Navigating the complexities of student loan debt can feel overwhelming, but understanding your options is the first step towards financial freedom. Student loan consolidation offers a potential pathway to simplify repayment, potentially lowering monthly payments and streamlining the process. This guide explores the mechanics of consolidation, eligibility requirements, and the crucial factors to consider before making this significant financial decision. We’ll examine both the advantages and disadvantages, empowering you to make an informed choice.

From understanding different consolidation programs and their associated interest rates to navigating the application process and assessing potential risks, we’ll provide a clear and concise overview. We’ll also delve into the importance of considering your long-term financial goals and seeking professional advice when necessary. This guide aims to equip you with the knowledge you need to confidently approach student loan consolidation.

Understanding Student Loan Consolidation

Student loan consolidation simplifies your repayment by combining multiple federal or private student loans into a single loan. This can lead to a more manageable monthly payment and potentially a lower interest rate, although this isn’t always guaranteed. Understanding the mechanics and implications of consolidation is crucial before making a decision.

Mechanics of Student Loan Consolidation

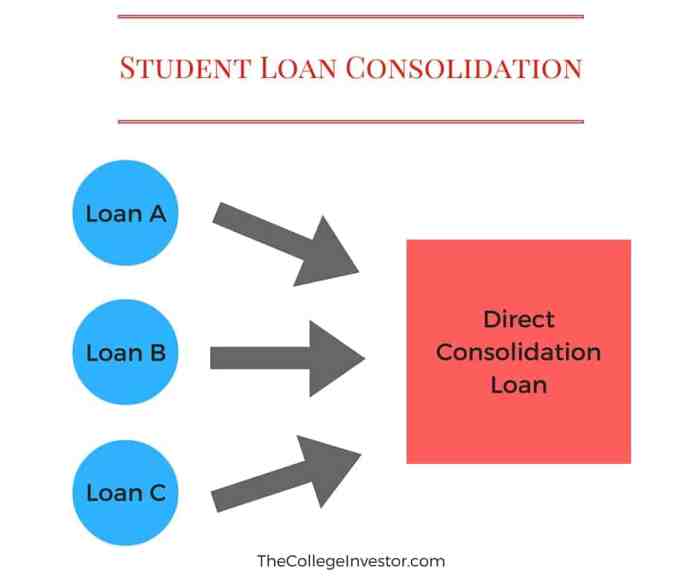

Consolidation works by replacing your existing loans with a new loan that encompasses the total outstanding balance. The lender providing the consolidation loan pays off your previous loans, and you then make a single monthly payment to them. Your credit history related to the original loans remains, but the new loan will appear on your credit report. The interest rate on your consolidated loan will be a weighted average of your existing loan interest rates, or a fixed rate offered by the lender, potentially resulting in either a higher or lower interest rate depending on your current loan terms. The length of your repayment plan can also change, potentially extending the repayment period.

Types of Student Loan Consolidation Programs

Federal student loan consolidation is handled by the Department of Education through the Direct Consolidation Loan program. This program allows you to combine eligible federal student loans, including Direct Loans, Federal Family Education Loans (FFEL), and Perkins Loans. Private student loan consolidation, on the other hand, involves consolidating multiple private student loans with a single private lender. This process typically involves applying directly to a private lender, who will then assess your creditworthiness and offer a consolidation loan.

Step-by-Step Guide to the Application Process

The application process varies depending on whether you are consolidating federal or private loans. For federal loans, you typically apply online through the Federal Student Aid website (studentaid.gov). This involves gathering your loan information, completing an application, and providing supporting documentation. For private loans, the process is similar but involves contacting a private lender directly, comparing offers, and completing their application process. Expect to provide documentation like your Social Security number, loan details, and income information. It’s advisable to carefully compare interest rates and repayment terms from multiple private lenders before making a decision.

