The landscape of student loan repayment is constantly shifting, presenting both challenges and opportunities for borrowers. From fluctuating interest rates and evolving forgiveness programs to the impact of policy changes and the rise of refinancing options, understanding these dynamics is crucial for effective debt management. This exploration delves into the complexities of student loan changes, providing insights and strategies to navigate this evolving financial terrain.

This guide aims to equip borrowers with the knowledge necessary to make informed decisions regarding their student loan debt. We’ll examine various repayment plans, explore the potential benefits and risks of refinancing, and analyze the broader economic implications of student loan debt. By understanding the current climate and available resources, borrowers can proactively manage their debt and work towards a financially secure future.

Student Loan Forgiveness Programs

Navigating the complex landscape of student loan repayment can be daunting. Fortunately, several federal and state programs offer avenues for loan forgiveness, providing relief to borrowers who meet specific criteria. Understanding the nuances of these programs is crucial for maximizing financial well-being.

Types of Student Loan Forgiveness Programs

Several student loan forgiveness programs exist in the United States, each with its own eligibility requirements and benefits. These programs generally target specific professions, employment settings, or types of borrowers experiencing financial hardship. The most prominent programs are often tied to public service, teaching, or working in underserved communities.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program is designed to forgive the remaining balance on federal Direct Loans after 120 qualifying monthly payments while working full-time for a qualifying employer. Eligibility requires employment by a government organization or a non-profit organization. Payments must be made under an income-driven repayment plan. A significant drawback is the stringent requirements, leading to a high rate of denied applications due to issues like inconsistent payments or ineligible loan types. Many borrowers find the 10-year commitment substantial.

Teacher Loan Forgiveness Program

This program forgives up to $17,500 of federal student loans for teachers who have completed five years of full-time teaching in a low-income school or educational service agency. The eligibility criteria include teaching specific subjects in designated schools, and meeting income requirements. The benefit is significant loan forgiveness for those dedicated to education in underserved areas. However, the program’s limitations on qualifying schools and subjects might restrict eligibility for some teachers.

Income-Driven Repayment (IDR) Plans

Income-Driven Repayment plans don’t technically “forgive” loans, but they significantly reduce monthly payments based on income and family size. After a set period (typically 20 or 25 years), any remaining loan balance is forgiven. Eligibility is broad, applying to most federal student loans. The benefit is affordable monthly payments, but the drawback is that forgiven amounts are considered taxable income. This can lead to a significant tax burden at the end of the repayment period.

Comparison of Key Features

| Program | Loan Type | Eligibility Requirements | Forgiveness Amount |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Federal Direct Loans | 120 qualifying payments under an IDR plan while employed full-time by a qualifying employer | Remaining loan balance |

| Teacher Loan Forgiveness | Federal Stafford, Subsidized Stafford, and Unsubsidized Stafford Loans | 5 years of full-time teaching in a low-income school or educational service agency | Up to $17,500 |

| Income-Driven Repayment (IDR) Plans | Most federal student loans | Income-based monthly payments | Remaining balance after 20-25 years (taxable) |

Changes in Interest Rates

Fluctuating interest rates significantly impact the cost and duration of student loan repayment. Understanding how these changes affect your loan and employing effective management strategies is crucial for minimizing long-term financial burden. This section will explore the relationship between interest rates and student loan repayment, providing practical examples and strategies for navigating periods of rising rates.

Interest rate changes directly influence the total amount repaid on a student loan. A higher interest rate means more money is added to your principal balance over time, leading to increased overall repayment costs. Conversely, lower interest rates reduce the total interest accrued, resulting in lower overall repayment costs. This impact is amplified by the loan’s principal balance and repayment term. Longer repayment periods generally lead to higher total interest paid, regardless of the interest rate.

Impact of Fluctuating Interest Rates on Repayment

Changes in interest rates affect student loan repayment in a predictable, yet potentially impactful way. A rise in interest rates increases the monthly payment amount if the loan term remains the same, or extends the repayment period if the monthly payment remains fixed. Conversely, a decrease in interest rates can lead to lower monthly payments or faster loan payoff. This variability makes proactive financial planning essential. For example, a borrower with a $50,000 loan at a 5% fixed interest rate will pay significantly less in total interest over the life of the loan compared to the same loan at a 7% fixed interest rate. The difference can amount to thousands of dollars, depending on the loan term.

