment history, Income details).

Arrow to Box 4: Submit Application.

Arrow to Box 5: Application Review and Processing.

Arrow to Box 6: Approval/Rejection.

Arrow from Approval to Box 7: Loan Cancellation.

Arrow from Rejection to Box 8: Review Rejection Reasons, Resubmit if eligible.

This visual representation simplifies the process, highlighting key decision points and potential outcomes. The process may require multiple iterations, especially in cases of rejection.

Final Summary

Successfully navigating a student loan cancellation application requires careful preparation, meticulous attention to detail, and a proactive approach to communication. By understanding the application process, eligibility criteria, and potential challenges, applicants can significantly improve their chances of approval. Remember to thoroughly review all requirements, maintain clear communication with your loan servicer, and don’t hesitate to appeal a rejection if necessary. This guide serves as a valuable resource, offering a clear path toward a successful application and potential debt relief.

Clarifying Questions

What happens if my application is incomplete?

Incomplete applications are typically returned to the applicant with a request for the missing information. Addressing these deficiencies promptly is crucial to avoid delays.

How long does the application process usually take?

Processing times vary depending on the program and the volume of applications. It’s best to check the specific program guidelines for estimated timelines.

Can I appeal a rejected application?

Yes, most programs allow for appeals. The appeal process usually involves submitting additional documentation or explaining extenuating circumstances.

What if I made a mistake on my application?

Contact your loan servicer immediately to correct any errors. They may be able to amend the application or guide you through the necessary steps.