Federal vs. Private Loan Consolidation: Benefits and Drawbacks

| Feature | Federal Loan Consolidation | Private Loan Consolidation |

|---|---|---|

| Eligibility | Requires eligible federal loans | Requires good to excellent credit |

| Interest Rates | Weighted average of existing rates or a fixed rate | Variable or fixed rates based on creditworthiness |

| Repayment Plans | Access to income-driven repayment plans | Limited repayment options, often fewer than federal options |

| Benefits | Simplified repayment, potential access to income-driven repayment plans | Potential for lower monthly payments (depending on interest rate and term) |

| Drawbacks | May not lower interest rate significantly | Higher interest rates possible, limited repayment flexibility |

Decision-Making Flowchart for Consolidation

This flowchart visually represents the decision-making process. Imagine a branching diagram. Start with the question: “Do I have multiple federal student loans?” If yes, proceed to “Explore Federal Direct Consolidation Loan Program.” If no, proceed to “Do I have multiple private student loans and good credit?” If yes, “Explore Private Loan Consolidation Options and compare offers from multiple lenders.” If no, “Re-evaluate your current repayment strategy.” Each step would then involve evaluating the pros and cons specific to that path. This would conclude with a final decision point of either “Consolidate Loans” or “Maintain Current Loan Structure.”

Eligibility Criteria and Requirements

Consolidating your federal student loans can simplify your repayment process by combining multiple loans into a single one. However, eligibility depends on several factors. Understanding these requirements is crucial before you begin the application process. This section will Artikel the key criteria and necessary documentation.

Federal Student Loan Consolidation Eligibility

To be eligible for federal student loan consolidation, you must have eligible federal student loans. This typically includes Direct Loans, Federal Family Education Loans (FFEL), and Perkins Loans. However, not all loans within these programs are necessarily eligible. For instance, defaulted loans may require rehabilitation before consolidation. It’s essential to check the specific eligibility of each loan before applying. You should also be aware that private student loans are not eligible for federal consolidation programs.

Required Documentation for Application

The necessary documentation for your application will vary slightly depending on your specific circumstances, but generally includes your Social Security number, loan details (including loan numbers and amounts), and contact information. You may also need to provide tax information, proof of income, and potentially other supporting documentation depending on the specific requirements of your chosen consolidation program. It’s always best to gather all potentially relevant documentation beforehand to streamline the application process.

Income Limitations for Loan Consolidation

There are no income limitations for federal student loan consolidation. Unlike some other government assistance programs, your income level does not affect your eligibility for this program. This makes it accessible to a wide range of borrowers, regardless of their financial situation.

Impact of Credit Score on Loan Consolidation Approval

Your credit score does not directly impact the approval of federal student loan consolidation. Unlike private loan consolidation, the federal government does not use your credit score as a primary factor in determining eligibility. However, having a poor credit history might affect your ability to secure favorable terms on future loans.

Comparison of Eligibility Criteria for Different Loan Consolidation Programs

| Program | Eligible Loan Types | Income Requirements | Credit Score Impact |

|---|---|---|---|

| Federal Direct Consolidation Loan | Direct Loans, FFEL Program Loans, Perkins Loans (with limitations) | None | None |

| Private Loan Consolidation | Private student loans | Varies by lender | Significant; impacts interest rates and approval |

Interest Rates and Repayment Plans

Consolidating your student loans can offer significant advantages in managing your debt, but understanding the intricacies of interest rates and repayment plans is crucial for making informed decisions. This section will clarify how interest rates are affected by consolidation and detail the various repayment options available to you. We’ll also explore the mechanics of interest capitalization and provide illustrative examples of repayment schedules.

A key consideration when consolidating is the impact on your interest rate. While consolidation simplifies your payments by combining multiple loans into one, the resulting interest rate isn’t simply an average of your original rates. The new interest rate is typically a weighted average of your existing loan rates, but it can be higher, lower, or the same depending on prevailing interest rates and your creditworthiness at the time of consolidation. It’s essential to compare the weighted average interest rate offered by the consolidation lender to your current rates before proceeding. A higher interest rate on a consolidated loan could ultimately cost you more in the long run. Conversely, a lower rate will lead to significant savings over the life of the loan.

Consolidated Loan Interest Rates Compared to Original Loans

The interest rate on your consolidated loan will be a fixed rate, determined by the lender at the time of consolidation. This fixed rate may differ from the rates of your individual loans. For example, if you had three loans with interest rates of 5%, 6%, and 7%, your consolidated loan rate might be 6.2%, reflecting a weighted average. However, this is only an example; the actual rate will depend on various factors, including your credit history and the prevailing market interest rates. It’s vital to obtain a detailed loan offer before finalizing the consolidation to see the precise interest rate and compare it to the total interest you would pay under your current loan arrangements.