Examples of Different Interest Rate Scenarios

Let’s consider two scenarios to illustrate the impact of interest rate changes. Scenario 1: A borrower has a $30,000 loan at a 4% fixed interest rate with a 10-year repayment plan. Scenario 2: The same borrower has the same loan amount but with a 6% fixed interest rate and a 10-year repayment plan. The higher interest rate in Scenario 2 will result in significantly higher monthly payments and a substantially greater total interest paid over the life of the loan. This difference highlights the importance of securing the lowest possible interest rate when taking out student loans and actively monitoring interest rate changes.

Strategies for Managing Debt During Rising Interest Rates

Several strategies can help borrowers manage their student loan debt during periods of rising interest rates. These include exploring refinancing options to secure a lower interest rate, increasing monthly payments to shorten the repayment period, making extra payments whenever possible to reduce the principal balance faster, and consolidating multiple loans into a single loan with a potentially more favorable interest rate. Additionally, maintaining a strong credit score can improve eligibility for better loan terms. Careful budgeting and prioritizing debt repayment are also essential components of a successful strategy.

Hypothetical Repayment Plan Demonstrating a 1% Interest Rate Increase

Consider a $25,000 student loan with a 10-year repayment term. At a 5% interest rate, the monthly payment would be approximately $265, and the total interest paid over 10 years would be approximately $6,000. Now, let’s increase the interest rate by 1% to 6%. With the same loan amount and repayment term, the monthly payment increases to approximately $280, and the total interest paid over 10 years rises to approximately $7,200. This hypothetical example demonstrates that even a seemingly small 1% increase in the interest rate can result in a significant increase in the total interest paid over the life of the loan. This underscores the importance of actively managing student loan debt and seeking ways to mitigate the impact of rising interest rates.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan repayment more manageable by basing your monthly payments on your income and family size. Several different plans exist, each with its own nuances and eligibility requirements. Understanding these differences is crucial for borrowers to choose the plan best suited to their financial circumstances.

Types of Income-Driven Repayment Plans

The federal government offers several IDR plans. These include the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE) plans. While PAYE is no longer accepting new borrowers, existing borrowers may remain on the plan. Each plan employs a different formula to calculate monthly payments, resulting in varying payment amounts and loan forgiveness timelines. The key distinctions lie in the income percentage used in the calculation, the length of repayment, and the specific forgiveness provisions.

Key Differences Between IDR Plans

| Plan | Income Percentage | Repayment Period | Forgiveness After |

|---|---|---|---|

| REPAYE | 10% of discretionary income | 20 or 25 years | 20 or 25 years |

| IBR (Graduated & Unsubsidized) | 10% or 15% of discretionary income | 25 years | 25 years |

| ICR | 20% of discretionary income | 12 or 25 years | 25 years |

| PAYE (Existing Borrowers Only) | 10% of discretionary income | 20 years | 20 years |

*Note: “Discretionary income” is calculated by subtracting 150% of the poverty guideline for your family size from your adjusted gross income (AGI). Repayment periods and forgiveness timelines can vary depending on loan type and when the loan was originated.

IDR Payment Calculation

The calculation of monthly payments under IDR plans is complex but generally follows a similar structure across plans. First, your discretionary income is determined as explained above. Then, this income is multiplied by the plan’s specified percentage (e.g., 10% for REPAYE). This result represents your monthly payment amount. However, it’s important to remember that the specific formula and the definition of “discretionary income” may vary slightly depending on the plan. For example:

A borrower with an AGI of $60,000 and a family size of 2 (using a hypothetical poverty guideline of $20,000) would have a discretionary income of $30,000 ($60,000 – (150% * $20,000)). Under REPAYE (10% of discretionary income), their monthly payment would be $250 ($30,000 * 0.10 / 12 months).

Factors Affecting IDR Plan Eligibility

Several factors influence eligibility for IDR plans. It’s crucial to meet these requirements to enroll.

- Loan Type: Generally, only federal student loans qualify for IDR plans. Private student loans are not eligible.

- Credit History: While not a direct eligibility requirement, a poor credit history might affect your ability to obtain a loan modification or refinance.