Repayment Plan Options After Consolidation

After consolidating your student loans, several repayment plans are typically available, each designed to cater to different financial situations and repayment preferences. Choosing the right plan can significantly impact your monthly payments and the total interest you pay over the life of the loan. Careful consideration of your financial capabilities and long-term goals is crucial.

- Standard Repayment Plan: This plan typically involves fixed monthly payments over a 10-year period. It offers the shortest repayment period and results in the lowest total interest paid but requires higher monthly payments.

- Extended Repayment Plan: This plan extends the repayment period, typically to 25 years, lowering your monthly payments. However, it results in a higher total interest paid over the life of the loan.

- Graduated Repayment Plan: This plan starts with lower monthly payments that gradually increase over time, usually over a 10-year period. This can be beneficial for those anticipating increased income in the future.

- Income-Driven Repayment (IDR) Plans: These plans (such as ICR, PAYE, REPAYE, andIBR) base your monthly payments on your income and family size. Your payments may be significantly lower than under other plans, but the repayment period can be much longer, potentially up to 20 or 25 years, leading to higher overall interest costs.

Interest Capitalization in Consolidated Loans

Interest capitalization is the process of adding accrued but unpaid interest to the principal balance of your loan. This means that unpaid interest is essentially added to your loan balance, increasing the total amount you owe. In consolidated loans, interest capitalization typically occurs at the end of each payment period if you don’t make payments that cover all the accrued interest. This can significantly increase the total cost of your loan over time, so it’s essential to make payments that cover at least the accruing interest to minimize this effect.

Examples of Repayment Schedules

Let’s illustrate with hypothetical examples. Suppose you consolidate $30,000 in loans at a 6% interest rate. Under a standard 10-year repayment plan, your monthly payment would be approximately $330, resulting in a total interest paid of around $7,800. With an extended 25-year plan, your monthly payment might drop to roughly $180, but the total interest paid would increase significantly, potentially to over $21,000. An income-driven repayment plan would adjust your monthly payments based on your income, potentially leading to significantly lower monthly payments but a much longer repayment period and higher total interest.

Potential Benefits and Risks

Student loan consolidation can significantly impact your financial future, offering potential benefits but also carrying inherent risks. Understanding these aspects is crucial before making a decision. Careful consideration of your individual circumstances is key to determining whether consolidation aligns with your long-term financial goals.

Long-Term Financial Benefits of Consolidation

Consolidating your student loans can simplify your repayment process by combining multiple loans into a single monthly payment. This streamlined approach can improve your budget management and reduce the administrative burden of tracking multiple loan accounts and due dates. Furthermore, depending on the consolidation program, you may qualify for a lower interest rate, potentially saving you a considerable amount of money over the life of the loan. A lower interest rate translates directly to reduced overall interest payments and faster debt repayment. This can free up funds for other financial priorities, such as saving for a down payment on a house, investing, or paying off other debts.

Drawbacks and Risks Associated with Consolidation

While consolidation offers advantages, it’s important to be aware of potential drawbacks. One significant risk is extending the repayment period. While a lower monthly payment might seem appealing, lengthening the repayment term can ultimately lead to paying more interest over the loan’s lifespan. This is because you’ll be paying interest for a longer period. Another risk is the potential loss of benefits associated with specific federal loan programs, such as income-driven repayment plans or loan forgiveness programs. Carefully review the terms of your consolidation before proceeding to avoid unforeseen consequences. Additionally, if you consolidate private loans with federal loans, you’ll lose the protections afforded by federal student loan programs.

Impact of Consolidation on Credit Score

The impact of consolidation on your credit score is complex and depends on several factors. The initial application process might cause a slight temporary dip in your score due to a hard credit inquiry. However, if consolidation leads to improved repayment behavior (e.g., consistently making on-time payments on a single, manageable loan), your credit score could improve over time. Conversely, missing payments on your consolidated loan could severely damage your credit score. Therefore, responsible management of the consolidated loan is paramount for maintaining or improving your credit rating.