- Income Verification: Borrowers must provide documentation of their income and family size to determine their monthly payment.

- Repayment History: While not directly impacting eligibility, a history of missed payments may impact your ability to enroll or continue on an IDR plan.

Student Loan Refinancing Options

Refinancing your student loans can be a strategic move to potentially lower your monthly payments and overall interest costs. However, it’s crucial to understand the process and implications before making a decision. This section explores the various aspects of student loan refinancing, helping you navigate the options and make an informed choice.

Refinancing involves replacing your existing federal or private student loans with a new loan from a private lender. This new loan typically comes with a different interest rate, repayment term, and potentially different fees. The primary goal is often to secure a lower interest rate, resulting in significant long-term savings. However, refinancing also carries certain risks, which will be discussed below.

Comparison of Student Loan Refinancing Lenders

Several companies offer student loan refinancing, each with its own eligibility requirements, interest rates, and fees. A thorough comparison is essential. Factors to consider include the lender’s interest rate offerings (fixed versus variable), loan terms, fees (origination fees, prepayment penalties), and customer service reputation. Some lenders specialize in specific borrower profiles, such as those with high credit scores or specific professional backgrounds. Direct comparison of interest rates and fees from multiple lenders using online tools or comparison websites is highly recommended. For example, a borrower with excellent credit might find significantly lower rates from one lender compared to another, highlighting the importance of a comprehensive search.

The Refinancing Process

The process typically begins with an online application, requiring information such as your credit score, income, and details of your existing student loans. Lenders will then perform a credit check and review your financial information to assess your eligibility. Upon approval, you’ll receive a loan offer outlining the terms, including the interest rate, repayment period, and monthly payment. You’ll then need to sign the loan documents electronically or physically, and the lender will pay off your existing student loans. The entire process can take several weeks, depending on the lender and your individual circumstances. It is vital to carefully review all loan documents before signing to ensure you fully understand the terms and conditions.

Benefits and Risks of Refinancing

Refinancing can offer significant benefits, such as lower monthly payments and a reduced overall interest cost, leading to substantial long-term savings. A lower interest rate can also make it easier to manage your budget and achieve financial goals sooner. However, refinancing also carries risks. One major risk is losing access to federal student loan benefits, such as income-driven repayment plans and loan forgiveness programs. Additionally, if your financial situation deteriorates after refinancing, you might have difficulty making payments on a private loan, as they typically lack the same consumer protections as federal loans. A thorough assessment of your personal financial situation and future projections is crucial before making a decision. For instance, a borrower anticipating a significant income increase might find refinancing advantageous, while someone expecting a period of unemployment might not.

Questions to Ask Potential Lenders

Before committing to a refinancing loan, borrowers should thoroughly research and ask potential lenders several key questions. This will ensure they are making an informed decision and selecting the most suitable option for their needs.

- What is your current interest rate for my credit profile?

- What are your fees (origination, prepayment penalties, etc.)?

- What is the repayment term offered?

- What are your eligibility requirements?

- What happens if I miss a payment?

- What are your customer service policies and procedures?

- What is your process for handling hardship or deferment requests?

- What are the consequences of defaulting on the loan?

Impact of Policy Changes on Borrowers

Recent and proposed legislative changes concerning student loan debt have significantly impacted borrowers, creating both opportunities and challenges. These changes affect repayment options, overall debt burden, and the broader political discourse surrounding higher education affordability. Understanding these impacts is crucial for borrowers navigating the complexities of student loan repayment.

Effects of Legislative Changes on Student Loan Debt

Policy shifts, such as the extended pause on federal student loan payments during the COVID-19 pandemic, provided temporary relief to millions of borrowers. However, the subsequent resumption of payments, along with changes to income-driven repayment (IDR) plans and the ongoing debate surrounding broad-based forgiveness, have introduced considerable uncertainty and financial strain for many. For example, the Biden administration’s proposed plan for targeted loan forgiveness faced legal challenges and ultimately had limited implementation, leaving many borrowers still grappling with substantial debt. The long-term effects of these fluctuating policies remain to be seen, particularly on borrowers who have experienced periods of both relief and increased repayment pressures.

Examples of Policy Impacts on Repayment Options

The expansion of income-driven repayment (IDR) plans, while offering potential benefits, has also presented complexities. Some borrowers find the application process cumbersome, while others struggle to understand the long-term implications of different IDR plans on their overall repayment timelines and total interest paid. For instance, the SAVE plan, introduced in 2023, lowered monthly payments for many borrowers, but it also extended the repayment period for some, potentially increasing the total amount paid over the life of the loan. Conversely, the elimination or modification of certain IDR plans could significantly increase monthly payments for borrowers who relied on these options to manage their debt.

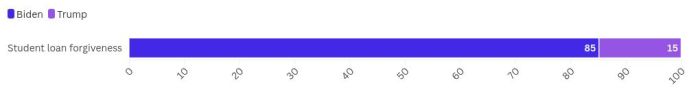

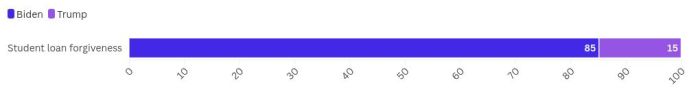

Political Landscape of Student Loan Debt Relief

The issue of student loan debt relief is highly politicized, with differing viewpoints on the government’s role in addressing the problem. Arguments range from calls for broad-based forgiveness to emphasize equity and economic stimulus to concerns about the fiscal impact of such measures and the potential for encouraging irresponsible borrowing in the future. Conservative viewpoints often advocate for market-based solutions, such as increased competition among lenders and greater transparency in loan terms, while progressive viewpoints emphasize the need for government intervention to address systemic inequalities in access to higher education and the disproportionate burden of student debt on marginalized communities.

Arguments For and Against Student Loan Policy Changes

| Argument | For Policy Change (e.g., Forgiveness or Expanded IDR) | Against Policy Change |

|---|---|---|

| Economic Impact | Stimulates the economy by freeing up borrowers’ disposable income; reduces the overall debt burden on individuals and the economy. | Could lead to inflation; may unfairly benefit higher earners who borrowed more; may create moral hazard by encouraging excessive borrowing in the future. |

| Social Equity | Addresses historical inequities in access to higher education; provides relief to borrowers disproportionately affected by systemic racism and economic disadvantage. | May not effectively target those most in need; may create resentment among those who did not attend college or paid off their loans. |

| Fiscal Responsibility | Could be offset by increased tax revenue from a stronger economy; reduces the long-term cost of loan defaults. | Could lead to a significant increase in the national debt; may require higher taxes or reduced spending in other areas. |

| Individual Responsibility | Acknowledges the systemic factors contributing to high levels of student debt; offers a pathway to financial stability for borrowers. | Emphasizes personal responsibility for borrowing decisions; may discourage future responsible borrowing behavior. |

The Role of Student Loan Debt in the Economy

Student loan debt has become a significant factor in the US economy, impacting various aspects from consumer spending to overall economic growth. Its pervasive influence necessitates a thorough understanding of its multifaceted role. The sheer volume of outstanding student loan debt, coupled with its implications for individual borrowers and the broader financial system, presents both challenges and opportunities for policymakers and economists alike.

The accumulation of student loan debt significantly affects consumer spending and economic growth. A large portion of borrowers’ disposable income is allocated to loan repayments, leaving less for other expenditures such as housing, transportation, and discretionary purchases. This reduced consumer spending can dampen economic growth, as it represents a decrease in overall demand for goods and services. Furthermore, the weight of student loan debt can delay major life decisions like homeownership or starting a family, further impacting economic activity.

Student Loan Debt and Economic Indicators

Student loan debt exhibits a demonstrable correlation with several key economic indicators. For instance, high levels of student loan debt can be associated with lower rates of homeownership among young adults, impacting the housing market. Similarly, it can correlate with lower rates of entrepreneurship, as individuals burdened by debt may be less inclined to take the financial risks associated with starting a business. These effects can ripple through the economy, influencing employment rates and overall economic productivity. Conversely, periods of robust economic growth might see a temporary increase in student loan borrowing as more individuals pursue higher education, creating a complex interplay between economic performance and student loan debt levels.