Scenarios Where Consolidation Is Beneficial and Not Beneficial

Consolidation is generally beneficial when you have multiple student loans with varying interest rates, and a lower interest rate is available through consolidation. This is especially true if you’re struggling to manage multiple payments and a simplified repayment plan would improve your financial organization. Conversely, consolidation may not be beneficial if you are already on track with your payments, have a low interest rate on your existing loans, or stand to lose valuable benefits from federal loan programs. For example, a borrower with several high-interest private loans might benefit significantly, while a borrower with low-interest federal loans and access to income-driven repayment plans might be better off managing their loans individually.

Visual Representation of Financial Outcomes

Imagine two bar graphs. The first represents a scenario without consolidation, showing several separate bars representing different loans with varying interest rates and repayment periods. The total height of these bars represents the total amount paid over the life of the loans (principal plus interest). The second bar graph shows a single, taller bar representing the consolidated loan. If consolidation is beneficial, this single bar will be shorter than the sum of the bars in the first graph, indicating lower total interest paid. However, if the consolidation results in a longer repayment period, this single bar might be taller, demonstrating the increased total amount paid despite a lower monthly payment. The difference in the height of the total bars clearly illustrates the financial implications of each scenario.

Factors to Consider Before Consolidating

Student loan consolidation can seem like a straightforward solution to managing multiple loans, but it’s crucial to carefully weigh the pros and cons before making a decision. Failing to consider all the implications could lead to unforeseen financial challenges down the line. This section Artikels key factors to consider to ensure you’re making an informed choice.

Loss of Access to Certain Repayment Plans

Consolidating your federal student loans often means losing access to income-driven repayment (IDR) plans, such as ICR, PAYE, REPAYE, and IBR. These plans base your monthly payments on your income and family size, making them particularly beneficial for borrowers facing financial hardship. Once you consolidate, your loans are typically placed into a standard repayment plan with a fixed monthly payment, potentially increasing your monthly expenses. This shift could significantly impact your budget, especially if your income is currently low or unpredictable. For example, a borrower previously on an IDR plan might see their monthly payment increase substantially after consolidation, potentially leading to delinquency or default.

Impact on Loan Forgiveness Programs

Certain federal student loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness, require borrowers to make a specific number of qualifying payments under an eligible repayment plan. Consolidating your loans can reset the progress you’ve already made toward forgiveness. If you’re close to qualifying for forgiveness, consolidation could delay or even prevent you from receiving it. For instance, a borrower who has made 90 out of 120 required payments under an IDR plan for PSLF would lose that progress if they consolidate, needing to start the 120-payment count anew.

Seeking Professional Financial Guidance

Navigating the complexities of student loan consolidation can be challenging. Seeking advice from a qualified financial advisor or student loan counselor is highly recommended. These professionals can provide personalized guidance based on your individual financial situation, helping you understand the potential benefits and drawbacks of consolidation in relation to your specific circumstances. They can also assist in exploring alternative strategies for managing your student loan debt. For example, a financial advisor could help you compare the long-term costs of consolidation versus other debt management strategies, taking into account your income, expenses, and financial goals.

Checklist of Considerations Before Applying for Student Loan Consolidation

Before applying, it’s crucial to thoroughly assess your situation. Consider the following:

- Current Loan Details: List all your federal and private student loans, including interest rates, balances, and repayment plans.

- Consolidated Loan Terms: Research the interest rate and repayment terms offered for a consolidated loan. Compare this to your current loan terms.

- Impact on Repayment Plans: Determine if you’ll lose access to any income-driven repayment plans or forgiveness programs.

- Financial Situation: Analyze your current income, expenses, and debt-to-income ratio to assess your ability to manage higher monthly payments.

- Long-Term Financial Goals: Consider how consolidation might affect your long-term financial goals, such as saving for retirement or buying a home.

- Professional Advice: Seek guidance from a financial advisor or student loan counselor to discuss your options and make an informed decision.