Visual Representation of Student Loan Money Flow

Imagine a circular flow diagram. At the top, we see the federal and private lending institutions, representing the source of funds. Arrows flow downwards, indicating the disbursement of loans to students for tuition, fees, and living expenses. These funds then flow into the educational institutions (colleges and universities), which provide educational services. From the universities, a portion of the money flows back to the economy through salaries paid to faculty and staff, and spending on goods and services by the institutions themselves. Students, upon graduation, enter the workforce and a significant portion of their income flows upwards as loan repayments to the lending institutions. A smaller portion flows back into the economy through consumer spending, while another portion might be directed towards investments or savings. This illustrates the complex cycle of money involving student loans and its impact on various sectors of the economy. The size of the arrows representing loan repayments versus consumer spending can visually represent the impact of high debt levels on economic activity. A larger arrow for repayments suggests a smaller arrow for consumer spending, indicating a dampening effect on economic growth.

Strategies for Managing Student Loan Debt

Managing student loan debt effectively requires a proactive and organized approach. Understanding your repayment options, budgeting carefully, and prioritizing financial literacy are crucial steps towards successfully navigating this significant financial obligation. Failing to plan can lead to missed payments, accumulating interest, and long-term financial strain.

Budgeting and Managing Student Loan Payments

Creating a realistic budget is fundamental to managing student loan payments. This involves tracking income and expenses to identify areas where savings can be made. A comprehensive budget should allocate funds for essential expenses like housing, food, transportation, and utilities, while also reserving a dedicated amount for student loan payments. Unexpected expenses should also be considered, with a contingency fund established to avoid defaulting on loan payments due to unforeseen circumstances. Regularly reviewing and adjusting the budget ensures it remains aligned with your financial situation and changing priorities. For example, a student might allocate 20% of their post-graduation income to student loan repayment, while setting aside 10% for emergency savings.

The Importance of Financial Literacy in Managing Student Loan Debt

Financial literacy is essential for effectively managing student loan debt. Understanding concepts such as interest rates, repayment plans, and credit scores allows borrowers to make informed decisions about their repayment strategy. Resources like online courses, workshops, and financial advisors can provide valuable insights into personal finance management. For example, understanding the difference between simple and compound interest allows borrowers to make more informed decisions about loan repayment strategies and the potential long-term impact of interest accumulation.

Negotiating with Lenders for Better Repayment Terms

Borrowers may be able to negotiate with their lenders to secure more favorable repayment terms. This could involve exploring options like income-driven repayment plans, which adjust monthly payments based on income and family size. It’s also advisable to contact the lender to discuss hardship situations that may warrant temporary forbearance or deferment. Documentation of financial difficulties, such as job loss or medical expenses, can strengthen the negotiation. For example, a borrower experiencing unexpected unemployment might successfully negotiate a temporary reduction in monthly payments or a deferment period.

Sample Budget Incorporating Student Loan Payments

| Category | Monthly Allocation |

|---|---|

| Housing | $1000 |

| Food | $400 |

| Transportation | $200 |

| Utilities | $150 |

| Student Loan Payment | $300 |

| Savings (Emergency Fund) | $100 |

| Other Expenses (Entertainment, etc.) | $150 |

| Total Monthly Expenses | $2300 |

Note: This is a sample budget and should be adjusted to reflect individual income and expenses. The amounts allocated to each category are illustrative and may vary significantly depending on individual circumstances and location.

Last Point

Successfully navigating the complexities of student loan debt requires a proactive and informed approach. By understanding the various repayment options, leveraging available resources, and staying abreast of policy changes, borrowers can significantly improve their financial well-being. Remember that seeking professional financial advice can provide personalized guidance tailored to your unique circumstances, ensuring you’re equipped to make the best decisions for your future.

FAQ Summary

What is the difference between forbearance and deferment?

Forbearance temporarily suspends your payments, but interest usually continues to accrue. Deferment postpones payments, and in some cases, interest may not accrue.

Can I consolidate my federal and private student loans?

You can generally consolidate federal loans, but private loans typically cannot be consolidated with federal loans. Refinancing is an option for consolidating private loans or a mix of federal and private loans.

What happens if I default on my student loans?

Defaulting can lead to wage garnishment, tax refund offset, and damage to your credit score. It can also make it difficult to obtain future loans.

How can I find a reputable student loan refinancing lender?

Research lenders thoroughly, compare interest rates and fees, check reviews, and verify their licensing and accreditation before refinancing.