Finding Reliable Information and Resources

Navigating the world of student loan consolidation can be overwhelming, especially with the abundance of information – both accurate and inaccurate – available online. It’s crucial to rely on trustworthy sources to ensure you make informed decisions about your financial future. This section Artikels how to locate reliable information and resources to guide your consolidation journey.

Understanding the credibility of sources is paramount. Misinformation can lead to costly mistakes, so verifying the legitimacy of any information you encounter is a vital first step.

Trustworthy Sources for Student Loan Consolidation Information

Finding reliable information requires careful discernment. Several government agencies and reputable non-profit organizations offer unbiased and accurate guidance. Consulting these resources is essential before making any decisions about consolidating your student loans.

- The Federal Student Aid website: This website, maintained by the U.S. Department of Education, provides comprehensive information on federal student loans, including details on consolidation programs. It offers clear explanations of eligibility, repayment plans, and potential benefits and drawbacks.

- The National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that offers free and low-cost credit counseling services. They provide unbiased advice on managing debt, including student loans, and can help you explore different options for consolidation.

- Your loan servicer: Your loan servicer is the company responsible for managing your student loans. They can provide personalized information about your loans and the consolidation process.

- Consumer Financial Protection Bureau (CFPB): The CFPB is a government agency that protects consumers’ financial rights. They offer resources on student loan debt and other financial matters.

Contact Information for Relevant Government Agencies and Non-Profit Organizations

Direct contact with these organizations can provide personalized guidance and address specific questions.

- Federal Student Aid: Information on their website includes contact numbers and email addresses for inquiries. They also have a robust FAQ section addressing common questions.

- National Foundation for Credit Counseling (NFCC): Their website provides a directory of member agencies across the country, allowing you to find a local counselor. Contact information for the national organization is also readily available.

- Consumer Financial Protection Bureau (CFPB): The CFPB’s website offers multiple avenues for contact, including phone numbers, email addresses, and online complaint forms.

Verifying the Legitimacy of Online Information

The internet is a vast resource, but it also contains a significant amount of misleading information. Therefore, it is critical to assess the credibility of online sources.

- Check the website’s domain name: Look for official government (.gov) or educational (.edu) domains, or reputable non-profit organizations. Be wary of sites with generic top-level domains (.com) unless you have verified their legitimacy through other means.

- Look for author credentials: Reliable sources will typically identify the authors and their qualifications. Check for credentials and affiliations that suggest expertise in student loan management or financial planning.

- Cross-reference information: Compare information found on one website with information from multiple other trusted sources. Inconsistencies should raise red flags.

- Be cautious of unsolicited offers: Avoid clicking on links or responding to emails that promise unrealistic benefits or quick solutions related to student loan consolidation. Legitimate organizations rarely use aggressive or high-pressure tactics.

Understanding Terms and Conditions Before Signing Documents

Before signing any documents related to student loan consolidation, carefully review all terms and conditions. This includes understanding the interest rate, repayment terms, fees, and any other relevant details. Failure to understand these terms can lead to unexpected costs and financial difficulties. If anything is unclear, seek clarification from the lender or a financial advisor before proceeding.

Last Recap

Student loan consolidation presents a valuable tool for managing student loan debt, but it’s crucial to approach it strategically. By carefully weighing the potential benefits against the risks, understanding your eligibility, and exploring various repayment options, you can determine if consolidation aligns with your individual financial circumstances. Remember, seeking professional financial guidance can provide invaluable support in making the best decision for your future. Taking the time to thoroughly research and understand the process will ultimately lead to a more confident and informed approach to managing your student loans.

Essential Questionnaire

What happens to my original loans after consolidation?

Your original loans are replaced by a single, new loan. The original loans are paid off with the proceeds from the new consolidated loan.

Can I consolidate private and federal loans together?

Generally, you cannot consolidate federal and private student loans into a single federal loan. You may be able to refinance private loans, which combines them into a new private loan.

Will consolidating my loans affect my credit score?

The impact on your credit score is generally minimal, but it could potentially improve if you manage your consolidated loan responsibly. However, a hard inquiry on your credit report may temporarily lower your score.

What if I default on my consolidated loan?

Defaulting on a consolidated loan has serious consequences, including damage to your credit score, wage garnishment, and potential tax refund offset.